Markets

I Bought MicroStrategy (MSTR) Stock For No Real Reason

Published

1 month agoon

By

admin

The price of MicroStrategy stock surging above $200, the MSTR bulls were out in force last week, insufferably posting about how Michael Saylor’s tech firm, a once dead tech company from the dot-com era, will outperform everything again this cycle.

Look, I’m not going to even start parsing the hokum. You can follow BitPaine, Dan Hillery, or one of the hundreds of Bitcoin X accounts which now comprise the MSTR bull twitterverse.

There’s videos, threads, and of course, a lot of people who are irresponsibly long…

But the general gist is this:

- Michael Saylor’s has decided to buy over 200,000 BTC, and to keep buying Bitcoin until the fiat system collapses. He will continue leveraging cheap debt to do this, which he can borrow because this is how the fiat system works, infinite money glitch.

- This will make his company more valuable than other companies – since it offers exposure to a valuable and scarce commodity (Bitcoin), but with added beta due to the companies existing profitable product suite. Said another way, as the Bitcoin they accumulate gains in value, Microstrategy stock will look undervalued compared to the underlying collateral.

- Since BTC won’t go to zero, and the Federal Reserve has to keep cutting rates (boosting stocks), this is a perfect storm for MSTR, and it will benefit from the liquidity injection and outperform Bitcoin even as Bitcoin enters its 4-year cycle … blah blah blah.

This is my best attempt to repeat this thesis, I wrote it in 2 minutes. I refuse to even copy edit it. The gist is companies that some people believe buying Bitcoin stock can outperform Bitcoin for some reason, and that this isn’t speculation, but morally aligned Bitcoin maximalism, or something…

Maybe Dylan LeClair can explain the math to you. He’s tried with me multiple times, and I’ve never understood anything more than the above. Amount of Bitcoin the company owns per share = good. No Bitcoin divided by shares = bad.

So, why did I buy MSTR? Short story, I had money in my 401(k) that I can only invest in regulated investments. (Yes, that means I own Bitcoin ETFs as well.)

But that’s not really the whole story. Really, I’m just tired of watching the MSTR bulls be right about whatever it is they are talking about, and want some skin in the upside. Should I have done some diligence here? Should I have some hypothesis? Shouldn’t I just be HODLING?

Maybe, but have you considered Michael Saylor, bull, bull, bull?

Source link

You may like

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Bitcoin Magazine Pro

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Published

1 day agoon

November 23, 2024By

admin

Bitcoin’s recent price action has been nothing short of exhilarating, but beyond the market buzz lies a wealth of on-chain data offering deeper insights. By analyzing metrics that gauge network activity, investor sentiment, and the BTC market cycles, we can gain a clearer picture of Bitcoin’s current position and potential trajectory.

Plenty Of Upside Remaining

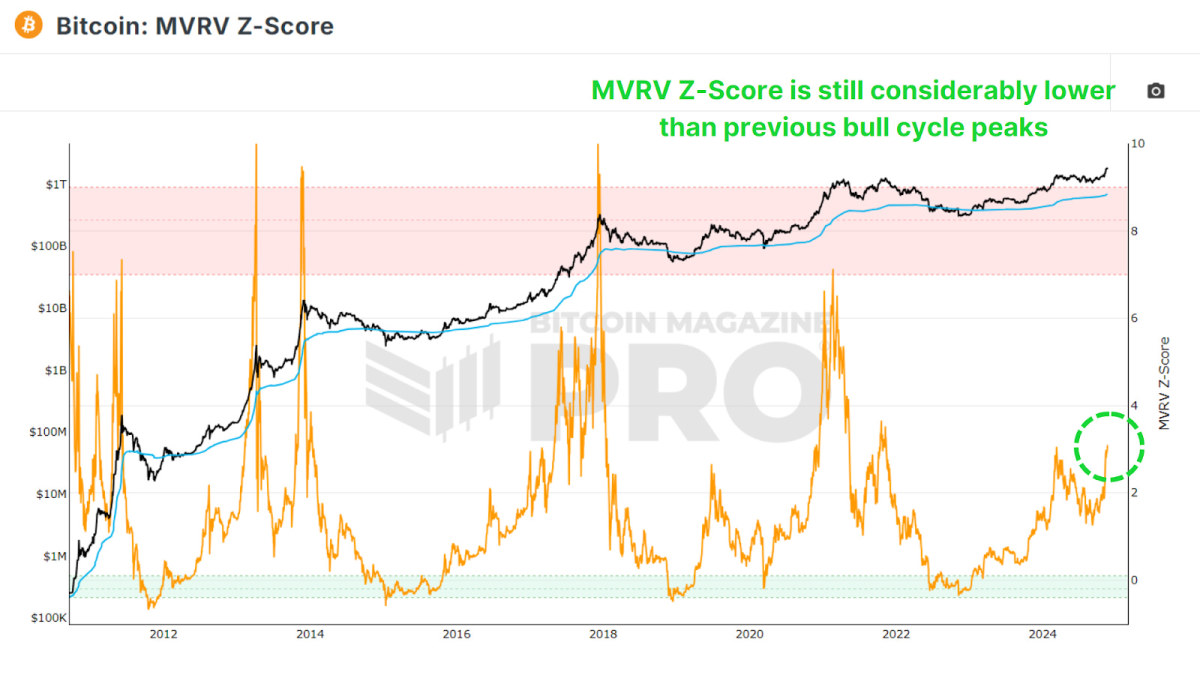

The MVRV Z-Score compares Bitcoin’s market cap, or price multiplied by circulating supply, with its realized cap, which is the average price at which all BTC were last transacted. Historically, this metric signals overheated markets when it enters the red zone, while the green zone suggests widespread losses and potential undervaluation.

Currently, despite Bitcoin’s rise to new all-time highs, the Z-score remains in neutral territory. Previous bull runs saw Z-scores reach highs of 7 to 10, far beyond the current level of around 3. If history repeats, this indicates significant room for further price growth.

Miner Profitability

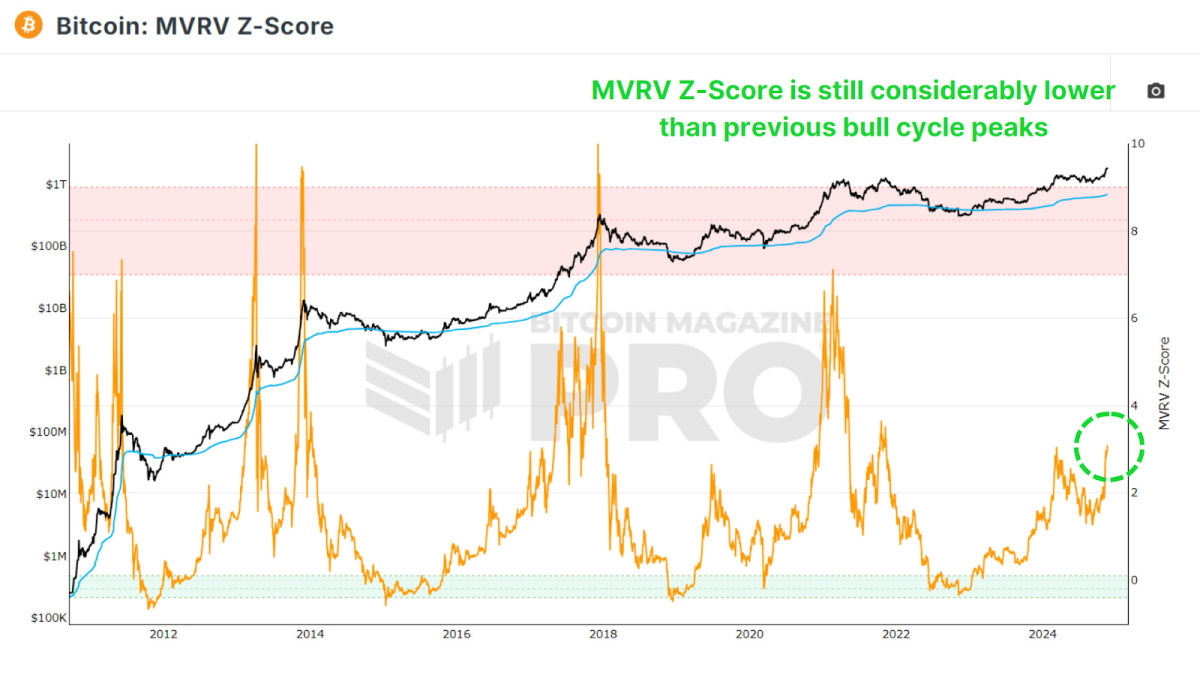

The Puell Multiple evaluates miner profitability by comparing their daily USD-denominated revenue to their previous one-year moving average. Post-halving, miners’ earnings dropped by 50%, which led to a multi-month period of decreased earnings as the BTC price consolidated for most of 2024.

Yet even now, as Bitcoin has skyrocketed to new highs, the multiple indicates only a 30% increase in profitability relative to historical averages. This suggests that we are still in the early to middle stages of the bull market, and when comparing the patterns in the data we look like we have the potential for explosive growth akin to 2016 and 2020. With a post-halving reset, consolidation, and a finally a reclaim of the 1.00 multiple level signifying the exponential phase of price action.

Measuring Market Sentiment

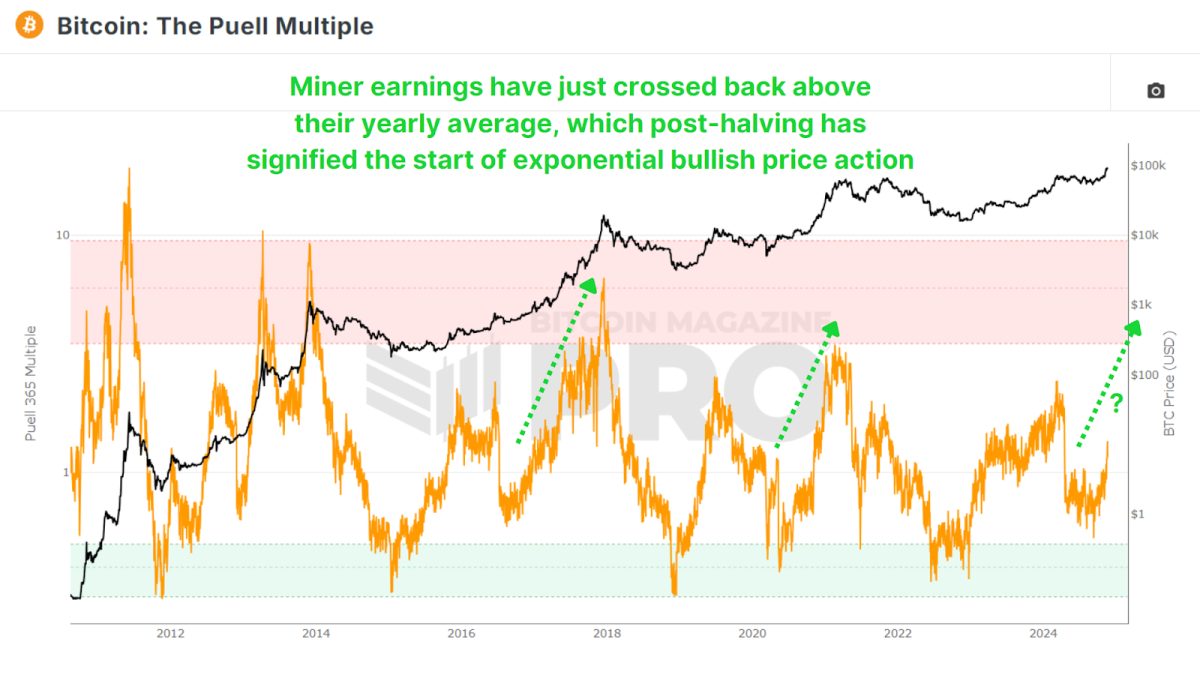

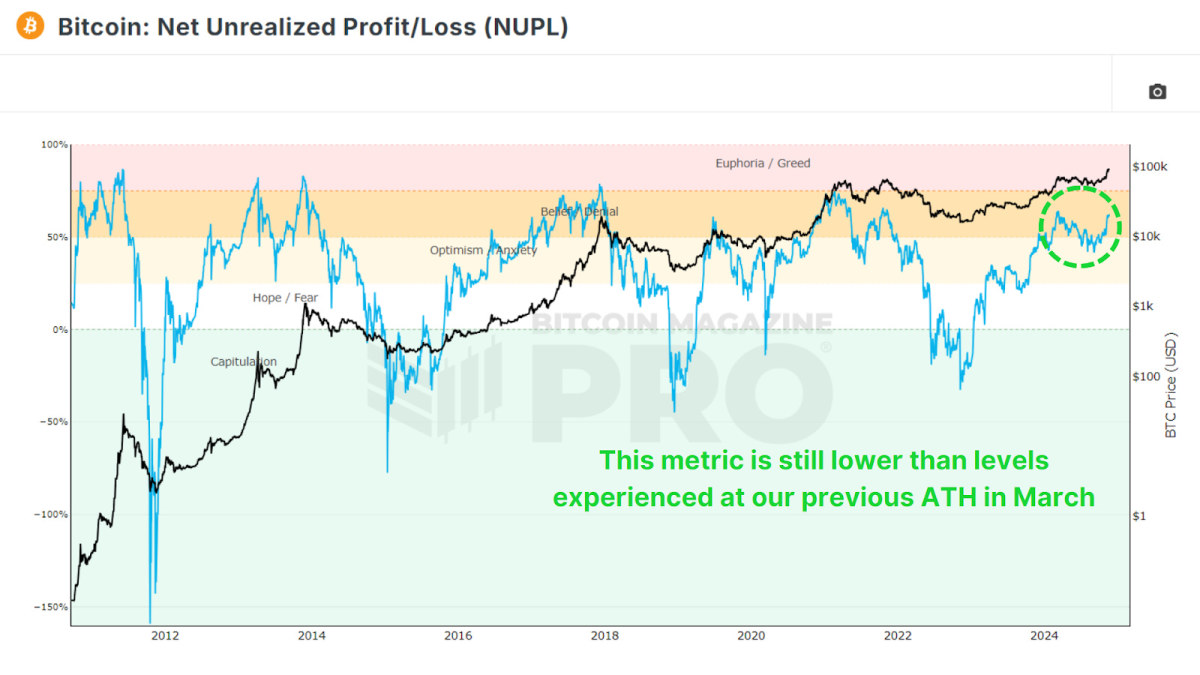

The Net Unrealized Profit and Loss (NUPL) metric quantifies the network’s overall profitability, mapping sentiment across phases like optimism, belief, and euphoria. Similar to the MVRV Z-Score as it is derived from realized value or investor cost-basis, it looks at the current estimated profit or losses for all holders.

Presently, Bitcoin remains in the ‘Belief’ zone, far from ‘Euphoria’ or ‘Greed’. This aligns with other data suggesting there is ample room for price appreciation before reaching market saturation. Especially considering this metric is still at lower levels than this metric reached earlier this year in March when we set out previous all-time high.

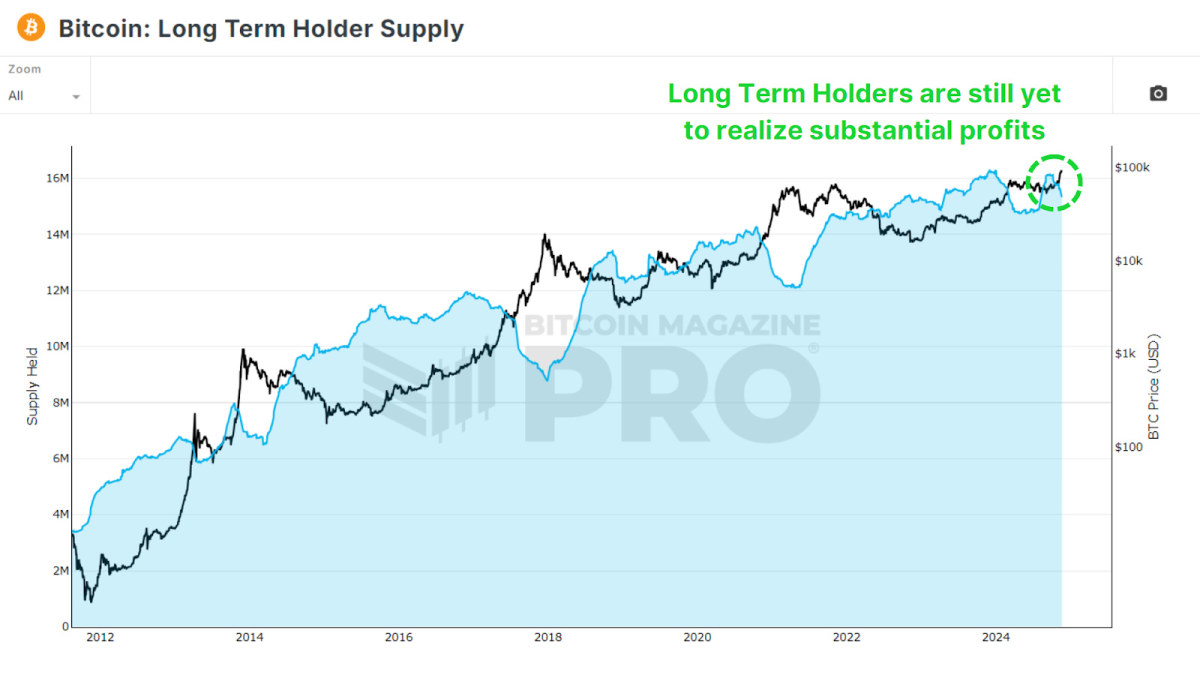

Long-Term Holder Trends

The percentage of Bitcoin held for over a year, represented by the 1+ Year HODL Wave, remains exceptionally high at around 64%, which is still higher than at any other point in Bitcoin history prior to this cycle. Prior price peaks in 2017 and 2021 saw these values fall to 40% and 53%, respectively as long-term holders began to realize profits. If something similar were to occur during this cycle, then we still have millions of bitcoin to be transferred to new market participants.

So far, only around 800,000 BTC has been transferred from the Long Term Holder Supply to newer market participants during this cycle. In past cycles, up to 2–4 million BTC changed hands, highlighting that long-term holders have yet to cash out fully. This indicates a relatively nascent phase of the current bull run.

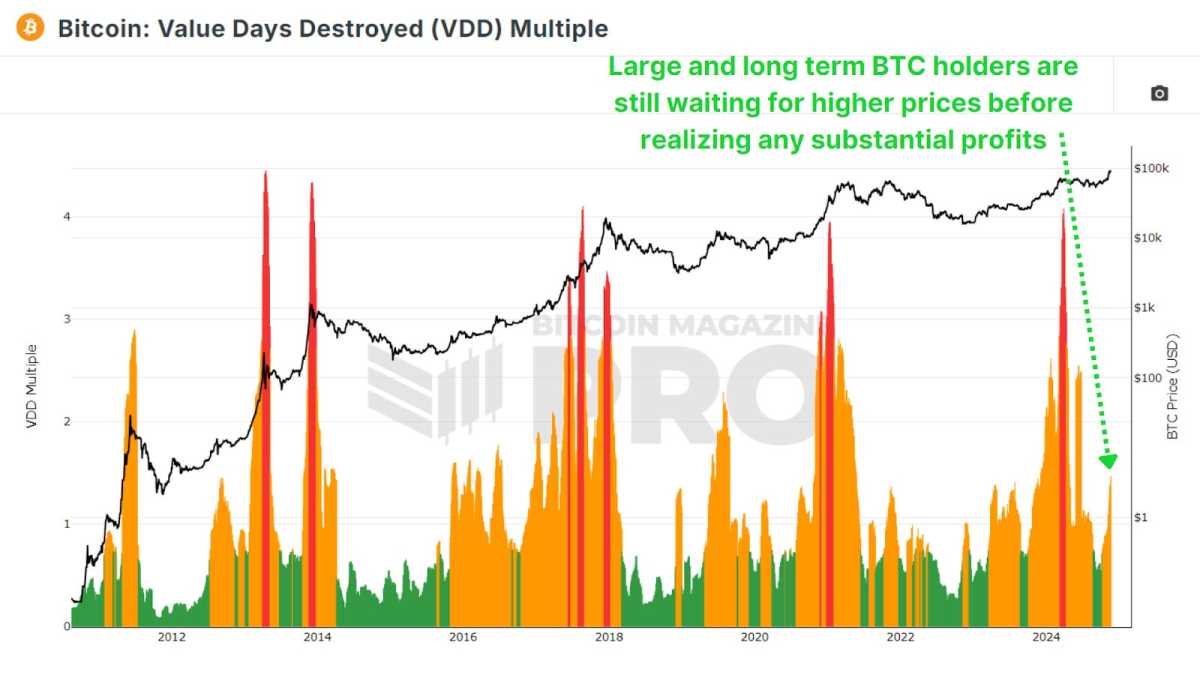

Tracking “Smart Money”

The Coin Days Destroyed metric weighs transactions by the holding duration of coins, emphasizing whale activity. We can then multiply that value by the BTC price at that point in time to see the Value Days Destroyed (VDD) Multiple. This gives us a clear insight into whether the largest and smartest BTC holders are beginning to realize profits in their positions.

Current levels remain far from the red zones typically seen during market tops. This means whales and “smart money” are not yet offloading significant portions of their holdings and are still awaiting higher prices before beginning to realize substantial profits.

Conclusion

Despite the rally, on-chain metrics overwhelmingly suggest that Bitcoin is far from overheated. Long-term holders remain largely steadfast, and indicators like the MVRV Z-score, NUPL, and Puell Multiple all highlight room for growth. That said, some profit-taking and new market participants signal a transition into the mid to late-cycle phase, which could potentially be sustained for most of 2025.

For investors, the key takeaway is to remain data-driven. Emotional decisions fueled by FOMO and euphoria can be costly. Instead, follow the underlying data fueling Bitcoin and use tools like the metrics discussed above to guide your own investing and analysis.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Source link

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

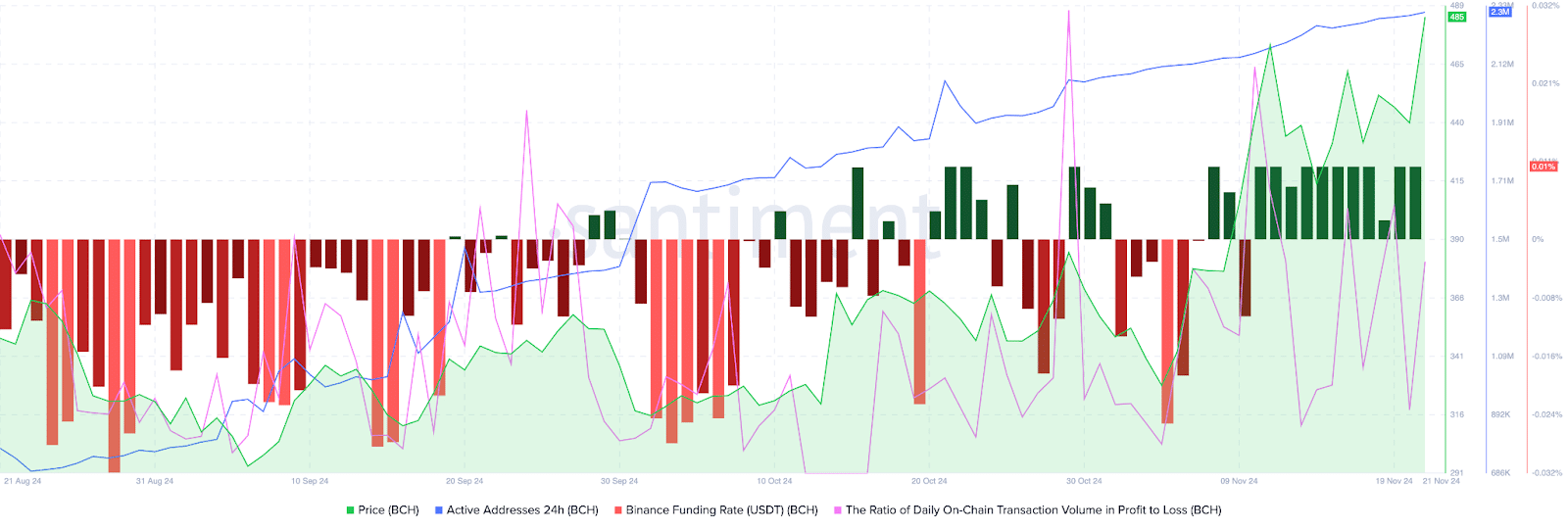

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

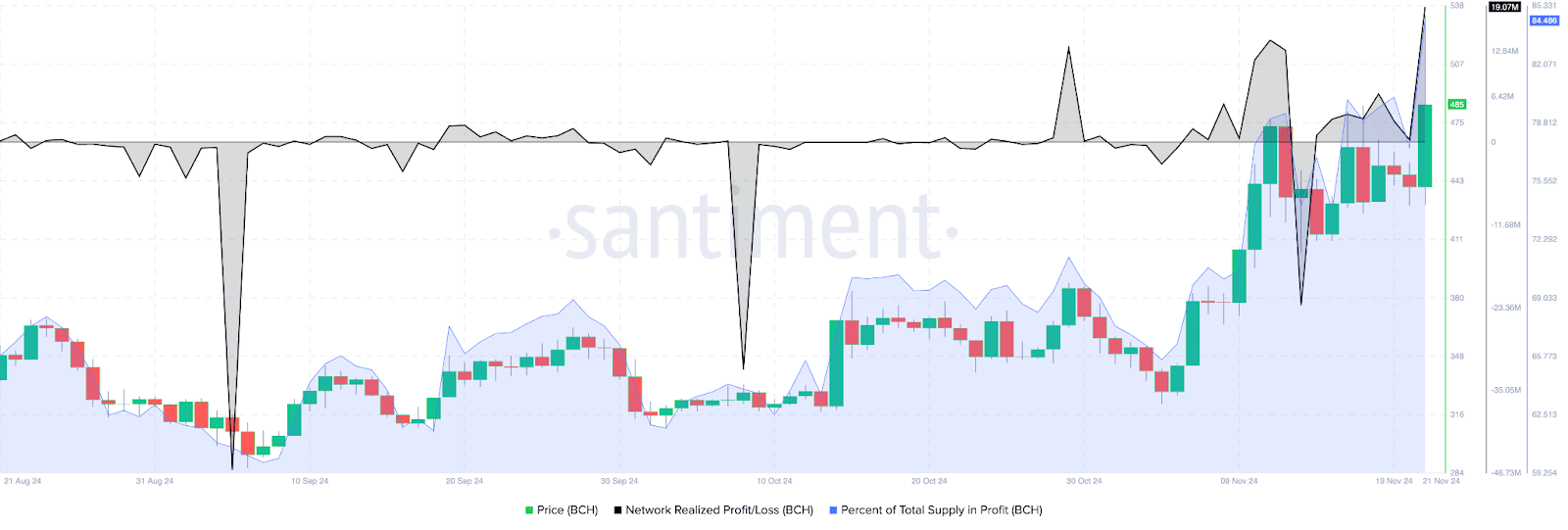

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

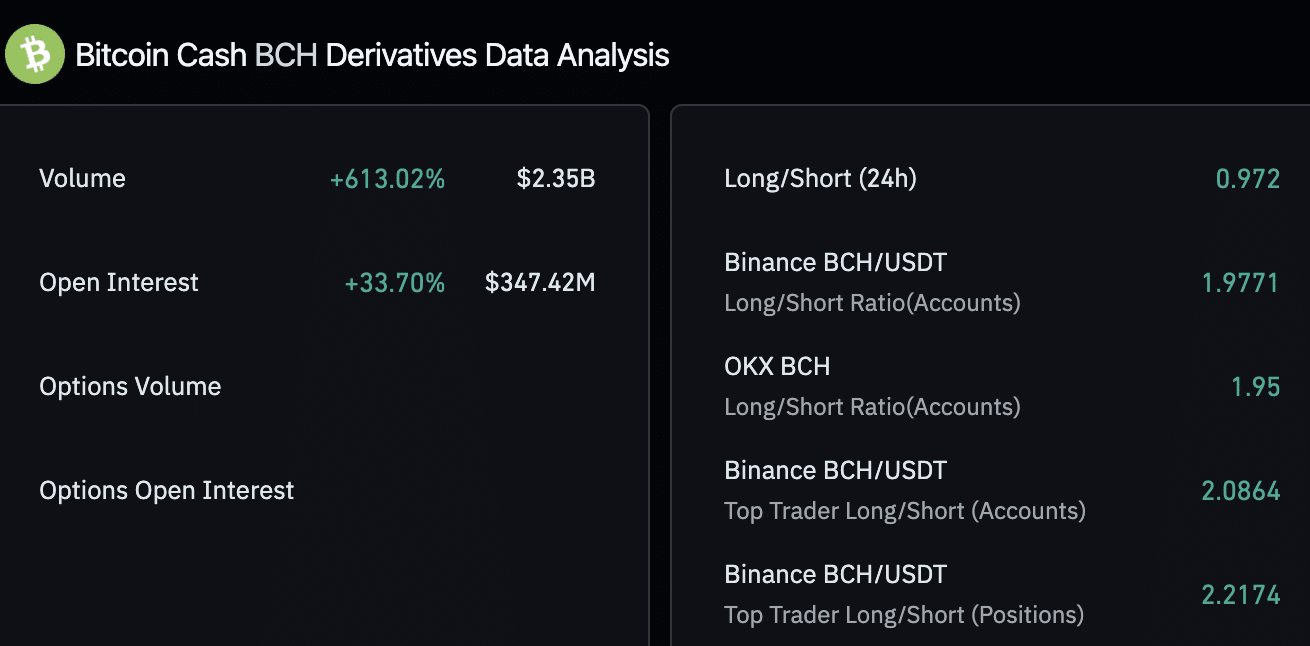

Derivatives traders are bullish on BCH

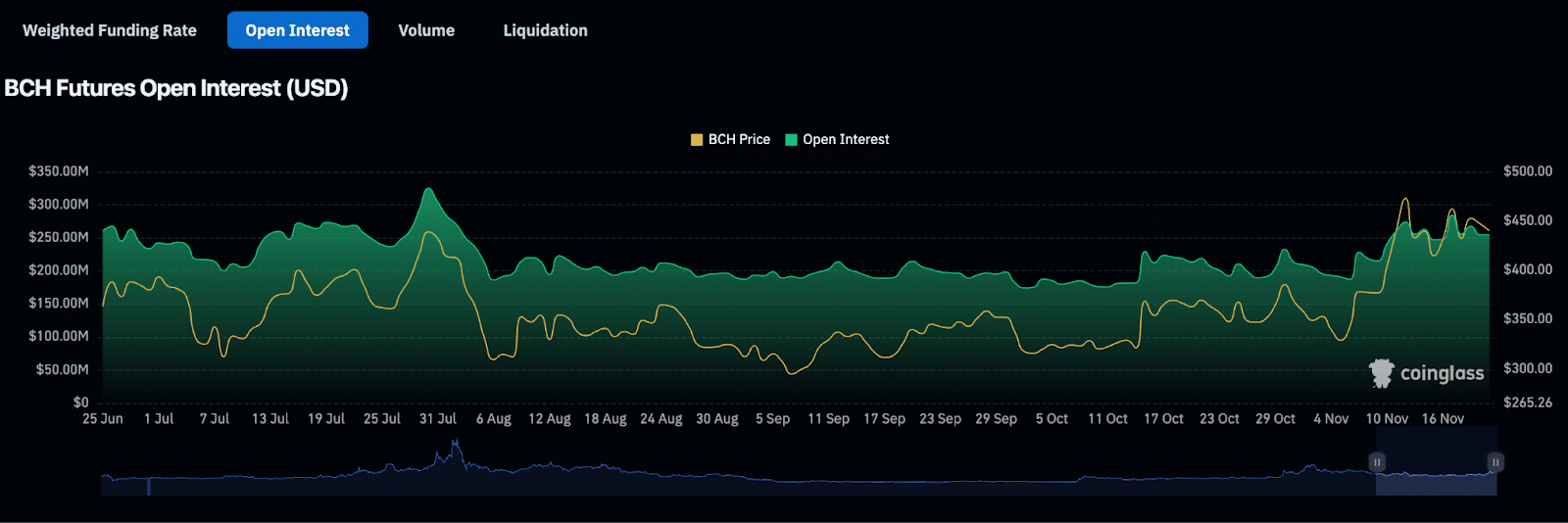

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

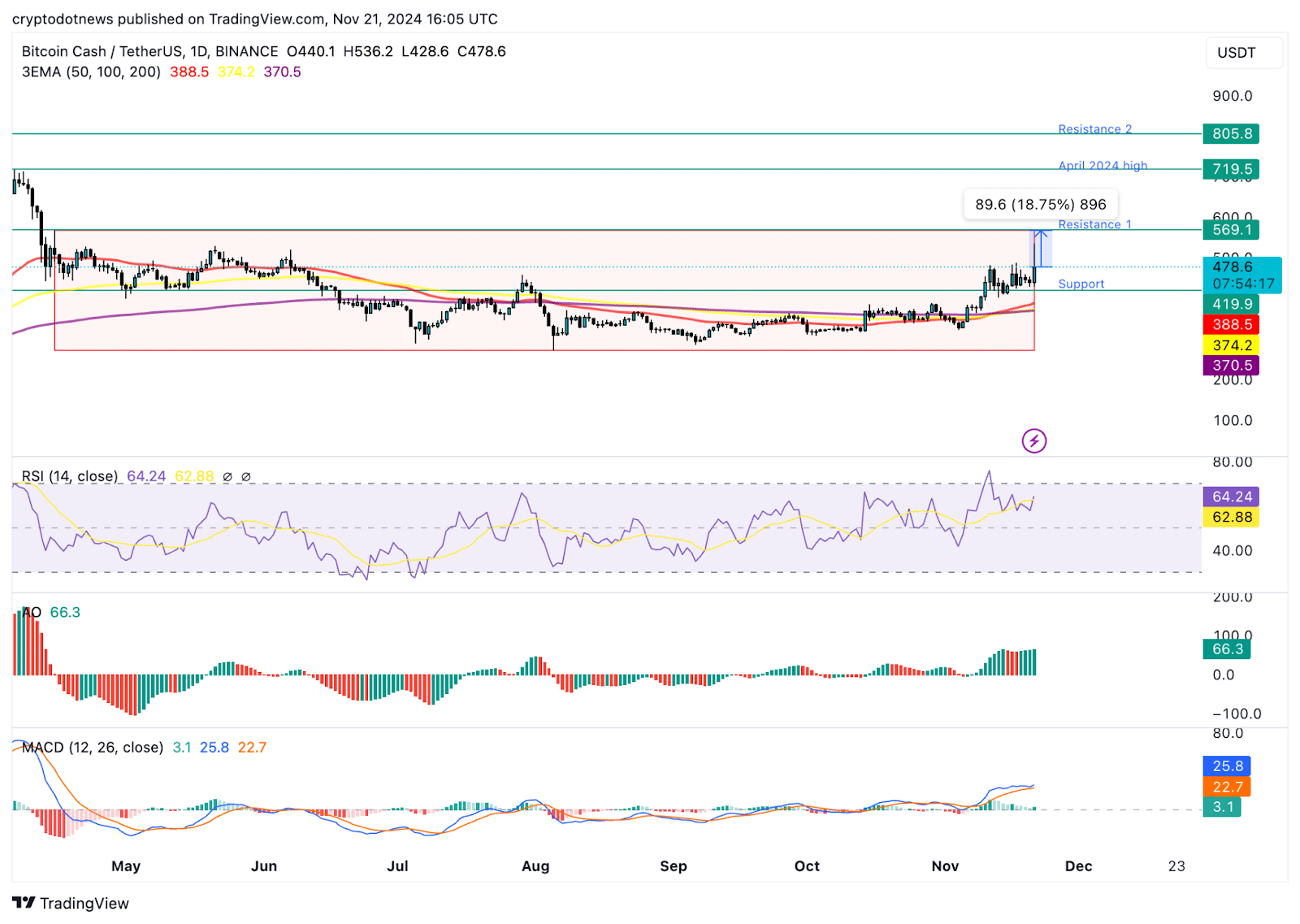

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin Magazine Pro

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Published

2 days agoon

November 22, 2024By

admin

The Bitcoin Pi Cycle Top Indicator has gained legendary status in the Bitcoin community for its uncanny accuracy in identifying market cycle peaks. Historically, it has timed every single Bitcoin cycle high with remarkable precision—often within just three days. Could it work its magic again this cycle? Let’s dive deeper into how it works and its significance in navigating Bitcoin’s market cycles.

What is the Pi Cycle Top Indicator?

The Pi Cycle Top Indicator is a tool designed to identify Bitcoin’s market cycle tops. Created by Philip Swift, Managing Director of Bitcoin Magazine Pro in April 2019, this indicator uses a combination of two moving averages to forecast cycle highs:

- 111-Day Moving Average (111DMA): Represents the shorter-term price trend.

- 350-Day Moving Average x 2 (350DMA x 2): A multiple of the 350DMA, which captures longer-term trends.

When the 111DMA rises sharply and crosses above the 350DMA x 2, it historically coincides with Bitcoin’s market cycle peak.

The Mathematics Behind the Name

Interestingly, the ratio of 350 to 111 equals approximately 3.153—remarkably close to Pi (3.142). This mathematical quirk gives the indicator its name and highlights the cyclical nature of Bitcoin’s price action over time.

Why Has It Been So Accurate?

The Pi Cycle Top Indicator has been effective in predicting the peaks of Bitcoin’s three most recent market cycles. Its ability to pinpoint the absolute tops reflects Bitcoin’s historically predictable cycles during its adoption growth phase. The indicator essentially captures the point where the market becomes overheated, as reflected by the steep rise of the 111DMA surpassing the 350DMA x 2.

How Can Investors Use This Indicator?

For investors, the Pi Cycle Top Indicator serves as a warning sign that the market may be approaching unsustainable levels. Historically, when the indicator flashes, it has been advantageous to sell Bitcoin near the top of the market cycle. This makes it a valuable tool for those seeking to maximize gains and minimize losses.

However, as Bitcoin matures and integrates further into the global financial system—bolstered by developments like Bitcoin ETFs and institutional adoption—the effectiveness of this indicator may diminish. It remains most relevant during Bitcoin’s early adoption phase.

A Glimpse Into the Future

The big question now is: will the Pi Cycle Top Indicator remain accurate in this cycle? With Bitcoin entering a new era of adoption and market dynamics, its cyclical patterns may evolve. Yet, this tool has proven its worth repeatedly over Bitcoin’s first 15 years, offering investors a reliable gauge of market tops.

Final Thoughts

The Pi Cycle Top Indicator is a testament to Bitcoin’s cyclical nature and the power of mathematical models in understanding its price behavior. While its past accuracy has been unparalleled, only time will tell if it can once again predict Bitcoin’s next market cycle peak. For now, it remains an indispensable tool for those navigating the thrilling highs and lows of Bitcoin.

Explore the full chart and stay informed.

Source link

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential