24/7 Cryptocurrency News

US SEC Enforcement Costs Crypto Firms $400M Under Gensler

Published

3 weeks agoon

By

admin

In a revealing update from the Blockchain Association, a crypto industry group, firms have reported substantial financial burdens due to the actions of the U.S. Securities and Exchange Commission (SEC) under the leadership of Chair Gary Gensler. This data, compiled and released in cooperation with HarrisX, shows that since April 2021, when Gensler took office, the crypto industry has incurred $400 million in costs related to these regulatory actions.

US SEC Crackdown: Crypto Firms Report $400M in Compliance Costs Under Gary Gensler

According to a Blockchain Association report, the accumulated expenses resulting from US SEC enforcement have impacted the operations of major crypto firms. The association, which includes key industry players like Ripple, Coinbase, and Kraken, indicates that the costs stem primarily from legal defenses and compliance adjustments necessitated by the regulatory body actions.

Additionally, the report sheds light on the aggressive regulatory approach since Gary Gensler assumed the chairmanship. Gensler has been vocal about his stance that most cryptos qualify as securities and that the industry should align with traditional regulatory frameworks. This position has led to increased legal complexities for crypto enterprises.

Alongside the financial disclosures, the Blockchain Association and HarrisX conducted a national survey from October 25-28, polling 1,717 registered U.S. voters on their views toward US SEC enforcement in the crypto industry. The results indicated two-thirds expressed that the US SEC should provide clearer guidelines on crypto regulations. Although Congress has proposed bills addressing the industry and specific regulatory measures for stablecoins, these have yet to pass into law.

The survey also reveals a near-even split in party preference regarding which political party is more likely to support innovation in digital assets. For context, 34% favored the GOP and 32% favoring Democrats.

Industry Reactions and Ongoing Challenges

More so, the rigorous enforcement have prompted varied reactions across the crypto industry. Earlier in the month, Coinbase’s Chief Legal Officer, Paul Grewal, highlighted inconsistencies in the SEC’s legal positions. He criticized the lack of clear regulatory standards.

Following the recent financial report, the Coinbase’s Chief Legal Officer commented,

“These dollars are yours. Mine. All of ours. Think about that when you punch your clock. Think about that when you fill out your tax forms. And definitely think about that when you vote.”

Moreover, the regulatory body recently issued a Wells Notice to Immutable, signaling further enforcement actions. The regulatory body reportedly informed the firm that its IMX actions may have breached the law.

In parallel, Consensys had to reduce its workforce by 20% citing the SEC’s actions as a primary factor, underscoring the tangible impacts of regulatory challenges. These developments paint a complex picture of the crypto regulatory environment.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

24/7 Cryptocurrency News

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

Published

2 hours agoon

November 23, 2024By

admin

Ripple CEO Brad Garlinghouse has shared another good news with the XRP community. US President-elect Donald Trump has finally picked his Treasury Secretary, making the crypto community including Garlinghouse bullish on XRP and the end of the SEC lawsuit. Ripple CEO Garlinghouse claims Scott Bessent is the perfect pick.

Donald Trump Nominates Scott Bessent As US Treasury Secretary

US President-elect Donald Trump has nominated Scott Bessent to lead the US Treasury Department. The new Treasury Secretary is the founder of hedge fund manager Key Square Group. He is known for the famous short bet against the British sterling in 1992 when he worked for George Soros.

Picking the US Treasury chief proved to be one of Trump’s most crucial decisions as Wall Street closely watched the drama. Apollo Global Management CEO Marc Rowan and former Federal Reserve Governor Kevin Warsh were in the race.

“Scott is widely respected as one of the World’s foremost International Investors and Geopolitical and Economic Strategists,” Trump wrote on Truth Social, reported Reuters.

Both Wall Street and the crypto market reacted bullishly as Trump named Scott Bessent to lead Treasury Department. Bessent is positive on crypto adoption policy, but investors await more details on his views on fiscal policy and the next steps.

Ripple CEO Brad Garlinghouse Hails Trump’s Treasury Sec Pick

Ripple CEO Brad Garlinghouse took to X to express his satisfaction with Scott Bessent as Treasury Secretary. He said “I don’t want to get too far ahead of myself but… Scott Bessent is the perfect pick.” He claims Bessent will be the most pro-innovation, pro-crypto Treasury Secretary ever seen.

Other crypto executives and experts including Charles Hoskinson, John Deaton, Matthew Sigel, and David Bailey reacted positively.

Pro-XRP lawyer John Deaton said the Trump transition team now needs to get “SEC Chair right, we are about to enter the Digital Age of Innovation.” Meanwhile, Pro-XRP lawyer Jeremy Hogan predicted a potential conclusion timeline for Ripple SEC case.

XRP Price Rises Over $1.60 As Ripple CEO Turns Bullish

Bullish reactions from Ripple CEO and Cardano founder Hoskinson triggered further rally in XRP and ADA prices. All eyes are now on upcoming nominations by Donald Trump.

XRP price extended its weekly rally to more than 60%, with a 12% pump in the last 24 hours. XRP saw a 24-high of $1.62 as trading volume climbed further by 22%. Popular analysts predicted an XRP price target of $2.

ADA price jumped 22% in the past 24 hours, with the price finally surpassing $1. The 24-hour low and high are $0.856 and $1.140, respectively. Furthermore, the trading volume has increased by 130% in the last 24 hours, indicating a massive interest among traders.

Varinder Singh

Varinder has 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently covering all the latest updates and developments in the crypto industry.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Published

6 hours agoon

November 23, 2024By

admin

Cardano (ADA) has made a fantastic recovery as the token surged past the $1 price level for the first time since April 2022. ADA price has defied the bear trend by rising over 30% in the last 24 hours and is currently at $1.06. Similarly, trading volume increased by 150% to $6.7 billion suggesting increased market activity.

Nonetheless, experts claim that this has only begun, with some contributing on the projection of the future events. As ADA enjoys the bullish on-chain metrics, the question that continues to be asked is; where is ADA headed next?

Cardano Price Records 30% Surge to $1 Amid Bullish Metrics

After the recent crypto rally, Cardano price has grown by 30%, with a current price of $1.06 within 24 hours. The present value is the highest ADA has reached since April 2022. Trading activity also rose sharply with volumes going up by 150% to $6.7 billion in a single day.

More so, the crypto rally aligns with recent analysis predicting ADA price could cross the $1 mark this weekend. Analysts have suggested that the crypto is yet to fully realize its potential. Ali Martinez expressed optimism stating,

“$ADA has surged nearly 200% in the last three weeks! But that’s nothing compared to what is coming.”

As one of the leading crypto analysts, Ali Martinez claims that all that has happened with Cardano is a warm-up to even bigger gains. Martinez noted that ADA whales with stakes between $1 million and $10 million have seen their ADA holding rise by over 100% in the last month. This has resulted in large transactions exceeding $22 billion daily on the network, signifying robust accumulation activity.

From a technical standpoint, Martinez noted that ADA is mirroring its previous bullish cycle. If this pattern continues, ADA could aim for targets as high as $6. However, he emphasized that the $0.80 support level, where 1.2 billion ADA were purchased by 48,000 addresses, remains crucial for sustaining the current bullish trend.

On-Chain Metrics Show Strong Momentum

In addition, on-chain data underscores the bullish sentiment surrounding ADA. According to CoinGlass, Cardano price has benefited from a 34% increase in open interest, which now stands at $972 million.

Moreover, short liquidations have reached $9.77 million in the past 24 hours, indicating that traders betting against ADA’s rally were forced to close their positions. This forced buying pressure has further fueled ADA price growth during the ongoing crypto rally.

Additionally, data from Santiment highlights Cardano’s tripling market cap over the past 17 days. Concurrently, the crypto recorded $165 million in realized profits in a single day, the highest in eight months. More so, the data show Social media discussions about ADA have reached an 11-month high, underlining the growing interest within the community.

Another analyst, Dan Gambardello, noted that ADA’s trajectory over the past three weeks, which saw nearly 200% growth, mirrors its previous bullish patterns. He identified key support zones around $0.80 and resistance near $1.05, suggesting further upside potential.

Gambardello was also keen to point out that, based on this narrative, Cardano price could potentially have its sights set on a $10 target. This recent rally has triggered different analysts and investors weigh in on possible price targets ADA, ranging from $1.00 to as high as $15.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Published

10 hours agoon

November 22, 2024By

admin

Bitcoin miner MARA Holdings has expanded its cryptocurrency portfolio by purchasing an additional 5,771 BTC for $572 million. The acquisition was completed at an average price of $95,554 per Bitcoin, according to the company.

With its 0% convertible note offering, the company has achieved a 35% BTC yield per share and now owns a total of approximately 33,875 BTC, currently valued at $3.4 billion based on Bitcoin’s spot price of $99,000. This move follows Bitcoin’s ongoing rally, with the cryptocurrency nearing the $100,000 milestone amid increasing institutional demand and limited supply.

Bitcoin Miner MARA’s 0% Convertible Notes Drive Bitcoin Accumulation

MARA Holdings has leveraged its 0% convertible senior note offering to fund its Bitcoin acquisitions and other corporate activities. The company raised $1 billion from its latest offering, generating $980 million in net proceeds after fees and discounts. MARA revealed that a portion of these proceeds has been used to purchase 5,771 BTC at an average price of $95,554 per Bitcoin.

This recent acquisition reinforces MARA’s strategy to accumulate Bitcoin as a corporate asset. The company now holds approximately 33,875 BTC, solidifying its position as one of the largest Bitcoin-holding miners globally. In a statement, the company reported a 35% BTC yield per share, underscoring the financial benefits of its aggressive Bitcoin accumulation strategy.

By issuing zero-coupon convertible notes, MARA has been able to access funds without the immediate burden of interest payments, allowing the company to focus on expanding its Bitcoin reserves and scaling its mining operations.

Bitcoin Rallies Toward $100k

Bitcoin continues to surge, with its price reaching $99,742 earlier today and nearing the highly anticipated $100,000 milestone. This price rally has fueled optimism across the cryptocurrency market, with Bitcoin’s total market capitalization now surpassing $1.9 trillion.

Galaxy Digital CEO Mike Novogratz described Bitcoin’s price movement as “a big moment,” highlighting the resilience of the crypto community during volatile times. “Shoutout to the crypto community. You’ve endured years of uncertainty and headwinds,” he noted in a recent social media post.

The rally has been driven by several factors, including rising institutional interest, expectations of regulatory clarity, and Bitcoin’s upcoming halving event in 2024, which is expected to reduce supply while demand continues to grow. However, some analysts have warned of potential short-term BTC price corrections as the market faces increased leverage and speculative activity.

Marathon Digital’s Growth Strategy Mirrors Saylor’s Playbook

MARA’s latest Bitcoin purchase aligns with strategies popularized by MicroStrategy’s Michael Saylor, who has championed Bitcoin as a corporate reserve asset. Saylor has often advocated for accumulating Bitcoin during dips, leveraging corporate debt to acquire the asset for long-term growth.

MARA’s use of convertible notes to fund its Bitcoin acquisitions mirrors this approach. The company has strategically positioned itself to benefit from Bitcoin’s price appreciation, viewing the cryptocurrency as a store of value and a hedge against inflation.

In addition to acquiring Bitcoin, MARA plans to allocate funds from its convertible note offering to expand mining operations, pursue strategic acquisitions, and repay debt. This diversification ensures the company remains financially stable while increasing its exposure to Bitcoin’s growth potential.

Regulatory Developments and Institutional Demand Support Bitcoin’s Momentum

The increasing corporate interest in Bitcoin comes amid growing optimism surrounding regulatory clarity and the potential approval of a U.S. spot Bitcoin ETF. Spot ETF inflows are expected to make Bitcoin more accessible to traditional investors, further boosting demand.

Meanwhile, U.S. Senator Cynthia Lummis recently suggested that Bitcoin could play a role in reducing national debt over the next 20 years, sparking interest in its long-term economic potential. As institutional and corporate players like MARA continue to strengthen their Bitcoin positions, the cryptocurrency’s path toward $100,000 could serve as a catalyst for further adoption.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

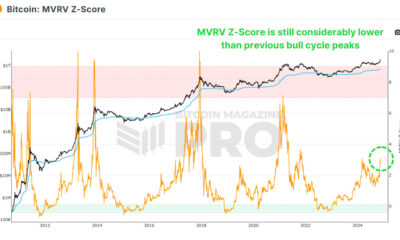

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: