News

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Published

4 weeks agoon

By

admin

Paolo Ardoino, the CEO of stablecoin issuer Tether, is squashing rumors that his firm is being probed by federal agencies.

In a post on the social media platform X, Ardoino addresses a Wall Street Journal (WSJ) report, which claims that authorities are investigating Tether for potential violations of anti-money laundering and sanctions laws.

The WSJ reports that the Manhattan U.S. Attorney’s Office is looking into whether Tether’s USDT has been used by bad actors to fund illegal activities or launder the proceeds generated by the criminal acts.

The report also claims that the Treasury Department is looking at possibly sanctioning Tether for the “widespread use” of USDT among entities sanctioned by the US.

In response, Ardoino says the WSJ is merely recycling long-played-out narratives.

“As we told the WSJ, there is no indication that Tether is under investigation. WSJ is regurgitating old noise. Full stop.”

Ardoino also highlights that Tether has been routinely cooperating with US authorities to prevent bad actors from using USDT to fund illicit activities.

“At Tether, we deal regularly and directly with law enforcement officials to help prevent rogue nations, terrorists and criminals from misusing USDT.

We would know if we are being investigated as the article falsely claimed. Based on that, we can confirm that the allegations in the article are unequivocally false.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

crime

Crypto cops record $8.2b in financial remedies for investors: SEC

Published

5 hours agoon

November 24, 2024By

admin

For all the complaints levied against the crypto-strict U.S. Securities and Exchange Commission (SEC), the agency successfully obtained orders for $8.2 billion in financial remedies for 2024.

This is despite a 26% decrease in total enforcement actions.

The successful prosecution of Terraform Labs helped the agency achieve this milestone. Once a jury verdict found Terraform Labs and founder Do Kwon liable for fraud, defendants agreed to a final judgment ordering them to pay more than $4.5 billion in penalties — the highest amount ever obtained by the SEC following a trial.

It accounted for more than half of the total monetary judgments, according to the details from the press release.

SEC’s 583 enforcement actions

The SEC’s enforcement efforts in 2024 showed significant shifts across multiple categories, with 583 total enforcement actions. This includes 431 stand-alone actions representing a 14% decrease, 93 follow-on administrative proceedings showing a 43% decrease, and 59 delinquent filing actions marking a 51% decline.

Despite the reduced number of cases, the financial impact reached these levels, combining $6.1 billion in disgorgement and prejudgment interest with $2.1 billion in civil penalties.

In the cryptocurrency sector, the SEC pursued several major cases, including charges against Silvergate Capital for misleading BSA/AML compliance disclosures and action against Barnbridge DAO for unregistered securities offerings.

The agency also tackled the HyperFund pyramid scheme involving $1.7 billion and the NovaTech fraud case affecting 200,000 investors. Notable first-time enforcement actions targeted relationship investment scams involving NanoBit and CoinW6 platforms.

The SEC’s Division of Enforcement won all five federal district court cases, including its crypto-related trial against Terraform Labs. This success extended to investor protection measures, with 124 individuals barred from serving as officers and directors of public companies.

SEC Chair Gary Gensler emphasized the Division’s role as a “steadfast cop on the beat,” while Acting Director Sanjay Wadhwa noted increased market participant cooperation and self-reporting.

The report somewhat justifies Gensler’s role as the top crypto enforcer. The outgoing SEC chair, set to resign on Jan. 20, faced harsh criticism from crypto enthusiasts and retail traders throughout his tenure for his regulatory approach.

And yet, the SEC distributed $345 million to harmed investors and processed a record 45,130 tips, complaints, and referrals, including over 24,000 whistleblower tips, resulting in $255 million in whistleblower awards.

The agency’s success in returning funds to investors has been substantial, with more than $2.7 billion distributed since fiscal year 2021.

But most of the actual scams were cyrpto 😬

— sean combs (@William48759211) November 22, 2024

Source link

Dogecoin

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Published

8 hours agoon

November 24, 2024By

admin

Some crypto enthusiasts speculate that the service, once live, might include transactions with some digital assets such as DOGE, given Musk’s long-standing affection for the token. Musk’s electric car company, Tesla, already accepts DOGE payments for some merchandise purchases in its online store.

Source link

ADA

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Published

16 hours agoon

November 24, 2024By

admin

The layer-1 blockchain Cardano (ADA) is primed to continue its long-awaited price surge, according to a popular crypto analyst.

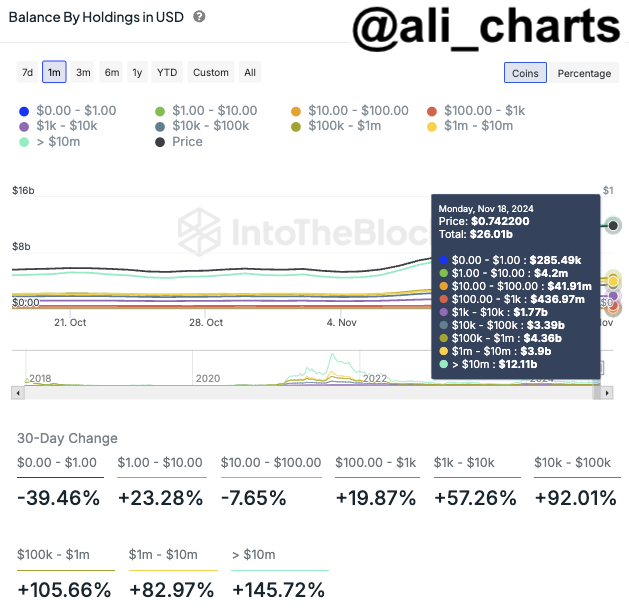

The digital asset trader Ali Martinez tells his 87,300 followers on the social media platform X that whales and “institutional players” have been buying into the Ethereum (ETH) competitor in anticipation of further price increases.

“The volume of large Cardano ADA transactions on the network has surpassed $22 billion per day. Those large transactions appear to be related to high accumulation levels. Indeed, whales holding from $1 million to over $10 million in ADA have increased their positions by more than 100% in the past month.

The high buying pressure is starting to move prices, and from a technical perspective, Cardano seems to be mirroring its previous bullish cycle. If this pattern holds true, ADA could target $6!”

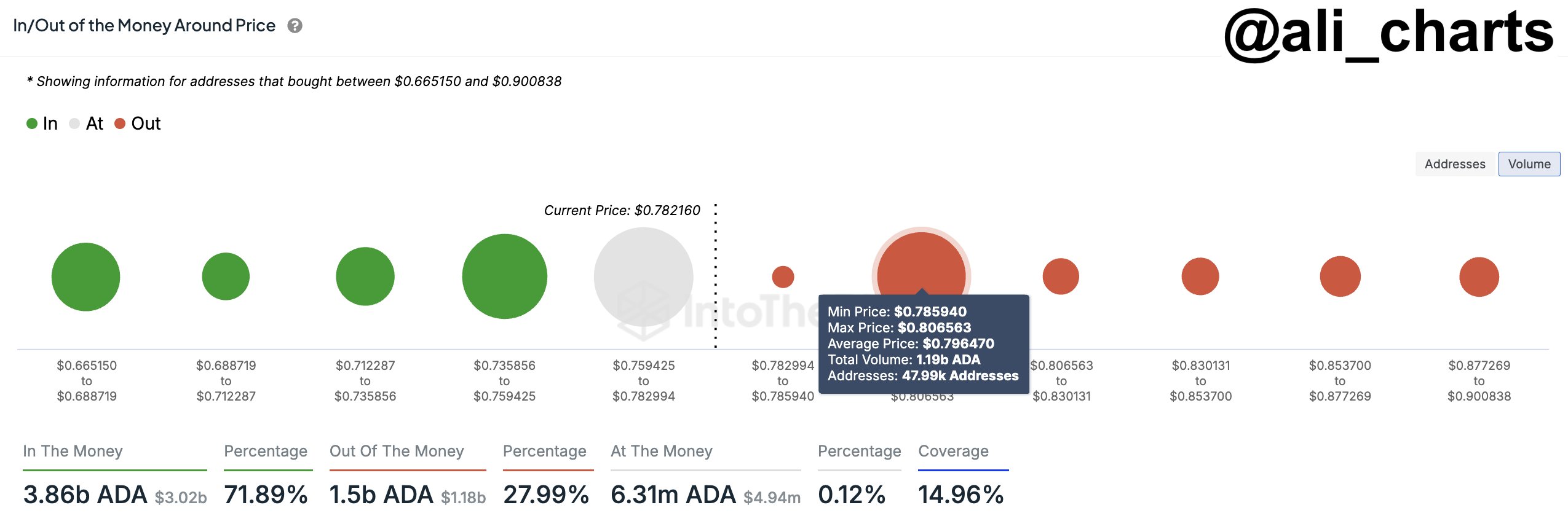

Martinez also notes that one “key area” of support that ADA needs to hold to maintain its bullish thesis is $0.80. At that price point, 48,000 addresses bought nearly 1.20 billion ADA.

ADA is trading at $1.06 at time of writing. The ninth-ranked crypto asset by market cap is up more than 24% in the past 24 hours, more than 48% in the past seven days and nearly 200% in the past month.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential