Bitcoin

BlockJoy Introduces ‘BlockVisor 2.0,’ a Bespoke Solution for Blockchain Node Operators

Published

4 weeks agoon

By

admin

In today’s issue: Privado ID, BlockJoy, Superstate, Phylax Systems, Mawari Network, Coinbase, Base, Soulbound, Termina, Nitro Labs, Deep Blue, Arbitrum, Ika, Sui, OKX Ventures, TOP, Folius Ventures, TON, Telegram, Nebra, Truflation, ALEX, XLink, NEAR, EtherMail, Unstoppable Domains.

Source link

You may like

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Bitcoin

Suriname presidential candidate eyes on Bitcoin adoption

Published

3 mins agoon

November 27, 2024By

admin

The use case of Bitcoin has spread around the globe since El Salvador adopted it as a legal tender, the U.S. planned it for a national strategic reserve, and now Suriname.

Maya Parbhoe, a Surinamese young lady who is running for president, is embracing the use of Bitcoin in the country, specifically for the national currency. She is also aware that the Bitcoin standard should be implemented in the country, as well as ending the systematic corruption regime if she is elected.

On May 25 – 2025, 6 months from now, the people of Suriname will have a clear choice to…

> End systemic corruption

> Embrace a full Bitcoin standard

> Become truly independentMany countries will follow.

Nothing stops this train🚉🫶 https://t.co/QR1b6tbJGr pic.twitter.com/xYCxJfYFmN

— Maya Parbhoe (@MayaPar25) November 25, 2024

According to Maya’s plan, she also aims to eliminate the country’s central bank, which was founded in 1957. She also focused on introducing free currency competition as the Suriname dollar (SRD) has inflated above 50% in the past 3 years and cooled down below 20% in 2024, according to Statista’s data.

On the economic development agenda, Maya targets building the first blockchain-based capital market in the world and boosting economic growth by financing Bitcoin bonds.

She was inspired by El Salvadorian President Nayib Bukele for adopting Bitcoin as a legal tender and Switzerland for opening the free currency competition in their respective nations.

Suriname-Poland, following other nation’s step

Numerous presidential candidates who are running for head of government positions are embracing Bitcoin as one of their political and economic campaigns. After El Salvador adopted Bitcoin as a legal tender and the United States announced its proposal as a national strategic reserve, many came to follow.

One of them is the chairman of the right-wing Polish political party New Hope, Slawomir Mentzen, who introduced the idea of a Bitcoin strategic reserve for running the presidential ticket.

Mentzen was also the figure in Poland who proposed that municipal schools and offices mine Bitcoin back in 2018, although it was considered an absurd idea.

“Now I am running for president of Poland and propose that we should keep its currency reserves in Bitcoins. This may seem abstract to someone now, but in a few years it will turn out again that it was a completely obvious decision to make,” he said on X post on Nov. 18.

Source link

Bitcoin

Bitcoin Crashes Under $93,000: What’s Behind It?

Published

3 hours agoon

November 27, 2024By

admin

Bitcoin has observed a plunge under the $93,000 level during the past day. Here’s what the trend in an indicator suggests about what could be behind this downturn.

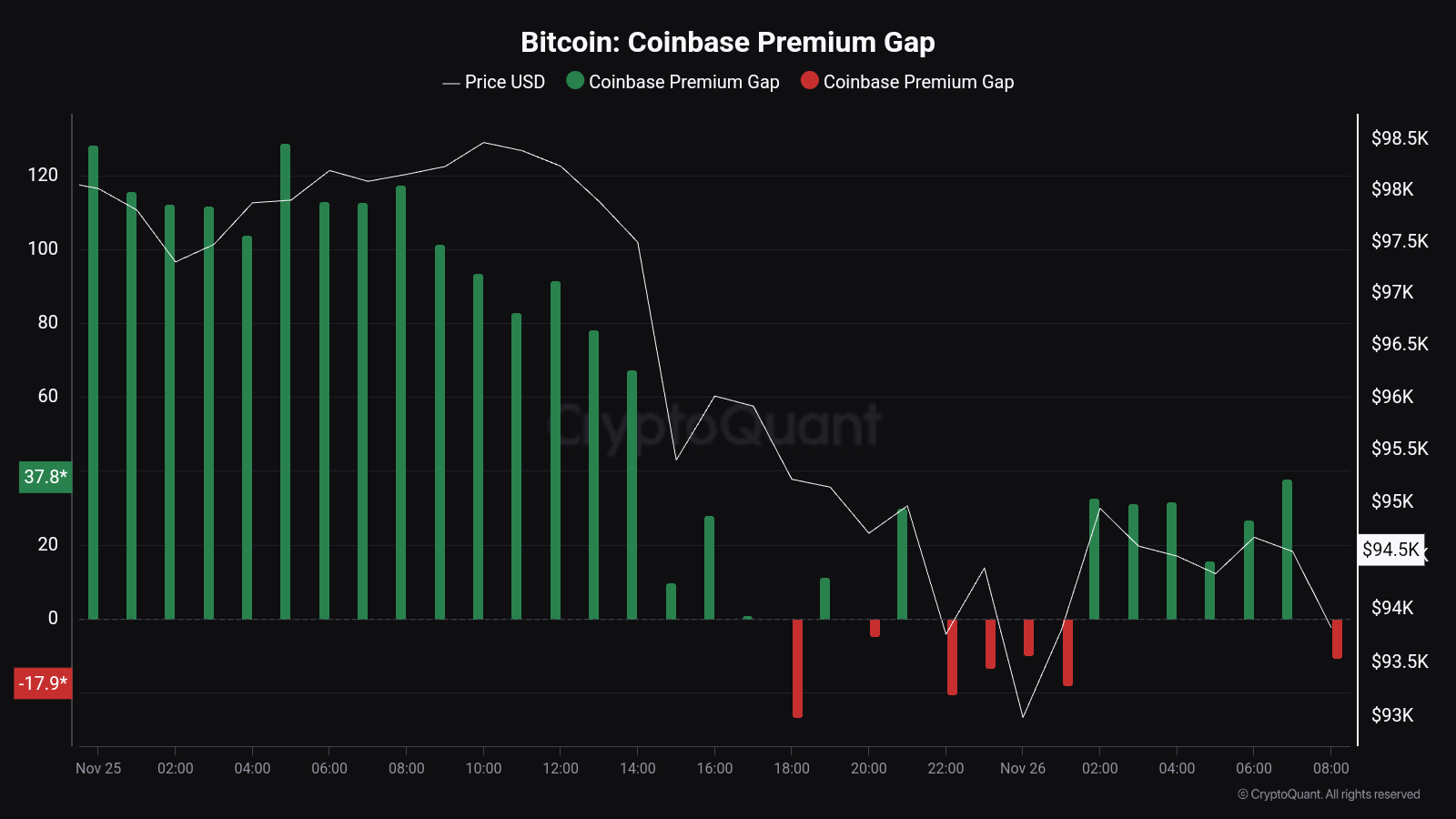

Bitcoin Coinbase Premium Gap Has Gone Cold

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Coinbase Premium Gap has returned to neutral levels recently. The “Coinbase Premium Gap” here refers to an indicator that keeps track of the difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair).

This metric essentially tells us about how the buying or selling behaviours differ between the user bases of the two cryptocurrency exchanges. Coinbase’s main traffic is made up of American investors, especially large institutional entities, while Binance serves investors around the world.

When the Coinbase Premium Gap has a positive value, it means the US-based whales are participating in a higher amount of buying or a lower amount of selling than the Binance users, which is why the asset is more expensive on Coinbase. Similarly, it being negative implies a net higher buying pressure on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past couple of days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had been at notable positive levels earlier, but during the past day, its value has declined to the neutral zero mark.

According to Maartunn, the source of the positive premium was Microstrategy’s latest buying spree. Indeed, the cooldown in the indicator matches up with the timing of the completion of the $5.4 billion purchase by Michael Saylor’s firm. The significant accumulation from the company had helped the cryptocurrency maintain its recent highs, but with the buying pressure depleted, Bitcoin has retraced to price levels under $93,000.

BTC and the Coinbase Premium Gap have held a close relationship throughout 2024, so the metric could be to keep an eye on in the near future, as where it goes next may once again foreshadow the asset’s next destination. Naturally, a decline into the negative region could spell further bearish action for its price.

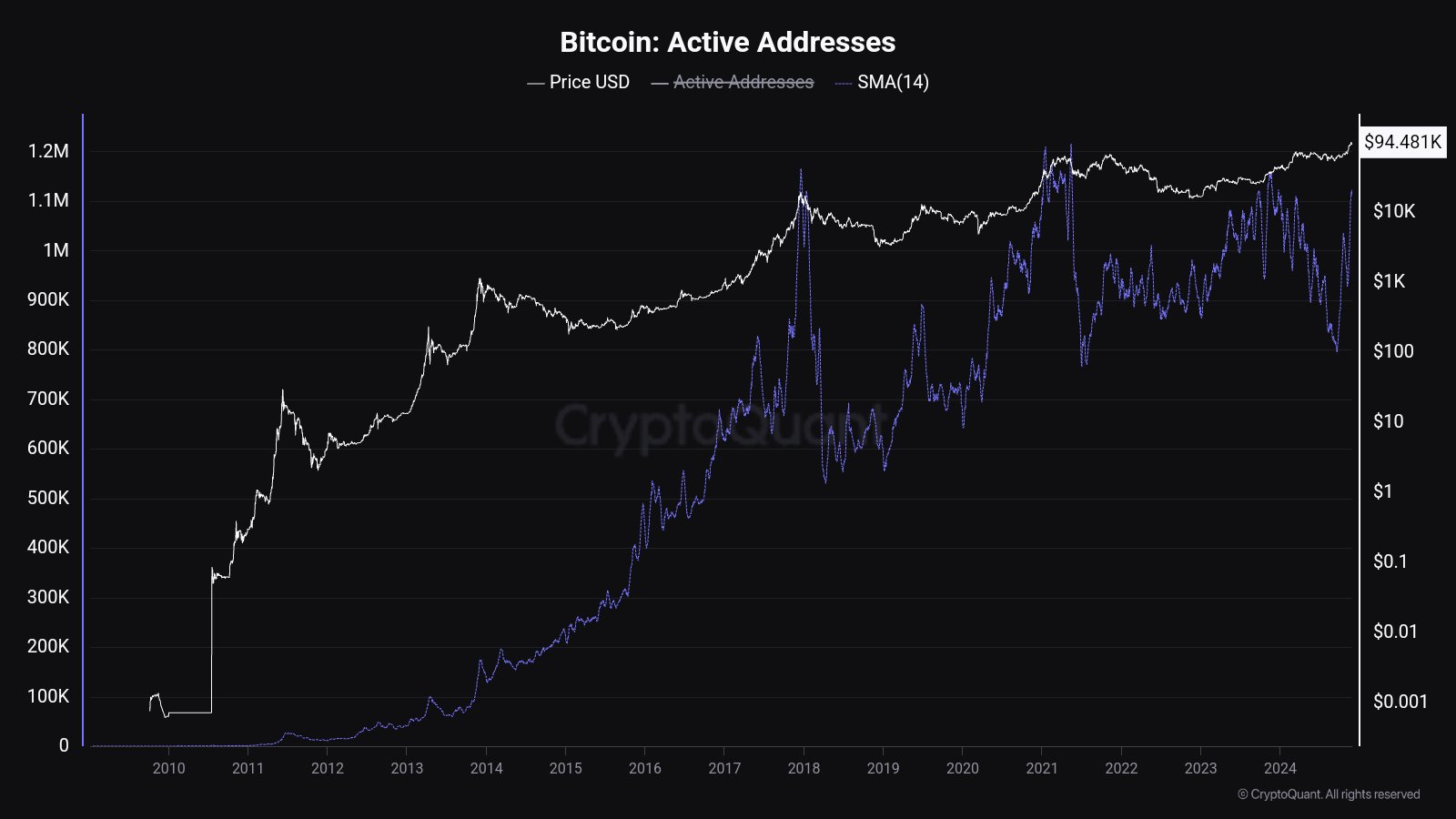

In some other news, the Bitcoin Active Addresses indicator has observed a sharp jump recently, as Maartunn has shared in another X post. This metric keeps track of the daily number of addresses that are participating in some kind of transaction activity on the network.

Below is the chart shared by the CryptoQuant analyst for the 14-day simple moving average (SMA) of the Active Addresses:

With this latest surge, the 14-day SMA of the Bitcoin Active Addresses has reached its highest point in eleven months. This suggests that a lot of activity has recently occurred on the network. Given that the asset has gone down in the past day, though, the most recent user interest has certainly not come for buying.

BTC Price

At the time of writing, Bitcoin is floating around $92,400, down almost 6% over the last 24 hours.

Source link

Bitcoin

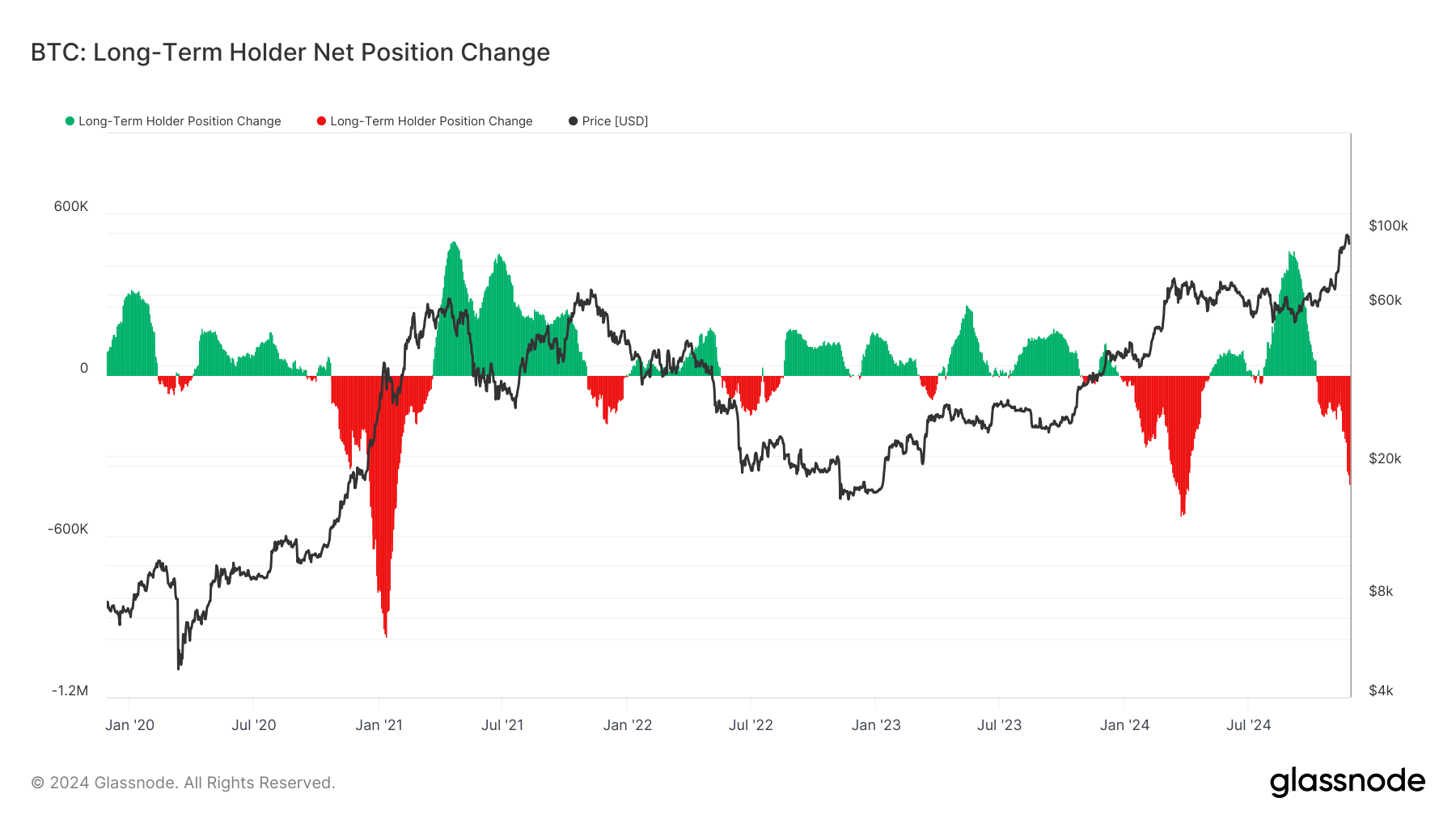

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

Published

15 hours agoon

November 26, 2024By

admin

Bitcoin (BTC) has dropped 7.6% since it almost — but not quite — touched the psychological wall of $100,000 on Nov. 22.

That’s the biggest drop since Donald Trump won the U.S. presidential election, sparking a rally that sent the largest cryptocurrency by market capitalization soaring from a level of around $66,000 through its record high.

Even so, the slide isn’t out of the ordinary. In bull markets bitcoin typically tumbles as much as 20% or even 30%, so-called corrections that tend to flush out leverage in an overheated market.

A large part of the reason the bitcoin price didn’t get to $100,000 was the amount of profit-taking that took place. A record dollar value of $10.5 billion of profit-taking took place on Nov. 21, according to Glassnode data, the biggest day of profit-taking ever witnessed in bitcoin.

At the root of the action are the long-term holders (LTH), a group Glassnode defines as having held their bitcoin for more than 155 days. These investors are considered “smart money” because they tend to buy when the BTC price is depressed and sell in times of greed or euphoria.

From September to November 2024, these investors have sold 549,119 BTC, or about 3.85% of their holdings. Their sales, which started in October and have accelerated since, even outweighed buying from the likes of MicroStrategy (MSTR) and the U.S. spot-listed exchange-traded funds (ETFs).

How long is this selling pressure going to last?

What’s noticeable from patterns in previous bull markets in 2017, 2021 and early 2024, is that the percentage drop gets smaller each cycle.

In 2017, the percentage drop was 25.3%, in 2021 it reached 13.4% and earlier this year it was 6.51%. It’s currently 3.85%. If this rate of decline were to continue, that would see another 1.19% drop or 163,031 BTC, which would take the cohort’s supply to 13.54 million BTC.

Each time, the long-term investors’ supply makes higher lows and higher highs, so this would also be in line with the trend.

Source link

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential