Donald Trump

Trump Wants Teresa Goody Guillén to Head the SEC

Published

4 months agoon

By

admin

Soon-to-be President Donald Trump is looking at Teresa Goody Guillén, an experienced Securities attorney with a strong background in traditional finance and blockchain regulation, as a potential candidate to head the U.S. Securities and Exchange Commission.

If chosen, her appointment could mark a significant shift in the agency’s regulatory stance compared to the current ‘anti-crypto’ approach under Gary Gensler.

The Trump administration has expressed its intention to move away from what it coined as “regulation by enforcement” in the cryptocurrency space. During his campaign, Trump promised to fire Gensler on his first day in office, and reports suggest that Gensler is already getting ready to resign before Trump takes office, for a second time, on Jan 20.

Trump’s team is said to be looking for someone who is knowledgeable about digital assets and can soften the SEC’s stance on harsh crypto regulations until Congress offers a more definitive legislative direction. The blockchain and finance moguls see Goody Guillén as a perfect fit for this vision. Her supporters point out her firm grasp of security law and thoughtful approach to regulation. Guillén’s unique blend of experience with the SEC and her advocacy of blockchain companies has earned her considerable backing from both crypto leaders and traditional finance executives.

Goody Guillén is a partner at BakerHostetler, where she co-heads the firm’s blockchain division. According to her LinkedIn, she worked in the SEC’s office as the general counsel from 2009 to 2011. She then collaborated with former SEC Chair Harvey Pitt to provide counsel on enforcement issues.

This combination of insider knowledge and advocacy against the SEC’s enforcement actions has made her an ideal candidate for the position, especially in the wake of Trump’s team looking for a pro-crypto regulator to revamp the SEC. Brendan Playford, co-founder of the decentralized data provider Masa, referred to her as “an instant change-maker” who has the potential to restructure the finance industry.

Goody Guillén is one of many competitive groups of candidates for the SEC Chair position, which also includes major figures like Robert Stebbins from Willkie Farr & Gallagher, Brad Bondi from Paul Hastings, former SEC commissioner Paul Atkins, and Brain Brooks, who previously served as Acting Controller of the Currency.

The Trump transition team is moving quickly this time around, and it is planning to announce the new SEC chair before Thanksgiving, as reported by CoinDesk. This urgency brings to light the administration’s focus on rapidly changing financial regulations. If Goody Guillén is appointed, her leadership could lead to significant shifts in how the SEC handles crypto regulations. With the Trump administration already making some bold and controversial picks for Cabinet positions, many are keeping a close eye, as this could mean a make-or-break for regulatory reforms in the next four years.

Source link

You may like

Elon Musk Folds X Into xAI, Creating a $113 Billion Juggernaut

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

US regulators FDIC and CFTC ease crypto restrictions for banks, derivatives

US Authorities Seize $201,400 Worth of USDT Held in Crypto Wallets Allegedly Intended to Support Hamas

Is Bitcoin’s Bull Market Truly Back?

Bitcoin

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Published

4 minutes agoon

March 29, 2025By

admin

Donald Trump’s upcoming “Liberation Day” tariff announcement is being framed by some experts as a reset of global trade and could have negative implications for crypto.

While much of the attention is focused on the political fallout and trade disruptions, the broader consequences for digital assets, and the global frameworks that support them, deserve a closer look.

Heidi Crebo-Rediker, senior fellow at the Council on Foreign Relations, recently described on Bloomberg TV U.S. President Donald Trump’s plans as a “tearing up” of existing free trade agreements with America’s closest allies. This includes the so-called “Dirty 15”, a group of major trading partners that together make up 80% of U.S. trade.

Trump’s proposed system, built on unilateral tariffs and non-tariff barriers, represents a complete shift away from the cooperative global order that has defined the last several decades of international trade.

Why does this matter for crypto?

Crypto is inherently cross-border. Its infrastructure, users, capital flows, and regulatory frameworks depend on global alignment and relatively open markets. Any shift toward economic fragmentation risks disrupting that progress.

Crebo-Rediker notes that countries like Canada are already preparing to diversify away from the U.S., bracing for a reconfiguration of trade and investment relationships. In this new era, markets could become more closed, regulation more inconsistent, and capital controls more common.

She may agree (I don’t know), but these are all hostile conditions for crypto adoption. She also warns of a broader retreat from the multilateral frameworks that underpin both global finance and regulatory cooperation.

If America turns inward while allies look elsewhere, especially towards China, which is positioning itself as a defender of the global system – it could weaken the West’s influence over digital asset standards.

Crypto advocates have cheered Trump’s recent embrace of stablecoins and digital finance, but they should be cautious. A fragmented world, with each country pulling in a different direction on trade and tech, is not a world where crypto can thrive.

Forget about Michael Saylor’s vision of Bitcoin surpassing a $200 trillion market cap and we can only hope it can hold on to a $1 trillion valuation.

If global coordination erodes, so too might the prospects for crypto’s next wave of adoption. If so, it was a fun run. If not, I’ll be glad to admit being wrong.

Source link

Altcoins

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Published

22 hours agoon

March 28, 2025By

admin

A whale who previously won big on the Official Trump (TRUMP) memecoin booked a loss on the controversial asset over the weekend, according to the crypto tracker Lookonchain.

Lookonchain notes on the social media platform X that the whale spent $5 million worth of Circle’s stablecoin, USDC, to buy TRUMP right after President Donald Trump posted “I LOVE $TRUMP” on his social media platform Truth Social.

The whale then sold the TRUMP stash an hour later, booking a $207,000 loss.

However, the loss pales in comparison to gains the whale made earlier this year when it spent 1.09 million USDC to buy 5.97 million TRUMP and booked a $108 million profit, according to Lookonchain.

The president launched the Official Trump memecoin in mid-January, days before he took office. The asset has generated controversy in and out of crypto circles, raising questions of corruption in an already heavily questioned administration.

Even Ethereum (ETH) founder Vitalik Buterin said in January that political coins represented “vehicles for unlimited political bribery.”

In a February letter to the U.S. Department of Justice (DOJ) and the Office of Government Ethics, officials at the nonprofit consumer advocacy organization Public Citizen argued TRUMP could be a violation of federal law regulating gifts to government officials.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Dogecoin could rally in double digits on three conditions

Published

1 day agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

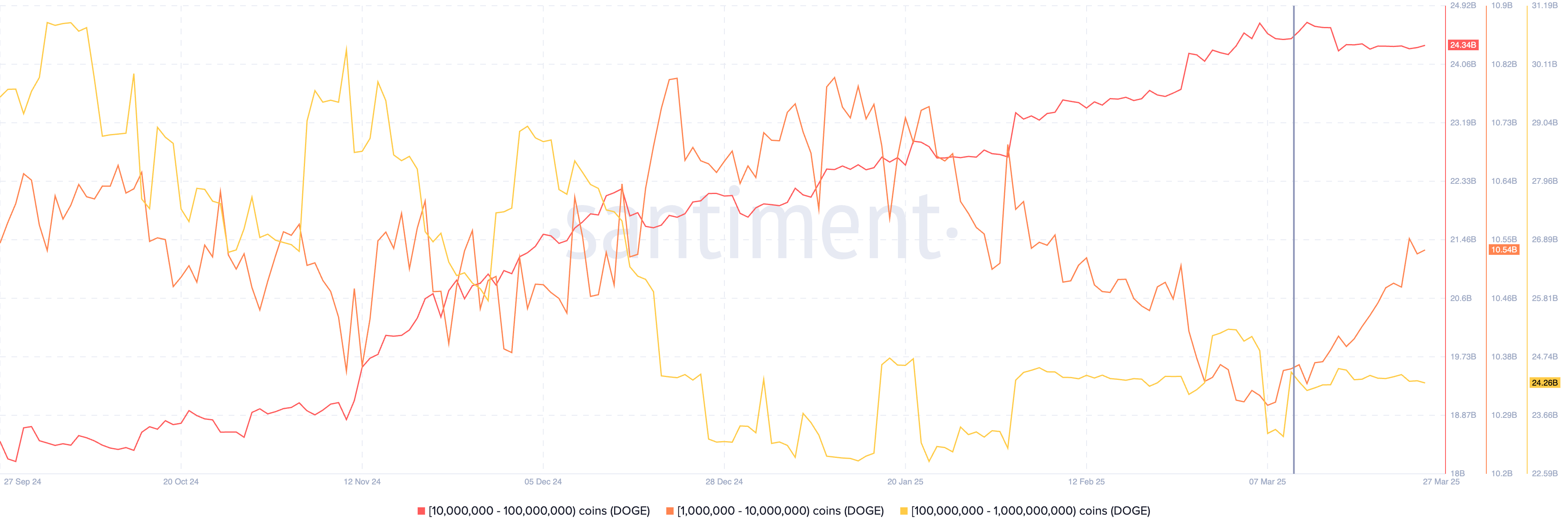

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Elon Musk Folds X Into xAI, Creating a $113 Billion Juggernaut

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Bitcoin Plunges Below $84K as Crypto Sell-Off Wipes Out Weekly Gains

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

Ethereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

US regulators FDIC and CFTC ease crypto restrictions for banks, derivatives

US Authorities Seize $201,400 Worth of USDT Held in Crypto Wallets Allegedly Intended to Support Hamas

Is Bitcoin’s Bull Market Truly Back?

Stablecoin Bills Unfairly Box Out Foreign Issuers Like Tether, Says House Majority Whip

THORChain price prediction | Is THORChain a good investment?

Strategy (MSTR) Holders Might be at Risk From Michael Saylor’s Financial Wizardry

3 Altcoins to Sell Before March 31 to Prepare for Crypto Bull Market

A Big Idea Whose Time Has Finally Come

XRP price may drop another 40% as Trump tariffs spook risk traders

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x