cryptocurrency

Theta Network hits 8-month high, open interest jumps by 77%

Published

3 days agoon

By

admin

Theta Network’s latest rally comes on the back of derivatives traders as its open interest hit a new all-time high.

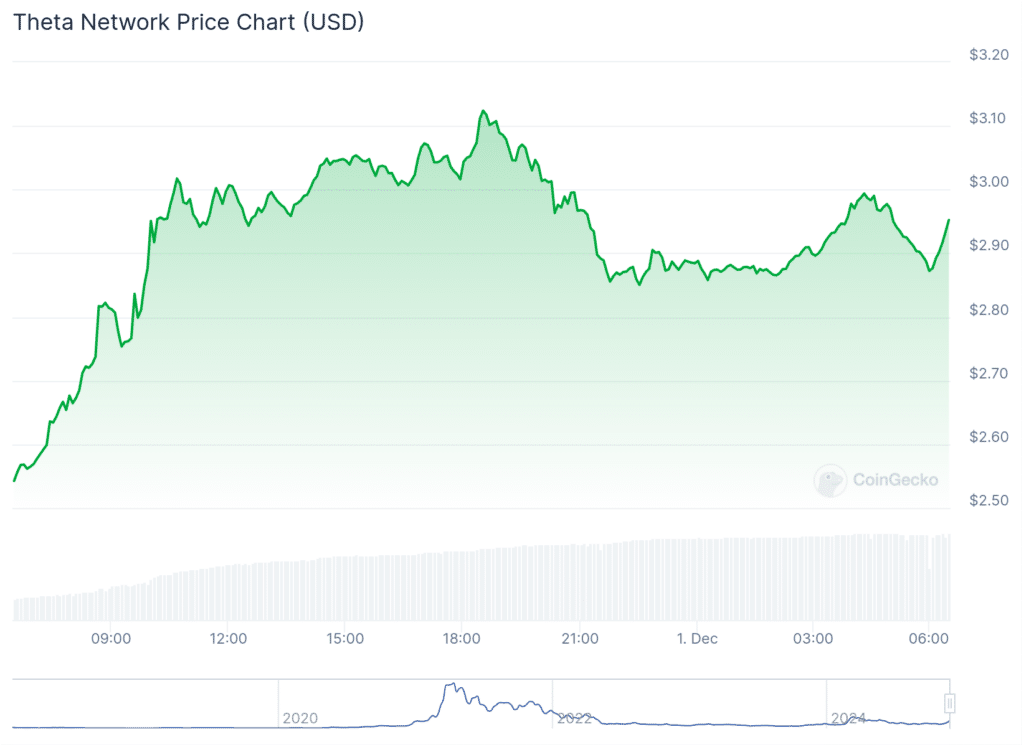

Theta Network (THETA) reached an eight-month high of $3.17 late Saturday as its daily trading volume skyrocketed 440% to $680 million. The asset witnessed a mild correction earlier today and is trading at $2.95 at the time of writing. See below.

The token currently has a market cap of $2.78 billion, securing the 53rd spot among leading cryptocurrencies.

Theta Network is a layer-1 proof-of-stake blockchain providing infrastructure for multimedia and artificial intelligence use cases.

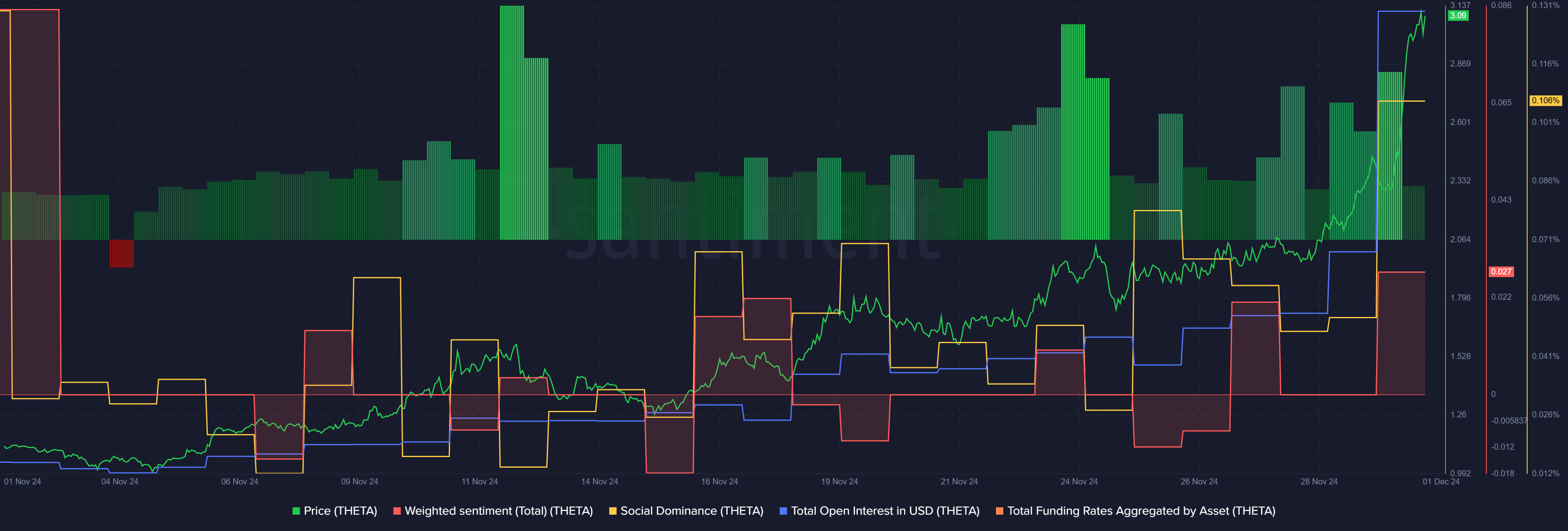

Data shows that its price surge brought a huge wave of derivatives traders. According to data provided by Santiment, open interest increased by 77% over the past day and reached an ATH of $84 million.

Theta chart

On the other hand, the funding rate aggregated from all exchanges declined from 0.03% to 0.009% as the asset’s price started to face correction, per data from Santiment.

The indicator shows that the number of traders betting on the price drop has increased. Consequently, high price volatility would be expected for the asset since any movements could potentially trigger increased liquidations.

Data from the market intelligence platform shows positive social sentiment and discussions around the blockchain have significantly increased over the last 30 days. This could raise the fear of missing out among investors.

Most notably, price rallies that emerge on the back of FOMO (fear of missing out) tend to be highly volatile due to the lack of major catalysts.

Theta Network was co-founded by Mitch Liu and Jieyi Long in 2017. Liu is a veteran in the video and gaming industries, who previously founded startups like Tapjoy and Gameview Studios.

IronSource purchased Tapjoy for $400 million.

Long is a specialist in blockchain, virtual reality and live-streaming.

Theta has attracted several high-profile investors and strategic partners from various industries, including Samsung, Sony, Digital Currency Group, Sierra Ventures and Heuristic Capital Partners.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

You may like

XRP, Stellar investors eye new DeFi token poised for 25x growth by new year

This Altseason Won’t Be What You Expected, According to CryptoQuant CEO – Here’s Why

Cardano Price Prediction as Trump’s New SEC Pick Could Be ADA Supporter

Heat Your Home While Earning Bitcoin With Heatbit

AMP price is rising as top crypto expert sees more upside

Monero Surges to Two-Year High of $211 as Privacy Coins Heat Up

cryptocurrency

AMP surged 60% amid increased whale interest

Published

8 hours agoon

December 4, 2024By

admin

Ampera’s AMP rose 62% in the last 24 hours and continued its rally as on-chain metrics indicated whales have begun accumulating the altcoin, driven by its increasing utility.

AMP (AMP) soared to a high of $0.0133 on Wednesday morning, marking a jump of over 330% from its lowest point this year. The surge in price pushed its market cap over $1 billion for the first time in 29 months before settling at $978 million when writing.

The altcoin’s rally coincided with a 750% surge in daily trading volume, which reached over $601 million, while AMP also trended on Google on the back of heightened retail interest.

Why is AMP price rising?

There are three potential catalysts driving AMP’s recent rally.

Firstly, AMP’s surge coincided with a broader rally in the altcoin market, as major cryptocurrencies like Binance Coin (BNB) and Tron (TRX) posted significantly higher daily gains of 17.6% and 68.8%, respectively, compared to Bitcoin’s modest 1.4% rise during the same period.

Second, Flexa, a digital payments platform that uses AMP as collateral, recently announced its integration with the Zcash wallet app ‘Zashi.’ The integration allows users to make purchases at Flexa-enabled U.S. stores without revealing their wallet or currency details.

As more transactions occur on the platform, the demand for AMP to serve as collateral naturally increases. This reduces the token’s available supply, creating upward pressure on its price, which is potentially fueling growth for the altcoin.

Third, AMP’s rally has been bolstered by a surge in whale activity over the past 24 hours. Data from IntoTheBlock shows that whale holder netflow jumped over 150%, shifting from a $186K outflow on Dec. 2 to $473K in inflows on Dec. 3, signaling renewed interest from large investors.

Meanwhile, on the daily chart, AMP has risen above both the 50-day and 200-day Simple Moving Averages, indicating bulls are still in control. Further, the 50-day SMA has crossed over the 200-day SMA, forming a golden cross, a major bullish sign in technical analysis.

Further, the MACD line (blue) and the signal line (orange) on the Moving Average Convergence Divergence indicator have been moving higher above the zero mark, which means the rally still holds significant momentum.

Considering these signals, AMP could potentially continue its rally, a sentiment also echoed by analyst Javon Marks, who projected that AMP could climb to $0.07048—a potential increase of over 470% from its current price.

Source link

Alex Mashinsky

Celcius founder plead guilty due to fraud charges

Published

14 hours agoon

December 4, 2024By

admin

Celcius, a global crypto and Bitcoin mining company has faced a fraud case since last year. Now, the founder pleaded guilty and agreed to be jailed for 30 years.

Alex Mashinsky, the founder and ex-CEO of Celcius Network, is set to plead guilty to fraud charges, Reuters reported on Dec. 03. The federal prosecutor accused Mashinsky of pursuing customers to invest in them and unnaturally inflating the value of the company on the crypto token.

In order to deal with prosecutors, Mashinsky agreed to be jailed in prison for 30 years or less. Therefore, his sentence is set to be announced by the court later next year on Apr. 08.

“I know what I did was wrong, and I want to try to do whatever I can to make it right,” he said.

Previously, he was counted for seven charges, including fraud, conspiracy, and market manipulation since last year. In court, he stated that he pleaded guilty to two out of those seven charges, which were commodity fraud and manipulating the Celcius token (CEL) price back in 2021.

Celcius price movement

Since the token was released, the CEL price has seen a meteoric increase of 14,700% from $0.05 to $7.4 in 2021. The surged price was only recorded in that year; after being accused, CEL saw an outflow and made the price go back to under $1 until Mashinsky’s arrest in July. 13; the token price was only $0.1.

Another development of the cases, Ben Armstrong, known as BitBoy Crypto, believes that Canadian businessman Kevin O’Leary was a key player in Celcius’s bankruptcy, as well as the FTX.

Source link

SynFutures, a decentralized exchange for perpetual derivatives trading on Base, has introduced SynFutures Foundation and announced an airdrop of its native token, F.

The SynFutures Foundation will collaborate with the community to oversee the DEX platform’s development and secure key partnerships. As a community-led governance initiative, the foundation aims to ensure the success of grants, project collaborations, and funding programs.

The F token is an Ethereum (ETH)-based mainnet asset, will grant holders governance rights, staking rewards, and fee discounts. The airdrop will distribute 10 billion F tokens to the community, with additional airdrops planned in the future.

SynFutures noted in a press release that the airdrop will benefit the community, the DEX’s backers and advisors, the foundation treasury, and core contributors. F is also reserved for liquidity and protocol development.

The community will receive 28.5% of the total F token supply, with 7.5% available for distribution during the Season 1 Airdrop on December 6, 2024. Eligible participants include users who have interacted consistently with SynFutures from v1 to v3.

Several crypto exchanges, including Bybit, Gate.io, Bitget, and KuCoin, have expressed support for the F token airdrop. Bybit will host a launchpool initiative between Dec. 2 and Dec. 5, allowing participants to earn F ahead of its listing. Gate.io is offering a similar program with 75,000 F tokens available.

SynFutures is backed by prominent venture capital platforms such as Pantera, Dragonfly, Polychain, Standard Crypto, and SIG.

The platform recently unveiled a Perp Launchpad, offering a $1 million grant to support tokens deemed under the radar. In September, SynFutures rolled out two perpertual contracts with 10x leverage that allowed traders to bet on the U.S. election.

Source link

XRP, Stellar investors eye new DeFi token poised for 25x growth by new year

This Altseason Won’t Be What You Expected, According to CryptoQuant CEO – Here’s Why

Cardano Price Prediction as Trump’s New SEC Pick Could Be ADA Supporter

Heat Your Home While Earning Bitcoin With Heatbit

AMP price is rising as top crypto expert sees more upside

Monero Surges to Two-Year High of $211 as Privacy Coins Heat Up

Red Alert For Pi Network Price As A Risky Pattern Forms

AMP surged 60% amid increased whale interest

Top Analyst Confirms Altcoin Season, What’s Next for XRP, SOL, HBAR, and SHIB?

DCG Confirms Reports Foundry Layoffs, Says its 16% of U.S. Employees

Arbitrum One as the first layer-2 to reached $20 bilion in TVL

Pepe Coin Whales Continue To Accumulate Signaling 7x Gains For PEPE Looms

Solana (SOL) Back on Track: Is The Uptrend Here to Stay?

Celcius founder plead guilty due to fraud charges

BNB Price Skyrockets To New All Time High, Rally To $1000 Near?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential