cryptocurrency

Block Inc. shifts focus to Bitcoin mining amid plans to sunset Web5-focused TBD

Published

2 weeks agoon

By

admin

Jack Dorsey founded payments firm Block Inc. is pivoting its focus towards the cryptocurrency mining sector.

In a Nov. 7 shareholder letter, Block, formerly Square Inc., said it would dial down resources towards its music streaming service TIDAL, and sunset TBD, a venture focusing on decentralizing the internet, to focus on expanding its presence in the Bitcoin mining sector.

Block acquired TIDAL in a 2021 acquisition for roughly $300 million, as the streaming service was facing stiff competition and failing to gain traction. The platform has continued to struggle, with reports indicating workforce reductions and a $132.3 million impairment charge.

Meanwhile, TBD, a subsidiary of Block, set out to create a decentralized web experience in 2022 which it dubbed Web5. It is not clear why the company intends to shut down operations.

The timing of Block’s announcement coincides with Donald Trump winning the U.S. presidential election.

Recall that in June, Trump said he’d like to see all remaining Bitcoin mined in the U.S., highlighting its potential to help the country dominate the energy sector. The news was a big boost for Bitcoin mining stocks and brought some energy back to a sector that’s been struggling with profits since this year’s halving slashed mining rewards by half.

Block seems to be positioning itself to capitalize on the renewed momentum in the U.S. mining sector, which it believes has “a healthy pipeline of demand.”

While Block doesn’t mine Bitcoin directly, it develops mining equipment through its Proto initiative. Earlier this year, the company revealed it had developed a 3-nanometer mining chip, which prominent Bitcoin miner Core Scientific has decided to incorporate into its operations.

Block will also allocate a portion of the restructured resources towards its self-custodial hardware wallet offering Bitkey, the letter noted. Launched in March 2024, the device lets users store BTC while also facilitating purchases via traditional channels leveraging its partnerships with exchanges and payment providers.

The company’s new direction comes as its revenue missed Wall Street estimates, reporting $5.98 billion for the third quarter, falling short of the expected $6.24 billion, and follows layoffs across the Cash App, Foundational, and Square divisions in January, along with a reduction of around 40 Tidal employees in December.

Meanwhile, as Block narrows its focus on the mining market, U.S. Bitcoin miners have been expanding operations over the past month. In September, CleanSpak acquired seven Bitcoin mining facilities in a bid to reach its goal of boosting its hashrate to 37 EH/s by the end of 2024.

In August, Marathon Digital Holdings raised $292.5 million to fund its strategic expansions.

According to an H.C. Wainwright & Co. report in the third quarter of 2024, publicly listed Bitcoin mining firms collectively saw a 4.5% increase in hash rate.

Source link

You may like

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

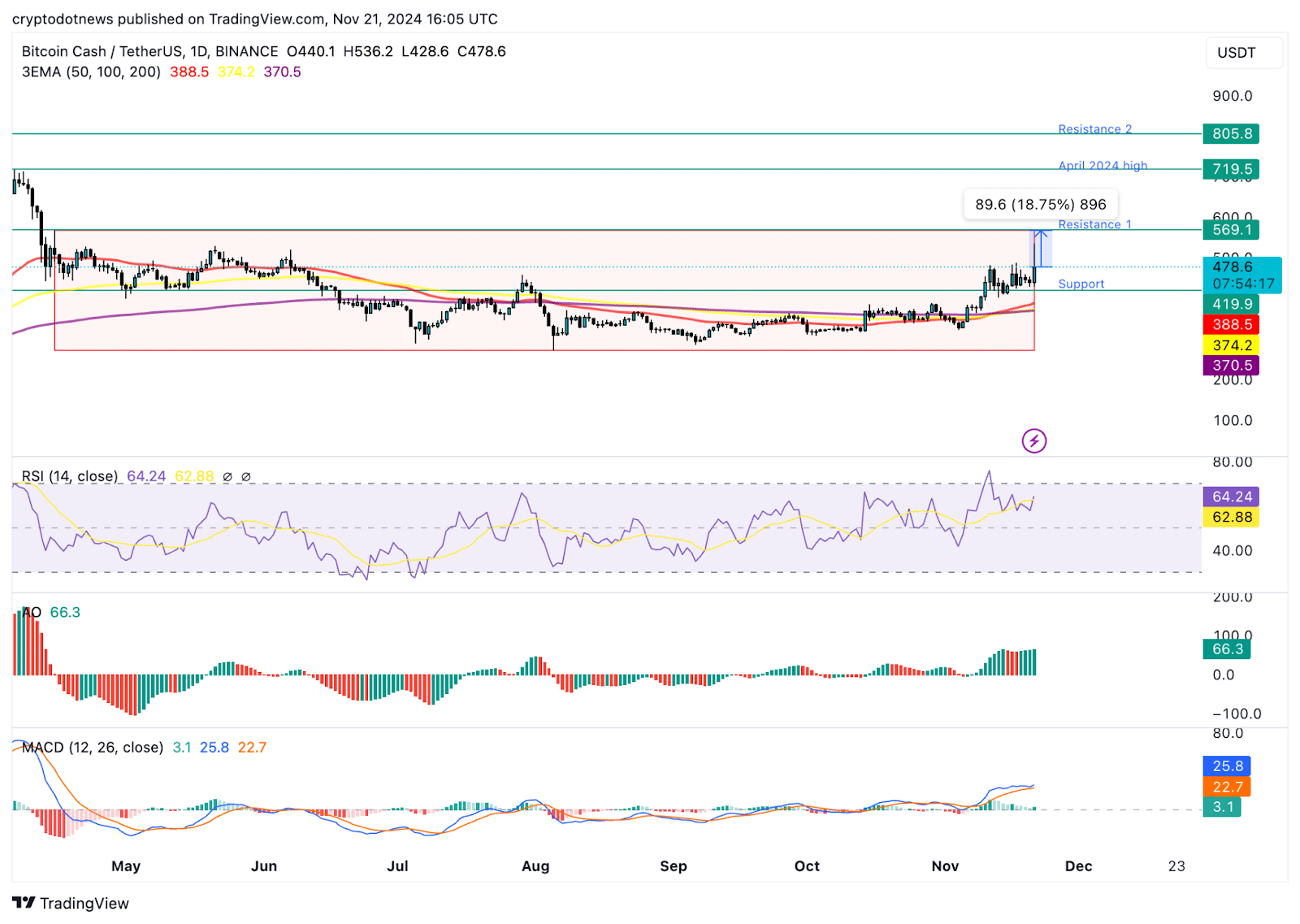

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

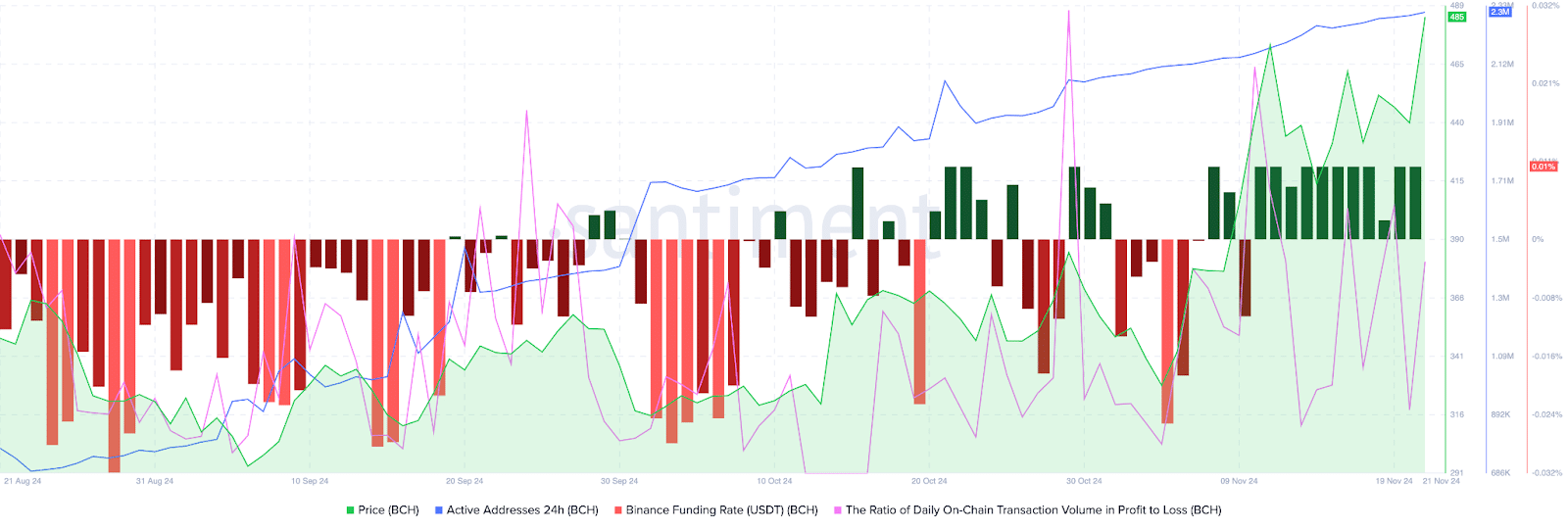

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

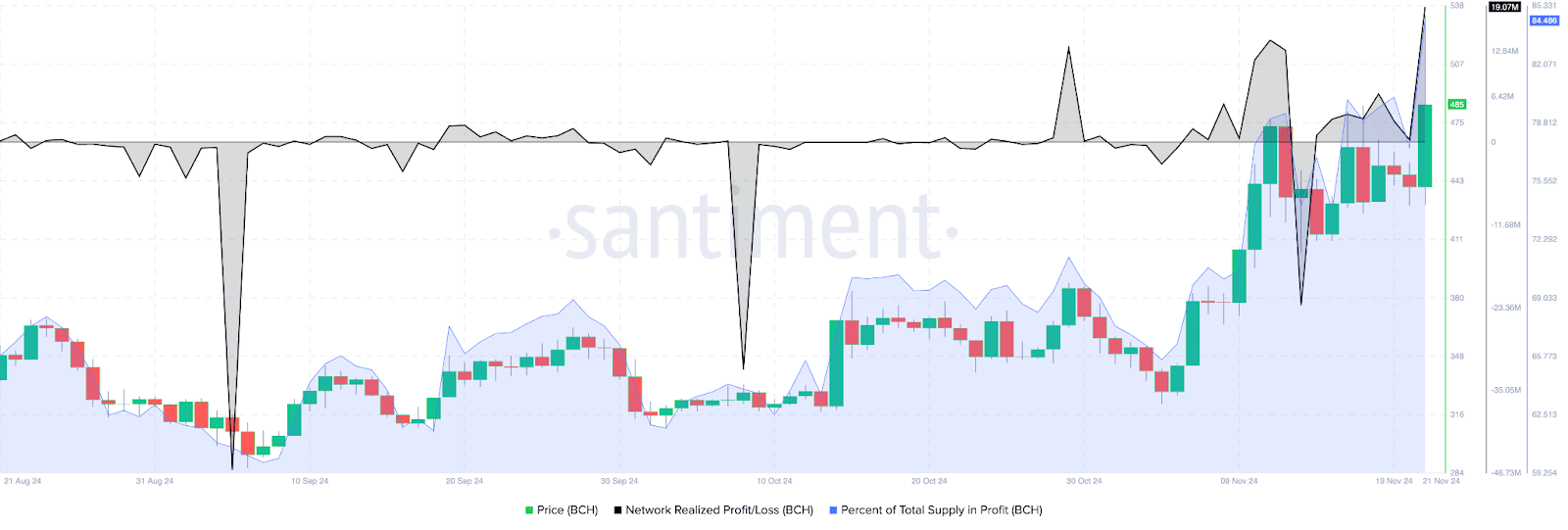

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

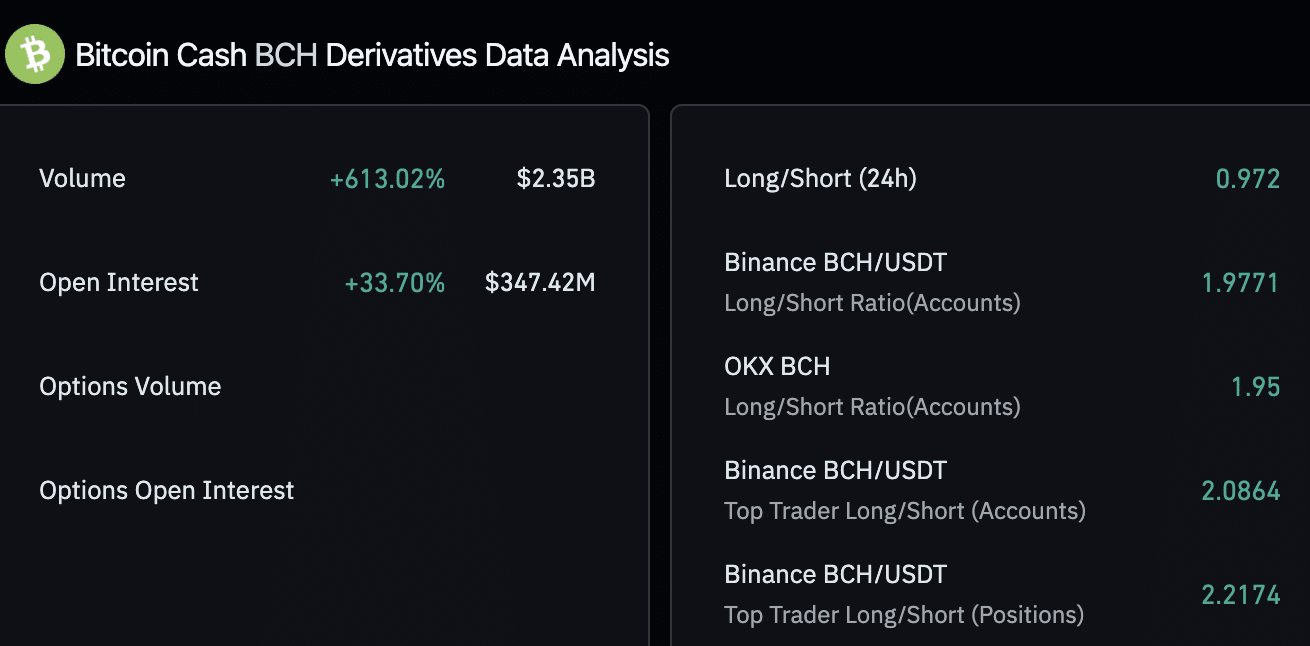

Derivatives traders are bullish on BCH

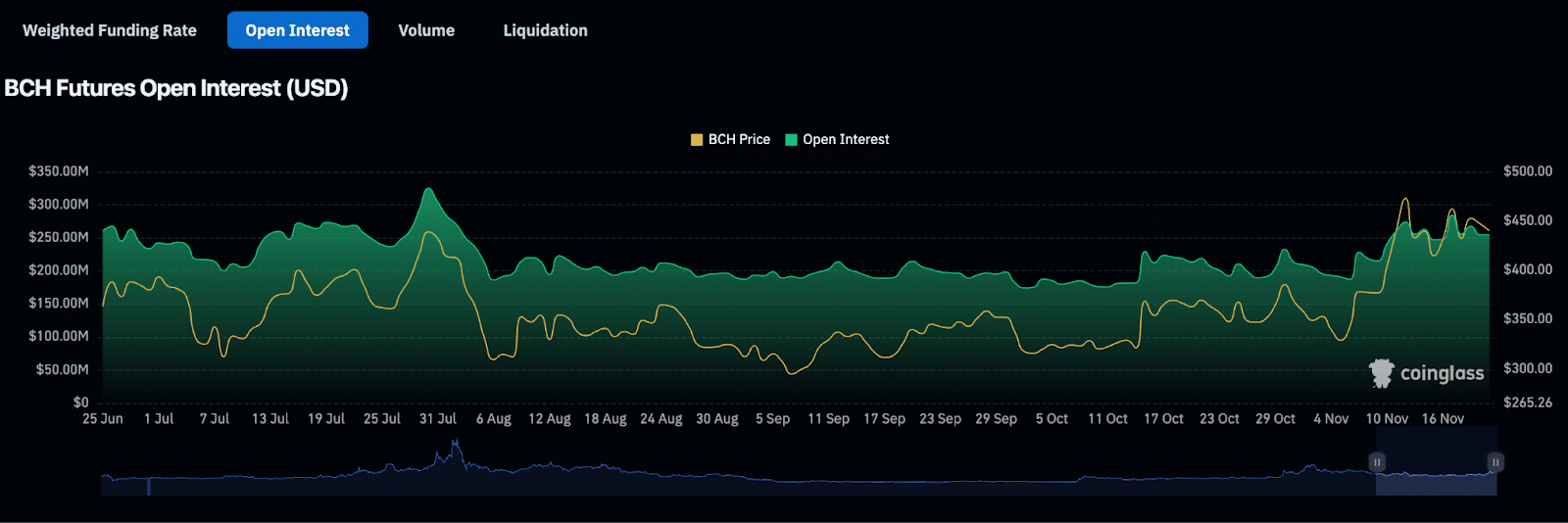

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Blockchain

Sui Network blockchain down for more than two hours

Published

3 days agoon

November 21, 2024By

admin

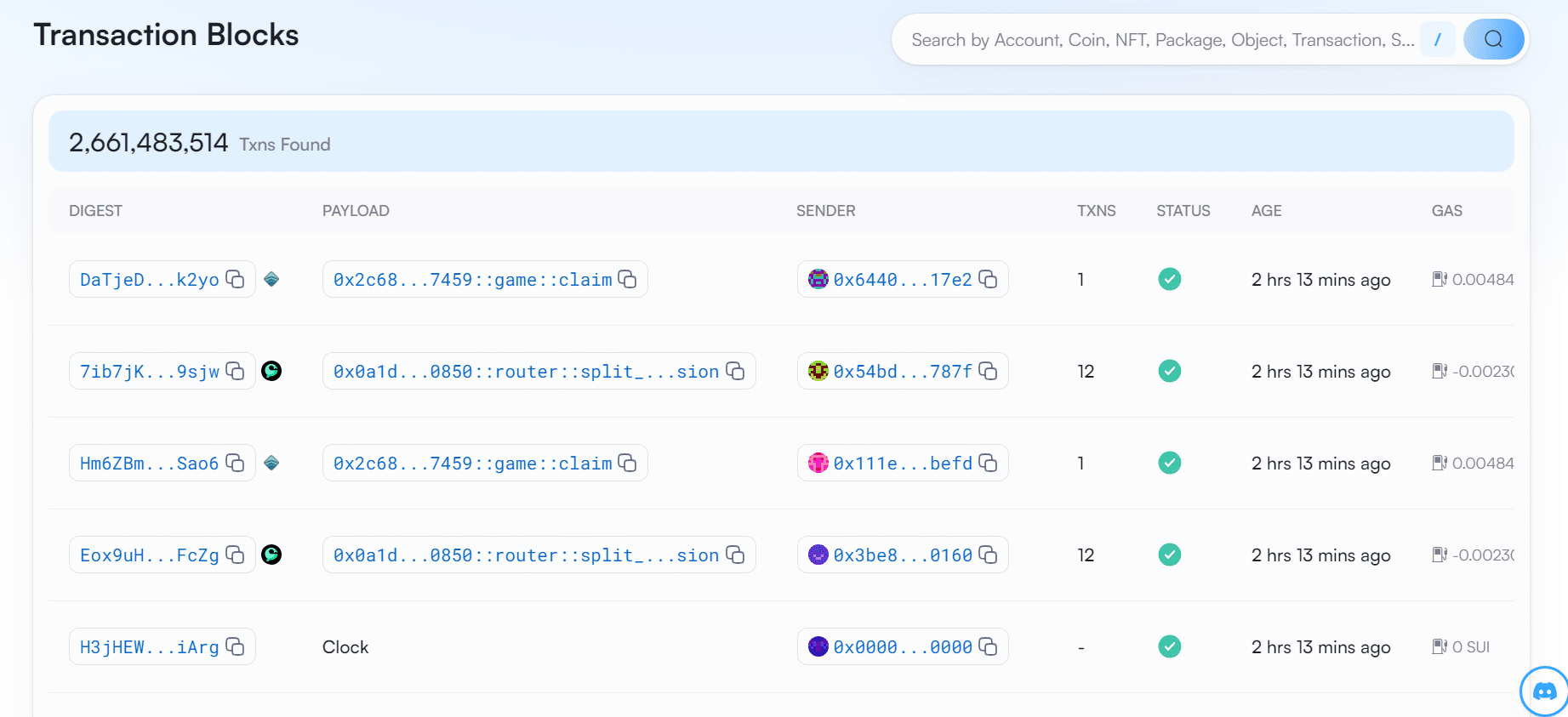

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

cryptocurrency

BONK hits new all-time high following Upbit listing

Published

4 days agoon

November 20, 2024By

admin

BONK has emerged as the top gainer among the leading 100 assets following a major announcement from the South Korean crypto exchange Upbit.

Bonk (BONK), the first Solana-based meme coin, surged 18% on Wednesday to hit a new all-time high of $0.000058. Its market cap soared to over $4.1 billion when writing, flipping Dogwifhat’s (WIF) $3.2 billion market cap to reclaim its position as the largest meme coin on the Solana blockchain.

Why is BONK going up?

The altcoin’s price uptick coincided with a jump in the meme coin’s futures open interest. According to data from CoinGlass, OI for BONK’s futures market rose to an all-time high of $53.5 million, more than 7 times its monthly low of $6.3 million, suggesting a growing demand from investors.

Bonk’s recent rally followed its listing on South Korea’s largest crypto exchange, Upbit. BONK’s daily trading volume shot up 95% amid the listing, hovering over $3.5 billion when writing.

Another key factor driving the altcoin’s gains is Bonk DAO’s announcement of a massive 1 trillion token burn scheduled for Christmas Day, which is set to reduce the total number of tokens in circulation, thereby increasing scarcity.

Whales have also been interested in the meme coin lately. According to data shared by Lookonchain, a whale with a history of profitable meme coin investments has spent 3.4 million USDC to buy 65.4 billion BONK tokens. Last week, another whale was seen picking up 29.32 billion BONK at $0.0000387.

Whale buying typically boosts retail investor confidence in an asset, potentially driving FOMO (fear of missing out) among those seeking quick gains.

Bullish momentum to continue

BONK’s rally hasn’t lost strength despite surging over 72% in the past week alone. On the 1-day BONK/USDT price chart, BONK’s EMA lines show a strong bullish trend, with the short-term 50-day EMA above the long-term 200-day EMA and the price staying above both lines.

Based on this setup, the bullish trend is expected to continue in the short term as the buyers remain in control. However, the Relative Strength Index showed a reading of 82, which confirms the bullish momentum but puts the meme coin at overbought levels.

Despite the overbought status, an analyst suggests that BONK is undergoing a ‘Blue Sky breakout,’ which could sustain its upward trajectory in the coming days.

This speculation is supported by strong catalysts driving the uptrend and the current hype around meme coins. Separately, Bitcoin’s recent rally to new highs has amplified market-wide sentiment, further boosting interest in the meme coin sector, which gained 2.3% over the past day.

Source link

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

SHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential