24/7 Cryptocurrency News

Trump Memecoins Tanked More than 50%: Is It The End or Just A Temporary Downfall?

Published

5 months agoon

By

admin

With Donald Trump’s win in the 2024 US elections, the crypto enthusiasts’ daydreams have come true, as the crypto market is on the uptrend. In the last 24 hours, the global market capitalization has surged to $2.52T, and trading volume is up to $174 Billion, clearly signifying the traders’ rising interest. More importantly, most crypto coins have achieved new gains, including Bitcoin, Ethereum, and more, but the Trump memecoins have plummeted heavily, concerning holders for its future.

Analyzing The Trump Memecoins 50% Drop

With Donald Trump’s win, the biggest impact was on the Bitcoin price, which hit an all-time high of $76,460.15. More importantly, other popular altcoins have surged to new highs, but the Trump memecoins plummeted heavily. However, it does not mean that these tokens missed the market rally. Interestingly, they were the first to jump, witnessing quite a surge.

There are four Trump coins to buy, MAGA (MAGA), MAGA (Trump), Dark MAGA (DMAGA), and Super Trump (STRUMP), and these are also the most favored by investors. However, all these had a significant rally before tanking 50% today. Here, the TRUMP token is presently trading at $2.22 despite its peak of $4.6 on November 6 after the US election result. Around the same time, MAGA recovered to $0.0002048 before falling to $0.00009533 today.

The biggest drop is in the DMAGA token price, as at one point, it surged to $0.02034, which was quite close to its all-time high of $0.0232. However, now it has dropped to $0.005401, disappointing its holders. Last but not least, the same is the STRUMP, which is now worth $0.002345 despite yesterday’s peak of $0.0084.

Overall, all the Trump memecoins had a 180 shift in the last few hours, which is not what the holders have been waiting for.

What Are The Reasons Behind All These Trump Token Dips?

As per Arkham intelligence, Donald Trump’s crypto holdings include $1.33M worth of TRUMP tokens. Many crypto analysts claim that it is a positive factor that could boost Trump-themed coins after the election win. However, instead of gains, they are facing a major decline, and the biggest reason behind this is that investors have shifted to other popular cryptos like Bitcoin, Ethereum, and others.

It is one of the most common trading practices, where investors flock to rising cryptos or to those that offer long-term investment benefits. This is how a dormant Ethereum whale made $30M today after returning to the market after 8 years.

With this focus shift and heavy selling pressure on the Trump memecoins after sellers took advantage of the early rally, the tokens are following a downtrend. As a result, even Donald’s TRUMP holdings are facing a 27.3% drop, and the same is true with remaining holders. However, this might be a temporary consolidation, which happened after its sudden rise past Trump’s win.

More importantly, as the market is focused on bigger cryptos, popular memecoins like these might face high volatility for the next few days. Once the selling pressure cools off, these Trump tokens might regain strength, but the consolidation might continue for now.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

This Week in Crypto Games: ‘Off the Grid’ Token, GameStop Goes Bitcoin, SEC Clears Immutable

Binance debuts centralized exchange to decentralized exchange trades

Why Is the Crypto Market Down Today? Bitcoin Drops to $82K as Traders Flee Risk Assets Amid Macro Worries

BTCFi: From passive asset to financial powerhouse?

Hyperliquid Delists $JELLY, Potentially Causing $900K in Losses. Here’s Why Best Wallet Token Can 100x

Cryptocurrencies to Sell Fast if Bitcoin Price Plunges Below $80K

24/7 Cryptocurrency News

BitGo CEO Calls For Regulation Amid Galaxy Digital’s Settlement

Published

19 hours agoon

March 29, 2025By

admin

Mike Belshe, the CEO of BitGo, has commented on the recent settlement between Mike Novogratz’s Galaxy Digital and the New York Attorney General (NYAG). Known as one of the top advocates of deregulation, Belshe, per his latest updates on X, appears to favor regulatory intervention to prevent some fraudulent practices in the industry.

BitGo CEO Comments on Galaxy Digital Settlement

Responding directly to a post from Anthony Scaramucci, Belshe said it is hard to deny that NYAG laid a compelling case against Galaxy Digital. He highlighted the firm’s pump-and-dump actions. The BitGo CEO noted that selling tokens as soon as they are vested and shilling to HODL when one is actually selling is wrong.

Notably, he reiterated his respect for Novogratz and his contributions to the industry. However, considering the NYAG’s position, Mike Belshe said Galaxy Digital’s actions are unethical.

‘So, legal overreach or not, it’s not ethical, and this type of behavior makes our entire industry look bad. Unchecked, this is what leads to “over-regulation,”’ he said, advocating for users to read the controls put onto Galaxy as part of this settlement!

The Advocacy for Crypto Regulation

As reported by CoinGape, Galaxy Digital settled with NYAG with $200 million over the controversial Terra (LUNA) sales. The BitGo CEO said if the right regulations are not in place and top leaders are this manipulative, the industry may not be taken seriously.

In his calls for oversight, Mike Belshe defined this as ‘Principles-based regulation.’ He further explained what he meant, noting that no one should lie to promote assets they hold. He also advocated that influential leaders should not tell others to buy while hiding the fact that they are selling.

Over the past few years, industry leaders have often denounced the regulation through key regulators’ enforcement tactics. Things have changed drastically since Mark Uyeda came on board as Acting Chair of the US SEC.

The commission has even established a Crypto Task Force to help introduce frameworks to guide the industry.

President Trump Fulfilling Campaign Promises

The BitGo CEO’s new crypto regulation push is not on the radar. While industry experts like John Deaton agreed with his proposition, US regulatory agencies are cleaning the house to help fulfill President Donald Trump’s campaign promises.

In a recent update, the FDIC advised Federal Banks about crypto. The commission said financial institutions under its umbrella do not need prior approval to gain exposure to the crypto industry. Thus far, this positive regulatory shift has triggered a new adoption trend for the digital currency ecosystem.

One of the core positive moves was Fidelity Investments’ launch of a stablecoin on a public blockchain.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Here’s Why Crypto Market Is Bleeding Today

Published

1 day agoon

March 29, 2025By

admin

The drawdown in the broader crypto market has extended to this weekend as losses shifted from Bitcoin (BTC) to altcoins. The combined market cap has lost 2.82% to $2.68 trillion, which suggests the selloff might deepen more. With the mix of bullish news in the trailing 7-day period, the question among analysts remains what is behind the latest slump.

What Is Behind Crypto Market Crash?

Since the inauguration of President Donald Trump, the broader digital currency ecosystem has witnessed positive backing.

As reported earlier by CoinGape, President Trump granted full pardon to Arthur Hayes, and other BitMEX co-founders Benjamin Delo and Samuel Reed. While this news is localized to the beneficiaries, it generally signals the positive shift in White House’ perception of the industry.

Despite these updates, the crypto market is still reeling with losses. The same Trump administration’s trade policies have continued to weigh down investor sentiment. The April 2 reciprocal tariff timeline has placed investors on the edge.

These tariffs and trade wars have ushered in economic uncertainties and potential inflation drag. With the Federal Reserve keeping rates unchanged, the impact of inflation may force traditional firms to adjust their positions. This in turn impact the crypto market sentiment overall.

Bitcoin and Altcoin Performance Review

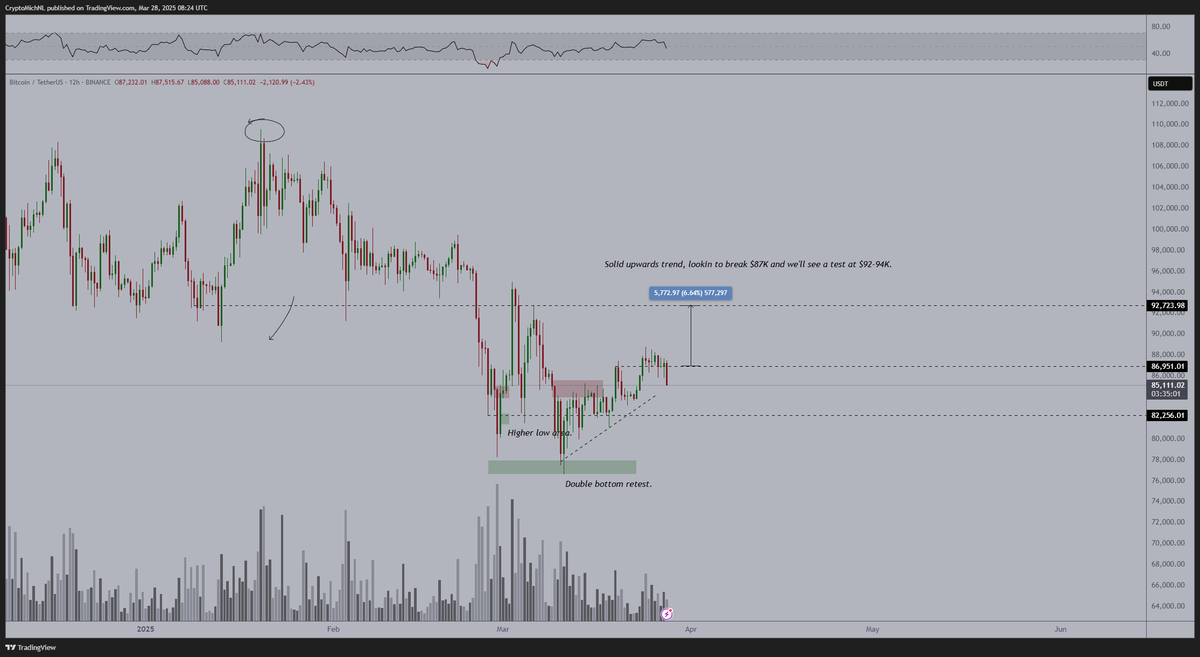

As of writing, the price of BTC has lost its $83,000 support and currently trading at $82,476.30 per data from CoinMarketCap. The top coin has fallen by 2.43% in 24 hours and has extended its Year-to-Date (YTD) losses to 12.5%.

Top altcoins have also lost their positions with Ethereum down 2.25% to $1,846. XRP has fallen by more than 3% to $2.115, while Cardano has shed off 3.92% to $0.6721. The altcoin response has seen Dogecoin forming a wedge pattern in what may serve as a make-it-or-break-it switch for the memecoin.

While it appears as though many of these top assets are bottoming out, their correlations with Bitcoin may extend their overall drawdow.

What Next for the Crypto Market?

Thus far this year, top coins like Bitcoin have often showcased resilience in the face of massive sell-off and crypto liquidations. Although the current price floor for Bitcoin remain undefined, with analysts keeping an eye on the $82,000 floor.

The digital currency has not breached this level in close to two weeks. While legendary trader Peter Brandt agrees BTC price may fall to $65,635, this bearish projection may be averted if the $82,500 support holds through the weekend.

Altcoins may likely boost their price recovery by relying on BTC breakout and their internal fundamental updates.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Published

1 day agoon

March 29, 2025By

admin

Peter Schiff, a BTC critic, has recently predicted that Bitcoin price could plummet to as low as $10,000. Schiff has expressed concerns over Bitcoin’s long-term viability, particularly in comparison to gold. His argument revolves around Bitcoin’s current performance, which he believes is being driven by short-term hype rather than solid fundamentals.

Schiff’s prediction is particularly alarming for those who view Bitcoin as a store of value. In the current trends, Peter Schiff notes that millions of young people are invested in Bitcoin while gold, a standard hedge, is pushing higher.

This view stems from his assertion that when gold prices rise to new record levels then the value of Bitcoin may plummet.

“By the time they get to their target of $5K for gold, they will drag Bitcoin down to $10K, meaning a drop of 95% from the highest it was valued at in 2021,” Schiff reasoned.

Bitcoin Price Recent Performance Against Gold

According to Peter Schiff, Bitcoin price has underperformed in relation to gold. Gold prices recently broke through $3,000 per ounce as global economic conditions continued to affect the global economy. Meanwhile, Bitcoin has depreciated in value, especially in terms of the precious metal, gold.

Since early 2025, the prices of Bitcoin have come down by over 30% against gold with one Bitcoin currently only equivalent to 27.4 ounces of gold as compared to 41 ounces in December of 2021.

If Bitcoin is an asset that people only buy when the stock market is going up and risk appetite is high, what is it that investors are buying? It’s not a stock as it will never have earnings or pay a dividend. It’s clearly not a risk-off asset, a store of value, or digital gold.

— Peter Schiff (@PeterSchiff) March 28, 2025

Another issue that Schiff dislikes about Bitcoin also revolves around its categorization as a “risk asset.” He says that BTC price movements are synchronized with the rest of the market, especially when investors are more willing to take risks. While gold provides investors with a safe-haven, the Bitcoin price operation is defined as having a volatility closer to that of the traditional markets among investors. Therefore, as argued by Peter Schiff, BTC price may decline as investors turn to the safe-havens, such as gold, in turbulent times.

Market Analyst Weigh In On Bitcoin Trend

Several market analysts are echoing Schiff’s concerns, suggesting that Bitcoin price could face challenges in the near term. Peter Brandt, a veteran trader, has pointed out that Bitcoin might be on a path to $65,635, citing a “bear wedge” pattern that has emerged in the cryptocurrency’s price charts.

Meanwhile, crypto trader Michaël van de Poppe shared his own cautious outlook on Bitcoin’s short-term prospects. Van de Poppe noted that while Bitcoin price has been holding above the $80,000 mark, its price action is starting to show signs of weakness. He added, “It starts to look slightly less good,” and suggested that if Bitcoin falls below $84,000, a deeper correction could be imminent.

Similarly, the crypto trader TheKingfisher expressed doubts about a sustained bullish recovery, indicating that Bitcoin’s current price movement aligns with a typical market cooldown. He suggested that Bitcoin could be approaching a “seasonal reset” as part of the broader market trend.

Alternative Views on Bitcoin’s Future Trend

Not everyone shares Peter Schiff’s pessimism about Bitcoin price. Charlie Morris, founder of ByteTree, highlighted that despite recent challenges, Bitcoin may have already seen its worst. He explained that while gold ETFs are experiencing slower inflows, Bitcoin could be positioned for a potential recovery.

This view contrasts sharply with Peter Schiff’s, emphasizing that the cryptocurrency may not be as doomed as some critics suggest.

Additionally, Robert Kiyosaki, author of Rich Dad Poor Dad, has weighed in on the broader market of precious metals and cryptocurrencies. While Kiyosaki acknowledged Bitcoin’s role as a hedge against inflation, he predicted that silver would outperform both Bitcoin and gold in the near term

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

This Week in Crypto Games: ‘Off the Grid’ Token, GameStop Goes Bitcoin, SEC Clears Immutable

Binance debuts centralized exchange to decentralized exchange trades

Why Is the Crypto Market Down Today? Bitcoin Drops to $82K as Traders Flee Risk Assets Amid Macro Worries

BTCFi: From passive asset to financial powerhouse?

Hyperliquid Delists $JELLY, Potentially Causing $900K in Losses. Here’s Why Best Wallet Token Can 100x

Cryptocurrencies to Sell Fast if Bitcoin Price Plunges Below $80K

‘Extremely High’ Odds of V-Shaped Recovery for Stock Market, According to Fundstrat’s Tom Lee

Is XRP price around $2 an opportunity or the bull market’s end? Analysts weigh in

What is Dogwifhat (WIF)? The Solana Dog Meme Coin With a Hat

Ethereum’s time is ‘meow?’ Vitalik Buterin video go ‘vrial’

Bitcoin Miner MARA Starts Massive $2B At-the-Market Stock Sale Plan to Buy More BTC

Paul Atkins “Conflict of Interest” Triggers $220M Withdrawals from Ripple Markets

Bitcoin CME Gap Close About To Happen With Push Toward $83k

Listing an altcoin traps exchanges on ‘forever hamster wheel’ — River CEO

Nasdaq Files To Launch a New Grayscale Avalanche (AVAX) Exchange-Traded Fund

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: