24/7 Cryptocurrency News

Fetch AI Completes Network Upgrade, Can FET Price Reach $13?

Published

4 weeks agoon

By

admin

Fetch ai has successfully completed its network upgrade under Proposal 33, marking a pivotal moment for the decentralized AI-focused platform. The upgrade seamlessly integrates the Fetch ai mainnet with the CUDOS network, merging all CUDOS tokens and staked assets according to predefined token ratios and a three-month vesting schedule.

Following the upgrade, analysts are optimistic about the potential impact on Fetch.ai’s (FET) price, with some projecting substantial gains.

Fetch AI Completes Network Upgrade

The integration of the CUDOS mainnet into Fetch ai brings new interoperability and functionality to the Fetch.ai ecosystem. By merging with CUDOS, Fetch.ai has broadened its decentralized computing capabilities, allowing for more efficient and scalable AI and blockchain-based applications.

Sebsequently, the Fetch ai team acknowledged the rapid and professional efforts of its validators, who ensured that the network upgrade went smoothly, restoring consensus formation and stable network operations.

The community’s patience and support throughout the upgrade were also highlighted by Fetch.ai, as this integration paves the way for further advancements. With this merger, Fetch.ai aims to strengthen its position within the Artificial Superintelligence (ASI) Alliance, a consortium of decentralized AI platforms including SingularityNET and Ocean Protocol.

New Cross-Chain Opportunities with Injective Partnership

Fetch.ai is also making strides in cross-chain interoperability through a recent partnership with Injective, a decentralized finance (DeFi) protocol. This collaboration allows Fetch.ai to replace its Inter-Blockchain Communication (IBC) protocol light client with Injective’s technology, enabling more efficient cross-chain asset transfers between the Fetch.ai and Injective networks.

According to market observers, this could open up new DeFi opportunities, further boosting the company’s ecosystem.

Market activity around Fetch.ai derivatives has already increased, with trading volume rising by 93.89% to reach $121.26 million. Open interest, a metric indicating the total number of outstanding derivative contracts, has also seen a 3.22% uptick, suggesting renewed interest from traders. This heightened activity reflects growing market confidence and perhaps bullish sentiment toward Fetch.ai’s recent upgrades.

Analysts Predict Strong Price Potential for FET

Market analysts are closely monitoring FET’s price action following the network upgrade and the Injective partnership. Technical analyst “World of Charts” recently noted a breakout from a descending channel, signaling a potential reversal from the previous bearish trend. After breaking out, the price retested this level, which could confirm a bullish trend if sustained. World of Charts suggests that this setup could propel FET towards a $5 target in the short term.

On a more optimistic note, crypto analyst DamiDefi has projected that FET price could climb to as high as $13. According to DamiDefi, the combination of the technical breakout, increased trading activity, and the successful network upgrade provides a strong foundation for further price appreciation.

The recent formation of a “Cup and Handle” pattern, a bullish continuation indicator, supports this prediction. If FET breaks out from this pattern with high volume, a significant price rise could follow. The Relative Strength Index (RSI) for FET remains within a neutral range, around 44.68, suggesting that the asset has room for upward movement without being overbought.

The price is also testing a key support level around $1.25, which could serve as a solid foundation for further gains if it holds. Analysts note that breaking through resistance levels at $1.40, $1.70, and $2.10 could confirm a stronger bullish momentum, potentially leading to new highs.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

24/7 Cryptocurrency News

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Published

32 mins agoon

November 24, 2024By

admin

A crypto trader made a $2.5M profit today by turning 13 SOL into 9,718 SOL through trading 76.46M FATHA tokens. The trader bought the tokens on Pump.fun, capitalizing on a rapid increase in FATHA’s market cap, which surged to over $60M. The trader sold the tokens at the peak, realizing a 750x return.

Trader Makes $2.5M Profit Trading FATHA Token

The crypto trader turned 13 SOL (around $3.3K) into 9,718.5 SOL, making a $2.5M profit by trading 76.46M Slopfather (FATHA) tokens. On November 23, the trader purchased the tokens on Pump.fun, and within 40 minutes, FATHA’s market cap surged to over $60M. After holding the tokens, the trader sold them at the highest point, securing a 750x return.

The trader capitalized on the rapid market shift and seized the opportunity to make a significant profit. As per solscan, 9,500 SOL was swapped for USDC and bridged to Ethereum, demonstrating how quickly substantial profits can be made in the volatile meme coin market. The trade reflects the growing influence of meme coins on the Solana blockchain.

On-chain data indicates that the wallet involved in this trade may belong to BT (@cooksassistant), who has traded 60 tokens over the past three days. With a win rate of 42.37%, BT has generated $2.7M in total profit.

What a lucky trader!!!

6 hours ago, this trader sniped 76.46M $FATHA for just 2.93 $SOL ($765).

Currently, these $FATHA are worth $2.7M. The sniper has made x3483.https://t.co/MVgcAnWR1R pic.twitter.com/seXfdgAq6r

— Onchain Lens (@OnchainLens) November 23, 2024

FATHA Token Surge and Solana’s Meme Coin Boom

Slopfather (FATHA) token has surged to $0.03841, with a market cap of $38 million, allowing the crypto trader to book a massive profit. Its 24-hour trading volume is $156 million, reflecting a 4000% increase in the last 24 hours. This dramatic rise shows the growing demand for meme coins in the crypto market.

Solana’s blockchain is becoming a top platform for meme coin launches. Projects like PNUT, WIF, GOAT, and BONK are leading the way. Additionally, Arthur Hayes’ endorsement of the Solana-based FLOWER coin boosted interest, driving the growth of meme coins on Solana.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Published

7 hours agoon

November 24, 2024By

admin

Gemini co-founder and CEO Cameron Winklevoss is calling for a probe into the drop of a controversial charge involving FTX co-founder Sam Bankman-Fried (SBF). It has been 8 months since Judge Lewis Kaplan sentenced SBF to 25 years in jail. However, to Tyler, this has not resolved some major aspects of his fraudulent reign as FTX CEO.

Cameron Winklevoss to Trump’s Attorney General

Directing his X post to the community, the Gemini CEO asked the incoming Attorney General to investigate SBF’s $100 million campaign finance breaches. Notably, the Department of Justice (DoJ) dropped these charges mid-last year, moving the SBF saga away from politics.

To Cameron Winklevoss, the public deserves to know why the charges were dropped. In addition, he said it is in the public interest to know why the funds went to fund Democrat elections. The post from the Gemini co-founder has generated a lot of reaction among crypto stakeholders.

One X user Nguyễn Minh Quân (@theUxBlockChain), highlighted how dropping charges on high profile cases can erode trust in public offices.

Public trust in the legal system takes a hit when high-profile cases involving political donations end with charges being dropped. People expect the justice system to fully investigate financial crimes, especially those that could have impacted political decisions or outcomes.

— Nguyễn Minh Quân (@theUxBlockChain) November 23, 2024

In a separate post, the Winklevoss twin hailed the nomination of Scott Bessent as Treasury Secretary. Bessent aligns with crypto values and according to the Gemini CEO, he explains the Democrat war on the industry better. In Scott Bessent referenced video, he claimed the Democrats are fighting the industry to cover up the bad act from one party – SBF.

Contained Complications from SBF Role At FTX

Cameron Winklevoss’ is one of the major firms impacted, indirectly, by the FTX implosion. Over, the exchange’s bankruptcy became imminent with over $8 billion of customer’s funds lost.

In fairness attribution to the justice system, Caroline Ellison and Ryan Salame also got 2 and 7.5 years for helping to wreck the exchange. However, Gary Wang escaped prison, enjoying rare leniency like Nishad Singh.

With the exchange’s executives now sentenced, the firm has announced January as the timeline to begin the FTX reognization plan. While the entire bankruptcy plan is almost over, the last phase, the reognization plan still require one more court order.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Published

10 hours agoon

November 24, 2024By

admin

Stellar price has seen a remarkable surge, climbing over 80% in the last 24 hours, rising to number one in the top gainers. The bullish momentum has pushed XLM from $0.302 to a peak of $0.55, as traders and analysts anticipate the possibility of the asset nearing the $1 mark.

Stellar Price Reaches $0.55 Amid Bullish Momentum

Stellar’s price rise reflects strong buying interest as it touched $0.55, marking a significant upward trend. After a period of consolidation around $0.40, the cryptocurrency broke through resistance levels, delivering impressive returns for investors.

Market participants have noted this upward movement as a sign of renewed confidence in the asset’s potential. However, the price also briefly retraced from its peak as it faced resistance at the $0.55 level, suggesting that $1 remains a potential milestone rather than an immediate outcome. Jed McCaleb, Stellar’s founder, has also added to the growing optimism surrounding the network.

In a recent statement, McCaleb commented on Stellar’s current momentum and its role in global financial systems. “Stellar is the most underrated and least understood crypto project,” McCaleb remarked, emphasizing its ability to facilitate real-world transactions and its high efficiency. He noted,

“The best and most impactful use of crypto is as digital money, and this is what Stellar is built for.”

Grayscale Stellar Lumens Trust Records 10% Asset Growth

Grayscale Investments LLC’s recent 10-K filing highlighted a 10% increase in the net assets of its Stellar Lumens Trust during the fiscal year ending September 2024.

Despite the challenges posed by XLM price fluctuations and management fees, the trust managed to grow its assets due to the addition of 34,875,230 XLM tokens valued at $3,923.

Trading activity around Stellar has surged, with derivatives markets experiencing substantial growth in both volume and open interest. The trading volume for XLM derivatives rose by 284.26%, reaching $8.98 billion, while open interest increased by 125.88% to $393.05 million.

The filing also outlined that the trust faced losses stemming from token depreciation earlier in the year, but these were offset by a robust recovery and asset inflows. The document underscores the growing institutional interest in Stellar as an investment vehicle, aligning with its recent market performance.

Analyst Predicts Multi-Year Price Pattern May Propel XLM to $3-$5

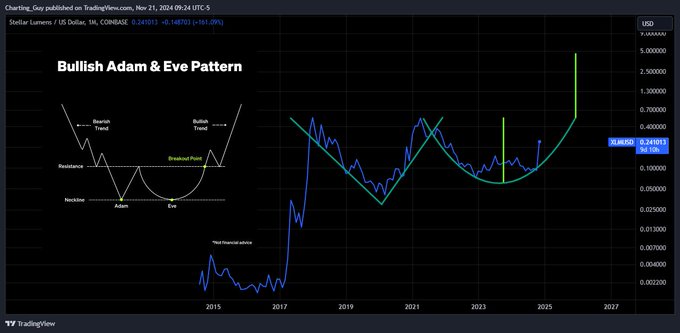

Cryptocurrency analysts have highlighted a multi-year price structure for Stellar, suggesting that it may be poised for further growth. A prominent market speculator, known as “Charting Guy,” recently shared a prediction that Stellar could achieve price targets between $3 and $5.

According to the analyst, XLM price has been forming a bullish “Adam and Eve” pattern on the monthly chart since 2017. This chart pattern is often associated with long-term upward momentum.

Charting Guy emphasized patience, indicating that the current rally could lead to substantial gains for long-term holders. A potential breakout from this pattern could result in a 930% to 1,617% increase from current levels, further reinforcing optimism in Stellar’s market trajectory.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto Trader Records $2.5M Profit With This Token, Here’s All

Trump taps crypto bros to be in charge: What’s at stake?

Charles Schwab Looking at Spot Crypto Trading Following Regulation Shift: Report

Here’s Why XRP Price Will Hit $20

3 cryptos under $0.5 that experts believe could deliver 1500% returns

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: