Crypto Daybook Americas

Bitcoin (BTC) Dominance Tumbles as Altcoins Rumble: Crypto Daybook Americas

Published

4 months agoon

By

admin

(All times ET unless indicated otherwise)

By Omkar Godbole

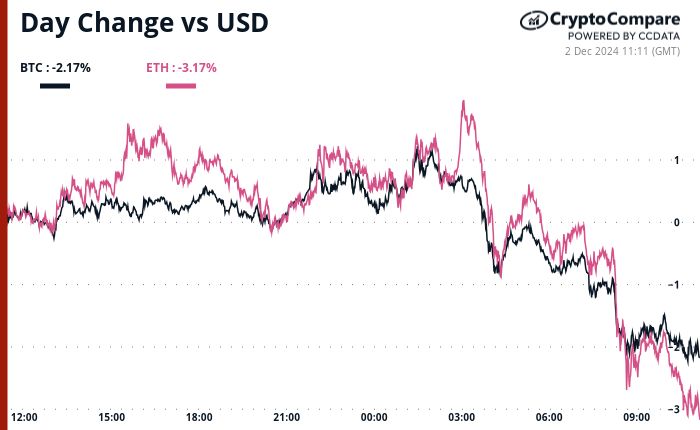

Bitcoin is starting the week on a despondent note, trading 2% lower at $95,000 amid risk-off sentiment in traditional markets. European stocks are falling and the euro is diving against the dollar as concern the French government is on the verge of collapse pushes its bond yields to levels matching those of debt-ridden Greece.

BTC’s decline follows a failed attempt to break through the multimillion-dollar wall of sell orders near $100,000 over the weekend and MicroStrategy’s Michael Saylor’s bitcoin presentation to Microsoft.

Still, bulls shouldn’t lose hope just yet, because the supply scarcity is real, with nearly 75% of bitcoin classified as illiquid and less than 14% in centralized exchanges, according to Andre Dragosch of Bitwise.

There’s chatter about countries adopting BTC as a strategic reserve, with a Middle Eastern nation potentially unveiling something big at the Abu Dhabi Finance Week that runs Dec. 9-12. The noise could get louder as the event draws close.

Ether’s technical analysis is particularly bullish, reminiscent of BTC’s positioning in mid-October, which was signaling a massive rally even before the U.S. elected crypto-friendly Donald Trump as president.

Market flows are on the same page. On Friday, net inflows into nine ether ETFs listed in the U.S. hit nearly $333 million. That’s even more than the BTC funds’ $320 million. Talk about the change in market leadership. In addition, ETH whales have snapped up ETH worth $5.7 billion in 20 days, according to IntoTheBlock.

Meanwhile, XRP has surged over 27% in just 24 hours, making it the third-largest cryptocurrency by market value and pushing Tether’s USDT to fourth place. The rally was accompanied by record volumes in South Korea, indicating strong retail participation. While a surge of 350% in four weeks may look overstretched, that’s not necessarily the case. XRP’s market value-to-realized value (MVRV) ratio, a popular metric modeled alongside the price-to-book ratio in equities and tracked by Santiment, has bounced only to its lifetime average, meaning prices need to rise more before we can start talking about overvaluation.

On the macro front, this week’s focus is the U.S. ISM non-manufacturing PMI on Wednesday, along with Friday’s payrolls and average hourly earnings report. If the employment component and wage growth exceed expectations, the dollar could get a lift while trimming Fed rate-cut bets. Additionally, there’s talk of more easing from China, though the impact of earlier measures has been downplayed. Stay alert!

What to Watch

- Crypto:

- Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

- Macro

- Dec. 2, 3:15 p.m.: Fed governor Christopher J. Waller gives a speech (“Economic Outlook”) at the American Institute for Economic Research (AIER) Monetary Conference, in Washington, D.C.

- Dec. 4, 4:00 a.m.: The Organisation for Economic Co-operation and Development (OECD) is set to release its latest Economic Outlook. Secretary-General Mathias Cormann and Chief Economist Álvaro Pereira present the findings during an event available online.

- Dec. 4, 10:00 a.m.: The Institute for Supply Management (ISM) releases its Services Purchasing Managers Index (PMI) for November. Est. 55.5 vs Prev. 56.0.

- Dec. 4, 1:45 p.m.: Fed Chair Jerome H. Powell takes part in a moderated discussion at The New York Times DealBook Summit in New York City.

- Dec. 4, 2:00 p.m.: The Fed releases the Beige Book, an economic summary used ahead of FOMC meetings.

- Dec. 6, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases the October Employment Report.

- Nonfarm Payrolls (NFP) Prev. 12K.

- Unemployment Rate Prev. 4.1%.

Token Events

- Token unlocks

- Ethena (ENA) to unlock 0.44% of circulating supply worth $10.75 million on Dec. 3.

- Cardano (ADA) to unlock 0.05% of circulating supply worth $20.18 million on Dec .4.

- Jito (JTO) to unlock 102.7% of circulating supply worth $464.1 million on Dec. 7.

- Governance votes

- SafeDAO opened preliminary discussions on allocating $50,000 toward creating a modular treasury management system. The discussion opened on Dec. 1.

- Arbitrum is voting on allocating $20,000 to research user behavior and subsequent development direction. The vote closes Dec. 5.

Conferences:

Token Talk

By Oliver Knight

HyperLiquid’s native token, HYPE, hit the market last week to become one of the most profitable airdrops of the year. It tripled in price over the weekend after debuting at a $1 billion market cap. The token is now trading at $8.57 after touching a record high of $9.79.

Unlike many other generic native tokens that offer utility through governance votes, HYPE can be staked to secure HyperBFT, the proof-of-stake consensus algorithm that powers the HyperLiquid exchange. It is also being used as the primary token for paying transaction fees on the network.

True to its ticker, the token garnered notable attention among crypto enthusiasts on X (the so-called Crypto Twitter community) with almost all of the well-known influencers mentioning, recommending and occasionally scrutinizing it.

The bull case for HYPE is in the tokenomics because supply is skewed toward the community as opposed to venture capitalists and early investors. As a result, it is trading more like a meme coin with a viral following without the risk of supply suppression by anyone who bought in a funding round at a cheaper price.

Quant trader Flood, who goes under the X account @ThinkingUSD, wrote that they were “adding huge” under $4 on the day of release. Since then trading terminal Insilico announced it was strategically accumulating a HYPE reserve, allocating 25% of weekly revenue.

Derivatives Positioning

- The three-month basis in BTC and ETH futures on offshore exchanges has softened from weekend highs, suggesting a moderation in bullish sentiment.

- Perpetual funding rates across the broader market are normalizing, which could pave the way for a more sustained price rally.

- In the options market, calls for BTC and ETH are still trading at a premium to puts. However, ETH calls are more expensive than BTC calls, indicating bullish expectations for ether relative to bitcoin.

- IBIT and MSTR’s high implied volatility has sparked interest in covered call strategies.

Market Movements:

- BTC is down 2.6% from 4 p.m. ET Friday to $94,939.66 (24hrs: -2%)

- ETH is down 0.5% at $3,579.86 (24hrs: -3%)

- CoinDesk 20 is up 3.6% to 3,641.28 (24hrs: 6+2.13%)

- Ether staking yield is unchanged at 3.07%

- BTC funding rate is at 0.017% (18.8% annualized) on Binance

- DXY is up 0.4% at 106.2

- Gold is down 0.6% at $2,635.20/oz

- Silver is up 1.2% to $30.26/oz

- Nikkei 225 closed +0.8% at 38,513.02

- Hang Seng closed 0.65% at 19,550.29

- FTSE is up 0.14% at 8,273.78

- Euro Stoxx 50 is 0.20% at 4,813.85

- DJIA closed on Friday +0.42% to 44,910.65

- S&P 500 closed +0.56% at 6,032.38

- Nasdaq closed +0.83% at 19,218.17

- S&P/TSX Composite Index closed +0.41% 25,648

- S&P 40 Latin America closed -1.58% at 2,328.18

- U.S. 10-year Treasury was unchanged at 4.2%

- E-mini S&P 500 futures are down 0.2% to 6039.50

- E-mini Nasdaq-100 futures are down 0.21% to 20949

- E-mini Dow Jones Industrial Average Index futures are down 0.12% at 44999

Bitcoin Stats:

- BTC Dominance: 56.78% (-0.04%)

- Ethereum to bitcoin ratio: 0.0379 (-0.37%)

- Hashrate (seven-day moving average): 744 EH/s

- Hashprice (spot): $62.14

- Total Fees: 20.1 BTC/ $1.9 million

- CME Futures Open Interest: 181,105 BTC

- BTC priced in gold: 36.2 oz

- BTC vs gold market cap: 10.32%

- Bitcoin sitting in over-the-counter desk balances: 421,809

Basket Performance

Technical Analysis

BTC’s dominance rate has slipped below an ascending trendline that tracks its year-to-date rise. The breakdown points to a continued investor preference for altcoins over bitcoin.

TradFi Assets

- MicroStrategy (MSTR): closed on Friday at $387.47 (-0.35%), down 2.17 % at $379.05 in pre-market.

- Coinbase Global (COIN): closed at $296.20 (-4.75%), up 0.22% at $296.84 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$25.61 (+1.83%)

- MARA Holdings (MARA): closed at $27.42 (+1.86%), down 1.42% at $27.03 in pre-market.

- Riot Platforms (RIOT): closed at $12.65 (+2.26%), down 1.03% at $12.52 in pre-market.

- Core Scientific (CORZ): closed at $17.88 (+0.96%), down 1.17% at $17.67 in pre-market.

- CleanSpark (CLSK): closed at $14.35 (+3.54%), up 0.14% at $14.37 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $29.14 (+4.18%).

- Semler Scientific (SMLR): closed at $57.02 (-6.6%), up 0.63% at $57.38 in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net inflow: $320 million

- Cumulative net inflows: $30.67 billion

- Total BTC holdings ~ 1.076 million.

Spot ETH ETFs

- Daily net inflow: $332.9 million

- Cumulative net inflows: $576.8 million

- Total ETH holdings ~ 3.047 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows the 30-day change in the fully diluted market capitalizations of tokens grouped by category.

- The store-of-value sector, comprising cryptocurrencies with BTC-like appeal, has seen an industry-beating 262% surge in four weeks.

- DeFi, meanwhile, has put in a below-average performance.

While You Were Sleeping

- XRP Replaces Tether as 3rd-Largest Cryptocurrency While BTC Faces $384M Sell Wall (CoinDesk): XRP has surged 375% in 30 days to $2.40, becoming the third-largest cryptocurrency by market cap. TikTok trends, speculation on a Ripple stablecoin and ETF hopes are fueling interest. Bitcoin, meantime, faces resistance near $100,000, with a $384 million wall of sell orders.

- Ether’s Price Chart Now Mirrors a Pattern That Foretold Bitcoin’s Record Rally (CoinDesk): Ethereum’s price chart shows a bullish breakout, ending an eight-month corrective trend and resuming its October 2023 uptrend from $1,500. Similar to Bitcoin’s October rally, it may trigger cascading gains. Supporting this are rising network activity and $332.9 million in net inflows to U.S. spot ether ETFs last Friday.

- Ethereum ETFs See Record $333M Inflows, Outpacing Bitcoin Funds as Catch-Up Trade Gains Momentum (CoinDesk): Ethereum ETFs in the U.S. saw record inflows Friday, totaling $332.9 million, led by BlackRock and Fidelity funds. Last week, ether outpaced bitcoin in ETF flows and price gains, hitting $3,700. Analysts attribute the resurgence to improving DeFi sentiment, anticipation of regulatory clarity and potential bottoming in the ETH-BTC ratio after three years.

- Establishment’s Takeover of Bitcoin Creates a New List of Risks (Bloomberg): Spot bitcoin ETFs hold over 1 million tokens, or 5% of the supply, rivaling Satoshi Nakamoto’s stash. Rising institutional demand, potential U.S. government stockpiles and supply constraints fuel price forecasts of high as $1 million per BTC. However, concentrated ownership and policy risks could create market vulnerabilities despite ongoing price surges.

- Yen Strengthens Past 150 per Dollar on BoJ Rate Rise Expectations (Financial Times): The yen has strengthened past 150 per dollar after stronger Tokyo inflation data fueled speculation of a December Bank of Japan interest-rate increase. Core CPI rose 2.2% year-on-year, driven by higher rice costs. Despite recent yen declines and $100 billion in interventions, a rapid yen appreciation could deter the bank from raising rates.

- Russia’s Central Bank Acknowledges ‘Short-Term’ Impact on Ruble Exchange Rate (The Moscow Times): On Friday, Russia’s Central Bank attributed the ruble’s drop to U.S. sanctions on Gazprombank while expressing confidence in its own actions, including halting foreign currency purchases and maintaining a 21% interest rate. Friday’s official rate was 109.57 per dollar and 116.14 per euro, with officials optimistic about currency stabilization.

In the Ether

Source link

You may like

CryptoPunks NFT Sells for $6 Million in Ethereum—At a $10 Million Loss

SEC drops suit against Helium for alleged securities violations

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

Crypto Daybook Americas

BTC’s Haven Claim Hit as U.S., China Play Tariff Chicken

Published

2 days agoon

April 8, 2025By

admin

By James Van Straten and Omkar Godbole (All times ET unless indicated otherwise)

One thing markets despise is uncertainty, and right now it’s coming from all corners of the globe, largely fueled by Trump’s tariffs.

Markets rebounded somewhat on Tuesday following Monday’s bloodbath in Asia and Europe, but it was more of a relief rally than a true recovery. At the heart of the conflict are the U.S. and China, both refusing to be the first to blink — even if it means prolonged uncertainty and pain for global markets.

As markets took a breather from the turmoil, crypto skeptics were quick to point out how bitcoin’s (BTC) safe haven narrative — bolstered by its resilience late last week — quickly unraveled on Monday when the price crashed to $75,000.

While that’s true, expecting the bitcoin price to remain unaffected was overly optimistic. During crises investors historically rush to cash, liquidating even traditional havens investments such as gold. Monday was no exception. Still, bitcoin has shown lower beta than U.S. equities since the tariff announcement.

In the bigger picture, bitcoin is holding up fairly well. The Nasdaq is down over 22% from its all-time high, while bitcoin is off by 28%. In previous episodes — like the yen carry-trade unwind in August 2024 or the COVID crash in March 2020 — bitcoin suffered far deeper relative losses.

Since the New York market closed on Wednesday, BTC has declined 8.4%, outperforming the S&P 500’s 10% drop and the Nasdaq’s 11% fall.

“What matters is that BTC’s beta to broader risk assets appears meaningfully lower in this sell-off than in previous ones. This suggests a growing recognition of bitcoin’s potential role as a non-sovereign store of value during periods of economic stress,” David Lawant, head of research at FalconX, said in an email.

Monday’s trading session also included an episode of “short-term madness” driven by false reports about a 90-day tariff delay. The markets spiked and then promptly crashed back down after the reports were refuted. Stay alert!

What to Watch

- Crypto:

- Macro

- April 9, 12:01 a.m.: The Trump administration’s higher individualized tariffs on imports from top U.S. trade deficit countries take effect.

- April 9, 8:00 a.m.: Mexico’s Instituto Nacional de Estadística y Geografía (INEGI) releases March consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.48%

- Core Inflation Rate YoY Prev. 3.65%

- Inflation Rate MoM Prev. 0.28%

- Inflation Rate YoY Prev. 3.77%

- April 9, 12:01 p.m.: China’s 34% retaliatory tariffs on U.S. imports take effect.

- April 9, 2:00 p.m.: The Fed releases minutes of the FOMC meeting held March 18-19.

- April 9. 8, 9:30 p.m.: China’s National Bureau of Statistics (NBS) releases March’s Consumer Price Index (CPI) report.

- Inflation Rate MoM Prev. -0.2%

- Inflation Rate YoY Est. 0% vs. Prev. -0.7%

- PPI YoY Est. -2.3% vs. Prev. -2.2%

- April 10, 10:00 a.m.: U.S. Senate Banking Committee hearing on the nomination of Michelle Bowman as Federal Reserve Vice Chair for Supervision. Livestream link.

- April 14: Salvadoran President Nayib Bukele will join U.S. President Donald Trump at the White House for an official working visit.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Unlocks

- April 8: Tensor (TNSR) to unlock 35.96% of its circulating supply worth $14.44 million.

- April 9: Movement (MOVE) to unlock 2.04% of its circulating supply worth $15.84 million.

- April 12: Aptos (APT) to unlock 1.87% of its circulating supply worth $51.01 million.

- April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating supply worth $21.18 million.

- April 15: Starknet (STRK) to unlock 4.37% of its circulating supply worth $15.79 million.

- April 16: Arbitrum (ARB) to unlock 2.01% of its circulating supply worth $25.22 million.

- Token Listings

Conferences

Token Talk

By Shaurya Malwa

- Fartcoin (FART) jumped 30% to extend monthly gains over 130%.

- The absurdly-named token extended a multiday run the broader crypto market staged a relief rally, displaying signs of steady buying demand from traders.

- Speculators keep an eye on continual strength in memecoins, especially when they tend to buck market trends, because the tokens tend to jump higher after a sell-off in the market. This can create possible profit opportunities for short-term traders, with some eyeing a move higher for the token in coming weeks.

FARTCOIN is giving me similar vibes to $PEPE when it ranged around $300m to $500m before its rapid, explosive move to $3 billion market cap last year

the relative strength and volume on this is insane ngl

— Unipcs (aka ‘Bonk Guy’)

(@theunipcs) April 8, 2025

- FART, among some crypto circles, is a symbol of the absurd and a light-hearted rebellion against the grim financial forecasts. It holds no intrinsic value, but enjoys a cult following — possibly driving buying demand even as the market falls.

Derivatives Positioning

- Bitcoin CME futures basis is holding firm above an annualized 5% amid the macro turmoil.

- CME options skew, however, is showing bias for downside protection, or puts.

- Together, both metrics show cautious sentiment without signaling panic, according to Thomas Erdösi, head of product at CF Benchmarks.

- On Deribit, BTC and ETH put biases have moderated, but BTC implied volatility term structure remains in backwardation, indicating persistent fears of wild price swings in the short-term.

- In BTC options, the $70K put is now the most popular strike, boasting a notional open interest of $957 million. That’s a 180-degree shift from the bias for $100K-$120K strike calls early this year.

- Most of the top 25 coins, excluding TRX, HBAR, LINK and DOT, have seen a drop in perpetual futures open interest in the past 24 hours.

Market Movements

- BTC is unchanged from 4 p.m. ET Monday at $78,894.34 (24hrs: +2.61%)

- ETH is down 0.32% at $1,514.40 (24hrs: +5.22%)

- CoinDesk 20 is up 0.8% at 2,268.01 (24hrs: +4.76%)

- Ether CESR Composite Staking Rate is up 77 bps at 3.69%

- BTC funding rate is at 0.0049% (5.3118% annualized) on Binance

- DXY is unchanged at 103.32

- Gold is up 2.19% at $3015.9/oz

- Silver is up 1.9% at $30.07/oz

- Nikkei 225 closed +6.03% at 33,012.58

- Hang Seng closed +1.51% at 20,127.68

- FTSE is up 2.1% at 7,863.79

- Euro Stoxx 50 is up 1.36% at 4,719.66

- DJIA closed on Monday -0.91% at 37,965.60

- S&P 500 closed -0.23% at 5,062.25

- Nasdaq closed +0.1% at 15,603.26

- S&P/TSX Composite Index closed -1.44% at 22,859.50

- S&P 40 Latin America closed -2.94% at 2,227.14

- U.S. 10-year Treasury rate is down 2 bps at 4.16%

- E-mini S&P 500 futures are down 1.58% at 5,178.00

- E-mini Nasdaq-100 futures are up 1.35% at 17,799.50

- E-mini Dow Jones Industrial Average Index futures are up 2% at 38,930.00

Bitcoin Stats:

- BTC Dominance: 63.46 (-0.11%)

- Ethereum to bitcoin ratio: 0.01980 (0.97%)

- Hashrate (seven-day moving average): 902 EH/s

- Hashprice (spot): $40.50

- Total Fees: 6.59BTC / $510,645

- CME Futures Open Interest: 137,695 BTC

- BTC priced in gold: 26.2 oz

- BTC vs gold market cap: 7.43%

Technical Analysis

- The chart shows monthly activity in the U.S. 10-year Treasury yield since the 1980s.

- While the crypto community is hoping for a return to the zero-yield era, the chart suggests otherwise, revealing a long-term bullish shift in rates.

- The trend change is evident from the key 50-, 100- and 200-month simple moving averages — which are aligned bullishly one above the other for the first time since the 1980s.

- Elevated rates might be the new normal.

Crypto Equities

- Strategy (MSTR): closed on Monday at $268.14 (-8.67%), up 1.47% at $272.09 in pre-market

- Coinbase Global (COIN): closed at $157.28 (-2.04%), up 1.72% at $159.98

- Galaxy Digital Holdings (GLXY): closed at C$12.34 (-8.8%)

- MARA Holdings (MARA): closed at $11.26 (-0.35%), up 2.04% at $11.49

- Riot Platforms (RIOT): closed at $7.11 (-0.42%), up 0.28% at $7.13

- Core Scientific (CORZ): closed at $7.02 (-2.23%), up 1.85% at $7.15

- CleanSpark (CLSK): closed at $7.43 (+1.5%), up 0.67% at $7.48

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.41 (+0.73%)

- Semler Scientific (SMLR): closed at $34.15 (0.89%), down 1.02% at $33.80

- Exodus Movement (EXOD): closed at $41.84 (-6.25%), down 5.16% at $39.68

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$103.9 million

- Cumulative net flows: $36.07 billion

- Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

- Daily net flow: $0.0

- Cumulative net flows: $2.38 billion

- Total ETH holdings ~ 3.37 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart by CryptoQuant shows daily net flow of BTC from wallets linked with miners.

- On Monday, these wallets registered a cumulative net outflow of 1,627 BTC, the most since Dec. 24.

- According to Bloomberg, the Trump tariffs have disrupted the bitcoin mining industry.

While You Were Sleeping

In the Ether

Source link

Breaking News

Risk-Off Vibe Lifts BTC Price With CPI Data Looming

Published

4 weeks agoon

March 12, 2025By

admin

By James Van Straten (All times ET unless indicated otherwise)

Macroeconomic factors continue to drive bitcoin’s (BTC) short-term price volatility as it holds steady above $80,000, with a wave of significant news emerging over the past 24 hours.

Still, there’s a risk-off feeling in the air as the divergence between bitcoin and the broader crypto market grows. Bitcoin dominance has surged to 62%, approaching a year-to-date high, while the ether-to-bitcoin (ETH-BTC) ratio has turned negative on a four-year compound annual basis, meaning ETH is underperforming.

Meanwhile, Trump’s trade wars persist as another concern reining in optimism in the market. That’s not just with Canada, but also in the form of metal tariffs, prompting retaliatory measures from the European Union.

One of the most intriguing developments comes from Canada, where newly appointed Prime Minister Mark Carney has filed to sell U.S. dollar bonds. While the size of the sale remains undisclosed, it’s worth noting the country is the sixth-largest holder of U.S. Treasuries, possessing $379 billion as of the end of 2024. If the sale proceeds, it could put upward pressure on yields, which is the opposite of what Trump wants.

The Treasury yield narrative is paramount because roughly $9 trillion worth of U.S. debt is set to mature or require refinancing this year alone. This is one of the key reasons why the U.S. administration is eager to bring down Treasury yields.

More immediately, market attention is turning to today’s Consumer Price Index (CPI) report, with risk-asset bulls hoping for a softer inflation print. The S&P 500 is hovering around correction territory, down nearly 10%. If inflation comes in hotter than expected, risk assets could face further downside. Stay Alert!

What to Watch

- Crypto:

- Macro

- March 12, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases February consumer price inflation data.

- Inflation Rate MoM Est. 1.3% vs. Prev. 0.16%

- Inflation Rate YoY Est. 5% vs. Prev. 4.56%

- March 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February consumer price inflation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

- Core Inflation Rate YoY Est. 3.2% vs. Prev. 3.3%

- Inflation Rate MoM Est. 0.3% vs. Prev. 0.5%

- Inflation Rate YoY Est. 2.9% vs. Prev. 3%

- March 12, 9:45 a.m.: The Bank of Canada announces its interest-rate decision followed by a press conference (livestream link) 45 minutes later.

- Policy Interest Rate Est. 2.75% vs. Prev. 3%

- March 12, 12:00 p.m.: Russia’s Federal State Statistics Service releases February consumer price inflation data.

- Inflation Rate MoM Est. 0.8% vs. Prev. 1.2%

- Inflation Rate YoY Est. 10.1% vs. Prev. 9.9%

- March 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February producer price inflation data.

- Core PPI MoM Est. 0.3% vs. Prev. 0.3%

- Core PPI YoY Est. 3.6% vs. Prev. 3.6%

- PPI MoM Est. 0.3% vs. Prev. 0.4%

- PPI YoY Est. 3.3% vs. Prev. 3.5%

- March 12, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases February consumer price inflation data.

- Earnings (Estimates based on FactSet data)

Token Events

- Governance votes & calls

- Unlocks

- March 12: Aptos (APT) to unlock 1.93% of circulating supply worth $58.26 million.

- March 14: Starknet (STRK) to unlock 2.33% of its circulating supply worth $10.67 million.

- March 15: Sei (SEI) to unlock 1.19% of its circulating supply worth $10.35 million.

- March 16: Arbitrum (ARB) to unlock 2.1% of its circulating supply worth $31.53 million.

- March 18: Fasttoken (FTN) to unlock 4.66% of its circulating supply worth $79.60 million.

- March 21: Immutable (IMX) to unlock 1.39% of circulating supply worth $12.70 million.

- Token Listings

- March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

Token Talk

By Shaurya Malwa

- The freshly issued BMT tokens of Bubblemaps, a crypto transparency and on-chain analysis tool, are down more than 50% since going live on Tuesday.

- Bubblemaps uses clustering to group wallet addresses into bubbles, revealing whale concentrations, insider control or suspicious patterns (e.g. a deployer with 76% of supply), helping investors assess risks through visual ownership maps.

- BMT can be used to access an “Intel Desk” for community-driven scam investigations and premium analytics features, and participate in governance.

- People are slamming BMT for a nearly 90% supply concentration in one wallet, a mintable contract risking inflation, an elitist airdrop excluding many, and unlocked liquidity raising rug-pull fears, which is rather ironic for a transparency-focused project.

Call me crazy but I don’t think the $BMT is going to end well.

CA tweeted 13 mins ago.

Dexscreener shows first token launched with that CA 14 hrs ago.

10+ scam tokens using same CA.

Insiders holding insane amounts of supply.

Majority of the volume coming from new wallets. pic.twitter.com/5KLksCZyYS

— Cashper

(@NotRealCashper) March 11, 2025

Derivatives Positioning

- Cumulative open interest in ETH standard and perpetual futures has risen to 9.75 million ETH, the highest since Feb. 3. The count has increased from 8.4 million ETH four weeks ago, which shows traders have been selling into the falling market.

- Open interest in BTC perp and standard futures remains light, with funding rates marginally positive. SOL, ADA, TRX and LINK still see negative perpetual funding rates.

- Deribit-listed BTC and ETH options continue to exhibit a bias for puts out to May expiry, with meaningful constructive outlook for calls emerging from the third quarter.

- Overnight block flows featured selling higher strike BTC and ETH calls and purchase of short-tenor puts.

Market Movements:

- BTC is down 0.55% from 4 p.m. ET Tuesday at $82,577.14 (24hrs: +0.87%)

- ETH is down 2.6% at $1,892.41 (24hrs: -1.58%)

- CoinDesk 20 is down 1% at 2,556.70 (24hrs: +0.52%)

- Ether CESR Composite Staking Rate is up 32 bps at 3.43%

- BTC funding rate is at 0.007% (2.54% annualized) on Binance

- DXY is down 0.31% at 103.52

- Gold is unchanged at $2,914.29/oz

- Silver is up 0.69% at $33.01/oz

- Nikkei 225 closed unchanged at 36,819.09

- Hang Seng closed -0.76 at 23,600.31

- FTSE is up 0.43% at 8,532.17

- Euro Stoxx 50 is up 1.19% at 5,373.08

- DJIA closed on Tuesday -1.14% at 41,433.48

- S&P 500 closed -0.76% at 5,572.07

- Nasdaq closed -0.18% at 17,436.10

- S&P/TSX Composite Index closed -0.54% at 24,248.20

- S&P 40 Latin America closed +0.44% at 2,307.52

- U.S. 10-year Treasury rate is unchanged at 4.28%

- E-mini S&P 500 futures are up 0.54% at 5,607.25

- E-mini Nasdaq-100 futures are up 0.67% at 19,529.25

- E-mini Dow Jones Industrial Average Index futures are up 0.37% at 41,627.00

Bitcoin Stats:

- BTC Dominance: 62.13 (-0.16%)

- Ethereum to bitcoin ratio: 0.02290 (-0.06%)

- Hashrate (seven-day moving average): 815 EH/s

- Hashprice (spot): $46.1

- Total Fees: 6.03 BTC / $490,764

- CME Futures Open Interest: 142,725 BTC

- BTC priced in gold: 28.3 oz

- BTC vs gold market cap: 8.04%

Technical Analysis

- The dollar index, which represents the greenback’s exchange rate against a basket of fiat currencies, has dropped below the 61.8% Fibonacci retracement support of the late September to January rally.

- The breakdown means a potential soft U.S. CPI release could easily send the index sliding to 102.31, the 78.6% retracement support.

- A deeper slide in the dollar could bode well for risk assets, including BTC.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $260.59 (+8.91%), down 0.58% at $259.09 in pre-market

- Coinbase Global (COIN): closed at $191.69 (+6.95%), unchanged in pre-market

- Galaxy Digital Holdings (GLXY): closed at C$17.27 (-1.09%)

- MARA Holdings (MARA): closed at $13.32 (-0.67%), down 0.68% at $13.23

- Riot Platforms (RIOT): closed at $7.72 (+2.12%), down 0.26% at $7.70

- Core Scientific (CORZ): closed at $8.63 (+7.74%), down 0.46% at $8.59

- CleanSpark (CLSK): closed at $8.26 (+3.51%), down 0.73% at $8.20

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.08 (+4.14%)

- Semler Scientific (SMLR): closed at $32.80 (+0.18%)

- Exodus Movement (EXOD): closed at $24.50 (-0.41%), up 0.94% at $24.73

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$371 million

- Cumulative net flows: $35.47 billion

- Total BTC holdings ~ 1,121 million.

Spot ETH ETFs

- Daily net flow: -$21.6 million

- Cumulative net flows: $2.66 billion

- Total ETH holdings ~ 3.571 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows daily trading volume on Hyperliquid, the leading perpetual-focused decentralized exchange.

- Despite the market swoon, volumes have held remarkably steady, contrasting the sharp slowdown on other avenues like Solana’s Raydium.

While You Were Sleeping

In the Ether

Source link

Crypto Daybook Americas

FX Markets Signal BTC Upside as Tariffs Dominate Sentiment

Published

2 months agoon

February 4, 2025By

admin

By Omkar Godbole (All times ET unless indicated otherwise)

If you follow financial markets, you’ve probably come across the terms “risk-on” and “risk-off.” Now we seem to be entering a new era of “tariffs on/tariffs off.”

In a risk-on environment, growth-sensitive assets like stocks and cryptocurrencies tend to rise due to expectations of economic expansion or accommodative monetary policy. Conversely, risk-off situations reflects a lack of investor confidence, leading to sell-offs and a preference for safer assets.

But this week, President Trump’s tariffs announcement have single-handedly guided markets. Early Monday, bitcoin (BTC) plummeted to nearly $91,000 as Canada and Mexico retaliated against Trump’s tariffs. That was “tariffs on” trading.

Later, it rebounded above $100,000 after Trump paused the Mexico tariffs for the 30 days and announced the creation a sovereign wealth fund, which generated hopes of potential investments in BTC. That was “tariffs off.”

The bullish momentum ran out of steam early Tuesday as China retaliated against Trump’s import tax, reviving “tariffs on” trading. BTC fell over 3% to $98,000, dragging altcoins lower. Nasdaq futures dropped over 0.5% and the dollar drew haven bids.

Bitcoin and the broader crypto market will likely rebound should Trump announce an 11th-hour deal with China, just as he did with Mexico and Canada on Monday. Foreign-exchange market activity suggests that’s likely. The AUD/CAD is down just 0.3% for the day, a sign traders don’t expect a prolonged tariff war between the U.S. and China. (The Australian dollar is widely seen as a proxy for China).

“A cross like AUD/CAD should trade sharply lower in this situation given Canada has dodged tariffs and China has not, but it is only 0.5% lower on the day. That signals markets are pricing in a good chance that the US and China will also strike a deal and delay tariffs,” ING said in a note to clients.

That said, you can never be sure of Trump. So, expect heightened volatility and stay alert!

What to Watch

- Crypto:

- Macro

- Feb. 4, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December’s Job Openings and Labor Turnover Survey (JOLTS) report.

- Job Openings Est. 7.88M vs. Prev. 8.098M

- Job Quits Prev. 3.065M

- Feb. 4, 2:30 p.m.: White House AI and Crypto Czar David Sacks, along with four congressional leaders, hold a press conference on digital assets cooperation. Livestream link.

- Feb. 4, 7:30 p.m.: Fed Vice Chair Philip N. Jefferson is giving a speech titled “U.S. Economic Outlook and Monetary Policy.”

- Feb. 5, 9:45 a.m.: S&P Global releases January’s US Services PMI (Final) report.

- Feb. 5, 10:00 a.m.: The Institute for Supply Management (ISM) releases January’s Services ISM Report on Business.

- Services PMI Est. 54.3 vs. Prev. 54.1

- Services Business Activity Prev. 58.2

- Services Employment Prev. 51.4

- Services New Orders Prev. 54.2

- Services Prices Prev. 64.4

- Feb. 5, 10:00 a.m.: U.S. Senate Banking Committee hearing on “Investigating the Real Impacts of Debanking in America,” featuring four witnesses including Nathan McCauley, co-founder and CEO of Anchorage Digital. Livestream link.

- Feb. 5, 3:00 p.m.: Fed Governor Michelle W. Bowman is giving a speech titled “Brief Economic Update and Bank Regulation.”

- Feb. 4, 10:00 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December’s Job Openings and Labor Turnover Survey (JOLTS) report.

- Earnings

- Feb. 5: MicroStrategy (MSTR), post-market, $-0.09

- Feb. 10: Canaan (CAN), pre-market, $-0.08

- Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

- Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

- Feb. 12: Hut 8 (HUT), pre-market, break-even

- Feb. 12: IREN (IREN), post-market

- Feb. 12 (TBA): Metaplanet (TYO:3350)

- Feb. 12: Reddit (RDDT), post-market, $0.25

Token Events

- Governance votes & calls

- Compound DAO is discussing the creation of Morpho-powered lending vaults on Polygon curated by Gauntlet. Polygon Labs is set to offer $1.5 million in POL, matched with $1.5 million in COMP to incentivize usage.

- Arbitrum DAO is voting on whether to transfer 1,885 ETH in Nova transaction fees to its Treasury through the modernized fee collection infrastructure outlined in the ova Fee Router Proposal.

- Aave DAO is nearing the end of a vote on deploying Aave v3 on Sonic, a new layer-1 Ethereum Virtual Machine (EVM) blockchain with a high transaction throughput.

- Lido DAO is discussing distributing rewards to LDO stakers based on the protocol’s net revenue, as well as the use of a percentage of its annual revenue to buyback LDO tokens.

- Feb. 4, 1 p.m.: TRON DAO and CryptoQuant to host a network review diving into performance, adoption and key metrics.

- Feb. 4, 12 p.m.: Stellar to host its Q4 quarterly review.

- Unlocks

- Feb. 5: XDC Network (XDC) to unlock 5.36% of circulating supply worth $81.58 million.

- Feb. 5: Kaspa (KAS) to unlock 0.67% of circulating supply worth $17.29 million.

- Feb. 9: Movement (MOVE) to unlock 2.17% of circulating supply worth $31.60 million.

- Feb. 10: Aptos (APT) to unlock 1.97% of circulating supply worth $68.20 million.

- Token Launches

- Feb. 4: Vine (VINE), Bio Protocol (BIO), Swarms (SWARMS), and Sonic SVM (SONIC) to be listed on Kraken.

Conferences:

Token Talk

By Shaurya Malwa

- Entities behind President Donald Trump’s memecoin TRUMP amassed nearly $100 million in trading fees within two weeks of its Jan. 17 introduction.

- The fees were generated on Meteora, a DeFi exchange where the initial TRUMP coins were traded. Here, fees are charged for liquidity provision, which benefits the coin’s creators by allowing them to earn from trading activities indefinitely, according to Reuters.

- A marketwide drop on Monday sent the token spiraling further down, bringing losses from the peak to a staggering 75%.

- The president continues to endorse the token on his social media platform, Truth Social, where he posted “I LOVE $TRUMP!!” alongside a link to purchase the token over the weekend.

Derivatives Positioning

- Perpetual funding rates for SOL, DOGE, ADA, LINK and AVAX remain negative, indicating a bias for short positions. These coins may see outsized gains on the back of a short-squeeze should the market environment flip back to “tariffs off” during the American hours.

- Deribit’s ETH volatility index has retreated to 70% from above 100%. BTC’s volatility has faded from Monday’s spike to 61%.

- The perpetual futures open interest-adjusted cumulative volume delta for most large-cap tokens, excluding TRX, is negative for the past 24 hours. That raises a question on the sustainability of the price recovery.

- Deribit’s BTC, ETH options expiring this month continue to exhibit downside fears. The broader bias for bullish calls remains intact.

- Block flows featured a bear call spread in SOL, a calendar spread in BTC and long positions in the ETH $3K and $3.2K calls.

Market Movements:

- BTC is down 1.85% from 4 p.m. ET Monday at $99,347.23 (24hrs: +4.4%)

- ETH is up 2.3% at $2,777.08 (24hrs: +7.45%)

- CoinDesk 20 is down 2.21% at 3,154.76 (24hrs: +5.33%)

- CESR Composite Staking Rate is up 88 bps at 3.91%

- BTC funding rate is at 0.0035% (3.76% annualized) on Binance

- DXY is down 0.39% at 108.57

- Gold is down 0.16% at $2,814.16/oz

- Silver is up 0.18% at $31.65/oz

- Nikkei 225 closed +0.72% at 38,798.37

- Hang Seng closed +2.83% at 20,789.96

- FTSE is down 0.12% at 8,572.97

- Euro Stoxx 50 is up 0.13% at 5,224.71

- DJIA closed on Monday -0.28% at 44,421.91

- S&P 500 closed -0.76% at 5,994.57

- Nasdaq closed -1.2% at 19,391.96

- S&P/TSX Composite Index closed -1.14% at 25,241.76

- S&P 40 Latin America closed +0.25% at 2,376.48

- U.S. 10-year Treasury is up 2 bps at 4.58%

- E-mini S&P 500 futures are down 0.16% at 6012.75

- E-mini Nasdaq-100 futures are unchanged at 21,398.50

- E-mini Dow Jones Industrial Average Index futures are down 0.21% at 44,472.00

Bitcoin Stats:

- BTC Dominance: 61.70 (1.06%)

- Ethereum to bitcoin ratio: 0.02750 (-3.27%)

- Hashrate (seven-day moving average): 833 EH/s

- Hashprice (spot): $57.5

- Total Fees: 6.1 BTC / $592,574

- CME Futures Open Interest: 164,925 BTC

- BTC priced in gold: 35.0 oz

- BTC vs gold market cap: 9.94%

Technical Analysis

- Bitcoin’s daily chart shows a classic “stair step” bull run, characterized by price rises followed by consolidations, representing accumulation periods.

- The latest consolidation between $90,000 and $110,000 is the third such pattern since 2023. A breakout would mean continuation of the uptrend.

- Note, however, that gains seen after the second consolidation between $50,000 and $70,000 were significantly less than those seen after the first breakout in late 2023.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $347.09 (+3.67%), down 1.35% at $342.40 in pre-market.

- Coinbase Global (COIN): closed at $284.41 (-2.38%), down 0.47% at $283.08 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$28.02 (-1.62%)

- MARA Holdings (MARA): closed at $17.95 (-2.13%), down 1.23% at $17.73 in pre-market.

- Riot Platforms (RIOT): closed at $11.99 (+0.93%), down 0.58%% at $11.92 in pre-market.

- Core Scientific (CORZ): closed at $12.33 (+0.49%), down 1.05% at $12.20 in pre-market.

- CleanSpark (CLSK): closed at $10.59 (+1.44%), down 0.85% at $10.50 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.69 (+0.62%).

- Semler Scientific (SMLR): closed at $50.46 (-2.89%).

- Exodus Movement (EXOD): closed at $59.59 (+19.47%), unchanged in pre-market.

ETF Flows

Spot BTC ETFs:

- Daily net flow: -$234.4 million

- Cumulative net flows: $40.26 billion

- Total BTC holdings ~ 1.177 million.

Spot ETH ETFs

- Daily net flow: $83.6 million

- Cumulative net flows: $2.84 billion

- Total ETH holdings ~ 3.648 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

- Google trends for the worldwide search query “how to buy crypto” shows retail investor interest in digital assets has cooled since hitting a peak of 100 last month.

While You Were Sleeping

- Ethereum Raises Gas Limits for First Time Since 2021, Boosting ETH Appeal (CoinDesk): Ethereum’s gas limit rose to nearly 32 million units, which should help increase the network’s throughput and potentially lower transaction costs during periods of high demand.

- Lending Protocol Aave Processes $200M in Liquidation Without Adding to Bad-Debt Burden (CoinDesk): Aave processed $210 million in liquidations on Monday, the most since August, without adding new debt. Strong risk controls reduced existing liabilities by 2.7% amid market volatility.

- TRON, Movement Labs Deny ‘Token Swap’ Deal for World Liberty Financial Inclusion (CoinDesk): Representatives from TRON and Movement Labs rejected allegations of token swap deals for treasury inclusion with World Liberty Financial (WLFI).

- Yuan Extends Loss With China Proxies as US Trade War Reignites (Bloomberg): China’s retaliatory tariffs on U.S. coal, LNG, oil and agricultural equipment spooked Asia-Pacific markets, pressuring offshore Chinese yuan. Talks between the U.S. and China could help deescalate the trade war.

- Stocks Erase Gains After China Retaliates Against U.S. (Financial Times): Shortly after Trump’s 10% tariff on all Chinese goods took effect on Tuesday, Beijing hit back by imposing import tariffs on various U.S. goods, causing global stocks to give back some of Monday’s gains.

- Euro Stays Weaker Amid Tariff Risks (The Wall Street Journal): Danske Bank’s Stefan Mellin says Trump’s threats of tariffs on EU imports are likely to keep the euro under pressure over the next several weeks even though these might just be “primarily a negotiating tool.”

In the Ether

Source link

CryptoPunks NFT Sells for $6 Million in Ethereum—At a $10 Million Loss

SEC drops suit against Helium for alleged securities violations

Tokenized Gold Nears $2B Market Cap as Tariff Fears Spark Safe Haven Trade

Ross Ulbricht To Speak At Bitcoin 2025

Solana Eyes $200 Target As It Gains Momentum – Recovery Could Mirror 3-Month Downtrend

BTC-denominated insurance firm meanwhile secures $40m in VC funding

‘You Want To Own the Most Hated Thing’ – Arthur Hayes Says Ethereum Set To Outrun Solana As Memecoin Craze Fades

Crypto Braces for a Hidden $4.5 Trillion Catalyst for Bitcoin, Ethereum, Cardano, XRP Price

Block Agrees to $40M NYDFS Penalty Over Lackluster Compliance Program

Top Bitcoin miners produced nearly $800M of BTC in Q1 2025

Tariffs, Trade Tensions May Be Positive for Bitcoin (BTC) Adoption in Medium Term: Grayscale

The U.S. Tariff War With China Is Good For Bitcoin Mining

Dogecoin Bull Div Plays Out, Analyst Maps Next Price Targets

Web3 search engine can reshape the internet’s future

Billionaire Ray Dalio Says He’s ‘Very Concerned’ About Trump Tariffs, Predicts Worldwide Economic Slowdown

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x