Markets

Bitcoin Price Stabilizes as Analysts Flag an Accumulation Period

Published

1 month agoon

By

admin

In a nuanced shift in cryptocurrency markets, Bitcoin (BTC) appears to be entering a stabilization phase with indicators suggesting traders are moving into an accumulation period.

Analysts are noting the tepidly good news despite price fluctuations that have seen the leading cryptocurrency trading at $66,300, down 0.7%, but maintaining a 7% gain over the past two weeks.

Ethereum, meanwhile, is down 2% at $2,570, though it too has seen a rise of 5.5% over the last two weeks, according to data from CoinGecko.

Market analysts point to several key factors supporting this stabilization thesis. The $1.7 billion reduction in Circle’s USDC has been more than offset by significant liquidity indicators, including substantial stablecoin inflows totaling $38 billion this year—notably surpassing the $21 billion that has flowed into Bitcoin Spot ETFs.

According to 10x Research, the market is absorbing a number of factors before potentially resuming an upward trajectory. “Instead of turning overly pessimistic, we believe the market needs time to digest the higher bond yields before Bitcoin can resume its upward movement,” said 10x Research in a note to Decrypt.

They emphasized that while funding rates for Bitcoin and Ethereum have risen to 10%, spot prices have lagged, and retail participation remains subdued. “We’d like to see multiple indicators aligning to confirm bullish momentum, but this isn’t a significant concern. The market likely just needs a few days to absorb these factors.”

Adding to this, total stablecoin inflows have been a key driver of liquidity this year. “With $36 billion in stablecoin inflows since the Bitcoin Spot ETF launch, liquidity remains robust,” noted 10x Research, highlighting that these inflows continue to provide upward pressure on Bitcoin’s price.

Valentin Fournier, an analyst at BRN, also pointed to institutional activity as a key indicator.

“After a streak of seven consecutive days of ETF inflows totaling over $2 billion, Bitcoin’s ETF inflows have taken a temporary pause,” Fournier explained. “While this indicates a minor dip in institutional demand, we’re still seeing accumulation at the current price level, which suggests a potential uptrend once the market consolidates.”

Fournier also noted that while Bitcoin has retreated to $67,000 after being rejected at the $70,000 resistance level, this softer rejection suggests traders are accumulating in preparation for a bullish breakout. “The upcoming U.S. presidential election, potential interest rate cuts, and global stimulus efforts could drive cryptocurrencies to new highs in the weeks ahead,” he added.

However, Alex Kuptsikevich, senior market analyst at FxPro, urged caution as Bitcoin hovers near a key support level. “Bitcoin is close to a local support level at $66,800. A break below this support could open the way for a deeper correction toward $65,500,” Kuptsikevich said.

Despite the recent pullback, he emphasized Bitcoin’s dominance in the market, noting that BTC’s share of cryptocurrency market capitalization has risen to 57.3%, the highest since April 2021.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Dogecoin

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Published

2 hours agoon

November 24, 2024By

admin

Dogecoin got another leg up late Friday and into early Saturday, climbing to a price point not seen in over three years. But it has since fallen, with DOGE and other top meme coins among the biggest losers of the last 24 hours.

DOGE popped above the $0.475 mark on Saturday morning—the first time that the meme coin had risen that high since May 2021. Dogecoin has been on a torrid surge in recent weeks, starting before the election and becoming substantially more explosive in the days after.

Previously, in terms of recent moves, DOGE had previously popped as high as nearly $0.43 on November 13; at the time, it was a three-year high mark, but that local peak has since been topped. DOGE is now up 195% over the last 30 days, and 430% over the past year, per data from CoinGecko.

It was a short-lived peak, however, as is typical for such a volatile coin. DOGE is now down to about $0.41 as of this writing as the broader crypto market cools after last week’s surge. Bitcoin, for example, has now dipped to a price of $96,725 after setting a new all-time high price of $99,645 on Friday and coming close to the $100,000 milestone mark.

Dogecoin is now down 12% over the past 24 hours, though it’s not the biggest loser from the top 10 cryptocurrencies by market cap: XRP has dipped by 14% during the same span after pushing to its own three-year-high mark on Friday.

Zooming out, however, it is mostly meme coins that have fallen the hardest out of the top 100 coins over the past 24 hours. Brett (BRETT), Bonk (BONK), Popcat (POPCAT), Dogwifhat (WIF), Pepe (PEPE), and Floki (FLOKI) have all fallen by 10% or more during that span, alongside Dogecoin. Broadly, the crypto market is down by nearly 5% over the past day.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Dogecoin

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Published

6 hours agoon

November 24, 2024By

admin

Some crypto enthusiasts speculate that the service, once live, might include transactions with some digital assets such as DOGE, given Musk’s long-standing affection for the token. Musk’s electric car company, Tesla, already accepts DOGE payments for some merchandise purchases in its online store.

Source link

Bitcoin Magazine Pro

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Published

2 days agoon

November 23, 2024By

admin

Bitcoin’s recent price action has been nothing short of exhilarating, but beyond the market buzz lies a wealth of on-chain data offering deeper insights. By analyzing metrics that gauge network activity, investor sentiment, and the BTC market cycles, we can gain a clearer picture of Bitcoin’s current position and potential trajectory.

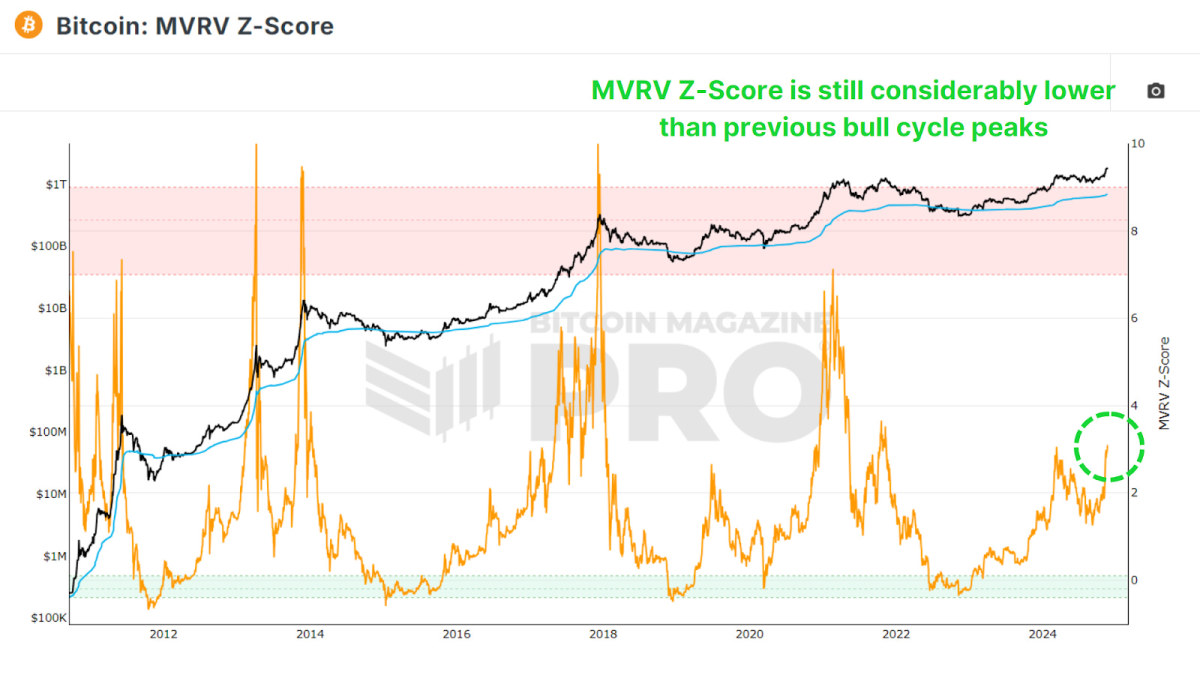

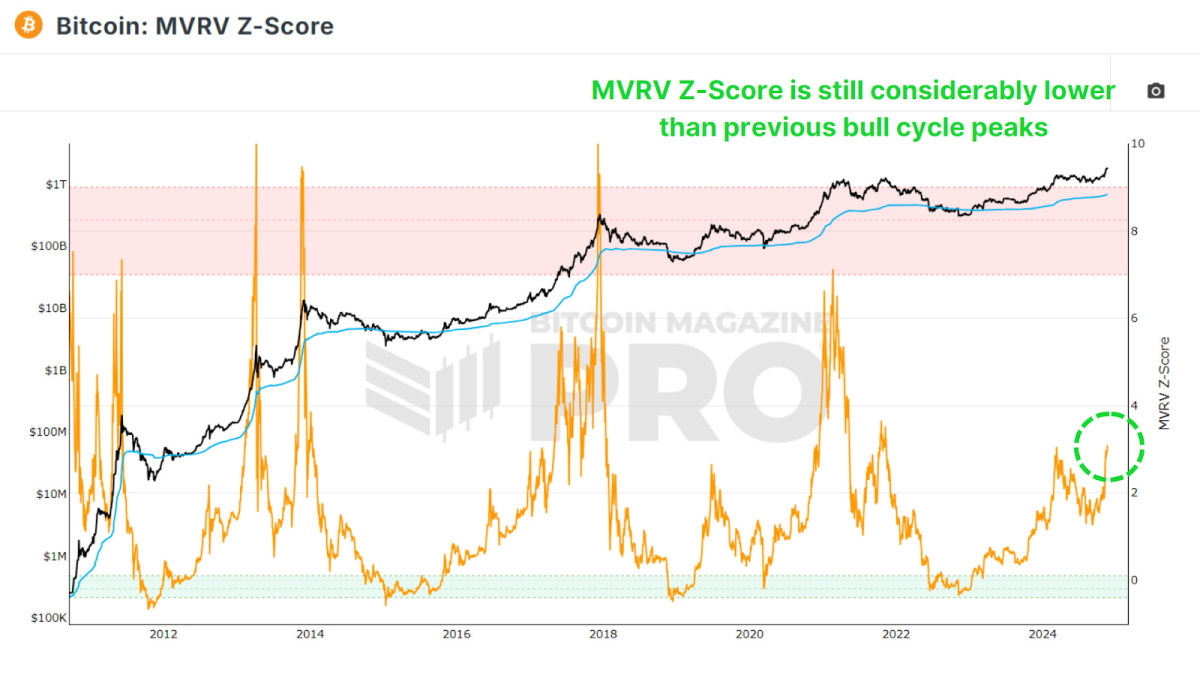

Plenty Of Upside Remaining

The MVRV Z-Score compares Bitcoin’s market cap, or price multiplied by circulating supply, with its realized cap, which is the average price at which all BTC were last transacted. Historically, this metric signals overheated markets when it enters the red zone, while the green zone suggests widespread losses and potential undervaluation.

Currently, despite Bitcoin’s rise to new all-time highs, the Z-score remains in neutral territory. Previous bull runs saw Z-scores reach highs of 7 to 10, far beyond the current level of around 3. If history repeats, this indicates significant room for further price growth.

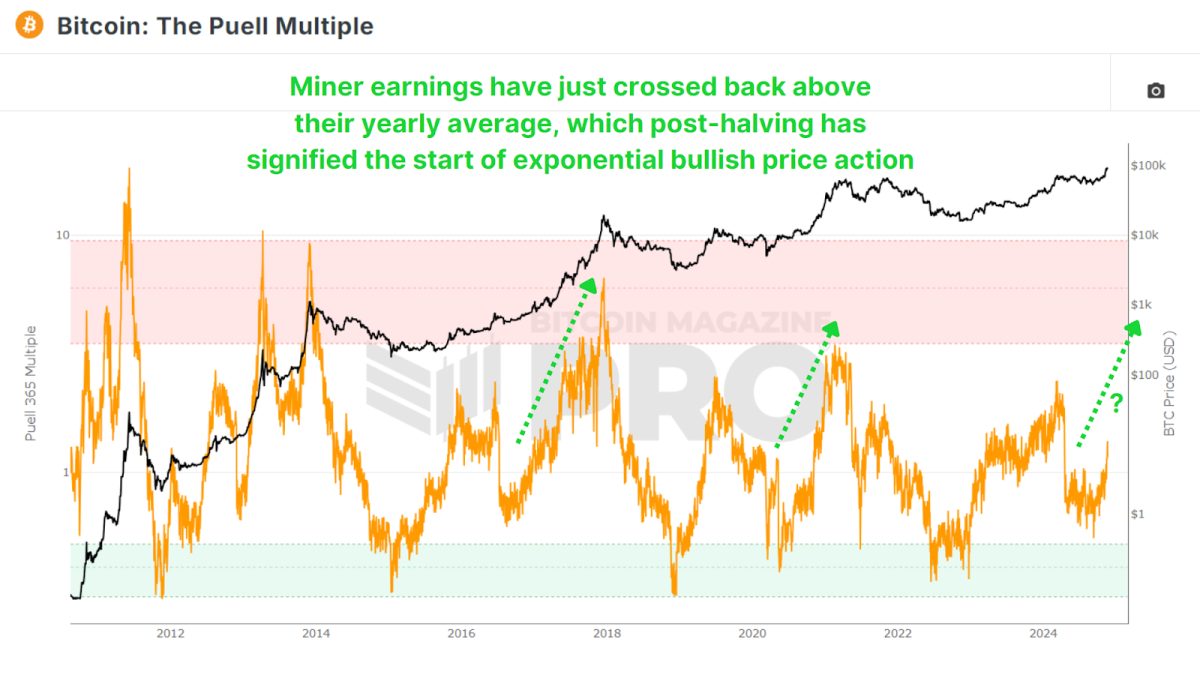

Miner Profitability

The Puell Multiple evaluates miner profitability by comparing their daily USD-denominated revenue to their previous one-year moving average. Post-halving, miners’ earnings dropped by 50%, which led to a multi-month period of decreased earnings as the BTC price consolidated for most of 2024.

Yet even now, as Bitcoin has skyrocketed to new highs, the multiple indicates only a 30% increase in profitability relative to historical averages. This suggests that we are still in the early to middle stages of the bull market, and when comparing the patterns in the data we look like we have the potential for explosive growth akin to 2016 and 2020. With a post-halving reset, consolidation, and a finally a reclaim of the 1.00 multiple level signifying the exponential phase of price action.

Measuring Market Sentiment

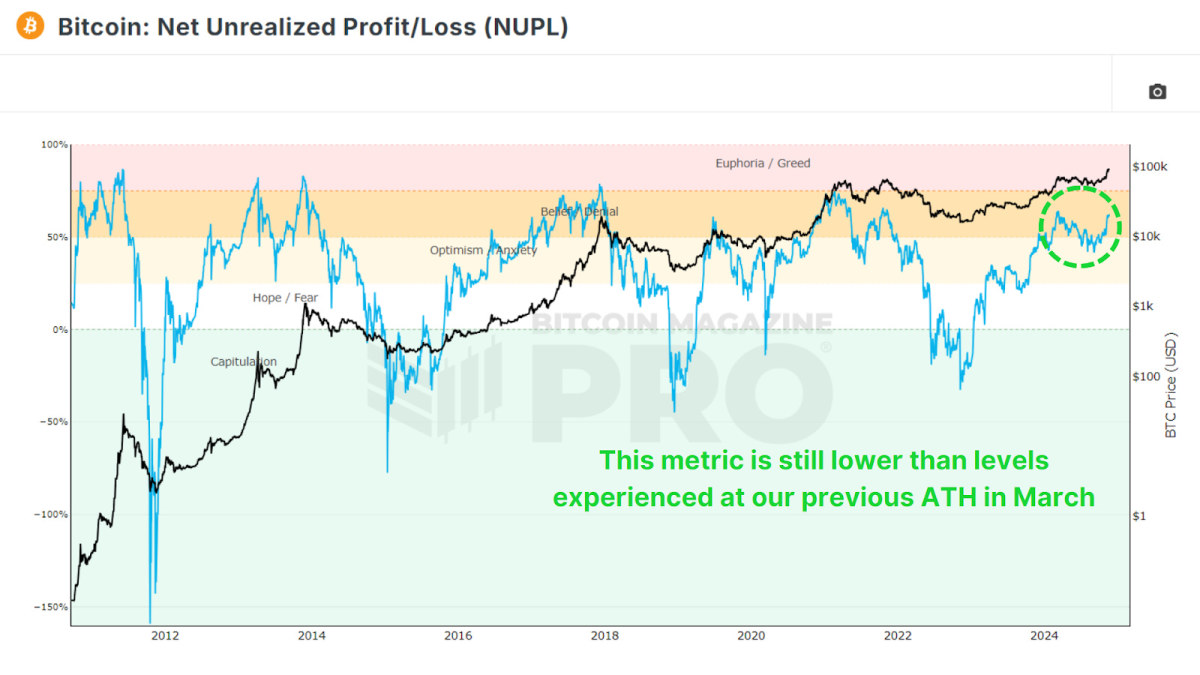

The Net Unrealized Profit and Loss (NUPL) metric quantifies the network’s overall profitability, mapping sentiment across phases like optimism, belief, and euphoria. Similar to the MVRV Z-Score as it is derived from realized value or investor cost-basis, it looks at the current estimated profit or losses for all holders.

Presently, Bitcoin remains in the ‘Belief’ zone, far from ‘Euphoria’ or ‘Greed’. This aligns with other data suggesting there is ample room for price appreciation before reaching market saturation. Especially considering this metric is still at lower levels than this metric reached earlier this year in March when we set out previous all-time high.

Long-Term Holder Trends

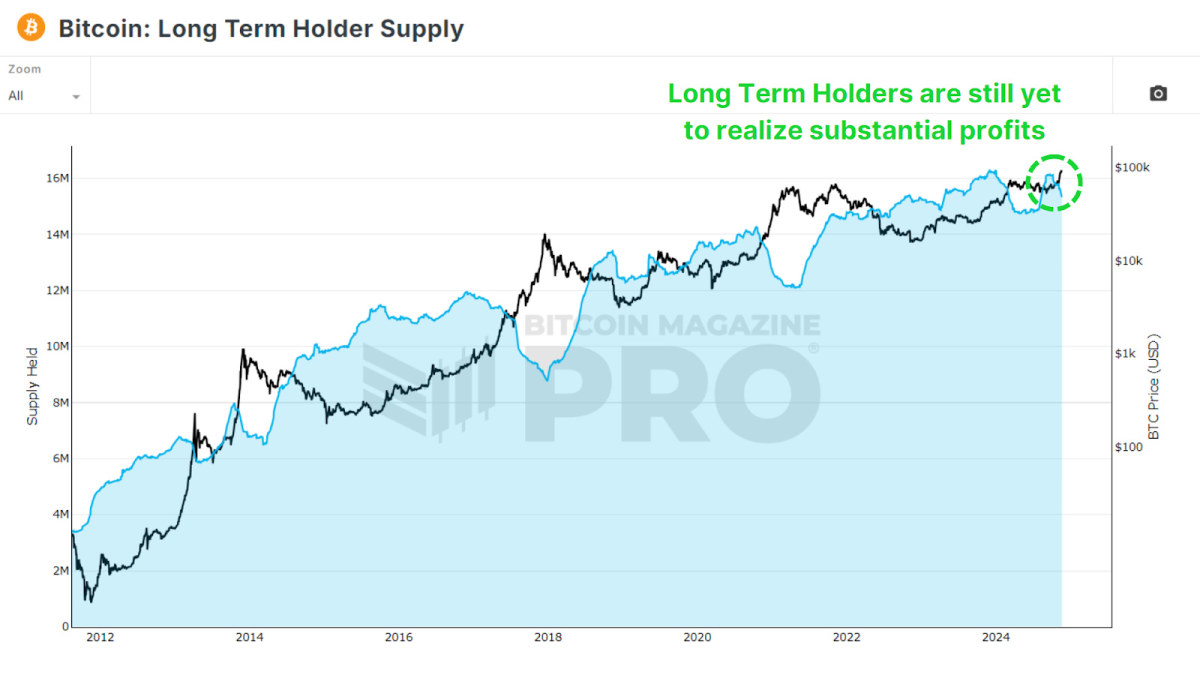

The percentage of Bitcoin held for over a year, represented by the 1+ Year HODL Wave, remains exceptionally high at around 64%, which is still higher than at any other point in Bitcoin history prior to this cycle. Prior price peaks in 2017 and 2021 saw these values fall to 40% and 53%, respectively as long-term holders began to realize profits. If something similar were to occur during this cycle, then we still have millions of bitcoin to be transferred to new market participants.

So far, only around 800,000 BTC has been transferred from the Long Term Holder Supply to newer market participants during this cycle. In past cycles, up to 2–4 million BTC changed hands, highlighting that long-term holders have yet to cash out fully. This indicates a relatively nascent phase of the current bull run.

Tracking “Smart Money”

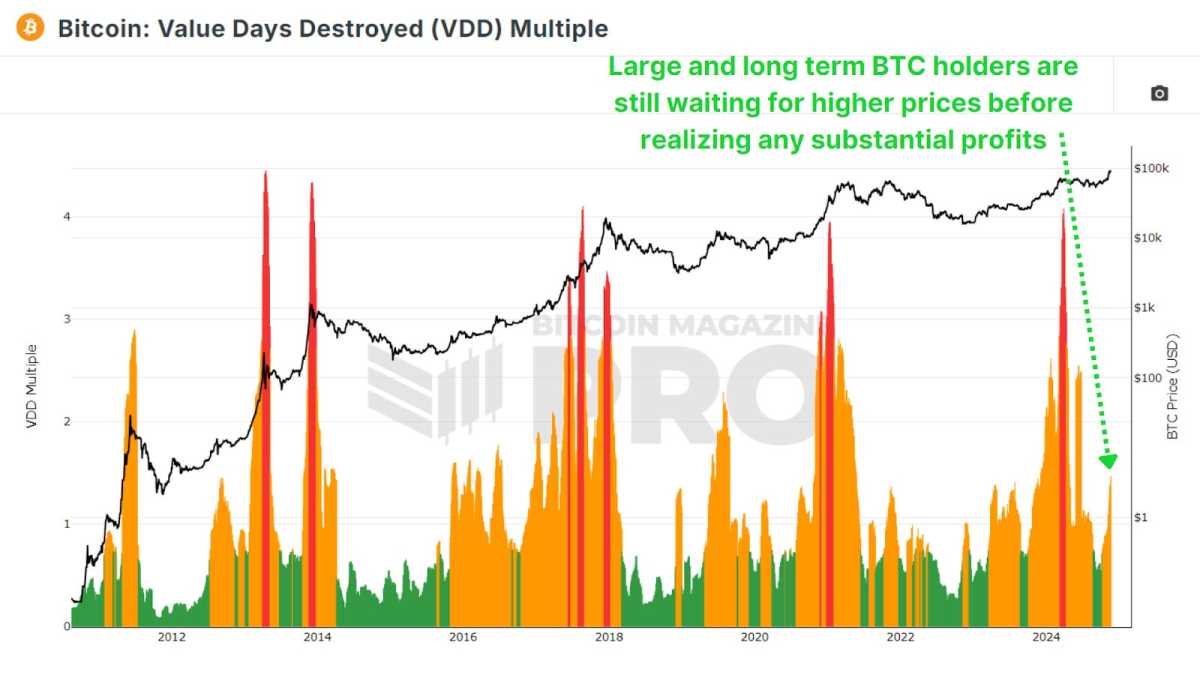

The Coin Days Destroyed metric weighs transactions by the holding duration of coins, emphasizing whale activity. We can then multiply that value by the BTC price at that point in time to see the Value Days Destroyed (VDD) Multiple. This gives us a clear insight into whether the largest and smartest BTC holders are beginning to realize profits in their positions.

Current levels remain far from the red zones typically seen during market tops. This means whales and “smart money” are not yet offloading significant portions of their holdings and are still awaiting higher prices before beginning to realize substantial profits.

Conclusion

Despite the rally, on-chain metrics overwhelmingly suggest that Bitcoin is far from overheated. Long-term holders remain largely steadfast, and indicators like the MVRV Z-score, NUPL, and Puell Multiple all highlight room for growth. That said, some profit-taking and new market participants signal a transition into the mid to late-cycle phase, which could potentially be sustained for most of 2025.

For investors, the key takeaway is to remain data-driven. Emotional decisions fueled by FOMO and euphoria can be costly. Instead, follow the underlying data fueling Bitcoin and use tools like the metrics discussed above to guide your own investing and analysis.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Source link

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential