Markets

Monochrome to Launch ‘World First’ Ethereum ETF on Cboe Australia

Published

1 month agoon

By

admin

Monochrome Asset Management is preparing to launch Australia’s first spot Ethereum exchange-traded fund on Cboe following the asset’s long-anticipated approval in the U.S. market.

Set to begin trading on Monday (Tuesday 10 AM AEDT), Monochrome’s Ethereum ETF (IETH) follows the launch of its Bitcoin ETF (IBTC) in August 2023, which has since garnered $15 million (US$10.1 million).

While that falls well short compared to the billions held in the U.S., the fund is positioning itself as the world’s first to offer in-kind Ethereum subscriptions and redemptions.

It’s a feature that could allow for greater tax efficiencies, CEO Jeff Yew told Decrypt in an exclusive interview.

The dual-access bare trust structure is designed to prevent a capital gains tax event, allowing long-term crypto participants to transfer Ethereum into the corresponding Monochrome ETF without triggering a change of legal and beneficial title.

“A ‘bare trust’ means that your investment in the ETF may be treated as if you directly own the Ethereum,” Yew explained.

In other words, the structure gives investors absolute entitlement to their allocated Ethereum, according to the fund’s public disclosure statement shared with Decrypt.

This means that any actions taken by the trustee are treated as actions of the investor, ensuring that no CGT event is triggered upon redemption or transfer as long as beneficial ownership remains unchanged.

This structure is what Monochrome is hoping sets its offering apart from its U.S. counterparts.

In January, the U.S. Securities and Exchange Commission approved 11 spot Bitcoin ETFs. That was later followed by the approval of nine Ethereum ETFs in May, with billions of dollars flowing into the funds in the months that followed.

While the Australian market is unlikely to ever match those inflows, Monochrome is hoping to build on surging investor interest this year.

“US crypto ETFs can’t be supported in kind, including Bitcoin ETFs, and they are not operated in this timezone,” Yew said.

IETH will track the CME CF Ether-Dollar Reference Rate – Asia Pacific Variant, with a management fee of 0.50%, reduced to 0.21% for accredited advisers. That places it within the range of its U.S. competitors, offering an average of 0.20% and 0.25%.

The ETF will also be available on most Australian brokerage platforms, supporting transfers from crypto platforms, decentralized wallets, and cold wallets.

Crypto financial services firm BitGo and crypto exchange operator Gemini will provide custody services for IETH, while State Street Australia will serve as the fund administrator.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Published

7 hours agoon

November 24, 2024By

admin

Dogecoin got another leg up late Friday and into early Saturday, climbing to a price point not seen in over three years. But it has since fallen, with DOGE and other top meme coins among the biggest losers of the last 24 hours.

DOGE popped above the $0.475 mark on Saturday morning—the first time that the meme coin had risen that high since May 2021. Dogecoin has been on a torrid surge in recent weeks, starting before the election and becoming substantially more explosive in the days after.

Previously, in terms of recent moves, DOGE had previously popped as high as nearly $0.43 on November 13; at the time, it was a three-year high mark, but that local peak has since been topped. DOGE is now up 195% over the last 30 days, and 430% over the past year, per data from CoinGecko.

It was a short-lived peak, however, as is typical for such a volatile coin. DOGE is now down to about $0.41 as of this writing as the broader crypto market cools after last week’s surge. Bitcoin, for example, has now dipped to a price of $96,725 after setting a new all-time high price of $99,645 on Friday and coming close to the $100,000 milestone mark.

Dogecoin is now down 12% over the past 24 hours, though it’s not the biggest loser from the top 10 cryptocurrencies by market cap: XRP has dipped by 14% during the same span after pushing to its own three-year-high mark on Friday.

Zooming out, however, it is mostly meme coins that have fallen the hardest out of the top 100 coins over the past 24 hours. Brett (BRETT), Bonk (BONK), Popcat (POPCAT), Dogwifhat (WIF), Pepe (PEPE), and Floki (FLOKI) have all fallen by 10% or more during that span, alongside Dogecoin. Broadly, the crypto market is down by nearly 5% over the past day.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Dogecoin

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Published

11 hours agoon

November 24, 2024By

admin

Some crypto enthusiasts speculate that the service, once live, might include transactions with some digital assets such as DOGE, given Musk’s long-standing affection for the token. Musk’s electric car company, Tesla, already accepts DOGE payments for some merchandise purchases in its online store.

Source link

Bitcoin Magazine Pro

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Published

2 days agoon

November 23, 2024By

admin

Bitcoin’s recent price action has been nothing short of exhilarating, but beyond the market buzz lies a wealth of on-chain data offering deeper insights. By analyzing metrics that gauge network activity, investor sentiment, and the BTC market cycles, we can gain a clearer picture of Bitcoin’s current position and potential trajectory.

Plenty Of Upside Remaining

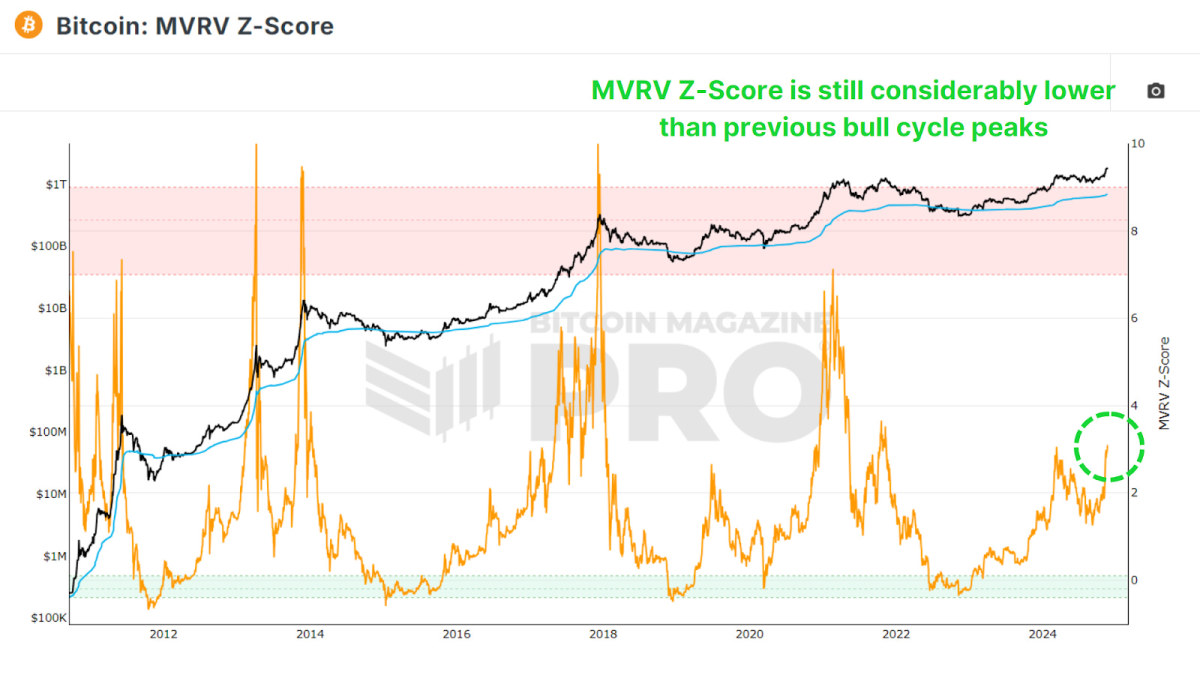

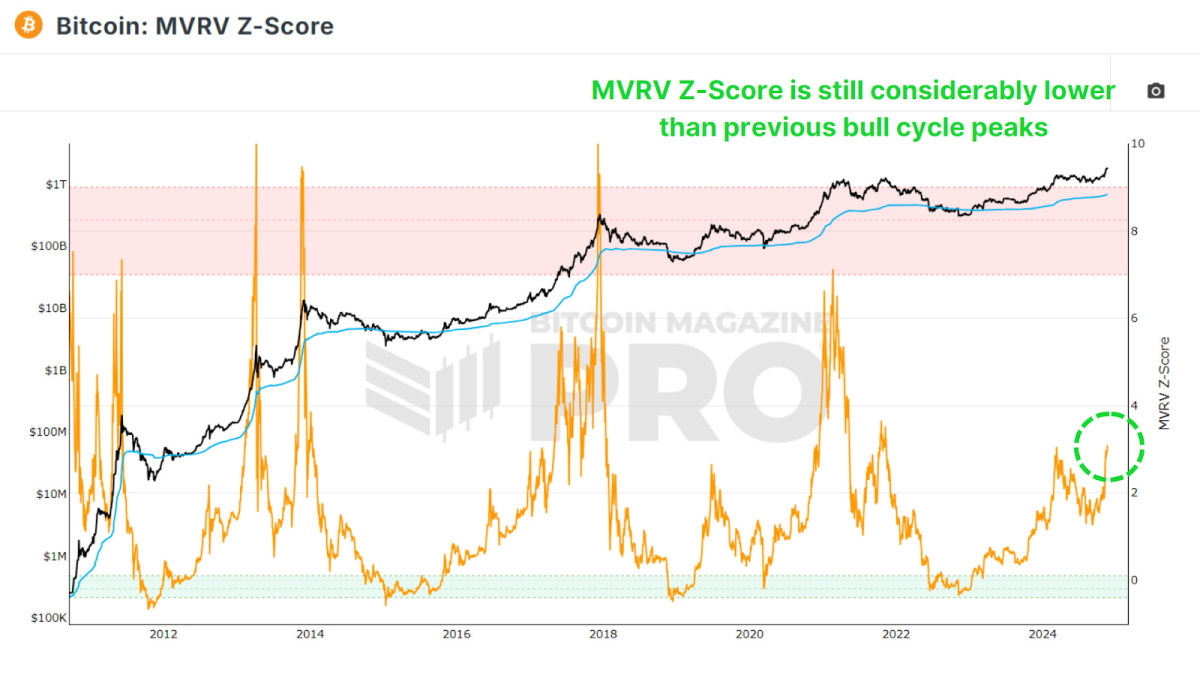

The MVRV Z-Score compares Bitcoin’s market cap, or price multiplied by circulating supply, with its realized cap, which is the average price at which all BTC were last transacted. Historically, this metric signals overheated markets when it enters the red zone, while the green zone suggests widespread losses and potential undervaluation.

Currently, despite Bitcoin’s rise to new all-time highs, the Z-score remains in neutral territory. Previous bull runs saw Z-scores reach highs of 7 to 10, far beyond the current level of around 3. If history repeats, this indicates significant room for further price growth.

Miner Profitability

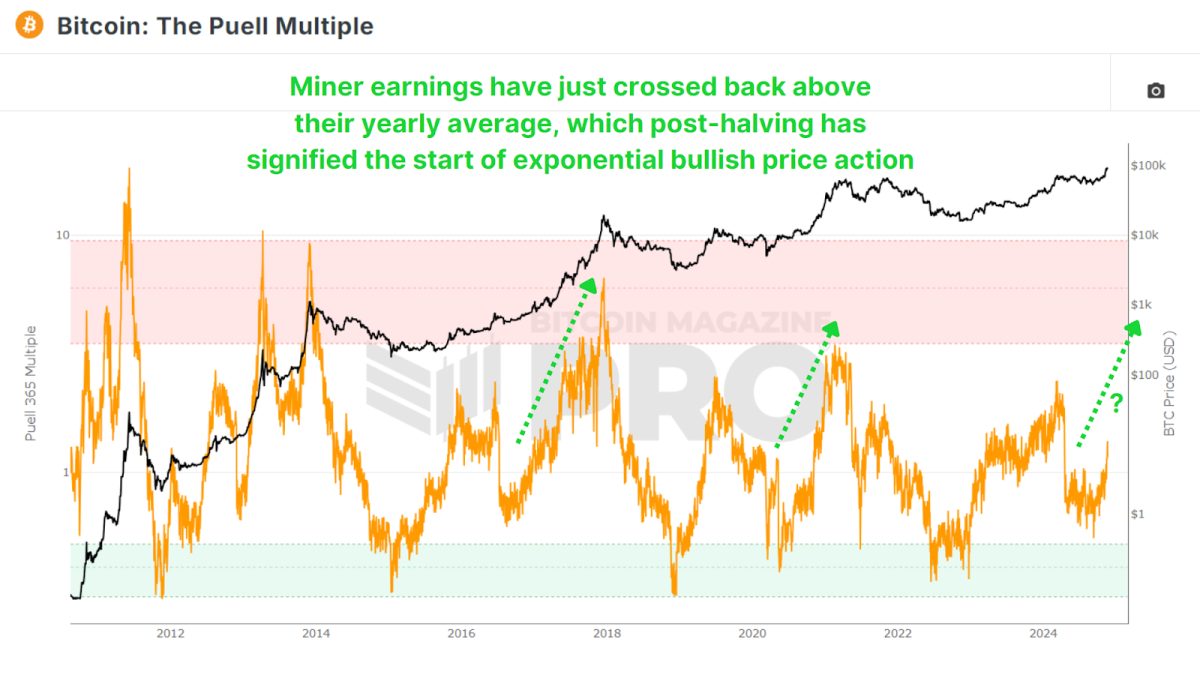

The Puell Multiple evaluates miner profitability by comparing their daily USD-denominated revenue to their previous one-year moving average. Post-halving, miners’ earnings dropped by 50%, which led to a multi-month period of decreased earnings as the BTC price consolidated for most of 2024.

Yet even now, as Bitcoin has skyrocketed to new highs, the multiple indicates only a 30% increase in profitability relative to historical averages. This suggests that we are still in the early to middle stages of the bull market, and when comparing the patterns in the data we look like we have the potential for explosive growth akin to 2016 and 2020. With a post-halving reset, consolidation, and a finally a reclaim of the 1.00 multiple level signifying the exponential phase of price action.

Measuring Market Sentiment

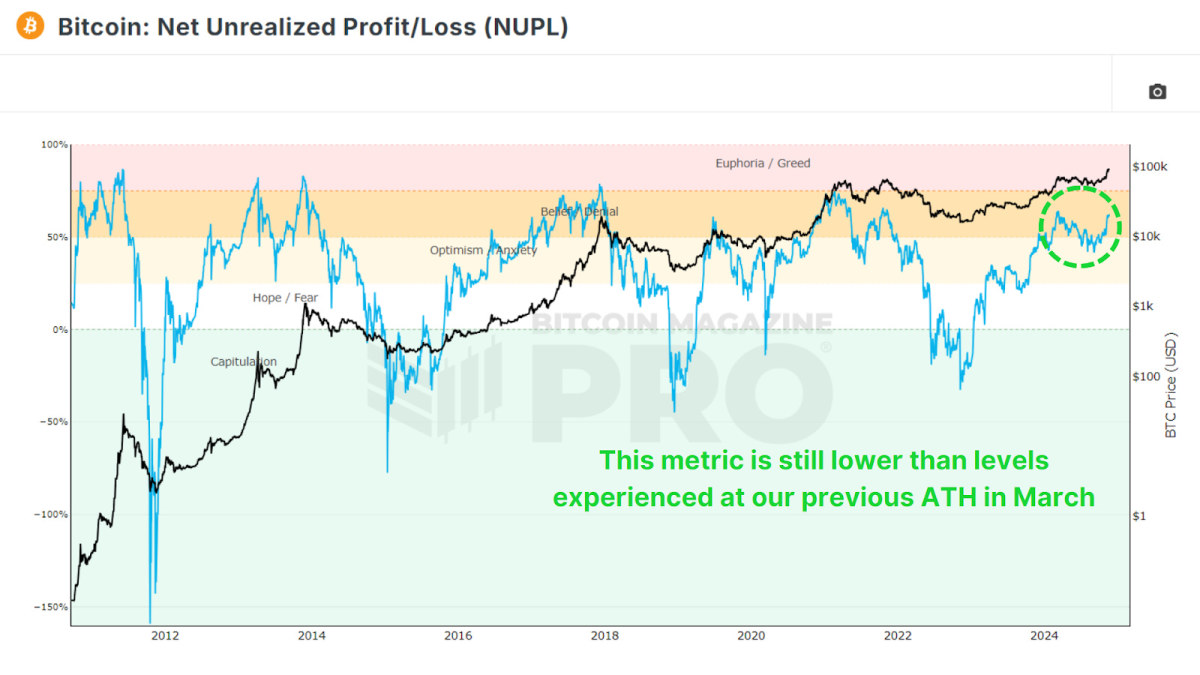

The Net Unrealized Profit and Loss (NUPL) metric quantifies the network’s overall profitability, mapping sentiment across phases like optimism, belief, and euphoria. Similar to the MVRV Z-Score as it is derived from realized value or investor cost-basis, it looks at the current estimated profit or losses for all holders.

Presently, Bitcoin remains in the ‘Belief’ zone, far from ‘Euphoria’ or ‘Greed’. This aligns with other data suggesting there is ample room for price appreciation before reaching market saturation. Especially considering this metric is still at lower levels than this metric reached earlier this year in March when we set out previous all-time high.

Long-Term Holder Trends

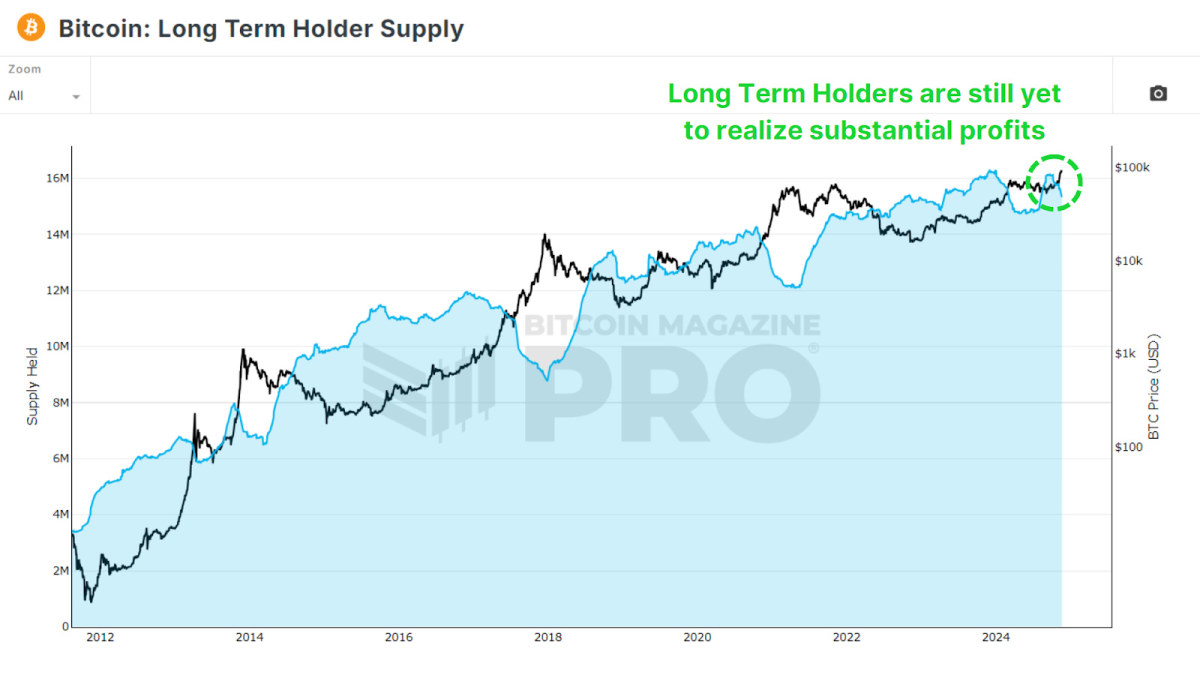

The percentage of Bitcoin held for over a year, represented by the 1+ Year HODL Wave, remains exceptionally high at around 64%, which is still higher than at any other point in Bitcoin history prior to this cycle. Prior price peaks in 2017 and 2021 saw these values fall to 40% and 53%, respectively as long-term holders began to realize profits. If something similar were to occur during this cycle, then we still have millions of bitcoin to be transferred to new market participants.

So far, only around 800,000 BTC has been transferred from the Long Term Holder Supply to newer market participants during this cycle. In past cycles, up to 2–4 million BTC changed hands, highlighting that long-term holders have yet to cash out fully. This indicates a relatively nascent phase of the current bull run.

Tracking “Smart Money”

The Coin Days Destroyed metric weighs transactions by the holding duration of coins, emphasizing whale activity. We can then multiply that value by the BTC price at that point in time to see the Value Days Destroyed (VDD) Multiple. This gives us a clear insight into whether the largest and smartest BTC holders are beginning to realize profits in their positions.

Current levels remain far from the red zones typically seen during market tops. This means whales and “smart money” are not yet offloading significant portions of their holdings and are still awaiting higher prices before beginning to realize substantial profits.

Conclusion

Despite the rally, on-chain metrics overwhelmingly suggest that Bitcoin is far from overheated. Long-term holders remain largely steadfast, and indicators like the MVRV Z-score, NUPL, and Puell Multiple all highlight room for growth. That said, some profit-taking and new market participants signal a transition into the mid to late-cycle phase, which could potentially be sustained for most of 2025.

For investors, the key takeaway is to remain data-driven. Emotional decisions fueled by FOMO and euphoria can be costly. Instead, follow the underlying data fueling Bitcoin and use tools like the metrics discussed above to guide your own investing and analysis.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Source link

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential