Opinion

Shielded CSV Protocol 🛡️

Published

4 weeks agoon

By

admin

Introduction

Bitcoin development today focuses on two major issues: (1) scaling and (2) privacy. The usual proposals to Bitcoin involve adding new opcodes and scripting tools. But an old idea is coming back, one that could make transactions more private and peer-to-peer. Right now, every Bitcoin transaction is broadcast to the entire network for verification. It’s an effective way to prevent double-spending, but it also means more information is exposed than is strictly necessary. This leads to heavier computational demands, higher costs, and a system that struggles to scale. But what if moving part of the transaction process client-side didn’t just improve efficiency, but also unlocks a whole new era of privacy on Bitcoin?

In our recently published paper, Blockstream, in collaboration with Alpen Labs and ZeroSync, we introduce the Shielded CSV Protocol, an improvement on Client-Side Validation (CSV) that offers truly private transactions. This new protocol is a significant step towards enhancing the privacy of Bitcoin transactions and has the potential to increase transaction capacity from 11 per second to over 100 per second, through some additional measures we’ll cover in this blog post.

This post offers a high-level overview of the Shielded CSV Protocol, which aims to advance layer one blockchain performance while remaining fully compatible with Bitcoin. Developed by the combined minds of Jonas Nick, Liam Eagen, and Robin Linus. Here’s the backstory on Shielded CSV, and why it has the potential to change everything.

Bitcoin Then and Now

The Double-Spend Problem: How Bitcoin Solved It

Before Bitcoin, it was widely believed that creating a reliable digital currency was impossible without a trusted middleman. The double-spend problem meant there was no way to ensure a “digital coin” couldn’t be spent more than once. It was a fundamental flaw that kept digital currency from becoming a reality.

Then, in 2009, Satoshi addressed this problem by introducing the shared public ledger called the blockchain. Instead of relying on a single trusted authority, Bitcoin uses a network of nodes on a shared public ledger, where every transaction is recorded and verified. This system ensures that each coin is unique, making it impossible to spend the same coin twice.

When a Bitcoin transaction is added to the chain, it follows this process:

- The user’s wallet signs the transaction and broadcasts it to the Bitcoin network.

- Full nodes on the network validate the transaction, ensuring everything checks out.

- The transaction is then included in a block, confirmed, and permanently recorded in the shared public ledger.

During validation, nodes verify that the coins exist, check the validity of the signature, and enforce the critical double-spend rule—making sure each coin is spent only once. The whole purpose of this ledger is to maintain order, showing clearly who owns which coins and when they moved.

The purpose of the ledger is to keep transactions in order, making it clear who owns what coins and when they were sent.

Since its inception, Bitcoin’s developers keep coming back to the same question: is this really the best and most private way to handle transactions? How can we make this system leaner, more efficient, and more private?

A Privacy Problem: Public Transactions

Bitcoin’s biggest privacy challenge is that bitcoin transactions are out there in the open on the blockchain. Satoshi saw this vulnerability from the beginning. In the original whitepaper, he suggested a straightforward solution: users should create new keys for each transaction and avoid reusing addresses.

The idea was to make it harder to link transactions back to a single owner. But in practice, with all the advanced chain analysis methods available today, maintaining privacy is much harder than it seems. Even with new addresses, linking transactions and identifying patterns has become easier for those intent on tracing user activity.

In response, privacy-focused protocols like Zcash have introduced novel ways to conceal transaction details using more advanced cryptography and things like zk-SNARKs. But these methods come with significant trade-offs: transactions are larger, making the verification process for nodes more resource-intensive and expensive to verify.

A Communication Problem: Communication is Inefficient

In Bitcoin’s design, mining serves two fundamental purposes: (1) proof-of-publication for transactions and (2) providing a consensus on the order of transactions. However, Bitcoins’ system also intertwines these core functions with less essential tasks, like transaction validation and coin issuance.

Across all blockchains, whether it’s Bitcoin, Ethereum, Zcash, or Dogecoin, the transaction process always looks the same: wallets sign transactions, broadcast them to the network, and full nodes validate them. But is validating every transaction directly on the blockchain really necessary?

We think there’s a better way. The idea traces back to a 2013 insight, when Peter Todd first mentioned Client-Side Validation. In this mailing list post he asks, ‘Given only proof-of-publication, and a consensus on the order of transactions, can we make a successful crypto-coin system? Surprisingly, the answer is yes!’

Instead of requiring every full node to verify every transaction, CSV allows you to send coins with proof of their validity directly to the recipient. It means that even if a block contains an invalid transaction, full nodes won’t reject it. The result? Less on-chain communication and a more efficient system overall.

CSV: A Peer-to-Peer Scaling Solution

CSV shifts the responsibility of transaction validation from every node in the network to the individual transaction recipients. This makes Bitcoin even more peer-to-peer. Imagine if we didn’t have to use the blockchain to store full transaction details. Instead of a detailed, identity-linked transaction, you’d only see a simple 64-byte nullifier, completely meaningless to anyone looking at the public record on the blockchain, but significant to the sender and recipient.

When every node is required to verify every transaction, it congests the network and slows it down. By shifting transaction validation to the client side, the amount of data stored on the blockchain can shrink significantly—from 560 weight units (WU) on average to something approaching 64 WU, which is about 8.75 times smaller, making the system leaner and more efficient.

The compliance protocol gives Bitcoin a massive scalability boost, allowing users to process nearly 10 times more transactions—close to 100 per second.

Bitcoin Tomorrow

You’re probably thinking, “This all sounds great, but how does this actually work, and what are the trade-offs here?”

How Does Shielded CSV Make Bitcoin More Private?

CSV protocols generally improve privacy over transparent blockchain transactions because some information is moved client-side. But in traditional CSV protocols like RGB and Taproot Assets, when a coin is sent, both the sender and receiver can view the full transaction history.

In Shielded CSV, we use zk-SNARK-like schemes to “compress” the proofs, ensuring that no transaction information is leaked. This means that the transaction history remains hidden, offering better privacy compared to existing protocols.

What is a Nullifier, and How Does it Prevent Double-Spends?

When making a payment, the sender hands the transaction directly to the receiver. A small piece of data derived from the transaction, gets written to the blockchain which is called the nullifier.

Full nodes in the network are only required to perform a single Schnorr signature verification per Shielded CSV nullifier. The receiver checks the coin’s validity and makes sure the nullifier is on the blockchain to stop any double-spending.

Other CSV protocols have nullifiers too, but in many cases they are full Bitcoin transactions, and not derived “random blobs” as we have here. Shielded CSV nullifiers make it harder to do chain analysis.

Does Shielded CSV Require a Soft or Hard Fork?

Shielded CSV doesn’t require a soft or hard fork. It works with Bitcoin as-is. CSV separates transaction validation from the consensus rules, allowing flexibility without changing the core protocol. Since Bitcoin blocks can store any type of data, different CSV protocols like RGB, Taproot Assets, or multiple versions of Shielded CSV can coexist without conflict.

Nodes don’t have to reject blocks containing unfamiliar data. Instead, they only need to interpret the data on the “client-side” if it’s relevant to them. By offloading transaction verification, the blockchain’s primary role is reduced to: confirming transaction data in an agreed-upon order and preventing double-spends.

Does Shielded CSV allow me to Transact in Bitcoin?

Shielded CSV operates as a separate system, using the Bitcoin blockchain to record nullifiers and prevent double-spending within the CSV protocol. But to integrate it directly with Bitcoin and allow seamless transactions, a bridging solution is still needed. The current protocol doesn’t dive deeply into how bridging with BitVM could function, but this area is a development that is still under active research.

Right now, bridging is possible through the use of a trusted party or a federation, but the end goal is a fully trustless system, one that eliminates the need for any intermediaries. Achieving this would mean true, seamless interaction between Bitcoin and Shielded CSV, allowing users to enjoy enhanced privacy without compromising on the trustless values of Bitcoin. It’s a complex challenge, but one that could redefine how Bitcoin scales and secures its transactions.

Read the Full Paper

The Shielded CSV Protocol offers an approach to improving Bitcoin’s scalability and privacy, potentially bringing in a new era of more efficient, peer-to-peer transactions. By offloading transaction validation to the client side, it significantly reduces on-chain data, allowing for greater transaction throughput and enhanced privacy—all without requiring a hard or soft fork. If you’re curious to read more about how this protocol works and the trade-offs involved, I highly encourage you to read the full paper, “Shielded CSV: Private and Efficient Client-Side Validation”. This might just be the future of Bitcoin.

This is a guest post by Kiara Bickers. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

Bitcoin Policy

Want Greater Bitcoin Adoption? Engage With Your Government.

Published

3 hours agoon

November 21, 2024By

admin

It’s been a good week for Bitcoin and its status in the eyes of federal deposit insurance corporations. (Well, there’s a weird sentence I never thought I’d write.)

On Tuesday, the anti-crypto U.S. Federal Deposit Insurance Corporation (FDIC) Chairman, Martin Gruenberg, announced he’d be stepping down in January.

And yesterday, Heritage Falodun, CEO of DigiOats, Nigeria’s leading Bitcoin education and consultancy platform, educated members of the Nigeria Deposit Insurance Corporation (NDIC) about the benefits of bitcoin and other digital assets.

Falodun, an indefatigable Bitcoin proponent, spearheaded a seminar for the NDIC entitled “Cryptocurrency in the Evolving Financial Industry”.

This week, @DigiOats alongside with #MassCyberTech completed a groundbreaking seminar for @NDICNigeria 🇳🇬on “Cryptocurrency in the Evolving Financial Industry”. We explored #Bitcoin adoption, regulation, and sustainable finance marking a key moment for Nigeria’s financial future pic.twitter.com/hpWQOqZt8L

— DigiOats⚡️ (@DigiOats) November 21, 2024

In it, he highlighted the following points:

- Bitcoin can serve as a reserve asset for nation states, including Nigeria

- Using bitcoin (and other digital assets), banks can reduce settlement time

- Bitcoin can reduce capital controls, as its censorship resistant

Falodun and his team also provided an overview on the evolution of money and financial systems and also touched on the ways in which bitcoin and crypto are already integrated into traditional financial structures in efforts to convince the NDIC of Bitcoin and crypto’s importance.

“Nigeria must adopt balanced regulations that protect citizens and foster innovation,” Falodun told Bitcoin Magazine. “By embracing Bitcoin’s uniqueness and engaging the Bitcoin community, Nigeria can lead the global financial revolution.”

Falodun knows that without properly educating government officials, Bitcoin runs the risk of being misunderstood and, therefore, regulated improperly.

“I would like regulators to understand that Bitcoin’s decentralized nature is not a flaw to be regulated out of existence, but a feature that offers unprecedented opportunities for inclusion, economic freedom and optimization of financial rails,” he added.

I respect Falodun’s efforts.

Before you go calling me a statist or some other silly reductive term, I’d like to remind you that even well-known cypherpunks like Adam Back have said that part of the struggle around greater Bitcoin adoption (and encryption in general) will include engaging with governments (and courts).

Proponents of Bitcoin should acknowledge our current political reality and make the case for Bitcoin to those in power if they want to see it flourish — or if they want to at least stop governments from crafting poor policy around Bitcoin and/or attacking the industry.

Take a cue from Falodun and do your part to educate local government officials, members of state-level administrative agencies or even Federal-level bureaucrats about Bitcoin.

It’s one of the most important things you can do to keep your country from falling behind.

Source link

Not all crypto projects have clear value, however. Memecoins, digital tokens whose value is driven by internet attention rather than tangible use, are divisive — even within crypto circles. For example, dogecoin, a favorite of Elon Musk, has a market value exceeding 94% of companies in the S&P 500, despite lacking a product or business model. Recently, Chris Dixon, at Andreessen Horowitz, even criticized memecoins’ as undermining understanding of the sector’s utility. If one was looking for a reason to argue crypto is a scam, you could find it in pockets of the memecoin world.

Source link

Markets

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

Published

7 hours agoon

November 21, 2024By

admin

Peak Bitcoin, hardly.

https://x.com/pete_rizzo_/

As I wrote in Forbes in 2021, the world is waking up to a new reality in regards to Bitcoin – the unlikely truth that Bitcoin’s programming has cyclical effects on its economy.

This has led to at least 4 distinct market cycles where Bitcoin has been branded a bubble, skeptics have rung their hands, and each time, Bitcoin recovers more or less 4 years later to set new all-time highs above its previously “sky-high” valuation.

I personally watched Bitcoin go from $50 to $1,300 in 2013. Then, from $1,000 to $20,000 in 2017, and I watched it go from $20,000 to $70,000 in 2021.

So, I’m just here to relate that, from my past experience, this market cycle is just heating up.

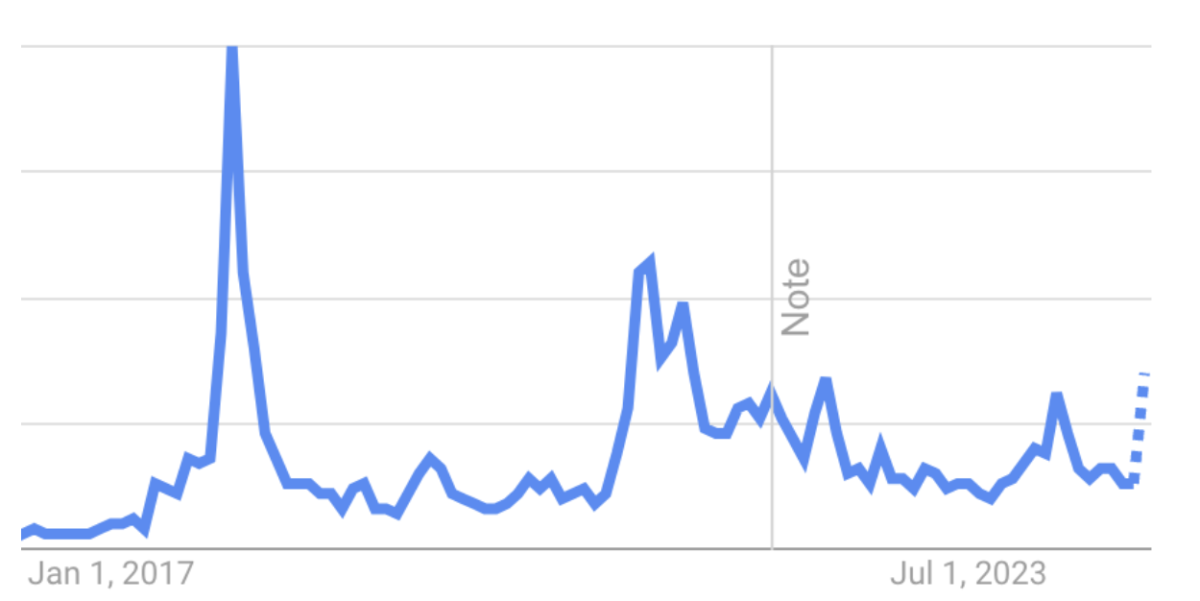

For those who have been in Bitcoin, there’s one tried-and-true and that’s Google Search. As long as I’ve been in Bitcoin, this has been the best indicator of the strength of the market.

Search is low, you’re probably in a bear market. Search heading back to all-time highs? This means new entrants are getting engaged, learning about Bitcoin, and becoming active buyers.

Remember, this is a habit change. Bitcoin HODLers are slowing shifting their assets to a wholly new economy. So, Google Trends search then, represents a snapshot of Bitcoin’s immigration. It shows how many new sovereign citizens are moving their money here.

And it’s something that all who are worried about whether bitcoin’s price topping out in 2024 should pay attention to.

Last year was the Bitcoin halving, and historically, the year following previous halvings has led to price appreciation. Maybe you’re tempted to think, “this time is different” – not me. I look at search and I see a chart that continues to accelerate into price discovery. Trust me when I say no one I know is selling bitcoin.

As shown above, buyer interest is accelerating, and these new buyers have to buy that Bitcoin from somewhere. Add nation states, US states, and a coming Trump administration set to ease the burden on the industry?

Well, I think the chart above says it all really.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

Sui Network blockchain down for more than two hours

Analyst Says Six-Figure Bitcoin Price Incoming – But Warns One Factor Could Delay BTC Rally Till Next Year

How Will BTC React to $3B Buying Spree?

ECB official calls for urgency on digital euro amid global CBDC race

The Story Behind a Crypto Trader Turning $378K into $35.2M

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential