Opinion

The Latest Fake Satoshi is the Fake Bitcoin Creator We All Need

Published

3 weeks agoon

By

admin

A press release circulating yesterday proved yet again that there’s nothing the mainstream media loves more than some crazy nut claiming to have created Bitcoin.

https://x.com/pete_rizzo_/

In honor of White Paper Day, the latest event, billed as the unveiling of the “legal identity” of Satoshi Nakamoto, attracted a who’s who of press, including the BBC, who were caught up in the Craig Wright scandal in 2016. (Wright was later legally deemed not to be Satoshi.)

Even that burn didn’t stop their reporters from interviewing the latest man who’s claiming – without evidence – that he created Bitcoin, though.

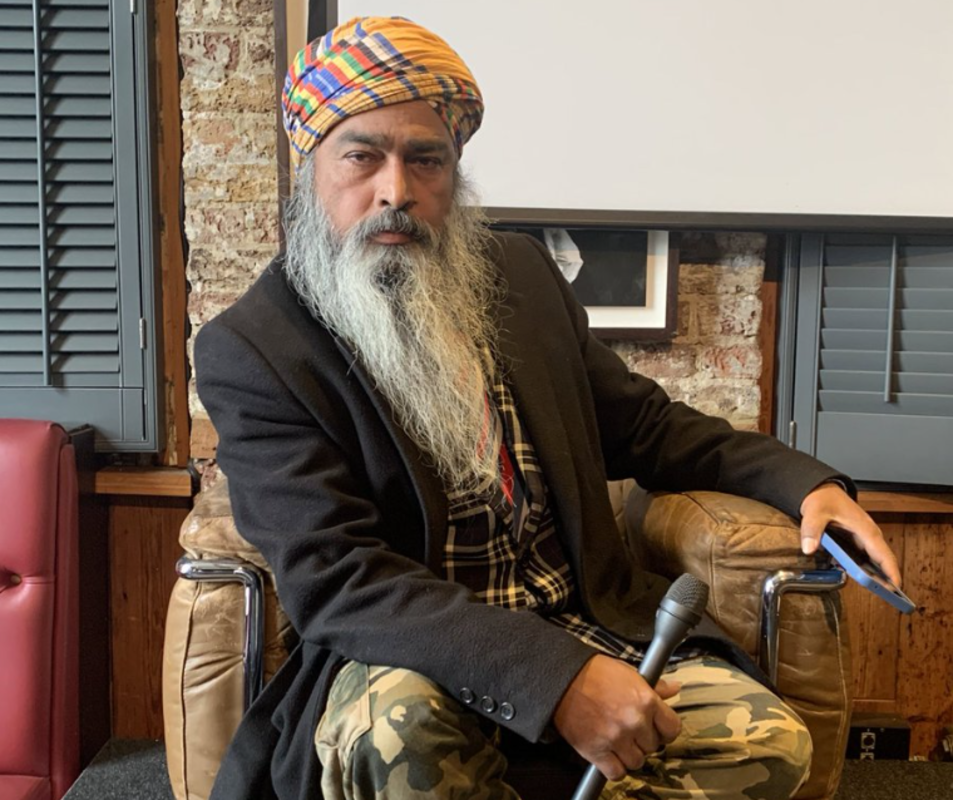

This time, our fake Satoshi is Stephan Mollah.

No, it’s not the first time Mollah has pulled this stunt. He sued crypto exchange Coinbase all the way back in 2021, claiming that they stole his company name from him, at the time saying that Satoshi Nakamoto was his pseudonym and true identity.

Long story short, the claim was so outlandish there’s even an online investigations company that uses Mollah as a way to advertise the effectiveness of their software.

You can follow the thread of the BBC’s reporting for the highlights, they’re full of his inane statements, as well as complaints from the reporters about what they had to sit through, including the “increasingly easy to fake screenshots” that he showed.

“I created the Bitcoin technology, but I am not happy with it,” Mollah said. “I have evidence of all of that, but I am here to make the statement.”

Mollah pledged to reveal the true details at some later date, finally showing the event for what it was, an announcement of a fake announcement.

Still, after all the hoopla over HBO’s documentary, which went to extraordinary lengths to fake a convincing Satoshi reveal earlier this month, I have to say, Mollah is somehow refreshing.

This is really the way all Satoshi Nakamoto reveals should be – total sideshows, devoid of any reasonable intrigue. Hopefully, if we get enough of these, we’ll convince the media to end its fruitless search for Satoshi’s true identity.

After all, as Bitcoin Mechanic says, isn’t that all he ever asked of us?

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

BitVM earlier this year came under fire due to the large liquidity requirements necessary in order for a rollup (or other system operator) to process withdrawals for the two way peg mechanisms being built using the BitVM design. Galaxy, an investor in Citrea, has performed an economic analysis looking at their assumptions regarding economic conditions necessary to make a BitVM based two way peg a sustainable operation.

For those unfamiliar, pegging into a BitVM system requires the operators to take custody of user funds in an n-of-n multisig, creating a set of pre-signed transactions allowing the operator facilitating withdrawals to claim funds back after a challenge period. The user is then issued backed tokens on the rollup or other second layer system.

Pegouts are slightly more complicated. The user must burn their funds on the second layer system, and then craft a Partially Signed Bitcoin Transaction (PSBT) paying them funds back out on the mainchain, minus a fee to the operator processing withdrawals. They can keep crafting new PSBTs paying the operator higher fees until the operator accepts. At this point the operator will take their own liquidity and pay out the user’s withdrawal.

The operator can then, after having processed withdrawals adding up to a deposited UTXO, initiate the withdrawal out of the BitVM system to make themselves whole. This includes a challenge-response period to protect against fraud, which Galaxy models as a 14 day window. During this time period anyone who can construct a fraud proof showing that the operator did not honestly honor the withdrawals of all users in that epoch can initiate the challenge. If the operator cannot produce a proof they correctly processed all withdrawals, then the connector input (a special transaction input that is required to use their pre-signed transactions) the operator uses to claim their funds back can be burned, locking them out of the ability to recuperate their funds.

Now that we’ve gotten through a mechanism refresher, let’s look at what Galaxy modeled: the economic viability of operating such a peg.

There are a number of variables that must be considered when looking at whether this system can be operated profitably. Transaction fees, amount of liquidity available, but most importantly the opportunity cost of devoting capital to processing withdrawals from a BitVM peg. This last one is of critical importance in being able to source liquidity to manage the peg in the first place. If liquidity providers (LPs) can earn more money doing something else with their money, then they are essentially losing money by using their capital to operate a BitVM system.

All of these factors have to be covered, profitably, by the aggregate of fees users will pay to peg out of the system for it to make sense to operate. I.e. to generate a profit. The two references for competing interest rates Galaxy looked at were Aave, a DeFi protocol operating on Ethereum, and OTC markets in Bitcoin.

Aave at the time of their report earned lenders approximately 1% interest on WBTC (Wrapped Bitcoin pegged into Ethereum) lent out. OTC lending on the other hand had rates as high as 7.6% compared to Aave. This shows a stark difference between the expected return on capital between DeFi users and institutional investors. Users of a BitVM system must generate revenue in excess of these interest rates in order to attract capital to the peg from these other systems.

By Galaxy’s projections, as long as LPs are targeting a 10% Annual Percentage Yield (APY), that should cost individual users -0.38% in a peg out transaction. The only wildcard variable, so to say, is the transaction fees that the operator has to pay during high fee environments. The users funds are already reclaimed using the operators liquidity instantly after initiating the pegout, while the operator has to wait the two week challenge period in order to claim back the fronted liquidity.

If fees were to spike in the meanwhile, this would eat into the operators profit margins when they eventually claim their funds back from the BitVM peg. However, in theory operators could simply wait until fees subside to initiate the challenge period and claim their funds back.

Overall the viability of a BitVM peg comes down to being able to generate a high enough yield on liquidity used to process withdrawals to attract the needed capital. To attract more institutional capital, these yields must be higher in order to compete with OTC markets.

The full Galaxy report can be read here.

Source link

Michael Saylor

Microsoft Should Buy $78 Billion Worth of Bitcoin

Published

24 hours agoon

November 22, 2024By

admin

As someone who has used Microsoft products my whole life, it pains me to see they are fumbling the bag on Bitcoin. The company’s $78 billion in cash reserves are losing value daily. Meanwhile, they stubbornly refuse to follow MicroStrategy’s proven winning strategy — convert those melting dollars to scarce Bitcoin!

Microsoft announced a couple of months ago that it would buy back shares up to $60 billion; it seems like this did nothing to increase the stock price. Imagine if they had bought Bitcoin instead. That money would have been much more powerful if allocated to Bitcoin. The company would likely have added hundreds of billions in market cap.

Just look at MicroStrategy. In just four years, they turned their $1 billion company into $100 billion by adopting Bitcoin as a treasury reserve asset. They are now the most compelling and successful story in corporate finance, with the best-performing stock in the last four years, beating every US company – even NVIDIA.

Yet Microsoft clings to an outdated financial strategy, destroying shareholder value. Microsoft should follow its technology instincts, not faulty financial logic. There is no long-term viability in holding cash.

I was listening to X Spaces yesterday, during which MicroStrategy’s CEO Michael Saylor revealed that he offered to explain Bitcoin’s benefits privately, but Microsoft’s CEO Satya Nadella rejected the meeting. Now, he is making a last-ditch appeal by presenting a 3-minute Bitcoin proposal to Microsoft’s board.

Earlier, the board already advised shareholders to reject assessing Bitcoin’s potential upside. Nonetheless, I am interested to see how this meeting will turn out. Saylor is a great educator, so you never know.

They should realise that no corporate treasury asset like Bitcoin can enhance enterprise value. Even a small $5 billion Bitcoin allocation could add tens of billions in market cap.

Look, Microsoft, the choice is clear – hoard melting dollars or embrace uncensorable digital gold. Your shareholders are begging you to buy Bitcoin. It’s time to listen before that $78 billion completely disappears. This is your fiduciary duty as Bitcoin continues mass adoption.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

1 day agoon

November 22, 2024By

admin

What an enormous day it has been today.

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential