SOL

Solana ‘Must Break Descending Resistance’ To Regain Bullish Momentum – Analyst

Published

3 weeks agoon

By

admin

Solana is trading above a critical demand level of around $157, showing signs of a potential bounce after a recent pullback. This critical level has held firm despite market volatility, and now all eyes are on Solana as it attempts to regain bullish momentum.

With the U.S. election unfolding and the Federal Reserve’s interest rate decision just around the corner, this week promises to bring heightened volatility across the crypto market.

Related Reading

Top analyst and investor Carl Runefelt has shared a technical analysis indicating that Solana must break above a key resistance level in the coming days to regain a strong uptrend. Runefelt notes that this resistance has kept the price in check, and a breakout likely leads to renewed optimism for SOL investors.

However, the risk of further downside remains if Solana fails to secure a position above this critical resistance. As these significant macro events unfold, Solana’s next moves will be closely watched, as breaking resistance could signal a larger rally in the near term.

Solana Trading Within Bullish Pattern

Solana has been a standout performer in this cycle, showing resilience as it holds above a crucial support level that previously acted as resistance. This pivotal moment could determine Solana’s near-term trajectory as it battles to reclaim bullish momentum.

According to top analyst Carl Runefelt, who shared insights on X, Solana faces a critical test at a descending resistance level that has consistently capped its gains. Runefelt’s technical analysis, focused on the 2-hour SOL chart, highlights this resistance around the $164 mark.

He suggests a confirmed breakout above this level would likely propel Solana higher, signaling a return to bullish price action.

However, there’s potential for sharp price swings this week, with the U.S. election and Federal Reserve interest rate decision creating an environment ripe for uncertainty and market manipulation. These macro events have the potential to significantly impact Solana’s movement, making the resistance break even more critical.

Related Reading

If Solana breaches this resistance and establishes support above $164, it could attract bullish sentiment, pushing the altcoin toward new local highs. However, failure to do so could lead to increased selling pressure and a risk of a retracement, especially if broader market volatility intensifies. As such, the upcoming days will be crucial for Solana’s path forward, with traders and investors closely monitoring this key level.

SOL Price Action: Key Levels To Watch

Solana (SOL) is trading at $161 after a recent bounce from local lows at $155. This move has established a strong support base of around $155, which has proven crucial in holding off further downside.

For bullish momentum to take hold, SOL now needs to clear the $165 resistance level, which would confirm the potential for upward price action. A sustained push above $165 could signal strength and encourage buyers, paving the way for further gains.

However, a retracement is likely if SOL fails to break above this critical level. In this scenario, the price could fall back to the subsequent demand zone around $150, which aligns closely with the 200-day moving average (MA). The 200-day MA is a widely observed indicator and often acts as a strong support level in technical analysis, reinforcing the $150 zone as a potential floor.

Related Reading

This consolidation phase places SOL in a pivotal position, with price direction largely dependent on its ability to overcome $165. As traders watch closely, this technical setup suggests that SOL’s next move will likely define its short-term trend, with $150 as a key fallback level if the bullish case doesn’t materialize.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Swiss lawmakers to study Bitcoin for power grid upgrade

Bitcoin Could Reach up to $500,000 Within 24 Months, Says Cardano Founder Charles Hoskinson – Here’s Why

Why Is The Worldcoin Price Up 20% Today, Rally To Continue?

Bybit x Block Scholes report

How High Can Shiba Inu Price Climb If Bitcoin Hits $100,000?

Need Gift-Buying Advice for That Special Someone? Our AI SantaBot is Here to Help

Altcoins

This Solana Rival Is Looking Great Amid Bitcoin Pullback, Says Top Crypto Analyst

Published

1 day agoon

November 27, 2024By

admin

A closely followed crypto analyst says that one Solana (SOL) rival is exhibiting market strength despite Bitcoin’s (BTC) pullback to the lower $90,000 range.

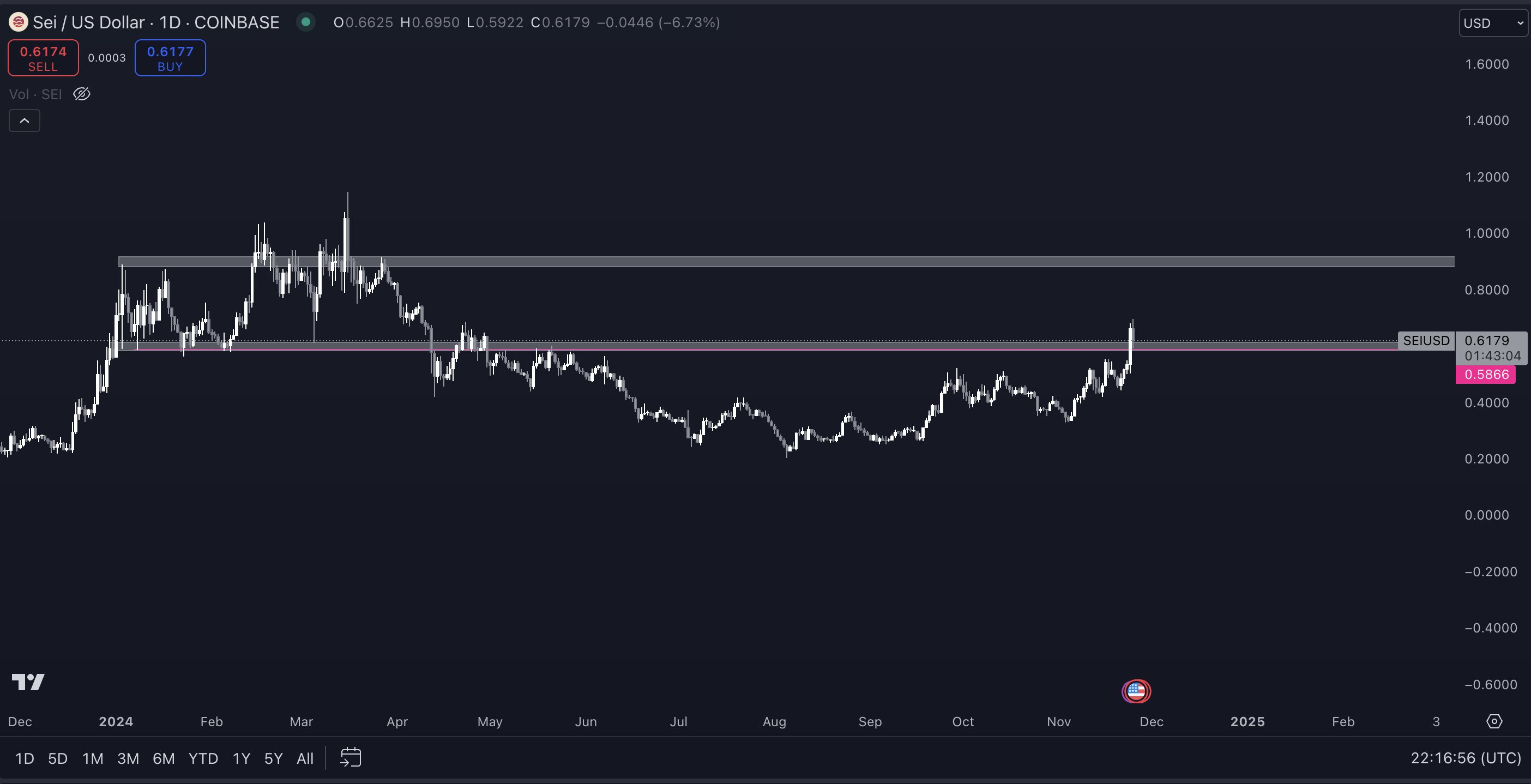

Pseudonymous analyst Pentoshi tells his 822,400 followers on the social media platform X that the native token of the layer-1 blockchain Sei (SEI) is primed for another leg up.

“SEI is another one that not only looks great with a high timeframe flip and clear invalidation, but also holding up very well like many alts on this BTC pullback. Here is the daily and weekly. Just to compare to a similar setup shared [on November 23rd]. When BTC chills out, alts should continue up.”

SEI is trading for $0.69 at the of writing, up 12.9% in the last 24 hours.

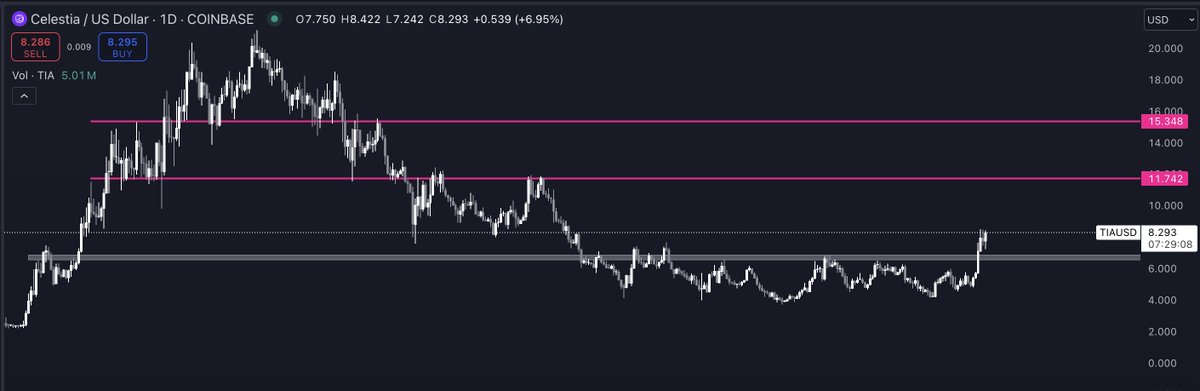

The analyst is also bullish on the modular blockchain network Celestia (TIA) after the native token took out its resistance at around $7.00.

“Really strong, and we should see it continue higher.”

TIA is trading at $8.22 at time, up 3.9% in the last 24 hours.

The analyst believes that many altcoins may start outperforming Bitcoin. He shares a chart of the Bitcoin Dominance (BTC.D), which has suddenly dropped out of the 60% range. The BTC.D index tracks how much of the total crypto market cap belongs to Bitcoin. A bearish BTC.D chart suggests that altcoins are about to outshine Bitcoin.

“Looks a lot more convincing 1732712443 and our large/mid caps have made some decent moves in terms of both USD and BTC pairs.”

The BTC.D is hovering at 58.61% at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

SOL

Solana ‘God Candle Is Close’ As It Breaks From Crucial Resistance – Top Analyst

Published

2 weeks agoon

November 14, 2024By

admin

Solana recently broke its yearly high at $210, sparking a surge in trading activity as the altcoin now attempts to consolidate above this key level. This period of volatile price action highlights Solana’s strong position within the market, as investors watch for signs of a further breakout.

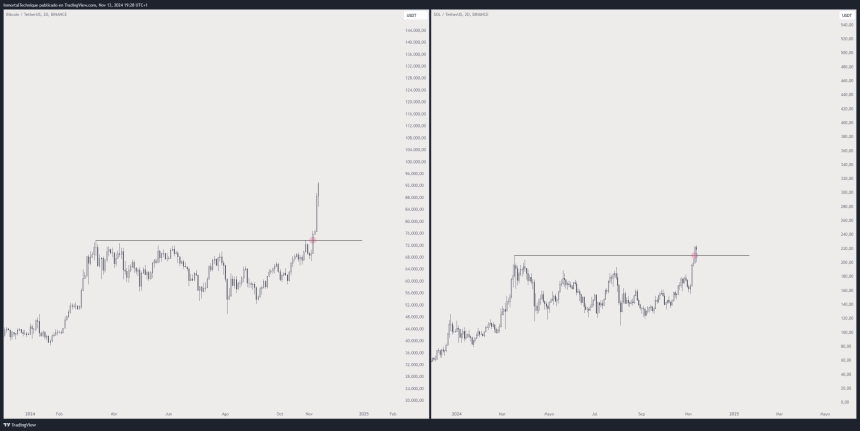

Top analyst and investor Immortal recently shared an insightful technical analysis comparing Solana’s chart to Bitcoin’s historical price movements, suggesting that Solana’s next breakout may be imminent.

Related Reading

As the market reaches new highs, Solana’s ability to hold above $210 could indicate strength, drawing in additional interest from retail and institutional investors. In the coming days, Solana’s price action will likely clarify whether this consolidation phase is merely a pause before a more substantial move.

With the broader crypto market reaching unprecedented levels, Solana is positioned at a critical juncture, and traders will closely monitor its performance for signs of a continuation of its upward trajectory.

Solana Preparing For A Rally

Solana appears poised for a significant rally, having broken out of an 8-month accumulation phase that began in March. This critical development has caught the attention of top analyst and trader Inmortal, who shared an analysis on X, comparing Solana’s recent chart patterns to those of Bitcoin. His technical perspective suggests that Solana mirrors Bitcoin’s past price movement and could be on the cusp of a substantial surge.

Following its break above the yearly high of $210, Solana’s next target is likely to be its all-time high of $258. This level is viewed by many as a critical resistance, and a successful test could pave the way for even greater price gains. The breakout from such an extended accumulation phase has bolstered confidence in Solana’s bullish structure, and the market is closely watching for signs of sustained momentum.

The timing of this potential move is also strategic. As Bitcoin consolidates just below its all-time high, a period of stability could provide the perfect window for altcoins, particularly Solana, to gain traction. This pause in Bitcoin’s rally allows liquidity to shift toward other strong projects, positioning Solana well for a possible continuation of its upward trend.

Related Reading

The next few days will be pivotal for Solana as traders look to see if it can sustain support above $210. If Solana holds this level and momentum remains, a push toward the $258 all-time high could unfold rapidly, further solidifying its role as a leading altcoin in the market’s current bull phase.

SOL Testing Last Supply Levels Before ATH

Solana is currently trading at $220, having broken its yearly highs, yet it’s now encountering some volatility as traders assess the next move. With SOL just 17% away from its all-time high of $258, many are watching closely to see if it can sustain this momentum without giving traders any lower entry points.

The $210 support level is particularly crucial in the coming days. If SOL fails to hold above this mark, a short-term correction could drive prices lower, potentially offering some breathing room for buyers looking to enter before the next rally. However, should SOL remain steady above $210, the likelihood of a rapid push to new highs becomes even stronger, as it signals ongoing bullish strength in a market eager for upward movement.

Related Reading

As Solana continues to consolidate at these elevated levels, a decisive break could ignite a swift rally, drawing in both retail and institutional interest. Traders are preparing for either outcome: a brief correction as a buying opportunity, or a breakout that takes Solana into uncharted territory, setting new highs and reaffirming its place among top-performing altcoins this cycle.

Featured image from Dall-E, chart from TradingView

Source link

Altcoins

Ethereum Rival Solana in All-Time High ‘Waiting Room,’ Says Crypto Analyst – Here’s His Outlook

Published

3 weeks agoon

November 9, 2024By

admin

A widely followed analyst and trader is leaning bullish on a large-cap altcoin amid a broader crypto market rally.

The analyst pseudonymously known as Pentoshi tells his 809,700 followers on the social media platform X that Solana (SOL) is in the “all-time high waiting room.”

On the weekly time frame, Pentoshi shares a chart suggesting that Solana has formed a double-bottom pattern, a technical analysis structure that’s typically considered bullish as buyers step in to keep an asset from printing new lows.

According to the widely followed analyst, Solana is on the cusp of taking out its resistance at around $204, which has kept SOL bearish since 2022.

“While there could be some short-term resistance ahead, I don’t expect to last too long.

Structurally this looks great, and in my opinion, dips are for buying.

It should be challenging all-time highs this month.”

The analyst also says his long-term target for Solana is a price around 110% above the current level.

“Above $200 and it likely sees all-time highs shortly after. Long-term target $420.69. Not a cent higher.”

Solana is trading at $200 at time of writing, up by around 20% this month.

Turning to the wider altcoin market, Pentoshi says that TOTAL3, which tracks the total market cap of all crypto assets excluding Bitcoin (BTC) and Ethereum (ETH) and stablecoins, is likely to rise by about 14% from the current level.

“Altcoins. I think we will see a breakout in the near future and move back towards the $760 billion mark. It keeps knocking at this and I believe the space got the green light.”

The market cap of TOTAL3 is hovering at $668 billion.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Swiss lawmakers to study Bitcoin for power grid upgrade

Bitcoin Could Reach up to $500,000 Within 24 Months, Says Cardano Founder Charles Hoskinson – Here’s Why

Why Is The Worldcoin Price Up 20% Today, Rally To Continue?

Bybit x Block Scholes report

How High Can Shiba Inu Price Climb If Bitcoin Hits $100,000?

Need Gift-Buying Advice for That Special Someone? Our AI SantaBot is Here to Help

These 3 meme coins are set to boom in 2025 without SHIB or DOGE

Pro Gamer Linked to $3.5M Meme Coin Scam: ZachXBT

Bitcoin Miners Near $40B Market Cap as Mining Difficulty Set for Fifth Straight Increase

Metaplanet aims to raise $62m from Stock Acquisition Rights to buy more Bitcoin

XLM Price Kickstarts Parabolic Rally to $1 After Recent Breakout

Here’s How To Talk About Bitcoin At The Thanksgiving Table

BitBasel + VESA

Metaplanet shares added to Amplify Transformational Data Sharing ETF

Ethena Price Shoots 20% Amid Heavy ENA Accumulation by Arthur Hayes

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential