News

Market insider picks 5 altcoins that could make 20-year-olds millionaires by 2025

Published

2 weeks agoon

By

admin

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Young investors are eyeing five lesser-known altcoins that could skyrocket by 2025, transforming modest investments into wealth.

Young investors are searching for the next big opportunity in the crypto world. A seasoned analyst has spotlighted five lesser-known digital currencies that might skyrocket in value by 2025. These altcoins could transform modest investments into substantial wealth. Discover which cryptocurrencies could be the game-changers for the new generation of investors.

CYBRO presale approaches $4M milestone, sees 300% price surge

The CYBRO presale continues to attract attention across the crypto landscape, now in its sixth phase and nearing a notable $4 million raised. Since launch, CYBRO’s token price has surged 300%, climbing from $0.01 to $0.04 and capturing the interest of investors eager to participate in what aims to be a revolutionary DeFi project.

CYBRO, a DeFi platform powered by the advanced Blast Layer-2 solution, offers elevated yields on ETH and stablecoins, with AI-enhanced tools to optimize crypto earnings. Early investors with $1,000 or more in CYBRO can access the Pre-Alpha Yield Program, unlocking weekly variable ETH yields available post-Token Generation Event (TGE)—a compelling incentive for early adopters.

Early investor advantage – Unlock DeFi’s potential with CYBRO

Built to cater to investors’ needs, the CYBRO app provides a streamlined experience, supporting over 420 wallets and featuring customizable yield options averaging a competitive 10% APY. Users can select vaults by trust score, total value locked (TVL), and APY, tailoring portfolios to individual risk preferences.

CYBRO’s comprehensive tokenomics further bolster its appeal, with benefits including reduced service fees, cashback rewards, lower transaction costs, robust insurance protections, and airdrop opportunities. Currently available at a 40% discount from the anticipated listing price, CYBRO presents an entry point that some analysts suggest could deliver up to 1200% gains over the next year.

Ethereum: Proof-of-Stake blockchain powering DeFi, smart contracts, and fast transactions

Ethereum is a blockchain that uses a system called Proof-of-Stake. It’s known for programmable agreements called smart contracts and a large network of applications. It supports decentralized finance and uses tools like Arbitrum and Polygon to make transactions faster and cheaper. Ethereum introduced a type of token used in many applications for decision-making, utility, and storing value. Transactions need ETH to pay for fees. Since it was started by Vitalik Buterin, Ethereum has grown, changing to Proof-of-Stake with an upgrade called the Merge. Ether (ETH) is important to the system, allowing transactions, rewarding those who stake, and acting as an asset that can be traded and used as collateral.

Chainlink bridging smart contracts with real-world data

Chainlink is a network that helps smart contracts connect with real-world data. Smart contracts on the blockchain become more powerful when they access external information. Chainlink works by fetching data from outside sources, checking it for accuracy, and delivering it securely to smart contracts. It uses multiple nodes to ensure the data is correct. The LINK token pays for data services and rewards those who provide data. This system makes smart contracts more useful by letting them interact with things outside the blockchain.

Aave: decentralized lending on Ethereum with flash loans and AAVE governance

Aave is a cryptocurrency that powers a decentralized lending system on Ethereum. It lets users lend, borrow, and earn interest on crypto assets without middlemen. Aave uses smart contracts to manage funds, relying on code instead of banks. It supports 17 cryptocurrencies for lending and borrowing. Lenders receive aTokens that represent their deposits and earn interest.

Aave is known for flash loans, which are instant and require no collateral but must be repaid within the same block. The AAVE token is central to the system, offering fee discounts and voting rights on changes. It can also be used as collateral with added benefits. The platform includes a Safety Module for staking to manage risks, and AAVE’s limited supply can enhance its value.

Sui: A new layer-1 blockchain enhancing scalability and user experience

Sui is a blockchain platform built to support global users with a secure and scalable environment. It uses a unique object-centric data model and the Move programming language to solve problems found in other blockchains. Sui focuses on making blockchain interactions smoother by removing common hurdles. Features like zkLogin, sponsored transactions, and programmable transaction blocks help make applications more user-friendly. This approach aims to make blockchain technology more accessible and easier to use for everyone.

Uniswap’s UNI: decentralized trading and community governance

Uniswap is a decentralized exchange on the Ethereum blockchain. It uses an automated liquidity protocol, allowing trading without an order book. Users keep full control of their funds, improving security and accessibility. Uniswap’s governance token, UNI, lets holders vote on platform changes like fee structures and token distribution. To encourage loyalty, Uniswap gave 150 million UNI tokens to past users, each receiving 400 UNI tokens worth over $1,000 at launch. As a result, UNI holders can influence the platform’s future direction. Uniswap is the fourth-largest DeFi platform, with over $3 billion in assets. Its open-source technology and free token listing set it apart from centralized exchanges. The blend of decentralized trading and community governance highlights the potential for user-driven financial platforms.

Conclusion

In conclusion, while established cryptocurrencies like ETH, LINK, AAVE, and SUI may offer less potential for rapid gains in the short term, CYBRO stands out as a remarkable opportunity for investors seeking significant returns. As a technologically advanced DeFi platform, CYBRO enhances earnings through AI-powered yield aggregation on the Blast blockchain. Its features include attractive staking rewards, exclusive airdrops, and cashback on purchases, all designed to provide a superior user experience with seamless deposits and withdrawals. By focusing on transparency, compliance, and quality, CYBRO has attracted strong interest from prominent crypto investors and influencers. This positions it as a promising project for those looking to maximize their investments during the current market uptrend.

For more information, visit the official CYBRO website and join the community on X, Telegram, and Discord.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Source link

You may like

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Approaches $100K; Retail Investors Stay Steady

crypto

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Published

2 hours agoon

November 22, 2024By

admin

The new Labour government, elected in July, intends to implement its predecessor’s crypto proposals on the creation of regulated activities, including operating a crypto trading platform and a market abuse regime, in full, Siddiq said. Under current plans, stablecoins will no longer fall under the U.K.’s payments regime. There will also be a carve out for staking to prevent it being treated like a collective investment scheme.

Source link

Bitcoin

Bitcoin Approaches $100K; Retail Investors Stay Steady

Published

6 hours agoon

November 22, 2024By

admin

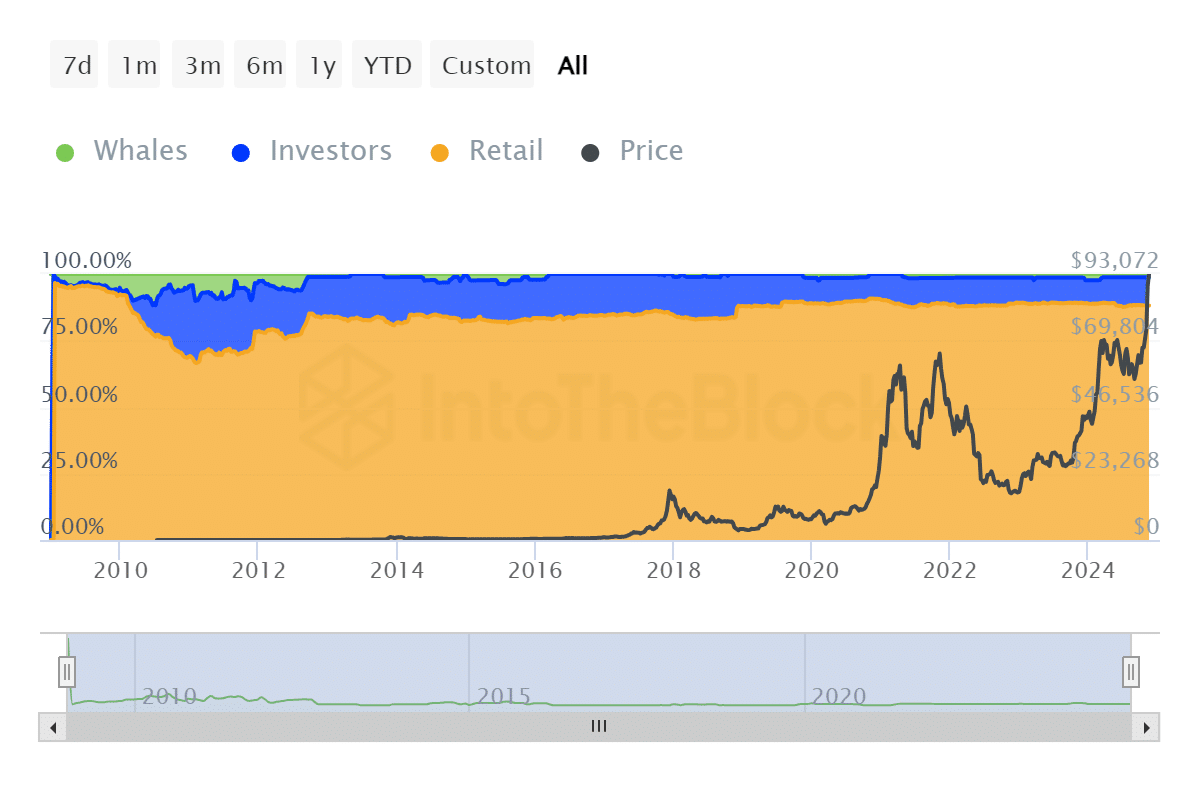

Bitcoin trades at $99,340.23, approaching the $100K mark as retail investors retain market dominance.

What is more interesting about this rally is the dominance of retail investors, who currently account for 88.07% of all Bitcoin (BTC) in circulation, according to The Block. Contrary to the recent claims that institutional investors are leaving retail investors behind in ownership of BTCs, the asset is still in the hands of retail investors, which underlines their stronghold in the market. This grassroots stronghold contrasts the much smaller shares held by whales at 1.26% and institutional investors at 10.68%.

Adding momentum to BTC, the historic debut of BlackRock’s BTC ETF options witnessed $1.9 billion in notional value traded on the first day. It is a landmark news because it signifies growing institutional interest in BTC, yet lowers entry barriers for everyday investors. But there’s still some way to go, says Jeff Park, Head of Alpha Strategies at Bitwise Invest, in his observations on X about the ETF’s potential to reshape access to BTC.

1/ Just as we expected, the market launched with a beautiful “volatility smile” quickly established by 945AM and for the rest of the day. In fact, the smile got even wider throughout the day, finishing with higher wings by EoD. pic.twitter.com/BHI09pORS4

— Jeff Park (@dgt10011) November 20, 2024

Bitcoin Breakdown:

How BTC ownership is distributed supports the overall trend of asset availability in the market. Companies such as Coinbase have substantial quantities of BTC, holding more than 2.25 million BTC. However, most of this is kept for their clients. Satoshi Nakamoto‘s wallet, which contains 96,8452 BTC, remains untouched as it played a role in creating the Genesis block.

Overall, funds and ETFs account for 1.09 million BTC, or about 5.2%, while governments such as the U.S. and China collectively hold around 2.5%.

Despite BTC witnessing price surges, the market is far from stable and often shows extreme volatility. For instance, on Nov. 21, the price of BTC dipped to $95,756.24, with trading volume reaching $98.40 billion. This volatility then reflects the vital role that retail investors play during price hikes, even as institutional investors become more active in the market.

Some argue that BTC is becoming more centralized, but the data does not back this claim. Financial products like ETFs are attractive to institutions, but they also make BTC more accessible to retail investors. BTC continues to align with Satoshi Nakamoto’s vision of a decentralized and democratized financial system. As BTC nears the $100,000 threshold, its open-and-shut conversation that BTC’s ownership remains essential.

Source link

ETH

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

Published

10 hours agoon

November 22, 2024By

admin

Believers in Ethereum (ETH) could be on the verge of an opportunity, according to Ki Young Ju, the founder and chief executive of the digital asset analytics firm CryptoQuant.

Young Ju tells his 370,400 followers on the social media platform X that the ETH/Bitcoin (BTC) Net Unrealized Profit/Loss level just hit a four-year low.

“Despite Ethereum’s underperformance against Bitcoin, ETH holders endure losses without realizing them. This mirrors levels from its early 2020 bottom.

This might be an opportunity for ETH believers.”

Young Ju also notes that ETH is becoming less correlated with BTC.

“The 180-day BTC-ETH Pearson correlation is at a three-year low. A 10% rise in Bitcoin could result in only a 3% gain for Ethereum.

Just because BTC is strong doesn’t mean you should buy ETH. Each asset is now following its own path.”

Young Ju isn’t the only crypto analyst who’s bullish on Ethereum: Former Goldman Sachs executive Raoul Pal also thinks ETH is primed for big gains.

The Real Vision CEO says ETH’s current chart is playing out similarly to Bitcoin’s between 2011 and 2019.

“Ethereum now versus the previous periods is following the last in Bitcoin. Now whether it gets to the target here of $20,000/ETH, who knows. Doesn’t really matter. But directionally, we’ll see what happens. ETH should accelerate from here, and I’m pretty confident that it will.”

ETH is trading at $3,054 at time of writing. The second-ranked crypto asset by market cap is down more than 1% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential