Bitcoin

Franklin Templeton crypto index ETF delayed by SEC

Published

4 months agoon

By

admin

Franklin Templeton, one of the crypto exchange-traded fund (ETF) issuers, has expressed interest in releasing the crypto index ETF, but the authorities are now delaying it.

The Securities and Exchange Commission (SEC) detained the deadline for approving the crypto index ETF by Franklin Templeton. According to the filing on Nov. 20, the authorities raised their concern about the sufficient time they needed to decide whether it would be accepted or declined.

“The Commission may designate if it finds such longer period to be appropriate and publishes its reasons for so finding or as to which the self-regulatory organization consents, the Commission shall either approve the proposed rule change, disapprove the proposed rule change, or institute proceedings to determine whether the proposed rule change should be disapproved,” SEC fillings.

On August. 17, based on their filing, Franklin proposed the crypto index ETF by holding Bitcoin (BTC) and Ethereum (ETH) with the ticker EZPZ. The proposed fund would allow the two most prominent crypto in the world under the same index with an unspecified ratio weighted by market capitalization.

If approved by the authorities, EZPZ would use the Coinbase custody and be listed on the Cboe BZX exchange. Franklin may add another crypto into the index but should gain approval from the SEC.

Franklin Templeton moves on crypto

Franklin Templeton, which is based in New York, is one of the most adaptable asset managers that allows investors to gain more exposure from the crypto price movement. Franklin created another crypto-related product after receiving the authority approval in January for Bitcoin spot ETF.

On October. 31, they tokenized money market funds into several blockchains, including Base, Arbitrum, Polygon, Avalanche, Aptos, and Stellar. The U.S. government money market fund (FOBXX) has $410 million in assets being tokenized into that blockchain.

Franklin also works with SBI Group in Japan to prepare for the possibility of accepting the crypto fund in the country, but this work’s development has not been published yet.

Source link

You may like

Crypto Whale’s Losses on TRUMP Memecoin Balloon to $15,700,000 After Exiting Three Losing Trades in a Row

FDIC Says Banks Can Engage In Bitcoin And Crypto Without Prior Approval

FDIC Clears Path for Bank Crypto Activities Without Prior Approval

Seasoned traders reveal leading crypto for 2025 and it’s not XRP or Solana

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Chainlink Monthly Close To Determine LINK’s Fate, $19 Next?

24/7 Cryptocurrency News

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Published

6 hours agoon

March 29, 2025By

admin

Peter Schiff, a BTC critic, has recently predicted that Bitcoin price could plummet to as low as $10,000. Schiff has expressed concerns over Bitcoin’s long-term viability, particularly in comparison to gold. His argument revolves around Bitcoin’s current performance, which he believes is being driven by short-term hype rather than solid fundamentals.

Schiff’s prediction is particularly alarming for those who view Bitcoin as a store of value. In the current trends, Peter Schiff notes that millions of young people are invested in Bitcoin while gold, a standard hedge, is pushing higher.

This view stems from his assertion that when gold prices rise to new record levels then the value of Bitcoin may plummet.

“By the time they get to their target of $5K for gold, they will drag Bitcoin down to $10K, meaning a drop of 95% from the highest it was valued at in 2021,” Schiff reasoned.

Bitcoin Price Recent Performance Against Gold

According to Peter Schiff, Bitcoin price has underperformed in relation to gold. Gold prices recently broke through $3,000 per ounce as global economic conditions continued to affect the global economy. Meanwhile, Bitcoin has depreciated in value, especially in terms of the precious metal, gold.

Since early 2025, the prices of Bitcoin have come down by over 30% against gold with one Bitcoin currently only equivalent to 27.4 ounces of gold as compared to 41 ounces in December of 2021.

If Bitcoin is an asset that people only buy when the stock market is going up and risk appetite is high, what is it that investors are buying? It’s not a stock as it will never have earnings or pay a dividend. It’s clearly not a risk-off asset, a store of value, or digital gold.

— Peter Schiff (@PeterSchiff) March 28, 2025

Another issue that Schiff dislikes about Bitcoin also revolves around its categorization as a “risk asset.” He says that BTC price movements are synchronized with the rest of the market, especially when investors are more willing to take risks. While gold provides investors with a safe-haven, the Bitcoin price operation is defined as having a volatility closer to that of the traditional markets among investors. Therefore, as argued by Peter Schiff, BTC price may decline as investors turn to the safe-havens, such as gold, in turbulent times.

Market Analyst Weigh In On Bitcoin Trend

Several market analysts are echoing Schiff’s concerns, suggesting that Bitcoin price could face challenges in the near term. Peter Brandt, a veteran trader, has pointed out that Bitcoin might be on a path to $65,635, citing a “bear wedge” pattern that has emerged in the cryptocurrency’s price charts.

Meanwhile, crypto trader Michaël van de Poppe shared his own cautious outlook on Bitcoin’s short-term prospects. Van de Poppe noted that while Bitcoin price has been holding above the $80,000 mark, its price action is starting to show signs of weakness. He added, “It starts to look slightly less good,” and suggested that if Bitcoin falls below $84,000, a deeper correction could be imminent.

Similarly, the crypto trader TheKingfisher expressed doubts about a sustained bullish recovery, indicating that Bitcoin’s current price movement aligns with a typical market cooldown. He suggested that Bitcoin could be approaching a “seasonal reset” as part of the broader market trend.

Alternative Views on Bitcoin’s Future Trend

Not everyone shares Peter Schiff’s pessimism about Bitcoin price. Charlie Morris, founder of ByteTree, highlighted that despite recent challenges, Bitcoin may have already seen its worst. He explained that while gold ETFs are experiencing slower inflows, Bitcoin could be positioned for a potential recovery.

This view contrasts sharply with Peter Schiff’s, emphasizing that the cryptocurrency may not be as doomed as some critics suggest.

Additionally, Robert Kiyosaki, author of Rich Dad Poor Dad, has weighed in on the broader market of precious metals and cryptocurrencies. While Kiyosaki acknowledged Bitcoin’s role as a hedge against inflation, he predicted that silver would outperform both Bitcoin and gold in the near term

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Chainlink Monthly Close To Determine LINK’s Fate, $19 Next?

Published

8 hours agoon

March 29, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

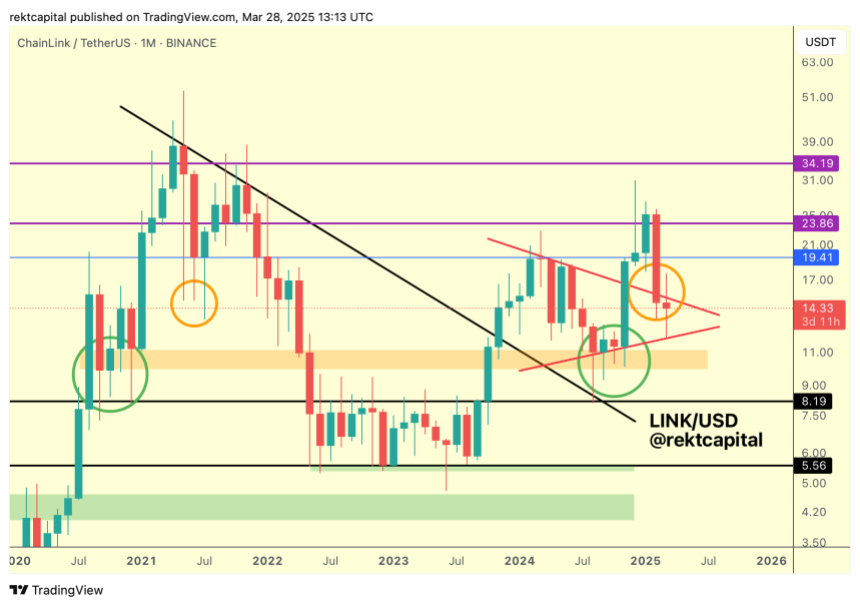

Amid today’s market correction, Chainlink (LINK) has lost its recent gains, falling back to a crucial support level. An analyst suggests a monthly close above its current range could position the cryptocurrency for a 35% surge.

Related Reading

Chainlink Retest Crucial Price Zone

Chainlink has retraced 9.1% in the past 24 hours to retest the key $14 support zone again. The cryptocurrency surged 15.7% from last Friday’s lows to hit an 18-day high of $16 on Wednesday, momentarily recovering 35% from this month’s low.

However, the recent market correction halted the momentum of most cryptocurrencies, with Bitcoin (BTC) falling back to the $83,700 mark and Ethereum (ETH) dipping to the $1,860 support zone.

Today, LINK dropped from $15 to $14.07, losing all its Wednesday gains. Previously, analyst Ali Martinez noted that the cryptocurrency has been in an ascending parallel channel since July 2023.

Chainlink has hovered between the pattern’s upper and lower boundary for the last year and a half, surging to the channel’s upper trendline every time it retested the lower zone before dropping back.

Amid its recent price performance, the cryptocurrency is retesting the channel’s lower boundary, suggesting a bounce to the upper range could come if it holds its current price levels.

Meanwhile, Rekt Capital highlighted that the token is testing its multi-month symmetrical triangle pattern, which could determine the cryptocurrency’s next move.

As the analyst explained, Chainlink consolidated inside a “Macro Triangular market structure” for most of 2024 before breaking out of the pattern during the November market rally.

During the Q4 2024 breakout, the cryptocurrency hit a two-year high of $30.9 but failed to hold this level in the following weeks. As a result, it has been in a downtrend for the past three months, with LINK’s price falling back into the Macro Triangle.

“The main goal for LINK here is to retest the top of the pattern to secure a successful post-breakout retest,” Rekt Capital detailed, adding, “It’s possible this is a volatile post-breakout retest.”

LINK Needs To Hold This Level

Rekt Capital pointed out that, historically, Chainlink has had downside deviations into this price range: “Back in mid-2021, LINK produced a downside deviation into this price area in the form of multiple Monthly downside wicks.”

Nonetheless, the cryptocurrency is downside deviating “but in the form of actual candle-bodies closes rather than downside wicks” this time.

The analyst also highlighted that, like in 2021, LINK is trading within a historical demand area, at around $13-5 and $15.5, testing this zone as support. Based on this, the cryptocurrency must successfully hold this area to “position itself for upside going forward.”

Related Reading

Moreover, the retest is key for reclaiming the top of its triangular market structure. Breaking and recovering that level would “exact a successful post-breakout retest” and enable the price to target the $19 resistance in the future.

The analyst concluded that if LINK closes the month above the triangle top, it “would position price for a successful retest, despite the downside deviation.”

As of this writing, Chainlink trades at $14.09, a 6.9% drop in the monthly timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Bitcoin

Proposed South Carolina Bill Lets State Treasurer Invest 10% Of State Funds In Bitcoin

Published

10 hours agoon

March 29, 2025By

admin

Yesterday, Rep. Jordan Pace reintroduced Bill H. 4256, The “Strategic Digital Assets Reserve Act Of South Carolina”, into South Carolina’s House of Representatives.

Highlights from the bill include the fact that it enables the State Treasurer to invest up to 10% of the funds under the state’s management into digital assets, including bitcoin, and that the state’s Strategic Digital Assets Reserve can include up to one million bitcoin.

The bill also states that the reason for establishing such a reserve is because “inflation has eroded the purchasing power of assets held in state funds” and that “bitcoin, a decentralized digital asset, and other digital assets offer unique properties that can act as a hedge against inflation and economic volatility.”

The bill does not stipulate whether or not state officials should hold the private keys to the bitcoin and other digital assets that it accumulates for the reserve, though it enables the State Treasurer to develop policies and protocols to protect the assets held in the reserve, including the use of cold storage or the contracting of a third party to maintain custody of the assets. The State Treasurer can also utilize a third party to assist in the creation, maintenance, and administration of the reserve’s security.

As per the bill, the State Treasurer would be responsible for preparing a biennial report that includes the total amount of digital assets held in the reserve, the U.S. dollar value of those assets, and transactions and expenditures related to the reserve since the previous report. Also, the State Treasurer would be required to publish proof of reserves, which includes the public addresses of the digital assets held in the reserve on an official state website, enabling citizens to independently audit and verify the reserve’s holdings.

Finally, the bill stipulates that the Strategic Digital Asset Reserve undergo audits that include an examination of the quality of the security of custody solutions; an assessment of compliance with local, state and federal laws; and an evaluation of internal controls to mitigate against cyberattacks and mismanagement.

According to the bill, the independent audits should be conducted annually and submitted to the relevant oversight committee. Any recommendations resulting from the independent audits must be addressed within 90 days of the issuance of the report, and a follow-up reporting detailing the corrective actions taken must also be provided to the oversight committee.

Source link

Crypto Whale’s Losses on TRUMP Memecoin Balloon to $15,700,000 After Exiting Three Losing Trades in a Row

FDIC Says Banks Can Engage In Bitcoin And Crypto Without Prior Approval

FDIC Clears Path for Bank Crypto Activities Without Prior Approval

Seasoned traders reveal leading crypto for 2025 and it’s not XRP or Solana

President Trump Pardons Arthur Hayes, 3 Other BitMEX Co-Founders and Employee

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Chainlink Monthly Close To Determine LINK’s Fate, $19 Next?

Elon Musk’s sale of X to xAI just made fraud lawsuit a ‘lot spicer’

494,000 Americans Affected As Massive Data Breach Exposes Names, Financial Records, Medical Data, Social Security Numbers and More: Report

Proposed South Carolina Bill Lets State Treasurer Invest 10% Of State Funds In Bitcoin

Elon Musk Folds X Into xAI, Creating a $113 Billion Juggernaut

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Bitcoin Plunges Below $84K as Crypto Sell-Off Wipes Out Weekly Gains

Top 4 Crypto to Buy Now as XRP Price Struggles above $2

Ethereum Price Hits 300-Week MA For The Second Time Ever, Here’s What Happened In 2022

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: