Mining

Riot stocks poised for a comeback ahead of Oct. 30 earnings release

Published

3 weeks agoon

By

admin

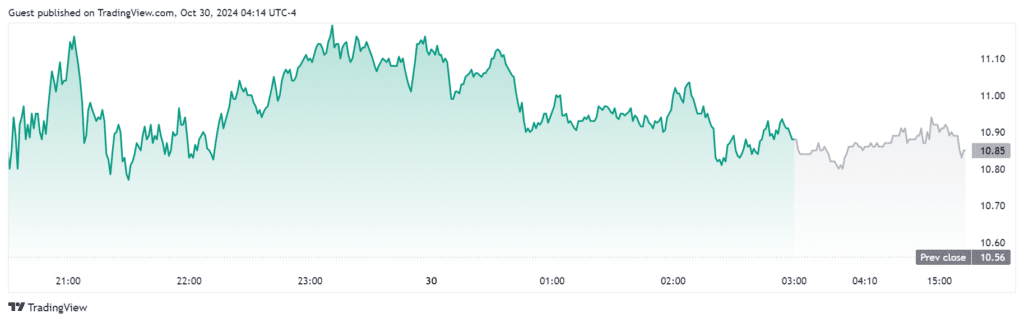

Bitcoin mining company Riot stocks are predicted to make a comeback after experiencing a 28.96% decline in year-to-date. Its shares are on an upward trend in anticipation of the company’s Q3 2024 earnings report on Oct. 30.

According to data from Trading View, Riot’s stocks are on the rise at nearly 3% in the past day. The Bitcoin (BTC) mining company is expected to release its third quarter 2024 earnings on Oct. 30 after markets close at 4:00 PM EST.

Riot Platform’s shares have been experiencing a year-to-date decline of 28.96%. Although, its stock price has seen a rise of 13.91% in the past year. In fact, the company is anticipating a loss of $0.16 per share with revenues of $95.35 million. At the time of writing, the Riot stock is trading hands at $10.87.

Although things are not looking good, there are signs that suggest a turnaround for Riot may be possible. Riot’s shares are on a bullish run, going above their five, 20,and 50-day exponential moving average. If it can maintain its bullish pressure, Riot Platforms could experience a comeback.

Moreover, Riot’s moving average convergence or divergence is indicated to be positive, at 0.73. While the stocks’ Relative Strength Index is at 73.07, which means that the stock is currently in overbought territory.

Based on data on Trading View, the stock has been going up due to a similar rise also found in other crypto mining stocks.

Reminder: Riot’s Q3 2024 earnings conference call is tomorrow, Wednesday, October 30, 2024, at 4:30 PM EST!

🖥 For the audio-only webcast, register here: https://t.co/YOrtZ57wgo.

📞 To dial in from the U.S. or internationally, register here: https://t.co/yNuMCbHmKX.

— Riot Platforms, Inc. (@RiotPlatforms) October 29, 2024

On Oct. 29, Riot Platforms posted a reminder on its X account that the company will be holding a conference call to go over its third quarter Q3 2024 earnings report on Oct. 30 4:30 PM EST. Its previous Q2 2024 earnings report showed a total revenue of $70 million, decreasing by 8.7% compared to its Q2 2023 revenue, which was $76.7 million.

The company stated the decrease was driven by a $9.7 million decrease in engineering revenues. Though, this was offset by a $6 million increase in Bitcoin mining revenue.

According to its press release, Riot is a Bitcoin mining and digital infrastructure company focused on a vertically integrated strategy. Founded in 2000, Riot has Bitcoin mining operations located in central Texas and Kentucky, as well as electrical switchgear engineering and fabrication operations in Denver, Colorado.

Source link

You may like

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Mining

BIT Mining settles with SEC for $4m amid bribery allegations in Japan

Published

4 days agoon

November 19, 2024By

admin

Crypto mining firm BIT Mining has agreed to pay a $4 million civil penalty after the SEC charged it with violating the Foreign Corrupt Practices Act.

The U.S. Securities and Exchange Commission has charged crypto mining firm BIT Mining, formerly known as Chinese online betting platform 500.com, with violating the Foreign Corrupt Practices Act through a bribery scheme aimed at influencing Japanese government officials. The SEC announced in a Monday filing on Nov. 18 that the firm agreed to pay a $4 million civil penalty to resolve the charges.

Between 2017 and 2019, BIT Mining allegedly paid $2.5 million in cash bribes and gifts to several officials, including members of Japan’s parliament, in an effort to secure a bid to open an integrated resort casino in Japan. The company disguised the payments as fake consultant contracts and management advisory fees, according to the SEC.

Simultaneously, the U.S. Department of Justice stated that BIT Mining has also agreed to pay a $10 million criminal fine, with $4 million of that amount credited toward the SEC settlement.

“The illegal scheme started at the top, with the company’s CEO allegedly fully involved in directing the illicit payments and the subsequent efforts to conceal them.”

U.S. Attorney Philip R. Sellinger for the District of New Jersey

According to the DoJ, BIT Mining acknowledged under the U.S. Sentencing Guidelines that the “appropriate criminal penalty is $54 million.” However, the agency reduced the amount to $10 million, citing the company’s “financial condition and demonstrated inability to pay the penalty.”

BIT Mining also entered into a three-year deferred prosecution agreement with the DoJ, resolving charges of conspiracy to violate the anti-bribery and books-and-records provisions of the FCPA, as well as direct violations of the books-and-records provisions.

Source link

Acquisition

Kaixin plans crypto mining expansion amid Bitcoin’s new all-time high

Published

6 days agoon

November 17, 2024By

admin

Chinese electric vehicle manufacturer Kaixin is looking for a strategic shift with plans to acquire a controlling stake in a Middle Eastern cryptocurrency mining operation.

The announcement depicts a major jump and diversification from its traditional automotive business.

Kaixin in advanced stages of acquisition

According to Kaixin’s press release, the Beijing-based company is in advanced stages of evaluating the potential acquisition.

The target operation features cost-efficient Bitcoin mining machines and provides comprehensive cloud hosting services to meet growing industry demand.

Kaixing stated that the facility’s key advantage lies in its access to stable, long-term energy supplies. The company stated that this is crucial for maintaining profitable operations.

This energy security aspect appears to be a primary driver behind the strategic choice of location.

Kaixin currently operates as a leading new energy vehicle manufacturer in China. The company maintains professional teams across R&D, production, and marketing.

Unlike many traditional automotive companies, Kaixin’s move into cryptocurrency mining represents a different and bold strategic pivot.

The company aims to use its existing expertise in sustainable operations while expanding into the crypto sector.

Kaixin stated in its press release:

“This acquisition represents our commitment to exploring new growth avenues while maintaining our core automotive excellence.”

However, the exact timeline for when the deal will close remains unclear as the company continues its evaluation process.

The global crypto market cap has also surged past $3.04 trillion as Bitcoin (BTC) has created new all-time highs in the past few days. Alongside BTC, several other altcoins have exhibited double-digit gains in the last seven days.

Source link

ASIC

Bitcoin miner Hut 8 to increase hashrate with fleet upgrade

Published

2 weeks agoon

November 6, 2024By

admin

Hut 8 has announced an upgrade to its ASIC fleet with the purchase of 31,145 Antminer S21+ units at $15 per terahash.

North American cryptocurrency mining giant Hut 8 has unveiled plans to upgrade its ASIC fleet with the purchase of 31,145 Bitmain Antminer S21+ miners.

In a Nov. 6 press release, the Miami-headquartered mining company stated that under the purchase agreement, it will acquire the miners at $15.00 per terahash, with delivery expected in early 2025. This upgrade is set to add 3.7 exahashes per second to Hut 8’s self-mining capacity, boosting it to approximately 9.3 EH/s, a 66% increase from current levels.

The new units are expected to enhance fleet efficiency by 37%, lowering average energy consumption per terahash from 31.7 to 19.9 joules, according to the press release.

Hut 8 upgrades mining fleet

Alongside an existing option to purchase an additional 15 EH/s of Bitmain miners at its Vega site, Hut 8 stated its goal to reach around 24 EH/s in self-mining hashrate and 15.7 J/TH in fleet efficiency by mid-2025.

Hut 8 chief executive Asher Genoot noted that the S21+ offers a “faster payback period than more efficient models across a wide band of future hashprice scenarios,” adding that these machines could help the company optimize investment returns. Following the news, Hut 8 shares rose nearly 7.6% to $16.74, according to data from Nasdaq.

The upgrade comes just a few months after Hut 8 expanded its partnership with Bitmain, revealing the upcoming launch of the U3S21EXPH, a next-generation ASIC miner capable of reaching up to 860 TH/s. Scheduled for deployment in Q2 2025, the miner is the first mass-commercialized ASIC model to feature direct liquid-to-chip cooling in a U-form factor.

Source link

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential