cryptocurrency

Copper adds custody support for USDC on Sui

Published

4 months agoon

By

admin

Copper, a digital assets custody and collateral management platform, has integrated support for the USDC stablecoin on Sui.

The platform announced on Dec. 5 that USDC (USDC), a U.S. dollar-pegged stablecoin, is now available on Sui (SUI) via its infrastructure. This makes Copper one of the first digital asset custodians to support the stablecoin on the layer-1 blockchain.

Circle enabled native USDC on Sui mainnet in October, bringing the stablecoin’s liquidity to developers and users on the Move programming language-based blockchain network. Native support eliminates the need for bridged USDC, enabling businesses to build decentralized applications across use cases such as decentralized finance, gaming, decentralized physical infrastructure networks and ecommerce.

In its announcement, Copper highlighted that support for the stablecoin on Sui’s mainnet and layer-2 assets will provide users with streamlined USDC usage.

“Support USDC on the Sui blockchain is a notable step in strengthening our partnership with Sui. With much more to unlock across the stablecoin and Real-World Asset spaces, we’re committed to connecting the institutional finance world to on-chain opportunities on the Sui Network,” Adam VandenBoogaard, co-head of revenue Americas at Copper noted.

The price of Sui has surged to a new all-time high amid growth across its DeFi, DePIN, and gaming ecosystems. On Dec. 5, the SUI token reached a record $4.40, reflecting total gains of 110% in the past month and over 560% in the past year.

Meanwhile, its total value locked has soared past $2 billion – DeFiLlama data shows it’s at $2.2 billion at the time of writing. Jameel Khalfan, head of ecosystem development at Sui Foundation said Copper’s collaboration will only boost the network further.

“Adding support for this asset within Copper’s enterprise-grade custody services will only add to the astounding growth of Sui as a destination for DeFi users,” Jameel noted.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

Altcoin

Dogecoin could rally in double digits on three conditions

Published

11 hours agoon

March 28, 2025By

admin

Dogecoin rallied nearly 10% this week, resilient in the face of the U.S. President Donald Trump’s tariff war and macroeconomic developments. Most altcoins have suffered the negative impact of Trump’s announcements, DOGE continues to gain, back above $0.2058 for the first time in nearly two weeks.

Dogecoin rallies in double-digits, what to expect from DOGE price?

Dogecoin (DOGE) hit a near two-week peak at $0.20585 on Wednesday, March 26. In the past seven days, DOGE rallied nearly 10%, even as altcoins struggled with recovery in the ongoing macroeconomic developments in the U.S.

The largest meme coin in the crypto market could continue its climb, extending gains by nearly 11%, and testing resistance at the lower boundary of the imbalance zone between $0.24040 and $0.21465.

The upper boundary of the zone at $0.24040 is the next key resistance for DOGE, nearly 24% above the current price.

Two key momentum indicators, the RSI and MACD support a bullish thesis for Dogecoin. RSI is 52, above the neutral level. MACD flashes green histogram bars above the neutral line, meaning there is an underlying positive momentum in Dogecoin price trend.

Dogecoin on-chain analysis

On-chain analysis of the largest meme coin shows that the number of holders of DOGE is on the rise. If Dogecoin’s number of holders keep climbing or steady in the coming week, the meme coin could remain relevant among traders.

The network realized profit/loss metric shows that DOGE holders have realized profits on a small scale. Typically, large scale profit-taking increases selling pressure on the meme coin and could negatively impact price.

The metric supports a bullish thesis for DOGE in the coming week. Dogecoin’s active address count has been steady since mid-March, another sign of the meme coin’s resilience.

DOGE derivatives analysis and price forecast

The analysis of Dogecoin derivatives positions across exchanges shows that open interest is recovering from its March 12 low. Open Interest is $1.98 billion, as Dogecoin trades at $0.19. Coinglass data shows a steady climb in OI in the chart below.

The total liquidations data shows $4.29 million in long positions were liquidated on March 27. Sidelined buyers need to watch liquidations data and prices closely before adding to their derivatives position.

The long/short ratio on top exchanges, Binance and OKX exceeds 1, meaning derivatives traders are betting on an increase in DOGE price.

When technical analysis and derivatives data is combined, it is likely Dogecoin price could test resistance at $0.21465 next week, if spot prices follow the cue of derivatives traders.

What to expect from DOGE

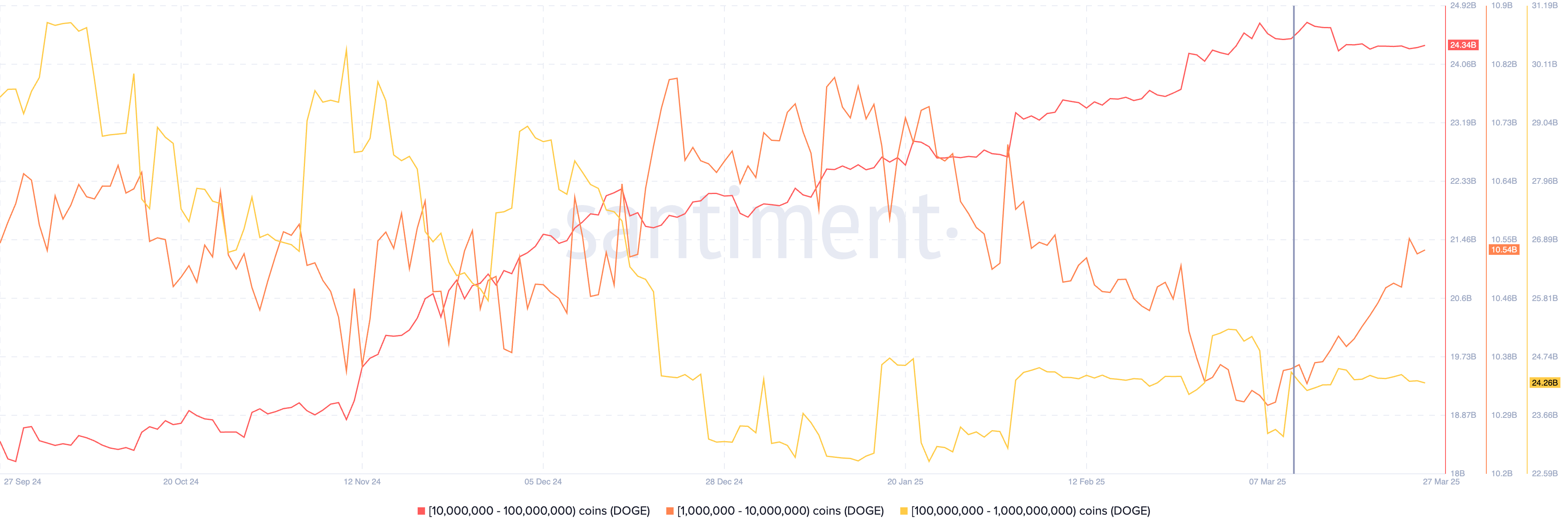

Dogecoin wallets holding between 1 million and 10 million DOGE tokens added to their portfolio consistently between March 10 and 27, while the other two categories, holding between 10 million and 100 million DOGE and 100 million and 1 billion DOGE tokens held nearly steady in the same timeframe.

The data from Santiment shows that DOGE’s traders holding between 1 million and 10 million tokens are rapidly accumulating, even as the token’s price rises. This supports demand for DOGE and a bullish thesis for the meme coin.

Dogecoin ETF and DOGE catalysts

DOGE holders are closely watching developments in Bitwise’s Dogecoin ETF filing with the SEC. The ETF filing is an effort to legitimize the meme coin as an investment category for institutional investors, as DOGE price holds steady among altcoins rapidly eroding in value.

Bitcoin flashcrashes dragged Dogecoin down with it, to a small extent, however the meme token recovered each time and consistent gains could signal an end to DOGE’s multi-month downward trend.

Other key catalysts for Dogecoin are positive updates in crypto regulation, passage of the stablecoin bill in the Congress, and demand for DOGE among whales and large wallet investors.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

cryptocurrency

Crypto scammers nabbed in India for $700k fraud posing as a Japanese exchange

Published

1 day agoon

March 27, 2025By

admin

Law enforcement in India has arrested five suspects who allegedly duped a businessman out of roughly $700,000 via a fake cryptocurrency trading platform.

According to local media, the five suspects, including one woman, were taken into custody following an investigation by the cybercrime wing of Odisha’s Crime Branch.

The accused reportedly ran a scam using a bogus trading app called ZAIF, where they promised massive returns of up to 200% on digital currency investments. The trading platform was promoted as being based in Japan.

It’s worth noting that ZAIF is the name of a legitimate Japanese cryptocurrency exchange, which suffered a $60 million hack in 2022. However, the platform used in this scam is likely unaffiliated and merely borrowed the name to appear credible.

The fraud kicked off when the victim, an Indian businessman, was contacted on Facebook by a woman claiming to be a Hong Kong-based IBM software developer.

She gained his trust and convinced him to invest in crypto via ZAIF. Over a month, he transferred more than INR 6 crore (approximately $$699,352) across various accounts controlled by the scammers.

As is common in such crypto trading scams, the victim was initially shown fake profits on the platform to build trust. However, when the victim attempted to withdraw gains, the platform demanded an additional INR 89 lakh to unlock the funds — a tactic commonly referred to as an advance fee fraud.

Once the victim refused, the scammers vanished, cutting off contact.

Police tracked down the suspects through digital trails and banking records. Authorities seized phones, SIM cards, ID documents, and other incriminating materials during a raid.

With cryptocurrencies still operating in a grey area, India remains a hotspot for scams and fraud targeting unsuspecting users. Earlier this month, police cracked down on a similar scam that promoted a fake token called RSN and promised 2% daily returns. Losses were estimated to be between $1.14 and $2.29 million.

Source link

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

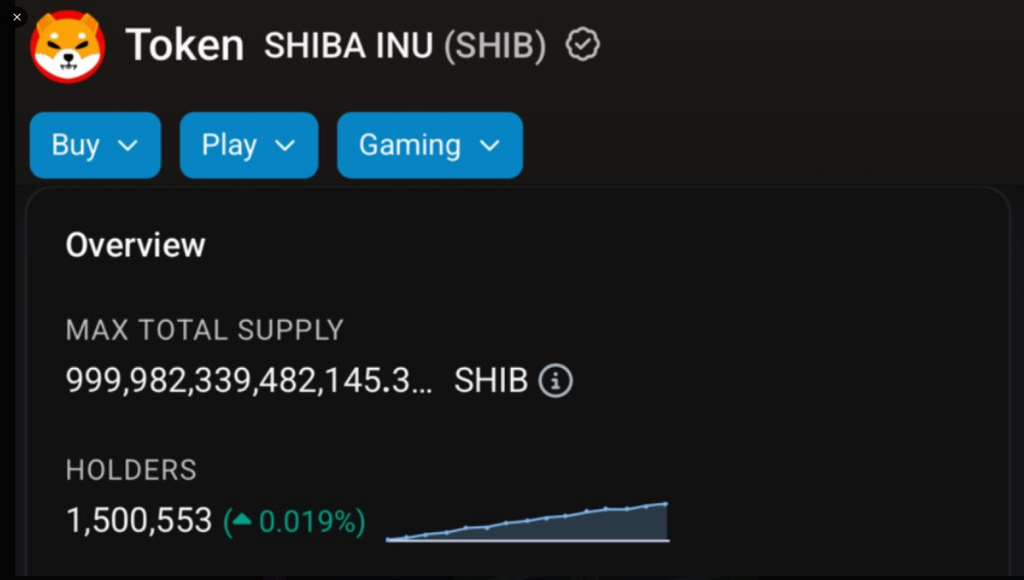

The ecosystem of a popular meme coin has attained two major milestones, showing the continued interest in the token that could lead to a bullish scenario. Analysts reported that Shiba Inu recently reached 1.5 million holders while its Shibarium recorded 10 million blocks, an indicator that the SHIB ecosystem could attract new users.

Related Reading

1.5 Million SHIB Holders

Crypto analysts revealed Shiba Inu successfully achieved a major milestone, offering a bright spot for the broader cryptocurrency market which has faced some challenges recently.

The project’s marketing lead, LUCIE noted that the meme coin hit 1.5 million holders on March 18, reaching such a milestone is an important achievement for any crypto.

As of writing, about 843 new holders have joined the Shiba Inu ecosystem, indicating that the token remained attractive to traders.

SHIB has reached 1.5 million on-chain holders!

pic.twitter.com/sKaAO57R6I

— 𝐋𝐔𝐂𝐈𝐄 (@LucieSHIB) March 18, 2025

Analysts believe that Shiba Inu’s milestone suggests continued interest in the meme coin, fueling the token’s significant growth. It also showed a bullish outlook on the meme coin.

Market observers said that the milestone might signify the unwavering belief of its community in the token.

10 Million Blocks For Shibarium

Meanwhile, Shiba Inu’s Ethereum Layer 2 network, Shibarium also recorded a win after surpassing 10 million blocks with an estimated 10,010,974 blocks as of press time.

Crypto analysts said that this achievement is proof of the network’s longevity and reliability, adding that it could entice more new users.

Market observers noted that the network has experienced exponential growth in total addresses in the last few weeks as it now tallies almost 175 million.

Shibarium’s growth is crucial in burning SHIB tokens and a major price control mechanism. Many investors are optimistic that diminishing supply and solid demand might send the token to surge. Shibarium played an essential role in burning around 713 million SHIB.

Unmoved By The Crypto Downturn

Many analysts say that milestones achieved by Shiba Inu and Shibarium offer a great deal of hope to investors, considering the ongoing downtrend in the cryptocurrency market.

For instance, Shiba Inu tanked by about 68% in the last four months, dipping from a high of $0.00003343 in December 2024 to a low of $0.00001082 in March 2025.

On the other hand, some analysts raised their concern about Shiba Inu underperforming the competition, noting that the token only increased by 98% following the US presidential election, while the Dogecoin skyrocketed by 200%.

Related Reading

Currently, Shiba Inu is traded at $0.00001288 per token, down by 0.2% in the past 24 hours with a total market cap of over $7.5 billion.

Featured image from Getty Images, chart from TradingView

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x