Price analysis

Will XRP Price Go Down to Zero?

Published

1 month agoon

By

admin

Amid ongoing regulatory battles and market uncertainty, investors are questioning the future of the XRP price. The SEC’s efforts to overturn the non-security ruling have heightened fear, uncertainty, and doubt (FUD), raising concerns about whether XRP could face a catastrophic drop to zero. With the cryptocurrency’s volatility and a long-standing lawsuit, many wonder if XRP will succumb to the pressure. What is the likelihood of such a scenario?

The price of XRP hit a low of $0.3834 on July 1 before surging 72% to $0.6645 on Sept. 23. The price has since retraced and is hovering around $0.54.

Is XRP Price Destined to Go to Zero?

Investors and analysts debate the possibility that XRP could drop to zero. While some believe regulatory challenges and market dynamics could drive the price down, others argue that XRP’s utility and adoption will prevent such an outcome. Some of the reasons why the XRP price could drop to zero include:

- The U.S. Securities and Exchange Commission (SEC) managed to twist the case in their favor, overturning the XRP non-security ruling. This move would likely instill panic and FUD in the market, driving the asset’s price to new all-time lows.

- Bitcoin creator Satoshi Nakamoto being revealed could impact the price of XRP and every other crypto as it would lead to movement of his 1.1 million BTC. Such an influx into the market would cause significant price drops as panic grips investors.

- Stiff competition in the market with the likes of Hedera Hashgraph (HBAR), Algorand (ALGO), and Chainlink (LINK) is making significant strides with their rate of adoption by financial institutions—Ripple’s main clientele.

Despite these circumstances that threaten the XRP price, Ripple’s efforts to expand its use cases and partnerships could provide a buffer against a complete price collapse. Additionally, the broader cryptocurrency market trends and Bitcoin’s performance often play a crucial role in determining the direction of crypto prices.

Currently, the Ripple price is trading around $0.5399, and despite facing significant legal hurdles, it has maintained a relatively stable position in the market. The average cost for Ripple in 2024 is currently standing at $0.57. That means everyone who bought above that price is currently sitting in losses.

Ripple Price Analysis: What’s Next for XRP?

XRP has shown resilience despite the bearish sentiment. The price has been fluctuating within a tight range, with significant support levels around $0.50 and $0.64. Technical indicators suggest that the asset might experience further volatility, but a complete drop to zero seems unlikely in the near term.

Historically, the XRP price has had only two massive price jumps since its inception in late 2013. The asset bull run happened 252 days after the 2016 Bitcoin halving, pushing the asset 41,000% up. However, the second halving found XRP entangled with the SEC in a lawsuit, and the resulting bull market saw the asset rise by only 1,000% 232 days after halving. Nevertheless, this was still commendable, given the vice grip by the SEC.

The average waiting duration for the two waiting durations following the halving before the XRP rally kicked off is 241 days. Given that it has been 175 days since the 2024 bitcoin halving, the XRP bull market could begin in 66 days, surging 21,000% to $132.

Interestingly, December 19, 2024, is 66 days from today, marking five years since the SEC v. Ripple lawsuit began. If Ripple can overcome its legal challenges and continue to secure strategic partnerships, it could see an XRP price recovery. On the other hand, if the regulatory environment worsens or if Ripple fails to deliver on its promises, the price could face downward pressure.

Frequently Asked Questions (FAQs)

No one can predict with certainty, but it is unlikely in the near term. While XRP has faced legal challenges, especially from the SEC, it has maintained stability and utility within the crypto market.

Since its inception in 2013, XRP has had two major price rallies. After the 2016 Bitcoin halving, XRP surged by 41,000%. However, during the 2020 halving, which coincided with Ripple’s lawsuit, XRP rose only 1,000%.

December 19, 2024, marks the 5th anniversary of the SEC v. Ripple lawsuit and coincides with historical patterns suggesting the start of an XRP bull run. If legal outcomes favor Ripple and market conditions align, a significant price rise could occur.

Related Articles

Evans Karanja

Evans Karanja is a crypto analyst and journalist with a deep focus on blockchain technology, cryptocurrency, and the video gaming industry. His extensive experience includes collaborating with various startups to deliver insightful and high-quality analyses that resonate with their target audiences. As an avid crypto trader and investor, Evans is passionate about the transformative potential of blockchain across diverse sectors. Outside of his professional pursuits, he enjoys playing video games and exploring scenic waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Will The Bitcoin Price Repeat the November 28 ATH Pattern of 2013 and 2017 in 2024?

Former commissioner Paul Atkins is top candidate for SEC chair

Will Algorand (ALGO) Price Hit $1 Soon?

Bitcoin is Neither Racist, Xenophobic, nor Misogynistic: A Response to Ideological Stereotyping

Bitcoin Price Is Mirroring The Same Movements From 2023, Here’s What It Means

Tether ends support for EURT stablecoin amid MiCA compliance

meme coin

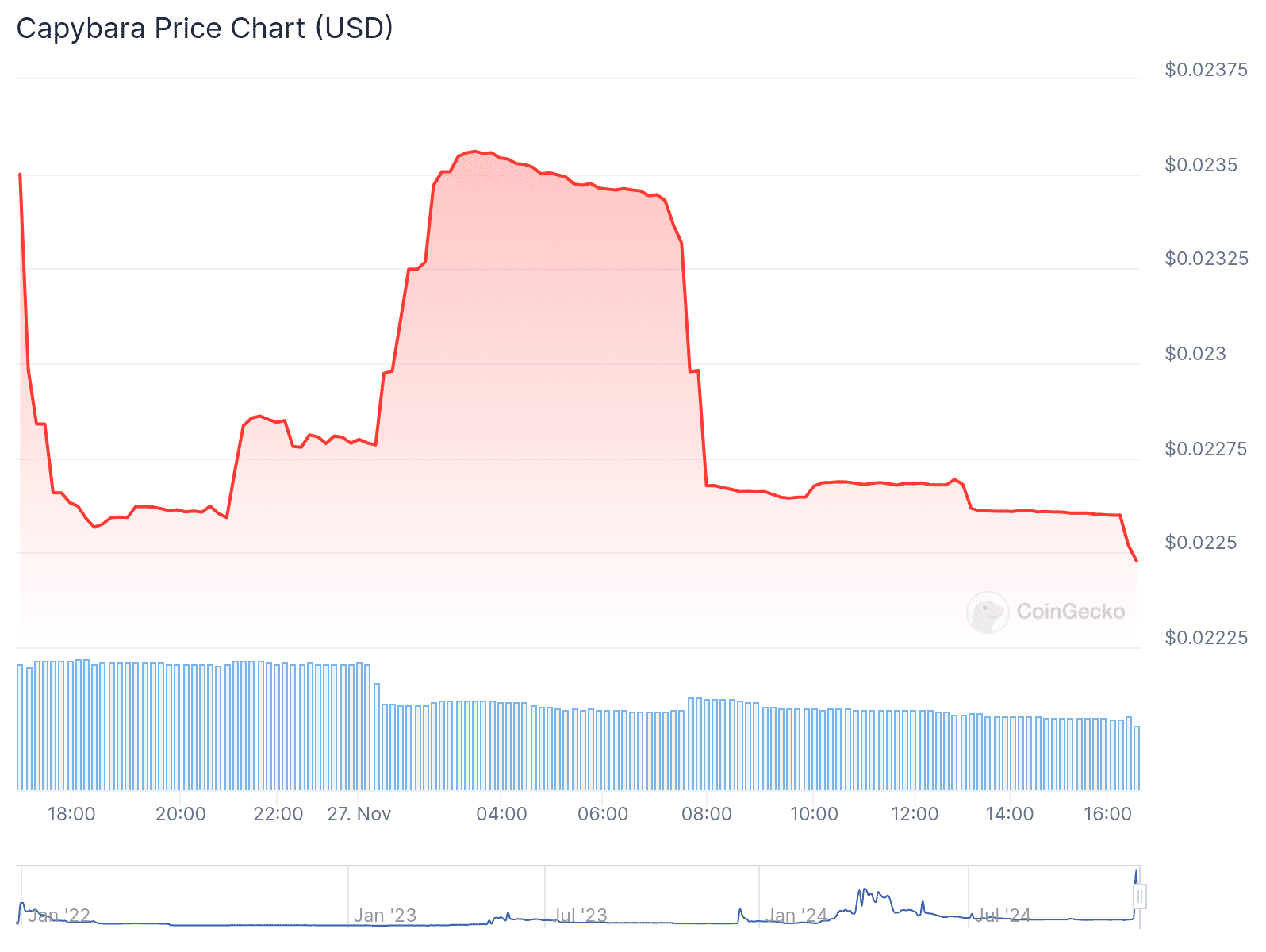

Capybara is down by nearly 30% in 24-hour trading

Published

11 hours agoon

November 27, 2024By

admin

The Capybara token has gone down by 29.2% in the past 24-hours of trading, despite the Solana-powered token having soared through the week at 76%.

In the past day, the Capybara(CAPY) token has slid down by 29.2% according to data from crypto.news. The animal-themed token is currently trading hands at $0.002478.

Despite the downhill slope it is currently in, CAPY has been on an upward trend in the past seven days, with its price going up by nearly 80%. The Solana-based token has even seen a 121.87% in the past month, but it seems its rally has come to an end.

The token featuring the adorable South America-native rodent has had an experience quite similar to other animal-themed meme coins such as MOODENG(MOODENG). Just a few days ago on Nov. 22, CAPY went through a meteoric rise, reaching a new all-time-high of $0.0191521. But the token has since struggled to climb back up to its peak.

At the time of writing, the Capybara token’s trading volume stands at $4,538, decreasing by more than 50% compared to the previous day. Though, the token does not have a visible market cap, therefore it is nowhere near the cryptocurrency rankings. Not only that, CAPY also does not have any tokens on its circulating supply, despite its total supply amounting to 1 billion tokens.

On X, CAPY is being tweeted almost every minute along with other meme coins like CATI, HMSTR, DUCKS and DOGS. Most of these tweets seem to be automatically generated by bots using random accounts.

On the official website, Capybara World, the CAPY token is described as a community-driven token inspired by “the most peaceful animal in the world.” The Capybara token was launched in Dec. 2021, available for trading on Raydium and dexlab.

Over the years, the capybara has become one of the internet’s favorite animals. According to the South China Morning Post, there has been an influx of capybara content on various social media platforms like Instagram, TikTok and YouTube. The capybara is known for its laid-back and serene demeanor, becoming a symbol of peace and tranquility.

Source link

Doge price

Can Dogecoin Price Realistically Hit $4.20?

Published

12 hours agoon

November 27, 2024By

admin

Cryptocurrencies stabilized a bit on Wednesday after slipping in the past two consecutive days. Dogecoin price rose slightly as traders anticipated Elon Musk’s DOGE success. One analyst predicted that the dog-themed coin would jump to $4.20 in the ongoing crypto bull run.

Analyst Predicts Dogecoin Price Could Hit $4.20

Dogecoin price has been in a strong uptrend in the past few weeks as it jumped by almost 500% between August 5 and November 23. This rally coincided with the broader uptrend in the crypto industry after Donald Trump won the election and appointed Elon Musk to lead the Department of Government Efficiency (DOGE).

In an X post, CEO, a popular crypto investor with over 511,000 followers, predicted that the DOGE price would jump to $4.20 in the ongoing cycle. If that was to happen, it would mean that the coin will rise by 976% from the current level. Such a move is possible in the crypto industry since DOGE has already risen by 160% in the past few days. If it happened, DOGE’s market cap would jump from the current $57 billion to over $613 billion.

For this to happen, cryptocurrencies need to be in a strong bull run, which would attract a sense of greed in the market. Also, Bitcoin, the biggest cryptocurrency in the market would need to continue its uptrend. In most periods, altcoins like Dogecoin thrive when Bitcoin is in a strong rally.

Other cryptocurrencies are highly bullish on the Dogecoin price. In a post, The Cryptomist noted that the coin was forming a falling wedge pattern. This pattern forms when an asset forms two descending and converging trendlines. It usually leads to a strong breakout when the wedge is about to converge.

DOGE Price Chart Points To Eventual Breakout

While talk of DOGE price surging to $4.2 is good, the most realistic situation is to first target the psychological point at $1.

The weekly chart shows that the value of DOGE has been in a long bullish trend as it jumped for six consecutive weeks. In most cases, assets tend to take a breather after such a long bull run.

It remains above the important resistance level at $0.2278, its highest point in March this year. Moving above that point invalidated a double-top pattern whose neckline was at $0.0836. The coin remains significantly higher than the 50-week and 200-week moving averages.

More Dogecoin price upside will be confirmed if it jumps above this month’s high at $0.4790. Such a move will raise the chances of it rising to its all-time high of $0.7393, which is about 87% above the current level.

This Dogecoon price prediction will become invalid if it drops below the key support at $0.2833, the 61.8% Fibonacci Retracement point. Such a move will raise the possibility of it dropping to $0.20.

Frequently Asked Questions (FAQs)

Yes, the coin can jump to $4.2 since everything in the crypto industry is possible. For example, Bitcoin has risen from below $1 in 2016 to near $100,000 today. DOGE needs to jump by less than 1,000% to get to $4.2.

For Dogecoin to hit $1, it first needs to rise above this month’s high of $0.4790. A move above that level will raise the possibility of it retesting its all-time high of $0.7393.

Dogecoin has a market cap of over $57 billion. A move to $1 would push its valuation to over $147 billion.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Doge price

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Published

1 day agoon

November 26, 2024By

admin

Bitcoin’s recent sell-off has affect, Dogecoin leading to a 21% crash. Regardless, the long-term outlook remains bullish, which leads many to believe that the Dogecoin price could be on a path to retest $1 this year. Will DOGE bulls pull through?

Dogecoin Price Could Surge To $1: Analyst

Dogecoin price has dropped to $0.3787, down by 21% from its highest level this year. A 20% drop from a local top of $0.4790 is a sign that it has moved into a short-term retracement. This decline is most likely because of the ongoing crypto sell-off, with Bitcoin falling from this month’s high of $99,700 to $92,000.

However, some analysts believe that the Dogecoin price will bounce back and hit $1. As such, the coin needs to rise by 164% from the current level. In a note, Bluntz, who has almost 300,000 followers, noted that the coin was in the fourth phase of the Elliot Wave.

Elliot Wave is a theory that explains how financial assets move over time. Its impulse phase is made up of five stages, with the third one being the longest. The fourth wave is usually a corrective one and is followed by the bullish fifth wave.

In another post, Gladiator, a popular analyst, estimates that DOGE price has more upside as its performance mirrors that of the last bull cycle in 2021. He expects that the coin could jump to as high as $10 at the turn of the year.

Meanwhile, Trader Tardigrade noted that the value of DOGE coin was forming a high tight flag pattern, a rare sign that indicates a strong upward movement. He expects that Dogecoin will jump to $1, especially if FOMO resumes.

DOGE Price Analysis As It Hits Key Support

Dogecoin price has pulled back after it formed a doji candlestick pattern on November 24. A doji is characterized by long upper and lower shadows and a small body. It is one of the most bearish reversal patterns in the market.

The coin has dropped and hit a crucial support, which is made up of the lowest swings on November 12 and 17. If it ends the day above that support level, it will be a sign that it has formed a morning star candle, a popular bullish reversal sign.

Dogecoin price has remained above the 50-day and 200-moving averages. It is also above the key support at $0.2286, the upper side of the cup and handle pattern.

Therefore, since it has formed a bullish-flag-like pattern, there is a likelihood that it will bounce back in the coming days. If this happens, the initial target will be at $0.4795, its highest swing this month. A break above that level will point to more gains, potentially to $1.

On the other hand, a drop below the lower side of the ascending channel at $0.3646 will invalidate the Dogecoin price prediction. That breakdown could push it to the psychological level at $0.30.

Frequently Asked Questions (FAQs)

Dogecoin needs to rise by 165% to get to $1, which is a possibility in the crypto industry. Just recently, it jumped by 486% from its lowest point in August and this month’s high.

The cryptocurrency industry needs to be doing well and the coin needs to move above the resistance level at $0.4795 for this bull run to happen.

Dogecoin can crash to as low as $0.2286, the upper side of the cup and handle pattern. That move will be confirmed if it drops below $0.30.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Will The Bitcoin Price Repeat the November 28 ATH Pattern of 2013 and 2017 in 2024?

Bitcoin Bridged Trustlessly to L2; Ethereum’s Blob Mob

Former commissioner Paul Atkins is top candidate for SEC chair

Will Algorand (ALGO) Price Hit $1 Soon?

Bitcoin is Neither Racist, Xenophobic, nor Misogynistic: A Response to Ideological Stereotyping

Bitcoin Price Is Mirroring The Same Movements From 2023, Here’s What It Means

Tether ends support for EURT stablecoin amid MiCA compliance

Will This Sell Signal Trigger ETH Crash?

No, Michael Saylor Doesn't Control Bitcoin

This Solana Rival Is Looking Great Amid Bitcoin Pullback, Says Top Crypto Analyst

Capybara is down by nearly 30% in 24-hour trading

Can Dogecoin Price Realistically Hit $4.20?

Remembering John McAfee's Bullish Bitcoin Price Bet as we near $100K Milestone

Cramer Doubles Down on Bitcoin, Pushes Back Against Criticism He Called the Top

Tornado Cash smart contracts cleared of OFAC sanctions in latest ruling

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: