Bitwise XRP ETF Filing – Potential 7,000% Gains for ETFSwap

Published

1 month agoon

By

admin

The attention of the crypto market was shifted to the ETFSwap (ETFS) platform that is pioneering the tokenization of ETFs and real-world assets, following the news of Bitwise’s XRP ETF filing. Crypto investors are keeping a close watch on the ETFSwap (ETFS) tokens, which are now being projected to rise by a staggering 7,000%, a feat that is beyond Solana (SOL) and Dogecoin (DOGE).

ETFSwap (ETFS): The Future of Tokenized ETFs

The ETFSwap (ETFS) token stands out for its real-world utility. By tokenizing institutional ETFs and other valuable assets, the ETFSwap (ETFS) platform will provide investors access to high-value asset classes like stocks, commodities, bonds, and crypto ETFs like the newly filed XRP ETF directly from the comfort of their digital devices.

The ETFSwap (ETFS) platform is designed with advanced tools and features aimed at long-term success. Investors are incentivized to stake ETFS tokens and earn up to 87% annual percentage rates (APR), which is a great opportunity for passive income. Additionally, the demand for ETFS tokens is increasing as more users are drawn to its staking rewards and liquidity pools.

The ETFSwap (ETFS) platform allows users to participate in various liquidity pools and provides greater earning opportunities. Traders on the ETFSwap (ETFS) can trade tokenized ETFs with up to 50x margin, and the platform also offersa 10x margin on perpetuals, futures, and commodities to maximize their returns with the potential to achieve gains of up to 20,000%.

The Bitwise XRP ETF filing excites investors in the crypto marketplace. The ETFSwap (ETFS) platform will meet a potential increase in demand for XRP ETFs upon its approval and make them available for investors.

Investors on the ETFSwap (ETFS) platform can easily track ETF prices in real time. ETFSwap (ETFS) has a suite of AI-driven tools, such as the ETF Finder, ETF Filter, and ETF Tracker, which analyze market trends and sentiment to recommend the best ETFs for investors.

Impressively, ETFSwap (ETFS) has successfully completed the KYC verification of its team with SolidProof and a smart contract audit by CyberScope to guarantee security and transparency. The ETFSwap (ETFS) tokens are available in the ongoing presale at the price of $0.03846. With analysts predicting a 7,000% surge that could swiftly take the ETFS tokens to $1 upon their launch, now is the best time for investors to jump on the train and set themselves up for immense profits.

Solana (SOL) And Dogecoin (DOGE) Struggle For Stability

While Solana (SOL) has gained attention for its fast blockchain, the crypto space has also witnessed Solana (SOL) endure frequent outages and reliability issues. Solana (SOL) investors Solana (SOL) appears to have sustainable leadership in token launches due to its infrastructure. The Solana (SOL) network has created over 87% of all new tokens launched among tracked blockchains. But Solana (SOL), currently trading at $144, is yet to retest its previous high of $200 and falls behind the ETFSwap’s (ETFS) momentum for a 7,000% surge.

On the other hand, Dogecoin (DOGE) has relied heavily on its meme status and celebrity endorsements to stay relevant. Due to a lack of intrinsic Dogecoin (DOGE), it is only great for short-term traders seeking to make quick profits from short-lived hype. The inability of Dogecoin (DOGE) to retest its all-time high of $0.72 has been frustrating and resulted in the memecoin being left behind by investors for more valuable assets like the ETFSwap (ETFS) tokens.

The current Dogecoin price is $0.1052 as of the time of writing.

Conclusion: ETFSwap (ETFS) Outpaces Competition In Its Path To $1

The recent Bitwise XRP ETF filing has highlighted the significant importance of ETFs in the crypto space, and the ETFSwap (ETFS) platform stands to benefit greatly due to its exceptional tokenization utility. While Solana (SOL) and Dogecoin (DOGE) may continue to see short-term price action, they can’t compete with the real-world utility, stake rewards, advanced trading options, and the potential to trade XRP ETF that ETFSwap (ETFS) tokens offer.

For more information about the ETFS presale,

Disclaimer

This article is a paid publication and does not have journalistic/ editorial involvement of CoinGape. CoinGape does not endorse/ subscribe to the contents of the article/advertisement and/or views expressed herein. Do your market research before taking any actions . The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Will Algorand (ALGO) Price Hit $1 Soon?

Bitcoin is Neither Racist, Xenophobic, nor Misogynistic: A Response to Ideological Stereotyping

Bitcoin Price Is Mirroring The Same Movements From 2023, Here’s What It Means

Tether ends support for EURT stablecoin amid MiCA compliance

Will This Sell Signal Trigger ETH Crash?

No, Michael Saylor Doesn't Control Bitcoin

24/7 Cryptocurrency News

Will Algorand (ALGO) Price Hit $1 Soon?

Published

35 mins agoon

November 27, 2024By

admin

Algorand (ALGO) price has seen a bullish rally in the last week with the price jumping over 40%. Following the price rally crypto analysts are suggesting a potential breakout, raising questions about whether ALGO price could reach the $1 mark soon.

Algorand Price Double Bottom Pattern

Recent technical analysis of Algorand (ALGO) price charts reveals a double bottom pattern forming over the last two years. This pattern is often interpreted as a bullish indicator, signifying a potential shift from a downtrend to an uptrend.

On the charts, resistance levels have been identified around $0.3097 and $0.3017. If these levels are breached, analysts predict an upward trajectory, with price targets set at $1.2668 and $1.1345, respectively. Such a breakout could indicate strong bullish sentiment and pave the way for a sustained price rally.

Double bottom breakout looming for $Algo 👀

The neckline sits at $0,30#Algorand pic.twitter.com/TrdMqfEBej

— STEPH IS CRYPTO (@Steph_iscrypto) November 27, 2024

Currently, ALGO price is trading at $0.2993, following a 5% price surge in recent sessions. This positions the token just below key resistance levels, fueling anticipation of a potential breakout.

Increased Trading Volume and Open Interest

Trading activity for Algorand (ALGO) has seen a sharp rise, with trading volume surging by 55.20% to $466.91 million. This uptick indicates heightened interest in the asset and increased market liquidity.

Open interest, a metric tracking active positions in derivatives markets, has also risen slightly by 0.41% to $83.27 million.

This suggests traders are maintaining positions or opening new ones in anticipation of future price movements. Together, these metrics point to growing engagement with ALGO among market participants, potentially contributing to price volatility in the short term.

Community Governance Updates and Ecosystem Changes

Algorand’s ongoing governance developments could also play a role in shaping market sentiment. The Algorand Foundation recently opened its latest governance voting period, which includes proposals to introduce an xGov council. If approved, the council would transition decision-making power from the Foundation to community-elected representatives.

Additionally, the governance model is evolving to phase out incentivized rewards for participation, marking a shift in how the Algorand ecosystem operates. These changes aim to improve the ecosystem’s decentralization and sustainability. As governance shifts align with broader adoption efforts, they may influence investor confidence and long-term value.

Despite current price levels, Algorand (ALGO) faces a mixed scenario regarding profitability among its holders. Data shows that 26.13% of ALGO holders are currently “in the money,” having purchased the token at prices below the current $0.2993. Conversely, 66.22% of holders remain “out of the money,” indicating they bought at higher prices.

With strong support around $0.2851 and resistance at $0.31, ALGO’s price could experience volatility as it approaches these levels. Analysts are closely monitoring whether the price will surpass the $0.31 resistance, which could open the path to higher price targets in 2024.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

2024 Election

Bitcoin is Neither Racist, Xenophobic, nor Misogynistic: A Response to Ideological Stereotyping

Published

3 hours agoon

November 27, 2024By

admin

Just hours after the U.S. election results were announced, I received messages from friends filled with striking assumptions. Some congratulated me, mockingly saying, “Congrats, your side won for Bitcoin.” Others expressed disapproval with remarks like, “It’s pathetic!” and “I’m shocked that Americans just voted for Hitler.” One friend said, “You were lucky to find safety in the U.S. as a refugee under Biden’s administration. Refugees and asylum seekers will now face a harder time here, but, hey, it’s still good for your Bitcoin.” Many of these friends work in high-level corporate jobs or are university students.

As a Green Card holder, I was not eligible to vote, but I recognize their huge disappointment in seeing their preferred candidate lose. Their frustrations were directed at me because they know I support Bitcoin and work in the space. I understand that making me a scapegoat says less about me and more about their limited understanding of what Bitcoin’s value represents.

I’m aware that in this highly polarized political landscape, ideological stereotyping becomes evident—not only during election season but also in spaces where innovative thinking should be encouraged. A prime example of this ideological bias occurred during the Ohio State University commencement, where Chris Pan’s speech on Bitcoin was largely booed by students attending their graduation ceremony. I admire the courage it took to stand firm in front of over 60,000 people and continue his speech. My guess is that most of these graduating students have never experienced hyperinflation or grown up under authoritarian regimes, which likely triggered an “auto-reject”’ response to concepts beyond their personal experience.

I’ve encountered similar resistance in my own unfinished academic journey; during my time at Georgetown, I had several unproductive conversations with professors and students who viewed Bitcoin as a far-right tool. Once a professor told me, “Win, just because cryptocurrency (he didn’t use the term Bitcoin) helped you and your people in your home country doesn’t make it a great tool—most people end up getting scammed in America and many parts of the world. I urge you to learn more about it.” The power dynamics in academic settings often discourage open-minded discourse, which is why I eventually refrained from discussing Bitcoin with my professors.

I’ve learned to understand that freedom of expression is a core American value. Yet, I’ve observed that certain demographics or communities label anyone they disagree with as ‘racist.’ In more extreme cases, this reaction can escalate to using influence to have people fired, expelled from school, or subjected to coordinated cyberbullying. I’m not claiming that racism doesn’t exist in American society or elsewhere; I strongly believe both overt and subtle forms of racism still persist and are well alive today.

Although bias and inequality remain widespread, Bitcoin operates on entirely different principles. Bitcoin is borderless, leaderless, and accepting of any nationality or skin color all while without requiring any form of ID to participate. People in war-torn countries convert their savings into Bitcoin to cross borders safely, human rights defenders receive donations in Bitcoin, and women living under the Taliban get paid through the Bitcoin network.

Bitcoin is not racist because it is a tool of empowerment for anyone who is willing to participate. Bitcoin is not Xenophobic because it gives those forced to flee their homes the power to carry their hard-earned economic energy across borders and participate in another economy when every other option is closed. For activists, often branded as ‘criminals’ by authoritarian regimes, it supports them through frozen bank accounts and blocked resources. For women, enduring life under misogynistic rule, Bitcoin offers a rare chance for financial independence.

Going back to the U.S. election context, Bitcoin not only levels the playing field for people in the world’s most forgotten places and darkest corners, but it also opens new avenues for U.S. presidential candidates to engage with this growing community. President-elect Donald Trump has made bold promises regarding Bitcoin, signaling a favorable policy. In contrast, Democratic candidate Vice President Kamala Harris’s campaign reportedly declined to support the Bitcoin community. Grant McCarty, co-founder of the Bitcoin Policy Institute, stated, “Can confirm that the Harris campaign was offered MILLIONS of dollars from companies, PACs, and individuals who were looking for her to simply take meetings with key crypto stakeholders and put together a defined crypto policy plan. The campaign never took the industry seriously.” I believe this is something most people may be unaware of, and confirmation bias often leads to the assumption that all Bitcoin supporters back every policy of the other side, including potential drastic changes to America’s humanitarian commitments such as refugee resettlement and asylum programs, anti-trafficking and protection of vulnerable populations, and foreign aid and disaster relief.

Most people around the world lack a stable economic infrastructure or access to long-term mortgages; they live and earn with currencies more volatile than crypto gambling and, in some cases, holding their own fiat currency is as dangerous as casino chips, or worse.

The Fiat experiment has failed the global majority. I believe that Bitcoin and Bitcoin advocates deserve to be evaluated on their merits and work on global impact, rather than through the binary lens of political bias, misappropriated terms, or factually flawed yet socially accepted diminutive categorizing, which allows them to opt out of learning and evaluating assumptions.

This is a guest post by Win Ko Ko Aung. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Analyst

Bitcoin Price Is Mirroring The Same Movements From 2023, Here’s What It Means

Published

3 hours agoon

November 27, 2024By

admin

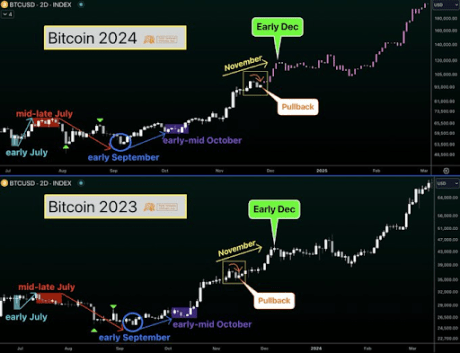

Crypto analyst Trader Tardigrade has drawn the community’s attention to the fact that the Bitcoin price is mirroring 2023 movements. The analyst further provided insights into what this means for the flagship crypto.

Bitcoin Price Mirroring 2023 Movements

In an X post, Trader Tardigrade said that the Bitcoin price stays on track with the 2023 moves. He further remarked that the flagship crypto has just completed the pullback. With the pullback complete, the crypto analyst asserted there will be a surge above 100,000, followed by a consolidation around that level.

Interestingly, Trader Tardigrade also predicted that the Bitcoin price would reach $200,000 in early 2025. The analyst’s accompanying chart showed that this price rally to this target will happen by March 2025.

This parabolic rally to $200,000 is expected to mirror a similar rally that BTC enjoyed from early December that year as it rose to the previous all-time high (ATH) of $73,000 in March earlier this year. Meanwhile, it is worth mentioning that Trader Tardigrade isn’t the only one who has predicted that the Bitcoin price can reach this level in this market cycle.

Bernstein analysts also previously predicted that the BTC price would reach $200,000 by year-end 2025, although they claimed that was a ‘conservative’ target. Geoffrey Kendrick, Standard Chartered’s Head of Research, also predicted that Bitcoin could reach this price target and gave a similar timeline as Bernstein analysts.

However, crypto analyst Tony Severino is skeptical that the Bitcoin price could reach $200,000 in this bull cycle. Instead, he has made a more conservative prediction, stating that the flagship crypto would likely peak somewhere in the $160,000 range. The analyst noted this was a more feasible target, considering that the golden ratio is in this range.

BTC Is “Far Away” From A Market Top

In an X post, crypto analyst Ali Martinez asserted that the BTC price is still “far away” from a market top. He made this statement while highlighting the market value to realized value (MVRV) indicator, which shows whether the asset is overvalued or undervalued. The chart showed that Bitcoin has yet to reach its true value.

Related Reading

The Bitcoin price is currently facing a significant price correction, having been pumping nonstop since Donald Trump’s victory. However, Martinez suggested this might be a great time to buy this dip. According to him, the TD Sequential presents a buy signal on the Bitcoin hourly chart, while a bullish divergence forms against the Relative Strength Index (RSI). He added that this could help Bitcoin rebound to between $95,000 and $96,000.

At the time of writing, the Bitcoin price is trading at around $93,400, down in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Will Algorand (ALGO) Price Hit $1 Soon?

Bitcoin is Neither Racist, Xenophobic, nor Misogynistic: A Response to Ideological Stereotyping

Bitcoin Price Is Mirroring The Same Movements From 2023, Here’s What It Means

Tether ends support for EURT stablecoin amid MiCA compliance

Will This Sell Signal Trigger ETH Crash?

No, Michael Saylor Doesn't Control Bitcoin

This Solana Rival Is Looking Great Amid Bitcoin Pullback, Says Top Crypto Analyst

Capybara is down by nearly 30% in 24-hour trading

Can Dogecoin Price Realistically Hit $4.20?

Remembering John McAfee's Bullish Bitcoin Price Bet as we near $100K Milestone

Cramer Doubles Down on Bitcoin, Pushes Back Against Criticism He Called the Top

Tornado Cash smart contracts cleared of OFAC sanctions in latest ruling

Bitcoin Price May Crash Below $88,000 On Global M2 Money Correlation

Use Bitcoin Easily And Privately With Cake Wallet

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: