24/7 Cryptocurrency News

Donald Trump’s World Liberty Financial Lowers $300M Public Sale Target

Published

4 weeks agoon

By

admin

Donald Trump’s World Liberty Financial has lowered its pubic sales target of $300 following its disappointing sales since the WLFI token sale launched two weeks ago. The company revealed its new target for public sale in a filing with the US Securities and Exchange Commission (SEC).

Donald Trump’s WLF Lowers Public Sale Target

World Liberty Financial revealed in an SEC filing that it currently only plans to sell up to $30 million in its WLFI token public sale before terminating the crypto presale. This is a 90% reduction from the company’s initial $300 million when they launched the WLFI token public sale two weeks ago.

This development is likely due to their unimpressive figures so far, as the company is still far from meeting its $300 million target. The filing revealed that the Donald Trump-backed company had sold about $2.7 million worth of WLFI tokens. Meanwhile, they still have about $285.7 million worth of tokens remaining to be sold.

Based on the new $30 million target for the public sale, the company still has about $27.3 million worth of WLFI tokens, which it still has to sell before the public sale closes. Meanwhile, according to a Fortune report, Donald Trump’s World Liberty Financial is also planning to launch its dollar-backed stablecoin. However, the company has yet to provide a timeline for when they will launch this stablecoin.

This stablecoin will likely play a huge role in the World Liberty Financial platform, which seeks to offer decentralized lending and borrowing services using the Ethereum-based Aave DeFi protocol.

Former US President Promises To End War On Crypto

In an X post, Donald Trump reaffirmed his pro-crypto stance and urged voters to join him in ending Kamala Harris’ war on crypto and ensuring that Bitcoin is “made in the USA.” He also wished Bitcoiners a happy 16th anniversary of Satoshi Nakamoto’s Bitcoin Whitepaper.

The crypto community has rallied behind Donald Trump because of his pro-crypto stance and hopes that the former US president will win in the upcoming November 5 elections. A Trump victory could be bullish for the Bitcoin price and the broader crypto market. The latest Polymarket data suggests that the former US president is still the clear favorite to become the next president.

Meanwhile, while the crypto community is banking on a Trump victory to help boost prices, BitMEX co-founder Arthur Hayes remarked that BTC will still reach new highs irrespective of who wins. He also indicated that Donald Trump’s pro-crypto stance wasn’t genuine.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Use Bitcoin Easily And Privately With Cake Wallet

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

24/7 Cryptocurrency News

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Published

4 hours agoon

November 27, 2024By

admin

A U.S. appeals court has ruled that the Treasury Department’s Office of Foreign Assets Control (OFAC) exceeded its authority by sanctioning Tornado Cash’s immutable smart contracts. This decision overturns earlier actions taken by OFAC and removes Tornado Cash’s smart contracts from the sanctions list, allowing U.S. citizens to resume their use of the protocol.

US Court Rules Tornado Cash Smart Contracts Not Property

On November 26, the Fifth Circuit Court of Appeals delivered a key ruling on the legality of sanctions imposed on Tornado Cash by OFAC. The court found that the sanctions were unlawful because Tornado Cash’s smart contracts, as immutable open-source code, cannot be owned or controlled by any entity or individual.

“We hold that Tornado Cash’s immutable smart contracts (the lines of privacy-enabling software code) are not the ‘property’ of a foreign national or entity,” the three-judge panel stated in its decision. The court explained that under the International Emergency Economic Powers Act (IEEPA), OFAC is only authorized to sanction property owned or controlled by foreign persons, which does not apply to the autonomous smart contracts.

The court directed a Texas district court to grant a motion for partial summary judgment filed by the plaintiffs, led by Joseph Van Loon, challenging the sanctions.

This Is A Breaking News, Please Check Back For More

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Will XRP Price Reach $2 By The End Of November?

Published

8 hours agoon

November 26, 2024By

admin

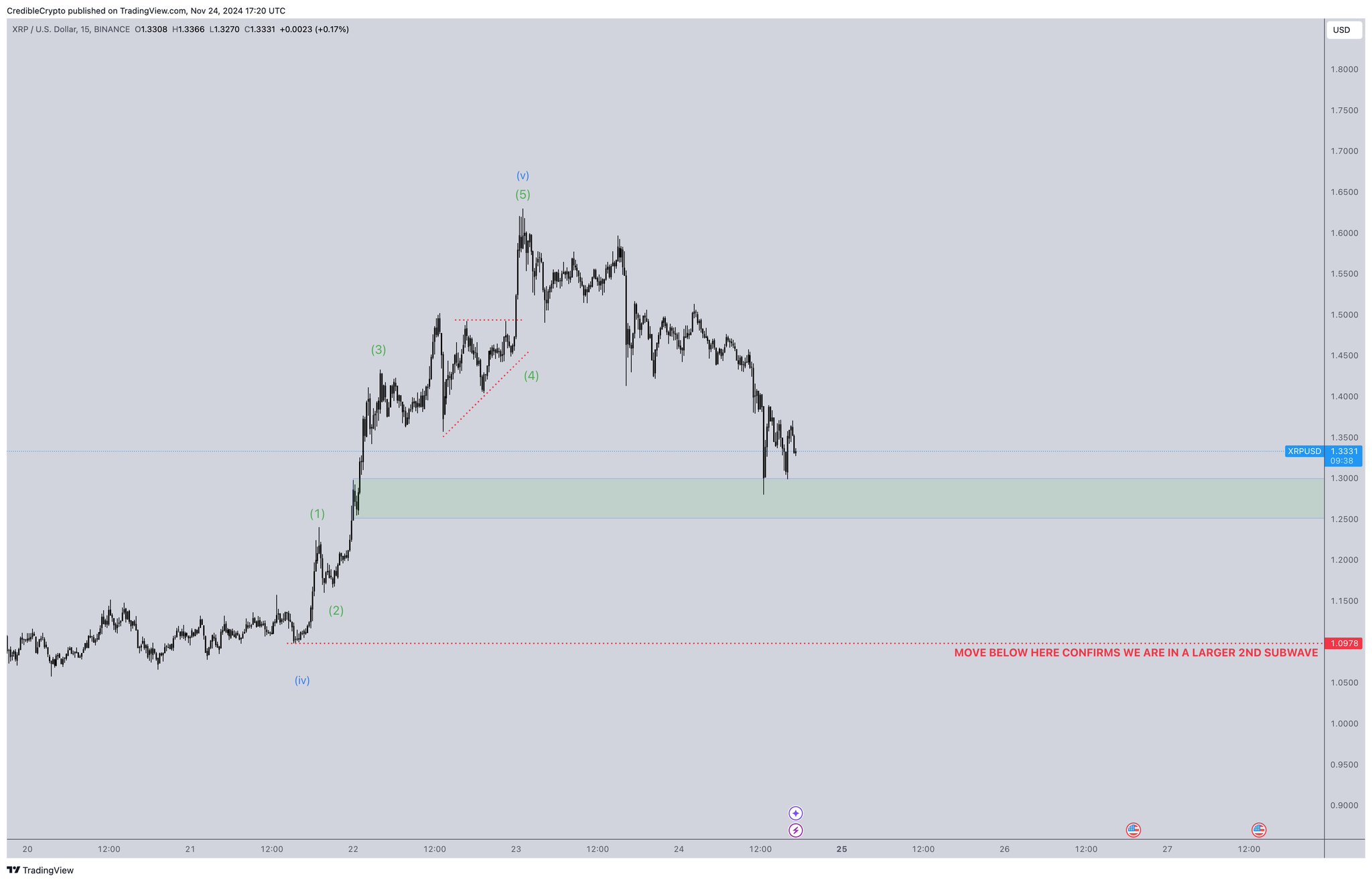

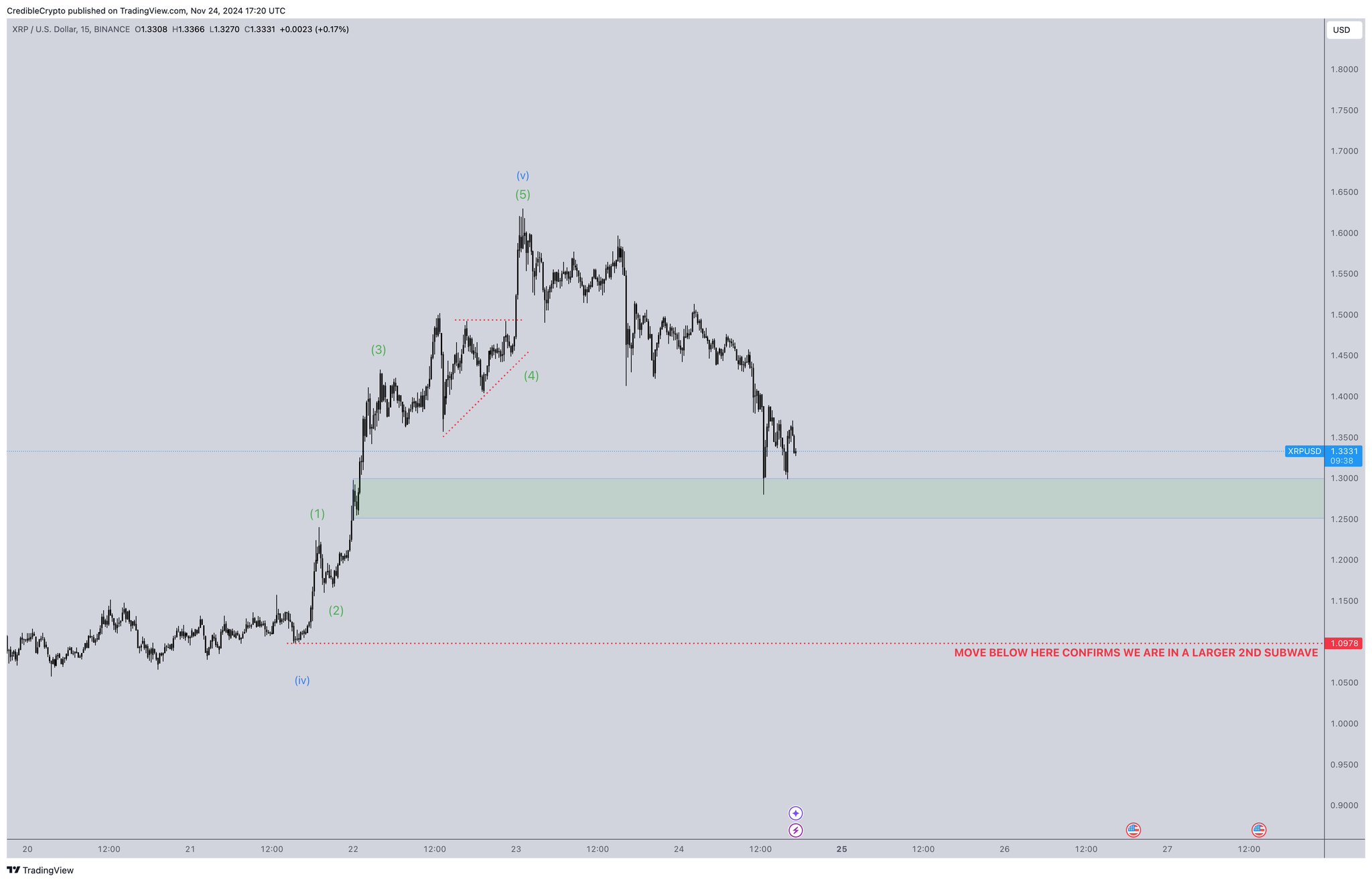

Crypto analysts Mikybull Crypto and CrediBULL Crypto have suggested that the XRP price could reach $2 by the end of November. However, CrediBULL Crypto warned about what could hinder XRP from reaching this target.

XRP Price To Reach $2 By The End Of November

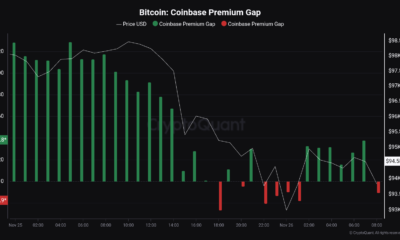

In an X post, Mikybull Crypto stated that the XRP price was looking so good at its current level and predicted that the crypto could reach $2 this week. CrediBULL Crypto also suggested that XRP could rally to $2 before this month ends but warned that it could depend on the Bitcoin price movement.

In an X post, the crypto analyst said that Bitcoin and XRP were at a pivotal point in their current price levels. He remarked that if the latter is at a level where it could record an extended 5th wave for this rally and continue above $2 without any significant pullback, it should be bottoming within its current range.

CrediBULL Crypto added that if the Bitcoin price holds 94,000, there is a decent chance the XRP price will be above $1.10, and the extended 5th wave will happen. However, if Bitcoin breaks below $1.10, it will confirm the completion of the first major Wave 1 from $0.48 to $1.62.

With the Bitcoin price falling today, this XRP rally to $2 before the end of this month could be at risk based on CrediBULL Crypto’s analysis. It is worth mentioning that the crypto analyst raised the possibility of XRP still enjoying this rally if Bitcoin can hold this $94,000 level and chop around this range for a bit.

The Rally To $2 Could Pave The Way To Double Digits

In an X post, crypto analyst Egrag Crypto suggested that the XRP price rally to $2 could pave the way for the crypto to reach double digits. This came as he revealed that the Fib channel 0.236 aligns perfectly at $2.

The crypto analyst remarked that with the right news and catalysts, XRP will soon break past this critical level, and then the real FOMO will kick in at $2. Egrag Crypto stated that reaching the Fib 0.5 level alone will take the XRP price into double digits. He noted that historically, the crypto has even surpassed this Fib level to hit at least 0.702.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Kraken To Shut Down Its NFT Marketplace

Published

12 hours agoon

November 26, 2024By

admin

American crypto trading platform Kraken has decided to shut down its Non-Fungible Token (NFT) marketplace. In a personal message circulating on X, the exchange informed some of its users holding NFT of the sunset plans.

End of Kraken NFT Marketplace

As the trading platform noted, the shutdown process will commence on November 27. The digital collectibles trading platform will enter a withdrawal-only mode on this date.

Once this mode kicks in, the exchange said users will not be able to list, purchase, bid on or sell any NFT they hold. With these features deactivated, it noted that any of its NFT holders can transfer their assets to a self-custodial wallet of their choice.

Kraken occupies an important place in the crypto ecosystem. Beyond NFTs, the exchange co-launched the Global Dollar Network in partnership with Galaxy Digital and other industry giants.

This is a developing story, please check back for updates!!!

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Use Bitcoin Easily And Privately With Cake Wallet

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: