layer 1

Polkadot price forms a rare pattern, 76% jump possible

Published

5 months agoon

By

admin

Polkadot price may be preparing for a major bullish breakout as a rare pattern that has been forming since August nears its completion.

Polkadot (DOT), a top layer-1 network, was trading at $4.30 on Friday, Nov. 8 after rising for four consecutive days. It has jumped by 18% from its lowest point this year month, meaning that it is approaching a bull market.

Crypto analysts are bullish on Polkadot despite of its weak fundamentals. One of the main themes has been a falling wedge pattern that has been forming since Aug. 1. In an X post, a crypto analyst known as Globe of Crypto, estimated that the coin could jump to between $9 and $10 when the break out happens. If this happens, it will see DOT token more than double.

A potential catalyst for the Polkadot price is the new connection of the network to other chains like Ethereum, Optimism, Arbitrum, Base, and Binance Smart Chain. This connection, which has been enabled by Hyperbridge, means that users can move assets across these chains without relying on middlemen.

Meanwhile, there are signs that open interest in the futures market is picking up momentum. DOT’s open interest rose to over $269 million, its highest level since June 17. It has had a strong comeback after bottoming at $179 million in September.

Still, the biggest challenge for Polkadot is that it has not gained a lot of traction among developers. Its ecosystem growth has been relatively weak such that it has been passed by other newer networks like Base and Sui.

Polkadot price analysis

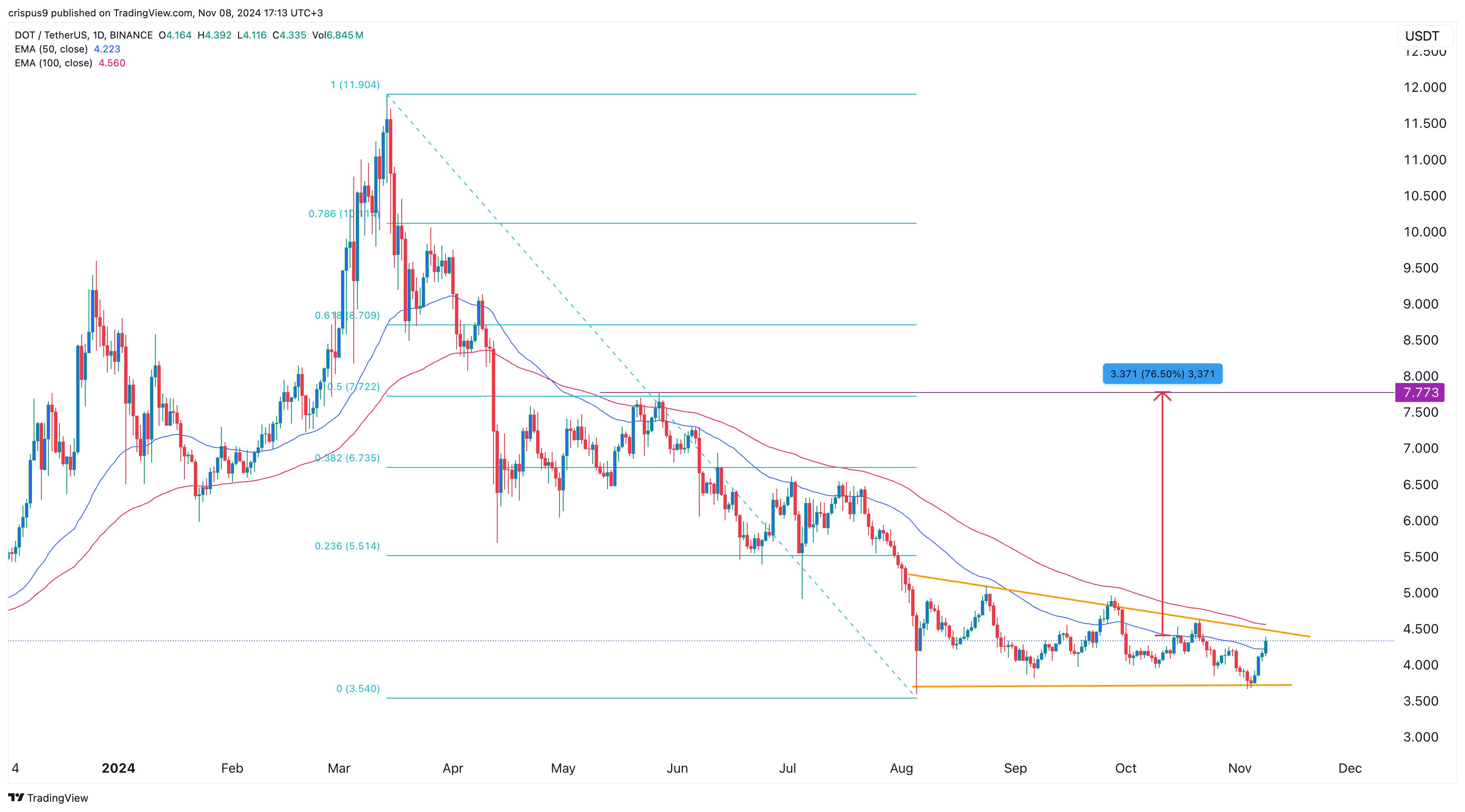

The daily chart shows that the DOT price has been in a tight range in the past few months. In this period, it has constantly remained below the 50-day and 100-day moving averages.

On the positive side, it has formed a falling wedge pattern, which is now nearing the confluence level. Such a move, especially at a time when oscillators like the Relative Strength Index (RSI) and Stochastic have pointed upwards, is a sign that the coin will soon have a bullish breakout.

If this happens, Polkadot price may jump to $7.77, its highest swing since May 27 and the 50% Fibonacci Retracement point. If this happens, the token will jump by 76.50% from the current level. This view will become invalid if it moves below this month’s low at $3.66.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

Cardano

Cardano price could surge to $2 as whale purchases rise

Published

3 days agoon

March 25, 2025By

admin

Cardano price has remained in a tight range over the past few weeks as market participants await the next catalyst.

Cardano (ADA) was trading at $0.760, down by 43% from its highest level in December last year. It has underperformed other popular coins like Mantra (OM) and Cronos (CRO) this month.

Cardano has three main catalysts that could propel it to $2 in the coming months. First, there are signs that whales are accumulating the coin in anticipation of more gains ahead. Data shows that whales have acquired over 240 million ADA coins in the past week, valued at over $182 million. The whale purchasing trend appears to be gaining momentum.

Second, Cardano could benefit from the likely approval of a spot ADA exchange-traded fund by the Securities and Exchange Commission. Grayscale Tuttle Capital Management have already submitted applications.

An ADA fund would be a positive development for the coin, as it could lead to more inflows from institutional investors.

Third, data shows that more investors are staking their Cardano coins, signaling that they intend to hold them long-term. The staking market cap has jumped by 8.1% to $16.1 billion, while the yield stands at 2.60%.

Cardano price technical analysis

The other catalyst for ADA price is that it is in the second phase of the Elliott Wave pattern. This phase is characterized by a brief pullback, followed by the third bullish wave — typically the longest.

Cardano has likely completed the second phase and is poised to enter the third wave, which could push it to the psychological level of $2. This target aligns with the 38.2% retracement level and represents a 160% increase from the current price.

Cardano remains above the 50-week Exponential Moving Average and is forming a bullish flag pattern, a bullish continuation signal comprising a vertical line and a flag-like consolidation.

However, this prediction is based on the weekly chart, meaning the pattern could take time to fully develop. The flag section of the bullish flag has already taken more than three months to form.

Source link

DeFi

Berachain rolls out next phase of proof-of-liquidity system

Published

4 days agoon

March 24, 2025By

admin

Berachain is rolling out the next phase of its proof-of-liquidity system, expanding governance and emissions beyond its native BEX pools.

Up until now, only Berachain’s (BERA) native exchange, BEX, was used to distribute rewards. Other decentralized applications will be able to apply for incentives through new reward vaults starting on Mar. 24, according to Berachain’s official announcement. This will help them expand by drawing liquidity.

https://twitter.com/berachain/status/1902854165883167167?s=46&t=nznXkss3debX8JIhNzHmzw

Liquidity pools from multiple decentralized finance platforms have been included in the initial set of vaults, with more to be added later. This has opened up a more transparent system where users have more control over how incentives are allocated and projects vie for rewards.

With Berachain’s PoL model, assets remain active in DeFi, in contrast to traditional proof-of-stake blockchains, where users lock up tokens for security. Network activity is limited in PoS systems because staked tokens are frequently not available for lending or trading.

The system used by Berachain ensures that validators send back some rewards to the network rather than keeping them. Applications that boost activity on the blockchain and aid in its growth receive these rewards. The governance token, BGT, gives holders the ability to vote on which validators and projects receive support, thereby determining how these rewards are distributed.

The first approved vaults focus on DEX liquidity pools, which allow users to swap tokens easily. These pools were selected based on their liquidity, security, and importance to the network. Liquidity pairs on BEX, Kodiak, Beradrome, and other protocols featuring key assets like BERA, HONEY, and BGT, as well as major stablecoins, are among the first approved vaults.

Berachain has grown rapidly since launching its mainnet on Feb. 6. The platform now has $3.1 billion in total value locked and almost $1 billion in circulating stablecoins. The trading volume in February alone was $1.9 billion, according to DefiLlama data.

Following launch, BERA hit an all-time high of $18.82 before falling to its present range of $6.03–$6.93. The network has a fully diluted volume of $3.37 and a $728 million market capitalization as of Mar. 24. The new governance initiative is expected to attract more users and contribute to further growth of the blockchain.

Source link

Blockchain

Solana Hits 400B Transactions, Nearly $1T in 5 Years

Published

2 weeks agoon

March 17, 2025By

admin

Solana, the layer-one blockchain platform, celebrated five years since the launch of its mainnet on March 16, 2020.

To celebrate the milestone, the network shared its accomplishments, which include more than 1,300 validators, nearly $1 trillion in trading volume, and over 408 billion total Solana transactions, in a post on its official X account.

https://twitter.com/solana/status/1901279678620749997?s=46&t=nznXkss3debX8JIhNzHmzw

Solana (SOL) was founded in 2017 by Anatoly Yakovenko with the goal of addressing the primary challenge facing blockchain technology. The network aims to strike the right balance between scalability, security, and decentralization.

When combined with proof-of-stake, Yakovenko’s proof-of-history system speeds up transaction processing. Solana has been able to grow while maintaining low costs as a result.

More than 254 million blocks have been generated by Solana since its mainnet went live in March 2020. Since then, the network has grown to be a major force in decentralized finance, with over $7 billion in total value locked in its protocols, according to DeFiLlama data.

Meanwhile, Solana’s stablecoin market has reached $11 billion, down from its peak of over $12.6 billion in February 2025. Similarly, its market cap, which once peaked at $127.5 billion, now stands at $65 billion.

Developer interest in Solana has also significantly increased. It surpassed Ethereum as the most popular blockchain for new developers in 2024. According to Electric Capital’s 2024 developer report, Solana attracted 7,625 new developers in the previous year, accounting for 19.5% of all new entrants in the market.

On Mar. 17, CME Group plans to introduce Solana futures contracts, subject to regulatory clearance. These futures, which are intended to assist investors in protecting themselves from price swings, indicate that Solana is becoming a more widely accepted asset in the cryptocurrency market.

Furthermore, Solana has been included in several exchange-traded funds applications, indicating its increasing mainstream acceptance and room for growth.

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x