News

XRP flipped USDT and Solana after price surged by 27%

Published

3 days agoon

By

admin

XRP, a cryptocurrency launched by Ripple Labs Inc, has grown significantly in the past 7 days. These surges have brought the market cap to the third biggest after Bitcoin and Ethereum.

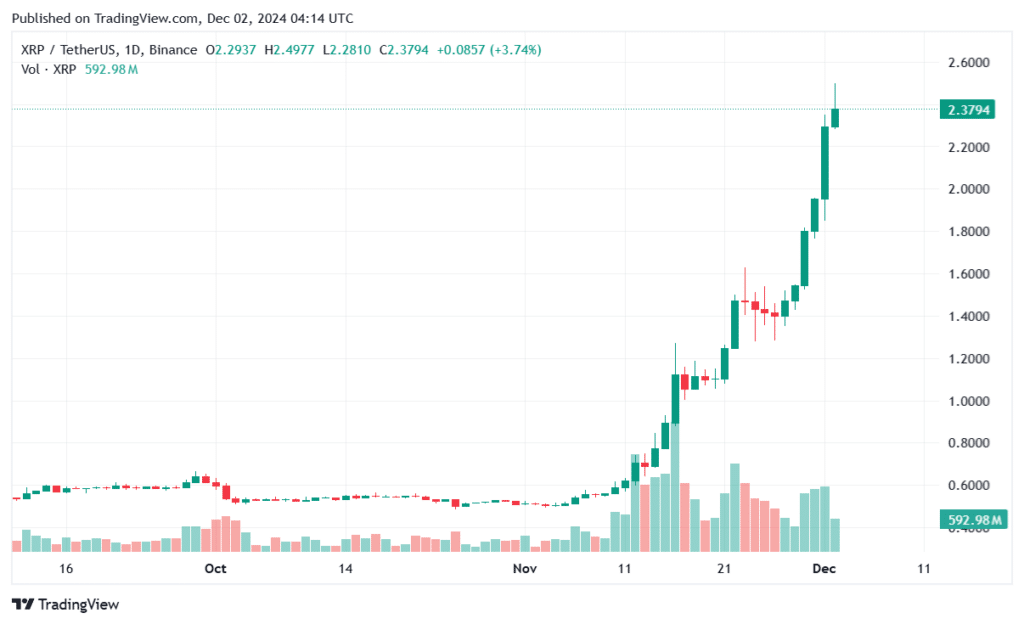

According to CoinMarketCap data on Nov. 02, XRP price has surged 27.72% from $1.8 to $2.3 at the time of writing. The price even meteorically increases by 365% from $0.51 in the past month, making them the top gainers along with Peanut (PNUT), Stellar (XLM), and Hedera (HBAR).

The price movement also made XRP’s market capitalization as the third largest in the world after surging 26% to $136 billion, surpassing Tether (USDT) and Solana (SOL) with $134 billion and $108 billion, respectively.

The tokens were also actively traded for about $26.41 billion, or an increase of 75% in a day. Earlier last week, XRP had already flipped Binance’s BNB after they reached $97 billion in market cap, while BNB was still on their $95 billion.

Ripple’s business expansion and market optimism pushed the price movement and headed to the all-time high record of $3.8 that was reached 7 years ago.

XRP’s move on financial market

WisdomTree, one of the U.S. Bitcoin ETF issuers, was proposed to the state of Delaware for XRP ETF on Nov. 25. Yet, it’s not officially purposed to the Securities and Exchange Commission (SEC); the market was already enthusiastic with the fillings which proposed to the division of corporations of the state.

21Shares also proposed the crypto-related product named 21Shares Core XRP Trust to the commission on Nov. 01. Bitwise also submitted a similar application for the product in early October.

Although the dispute between Ripple and SEC has not shown any better, the market is still optimistic about the next Trump administration, which supports crypto-friendly regulations. The new chairman of the SEC would also be picked after current executive Gary Gensler is about to withdraw before Trump’s inauguration.

Source link

You may like

Haliey Welch Releases HAWK Token

Bitcoin rebound and head to $100,000 target again

John Deaton Highlights 4 Key Actions New US SEC Must Take

Fed Chair Jerome Powell Is Correct: Bitcoin Is In Competition With Gold, Not The Dollar

Dogecoin Price Continues Trading Sideways But Bullish Pennant Says Get Ready For $1.30

Ripple executives praise Trump’s pro-crypto SEC head pick

Bitcoin

Bitcoin rebound and head to $100,000 target again

Published

55 mins agoon

December 5, 2024By

admin

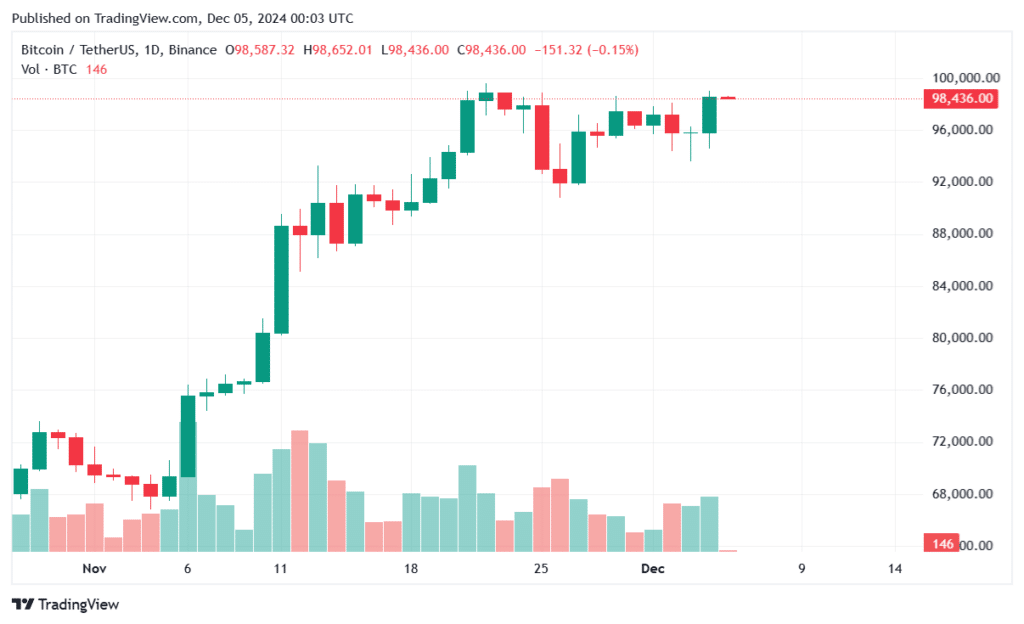

Bitcoin has rebounded to $98,000 today after dropping to its weekly lowest point, and several sentiments have made it back to head the $100,000 target price.

Bitcoin (BTC), the world’s largest cryptocurrency in the world by market capitalization, rose around 3% to $98,436 in the past week after dropping under the weekly average to $93,913 on Tuesday.

The South Korean martial law has brought a sentiment and dropped to its lowest record, but the token rebounded a few hours later after President Yoon Suk Yeol ended the order.

Trump nominated one-time Securities and Exchange Commission (SEC) Commissioner Paul Atkins to head the institutions, bringing a positive sentiment to the market. Ripple’s Brad Garlinghouse and Congressman Tom Emmer even support these nominations due to his stance as pro-crypto

Fed Chairman Jerome Powell’s acknowledgement of Bitcoin as a rival to gold also gives a perspective that this digital asset was commonly known as a safe-have instrument asset class.

Ethereum follows Bitcoin’s target movement

According to CoinMarketCap data on Dec. 05, Bitcoin dominance also showed a decrease of almost 5% to 54%, and this record was last seen this July. In comparison, Ethereum and other crypto recorded an increase to 12.9% and 32,6%, respectively, which indicates that Altcoins have room to grow.

Ethereum (ETH) increased by 5,21% to $3,813 in a day of trading. This largest blockchain token in the world is also heading to the next price target, which is $4,000, and possibly skyrocket to an all-time high of $4,891; the last time recorded was 3 years ago.

Although the other top cryptocurrencies have not performed yet, the crypto market cap in total is rising 1.87% to $3.58 trillion.

Source link

crypto assets

Ripple executives praise Trump’s pro-crypto SEC head pick

Published

5 hours agoon

December 4, 2024By

admin

Ripple executives Brad Garlinghouse and Stuart Alderoty voiced their support for Paul Atkins as the next U.S. Securities and Exchange Commission chair.

Their optimism centers on Atkins’ reputation as a pro-innovation advocate, signaling what they believe could be a major shift in the SEC’s approach to cryptocurrency regulation.

Alderoty praised the prospect of a leadership trio of Atkins, Hester Peirce, and Mark Uyeda, stating they would bring “common sense” and “true investor protection” back to the agency. Similarly, Garlinghouse described Atkins as “an outstanding choice,” emphasizing his potential to “end the prohibition era on crypto” and champion economic growth and innovation.

An outstanding choice – Paul Atkins at the helm of the SEC will bring common sense back to the agency. Along with Hester Peirce and Mark Uyeda, it’s time to swiftly and definitively end the prohibition era on crypto, restoring freedom of choice, economic growth, and innovation. https://t.co/w8Rqrnubyj

— Brad Garlinghouse (@bgarlinghouse) December 4, 2024

Paul Atkins, a former SEC commissioner, is known for his market-driven approach and advocacy for reducing regulatory burdens. His nomination follows President-elect Donald Trump’s crypto-friendly campaign, which promised regulatory clarity and support for blockchain technology.

Under Trump’s administration, Atkins could represent a significant departure from outgoing SEC Chair Gary Gensler’s enforcement-heavy stance, which drew criticism for stifling industry growth and innovation.

XRP surge

These comments come as Ripple (XRP) has experienced a notable surge, recently climbing to around $2.90, with speculation that it could reach $3 soon.

This increase is driven by multiple factors, including the anticipated launch of Ripple’s RLUSD stablecoin and growing optimism about regulatory clarity in the U.S. following recent political developments.

Source link

Bitcoin

This Altseason Won’t Be What You Expected, According to CryptoQuant CEO – Here’s Why

Published

8 hours agoon

December 4, 2024By

admin

The chief executive of blockchain intelligence platform CryptoQuant believes a potential incoming altseason will not be like prior ones for one key reason.

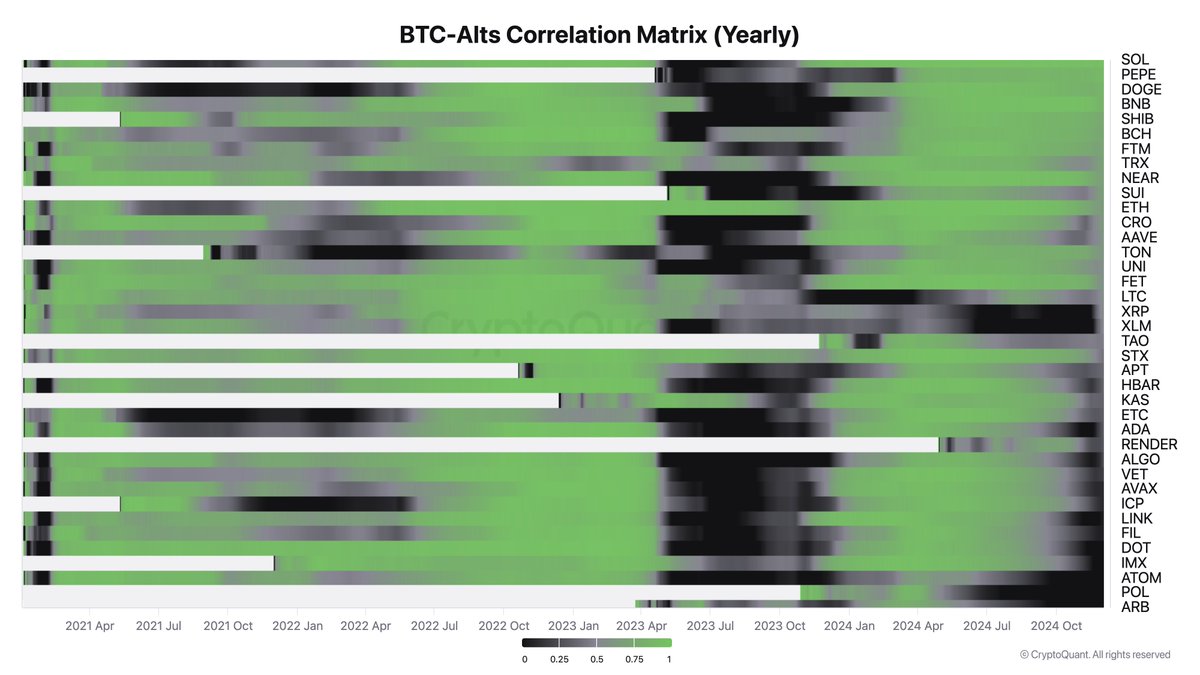

On-chain analyst Ki Young Ju tells his 381,200 followers on the social media platform X that, unlike past cycles, liquidity can no longer flow at the same levels from Bitcoin (BTC) into altcoins, sending them soaring.

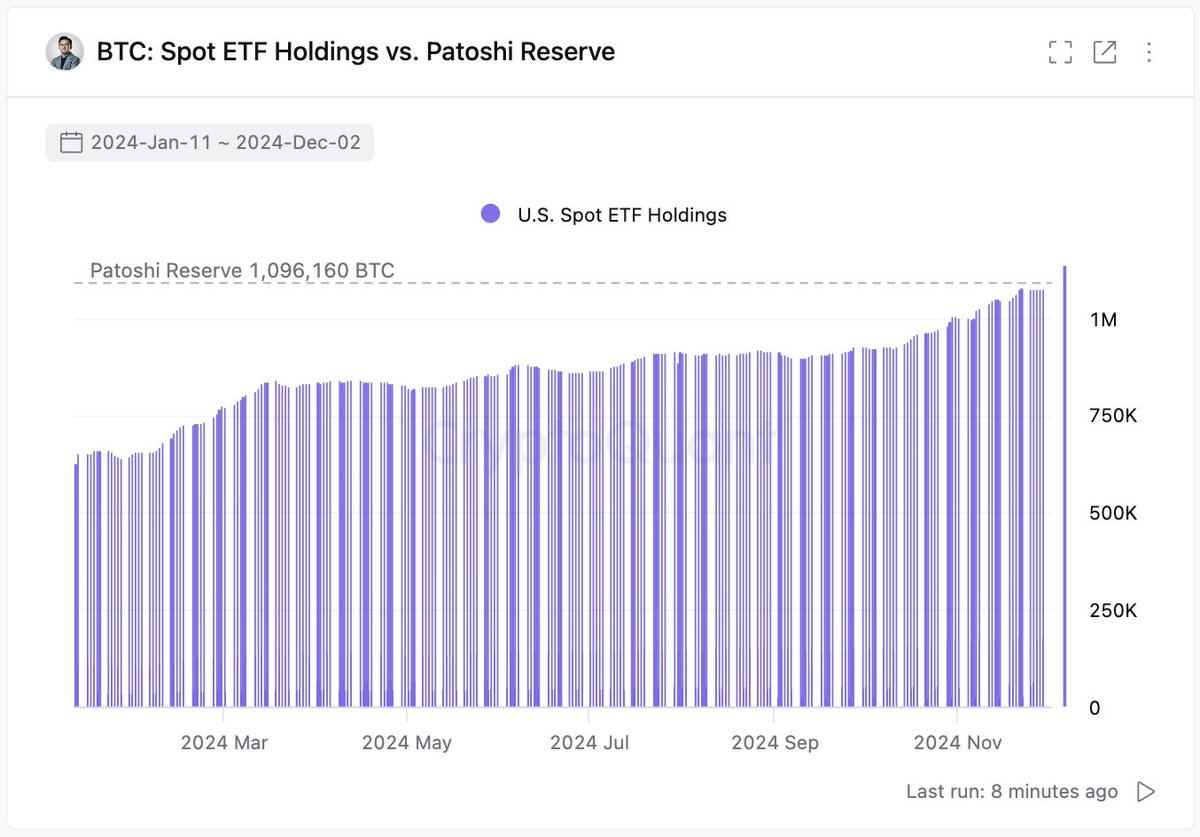

The analyst says there is now massive traditional finance participation in Bitcoin, including through spot market BTC exchange-traded funds (ETFs) and increased buying by software company MicroStrategy (MSTR).

“This alt season won’t be what you expected. It’s going to be weird and challenging. Only a chosen few will win the game. Market sentiment is good, but there isn’t much fresh liquidity. Bitcoin is drifting away from the crypto ecosystem. Bitcoin has built its own paper-based layer-2 ecosystem through ETFs, MSTR, funds and more. In this paper-based L2 Bitcoin bridging to other altcoins is impossible.”

He also shares a chart showing Bitcoin’s price correlation with alts. A score of 1 is the highest correlation, whereas the lowest correlation possible is 0.

“Altcoins used to move together based on their correlation with BTC, but that pattern has now broken. Only a few are starting to show independent trends as they attract new liquidity.”

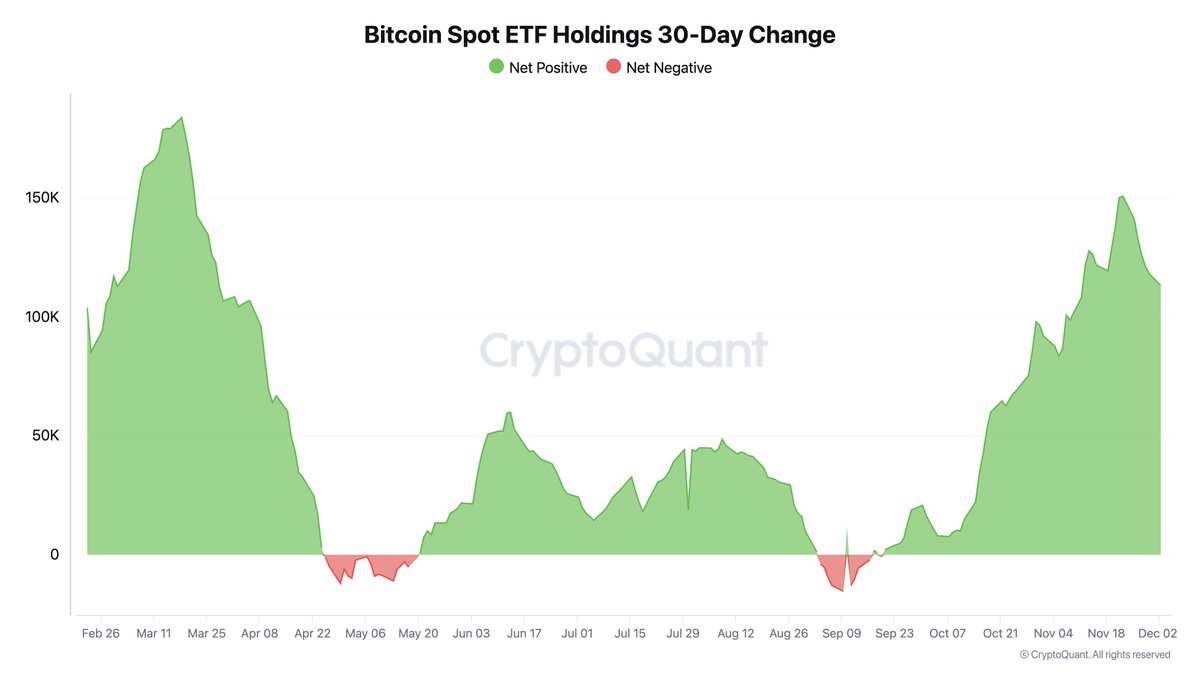

The analyst notes that spot market BTC ETFs have accumulated as much as is believed to have been mined by Bitcoin’s pseudonymous founder Satoshi Nakamoto in the early days of the cryptocurrency’s existence.

“Bitcoin spot ETFs now hold as much BTC as Satoshi Nakamoto (Patoshi).”

He also says that investor demand for the ETF product is returning to its historical high.

“Bitcoin ETF demand is as strong as at their initial approval this year.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Haliey Welch Releases HAWK Token

Bitcoin rebound and head to $100,000 target again

John Deaton Highlights 4 Key Actions New US SEC Must Take

Fed Chair Jerome Powell Is Correct: Bitcoin Is In Competition With Gold, Not The Dollar

Dogecoin Price Continues Trading Sideways But Bullish Pennant Says Get Ready For $1.30

Ripple executives praise Trump’s pro-crypto SEC head pick

Fed Chair Jerome Powell Compares Bitcoin To Gold

XRP, Stellar investors eye new DeFi token poised for 25x growth by new year

This Altseason Won’t Be What You Expected, According to CryptoQuant CEO – Here’s Why

Cardano Price Prediction as Trump’s New SEC Pick Could Be ADA Supporter

Heat Your Home While Earning Bitcoin With Heatbit

AMP price is rising as top crypto expert sees more upside

Monero Surges to Two-Year High of $211 as Privacy Coins Heat Up

Red Alert For Pi Network Price As A Risky Pattern Forms

AMP surged 60% amid increased whale interest

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential