Donald Trump

Gensler to resign as SEC chair: What’s next under Trump?

Published

4 months agoon

By

admin

Gary Gensler, the high-profile and often polarizing chair of the U.S. Securities and Exchange Commission, announced his resignation, effective the day President-elect Donald Trump takes office.

Here’s the announcement on X:

On January 20, 2025 I will be stepping down as @SECGov Chair.

A thread

— Gary Gensler (@GaryGensler) November 21, 2024

Gensler’s decision is hardly unexpected for those attuned to Washington’s political rhythms. Leadership changes at federal agencies often coincide with the arrival of a new administration, especially when there’s an ideological shift.

Here’s a closer look at the situation.

Gensler’s crackdown on crypto

Although Gensler’s term was slated to run through 2026, his resignation aligns with these unwritten rules of political transitions.

Gensler’s tenure, which began in 2021 under President Joe Biden, has been anything but uneventful. Known for his bold and uncompromising regulatory stance, he led an unprecedented crackdown on the crypto industry—a sector he once described as “rife with fraud and hucksters.”

Under his leadership, the SEC initiated a record 46 enforcement actions against crypto-related entities in 2023 alone, a 53% increase from 2022.

Some of the crypto-related lawsuits filed seemed reasonable. For example, the SEC’s case against Terraform Labs involved allegations of a massive fraud scheme. In June, a federal jury ruled against Terraform and its co-founder Do Kwon. They were ordered to pay over $4.5 billion in penalties, the largest ever imposed in a crypto-related case.

While some applauded his efforts to bring order to the industry, Gensler’s critics often accuse him of regulatory overreach and stifling innovation, particularly when it comes to cases against Ripple (XRP) and Coinbase.

Trump, whose family launched a crypto startup this year, vocalized his disdain for Gensler on the campaign trail and pledged to replace him “on day one.”

Dan Gallagher, Robinhood Markets’ chief legal officer, was considered a possible replacement for Gensler, but he is no longer interested.

As the SEC prepares for this leadership change, the agency faces critical questions about its future direction. What does Gensler’s departure mean for financial regulation in the U.S.? Who will take the reins, and how will their approach shape the nation’s financial landscape?

When Gensler confirmed his resignation, social media — particularly crypto enthusiasts populating X — erupted with tweets that ranged from bitter resentment to cautious relief.

Many within the crypto community didn’t hold back, particularly supporters of Ripple. Known as the “XRP Army,” they had long blamed Gensler for the SEC’s aggressive lawsuit against Ripple Labs, which tanked the value of XRP and dragged the community into a years-long legal battle.

“Congratulations to the XRP Army—this is the moment we’ve been waiting for,” one XRP supporter tweeted.

Congratulations to the XRP army on the one wish that we wanted for the past four years!

Yes, I am part of the XRP army.

— Tom Homan – Border Czar (Commentary account only) (@TomHoman_) November 21, 2024

Criticism extended beyond XRP, with retail investors calling Gensler’s tenure “the most destructive period in SEC history.” They cite his initial resistance to approving a Bitcoin (BTC) ETF and his handling of smaller investor disputes, such as the MMTLP stockholder case.

Adding to the backlash, the same post referenced a federal judge’s reported reprimand of the SEC in another enforcement case, framing it as a reflection of Gensler’s heavy-handed and controversial approach.

“Thank you for protecting no one from actual scams. You set America back years in crypto,” another social media user quipped.

Thank you for protecting no one from actual scams. You were a complete failure and you set america back years in crypto.

— Chainlink Red Pill (@ChainlinkP) November 21, 2024

High-profile industry figures also joined the chorus of criticism. Justin Sun, the founder of Tron (TRX), took a harsher tone, calling Gensler’s resignation “too late” and lamenting the “massive damage” he allegedly inflicted on U.S. markets and the global economy.

Finally, the end of an era—though, Gary, it’s a little too late. The damage is done, and it’s massive, scarring U.S. markets, the global economy, and everyday people. Let’s hope the next chapter brings accountability. If you need a job, contact me!

— H.E. Justin Sun

(@justinsuntron) November 22, 2024

In the end, Gensler’s exit isn’t just the close of a contentious chapter; it’s the start of a critical transition for the SEC and the industries it oversees.

Who will lead the SEC next?

With Gensler’s resignation, the focus is shifting to who will succeed him—a decision that could reshape the future of crypto regulation in the U.S.

Journalist Eleanor Terrett of Fox Business has suggested that the next SEC chair may bring a fresh outlook on crypto.

I’ve been told by sources close to the transition team that the new @SECGov chair will be pro-crypto, the nominee will also have to be well-equipped to handle all the other issues under the SEC’s purview — public companies, the stock market, the bond market, private funds, the… https://t.co/iIRrhwvSxx

— Eleanor Terrett (@EleanorTerrett) November 15, 2024

According to her sources, the incoming administration is prioritizing a candidate who is “pro-crypto” yet equipped to handle the SEC’s broader responsibilities, including oversight of public companies, stock and bond markets, and private funds.

Among the leading contenders is Paul Atkins, a former SEC commissioner known for his free-market philosophy and favorable stance on crypto.

Charles Gasparino of Fox Business reported that Atkins is currently viewed as a frontrunner, buoyed by strong support from both the business and crypto communities.

SCOOP: Former SEC commission Paul Atkins is said to be in the lead position to replace @GaryGensler as @SECGov chair, according to a person with direct knowledge of the matter. As with all things in Trump World this could change, of course. Fox Business has previously reported…

— Charles Gasparino (@CGasparino) November 21, 2024

Atkins’ approach stands in stark contrast to Gensler’s enforcement-heavy style. While critics argue that Atkins may be too lenient, his supporters believe his leadership would promote innovation by lowering regulatory barriers.

Another prominent name in the running is Robert Stebbins, a partner at Willkie Farr & Gallagher and former SEC General Counsel under Jay Clayton.

Scoop: A name that’s gaining steam in the race for @SECGov Chair is Robert Stebbins, a partner at Wilkie Farr & Gallagher, and former SEC General Counsel under Jay Clayton, nominee for US Atty Southern District. Keep an eye on this name.

— Charles Gasparino (@CGasparino) November 15, 2024

Stebbins is widely regarded as a steady and pragmatic candidate, offering deep legal and regulatory expertise. While his pro-crypto stance is less favorable than Atkins’, his previous experience at the SEC gives him credibility with both policymakers and financial institutions.

Teresa Goody Guillén is also emerging as a potential candidate. A veteran of the SEC and a partner at BakerHostetler, where she co-leads the blockchain practice.

BREAKING NEWS: @realDonaldTrump is considering blockchain lawyer Teresa Goody Guillén to replace Gary Gensler as head of the SEC.

Teresa has represented many blockchain companies against the SEC in her time as co-lead of BakerHostetler’s blockchain group.

She spent time in… pic.twitter.com/bg8fj8XZMS

— Dylan K (@MightyDylanK) November 20, 2024

Crypto companies are reportedly advocating for her nomination, confident that her dual experience as an SEC insider and blockchain advocate would bring a balanced perspective to the role.

Brian Brooks, the former Acting Comptroller of the Currency, is another notable name being floated for key financial regulatory positions, including the SEC chair.

NEW: FOX Business has learned that former OCC Acting Director under Trump @BrianBrooksUS is on the lists for “various financial agency roles besides the CFTC”, according to a source close to him.

Outside the CFTC, some of the other financial regulatory agencies are the…

— Eleanor Terrett (@EleanorTerrett) November 18, 2024

Dubbed the “Crypto Comptroller” for his blockchain-friendly policies during his tenure at the OCC, Brooks has been a vocal proponent of integrating crypto into mainstream banking.

While Terrett noted that Brooks is under consideration for multiple roles beyond the SEC, his appointment here could signal a transformative period for crypto regulation.

Interestingly, the shakeup may not be limited to the SEC. Terrett suggests that the Trump administration is exploring an expanded role for the Commodity Futures Trading Commission in crypto oversight.

Such a move could involve splitting regulatory responsibilities between the SEC and CFTC—or even transferring primary authority to the CFTC entirely.

However, as Terrett pointed out, this shift would require a colossal increase in funding for the CFTC, which currently lacks the resources to manage such an expansive mandate. For now, speculation continues.

Preparing for the change

Gensler’s resignation has left crypto industry insiders speculating about what lies ahead, with many experts pointing to a mix of challenges and opportunities.

Slava Demchuk, CEO of AMLBot, in a conversation with crypto.news talked about one of the most pressing issues: the lack of clear rules for crypto in the U.S., especially compared to the EU’s Markets in Crypto-Assets Regulation.

“Without clear regulations, crypto companies have been left in limbo, unable to fully understand compliance requirements or attract major institutional players.”

One particularly thorny problem is crypto companies’ struggles to access banking services. Niko Demchuk, Head of Legal at AMLBot, described how banks in the U.S. are often hesitant to work with crypto firms due to the risk of regulatory fallout.

“Banks don’t want to associate with companies that might be out of compliance. Even indirect ties to crypto can bring scrutiny or fines, creating bottlenecks for the industry, making it difficult for businesses to perform everyday financial operations.”

If the next chair adopts a more crypto-friendly stance, there’s potential for key improvements, including clearer regulations, better access to banking, and a more welcoming environment for innovation.

The prospect of a regulatory framework similar to the EU’s MiCA is also gaining traction. Experts believe that such a framework could bring greater consistency to the U.S. market, addressing issues like cybersecurity, anti-money laundering, and market manipulation.

For crypto companies, this transitional period is an opportunity to get ahead and focus on strengthening compliance systems, enhancing know-your-customer processes, and investing in tools like transaction monitoring.

“Businesses need to be proactive. Regulatory changes are coming, and those who are prepared will have a smoother adjustment,” Demchuk added.

For crypto firms, the time to act is now—because what comes next could reshape the future of the crypto industry in the U.S. and across the globe.

Source link

You may like

Sonic Labs ditch algorithmic USD stablecoin for UAE dirham alternative

Crypto Whale’s Losses on TRUMP Memecoin Balloon to $15,700,000 After Exiting Three Losing Trades in a Row

FDIC Says Banks Can Engage In Bitcoin And Crypto Without Prior Approval

FDIC Clears Path for Bank Crypto Activities Without Prior Approval

Seasoned traders reveal leading crypto for 2025 and it’s not XRP or Solana

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Bitcoin

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Published

12 hours agoon

March 29, 2025By

admin

Donald Trump’s upcoming “Liberation Day” tariff announcement is being framed by some experts as a reset of global trade and could have negative implications for crypto.

While much of the attention is focused on the political fallout and trade disruptions, the broader consequences for digital assets, and the global frameworks that support them, deserve a closer look.

Heidi Crebo-Rediker, senior fellow at the Council on Foreign Relations, recently described on Bloomberg TV U.S. President Donald Trump’s plans as a “tearing up” of existing free trade agreements with America’s closest allies. This includes the so-called “Dirty 15”, a group of major trading partners that together make up 80% of U.S. trade.

Trump’s proposed system, built on unilateral tariffs and non-tariff barriers, represents a complete shift away from the cooperative global order that has defined the last several decades of international trade.

Why does this matter for crypto?

Crypto is inherently cross-border. Its infrastructure, users, capital flows, and regulatory frameworks depend on global alignment and relatively open markets. Any shift toward economic fragmentation risks disrupting that progress.

Crebo-Rediker notes that countries like Canada are already preparing to diversify away from the U.S., bracing for a reconfiguration of trade and investment relationships. In this new era, markets could become more closed, regulation more inconsistent, and capital controls more common.

She may agree (I don’t know), but these are all hostile conditions for crypto adoption. She also warns of a broader retreat from the multilateral frameworks that underpin both global finance and regulatory cooperation.

If America turns inward while allies look elsewhere, especially towards China, which is positioning itself as a defender of the global system – it could weaken the West’s influence over digital asset standards.

Crypto advocates have cheered Trump’s recent embrace of stablecoins and digital finance, but they should be cautious. A fragmented world, with each country pulling in a different direction on trade and tech, is not a world where crypto can thrive.

Forget about Michael Saylor’s vision of Bitcoin surpassing a $200 trillion market cap and we can only hope it can hold on to a $1 trillion valuation.

If global coordination erodes, so too might the prospects for crypto’s next wave of adoption. If so, it was a fun run. If not, I’ll be glad to admit being wrong.

Source link

Altcoins

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Published

1 day agoon

March 28, 2025By

admin

A whale who previously won big on the Official Trump (TRUMP) memecoin booked a loss on the controversial asset over the weekend, according to the crypto tracker Lookonchain.

Lookonchain notes on the social media platform X that the whale spent $5 million worth of Circle’s stablecoin, USDC, to buy TRUMP right after President Donald Trump posted “I LOVE $TRUMP” on his social media platform Truth Social.

The whale then sold the TRUMP stash an hour later, booking a $207,000 loss.

However, the loss pales in comparison to gains the whale made earlier this year when it spent 1.09 million USDC to buy 5.97 million TRUMP and booked a $108 million profit, according to Lookonchain.

The president launched the Official Trump memecoin in mid-January, days before he took office. The asset has generated controversy in and out of crypto circles, raising questions of corruption in an already heavily questioned administration.

Even Ethereum (ETH) founder Vitalik Buterin said in January that political coins represented “vehicles for unlimited political bribery.”

In a February letter to the U.S. Department of Justice (DOJ) and the Office of Government Ethics, officials at the nonprofit consumer advocacy organization Public Citizen argued TRUMP could be a violation of federal law regulating gifts to government officials.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Dogecoin could rally in double digits on three conditions

Published

2 days agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

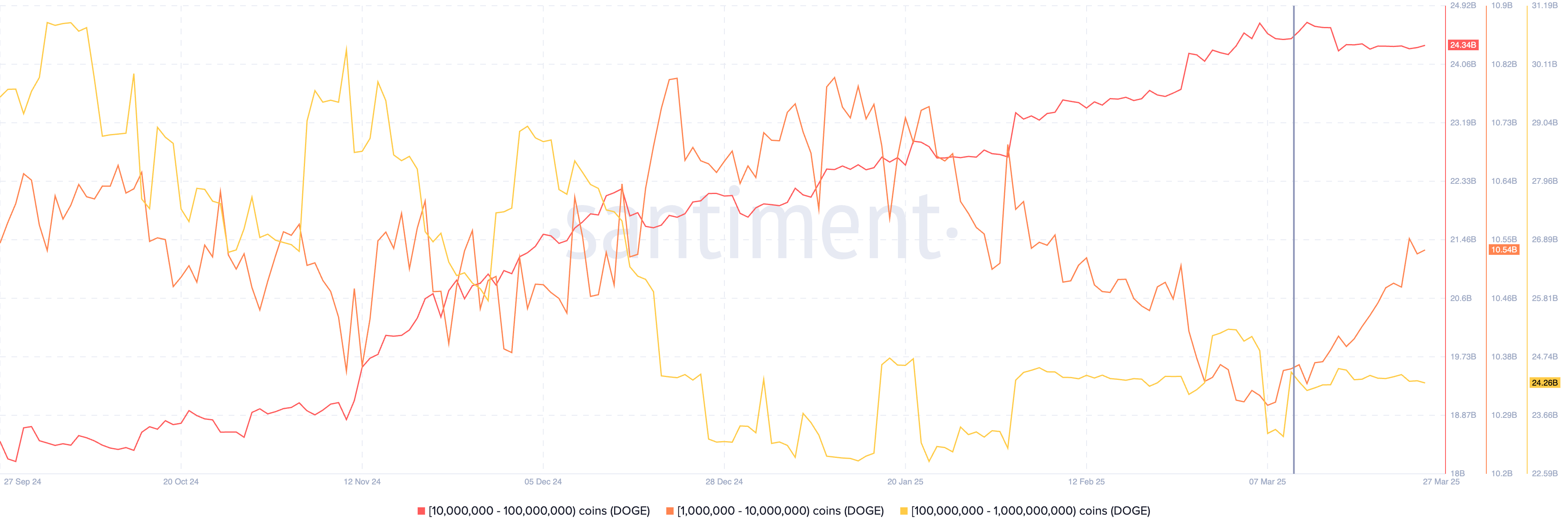

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Support Or Resistance? Chainlink (LINK) Investor Data Suggests Key Price Zones

Sonic Labs ditch algorithmic USD stablecoin for UAE dirham alternative

Crypto Whale’s Losses on TRUMP Memecoin Balloon to $15,700,000 After Exiting Three Losing Trades in a Row

FDIC Says Banks Can Engage In Bitcoin And Crypto Without Prior Approval

FDIC Clears Path for Bank Crypto Activities Without Prior Approval

Seasoned traders reveal leading crypto for 2025 and it’s not XRP or Solana

President Trump Pardons Arthur Hayes, 3 Other BitMEX Co-Founders and Employee

Here’s Why Peter Schiff Predicts Bitcoin (BTC) Price Crash to $10K

Chainlink Monthly Close To Determine LINK’s Fate, $19 Next?

Elon Musk’s sale of X to xAI just made fraud lawsuit a ‘lot spicer’

494,000 Americans Affected As Massive Data Breach Exposes Names, Financial Records, Medical Data, Social Security Numbers and More: Report

Proposed South Carolina Bill Lets State Treasurer Invest 10% Of State Funds In Bitcoin

Elon Musk Folds X Into xAI, Creating a $113 Billion Juggernaut

Why Trump’s ‘Liberation Day’ tariffs may hurt crypto’s global future

Bitcoin Plunges Below $84K as Crypto Sell-Off Wipes Out Weekly Gains

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x