Markets

Bitcoin (BTC) Miners Bitdeer (BTDR), MARA Holdings (MARA) Among Gainers as Price Nears $100K

Published

4 hours agoon

By

admin

One week after its first attempt, bitcoin (BTC) is once again approaching the $100,000 milestone on Friday as crypto prices surged higher alongside the return of U.S. traders following Thanksgiving.

The Coindesk Bitcoin Index climbed to a $98,690 session high during early U.S. hours, advancing 3.3% over the past 24 hours. The broad-market CoinDesk 20 Index surged 6.2% during the same period, indicating that altcoins led the advance. XRP, ADA, RENDER and HBAR booked double-digit gains during the day.

Traditional U.S. markets are having a shortened session today after being closed on Thursday’s holiday. U.S.-listed bitcoin miners — which don’t always rise just because the price of bitcoin gains —, are moving higher, led by Bitdeer’s (BTDR) 15% advance to notch a fresh all-time high above $14. Major miners including MARA Holdings (MARA), Riot Platforms (RIOT), were all up 5%-10% in the first hours of the session. Crypto equities Coinbase (COIN), MicroStrategy (MSTR) and Semler Scientific (SMLR) lagged behind the miners.

Bitcoin futures on the Chicago Mercantile Exchange (CME) briefly surpassed the $100,000 level during the day before slightly retreating, per TradingView data. That’s the second occasion after first hitting the milestone last Friday.

The price premium on futures relative to the spot market suggests strong institutional participation, with open interest for bitcoin CME futures sitting at all-time high levels.

The Coinbase Price Premium, which measures BTC spot price on Coinbase relative to the off-shore exchange Binance, also bounced back to positive territory since bitcoin pulled back below $91,000 earlier this week. The Coinbase Premium underscores that the rally is primarily driven by American market participants.

“Judging by order size, Coinbase whales are driving this bitcoin rally,” Ki Young Ju, CEO of CryptoQuant, said in an X post.

Source link

You may like

Virtuals Protocol Tokens on Base Skyrocket as AI Agent Demand Grows

Hedera (HBAR) Price Jumps 25% As Analyst Predicts 192% Rally

Cryptos compete to create most millionaires

Here Are Key Fundamentals That Can Drive Cardano Price To $10

Crypto whales secretly accumulate these 4 coins for 5,000% gains

Algorand (ALGO) Price Rockets 32% After Bullish Golden Cross

analysis

Will December Surpass November’s Record-Breaking Bitcoin Price Increase?

Published

9 hours agoon

November 29, 2024By

admin

Bitcoin is closing out one of its most remarkable months in history, surging over $30,000 in November and marking a renewed bullish sentiment in the market. As we look ahead to December and beyond, investors are eager to understand whether Bitcoin’s momentum can sustain itself into 2025. With macroeconomic conditions, historical trends, and on-chain data aligning in Bitcoin’s favor, let’s analyze what’s happening and what it could mean for the future.

November’s Record-Breaking Performance

November 2024 wasn’t just any month for Bitcoin; it was historic. Bitcoin’s price rose from around $67,000 to nearly $100,000, an approximate 50% peak-to-trough increase, making it the best-performing month ever in terms of dollar increase. This rally rewarded long-term holders who endured months of consolidation after Bitcoin’s all-time high of $74,000 earlier in the year.

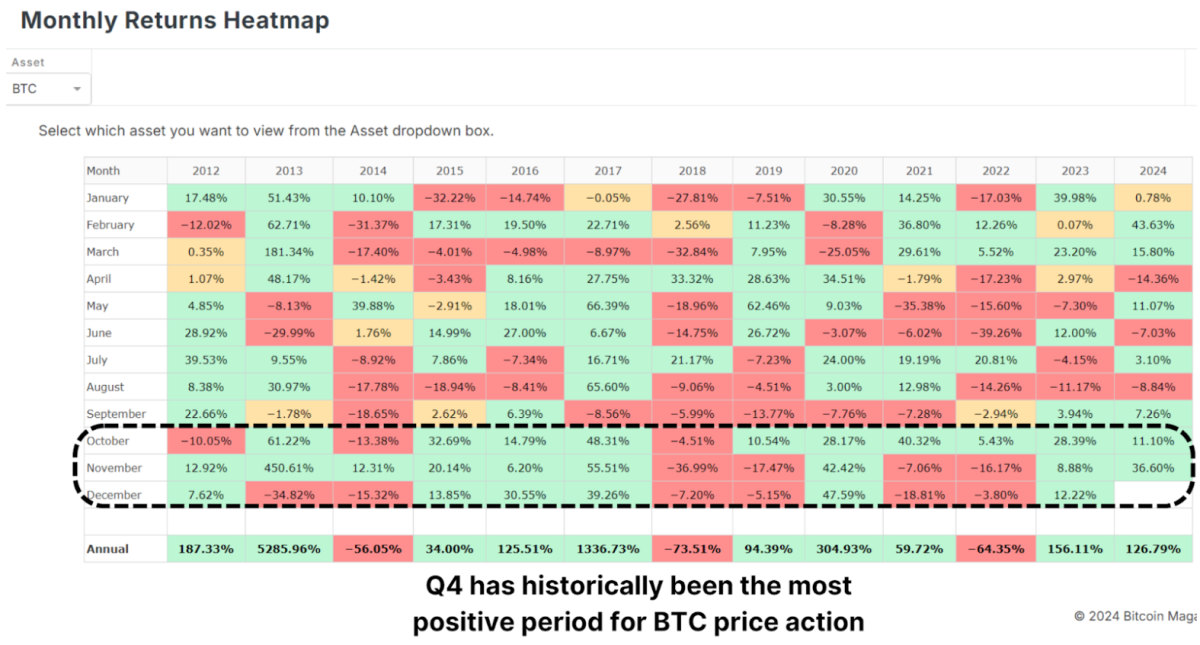

Historically, Q4 is Bitcoin’s strongest quarter, and November has often been a standout month. December, which has also performed well in past bull cycles, presents a promising outlook. But as with any rally, some short-term cooling might be expected.

The Role of the Dollar and Global Liquidity

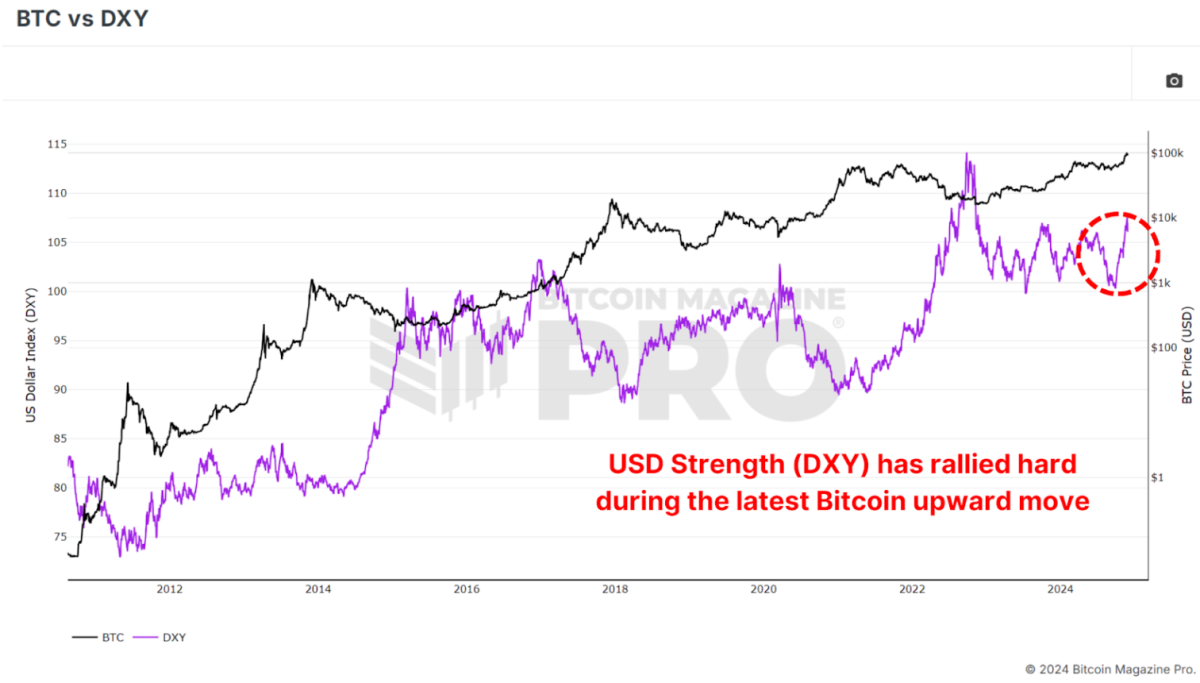

Interestingly, Bitcoin’s rise occurred against the backdrop of a strengthening U.S. Dollar Strength Index (DXY), a scenario that typically sees Bitcoin underperforming. Historically, Bitcoin and the DXY have maintained an inverse relationship: when the dollar strengthens, Bitcoin weakens, and vice versa.

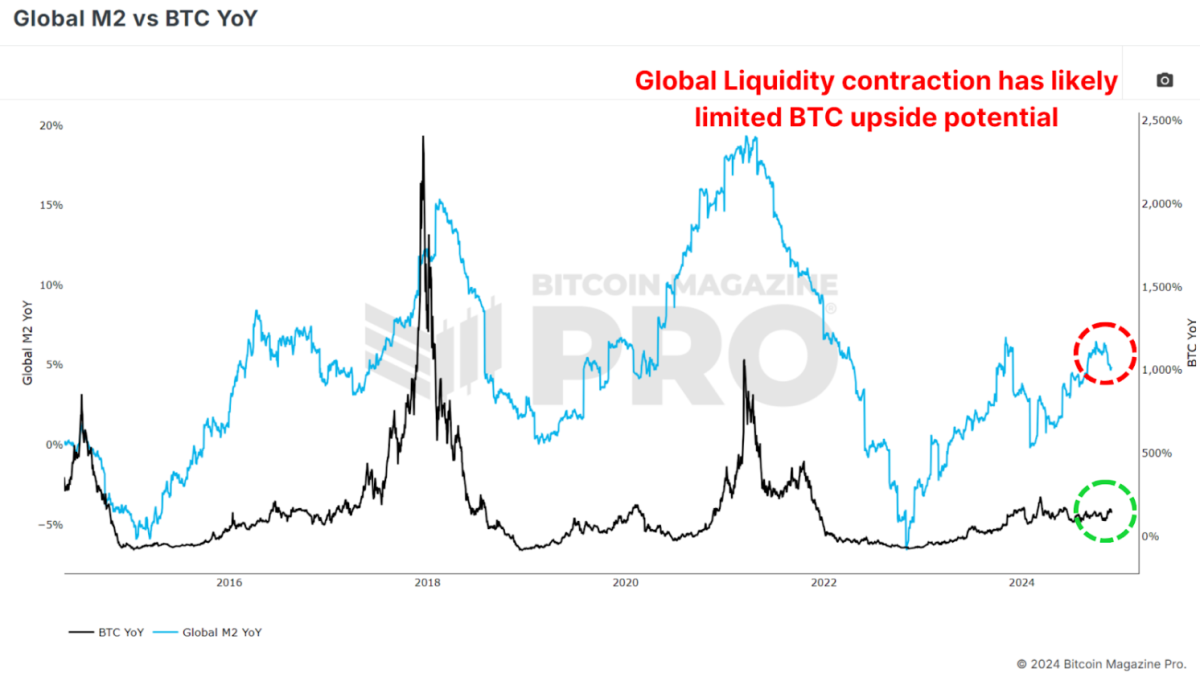

Similarly, the Global M2 money supply, another key metric, has shown a slight contraction recently. Bitcoin has historically correlated positively with global liquidity; thus, its current performance defies expectations. If liquidity conditions improve in the coming months, this could act as a powerful tailwind for Bitcoin’s price.

Parallels to Past Bull Cycles

Bitcoin’s current trajectory is strikingly similar to past bull markets, particularly the 2016–2017 cycle. That cycle began with gradual price increases before breaking key resistance levels and entering an exponential growth phase.

In 2017, Bitcoin’s price broke out from a key technical level of around $1,000, leading to a parabolic rally that peaked at $20,000, a 20x increase. Similarly, the 2020-2021 cycle saw Bitcoin rise from $20,000 to nearly $70,000 after breaking above the crucial YoY Performance threshold.

If Bitcoin can break out decisively from this historic level and above the key $100,000 resistance, we may witness a repeat of these explosive price movements as BTC enters its exponential phase of bullish price action.

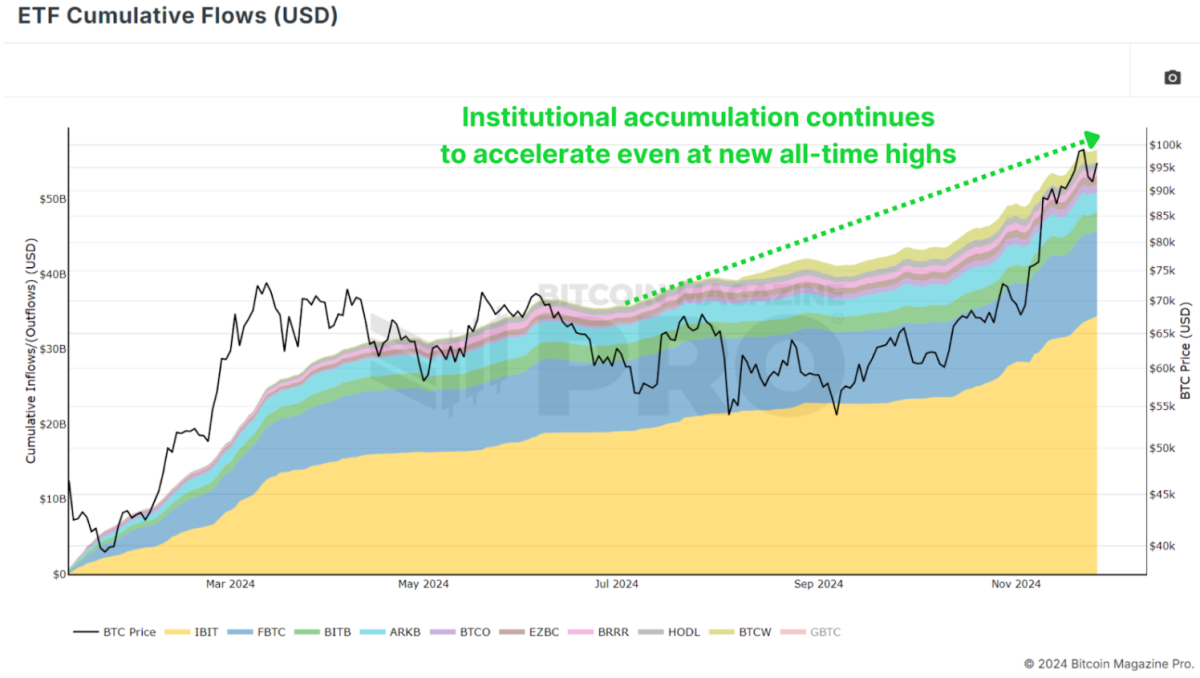

Institutional Adoption and Accumulation

A key factor underpinning Bitcoin’s strength is the continued accumulation by institutions. Bitcoin ETFs are adding billions of dollars worth of BTC to their holdings, and corporations like MicroStrategy have doubled down on their Bitcoin strategy, now holding close to 400,000 BTC. Even with BTC rallying to new all-time highs, ‘smart money’ is scrambling to accumulate as much as possible to ensure they’re not left behind.

This institutional demand indicates growing confidence in Bitcoin as a long-term store of value, even in volatile market conditions. Such accumulation also tightens the available supply, creating upward pressure on prices as demand increases.

Conclusion

While December has historically been a strong month for Bitcoin, short-term volatility could temper gains as the market digests November’s sharp rally. Although given the aggressive accumulation we’re witnessing from institutional participants anything is possible.

Longer-term, however, the outlook remains exceptionally bullish. The obvious level to watch is $100,000 as the next major milestone, which, if breached, could pave the way for a much larger rally in 2025. Bitcoin is entering one of its most exciting phases yet, with the stars seemingly aligning across macroeconomic, technical, and on-chain metrics.

For a more in-depth look into this topic, check out a recent YouTube video here: The BIGGEST Bitcoin Month EVER – So What Happens Next?

🎁 Black Friday: Our Biggest Ever Sale

The BEST saving of the year is here. Get 40% Off all our annual plans.

- Unlock +100 Bitcoin charts.

- Access Indicator alerts – so you never miss a thing.

- Private TradingView indicators of your favorite Bitcoin charts.

- Members-only Reports and Insights.

- Many new charts and features coming soon.

All for just $15/month with the Black Friday deal. This is our biggest sale all year.

UPGRADE YOUR BITCOIN INVESTING NOW

Don’t miss out! 👉 https://www.bitcoinmagazinepro.com/subscribe/

Source link

Algorand

Algorand price surges as crypto pundit sees it hitting $1.25

Published

10 hours agoon

November 29, 2024By

admin

Algorand price experienced a strong bullish breakout on Nov. 29 as cryptocurrencies continued their uptrend.

Algorand (ALGO), a top layer-1 network, surged to $0.40, marking its highest level since November 2022. The cryptocurrency has risen for four consecutive weeks, climbing over 240% from its lowest level this year.

Crypto analysts are still optimistic about the ALGO price. In an X post, Steph is Crypto, a popular analyst, noted that the coin would jump to $1.26. He cited a double-bottom pattern that happened on the weekly chart. If this forecast is correct, it means that the coin may jump by 300%.

Another analyst noted that the coin would rally because of its strong tokenomics, its real-world adoption, and the best technology. For example, Algorand has a partnership with FIFA, which uses its blockchain to run its NFT marketplace.

The total value locked in Algorand’s DeFi ecosystem has also risen, hitting $170 million, the highest since February. Key dApps in its ecosystem have seen significant inflows, with Folks Finance’s assets rising by 200% in the last 30 days. Lofty has $45 million in assets, while Tinyman holds $34.6 million.

Algorand’s rally aligns with the broader cryptocurrency market performance. Bitcoin surpassed $98,000 on Friday, and the total market cap of all cryptocurrencies reached over $3.4 trillion. Other traditional coins from 2021, such as Theta Network, Stellar, and MultiversX (formerly Elrond), also recorded significant gains.

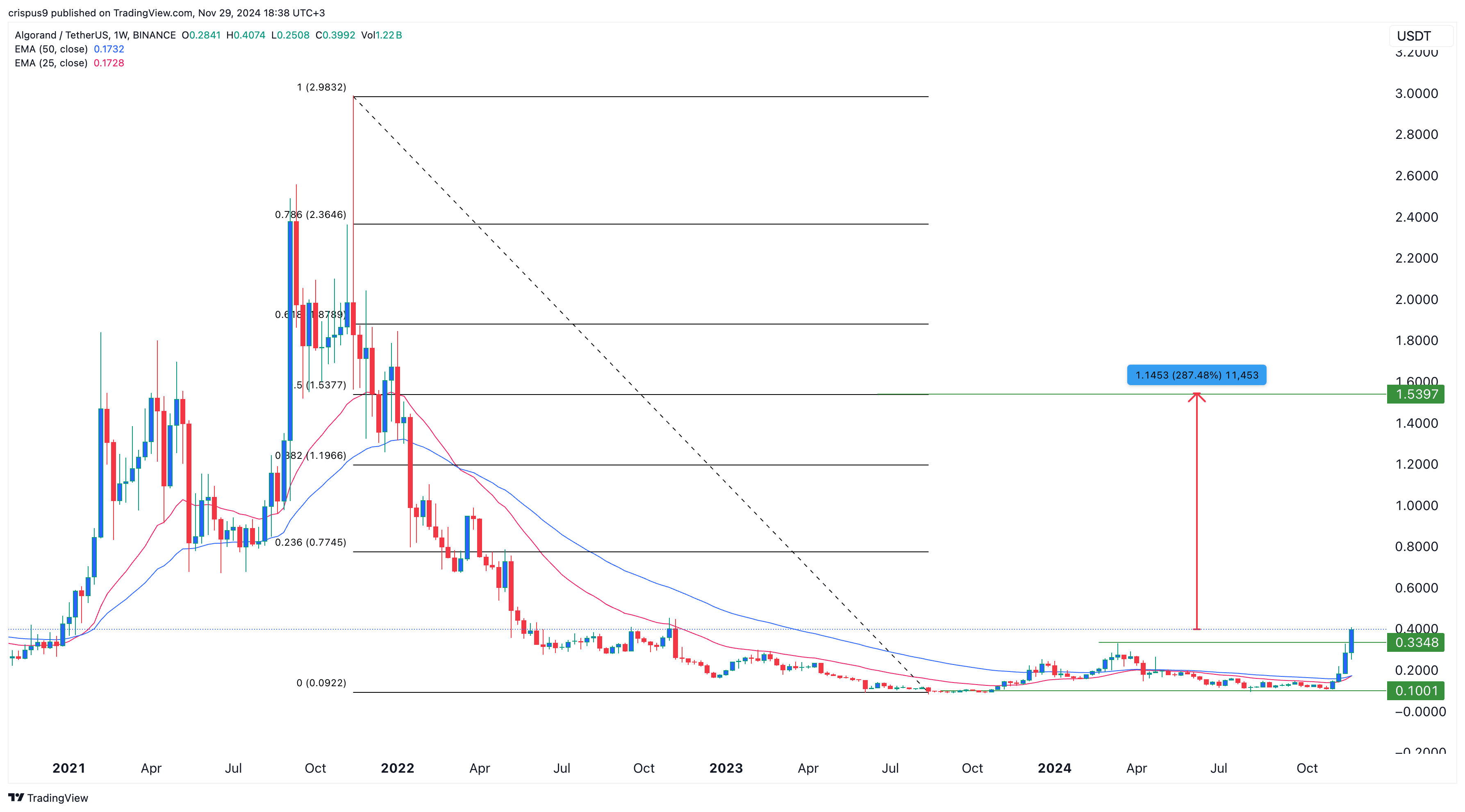

Algorand price analysis

The weekly chart supports the bullish outlook for ALGO, suggesting it may climb to $1.54 during the current bull run. The coin recently completed a double-bottom pattern at $0.10, which it has not breached since last year. It has now surpassed the neckline of this pattern at $0.3348, a typical bullish indicator.

If this trend continues, ALGO could target $1.54, representing a 287% increase from current levels and aligning with the 50% Fibonacci Retracement level. For this to happen, the coin must first break through the 23.6% retracement point at $0.7745 and the 38.2% level at $1.20. However, a drop below the support level at $0.20 could trigger downside momentum.

Source link

Bitcoin mining

Bitcoin Miners Near $40B Market Cap as Mining Difficulty Set for Fifth Straight Increase

Published

2 days agoon

November 28, 2024By

admin

Publicly traded bitcoin (BTC) miners are approaching the milestone of an aggregated $40 billion market cap, according to Farside data, doubling in seven months as bitcoin’s price rocketed through multiple record highs to approach six figures for the first time.

Miners’ biggest challenge is revenue. The reward they receive for confirming blocks on the Bitcoin blockchain was cut 50% in April, when their combined market cap was about $20 billion. In this current epoch, only 450 bitcoin are mined a day and fees paid to miners remain at cycle lows, just 10 BTC ($946,000) on Nov. 27 according to Glassnode data.

That means they either have to diversify revenue streams or produce bitcoin at a cheaper cost than the spot price, currently about $96,000.

That’s a challenge that is about to become more difficult. The mining difficulty, which measures how hard it is to produce the blockchain’s blocks, is expected to increase by a further 3% at some point in the next few days.

Mining difficulty, already firmly above 1 trillion, automatically adjusts every 2016 blocks or roughly every two weeks. The higher the difficulty, the harder — and costlier — for miners to produce a new block.

The heart of the issue is the soaring hashrate, which has held above 700 exahash per second (EH/s) for more than a month. The hashrate is the computational power required to mine and process transactions on a proof-of-work blockchain like Bitcoin.

On a seven-day moving average, the hashrate is currently at 726 EH/s, continuing to put in higher highs and higher lows since mid-year, according to Glassnode data.

In 2024, many miners have diversified their revenue streams by pivoting into the AI and high-performance computing (HPC) industries, where there is soaring demand for locations that can host the computing power they need.

One example is IREN (IREN), whose shares surged 30% on Wednesday on renewed AI interest.

Other, such as MARA Holdings (MARA), are leveraging their bitcoin stashes and bumping up their bitcoin balance sheet holdings. As of Nov. 27, MARA added a further 703 BTC after selling a 0% $1 billion convertible note to raise the funds. The company now owns a total 34,794 BTC.

The CoinShares Valkyrie Bitcoin Miners ETF is a proxy for publicly traded miners. Its share price is up 60% year-to-date, which is underperforming bitcoin’s 113%.

Source link

Virtuals Protocol Tokens on Base Skyrocket as AI Agent Demand Grows

Hedera (HBAR) Price Jumps 25% As Analyst Predicts 192% Rally

Cryptos compete to create most millionaires

Here Are Key Fundamentals That Can Drive Cardano Price To $10

Bitcoin (BTC) Miners Bitdeer (BTDR), MARA Holdings (MARA) Among Gainers as Price Nears $100K

Crypto whales secretly accumulate these 4 coins for 5,000% gains

Algorand (ALGO) Price Rockets 32% After Bullish Golden Cross

Crypto Guru Reveals His Top 10 AI Altcoins For 2025

Will December Surpass November’s Record-Breaking Bitcoin Price Increase?

Algorand price surges as crypto pundit sees it hitting $1.25

Solana Price Forecast: As SOL Flips Ethereum

‘Very Promising Start’: Top Analyst Says Ethereum Headed Higher Against Bitcoin – Here Are His Targets

5 hidden gems to watch as the market gears up for 10,000% surge

BTC Monthly Chart Reveals Bull Market Target

AI bot transfers $50k in crypto after user manipulates fund handling

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential