DEX

Ecosystem growth fuels Ethena rally, analysts eye 65% upside

Published

2 months agoon

By

admin

Ethena has broken out of a rare bullish pattern on the one-day charts and could see gains of over 65% from the current price.

Over the last seven days, Ethena (ENA) — best known for the USDe stablecoin — rose 24.4%. The crypto asset’s market cap surpassed the $1 billion mark on Oct. 14. It is now up 200% from its lowest point in September, and sits at $1.14 billion. Its daily trading volume hovers over $318 million.

According to analysts, Ethena has broken out of multiple patterns on the 1-day chart, which points to further upside.

Anonymous trader CryptoBull_360 noted that ENA has broken out from an inverse head and shoulders pattern, a rare pattern that signals a major bullish reversal that could further fuel the ENA rally. Moreover, It also rose above the upper side of a broadening wedge pattern that connects the highest swings since April 10.

The analyst sets a bullish target for ENA at $0.68. That’s up 65% from its current levels, provided that Bitcoin (BTC) continues to see positive momentum.

Other commentators echoed similar bullish sentiments with MisterSpread ENA to hit $0.52 in the short term as long as it holds above the support level at $0.42.

ENA’s price rally also coincided with a jump in futures open interest. According to CoinGlass, open interest in the futures market hit a high of $227 million, up from last week’s low of $137 million.

Previously, whales have also turned their attention towards the token and were seen accumulating the crypto throughout the past week as reported by crypto.news.

Smart DEX traders, known for consistently executing profitable swaps on decentralized exchanges, grabbed over 2.25 million ENA tokens over the past week, valued at $932.5K, demonstrating their confidence in the token’s potential growth.

Among other catalysts, is Ethena’s recent proposal to integrate its liquidity and hedging system into Hyperliquid, a decentralized exchange for perpetual trading.

The proposal, currently under review by the Ethena Risk Committee, suggests moving a portion of Ethena’s hedging flow on-chain to Hyperliquid, enhancing transparency and reducing counterparty risks.

Additionally, the proposal includes adding USDe stablecoin to Hyperliquid’s Layer 1 platform upon the launch of the EVM mainnet, further expanding its DeFi integrations.

At press time, ENA was exchanging hands at $0.403 per data from crypto.news.

Source link

You may like

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

DeFi

Solana beats Ethereum in a key metric 3 months in a row

Published

4 hours agoon

December 23, 2024By

admin

Solana’s continued doing well in December, as meme coins helped it gain market share against Ethereum and other blockchains.

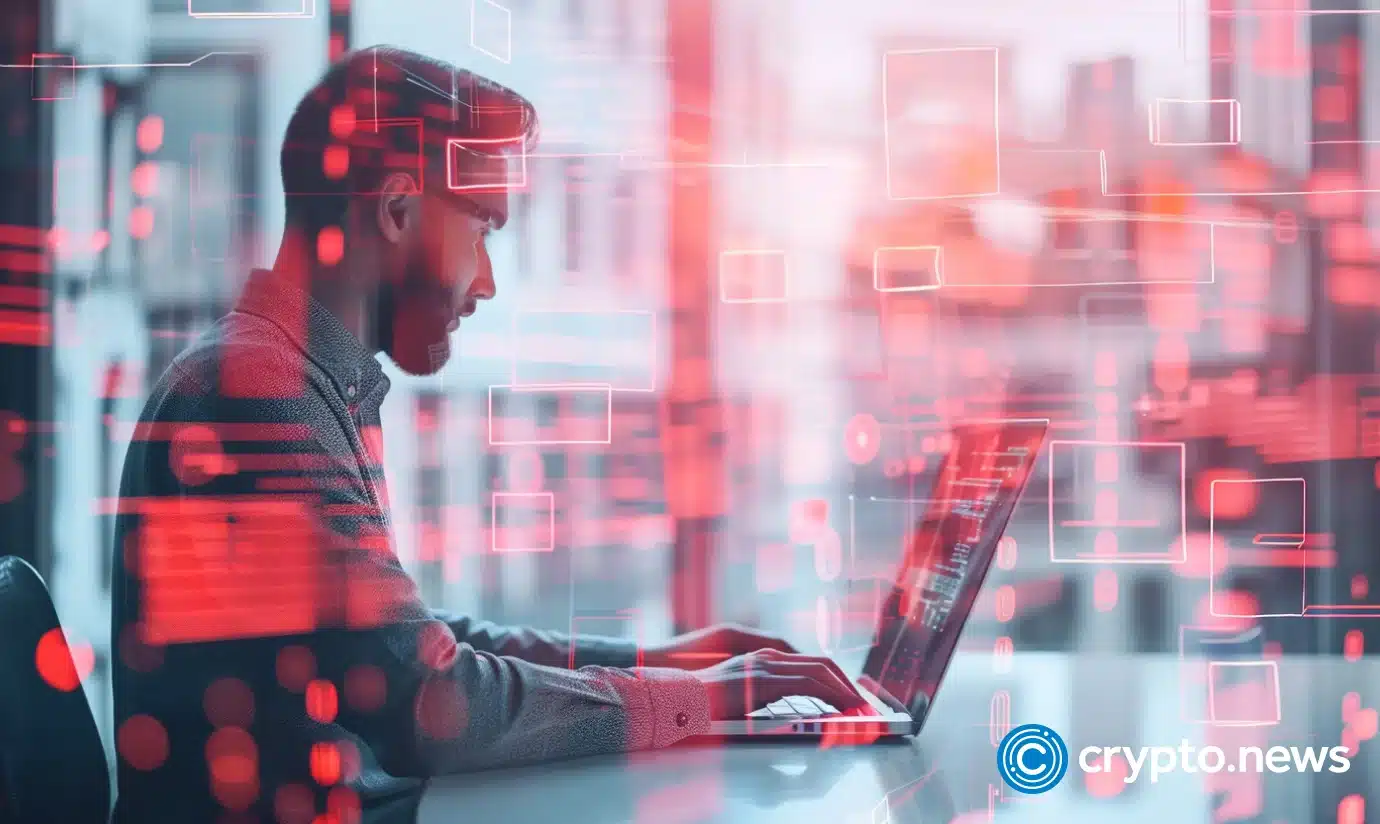

According to DeFi Llama, Solana’s (SOL) protocols in the decentralized exchange industry were the most active in December.

Its volume rose to over $97 billion, much higher than the $22.6 billion it handled in the same period last year.

Notably, it was the third consecutive month that Solana outperformed Ethereum (ETH), which has dominated the industry for years. Ethereum’s protocols had a volume of over $74 billion, while Base and Arbitrum handled $42 billion and $37 billion.

Solana also performed great in November, where its DEX networks had a volume of $129 billion, higher than Ethereum’s $70.6 billion. A month earlier, Solana handled volume of $52 billion, while Ethereum processed $41 billion.

Most of Solana’s DEX volume was because of Raydium (RAY), a network that handled coins worth $65 billion in the last 30 days. Orca handled $24 billion, while Lifinity, Pump, and Phoenix had volumes worth over $5.93 billion.

Solana’s DEX volume has jumped because of the meme coin industry, which has continued doing well this year. Solana has attracted thousands of meme coins this year, helped by the creation of Pump, the biggest token generator. All Solana meme coins have a market cap of over $14.1 billion, led by Bonk, Dogwifhat, Popcat, and Peanut the Squirrel.

This growth has been highly profitable for Solana and its native apps. All Solana native dApps generated a record $365 million in revenue in November, a record high. Similarly, according to TokenTerminal, Solana’s blockchain generated a record $725 million in fees in 2024, making it the third-most profitable chain after Ethereum and Tron.

Developers and users love Solana because of its substantially lower fees and higher throughput.

Base, the layer-2 network launched by Coinbase, has also been a big breakout star in 2024 as its total fees rose to over $82 million. It has become the biggest layer 2 network in the blockchain industry, with its DEX networks handling over $181 billion in assets, while its total value locked soared to $2 billion.

Source link

DeFi

Uniswap price rises as crypto experts see it hitting $50

Published

2 weeks agoon

December 12, 2024By

admin

Uniswap’s price has rallied, crossing a crucial resistance level, with many crypto experts predicting further gains ahead.

Uniswap (UNI) token surged to $19.44, its highest level since December 2021, as crypto momentum continued to strengthen.

This rally coincides with robust inflows across decentralized exchange (DEX) networks. Data indicates that DEX platforms handled over $372 billion worth of tokens in November, marking the largest monthly increase on record.

Uniswap alone processed $30.86 billion in volume over the last seven days, solidifying its position as the industry leader. Its volume significantly exceeded that of competitors like Raydium and PancakeSwap combined. Over its lifetime, Uniswap has facilitated over 465 million trades worth more than $2.36 trillion.

Uniswap’s price is also gaining momentum as traders anticipate the launch of UniChain, the platform’s independent Layer-2 chain. UniChain aims to enable seamless cross-chain trading on a single platform. Currently in the testnet phase, UniChain is set to launch early next year.

At the same time, there are rising odds that the Trump administration will abandon the case brought against Uniswap by the Securities and Exchange Commission. The SEC alleged that the company provided securities on its platform without registration.

Uniswap price analysis

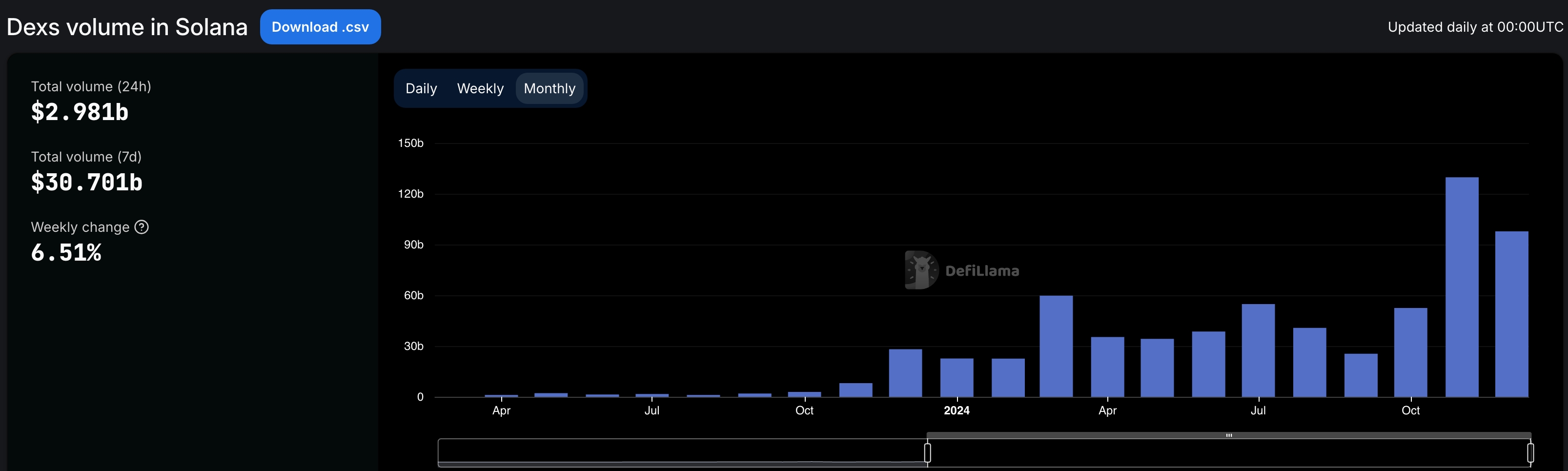

The weekly chart reveals that UNI has formed a slanted triple-bottom pattern, a bullish reversal indicator. The price has broken above the pattern’s neckline at $17.13, suggesting that bulls are firmly in control.

UNI is also approaching the 38.2% Fibonacci Retracement level at $19.23. Furthermore, it has moved above the 50-week moving average, while the MACD indicator and Relative Strength Index are both trending upwards.

The path of least resistance for UNI appears bullish, with a long-term target of $50, representing approximately a 180% increase from the current level. This aligns with predictions from analysts like Crypto Tigers predict.

For this to happen, Uniswap price will need to rise above the 50% retracement point at $24 and its all-time high of $45.

Source link

cryptocurrency

Uniswap launches permissionless bridging across nine networks

Published

2 months agoon

October 23, 2024By

admin

Decentralized exchange Uniswap has launched in-app, permissionless cross-chain bridging for its users, with service available across nine blockchain networks.

On Oct. 23, the Uniswap (UNI) team announced that its permissionless cross-chain bridge was now live, bringing the DEX protocol closer to enabling cross-chain swaps. The cross-chain intents protocol, Across Protocol, powers this in-app Uniswap bridging feature, according to the announcement.

Only native assets

With the launch, Uniswap users can now undertake cross-chain transactions across nine networks. These include Ethereum (ETH), Arbitrum (ARB) Polygon (POL) and ZKSync (ZK). Other networks with initial support are Base, Zora, Blast, OP Mainnet and World Chain.

The feature only supports native assets, such as ETH on the Ethereum network or ARB on the Arbitrum network. Bridging will also be available for stablecoins. In terms of functionality, users will perform cross-chain transactions directly via their Uniswap interface and Uniswap Wallet.

According to data from Dune, multi-chain access currently has a cumulative count of over six million Uniswap users. However, cross-chain bridge swaps remain low. The Uniswap Labs team aims to significantly increase this number.

Uniswap recently unveiled UniChain, a new layer-2 chain targeting DeFi and cross-chain liquidity. Announced on Oct. 10, UniChain aims to help the crypto market address DeFi’s challenges. Key to this vision are decentralization, near-instant transactions, and multi-chain swapping.

Source link

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential