Bitcoin reserve

MicroStrategy's Bitcoin Strategy Won't Work As Well for Other Companies

Published

4 hours agoon

By

admin

Look, I am not an expert in public markets, but raising money to buy more Bitcoin seems to be the obvious new alpha for public companies.

MicroStrategy pioneered this strategy, and now, 4 years later, it’s the most compelling and successful story in corporate finance. Microstrategy has been the best-performing stock in the last 4 years, beating every US company, including NVIDIA. That’s crazy, right? All thanks to Bitcoin.

I am sure the CFOs of most public companies are now looking at MicroStrategy and analysing how they turned a $1 billion company into a $70 billion empire in just 4 years, and they are thinking about how they can do the same.

Here’s the playbook:

Use Profits, Equity and Debt to buy more Bitcoin. And tell the world about it loudly.

But let’s be real — MicroStrategy’s Bitcoin playbook won’t pump stock prices forever, at least not for other public companies. The arbitrage opportunity is closing rapidly as more firms adopt similar strategies.

MicroStrategy enjoys first mover advantage and guru status with Michael Saylor. New corporate BTC buyers lack that credibility and cult following with Bitcoiners. The impact diminishes with each new adopter.

Bitcoin’s growth is slowing, too. Doing a 5x annually gets harder as the marginalized rising competition for a somewhat fixed BTC supply spells diminishing relative returns.

Let’s also remember — today’s investors can get Bitcoin exposure easier than when MicroStrategy started. ETFs and funds reduce the impact of new companies holding BTC directly.

All this means the MicroStrategy playbook is closing fast for public companies. Firms considering it must act quickly to maximize gains before the strategy gets overplayed.

To be clear, I’m incredibly bullish on corporations adopting BTC treasury reserves. It’s just that early movers will benefit the most. The impact will wane over time for new adopters.

And of course, regardless of time, companies will continue to benefit from adopting this strategy as the Bitcoin price continues to increase forever.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

The Many Ways Crypto Won in This Election

Bybit brings bbSOL yield to more users via key DeFi integrations

4 Crypto That Could Explode in November?

How Low Can Dogecoin Go Before Rallying Again?

Hedera’s HBAR momentum has just began, analyst says

Here’s Why Shiba Inu Price is About to Start Parabolic Phase

24/7 Cryptocurrency News

How Bitcoin Reserve Will Cut US National Debt by $16 Trillion? Michael Saylor Explains

Published

14 hours agoon

November 15, 2024By

admin

MicroStrategy chairman Michael Saylor has once again stressed the importance of the US having a strategic Bitcoin Reserve. In his latest CNBC interview, Saylor said that accumulating one million Bitcoins over the next five years can help the government reduce the US national debt by a staggering $16 trillion i.e. over 45% of the existing debt.

Bitcoin Reserve to Reducing US National Debt

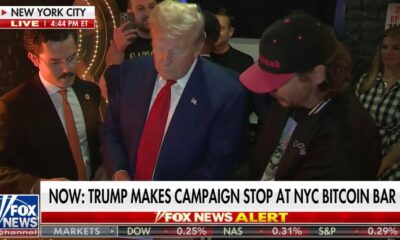

In his recent CNBC interview, Michael Saylor discussed the Red wave in the US elections and how Donald Trump’s victory can impact the crypto market. Besides, he also discussed MicroStrategy’s plans to raise $42 billion to buy additional Bitcoins.

Most importantly, Saylor believes that the US is most likely to have its own strategic Bitcoin reserve with a concrete plan in place very soon. Earlier this year during the Bitcoin 2024 conference in Nashville, President Donald Trump stated that he would make a plan for the US government to hold 200,000 Bitcoins as reserves.

Shortly afterward, Sen. Cynthia Lummis (R-Wyo.) introduced a bill proposing an increase in the country’s digital asset reserves. Moreover, she also shared a plan of accumulating one million tokens over a five-year period. In her recent comments on Thursday, Senator Lummis also proposed selling the Fed’s gold reserves partially to buy one million BTC.

If Sen. Lummis’ bill passes in its current form, the U.S. could realize a $16 trillion benefit from purchasing one million Bitcoin, according to Saylor. In his interview, the MicroStrategy executive chairman said:

“The best way to protect the dollar is make sure you retire the debt and become rich. The next best way to protect the dollar is to make sure that if anybody ever considers a different capital asset other than the treasury bill, you own it”. That asset is Bitcoin, he added.

Bitcoin is Manifest Destiny for the United States. My discussion of The Red Wave, MicroStrategy’s $42 Billion Plan, the compelling logic of the Strategic #Bitcoin Reserve, and getting ready for the 100K party, with @MorganLBrennan. pic.twitter.com/fvkwRnCzlU

— Michael Saylor⚡️ (@saylor) November 14, 2024

Michael Saylor Predicts Trump Max Case

Saylor highlighted that the U.S. acquiring strategic assets is not a new concept, citing some key asset purchases in the past. He also pointed out other strategic purchases throughout U.S. history, including gold, oil, grain, and helium, all of which have delivered multi-trillion-dollar in returns. In the latest such development, the Pennsylvania House passed a bill to build a state Bitcoin reserve. He added:

“You’re a nation, this is what nations do. … Bitcoin is manifest destiny for the United States. I think the Trump administration understands it, I think Senator Lummis understands it … that’s why it will happen.”

Saylor also outlined a “Trump Max” scenario, where the U.S. would purchase four million Bitcoins, a move he suggested could yield an $81 trillion return. According to Saylor, this “Trump Max” strategy represents the most “rational approach”.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin reserve

MicroStrategy Buys Additional $1.11 Billion Worth of Bitcoin

Published

2 months agoon

September 13, 2024By

admin

MicroStrategy announced it had purchased 18,300 Bitcoin for $1.11 billion, boosting its total holdings to 244,800 BTC acquired for $9.45 billion.

BREAKING: MicroStrategy buys an additional 18,300 #Bitcoin for $1.11 billion. pic.twitter.com/qhMg5EOqUF

— Bitcoin Magazine (@BitcoinMagazine) September 13, 2024

The business intelligence firm, led by Bitcoin bull Michael Saylor, has been steadily accumulating Bitcoin as part of its corporate strategy since 2020. MicroStrategy’s latest billion-dollar purchase was conducted at an average price of $60,408 per Bitcoin.

According to Saylor, the company has achieved a 17% Bitcoin yield year-to-date, capitalizing on BTC’s appreciation as it continues borrowing fiat at low interest rates to expand its holdings.

At current prices, MicroStrategy’s Bitcoin trove is worth over $15 billion, greatly benefiting shareholders. The company’s stock price has surged in tandem with its Bitcoin accumulation.

Despite rough market conditions in 2024, MicroStrategy continues compounding its Bitcoin position for the long term. The firm treats Bitcoin as a superior treasury asset compared to cash that is subject to inflationary debasement.

MicroStrategy is executing the biggest speculative attack on fiat currency in history by acquiring the hardest money for its treasury. Other public companies are following MicroStrategy’s lead by adopting Bitcoin treasury policies and acquiring Bitcoin exposure on their balance sheets. However, MicroStrategy remains the largest corporate holder of Bitcoin in the world.

By harnessing underutilized capital to capture Bitcoin’s upside, MicroStrategy has moulded itself into an emerging Bitcoin development company that is powering the worldwide adoption of Bitcoin.

Source link

Bitcoin reserve

Semler Scientific Buys Additional $5 Million Worth of Bitcoin

Published

3 months agoon

August 26, 2024By

admin

Medical device company Semler Scientific announced it purchased an additional 83 Bitcoin for $5 million in cash. This latest buy expands Semler’s total Bitcoin holdings to 1,012 BTC acquired for $68 million.

JUST IN: 🇺🇸 Public Company Semler Scientific buys another 83 #Bitcoin worth $5 million. pic.twitter.com/bQszFQcOF4

— Bitcoin Magazine (@BitcoinMagazine) August 26, 2024

The move comes as Semler embraces a strategy of adding Bitcoin to its balance sheet. In May, the company invested $40 million to purchase 654 BTC in its first major embrace of Bitcoin. Semler said it views Bitcoin as its primary treasury asset.

In June, Semler announced another $17 million Bitcoin acquisition of 247 BTC and said it planned to raise up to $150 million through an equity program to further boost its Bitcoin holdings. Earlier this month, they bought an additional 101 Bitcoin worth $6 million.

“Semler remains focused on our two strategies of expanding our healthcare business and acquiring and holding Bitcoin,” said CEO Doug Murphy-Chutorian in June. “We will continue to pursue our strategy of purchasing Bitcoins with cash.”

Semler appears to be following MicroStrategy’s Bitcoin treasury playbook. Since 2020, MicroStrategy has purchased over 225,000 bitcoins worth billions of dollars. Its Bitcoin bets have increased the company’s enterprise value dramatically.

Other public companies, such as MARA, Metaplanet, and others, have also added Bitcoin to their balance sheets. More firms are realizing the potential benefits of holding Bitcoin as a reserve asset and hedge against inflation.

Source link

The Many Ways Crypto Won in This Election

Bybit brings bbSOL yield to more users via key DeFi integrations

4 Crypto That Could Explode in November?

MicroStrategy's Bitcoin Strategy Won't Work As Well for Other Companies

How Low Can Dogecoin Go Before Rallying Again?

Hedera’s HBAR momentum has just began, analyst says

Here’s Why Shiba Inu Price is About to Start Parabolic Phase

See How Fast Your Savings and Salary Are Collapsing Against Bitcoin

Crypto Analyst Says Bitcoin’s Parabolic Phase Has Begun, Outlines Time Left Before BTC Hits the Bull Market Peak

Michael Saylor predicts Bitcoin will soar to $100k amid Trump’s pro-crypto administration

How Many Solana Tokens Make You A Crypto Millionaire?

ColliderScript: A $50M Bitcoin Covenant With No New Opcodes

Crypto Dad Giancarlo Denies SEC Job Rumors: ‘I’ve Already Cleaned Up Gensler Mess’

Dogwifhat’s X account hacked to promote meme coins: report

How Bitcoin Reserve Will Cut US National Debt by $16 Trillion? Michael Saylor Explains

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News2 months ago

News2 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

✓ Share: