Bitcoin

Senator to Push the Bill in Trump’s First 100 Days

Published

4 months agoon

By

admin

The Senate hopes to push through a Bitcoin reserve bill in the first 100 days of Trump’s presidency while the Republicans consult on crypto policy.

American Senator Cynthia Lummis expressed optimism that plans to create a strategic Bitcoin (BTC) reserve will be implemented soon after Donald Trump‘s inauguration.

“I believe we can get this done with bipartisan support in the first 100 days if we have the support of the people. It is a game changer for the solvency of our nation. Let’s put America on sound financial footing and pass the Bitcoin Act!”

Senator Cynthia Lummis

Lummis’s post responded to David Bailey, BTC Inc. CEO, who has been actively advising Trump on cryptocurrency policy. Bailey had previously suggested that such a reserve could be created quickly under the new administration.

“The Bitcoin and Crypto industry’s policy wishlist is long and pressing… but the Strategic Bitcoin Reserve is the #1 most urgent and transformational policy on President Trump’s agenda. The downstream effects change everything. We must get it done in the first 100 days.”

David Bailey, BTC Inc. CEO

Bailey also floated the idea of using Bitcoin more widely in government programs. He suggested that if Robert F. Kennedy Jr. were appointed Secretary of Health and Human Services and assumed responsibility for managing the Social Security program, there would be a discussion about paying 5-10% of Social Security payments in Bitcoin, stored in a strategic reserve.

What is known about the Bitcoin reserve project?

Trump announced the creation of a Bitcoin reserve in the U.S. in July 2024 during a speech at an event supporting his election campaign. A few days before the politician’s announcement, media reports appeared that Senator Cynthia Lummis was preparing a Bitcoin reserve bill called the BITCOIN Act of 2024.

The act proposes creating a network of decentralized vaults nationwide to securely store Bitcoin reserves. The U.S. Treasury Department is supposed to have 200,000 BTC annually for five years, and the U.S. reserves would eventually amount to one million BTC. It is also assumed that Bitcoin reserves will be stored for at least 20 years.

The cryptocurrency can be purchased at the expense of other assets at the authorities’ disposal, such as gold certificates. Lummis proposes to cover the costs of purchasing cryptocurrency by revaluing it.

In addition, the proposal plans to implement a reserve verification system to verify the availability of funds and consolidate all existing BTC that are currently in the possession of the U.S. government into a new reserve.

Bitcoin reserves to make the U.S. new crypto haven

Analysts at CoinShares write that implementing the plan to create strategic reserves in BTC can generate significant institutional and government interest in Bitcoin. According to their forecasts, this will potentially accelerate its growth and raise its value to new heights.

In general, many participants in the crypto community expect that the U.S. bet on Bitcoin can significantly increase the cryptocurrency’s investment attractiveness. For example, Anthony Pompliano, the founder of Pomp Investments, is confident that the initiative will cause the market to experience FOMO.

Lummis’ proposal implies that the pace of Bitcoin purchases may outpace the cost of BTC mining. In this case, a cryptocurrency deficit will form in the market, which can also support the growth of its rate.

Trump’s rally is in full swing. Or just a rally?

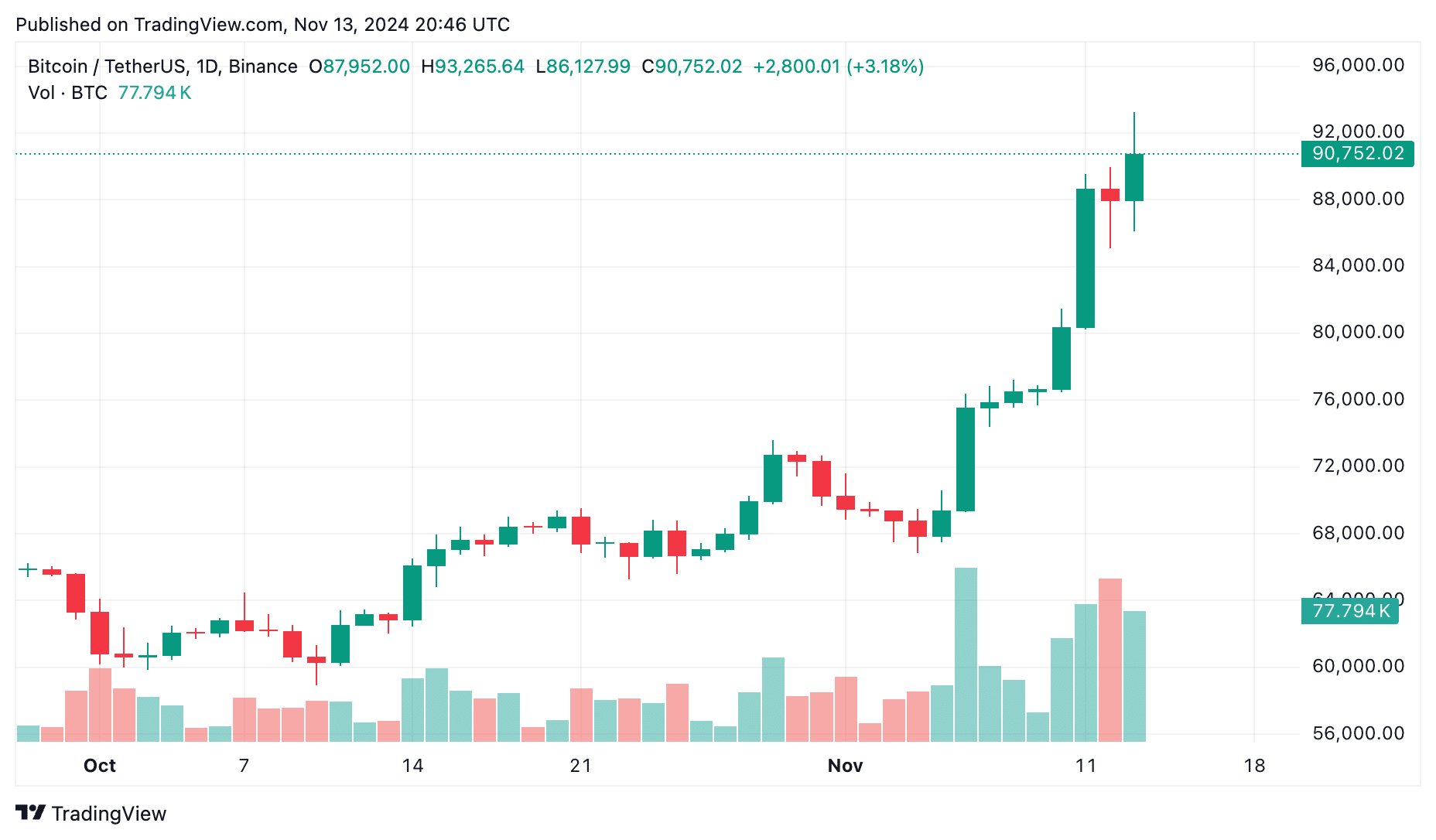

In general, Lummis’ words are confirmed based on the dynamics of Bitcoin and the entire crypto market since the U.S. elections. Over the past week, Bitcoin has repeatedly updated historical highs.

The total capitalization of the entire crypto market has grown by 25% in a week and exceeded $3 trillion. At the same time, the price of Bitcoin has increased by 23.8% in 7 days, several times updating the all-time high and reaching $93,000.

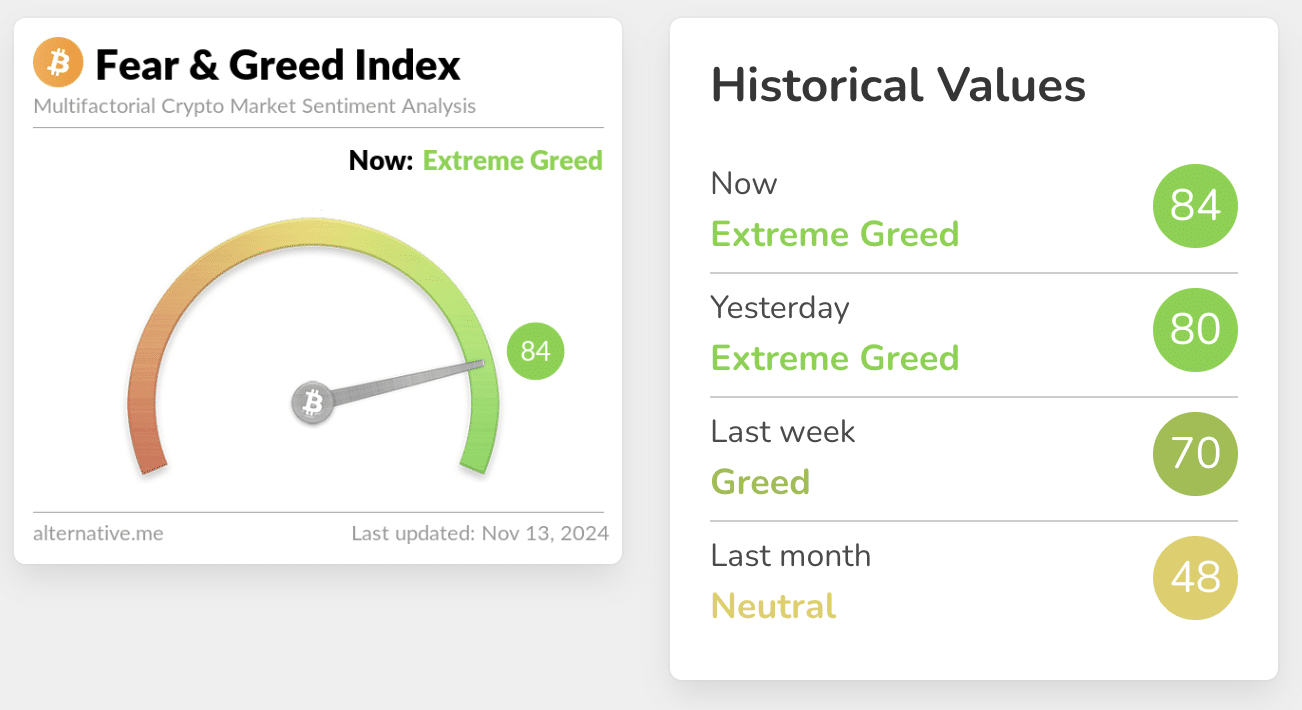

The crypto market’s index of fear and greed has grown by as much as 14 points in a week—from 70 points to 84 out of 100- indicating the market’s extreme greed.

However, some experts doubted that Trump’s victory was the only growth driver of the crypto market.

Thus, the co-founder of Onramp Bitcoin, Jesse Myers, noted that such crypto market dynamics are routine and predictable after the Bitcoin halving in April. During this time, a shortage of coins has arisen on the market, therefore the price is growing under pressure from demand. This triggers a chain reaction that should lead to another bubble.

If you’re wondering what’s happening with #Bitcoin…

Yes, the incoming Bitcoin-friendly administration has provided a recent catalyst…

But, that’s not the main story here.

The main story here is that we are 6+ months post-halving.

And that means a supply shock has… pic.twitter.com/XkwPoPxrj2

— Jesse Myers (Croesus

) (@Croesus_BTC) November 11, 2024

Myers reminded that the same situation happened after each previous Bitcoin halving, so it makes sense to expect something similar this time. The change of power in the U.S. to one potentially more friendly to cryptocurrencies only acted as a catalyst.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

Bitcoin

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

Published

1 hour agoon

March 28, 2025By

admin

On March 11, 2025, Rep. Ro Khanna gave a short but impactful talk at the Bitcoin Policy Institute’s Bitcoin for America summit.

“Bitcoin is transformational for so many people around the world,” Rep. Khanna stated at the summit. “That is why the Democratic Party should be embracing it as something that can create financial empowerment for people not just in the United States, but around the world.”

This is the type of message he’s been spreading for years now, and he’s urged his fellow Democrats to follow his lead. He’s implored them to not be scared of Bitcoin but to view it just as they view other major technological advancements of our time, including the internet itself.

“My goal is to make Bitcoin bipartisan,” Rep. Khanna told Bitcoin Magazine. “I want to convince Democrats that bitcoin is a next-generation store of value that millions of people around the world use and that America showing leadership on it allows us to connect with these people, often some of the most disenfranchised.”

For a party that often advocates for financial inclusion, it seems almost ironic that so many Democrats have looked past Bitcoin, an open-source technology that anyone can use with nothing more than an internet connection (and, in some cases, even without one).

With that said, Rep. Khanna made the point that, while he remains one of the few more vocal Democrats when it comes to being pro-Bitcoin, the number of Democratic politicians who have stated that they’re in favor of the technology has increased substantially over the past few years.

“We went from just 10 of us or so supporting Bitcoin and crypto to almost 70 or 80,” said Rep. Khanna. “It’s happening slowly.”

And while some have attributed to malice most Democrats’ historical stance on Bitcoin, Rep. Khanna claims the issue is more a lack of understanding of the technology’s purpose and use cases.

“Some Democratic politicians are not aware of how helpful Bitcoin can be with remittances or how it can be used by those who don’t have access to U.S. dollars,” said the congressman. “Many people around the world use it for both reasons,” he added, alluding to the idea that many, including some Democrats, might not be aware of this fact.

The Bitcoin And Crypto Voting Bloc In U.S. Swing States

According to research from Coinbase, in each of the swing states in the most recent U.S. presidential election, there were about 10 times the number of crypto holders compared to the vote differential between Biden and Trump in 2020.

Harris lost to Trump in each of these swing states, leaving some to speculate that the turnout of the Bitcoin and crypto voting bloc may have been one of the primary forces that swayed the election in Trump’s favor.

While Rep. Khanna doesn’t know to what extent this voting bloc impacted the election results, he agreed that it was likely one of many major factors that affected the outcome of the election.

“I think it made a difference,” said the congressman. “In such a close election, everything matters, and the fact that there were some Democrats who offended Bitcoin and crypto voters was not helpful.”

And Rep. Khanna is not alone in acknowledging this.

In December 2024, at the New York Times DealBook Summit, Van Jones — political analyst, media persona, and prominent voice within the Democratic party — stated that it was to the Democratic party’s detriment that it shut out pro-Bitcoin and pro-crypto voters.

Rep. Khanna sang Jones’ praises and said that we should be hearing more voices like Jones’ within the Democratic party speaking up in favor of Bitcoin in the near future.

“I have a lot of respect for Van Jones,” said Rep. Khanna.

“He spent some time in the Bay Area, so he gets technology. The party will be moving in a direction that’s going to embrace Bitcoin and other technologies,” he added.

Will President Trump’s Embrace Of Bitcoin Deter Democrats From Supporting It?

While it only seems logical that the Democratic party would reverse its stance on Bitcoin if it’s looking to pick up seats on the House and Senate come the 2026 midterm elections, it simultaneously seems difficult to imagine more Democrats coming out in support of Bitcoin given the highly partisan political climate in the U.S. coupled with the fact that President Trump is an ardent Bitcoin supporter.

Rep. Khanna argued that Democrats shouldn’t be thinking along party lines when it comes to Bitcoin, but rather assessing the technology based solely on what it is.

“Politicians are capable of evaluating Bitcoin on its merits,” said Rep. Khanna.

“Bitcoin is just a decentralized digital currency that enables peer-to-peer transactions without a need for an intermediary. People just need to study Bitcoin and learn that it’s just a medium of exchange,” he added.

Rep. Khanna also took a moment to differentiate between Bitcoin and meme coins, highlighting the fact that the president’s recently released coin ($TRUMP) creates much confusion regarding the value proposition of crypto assets, including bitcoin.

“We shouldn’t have elected officials like President Trump launching meme coins,” said the congressman.

Getting Democrats on the Right Side of History

At a time when many U.S. citizens are struggling to make ends meet, should Bitcoin be a front-and-center issue for Democrats, once widely regarded as the political party of the middle and working class?

Rep. Khanna doesn’t necessarily think so, but he also doesn’t think the party should continue to pooh-pooh the technology.

“There are far bigger issues at hand right now like the cuts in Medicaid, the firing of veterans, and the erratic policy of tariffs,” the congressman explained.

“But the Democrats were on the wrong side of issues of innovation and Bitcoin in 2022 and 2024, and we now have an opportunity to get on the right side of it,” he added.

So, how can pro-Bitcoin Democrat voters help to get their party on the right side of history when it comes to Bitcoin?

Rep. Khanna had a few suggestions:

“They should point to those of us who are leading on Bitcoin and crypto,” he said.

“They can encourage members of government to study the issue, so that they’re not uninformed,” he added.

“And they should talk about the enormous adoption of Bitcoin.”

Source link

Bitcoin

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Published

15 hours agoon

March 27, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A prominent crypto pundit has outlined a compelling case for the Bitcoin price outlook, predicting a surge to a target as high as $260,000 this bull cycle. However, a critical invalidation level stands in the way of this bullish scenario, threatening Bitcoin’s projected rally if breached.

On March 26, Gert van Lagen, a well-known crypto analyst on the X social media platform, predicted that the Bitcoin price could hit a bullish target between $200,000 and $300,000. The analyst’s chart suggests that Bitcoin’s price action in the past few years has closely followed a classic market cycle structure, moving through the Accumulation, Redistribution, Re-accumulation, and Distribution phases.

Bitcoin Price Eyes New ATH Above $260,000

Related Reading

After consolidating for seven months in mid-2023 – early 2024, Bitcoin formed a range, allowing the market to absorb supply before another price breakout. Notably, this trend continued in 2025, with BTC breaking out of a seven-month re-accumulation phase.

Based on the trajectory of Lagen’s price chart, Bitcoin’s next leg up is a sharp rise to $240,000, followed by a brief correction before rallying to a price peak between $290,000 and $300,000. After hitting this ATH, the analyst predicts that Bitcoin will decline and undergo a period of choppy trading, experiencing price fluctuations between $220,000 and $260,000.

Interestingly, Bitcoin’s projected rise to an ATH and the following sideways trading are expected to occur during its distribution phase, which is typically characterized by increased sell-offs and market volatility. Once BTC experiences a final surge to $260,000, Lagen predicts a price crash toward $148,000 – $136,000, marking the possible end of the bull rally and the start of the bear market.

Key Invalidation Level Threatening BTC’s Rally

Lagen’s optimistic price forecast for Bitcoin is being threatened by a key invalidation level, which could halt the cryptocurrency’s potential surge to $200,000 – $300,000. Although Bitcoin’s bullish structure remains intact, the analyst warns that a weekly close below the 40-week LSMA would invalidate its breakout.

Related Reading

As of writing, the Bitcoin price is consolidating above this key invalidation level at $73,900. As long as it holds above this level, Lagen believes that its bullish trajectory will be sustained. However, a drop below $73,900, which already represents a 15% decline from BTC’s current market price, could postpone the projected surge or cancel it altogether.

Featured image from Adobe Stock, chart from Tradingview.com

Source link

Bitcoin

Bitcoin faces 70% odds of another drop as April tariff fears shake markets, Nansen says

Published

19 hours agoon

March 27, 2025By

admin

As the risk of tariff-related uncertainty persists into the second quarter, the crypto market could face another dip following the recent correction in March, analysts at Nansen say.

As the industry heads into April, Bitcoin (BTC) and the wider crypto market could be staring down another dip as uncertainty surrounding tariffs and U.S. trade policy might cause further volatility.

According to Nansen’s analysts, there’s a chance that the market may face another correction in the weeks after April 2. In fact, the researchers believe there’s a 70% likelihood that another price dip will occur after this date.

President Donald Trump had earlier promised to roll out new tariffs on April 2, calling it a key moment for the economy just weeks after the last round shook up markets and sparked recession worries.

In a recent interview with crypto.news, Aurelie Barthere, principal research analyst at Nansen, shared her outlook on the market, stating that after a brief correction following April 2, she expects the market to stabilize and pave the way for future growth.

“In my main scenario, 70% subjective likelihood, I expect another leg down in crypto prices after April 2 after we reached a local bottom in mid-March. After this second correction, I expect we will be bottoming for the rest of the year (continuation of the bull market and revisit of the ATHs for BTC).”

Aurelie Barthere

However, it’s not all doom and gloom for the crypto market. While another dip isn’t ruled out, Barthere suggests that after that correction, Bitcoin could rebound, benefiting from a supportive macro environment, including the growing adoption of crypto in the U.S. and a lack of recession signals. Still, Barthere remains cautious as for the remaining 30% “it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto,” she said.

“For the remaining 30%: it would be if we have already bottomed or if this is just a dead cat bounce for U.S. equities and crypto (in case of a recession, which is not my base case, I think the U.S. is just slowing from 3% to 1.5-2% growth).”

Aurelie Barthere

Uncertainty may last well into Q2

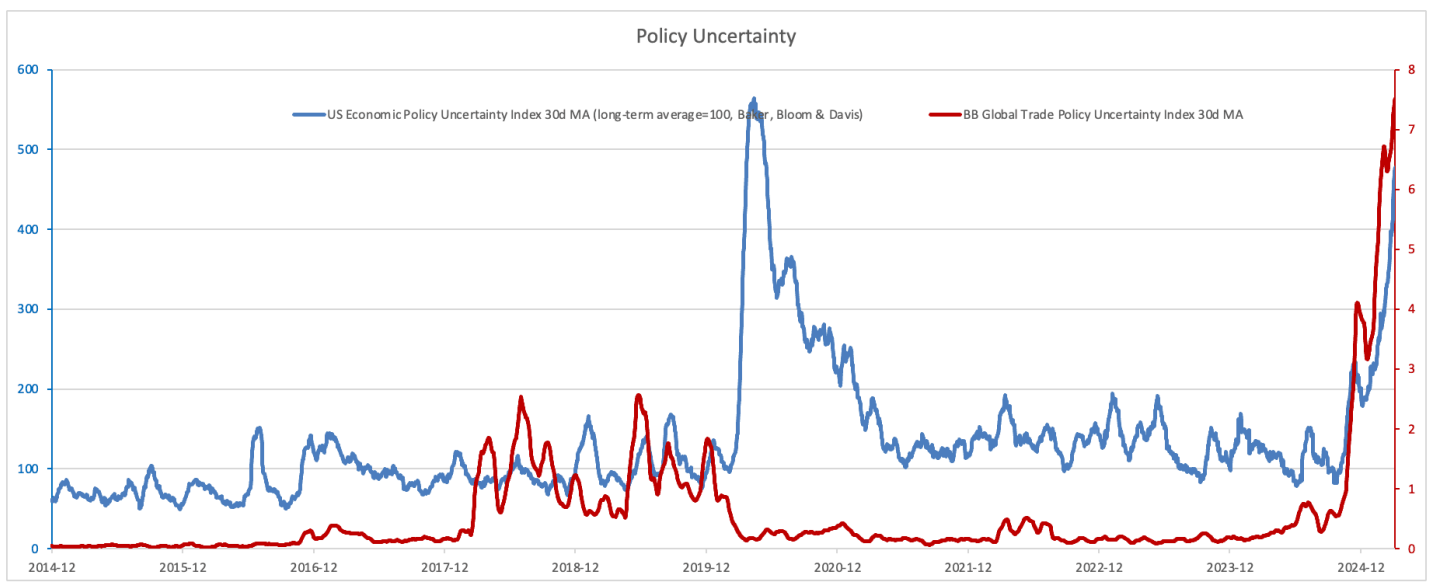

The tariff situation has been a significant driver of market volatility, with the U.S. policy uncertainty index reaching new highs. Trade discussions have become a key source of investor anxiety, but Nansen believes that uncertainty could peak soon.

As Treasury Secretary Bessent recently noted, many of the U.S. trading partners are already negotiating to lower their own trade barriers, which has helped to calm some fears. Even Trump recently hinted at potential tariff “exemptions” in certain circumstances. But as Barthere pointed out, while these talks may result in long-term growth benefits for the U.S., the lingering uncertainty may last well into Q2.

“Right now, I think that we are experiencing corrections within a crypto bull market. Why I see this as a bull market still: 1) Ongoing progress on crypto regulation and crypto institutionalization in the U.S., and 2) U.S. real growth has slowed but is not flashing ‘recession.’ Of course, this is my only main scenario, and I will continue to watch data and markets for signs that this is the correct reading.”

Aurelie Barthere

As Barthere put it, there’s a “50/50 chance that we’ve passed the peak of trade policy uncertainty,” adding that the true impact of these tariff negotiations might not be fully clear until mid-year. “We still see this peak uncertainty as more likely between April and June, especially with the start of U.S. tax cut package discussions,” she wrote in the research report.

The uncertainty, according to Nansen’s research, could trigger another short-term correction in both Bitcoin and U.S. equities.

No evidence of recession

Still, there’s reason for optimism. The report mentions that technicals are showing encouraging signs. “The dip is being bought, for BTC and for U.S. equities,” Barthere says, adding that spot Bitcoin ETFs recorded a “seven-day streak of net inflows, a first since crypto prices peaked.”

One way or the other, it’s clear that the market remains cautious. A lot of people are questioning whether the crypto bull run is still going strong or if we’re getting close to a peak. If history is any indication, times of economic uncertainty have often lined up with market downturns, making investors even more cautious.

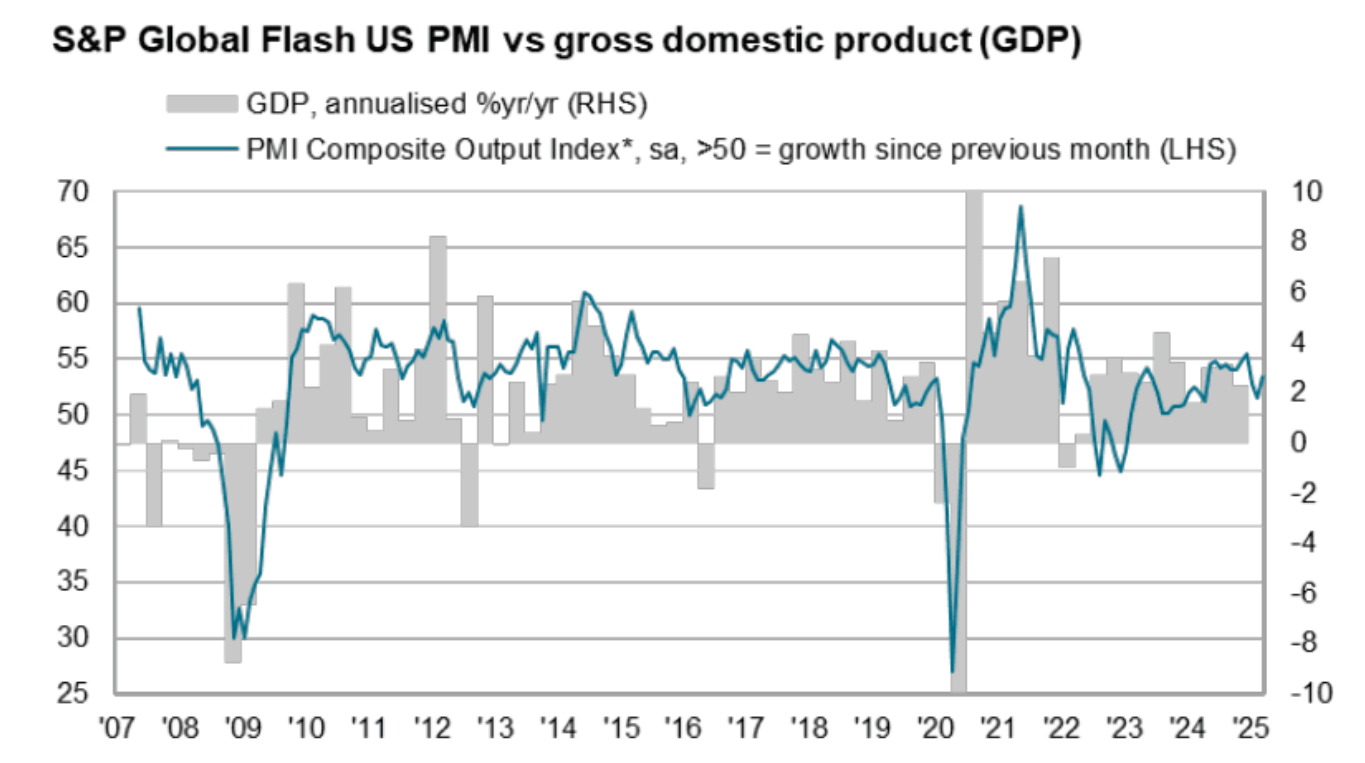

After market sentiment hit extreme fear last week, with some investment banks raising the U.S. recession probability to 40% this year, hard economic data has eased these concerns. The latest U.S. March flash PMI report shows a 53.5 score, the highest in three months, suggesting a 1.9% annual growth rate. However, the growth for the whole quarter is lower at 1.5% due to weaker data in January and February.

Barthere emphasized that so far, there’s no hard evidence of a recession as “most of the data weakness has been in sentiment indicators, while hard economic data has held up.” She added that “there is no evidence of recession at this stage, so no evidence that we have transitioned to a bear market.”

While the coming months may bring more ups and downs, Nansen’s report suggests that the overall bull market is still in play. As Barthere puts it, the market is “likely to see a correction, but then we’ll bottom out for the rest of the year and head towards new highs.”

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x