Guides

6 steps to move an old 401k into a bitcoin IRA

Published

1 month agoon

By

admin

Bitcoin could be on the verge of a major new bull run. According to Tuur Demeester of Adamant Research, in his publication How to Position for the Bitcoin Boom, we may be in the early stages of a new multi-year bull market that could propel bitcoin prices into six figures.

“During this accumulation phase, we expect bitcoin to trade in a range of $22,000 to $42,000, until a new multi-year bull market pushes it well north of $120,000,” Demeester noted.

Imagine securing a substantial allocation of bitcoin before this bull run begins—an allocation that could appreciate completely tax-free, funded by an old retirement account that you might have totally forgotten about!

Step 1: Purchase hardware wallets

The first step is obtaining the tools you need to ensure your bitcoin is secure. A hardware wallet allows you to store your bitcoin keys offline, giving you full control of your funds.

Begin by purchasing a couple of hardware wallets, such as those offered by Trezor or Ledger. Unchained currently supports a range of devices, including the Ledger Nano X, Trezor Model T, and Coldcard Mk4. Check out the full list of hardware wallets Unchained supports.

For optimal security, it’s recommended to buy directly from the manufacturer, but purchasing from a trusted third-party retailer, like Best Buy, is also acceptable. This is especially true in the context of multisig which eliminates any single key as a single point of failure.

Make sure to get at least two wallets—you’ll need both to set up your Unchained IRA vault.

Step 2: Create an account on Unchained.com

Next, go to Unchained and create an account. The process is simple: provide your name, email, phone number, and create a strong password. Unchained takes your privacy seriously.

Once your account is created, select the type of account you need—in this case we’re creating an IRA account. If you prefer personalized assistance, consider opting for Unchained’s Concierge Onboarding, where a bitcoin custody expert will guide you through every step.

Step 3: Create your Unchained IRA account—with no setup or account fees for the first year!

Now it’s time to set up your IRA account. With an Unchained IRA, you can save bitcoin in a tax-advantaged manner while maintaining full control of your keys. There is no third-party risk because you hold the keys—ensuring that no one else can access your bitcoin.

Setting up an account is straightforward—there are no setup fees, account fees don’t start until the second year, and you can see trading fees on our pricing page. Unchained’s IRA offers both Traditional and Roth options, allowing you to choose the best fit for your retirement strategy.

Step 4: Follow the Self-Service guide for vault setup

After setting up your account, it’s time to set up your multisig vault—one of the most secure ways to secure bitcoin. Multisig requires more than one key to authorize a transaction, which mitigates the risks associated with custodian and exchange hacks, bad business practices, or individual mistakes.

You can set up this secure multisig configuration in under an hour using Unchained’s Self-Service Onboarding. Simply follow the guide at diy.unchained.com to get started—if you’re using two hardware wallets to build your vault, you’ll choose the Lead custody model.

Step 5: Roll over your existing 401k/IRA

Next, you’ll need to fund your new IRA, and there are a few ways to do it: an IRA-to-IRA transfer, a 401(k)-to-IRA rollover, or an annual contribution. The most common method is rolling over funds from an existing 401(k) or IRA into your new Unchained IRA.

While this process can feel tedious—particularly if your 401(k) administrator needs to issue you a physical check—it is straightforward. Once you receive your funds, Unchained will convert them to bitcoin with our trading desk and deposit them into your IRA vault.

If you already hold bitcoin in another IRA, you can do an in-kind transfer to move your bitcoin directly to Unchained without converting to cash first. If you want to learn more about how to fund your IRA, we have a full Knowledge Base article for that.

Step 6: Enjoy the benefits of tax-advantaged bitcoin

Congratulations—your retirement savings are now secured in bitcoin! Unchained offers flat annual fees. Starting in year two, you’ll pay a flat $250 annual fee for your IRA account.

Holding bitcoin in a tax-advantaged account combines the inflation resistance of bitcoin with the benefits of an IRA. Most importantly, you remain in charge of your bitcoin—not an exchange or third party. If the bull run is approaching as many suspect, the Unchained IRA could put you in position to watch your retirement savings grow.

This article is provided for educational purposes only, and cannot be relied upon as tax or investment advice. Unchained makes no representations regarding the tax consequences or investment suitability of any structure described herein, and all such questions should be directed to a tax or financial advisor of your choice. Statements regarding market or other financial information, are obtained from sources that we believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information.

Source link

You may like

Bitcoin Price May Crash Below $88,000 On Global M2 Money Correlation

Use Bitcoin Easily And Privately With Cake Wallet

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Guides

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Published

7 hours agoon

November 27, 2024By

admin

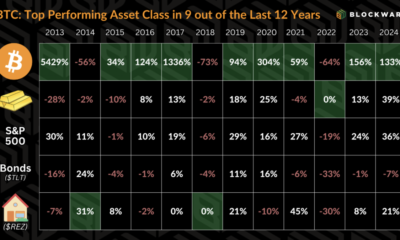

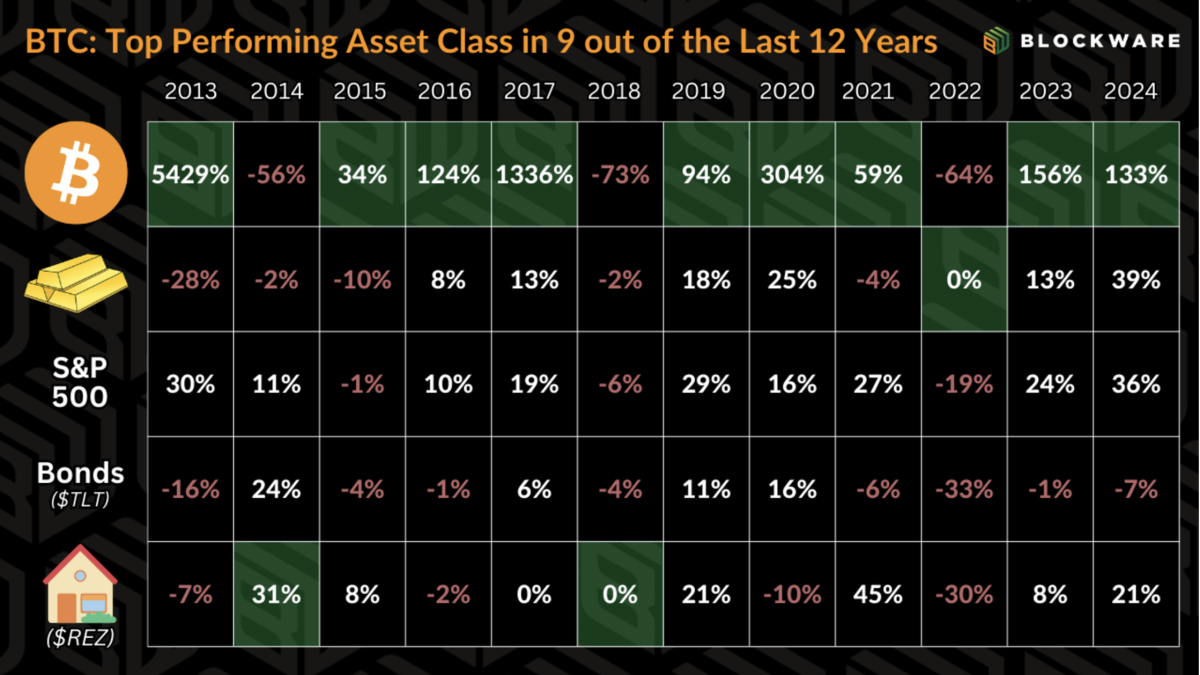

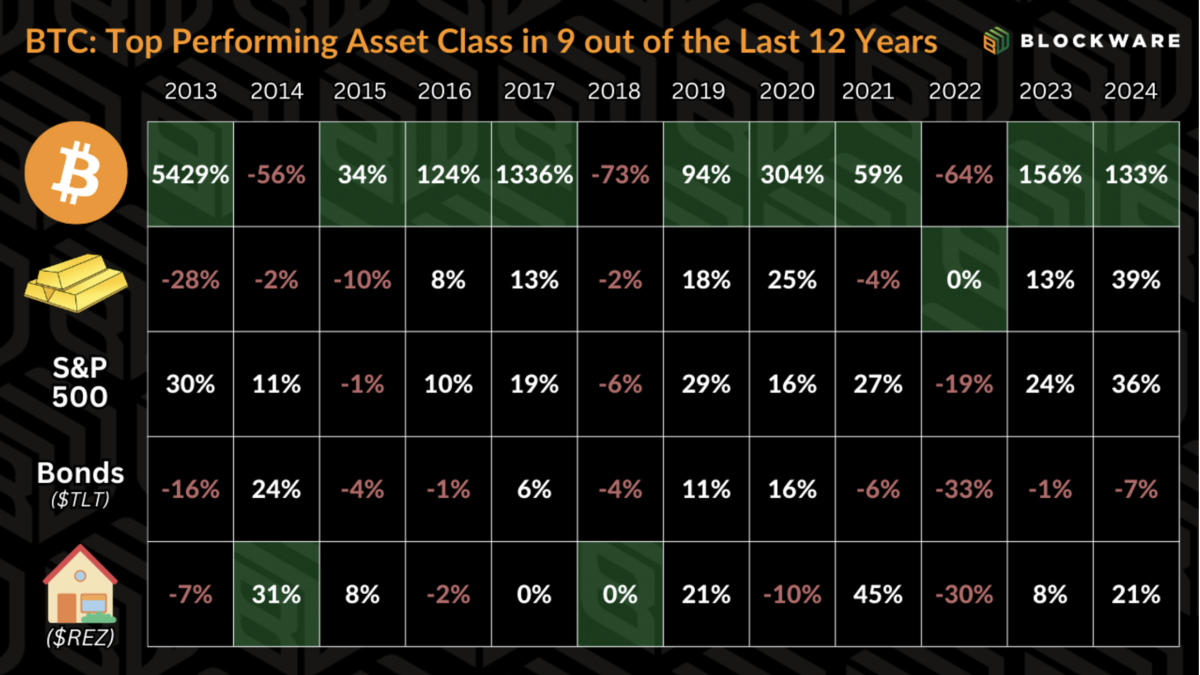

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

Bitcoin is the Hurdle Rate

Bitcoin is to digital assets what treasury bonds are to the legacy financial system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

With BTC outperforming every other asset class in 9 of the past 12 years (by orders of magnitude), it’s no surprise that it has usurped treasury bonds as the “risk free rate” in the minds of many investors – especially those knowledgeable about monetary history and thus the appeal of Bitcoin’s verifiable scarcity.

Another way to phrase this would be that the financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

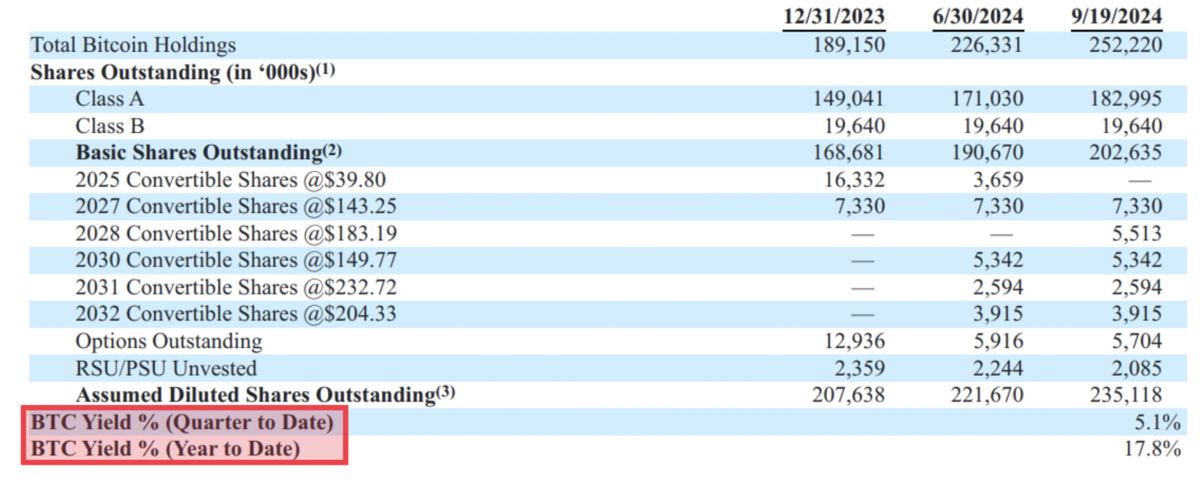

MicroStrategy has demonstrated what this looks like in the corporate world with their new KPI: BTC Yield. To quote from their September 20th, 8-K form: “The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders.” MicroStrategy has taken full advantage of the tools available to them as a multi-billion dollar public company: access to low interest rate debt and the ability to issue new shares. This KPI shows that they are acquiring more BTC per outstanding share despite the fact that they are engaging in the traditionally dilutive activity of new share issuance.

Mission accomplished: they are acquiring more bitcoin.

But MicroStrategy has an advantage that the average fund manager or retail investor does not: they are a publicly traded company with the ability to tap into capital markets at little to no relative cost. Individual holders are unable to issue shares into the public market in order to raise capital and acquire BTC. Nor can we issue convertible notes and borrow dollars at a near zero % interest rate.

So that begs the question: how can we accumulate more bitcoin? How can we have a positive ‘BTC Yield’?

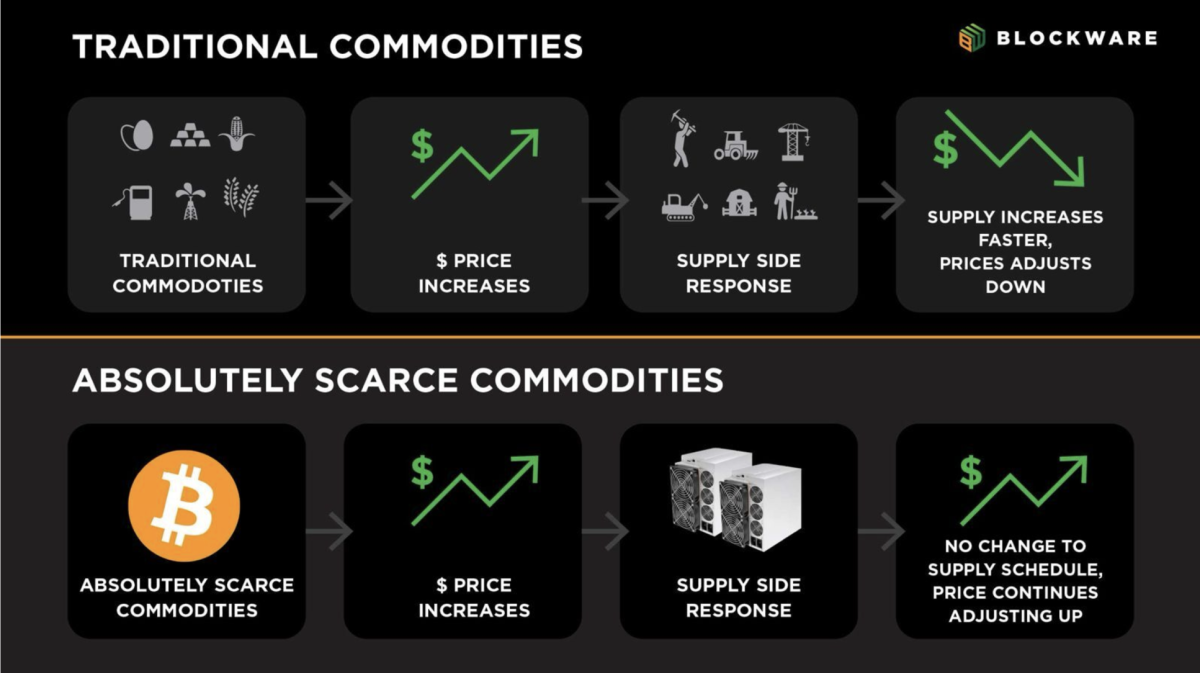

Bitcoin Mining

Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network, and receiving a greater amount of BTC than what it costs in electricity to operate their machine(s). Now this is easier said than done. The Bitcoin protocol enforces a predetermined supply schedule using “difficulty adjustments” – meaning that more computational power dedicated towards Bitcoin mining results in the finite block rewards getting split up into smaller pieces.

The most effective Bitcoin miners are those that maximize their computational power while minimizing their operational costs. This is accomplished by acquiring the latest, most-efficient Bitcoin mining hardware, and operating with the lowest possible electricity rate.

Under current market conditions (as of 11/21/2024), 1 bitcoin has a price of ~$98,000. However, an Antminer S21 Pro mining with an electricity rate of $0.078/kWh is able to produce 1 BTC for ~$40,000 in electricity. This is an operating margin of nearly 145%. A business is typically considered to have “healthy profit margins” if they are in the 5-10% range – mining beats this easily. This is in spite of the fact that as of the April 2024 Bitcoin halving, they earn half as much BTC per unit of compute.

Price Growth Outpacing Difficulty Growth

The price of a financial asset – specifically bitcoin – is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers. In other words, the price reflects what the last buyer is willing to pay and what the last seller is willing to accept.

This, in part, is what enables BTC’s notoriously volatile price action. A lack of sellers at price X means buyers must bid the price higher than X in order to find the next marginal seller. Inversely, a lack of buyers at price X means a seller must lower their ask to find the next marginal buyer. BTC can quickly move up or down based on a lack of sellers or buyers in a specific range.

Consequently, the velocity at which the Bitcoin price can move is much higher than that of network mining difficulty. Substantial growth in network mining difficulty is not achieved by marginal bid/ask spreads, it is achieved by the culmination of ASIC manufacturing, energy production, and mining infrastructure development. There is not shortcutting the time and human capital necessary to increase the total computational power on the Bitcoin network.

This dynamic is what creates opportunities for Bitcoin miners to accumulate vast amounts of bitcoin.

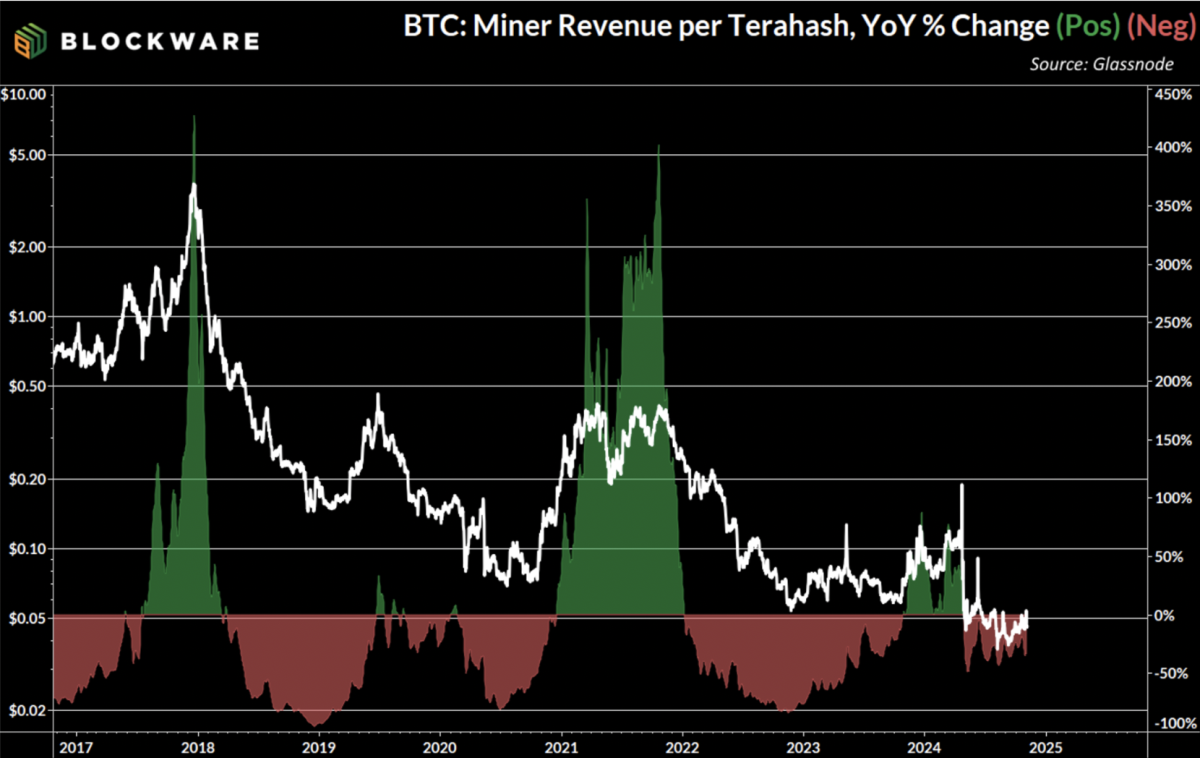

The chart here illustrates the explosive growth of Bitcoin mining profitability that takes place during bull markets. “Hashprice” measures the amount of revenue that Bitcoin miners earn per unit of compute on a daily basis. On a year-over-year basis, hashprice has increased by more than 300% at the height of each bitcoin mining cycle. This means that miners have had their profit margins more than triple in a 12-month span.

Over the long-run this metric trends down as more entities begin mining bitcoin, miners upgrade to more powerful & efficient machines, and the block subsidy is cut in half every four years. However, during bull markets, the combination of the forces that are a positive catalyst for mining difficulty (and thus net-negative for mining profitability) pale in comparison to the rapid growth in the price of bitcoin.

Price Volatility in Bitcoin Mining Hardware

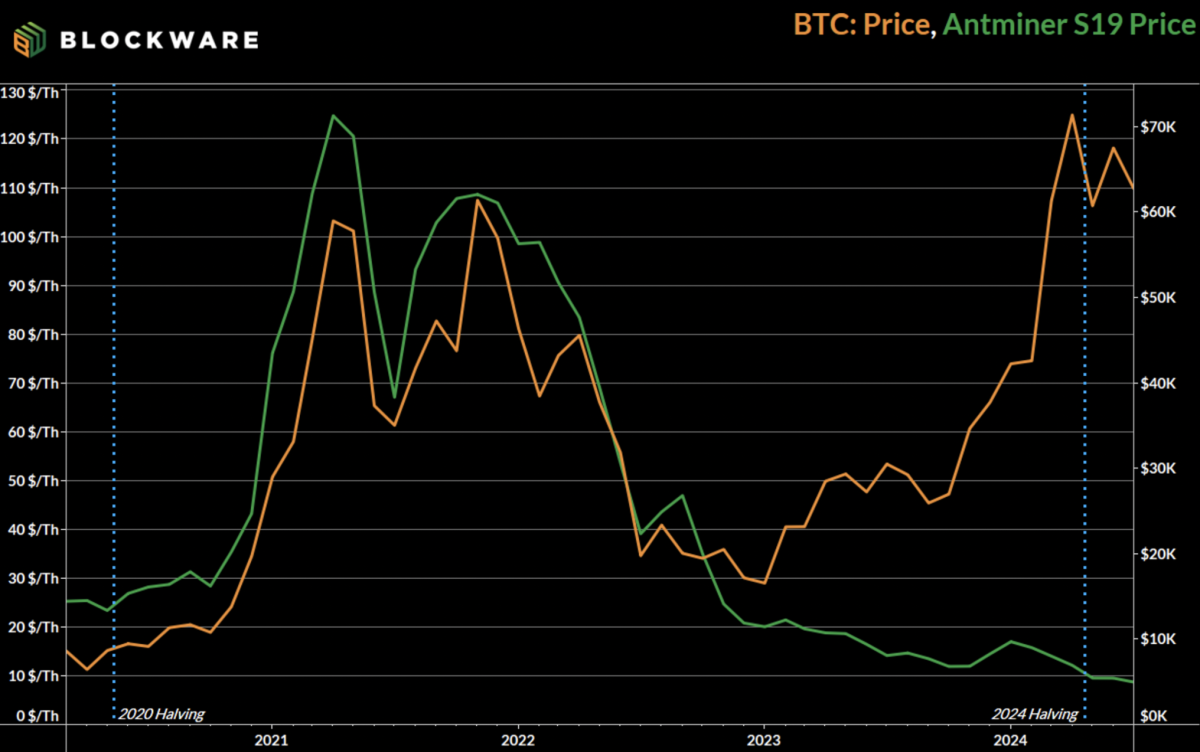

In addition to wider profit margins during bull markets, Bitcoin miners have the simultaneous benefit of the fact that ASIC prices tend to move in tandem with the Bitcoin price. During the 2020 – 2024 cycle, the Antminer S19 (most efficient ASIC at the time) began trading at ~$24/T. By November 2021 – when the BTC price was peaking – they began trading for north of $120/T.

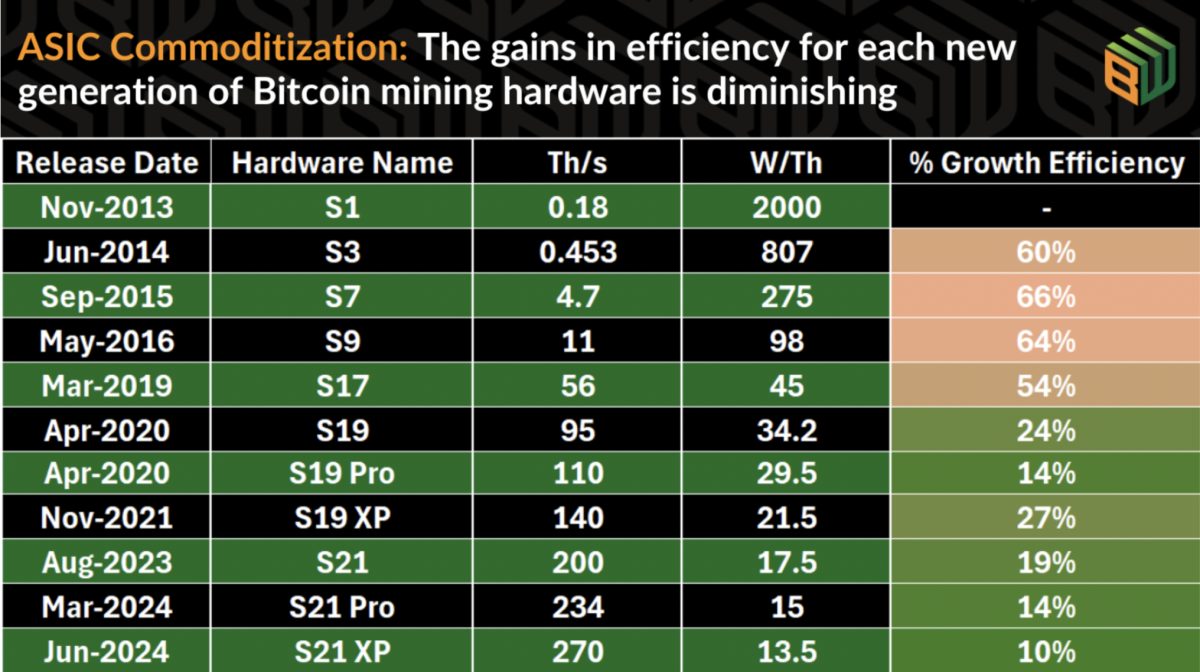

Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware. In the early days of Bitcoin mining, technological advancements were swift and forceful – to the point that new ASICs would make older models obsolete overnight. However, the marginal gains of new ASICs have diminished to the point that older models are able to remain competitive for multiple years after release.

Since the S19 was launched in 2020 and retains a non-zero market price today, it is reasonable to expect that the S21 line of machines will be able to retain value for even longer. This gives miners a significant leg-up when it comes to accumulating bitcoin, because the upfront cost of purchasing machines is no longer “sunk”. Their machines have a price, one that is correlated to bitcoin, and there is a resource available to get liquidity.

Blockware Marketplace

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. Users of the marketplace are able to purchase Bitcoin mining rigs that are hosted at one of Blockware’s tier 1 data centers and have access to industrial power prices. These machines are online already, eliminating lengthy lead times that have historically caused some miners to miss out on those key months in the cycle in which price is outpacing network difficulty.

Moreover, this platform is built by Bitcoiners, for Bitcoiners. Which means that machines are purchased using Bitcoin as the medium of exchange, and mining rewards are never held by Blockware – they are sent directly to the users own wallet.

Lastly, this provides miners with the aforementioned opportunity, but not obligation, to sell their machines at any time and price. This enables miners to capitalize on volatility in ASIC prices, recoup the cost of their machines, and accumulate more BTC faster than they would with a traditional “pure play” approach.

This innovation removes the obstacles that have historically made hosted mining difficult, enabling miners to concentrate on the mission: accumulating more Bitcoin.

For institutional investors looking for bulk pricing on mining hardware, contact the Blockware team directly.

Source link

Ever since its 2009 development by the mysterious Satoshi Nakamoto, Bitcoin has become foundational to the cryptocurrency and fintech landscape. As the first decentralized cryptocurrency, Bitcoin has driven significant growth in blockchain technology, becoming the most visible and widely adopted coin on the market. With the ability to conduct seamless transactions on the blockchain, Bitcoin has been adopted as legal tender in some countries and embraced worldwide for a variety of uses.

Today, Bitcoin is used by people globally for various services. Notably, Bitcoin has gained adoption not only as legal currency in El Salvador but also for every day transactions—whether trading a pizza from Papa John’s or depositing funds at online casinos and sports betting websites.

Bitcoin’s value lies in its enhanced privacy, cryptographic security, and the development of encrypted wallets that ensure safe transactions on a global scale. Let’s dive into how Bitcoin works, how to use it, and the best ways to keep it secure:

What is Bitcoin (BTC) & How Does it Work?

Despite being around for more than a decade, newcomers may still wonder, “what is bitcoin?” Simply put, Bitcoin is a decentralized digital currency that operates independently of any central bank. Instead of relying on a traditional financial institution, Bitcoin transactions are verified by networked computers through a process known as mining, which involves solving complex mathematical problems. Once mined, Bitcoin can be transferred directly to others or used for purchases with bitcoin-accepting vendors, with each transaction recorded on a public ledger—the blockchain.

This decentralized, peer-to-peer system ensures that all Bitcoin transactions are transparent yet pseudonymous. Even though each transaction is publicly available on the blockchain, the identities of the transacting parties can remain private.

How to Use Bitcoin Online

Before first buying and using bitcoin, you will need to set up a wallet in which to store it. Here’s a simple guide to start using Bitcoin:

Set Up a Wallet: Choose a secure Bitcoin wallet for your needs. You’ll need both a public key (like an account number) for receiving funds and a private key (like a password) for authorizing transactions. Many hot wallets and cold wallets are available, each with its pros and cons for different users.

Find Vendors that Accept Bitcoin: Many online services and products now accept Bitcoin, although some may only accept other cryptocurrencies. Once you’ve found a vendor, you can use your wallet to send Bitcoin directly for goods or services.

Send Bitcoin to Other Users: Bitcoin transfers are similar to traditional bank transfers, though they remain independent of banks. Ask the recipient for their wallet address, then transfer funds directly to their wallet.

How to Store Bitcoin Safely

When using Bitcoin, securing your funds is critical. Here are key wallet types and best practices for safe Bitcoin storage:

Hot Wallets: These are digital wallets connected to the internet, such as mobile or web apps. Hot wallets are convenient for frequent transactions but are more vulnerable to cyber threats. When using hot wallets, consider diversifying to reduce risk.

Cold Wallets: Cold wallets, like hardware wallets, are offline storage solutions, ideal for long-term holdings. These wallets are disconnected from the internet, making them less accessible to potential hackers. While they’re more secure, they can be less convenient for immediate transactions.

Seed Phrases and Private Keys: When you set up a wallet, you’ll often receive a seed phrase—a recovery phrase that enables you to restore your funds if you lose access to your wallet. It’s essential to keep both your seed phrase and private key secure and offline. The public key can be shared with anyone for receiving Bitcoin, but the private key must remain private to ensure the safety of your funds.

Why You Should Use Bitcoin

There are many reasons why people choose to use Bitcoin, and here are some of the most popular benefits:

- Privacy and Decentralization: Bitcoin’s independence from central banks and financial institutions allows users to make private, pseudonymous transactions. This feature makes it an appealing choice for those looking to protect their financial privacy.

- Global Payment Solution: Bitcoin allows users to conduct transactions across borders without worrying about exchange fees. You’ll only need to pay a small transaction fee on crypto exchanges, with no need to exchange fiat currencies like dollars to euros.

- Wider Acceptance: With increased adoption, Bitcoin is now accepted by a growing number of companies and online platforms. Whether it’s for gaming on sites like Stake.com or making everyday purchases, Bitcoin’s utility continues to expand.

Bitcoin: The Future of Finance

Bitcoin offers a decentralized, secure method of conducting transactions that emphasizes user control, privacy, and a simplified financial process. As Bitcoin continues to grow in use and adoption, learning how to use and store it safely has never been more critical. Following these best practices can help you protect your assets and enjoy the benefits of this revolutionary digital currency.

Source link

Bitcoin Price May Crash Below $88,000 On Global M2 Money Correlation

Use Bitcoin Easily And Privately With Cake Wallet

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential