Bitcoin

The Race Is On To Frontrun The U.S. Government

Published

2 weeks agoon

By

admin

https://x.com/pete_rizzo_/

With the 2024 election all but final, it’s clear Donald Trump, the soon-to-be 47th President of the United States, will be the most pro-Bitcoin leader in U.S. history

The big question remains, however: How effective will he be in operationalizing his strategy?

At Bitcoin 2024, Trump – as well as Robert F. Kennedy Jr. and Republican Senator Cynthia Lummis – made clear that they want the United States government to buy Bitcoin. All would seem to be in a better position to enact this following the election, as the Republican Party increased its representation in government considerably.

Yet, as for how quickly the U.S. could become active in the market, that’s more murky. Since announcing the bill, Bitcoin has surged from $60,000 to a high of $86,000, and with the U.S. government soon to be buying, there’s even more incentive for the price to escalate.

Herein lies the problem: The United States has essentially telegraphed to the world that it intends to buy an asset that’s in scarce supply, without the concrete ability to do so.

Even with a majority in the House of Representatives and Senate, passing the Strategic Bitcoin Reserve Legislation 2024 will still require an act of Congress, and the agreement of lawmakers. It would seem foolish to expect this won’t be complex or time-consuming.

For example, the bill proposes revaluing the Federal Reserve’s gold holdings, as well as integrating Bitcoin into government financial systems. Questions will likely abound, as will operational challenges. Let’s remember it took all of three years for SEC Staff Bulletins to be adjusted just to value Michael Saylor’s public markets Bitcoin buying spree correctly.

This is the nature of government — slow and bureaucratic. Even with Trump, RFK, and other Bitcoin backers in positions of power, the chances that the U.S. government begins to acquire Bitcoin on January 20, 2025 seem infinitesimal. This is not saying that it won’t happen at all, just that it won’t be timely.

This is even to omit that there could be a prioritization challenge. Maybe the crypto lobby wants to move quickly on the long delayed market infrastructure bill. If so, Congress could become more consumed with the guardrails for exchanges, and redefining securities laws than the question of the strategic reserve. After all, they helped bankroll Trump’s win.

How much could Bitcoin rise in the meantime? With the bull market in full force, I’d argue that institutions and governments have every reason to become active in the market. There are many regimes around the world where the executive branch has enough power to begin accumulating Bitcoin today. They’d be foolish not to frontrun the U.S. government.

El Salvador started this process in 2021, and it has amassed over 5,900 Bitcoin. Yet, it faced 2-3 years of market headwinds, as traders countered its entries. Lest we forget El Salvador bought hundreds of Bitcoin at $60,000, a move that for years was fuel for its enemies.

Trump may yet do his part to boost Bitcoin. Yet, in telegraphing his intentions, he’s almost certainly created conditions that can be exploited by savvy traders.

Time will tell them if, among them, we’ll see other nation states.

Today, I received confirmation that another nation state is currently discussing

– a Bitcoin strategic reserve

– drafting Bitcoin mining regulations so they can improve their electrical grid and better monetize stranded energyIt's happening

— Daniel Batten (@DSBatten) November 11, 2024

Source link

You may like

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Analyst

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Published

10 hours agoon

November 23, 2024By

admin

A crypto analyst who accurately forecasted the Bitcoin price increase to the $99,000 All-Time High (ATH) has just released a more detailed analysis of his prediction. The analyst shared a chart highlighting crucial technical indicators and price movements that suggest the cryptocurrency could be gearing up for an even higher ATH.

Analyst Projects $105,000 As The Next Price Target

Weslad, a TradingView analyst, has raised his Bitcoin price forecast, predicting the next upside target at $105,764 as the crypto market bull run gains momentum. The analyst reported that BTC has officially entered the bull market phase, characterized by explosive price increases and positive market sentiment.

Related Reading

His recent bullish prediction of the Bitcoin price is grounded on a key technical pattern known as the “Ascending Channel,” which indicates a bullish trend continuation. This chart pattern consists of two upward-sloping trend lines drawn parallel to each other, representing the resistance and support price levels, respectively.

Despite his optimistic outlook for the BTC price, Weslad has revealed that investors should anticipate a corrective move toward the immediate buy-back zone, which would provide an optimal entry point for opportunistic buyers. The analyst has also shared a detailed price chart that highlights the bullish ascending channel and key price levels that Bitcoin could reach in the short-term and long-term.

Overview Of The Analyst’s Bitcoin Price Chart Analysis

In his 4-hour Bitcoin chart, Weslad visualizes the cryptocurrency’s price action within an ascending channel, highlighting that the BTC is moving upwards within two trendlines. The analyst has provided a detailed roadmap for his $105,764 bullish target for the Bitcoin price.

Weslad highlighted the price range between $91,000 and $92,000 as an “important demand zone,” which acts as strong support where buyers are likely to step in if BTC slips any further. He also revealed that the price level at $94,327.99 has been identified as an ”immediate buy-back zone,” which also serves as an optimal entry point if BTC experiences any corrective pullback in its price.

Related Reading

The analyst has also highlighted $97,537 as the “immediate profit target,” suggesting that traders may consider locking in profits at this critical short-term price level. He has also pinpointed the “mid-term target” for the Bitcoin price, highlighting that the $100,334 mid-term level is important for investors holding longer positions.

Lastly, Weslad has highlighted $105,764 as the “projected final target” for Bitcoin, indicating that this may be the ultimate target for the present market cycle. For BTC to reach this bullish price target, it would require only a modest 6.83% increase from its current value. As of writing, the price of Bitcoin is trading at $99,072, marking a 12.73% increase over the past seven days, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

Source link

Bitcoin

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

Published

12 hours agoon

November 23, 2024By

admin

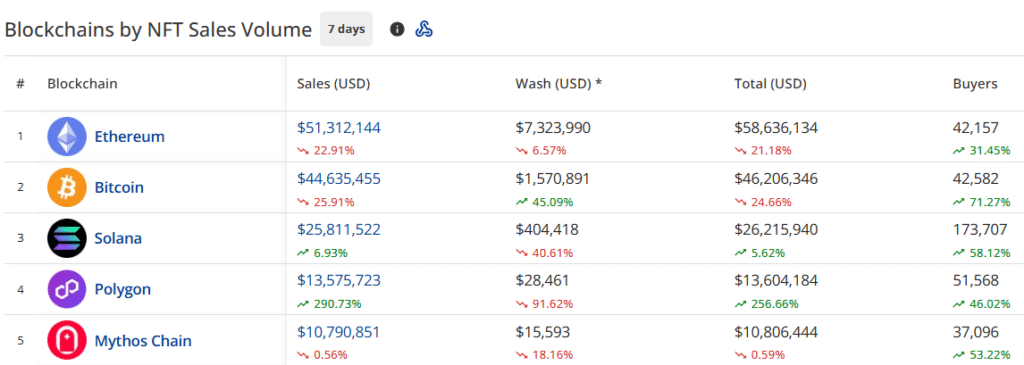

As Bitcoin surges toward the $100,000 mark, touching a new all-time high of $99,655.50, the non-fungible token (NFT) sales volume has shown a drop of 9.6% to $160.9 million.

The global cryptocurrency market capitalization has continued to surge, reaching $3.35 trillion from last week’s $3.03 trillion. This marks a 2% increase over the last day, with Bitcoin (BTC) currently trading at $98,620.

The last week’s NFT sales volume stood at $178.8 million. However, according to recent data from CryptoSlam, the NFT market has seen a pullback.

- NFT sales volume decreased to $160.9 million

- Ethereum (ETH) blockchain leads with $51.3 million in sales (23.07% decrease)

- Bitcoin follows with $44.6 million (25.67% decrease)

- NFT buyers surged by 52.93% to 450,512

- NFT sellers increased by 46.74% to 277,767

- NFT transactions slightly decreased by 1.26% to 1,606,261

Ethereum NFT sales decline by 23.07%

The Ethereum NFT blockchain sales volume fell to $51.3 million this week, marking a 23.07% decrease in the last seven days.

The number of NFT buyers on the Ethereum blockchain grew to 42,157, showing a 31.45% increase.

Bitcoin maintained its second position despite a 25.67% decrease in the last seven days.

According to the data, Bitcoin blockchain’s NFT volume stood at $44.63 million, with wash trading increasing by 46.05% to $1.57 million.

Solana (SOL) secured the third position with $25.8 million, showing resilience with a 6.83% increase during the last seven days.

Polygon (POL) jumped to fourth place with $13.5 million, displaying remarkable growth of 289.66% during the last seven days.

Mythos Chain (MYTH) took the fifth position with $10.7 million in sales, showing a marginal decline of 0.71%.

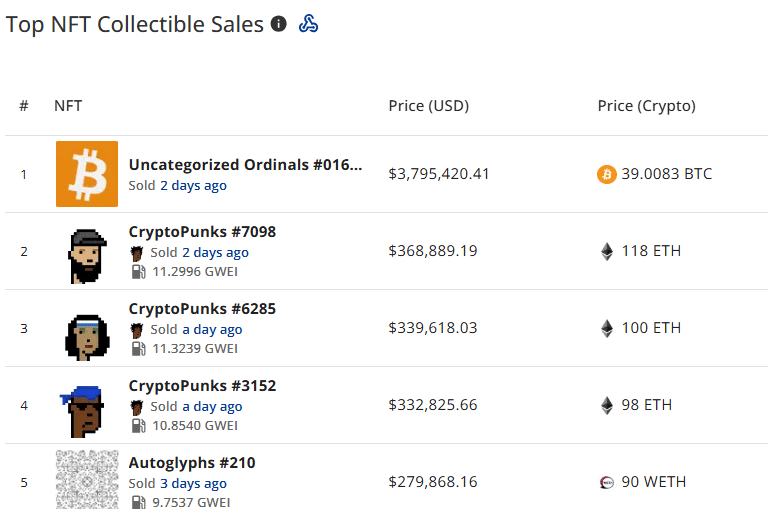

BRC-20 NFTs maintain market leadership

BRC-20 NFTs continue to lead with $16.6 million in sales volume, despite a 41.39% decrease.

MGGA Hat on Polygon secured second place with $10 million in sales, while CryptoPunks followed with $9.2 million, showing a 60.26% decrease.

The latest data shows that the following NFT collections topped the sales in the last week:

- Uncategorized Ordinals #016 sold for $3,795,420 (39.0083 BTC)

- CryptoPunks #7098 sold for $368,889 (118 ETH)

- CryptoPunks #6285 sold for $339,618 (100 ETH)

- CryptoPunks #3152 sold for $332,825 (98 ETH)

- Autoglyphs #210 sold for $279,868 (90 WETH)

Source link

Bitcoin

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

Published

14 hours agoon

November 23, 2024By

admin

A widely followed cryptocurrency analyst and trader is turning bullish on a large-cap altcoin that has more than doubled in price over the past two weeks.

The analyst pseudonymously known as Credible Crypto tells his 436,700 followers on the social media platform X that XRP is primed to reach a new all-time high a “lot quicker than most are expecting.”

“And I think it’s going to vastly outperform both Bitcoin and Ethereum from current levels while doing it.”

XRP is trading at $1.41 at time of writing, up by around 156% over the past two weeks.

Credible Crypto further says that XRP is on the cusp of entering the overbought zone of the Relative Strength Index (RSI) indicator on the monthly time frame. The RSI indicator, which is calibrated from 0 to 100, is used to determine overbought or oversold conditions, with levels between 70 to 100 indicating overbought conditions and levels between 0 to 30 indicating oversold conditions.

“This is bullish as f**k.

Contrary to popular belief, the higher RSI goes, the stronger the momentum is and the more bullish a coin is (absent bearish divergences) and like every other form of technical analysis the higher the time frame this is on, the more significant it is.

Next target is $2 and after that, we go for a new all-time high.”

According to the pseudonymous analyst, XRP also appears highly bullish in its Ethereum (ETH) pair and could be poised for triple-digit percentage gains against the second-largest crypto asset.

“XRP/ETH just reclaimed and retested a four-year-long range, with the first target being ~250% higher.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

SHIB Lead Shytoshi Kusama Hints At TREAT Token Launch

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential