Law and Order

Strike While the Crypto Iron is Hot Under Trump, Says Andreessen Horowitz

Published

2 weeks agoon

By

admin

Andreessen Horowitz’s (a16z) crypto arm sees former President Donald Trump’s re-election as a catalyst for a new era in crypto regulation, urging projects to embrace decentralized solutions and build confidently in the U.S.

The venture capital firm, which has invested heavily in crypto and web3 startups, sees Trump’s pro-crypto stance as a way forward, according to a blog post on Monday.

The firm’s crypto legal and policy experts—Miles Jennings, Michele Korver, and Brian Quintenz—outlined how the new political climate could pave the way for regulatory clarity.

With the election now decided, “we believe this is an incredible opportunity to build on the bipartisan progress from the last Congress,” they wrote.

The experts’ core message to crypto founders is to leverage the new administration’s openness towards digital assets. “Where there is trust, there is regulation,” the experts reminded builders, urging them to eliminate centralized dependencies to stay compliant.

The trio notes now is the time for projects that have held back on using tokens due to regulatory concerns. With Trump’s pro-crypto approach, founders should feel confident in using tokens as “legitimate and lawful tools,” according to experts.

“Today’s all-time high, driven by a Trump election win, signals that we are in the midst of a potential paradigm shift into the next phase of growth for crypto,” OKX chief legal officer Mauricio Beugelmans told Decrypt.

Much of the optimism stems from Trump’s campaign promises to ease restrictions on crypto and replace Securities and Exchange Commission Chair Gary Gensler, whose strict enforcement approach has been a thorn in crypto’s side.

“We hope forward-looking regulation that protects the industry and users and cultivates crypto innovation in America will become a bipartisan topic in the future,” Beugelmans added.

Trump’s re-election has sparked enthusiasm in the markets, with Bitcoin reaching new all-time highs well above $80,000.

“The confirmation of Republicans winning the House could provide an additional boost to the risk rally, but we may see some profit-taking in the coming weeks or months as actual policies are tested,” Aurelie Barthere, Nansen’s principal research analyst, told Decrypt.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

Law and Order

California Court Rules Lido DAO Members Can Be Held Liable Under Partnership Laws

Published

3 days agoon

November 19, 2024By

admin

A federal court judge ruled on Monday that Lido DAO, the governing body behind the popular liquid staking protocol, can be treated as a general partnership under state law.

The court rejected Lido’s claim that it isn’t a legal entity, classifying it as a general partnership and setting a precedent for how profit-driven DAOs are treated.

It was also ruled that identifiable participants were managing the DAO’s operations and, therefore, could not evade liability through its decentralized structure, according to court documents filed in the U.S. Northern District Court of California.

“[The lawsuit] presents several new and important questions about the ability of people in the crypto world to inoculate themselves from liability by creating novel legal arrangements to profit from exotic financial instruments,” Judge Vince Chhabria wrote in his ruling.

Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management were implicated as general partners based on their alleged active involvement in Lido governance and operations.

However, Robot Ventures, another Lido investor, was dismissed due to insufficient allegations of active participation.

General Counsel and Head of Decentralization at a16z crypto, Miles Jennings, said Judge Chhabria’s decision had “dealt a huge blow to decentralized governance” in a statement posted to X on Monday.

“Under the ruling, any DAO participation (even posting in a forum) could be sufficient to hold DAO members liable for the actions of other members under general partnership laws,” he said.

What happened

According to court documents, plaintiff Andrew Samuels purchased LDO tokens on the secondary market in April and May 2023 through the Gemini exchange.

By December of that year, Samuels filed a class-action lawsuit after incurring losses from purchasing the platform’s native LDO tokens, alleging they were sold to him as unregistered securities, and held Lido DAO liable for the decline in their value.

On Monday, the court agreed with Samuels’ contention, finding Lido’s structure—where token holders govern decisions and earn from staking rewards—constitutes a general partnership under California law. It also found Lido DAO’s lack of direct token sales did not exempt it from liability.

“The courts have construed the statutory phrase ‘offers or sells’ broadly to cover someone who ‘solicits’ the purchase of securities. Samuels has adequately alleged that Lido indeed solicited the purchase of these tokens on crypto exchanges.”

Lido DAO functions as a general partnership, as it involves “the association of two or more persons to carry on as coowners a business for profit forms a partnership, whether or not the persons intend to form a partnership,” the court ruled, citing state law.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

Crypto Dad Giancarlo Denies SEC Job Rumors: ‘I’ve Already Cleaned Up Gensler Mess’

Published

1 week agoon

November 15, 2024By

admin

J. Christopher Giancarlo, affectionately known as “Crypto Dad,” dismissed speculation that he is being considered to replace Gary Gensler as head of the Securities and Exchange Commission (SEC).

On Thursday, the former Chair of the U.S. Commodity Futures Trading Commission (CFTC) took to X to deny reports he was seeking the agency’s top job.

“I’ve made clear that I’ve already cleaned up an earlier Gary Gensler[‘s] mess,” he said. “[I] Don’t want to have to do it again.”

He also pushed back against rumors he was seeking “some crypto role” within the U.S. Treasury Department, claiming they were “also wrong.”

The buzz around Giancarlo’s potential return to a regulatory role comes amidst speculation of a shake-up at the SEC following Donald Trump’s re-election, with Gary Gensler’s position as chairman hanging in the balance.

Giancarlo served as a commissioner at the CFTC from June 2014 to April 2019, stepping into the role shortly after Gensler’s departure as CFTC chair.

He earned the nickname “Crypto Dad” as he became a top figure in the crypto community by advocating for crypto innovation during his tenure.

After stepping down from his role, he co-founded the Digital Dollar Project in January 2020, which seeks to promote discussions on the future of “digital monetary innovations.”

Giancarlo has maintained that central bank digital currencies (CBDCs) are not the only path forward, noting that “crypto, CBDCs, stablecoins, and more” is the global future.

President-elect Donald Trump, whose return to the Whitehouse in January marks a significant comeback for the Republican party, has vowed to quash any future CBDC policy.

The crypto community is bracing for the possibility of Gensler’s departure, as Trump has also promised to replace the current SEC chair, whose term runs until 2026.

Giancarlo is not the only name being floated; other pro-crypto candidates include SEC Commissioners Hester Peirce and Mark Uyeda, former Binance.US CEO Brian Brooks, and others.

Gensler, a contentious figure in the crypto space, hinted at his possible departure during a speech at the 56th Annual Institute on Securities Regulation on Thursday.

At the end of the speech, he stated, “It’s been a great honor to serve with them, doing the people’s work, and ensuring that our capital markets remain the best in the world,” referring to his SEC colleagues.

The pressure on Gensler is at an all-time high this week as 18 states, along with the DeFi Education Fund, filed a lawsuit accusing the SEC of overreaching its authority on crypto regulations.

Filed Thursday, the suit alleges that under Gensler’s leadership, the SEC deliberately bypassed standard procedures and withheld new crypto rules to pursue a “regulatory land grab.”

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

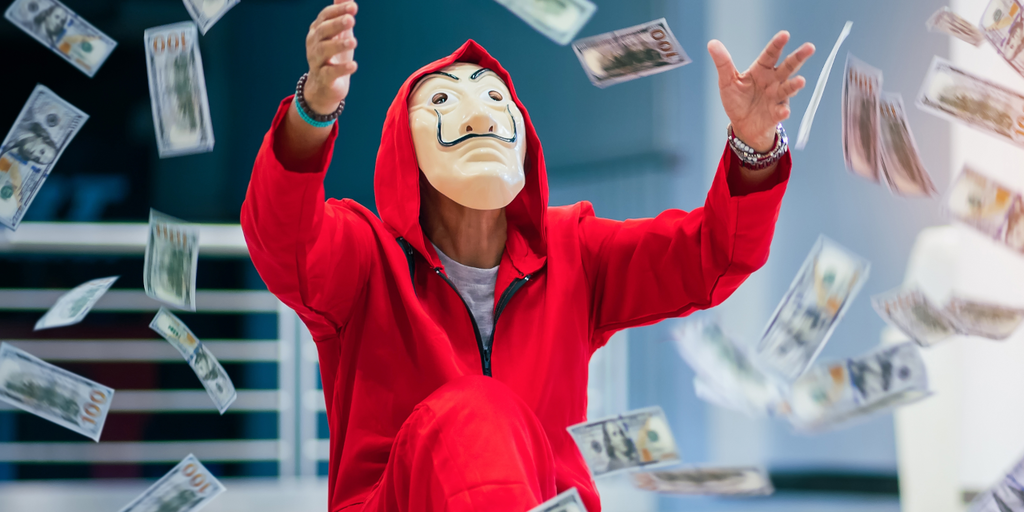

Scammer Tried to Hijack Kraken Crypto Account Wearing Rubber Mask of Victim

Published

2 weeks agoon

November 9, 2024By

admin

When trying to regain access to your Kraken account, you may be asked to jump on a video call with a support agent to prove you are actually who you say you are.

Last month, the centralized exchange said it caught someone wearing a Halloween-style rubber mask attempting to fool the worker on the other side of the call—but it didn’t work.

The attacker had raised a number of red flags during the first round of checks, such as failing to name the assets that the account held. These flags caused the agent working the case to require a video call to grant access to the account. During the call, the Kraken worker asked some more questions and checked the person’s ID.

The attacker failed this stage—in dramatic fashion.

“Our agent was like: This is absolutely ridiculous. This is a rubber mask the guy’s wearing,” Kraken Chief Security Officer Nick Percoco told Decrypt.

The mask didn’t even look like the person the attacker was claiming to be, Percoco said. The victim was a Caucasian male in his early 50s, so it appeared to Percoco that the attacker simply grabbed a mask that vaguely fit the description.

And this isn’t the first time someone has worn a disguise in an attempt to fool Kraken.

“[We] see things, from time to time, where people put on a fake mustache,” he told Decrypt. “They show [ID] and it looks close because they wear the same style glasses, have a mustache, and have blonde hair. We see that from time to time. They never pass.”

“But this is the first time,” he added, “that someone has gone out to the costume store to get a mask.”

To make matters worse, the attacker didn’t even have a believable ID. It was “clearly” Photoshopped and printed onto card stock, Percoco explained, albeit with the correct information on it.

While this wasn’t a sophisticated attack, it highlights that even sloppy scammers can potentially gain access to the private information of everyday people. Even with such an unpolished attempt, Percoco believes, attackers could see success.

“I think it must [work],” he told Decrypt. “I think people wearing disguises, people who breach another place and get a copy of your government ID, and then print it out on glossy paper, holding that up… for some exchanges, that probably works.”

He claimed that some exchanges do not have the same level of attention to detail that Kraken demands from its team. Percoco specifically points to companies that outsource their support, claiming that this is more likely to lead to mistakes.

If he’s correct, then this means that those using centralized exchanges shouldn’t always rely on the company to fend off bad actors. To protect themselves, Percoco says, users should deploy two-factor authentication “everywhere”—from your email to well beyond—to prevent bad actors getting any personal information at all costs.

Even with such protection methods employed, a user can still fall for phishing scams. For the top level of security, he recommends using FIDO2 and passkeys, which are hardware keys that can turn your phone or laptop into your password for an account.

“Passkeys are cryptographically bound to the sites and the applications you’re using them with,” he said, “so you can’t be duped into thinking you’re logging into Kraken.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential