Markets

How Bitcoin Traders Are Playing the US Election

Published

2 weeks agoon

By

admin

If you’re fixated on the price of Bitcoin, then you may already have your answer.

On Election Day, America’s choice between former President Donald Trump and Vice President Kamala Harris carries consequences for the crypto industry—from a potential shakeup at the Securities and Exchange Commission (SEC) to the passage of a regulatory framework.

It could take days to determine Tuesday’s White House winner, but analysts told Decrypt that there are several tea leaves that traders could read into in the meantime, ranging from Senate races to the resiliency of Bitcoin’s price in the face of normally bearish news.

While Bernstein analysts forecast that Bitcoin could pop to $90,000 on a Trump victory earlier this week, Amberdata’s Director of Derivatives Greg Magadini told Decrypt that the Bitcoin futures “market is pretty convinced a Trump victory brings us past $80,000” by the end of the month.

Bitcoin is currently trading for about $69,150 as of this writing, up more than 3% on the day—though it’s dipped from a daily high above $70,500 on Tuesday morning.

The implied volatility of Bitcoin futures contracts, measuring how much the market expects the asset’s price to change, is quite elevated at above 80%, Magadini added. The last two times the metric pushed as high was when spot Bitcoin ETFs launched in January and amid last year’s banking crisis, suggesting Bitcoin’s price could swing forcefully in either direction, he said.

Though Trump has turned himself into a vocal supporter of digital assets on the campaign trail, Grayscale’s Managing Director of Research Zach Pandl told Decrypt that Senate races are ultimately the most important barometer for the future outlook of the crypto industry.

Because the Senate has the authority to approve presidential appointees at agencies like the SEC, Harris’ camp would likely collaborate with Republicans if they’re able to gain control, Pandl said. At the same time, the Senate’s makeup could determine how the regulatory backdrop surrounding decentralized finance and the tokenization of assets develops, he said.

“As long as we see Republican control of the Senate, we think that we will have a balanced mix of financial service regulators in the United States that would put the whole industry on solid footing for the coming years,” Pandl said. “In my personal opinion, there’s actually more election risk for Ethereum and other coins beyond Bitcoin.”

The sentiment was echoed by Bitwise Chief Investment Officer Matt Hougan, who highlighted Solana’s 3.8% rise Tuesday to $165 as evidence of traders positioning around the election’s regulatory implications.

“I think Solana is the asset to keep an eye on,” he said. “Of the major assets, it’s probably the most exposed to the difference in regulatory uncertainty between a Harris and Trump regime.”

Alongside Bitcoin’s rise Tuesday, GSR Head of Research Brian Ruddick told Decrypt that some traders may be trying to allocate to the asset early based on Trump’s White House prospects.

Given that spot Bitcoin ETFs saw $500 million in net outflows Monday, he said the move would typically hurt Bitcoin’s price. Meanwhile, the defunct crypto exchange Mt. Gox moved $2.2 billion worth of Bitcoin to a new wallet late Monday, a move that has historically caused some market volatility.

“Prices are higher despite some negative news over the last day,” Ruddick said. “It seems like traders are trying to front-run the election and a potential Trump win.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

Markets

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

Published

6 hours agoon

November 21, 2024By

admin

Peak Bitcoin, hardly.

https://x.com/pete_rizzo_/

As I wrote in Forbes in 2021, the world is waking up to a new reality in regards to Bitcoin – the unlikely truth that Bitcoin’s programming has cyclical effects on its economy.

This has led to at least 4 distinct market cycles where Bitcoin has been branded a bubble, skeptics have rung their hands, and each time, Bitcoin recovers more or less 4 years later to set new all-time highs above its previously “sky-high” valuation.

I personally watched Bitcoin go from $50 to $1,300 in 2013. Then, from $1,000 to $20,000 in 2017, and I watched it go from $20,000 to $70,000 in 2021.

So, I’m just here to relate that, from my past experience, this market cycle is just heating up.

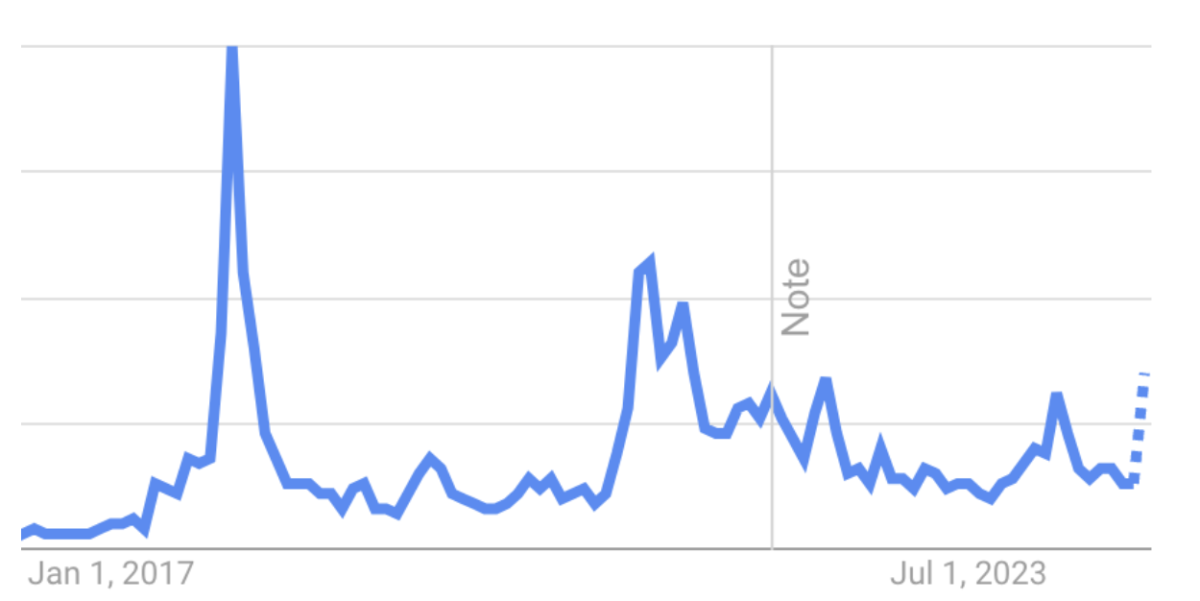

For those who have been in Bitcoin, there’s one tried-and-true and that’s Google Search. As long as I’ve been in Bitcoin, this has been the best indicator of the strength of the market.

Search is low, you’re probably in a bear market. Search heading back to all-time highs? This means new entrants are getting engaged, learning about Bitcoin, and becoming active buyers.

Remember, this is a habit change. Bitcoin HODLers are slowing shifting their assets to a wholly new economy. So, Google Trends search then, represents a snapshot of Bitcoin’s immigration. It shows how many new sovereign citizens are moving their money here.

And it’s something that all who are worried about whether bitcoin’s price topping out in 2024 should pay attention to.

Last year was the Bitcoin halving, and historically, the year following previous halvings has led to price appreciation. Maybe you’re tempted to think, “this time is different” – not me. I look at search and I see a chart that continues to accelerate into price discovery. Trust me when I say no one I know is selling bitcoin.

As shown above, buyer interest is accelerating, and these new buyers have to buy that Bitcoin from somewhere. Add nation states, US states, and a coming Trump administration set to ease the burden on the industry?

Well, I think the chart above says it all really.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Nears $96K, Continuing Wild ‘Trump Trade’ Rally

Published

19 hours agoon

November 21, 2024By

admin

BTC traded above $95,900 in early Asian hours, less than 6% from a landmark $100,000 figure that would push it above a $2 trillion market capitalization.

Source link

Bitcoin

Bitcoin Boosts MicroStrategy (MSTR) to Higher Trading Volume Than Tesla and Nvidia

Published

1 day agoon

November 20, 2024By

admin

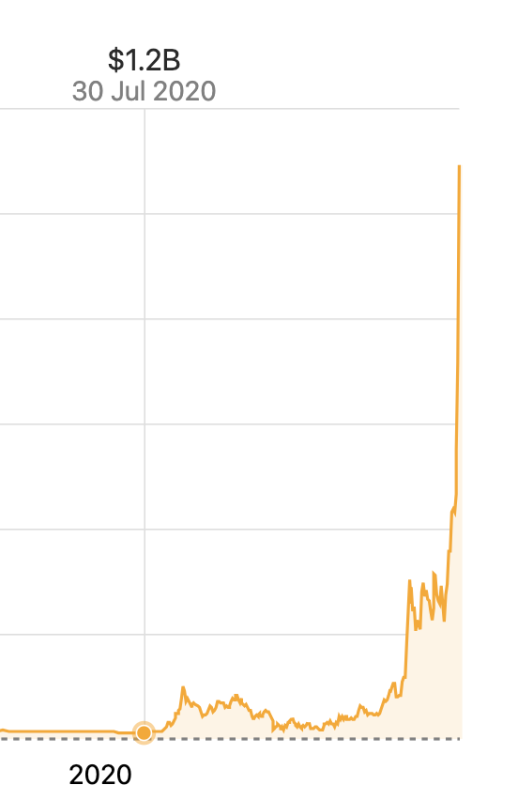

Today, MicroStrategy (MSTR) surpassed a $100 billion market cap to become the 93rd largest publicly-traded company in the U.S.

At the time of writing, MSTR has done more trading volume than both stock giants Tesla and Nvidia today, and has traditional stock traders like the Wall Street Bets community losing their minds.

Wow $MSTR is the most traded stock in America today.. to best $TSLA and $NVDA is crazy. It's been years since a stock has traded more than one of those two (it may have actually been $GME to last do it). It's also about double $SPY! Wild times.. pic.twitter.com/bUr8nycMX3

— Eric Balchunas (@EricBalchunas) November 20, 2024

This is absolutely mindblowing considering MicroStrategy was a mere $1 billion company when it first bought bitcoin for its treasury about four and a half years ago.

The big question I’m asking myself is, how and when does this end? Assuming MSTR continues to pump until the peak of this bull market, it’s anyone’s guess on how high MSTR may go.

But how hard will it crash in the bear market, considering it is essentially a leveraged trade on bitcoin? Dare I even suggest that this time may be different, and that the downside of the next bitcoin bear market won’t be as brutal as the 70%+ corrections we’re historically used to seeing?

Even with the spot bitcoin ETFs, and the notion that the US may lead the charge of nation states buying up mass amounts of bitcoin, I’m still not convinced that we don’t eventually see a massive downturn in bitcoin’s price. And I’m mentally preparing for a normal bitcoin bear market to commence after this bull market finishes sometime in the next year or so.

But back to MSTR — Michael Saylor has thus far proven that the Bitcoin for Corporations strategy works in stunning fashion. Public companies have been coming out of the woodwork this past week announcing that they’ve purchased bitcoin for their balance sheet or plan to do so, and it seems this trend will continue as the CEO of Rumble asked his X audience if he should add BTC to their balance sheet (almost 94% of his 42,522 voters voted “yes”).

Lets put this in a poll format…

Should Rumble add Bitcoin to its balance sheet?

— Chris Pavlovski (@chrispavlovski) November 19, 2024

Michael Saylor even offered to help explain how and why Rumble should adopt a corporate BTC strategy.

Institutional bitcoin adoption is here and it’s only going to grow for the foreseeable future. As companies figure out the logic behind adopting bitcoin as a strategic reserve asset, the number of publicly-traded companies that adopt this strategy is going to explode.

Companies that add bitcoin to their balance sheet will rise above most other companies — even top big tech giants — in terms of trading volume, as MicroStrategy has, until all companies add bitcoin to their balance sheet. I try to put myself in the shoes of a trader, with knowledge on Bitcoin and think to myself, “Why on earth would I buy any company’s stock if they don’t have bitcoin on their balance sheet?” I wouldn’t — it would be way too boring.

Putting BTC on the balance sheet helps create volatility, and therefore opportunity for stock traders, which is good for the traders, stock price, and company overall. If you are a publicly-traded company, it is a no brainer to adopt bitcoin as a treasury reserve asset.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

Sui Network blockchain down for more than two hours

Analyst Says Six-Figure Bitcoin Price Incoming – But Warns One Factor Could Delay BTC Rally Till Next Year

How Will BTC React to $3B Buying Spree?

ECB official calls for urgency on digital euro amid global CBDC race

The Story Behind a Crypto Trader Turning $378K into $35.2M

Justin Sun Goes Bananas: Snags Controversial “Comedian” Artwork for $6.4 Million

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential