Markets

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

Published

5 hours agoon

By

admin

Bitcoin witnessed a sharp sell-off on Monday, with the asset’s single-day performance giving up more than half of the gains made last week.

The world’s largest crypto fell 4.8% on the day to just above $93,000, with Monday’s drop totaling more than $4,800. For context, that’s more than 55% of last week’s $8,100 runup.

Still, analysts say the move is likely part of traders rebalancing their positions as they look to the end of the year, particularly in late December, which has proven to be a favorable month in the past.

“We see a combination of two catalysts pushing Bitcoin’s price down temporarily,” Ryan McMillin, chief investment officer at crypto fund manager Merkle Tree Capital, told Decrypt.

He pointed to a “sell wall” just below the “psychological barrier” right around $100,000, where traders are looking to capitalize on an explosive run following President-elect Donald Trump’s victory three weeks ago.

McMillin also pointed to a build-up of leveraged longs, or those betting on higher prices, as “too tempting” for market makers not to chase.

In other words, market makers who facilitate liquidity may intentionally drive prices down to trigger a liquidation of those leveraged longs.

Liquidations spiked on Monday to $550 million, 70% of which came from long positions. It follows a similar trend observed on Sunday. Still, McMillin says this is just part of normal market behavior.

“There isn’t much liquidity below $92,000, so that looks like the floor for this move,” McMillin said. “We expect the market to go and retest $100,000 before the week is out.”

Others agree, claiming Monday’s move is a part of typical market dynamics with traders hedging against potential downside risks, likely in response to recent moves.

“Pullbacks like these are not uncommon in bull markets,” Nick Forster, founder of DeFi derivatives protocol, Derive, told Decrypt. “We are seeing strong structural tailwinds for Bitcoin, bolstered by favorable conditions such as the interest-rate cutting cycle and evolving regulatory frameworks.”

Other cryptos in the top 10 by market capitalization have also dipped, with Dogecoin (DOGE) taking the most significant hit, down about 9.5% to $0.38, CoinGecko data shows.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

BTC Dips Below $95K, LDO Up 15%

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

Bitcoin

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Published

9 hours agoon

November 25, 2024By

admin

After a prolonged downtrend relative to bitcoin (BTC), Ethereum’s ether (ETH) is showing signs of a resurgence.

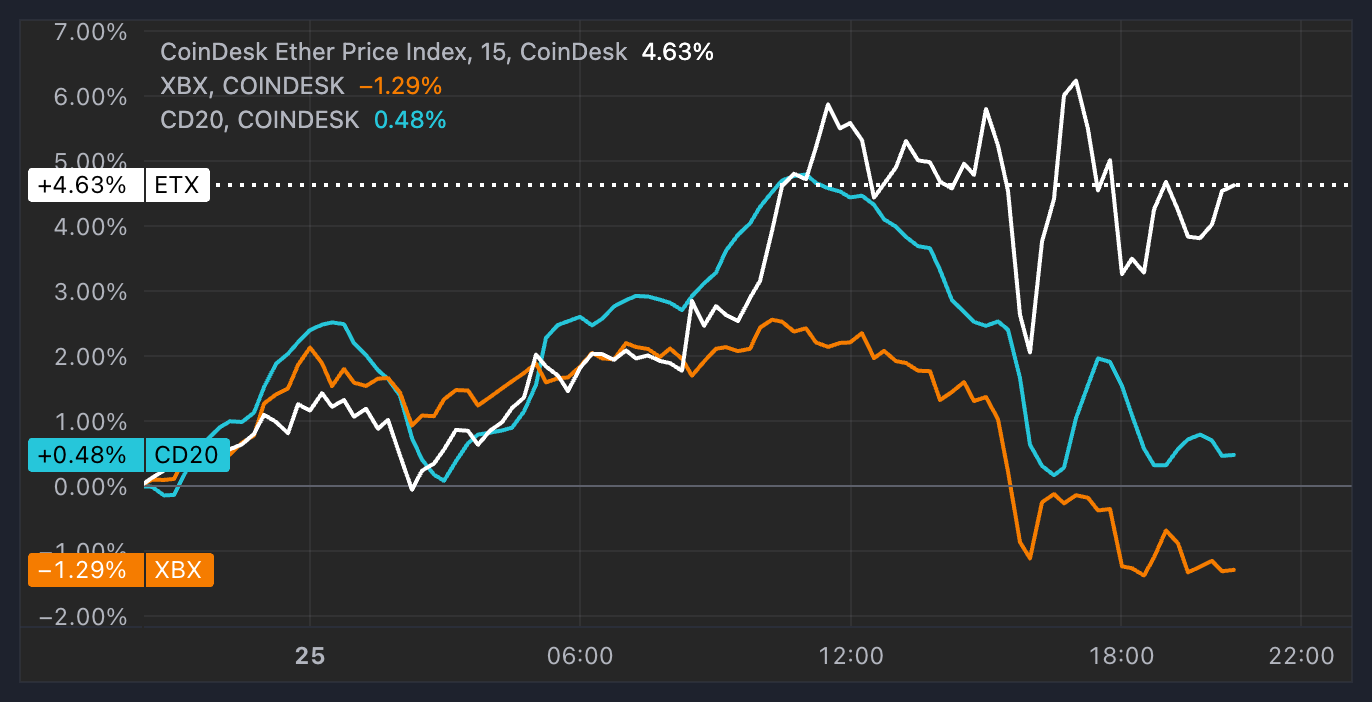

ETH, the second-largest cryptocurrency on the market, gained over 4% in the past 24 hours, while BTC lost 1.5% during the same time, dipping below $95,000 during the Monday session. ETH even outperformed the broad-market CoinDesk 20 Index, which was up 0.5%.

The outperformance happened as investors started to rotate capital to smaller, riskier cryptocurrencies over the weekend following the stall of bitcoin’s near-vertical surge since Donald Trump’s election victory. The ETH/BTC ratio, which measures ether’s strength vs. bitcoin, plummeted to as low as 0.0318 on Thursday, its weakest reading since March 2021, but the gague has gained 15% since to 0.3660 at press time.

“The market seems to be expecting BTC to trade sideways until December as attention shifts towards ETH in the near term,” digital asset hedge fund QCP said in a Monday note.

On the options markets, ETH risk reversals are heavily skewed in favor of frontend calls, meanwhile BTC calls seem to be more bid only from the end of December 2024 onwards, QCP noted. The positioning implies that traders anticipate ether to perform well in the short-term, while bitcoin could pick up pace next year. Risk reversal is a strategy that involves purchasing simultaneously a call option (bullish bet) and a put option (bearish bet) for a specific risk-reward profile.

ETH poised for a rebound vs. bitcoin

“We’re seeing some rotation from BTC to ETH coming from crypto-native hedge funds and family offices,” Joshua Lim from Arbelos Markets said.” Josh Lim, co-founder of crypto derivatives prime brokerage firm Arbelos Markets, said in a telegram message.

U.S.-listed spot ETH ETFs saw their first net inflows on Friday, led by $99 million allocation into BlackRock’s ETHA product, following six days of continuous outflows, data compiled by Farside Investors shows. Holders of ETHA include “the largest names in finance” including $80 billion hedge fund Millenium, analytics firm Kaiko said in a Monday report.

There could be more gains in store for ether against bitcoin in the coming period. The ETH/BTC ratio hit a key support level on Thursday and rebounded, while last week’s candle suggested a trend reversal, well-followed crypto trader Pentoshi noted.

“Quite possible the low is in here and that at least a short term reversal is coming,” Pentoshi said in an X post.

Bitcoin Stalls at $100K

Now extended far above its daily moving averages, bitcoin is likely trade sideways for a while as investors digest the steep rally since Donald Trump’s election victory, said Paul Howard, senior director at crypto trading firm Wincent.

“There is a significant sell wall at the psychological $100K level,” Howard told CoinDesk. “I would expect we oscillate around these levels until the new year. Staying market neutral and buying downside protection here is always a sensible risk reward,” he added.

Source link

Markets

Can the XRP price realistically jump to $10 in 2024?

Published

14 hours agoon

November 25, 2024By

admin

The XRP price has staged a strong recovery this month, making it one of the best-performing top ten cryptocurrencies.

Ripple (XRP) peaked at $1.6305 last week, rising 324% from its lowest point this year and pushing its market cap to over $81 billion. This valuation surpasses major global firms like Deutsche Bank, Marriott International, and BP.

With XRP’s bullish trajectory, analysts have shared optimistic forecasts. Edo Farina, a long-term Ripple supporter, predicted in an X post that the coin could surge to $10 during this bull run.

He cited fundamental catalysts, including expectations that Donald Trump’s victory could resolve Ripple’s ongoing conflict with the Securities and Exchange Commission will be over next year.

Meanwhile, Ripple and Archax have partnered to launch a tokenized fund on the XRP Ledger, signaling renewed activity on the network

Additionally, Ripple is developing RLUSD, a stablecoin intended to compete with Tether (USDT) PayPal USD, and USD Coin (USDC).

There are also rumors of Ripple launching an Initial Public Offering (IPO) in the coming years. A January CNBC report suggested the company postponed its IPO plans due to SEC challenges, a situation that could shift next year.

Can the XRP price jump to $10?

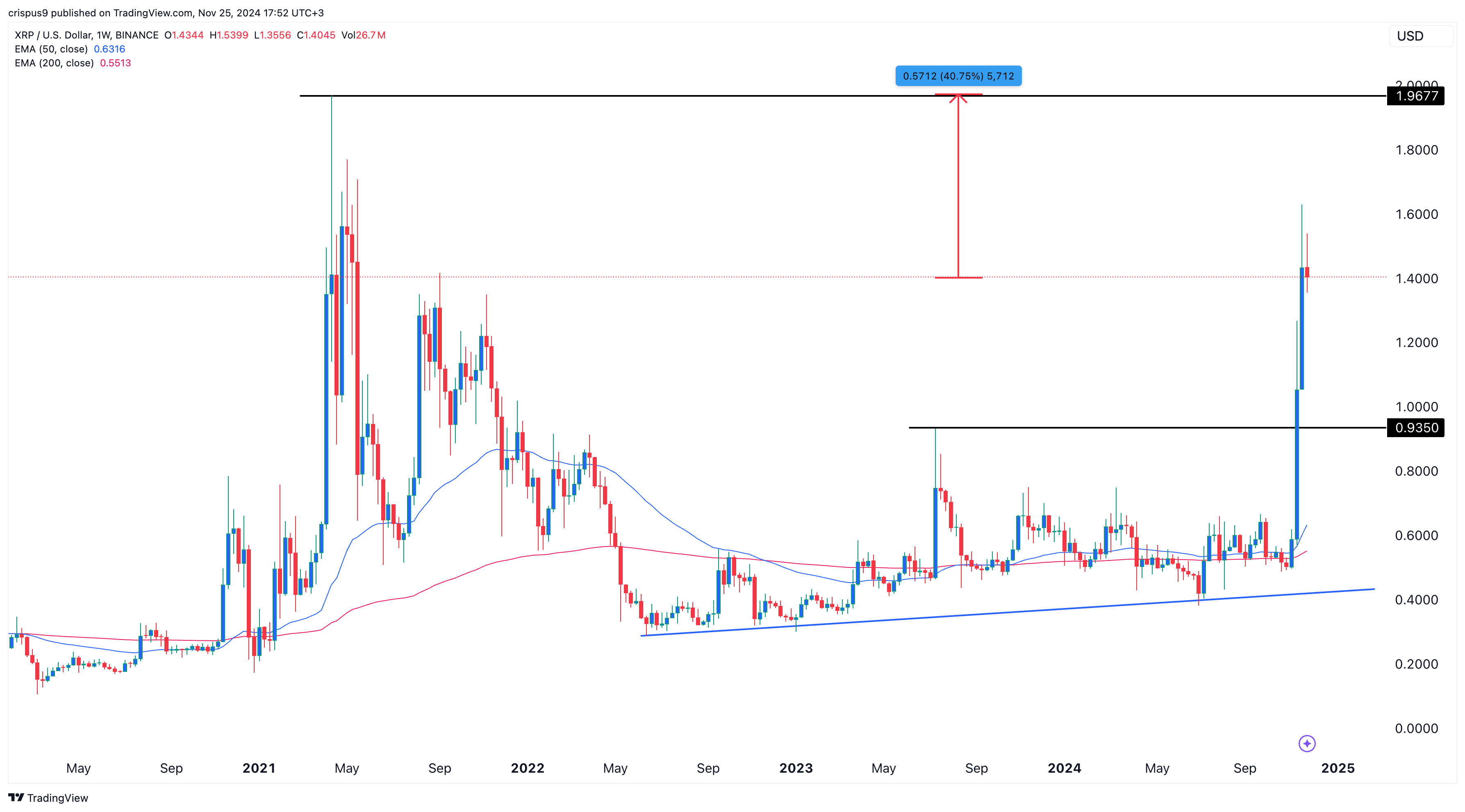

The price of Ripple traded at $1.4381 on Nov. 25, requiring a 600% increase to reach $10. Such a move would exceed its recent performance but aligns with past trends, like its 1,800% jump from 2020 lows to its all-time high in 2021.

The weekly chart shows that Ripple broke the significant resistance level of $0.9350, the neckline of a slanted triple-bottom pattern. The coin has moved above the 50-week and 200-week Exponential Moving Averages, suggesting positive momentum. There are also indications of a bullish pennant pattern forming.

While XRP may continue climbing, potentially reaching its all-time high of $1.96 and further to $5, a leap to $10 in 2024 remains unlikely.

Source link

Dogecoin

Dogecoin Jumps to 3-Year High Price—Before Bitcoin Cools and Meme Coins Plunge

Published

2 days agoon

November 24, 2024By

admin

Dogecoin got another leg up late Friday and into early Saturday, climbing to a price point not seen in over three years. But it has since fallen, with DOGE and other top meme coins among the biggest losers of the last 24 hours.

DOGE popped above the $0.475 mark on Saturday morning—the first time that the meme coin had risen that high since May 2021. Dogecoin has been on a torrid surge in recent weeks, starting before the election and becoming substantially more explosive in the days after.

Previously, in terms of recent moves, DOGE had previously popped as high as nearly $0.43 on November 13; at the time, it was a three-year high mark, but that local peak has since been topped. DOGE is now up 195% over the last 30 days, and 430% over the past year, per data from CoinGecko.

It was a short-lived peak, however, as is typical for such a volatile coin. DOGE is now down to about $0.41 as of this writing as the broader crypto market cools after last week’s surge. Bitcoin, for example, has now dipped to a price of $96,725 after setting a new all-time high price of $99,645 on Friday and coming close to the $100,000 milestone mark.

Dogecoin is now down 12% over the past 24 hours, though it’s not the biggest loser from the top 10 cryptocurrencies by market cap: XRP has dipped by 14% during the same span after pushing to its own three-year-high mark on Friday.

Zooming out, however, it is mostly meme coins that have fallen the hardest out of the top 100 coins over the past 24 hours. Brett (BRETT), Bonk (BONK), Popcat (POPCAT), Dogwifhat (WIF), Pepe (PEPE), and Floki (FLOKI) have all fallen by 10% or more during that span, alongside Dogecoin. Broadly, the crypto market is down by nearly 5% over the past day.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

BTC Dips Below $95K, LDO Up 15%

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4 Billion

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential