24/7 Cryptocurrency News

Donald Trump To Make US “Crypto Capital” With Pro-Crypto Candidates

Published

2 weeks agoon

By

admin

President-elect Donald Trump is preparing to shift the U.S. government toward a more crypto-friendly stance, aiming to fulfill his campaign promise to make the U.S. the “crypto capital of the planet.” To support this objective, Trump is reportedly considering industry-friendly candidates for key financial regulatory positions, focusing on individuals with pro-crypto views. This strategy comes as Trump’s advisers hold discussions with crypto industry leaders on potential federal policy changes.

Donald Trump Eyes Pro-Crypto Candidates to Make US ‘Crypto Capital’

According to recent reports, Donald Trump intends to appoint pro-crypto figures to lead major financial regulatory bodies in his second term. This move aligns with his goal to transform the U.S. into the leading global hub for cryptocurrency innovation and adoption. Trump’s advisors have been in discussions with various crypto industry leaders and executives to identify suitable candidates for roles in agencies such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Among those under consideration are Hester Peirce and Daniel Gallagher, both known for their favorable stance on digital assets. Peirce, often referred to as “Crypto Mom” for her support of a more open regulatory environment, has expressed criticism of the SEC’s current approach to digital assets. Gallagher, currently an executive at Robinhood, has also faulted the agency’s aggressive stance on crypto regulation.

More so, recent CoinGape report revealed that Gary Gensler is expected to step down by the end of the year. Sources suggest that the Trump administration is considering Dan Gallagher as his replacement to bring a more crypto-friendly approach to the SEC.

Similarly, industry experts and executives have voiced optimism for Trump’s proposed regulatory changes. For instance, Cardano founder Charles Hoskinson expressed a desire to collaborate with the U.S. government to develop clear and consistent regulations for the industry. Hoskinson’s involvement aims to offer the crypto sector a more structured framework to operate within.

Many in the industry see this approach as a step toward more concrete guidelines that will aid crypto business operations.

Pro-Crypto Stance Boosts Market, Rallies BTC To New ATH

Concurrently, Donald Trump’s unqualified support for cryptocurrency has sent a ripple through the markets, contributing to BTC price rally to an all-time high of over $89,000. Crypto investors are hopeful that Trump’s administration will enact policies favorable to the industry.

The incoming administration’s interest in pro-crypto policies has generated positive sentiment among major stakeholders. A clear and supportive regulatory framework will possibly drive further market rally.

However, some economic commentators remain critical. Economist and crypto critic Peter Schiff voiced concerns over Trump’s proposed national Bitcoin reserve, cautioning that it could harm the dollar’s stability. Schiff argues that if the government were to invest heavily in Bitcoin, the dollar might face devaluation. Nonetheless, Donald Trump’s team and industry advocates remain focused on making the U.S. a “crypto capital.”

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

24/7 Cryptocurrency News

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Published

1 min agoon

November 24, 2024By

admin

Gemini co-founder and CEO Cameron Winklevoss is calling for a probe into the drop of a controversial charge involving FTX co-founder Sam Bankman-Fried (SBF). It has been 8 months since Judge Lewis Kaplan sentenced SBF to 25 years in jail. However, to Tyler, this has not resolved some major aspects of his fraudulent reign as FTX CEO.

Cameron Winklevoss to Trump’s Attorney General

Directing his X post to the community, the Gemini CEO asked the incoming Attorney General to investigate SBF’s $100 million campaign finance breaches. Notably, the Department of Justice (DoJ) dropped these charges mid-last year, moving the SBF saga away from politics.

To Cameron Winklevoss, the public deserves to know why the charges were dropped. In addition, he said it is in the public interest to know why the funds went to fund Democrat elections. The post from the Gemini co-founder has generated a lot of reaction among crypto stakeholders.

One X user Nguyễn Minh Quân (@theUxBlockChain), highlighted how dropping charges on high profile cases can erode trust in public offices.

Public trust in the legal system takes a hit when high-profile cases involving political donations end with charges being dropped. People expect the justice system to fully investigate financial crimes, especially those that could have impacted political decisions or outcomes.

— Nguyễn Minh Quân (@theUxBlockChain) November 23, 2024

In a separate post, the Winklevoss twin hailed the nomination of Scott Bessent as Treasury Secretary. Bessent aligns with crypto values and according to the Gemini CEO, he explains the Democrat war on the industry better. In Scott Bessent referenced video, he claimed the Democrats are fighting the industry to cover up the bad act from one party – SBF.

Contained Complications from SBF Role At FTX

Cameron Winklevoss’ is one of the major firms impacted, indirectly, by the FTX implosion. Over, the exchange’s bankruptcy became imminent with over $8 billion of customer’s funds lost.

In fairness attribution to the justice system, Caroline Ellison and Ryan Salame also got 2 and 7.5 years for helping to wreck the exchange. However, Gary Wang escaped prison, enjoying rare leniency like Nishad Singh.

With the exchange’s executives now sentenced, the firm has announced January as the timeline to begin the FTX reognization plan. While the entire bankruptcy plan is almost over, the last phase, the reognization plan still require one more court order.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Published

3 hours agoon

November 24, 2024By

admin

Stellar price has seen a remarkable surge, climbing over 80% in the last 24 hours, rising to number one in the top gainers. The bullish momentum has pushed XLM from $0.302 to a peak of $0.55, as traders and analysts anticipate the possibility of the asset nearing the $1 mark.

Stellar Price Reaches $0.55 Amid Bullish Momentum

Stellar’s price rise reflects strong buying interest as it touched $0.55, marking a significant upward trend. After a period of consolidation around $0.40, the cryptocurrency broke through resistance levels, delivering impressive returns for investors.

Market participants have noted this upward movement as a sign of renewed confidence in the asset’s potential. However, the price also briefly retraced from its peak as it faced resistance at the $0.55 level, suggesting that $1 remains a potential milestone rather than an immediate outcome. Jed McCaleb, Stellar’s founder, has also added to the growing optimism surrounding the network.

In a recent statement, McCaleb commented on Stellar’s current momentum and its role in global financial systems. “Stellar is the most underrated and least understood crypto project,” McCaleb remarked, emphasizing its ability to facilitate real-world transactions and its high efficiency. He noted,

“The best and most impactful use of crypto is as digital money, and this is what Stellar is built for.”

Grayscale Stellar Lumens Trust Records 10% Asset Growth

Grayscale Investments LLC’s recent 10-K filing highlighted a 10% increase in the net assets of its Stellar Lumens Trust during the fiscal year ending September 2024.

Despite the challenges posed by XLM price fluctuations and management fees, the trust managed to grow its assets due to the addition of 34,875,230 XLM tokens valued at $3,923.

Trading activity around Stellar has surged, with derivatives markets experiencing substantial growth in both volume and open interest. The trading volume for XLM derivatives rose by 284.26%, reaching $8.98 billion, while open interest increased by 125.88% to $393.05 million.

The filing also outlined that the trust faced losses stemming from token depreciation earlier in the year, but these were offset by a robust recovery and asset inflows. The document underscores the growing institutional interest in Stellar as an investment vehicle, aligning with its recent market performance.

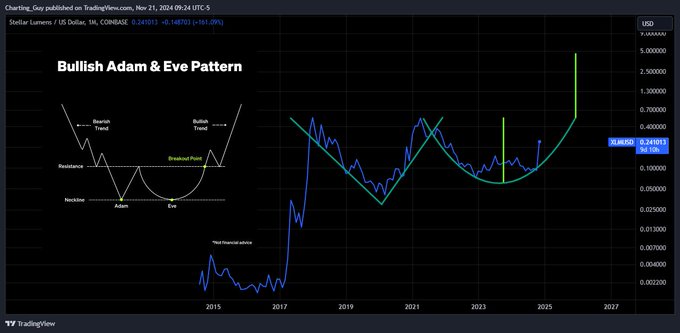

Analyst Predicts Multi-Year Price Pattern May Propel XLM to $3-$5

Cryptocurrency analysts have highlighted a multi-year price structure for Stellar, suggesting that it may be poised for further growth. A prominent market speculator, known as “Charting Guy,” recently shared a prediction that Stellar could achieve price targets between $3 and $5.

According to the analyst, XLM price has been forming a bullish “Adam and Eve” pattern on the monthly chart since 2017. This chart pattern is often associated with long-term upward momentum.

Charting Guy emphasized patience, indicating that the current rally could lead to substantial gains for long-term holders. A potential breakout from this pattern could result in a 930% to 1,617% increase from current levels, further reinforcing optimism in Stellar’s market trajectory.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

Published

6 hours agoon

November 24, 2024By

admin

Input Output Hong Kong (IOHK), the parent company of Cardano (ADA) has announced its upcoming Hydra testing campaign. Packaged as a gaming tournament on Doom, a title built on Hydra protocol, the startup said it plans to push the limit of the scaling solution.

Cardano Hydra Expectations

As IOHK revealed, the Hydra Doom deathmatch will kick off next month. The gamified testing is in stages and will feature both bots and humans. While the first round will feature players versus bots, the second round will see real players take on themselves.

Help us push Hydra to the limits on Cardano!

A tournament like no other, the Hydra Doom deathmatch kicks off this December, and 100,000 USDM in various prizes can be won. Featuring a brand new customized game look, multiple thrilling rounds of non-stop fragging, and an in-person… pic.twitter.com/iRLVFYrsld

— Input Output (@InputOutputHK) November 23, 2024

Cardano plans to incentivize participation in the Hydra Doom tournament with a 100,000 USDM prize pool. Cardano developed the protocol as its solution to scaling the mainnet. Doom is one of the dominant DApps that even Charles Hoskinson promotes as a showcase of the Hydra innovation.

This is not the first time the protocol will carry out related testing on Hydra. It relies on the performance and statistics from this testing to firther develop the protocol.

As reported earlier by Coingape, in previous testing, Hydra Doom recorded a total transaction of 3 million in approximately 1 hour. Beyond this, it achieved a 1663 Global TPS. In addition, it recorded more than a constant 1000 transactions with no failed transactions. Lastly, Cardano Hydra Doom attained a 14% 1 hour chain load.

Community and ADA Market Reaction

Cardano remains one of the best performing assets in the market at the month. Despite ADA price crossing the $1 mark, top market analysts believes it is just getting started.

Initial reaction that trailed the Hydra Doom testing has further sparked community intrigue. Many members of the Cardano ecosystem confirmed sign ups to the testing event, boosting ADA price sentiment.

At the time of writing, the coin was changing hands for $1.06, up 8.62% in 24 hours. Within this time span, the coin jumped from a low of $0.9508 to a high of $1.16. Riding on the broader Bitcoin price momentum, Cardano appears poised to reclaim new highs and current ecosystem upgrades might help achieve this goal.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Gemini’s Cameron Winklevoss Demands Fresh Probe Into SBF

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: