cryptocurrency

DeFi Technologies creates SolFi to be its ‘MicroStrategy for Solana’

Published

1 week agoon

By

admin

DeFi Technologies, a company bridging traditional finance with cryptocurrency by providing exposure to digital assets, has announced a new platform aimed at adding Solana to its balance sheet.

In an announcement on Nov. 12, DeFi Technologies revealed it had created a spinout entity named SolFi, which will focus on adopting a Solana (SOL) treasury strategy. According to a blog post, SolFi will offer investors direct exposure to Solana and its ecosystem, including “proprietary trading, validator node operations, and ecosystem investments.”

The company is looking to follow in the footsteps of MicroStrategy, whose Bitcoin (BTC) strategy has inspired similar approaches across the market. Metaplanet, often referred to as “Asia’s MicroStrategy” after acquiring substantial BTC holdings in recent months, is one such example.

Microstrategy inspired approach

According to DeFi Technologies, SolFi will act as its “MicroStrategy for Solana,” allowing the firm to tap into the SOL ecosystem’s high-yield staking and growth potential. SolFi plans to leverage capital structures beyond those available to exchange-traded funds to provide access to SOL’s potential upside and cash flow.

In a comment, DeFi Technologies chief executive officer Olivier Roussy Newton said:

“The success of Microstrategy has elevated exposure to the #1 digital asset in Bitcoin, and we look forward to focusing SolFi’s digital asset strategy towards Solana from the ground-up. Like Microstrategy, SolFi will generate cash flow from an operating company, and tap capital markets for creative financing structures that allows SolFi to quickly grow its treasury and accelerate its staking operations.”

SolFi will help DeFi Technologies bring more value to its shareholders, he added.

MicroStrategy recently purchased over $2 billion worth of BTC to see its holdings of the flagship digital asset reach 279,420 BTC. The company acquired this haul since August 2020 and has spent approximately $11.9 billion.

On November 12, MicroStrategy founder Michael Saylor shared that its treasury operations have seen it hit a BTC yield of 26.4% year-to-date, with shareholders receiving a net benefit of roughly 49,936 BTC.

“This is equivalent to 157.5 BTC per day, acquired without the operational costs or capital investments typically associated with bitcoin mining,” Saylor posted on X.

Source link

You may like

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

Blockchain

Sui Network blockchain down for more than two hours

Published

21 hours agoon

November 21, 2024By

admin

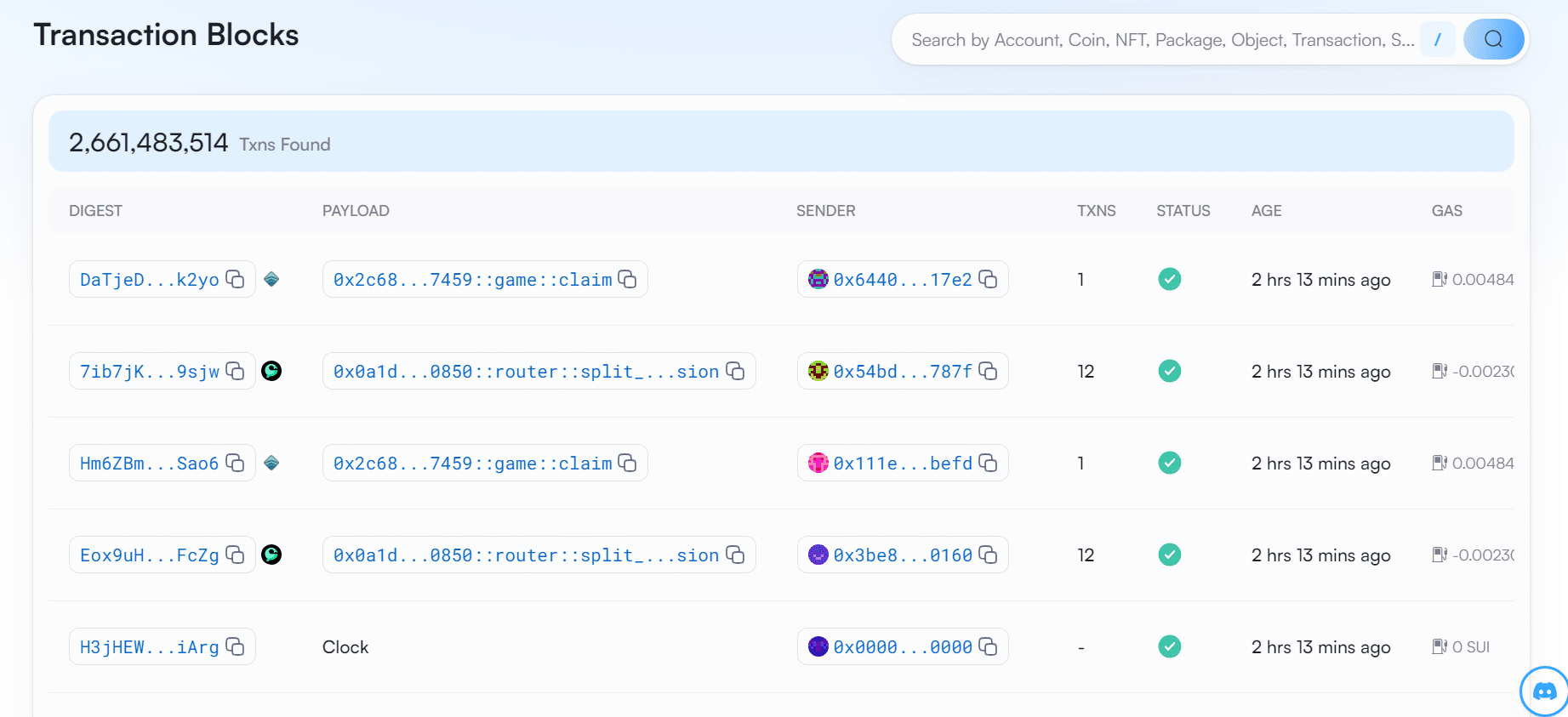

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

cryptocurrency

BONK hits new all-time high following Upbit listing

Published

2 days agoon

November 20, 2024By

admin

BONK has emerged as the top gainer among the leading 100 assets following a major announcement from the South Korean crypto exchange Upbit.

Bonk (BONK), the first Solana-based meme coin, surged 18% on Wednesday to hit a new all-time high of $0.000058. Its market cap soared to over $4.1 billion when writing, flipping Dogwifhat’s (WIF) $3.2 billion market cap to reclaim its position as the largest meme coin on the Solana blockchain.

Why is BONK going up?

The altcoin’s price uptick coincided with a jump in the meme coin’s futures open interest. According to data from CoinGlass, OI for BONK’s futures market rose to an all-time high of $53.5 million, more than 7 times its monthly low of $6.3 million, suggesting a growing demand from investors.

Bonk’s recent rally followed its listing on South Korea’s largest crypto exchange, Upbit. BONK’s daily trading volume shot up 95% amid the listing, hovering over $3.5 billion when writing.

Another key factor driving the altcoin’s gains is Bonk DAO’s announcement of a massive 1 trillion token burn scheduled for Christmas Day, which is set to reduce the total number of tokens in circulation, thereby increasing scarcity.

Whales have also been interested in the meme coin lately. According to data shared by Lookonchain, a whale with a history of profitable meme coin investments has spent 3.4 million USDC to buy 65.4 billion BONK tokens. Last week, another whale was seen picking up 29.32 billion BONK at $0.0000387.

Whale buying typically boosts retail investor confidence in an asset, potentially driving FOMO (fear of missing out) among those seeking quick gains.

Bullish momentum to continue

BONK’s rally hasn’t lost strength despite surging over 72% in the past week alone. On the 1-day BONK/USDT price chart, BONK’s EMA lines show a strong bullish trend, with the short-term 50-day EMA above the long-term 200-day EMA and the price staying above both lines.

Based on this setup, the bullish trend is expected to continue in the short term as the buyers remain in control. However, the Relative Strength Index showed a reading of 82, which confirms the bullish momentum but puts the meme coin at overbought levels.

Despite the overbought status, an analyst suggests that BONK is undergoing a ‘Blue Sky breakout,’ which could sustain its upward trajectory in the coming days.

This speculation is supported by strong catalysts driving the uptrend and the current hype around meme coins. Separately, Bitcoin’s recent rally to new highs has amplified market-wide sentiment, further boosting interest in the meme coin sector, which gained 2.3% over the past day.

Source link

Pump.fun, the meme coin launch platform that allows users to easily create their own meme coins, has sold another chunk of Solana tokens earned in fees.

On Nov. 18, blockchain data tracking platform Lookonchain reported that Pump.fun sold 105,000 Solana (SOL). tokens. The offloaded tokens came from the meme factory’s fee account and totaled more than $25 million at the time, Lookonchain shared on X.

This sale coincided with the altcoin’s price rising from $135 to nearly $180. Solana’s top meme coin generator, which has accumulated total revenue of 1,307,966 SOL worth over $315 million, has been consistently selling coins in recent months and weeks.

Pump.fun sold 43,000 SOL worth over $9.38 million seven days ago. Over the past few weeks, the platform has offloaded 352,400 SOL worth over $71 million. This includes the sale of 10,300 SOL that in September.

Overall, according to on-chain data, the SunPump rival has cashed out a total of 898,243 SOL worth of $157 million.

These sales from the fee account suggest a need for cash by the team, with this wallet being used not just for collecting transaction fees but also for covering operational costs for the platform.

SOL price

Pump.fun’s latest SOL sale comes amid the token’s price jump above $200. Over the past month, Solana’s price has increased by more than 50%, reaching new year-to-date highs above $247. According to market data from crypto.news, this bullish surge brought SOL to within 8% of its all-time high of $259.

SOL has since decreased from $247.84 to $237.41, cutting 24-hour gains to roughly 2% and seven-day gains to about 8.6%.

Source link

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential