Opinion

The Metric That Matters for the Lightning Network

Published

1 month agoon

By

admin

The Lightning Network is a revolutionary scaling solution for Bitcoin, enabling fast and inexpensive payments that make everyday transactions with Bitcoin possible. As the network grows, it’s essential to measure its health and efficiency accurately, so we can unlock its full potential.

Traditional metrics like node count, channel count, and capacity have been used to assess the Lightning Network, but they only tell part of the story. To truly understand the performance of this second-layer solution, we need to focus on flow—specifically, Max Flow, a metric with a long history of optimizing complex systems.

Max Flow: The Key to Understanding Lightning’s Health

Max Flow is a powerful metric that calculates how much value can theoretically flow through a network, considering constraints like channel capacity and liquidity. It’s an essential tool for evaluating network effectiveness and reliability, particularly in systems where smooth, uninterrupted flow is the key to success.

Max Flow has been used for decades in industries ranging from telecommunications to logistics. It’s already been applied to solve problems in:

- Telecom Networks: Max Flow helps allocate bandwidth efficiently, ensuring that data flows seamlessly across the internet.

- Supply Chains: Companies use Max Flow algorithms to optimize the movement of goods across their global distribution networks, reducing delays and maximizing efficiency.

- Transportation Systems: Cities apply Max Flow to traffic management, ensuring that vehicles move smoothly across road networks by optimizing flow through intersections.

These examples showcase how Max Flow improves efficiency in complex systems where resources need to move quickly and efficiently. Now, it’s being applied to the Lightning Network as seen in new data science research from René Pickhardt about feasible lightning payments. Applying Max Flow to the Lightning Network will help ensure that Bitcoin can flow smoothly between users, even as the network scales.

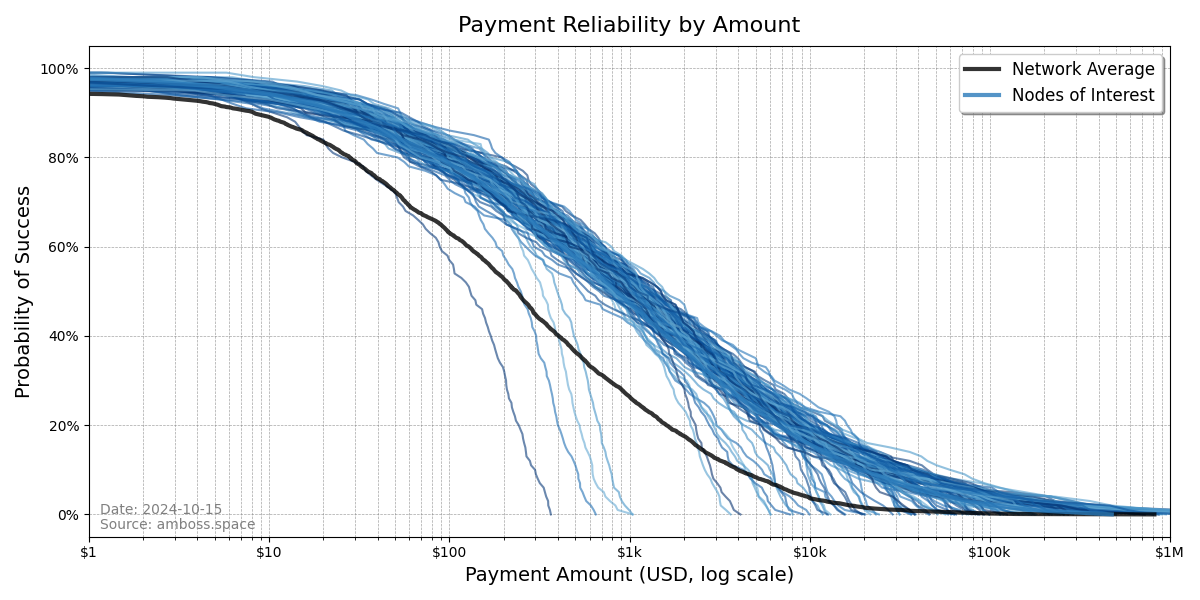

Max Flow isn’t about measuring the actual movement of value, but rather about understanding the probability of feasible payments across the network. By focusing on Max Flow, we gain a more accurate understanding of the Lightning Network’s true health. Instead of just counting channels or capacity, Max Flow shows us the likelihood of payment success, allowing node operators to optimize their liquidity and improve the overall performance of the network.

Traditional Metrics Fall Short

Metrics like node count, channel count, and capacity provide a snapshot of the Lightning Network’s infrastructure. But much like counting the number of roads or intersections in a city, these numbers don’t tell us how well traffic is flowing. In the case of the Lightning Network, what really matters is how efficiently Bitcoin can be routed through the system.

Critics who focus solely on these traditional metrics often draw limited conclusions about the network’s performance. While it’s important to know the size of the infrastructure, it’s far more valuable to understand the probability of successful payments.

Max Flow offers that deeper insight. By measuring the success probability of payments, it helps us see where liquidity is well-distributed and where bottlenecks might be forming. This enables operators to make data-driven decisions that improve the network’s performance and ensure that payments are routed reliably.

Max Flow Shows Lightning’s Performance Rises with Bitcoin Price

The Lightning Network is designed to scale with Bitcoin, offering fast and cheap transactions without overloading the Bitcoin blockchain. As Bitcoin’s price appreciates, the network’s capacity to handle larger payments grows naturally.

For example, if a channel holds 0.1 BTC and Bitcoin is priced at $50,000, that channel can route a $5,000 payment. If Bitcoin’s price doubles to $100,000, that same channel can handle $10,000—without any changes to the underlying infrastructure. As the bitcoin digital economy grows, so too will the capabilities of the Lightning Network. Bitcoin price increases coupled with data-driven changes to the Lightning Network will help expand the capabilities of Lightning.

Max Flow plays a critical role here, helping to measure the success probability of payments as the network scales. It provides an essential tool for monitoring payment reliability and ensuring that the network remains efficient as demand for Bitcoin transactions grows.

Max Flow is the Future of Lightning Monitoring

Max Flow is the next-generation metric that will help drive the Lightning Network forward. By moving beyond superficial statistics like capacity or node count, it offers node operators and investors a more accurate picture of the network’s performance. This, in turn, helps them make smarter decisions about liquidity allocation and payment routing.

For investors, Max Flow offers a more reliable measure of network health, revealing the underlying potential of the Lightning Network. Those who focus on Max Flow will gain deeper insights into the scalability and efficiency of Lightning, positioning themselves to capitalize on future growth.

For node operators, understanding Max Flow means being able to optimize their channels for better performance. It helps them manage liquidity more effectively, ensuring that payments flow reliably, and improving the user experience for those interacting with the network.

Conclusion: Max Flow is the Metric That Matters

As the Lightning Network evolves, Max Flow will be essential to its health and performance. While traditional metrics like node count and channel capacity offer a limited view of the network, Max Flow reveals how efficiently value can move through the system—a critical insight as Bitcoin grows and the demand for reliable payments increases.

Max Flow is more than just a new way to measure the network—it’s the key to unlocking the Lightning Network’s full potential. By focusing on the metrics that matter, node operators and investors can help the network scale smarter, ensuring that Bitcoin’s role in the global economy continues to expand.

TL;DR

- Traditional metrics like node count, channel count, and capacity don’t provide a full picture of the Lightning Network’s performance.

- Max Flow is the right metric to assess network health, as it evaluates the probability of feasible payments and liquidity optimization.

- As Bitcoin’s price appreciates, the Lightning Network’s capacity to handle larger payments grows naturally, and Max Flow helps monitor this process.

- Max Flow has proven its value in optimizing complex networks in industries like telecommunications, supply chains, and transportation.

- Max Flow will play a critical role in helping the Lightning Network scale efficiently, making it an essential tool for both investors and node operators.

This is a guest post by Jesse Shrader. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

About Amboss:

Amboss is building the infrastructure for the Bitcoin Lightning Network, enabling seamless, real-time transactions across industries. With machine-learning-powered routing and liquidity optimization, Amboss ensures billions of low-cost payments happen securely and efficiently. As AI-driven economies emerge, Amboss provides the backbone for autonomous systems to transact at scale.

Source link

You may like

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Adoption

Survival of the healthiest: Creating a successful crypto

Published

10 hours agoon

November 24, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Darwin’s theory of evolution suggests that living organisms best adjusted to their environment are the most successful at surviving. Organisms struggle against each other in competition for resources that are necessary for existence within their environment. The same principle can be applied to cryptocurrencies. In a volatile, decentralized world characterized by competition among networks, only the healthiest, most well-structured ecosystems survive. Developers should, therefore, focus on developing a ‘healthy’ underlying network for crypto to ensure they stand the best chance of surviving the next evolutionary cycle.

What makes a crypto ‘healthy’?

The nature of cryptocurrencies is vastly different from that of living organisms, so the resources that make a crypto ecosystem ‘healthy’ differ from those that make a living organism ‘fit.’

Cryptocurrencies are decentralized virtual assets existing in the web3 space, so they rely on many individual users to interact within this ecosystem to create a healthy store of value. Like fiat currencies, without this social network made up of token holders, a cryptocurrency asset has no value. Each cryptocurrency can represent its own ‘culture’ through a transactive coin, where value is rooted in the psychology of its holders. This is mirrored by the fact that social events, user perception, and supply often impact the value of the token.

Since all cryptocurrencies derive value from community and user interactions within the web3 environment, they compete within the same web3 parameters for user attention and transactions. The parameters used to define a ‘healthy’ crypto network relate to token holder activity and include the principles of distribution, variety of holders, variety of transactions, and token flow, where there must be a sustainable number of diverse transactions.

It is not just about having user activity, but the right kind. If one individual lived in a nation-state as its sole citizen with a bank account of $100 million, the GDP per capita of that nation would be the best in the world—yet its chances of survival would be non-existent. Since there is only one holder, there would be no scope for transactions or a variety of holders, rendering it defunct and with no value.

Whilst living organisms may be competing for things like food and resources in the real world, cryptocurrency tokens are competing for transactions and user attention in the web3 world.

Since cryptocurrencies rely on blockchain, an open-source ledger storing all transactions, it is possible to map all transactions between wallets within an ecosystem and measure the parameters that determine a ‘healthy’ network. In practice, we can see which token ecosystems are developing ‘healthy’ networks and which ones are slowly becoming extinct. Over time, any patterns that align with network failure, including manipulation or crime, like any other asset class, can increase the risk relating to a token. With this data, we can rate and rank ecosystems, determining which ones are winning the competition for survival.

Bitcoin & Matic: A success story

Bitcoin (BTC) has been able to construct a healthy network. It is estimated that 106 million people around the globe own Bitcoin, making it the most widely held token. Significantly, Bitcoin now represents 58% of the total value of crypto, showing that amongst web3 users, Bitcoin is overwhelmingly the most popular store of wealth. Not only is it widely held, but it is also widely transacted. Throughout the first half of 2024, Bitcoin’s blockchain regularly had over 400,000 transactions a day. This sustainable and high transaction volume is reflected in Bitcoin’s pricing. Whilst it has experienced several devaluations, it has been sitting above $50,000 for the past nine months, and it is one of the most stable cryptocurrencies in the market, having recently surpassed 90,000 USD.

Similarly, Polygon (MATIC), has constructed a healthy network. Around 633,588 wallets hold Matic, making it a widely held token. It is also widely transacted, in varying amounts and for a variety of reasons, making it robust. Throughout 2024, Matic has regularly had over 4100 transactions a day. This sustainable and high transaction volume is reflected in Matic’s 24-hour trading volume, which sits at 7.76m USD.

Dogecoin: A rapid unraveling

Although Dogecoin (DOGE) has rallied hard in recent years, it has failed to establish a ‘healthy’ network. At certain times, it has experienced a large amount of user activity, which has driven up prices momentarily. This includes early 2021, when Dogecoin’s price increased dramatically by 23,000%. However, the number of transactions that drove this price increase was not sustainable. The user activity here was driven by short-term hype, and the transactions taking place were not diverse. The majority of users were interacting with the network purely to ‘pump and dump‘ rather than for any long-term, sustainable utility. This was fuelled primarily by Elon Musk simply tweeting about the token, creating an anomalous spike in price. This rally demonstrated the token’s immense volatility and lack of an entrenched perception by users that Dogecoin has value rooted in something greater than a singular point of interest. Whilst it is still held by around 4 million people, and it still has relatively high levels of transactions, in October 2024, around 250,000 daily transactions. However, a significant 82% of the total circulating Dogecoin is held by a shockingly small amount of wallets, only 535, demonstrating a lack of variety of transactions.

Dogecoin is experiencing another surge thanks to the recent US election result and Elon Musk’s appointment to Trump’s Department of Government Efficiency. Yet, while it has moments of high price, these have not been driven by sustained and meaningful growth. Where Dogecoin has been unable to create a sustainable number of transactions from a diverse array of wallets, Bitcoin and Matic have been able to do so. The evidence is in Bitcoin and Matic’s comparatively stable growth and Dogecoin’s volatility. While DOGE is still holding on, this is driven by hype; like the dinosaurs that came before us, it will likely become extinct.

Focus on the network, not the price

The success of cryptocurrencies and sustainable price increases rests on the health of the web3 network underpinning the token. Rather than focusing on driving the price up for the sake of price, a cryptocurrency developer should, therefore, focus on developing a ‘healthy’ underlying network by harboring sustainable and diverse transactions. This will lay the groundwork for tokens to attract users, beat off competing networks, and ultimately lead tokens to grow in price.

Simon Peters

Simon Peters is the CEO and co-founder of Xerberus, a cryptocurrency risk rating protocol offering industry-leading analysis through its Wallet Graph™️ technology. Xerberus is designed to map and monitor the systemic health of a crypto asset in real-time through its investor wallet network.

Source link

BitVM earlier this year came under fire due to the large liquidity requirements necessary in order for a rollup (or other system operator) to process withdrawals for the two way peg mechanisms being built using the BitVM design. Galaxy, an investor in Citrea, has performed an economic analysis looking at their assumptions regarding economic conditions necessary to make a BitVM based two way peg a sustainable operation.

For those unfamiliar, pegging into a BitVM system requires the operators to take custody of user funds in an n-of-n multisig, creating a set of pre-signed transactions allowing the operator facilitating withdrawals to claim funds back after a challenge period. The user is then issued backed tokens on the rollup or other second layer system.

Pegouts are slightly more complicated. The user must burn their funds on the second layer system, and then craft a Partially Signed Bitcoin Transaction (PSBT) paying them funds back out on the mainchain, minus a fee to the operator processing withdrawals. They can keep crafting new PSBTs paying the operator higher fees until the operator accepts. At this point the operator will take their own liquidity and pay out the user’s withdrawal.

The operator can then, after having processed withdrawals adding up to a deposited UTXO, initiate the withdrawal out of the BitVM system to make themselves whole. This includes a challenge-response period to protect against fraud, which Galaxy models as a 14 day window. During this time period anyone who can construct a fraud proof showing that the operator did not honestly honor the withdrawals of all users in that epoch can initiate the challenge. If the operator cannot produce a proof they correctly processed all withdrawals, then the connector input (a special transaction input that is required to use their pre-signed transactions) the operator uses to claim their funds back can be burned, locking them out of the ability to recuperate their funds.

Now that we’ve gotten through a mechanism refresher, let’s look at what Galaxy modeled: the economic viability of operating such a peg.

There are a number of variables that must be considered when looking at whether this system can be operated profitably. Transaction fees, amount of liquidity available, but most importantly the opportunity cost of devoting capital to processing withdrawals from a BitVM peg. This last one is of critical importance in being able to source liquidity to manage the peg in the first place. If liquidity providers (LPs) can earn more money doing something else with their money, then they are essentially losing money by using their capital to operate a BitVM system.

All of these factors have to be covered, profitably, by the aggregate of fees users will pay to peg out of the system for it to make sense to operate. I.e. to generate a profit. The two references for competing interest rates Galaxy looked at were Aave, a DeFi protocol operating on Ethereum, and OTC markets in Bitcoin.

Aave at the time of their report earned lenders approximately 1% interest on WBTC (Wrapped Bitcoin pegged into Ethereum) lent out. OTC lending on the other hand had rates as high as 7.6% compared to Aave. This shows a stark difference between the expected return on capital between DeFi users and institutional investors. Users of a BitVM system must generate revenue in excess of these interest rates in order to attract capital to the peg from these other systems.

By Galaxy’s projections, as long as LPs are targeting a 10% Annual Percentage Yield (APY), that should cost individual users -0.38% in a peg out transaction. The only wildcard variable, so to say, is the transaction fees that the operator has to pay during high fee environments. The users funds are already reclaimed using the operators liquidity instantly after initiating the pegout, while the operator has to wait the two week challenge period in order to claim back the fronted liquidity.

If fees were to spike in the meanwhile, this would eat into the operators profit margins when they eventually claim their funds back from the BitVM peg. However, in theory operators could simply wait until fees subside to initiate the challenge period and claim their funds back.

Overall the viability of a BitVM peg comes down to being able to generate a high enough yield on liquidity used to process withdrawals to attract the needed capital. To attract more institutional capital, these yields must be higher in order to compete with OTC markets.

The full Galaxy report can be read here.

Source link

Michael Saylor

Microsoft Should Buy $78 Billion Worth of Bitcoin

Published

3 days agoon

November 22, 2024By

admin

As someone who has used Microsoft products my whole life, it pains me to see they are fumbling the bag on Bitcoin. The company’s $78 billion in cash reserves are losing value daily. Meanwhile, they stubbornly refuse to follow MicroStrategy’s proven winning strategy — convert those melting dollars to scarce Bitcoin!

Microsoft announced a couple of months ago that it would buy back shares up to $60 billion; it seems like this did nothing to increase the stock price. Imagine if they had bought Bitcoin instead. That money would have been much more powerful if allocated to Bitcoin. The company would likely have added hundreds of billions in market cap.

Just look at MicroStrategy. In just four years, they turned their $1 billion company into $100 billion by adopting Bitcoin as a treasury reserve asset. They are now the most compelling and successful story in corporate finance, with the best-performing stock in the last four years, beating every US company – even NVIDIA.

Yet Microsoft clings to an outdated financial strategy, destroying shareholder value. Microsoft should follow its technology instincts, not faulty financial logic. There is no long-term viability in holding cash.

I was listening to X Spaces yesterday, during which MicroStrategy’s CEO Michael Saylor revealed that he offered to explain Bitcoin’s benefits privately, but Microsoft’s CEO Satya Nadella rejected the meeting. Now, he is making a last-ditch appeal by presenting a 3-minute Bitcoin proposal to Microsoft’s board.

Earlier, the board already advised shareholders to reject assessing Bitcoin’s potential upside. Nonetheless, I am interested to see how this meeting will turn out. Saylor is a great educator, so you never know.

They should realise that no corporate treasury asset like Bitcoin can enhance enterprise value. Even a small $5 billion Bitcoin allocation could add tens of billions in market cap.

Look, Microsoft, the choice is clear – hoard melting dollars or embrace uncensorable digital gold. Your shareholders are begging you to buy Bitcoin. It’s time to listen before that $78 billion completely disappears. This is your fiduciary duty as Bitcoin continues mass adoption.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential