News

Stablecoins on shaky ground? US council calls on Congress to enact crypto oversight

Published

4 months agoon

By

admin

The Financial Services Oversight Council (FSOC) is urging Congress to pass legislation that establishes a comprehensive federal framework for regulating stablecoin issuers.

A government organization — established by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 — published a report on Friday, Dec. 6, detailing what it perceives as a growing threat to the U.S. financial system.

Stablecoins, the FSOC says, “continue to represent a potential risk to financial stability because they are acutely vulnerable to runs absent appropriate risk management standards.”

The sector also remains largely concentrated, with a single firm accounting for “around 70 percent of the sector’s total market value,” council stated, referring to Tether (USDT).

Why Tether is problematic

As of 2024, Tether remains the dominant player in the stablecoin space.

While the FSOC report did not mention any company names, it cautioned that the lack of risk management standards with firms involved with stablecoins makes the sector “vulnerable to runs.” And Tether has faced scrutiny for not providing audits to verify that its coin is backed 1:1 by U.S. dollars or other assets.

Critics argue that if Tether does not hold sufficient reserves, it could collapse, causing a major disruption in the crypto market. ng up over 70% of the $204 billion market.

In a Sept. 14 social media post, Cyber Capital founder Justin Bons criticized Tether for its “lack of third-party audits,” calling the stablecoin an “existential threat to crypto.” See below.

3/17) There has never been an audit of USDT, despite promising to do so since 2015

This means we have to take their word for the vast majority of reserves, as they cannot be independently verified

The first firm to attempt an audit even got fired for being too thorough in 2018! pic.twitter.com/OYfj21HsKJ

— Justin Bons (@Justin_Bons) September 14, 2024

Previously, the firm settled charges alleged by the U.S. Commodity Futures Trading Commission in 2021 for making “untrue or misleading statements” about the reserves backing its stablecoin.

Stablecoins have also faced heightened scrutiny since the collapse of TerraUSD (UST). Once a prominent stablecoin, UST lost its dollar peg in May 2022, triggering a catastrophic death spiral that wiped out over $40 billion in value from the crypto market.

Despite these concerns, stablecoins remain widely used, especially for trading and liquidity.

Specifically, the FSOC warned that if the market dominance expands, its potential failure could “disrupt the crypto-asset market” and trigger “knock-on effects” for the broader financial system.

A few stablecoin issuers are under state-level supervision, but many “operate outside of, or in noncompliance with, a comprehensive federal prudential framework.”

Further, it added that these firms often provide “limited verifiable information” about their reserves and holdings, making it difficult to ensure “effective market discipline.”

Calls for legislative action

The FSOC recommended passing stablecoin regulations to alleviate risks. It urged Congress to develop “a comprehensive federal prudential framework for stablecoin issuers” and provide federal financial regulators with explicit rulemaking authority over the crypto-asset spot market.

“If comprehensive federal legislation is not enacted, Council members remain prepared to consider steps available to them to address risks related to stablecoins,” it added.

This is not the first time the FSOC has pushed for such measures; similar recommendations were made in its 2023 annual report.

Congress is currently reviewing the Clarity for Payment Stablecoins Act, a bill aimed at establishing clear regulations for stablecoin issuers. While the legislation has yet to pass the House, crypto proponents believe it could progress under the incoming Trump administration.

Meanwhile, concerns over stablecoins extend beyond the U.S. On Dec. 4, the Australian Securities and Investments Commission published a consultation paper outlining plans to enhance oversight of the stablecoin sector.

Similarly, Banco Central do Brazil (BCB) has raised concerns about the risks stablecoins pose and has proposed banning withdrawals to self-custody wallets as part of efforts to tighten regulatory oversight.

Source link

You may like

This Week in Crypto Games: ‘Off the Grid’ Token, GameStop Goes Bitcoin, SEC Clears Immutable

Binance debuts centralized exchange to decentralized exchange trades

Why Is the Crypto Market Down Today? Bitcoin Drops to $82K as Traders Flee Risk Assets Amid Macro Worries

BTCFi: From passive asset to financial powerhouse?

Hyperliquid Delists $JELLY, Potentially Causing $900K in Losses. Here’s Why Best Wallet Token Can 100x

Cryptocurrencies to Sell Fast if Bitcoin Price Plunges Below $80K

crypto

‘Extremely High’ Odds of V-Shaped Recovery for Stock Market, According to Fundstrat’s Tom Lee

Published

7 hours agoon

March 30, 2025By

admin

The head of research of market intelligence firm Fundstrat says that the odds of a V-shaped recovery for the stock market in April are overwhelmingly high.

In a new interview with CNBC Television, Tom Lee says that based on historical patterns, the stock market could mount a recovery in early April.

“The spike in the VIX (volatility index) or the collapse in investor sentiment or consumer confidence, that all happened around February 2018, so really that coincided with the first low that was made in 2018, and the market began to stage its recovery…

But as we start to think about the second half of this year, first of all, we’ve already had the collapse in sentiment. We’ve seen $850 billion of cash raised over the past year in money market balances, and then in the second half, we were looking for tax reform, which really propelled stocks in 2017.”

According to Lee, much of the panic in the stock market has already taken place this year, leading him to believe that stocks should start regaining their bullish momentum this week.

“So I think that the odds of a V-shaped recovery in stocks that come after April 2nd is just extremely high, because we’ve already sequenced a lot of the panic that people saw in 2018. I think it’s already taking place.”

A V-shaped rally is a technical pattern indicating an abrupt bullish reversal and a sharp surge in the market.

Earlier this month, both the stock and crypto markets took a hard hit after President Donald Trump announced tariffs and refused to rule out an upcoming economic recession.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Ethereum

Ethereum’s time is ‘meow?’ Vitalik Buterin video go ‘vrial’

Published

9 hours agoon

March 30, 2025By

admin

Some commentators on X called it “sad.” Others used expletives. Either way, a video of Ethereum co-founder Vitalik Buterin went viral and not in a good way.

The crypto community on X.com, rarely known for decorum, blasted Buterin for kneeling before a robot and emitting what sounds like a “meow” sound.

To some, the video underscored why one needs to be “bullish” about Ethereum’s present and future. To others, it was worthy of a Studio Ghibli-style photo edit. Most people kept scrolling. See below.

https://twitter.com/Philfog/status/1905634153535541262

In the brief clip, Buterin pats the robot on the head after making the unusual sound. While he has yet to comment on the video, the moment has ignited chatter, particularly given Ether’s recent price struggles.

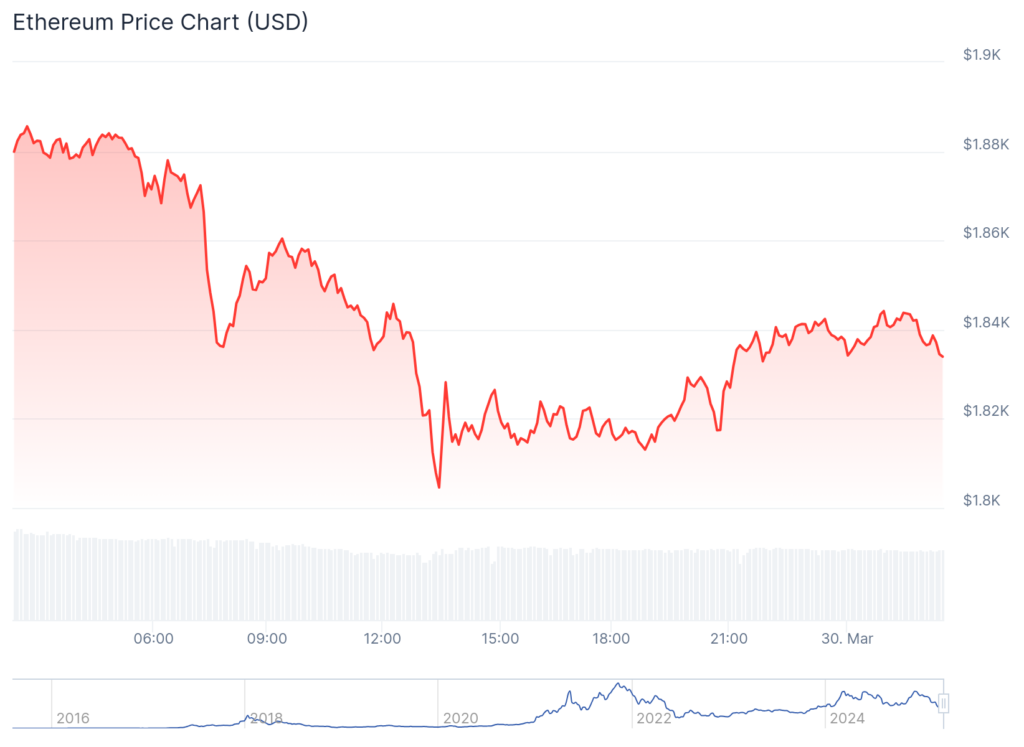

As of publication, Ether has dropped nearly 55% since reclaiming the $4,000 mark in December 2024, now trading at $1,833 — down over 8% in the past week.

Some crypto figures have expressed concern, with commentator “The Count of Monte Crypto” humorously noting that the state of Ether’s price was more worrying than Buterin’s quirky behavior.

And when Buterin tried posting about “how to fund public goods,” he was trolled by the crypto community with statements like: “NO ONE F–KING CARE[S]” and “YOU ARE THE ONLY FOUNDER THAT IS DOING 0 APART FROM DUMPING YOUR AIRDROPS! WAKE UP VITALIK.”

It’s noteworthy that Buterin has long been known for being quirky and, according to a recent Bloomberg feature, “monkish.”

But his behavior occasionally invites scrutiny. Iggy Azalea, for example, dissed Buterin for singing at TOKEN2049 in Singapore, calling it “loser s—.”

Buterin is also not clear-cut in his political affiliation, which is somewhat refreshing for today’s polarized crypto traders. He has spoken openly against former SEC chair Gary Gensler as well as the dangers of “large-scale political coins” — seemingly a critique at Trump.

Indeed, many crypto leaders have embraced Trump’s pro-crypto stance, but Buterin has distanced himself, rejecting what he called the “bronze-aged mindset” favored by some in the crypto community.

With Ether facing uncertain prospects and Buterin’s actions fueling speculation, it remains unclear whether his personal brand of decentralization or his refusal to align with Trump’s crypto-friendly policies will shape Ethereum’s path forward.

Source link

Altcoins

Nasdaq Files To Launch a New Grayscale Avalanche (AVAX) Exchange-Traded Fund

Published

15 hours agoon

March 30, 2025By

admin

Digital asset management giant Grayscale hopes to launch an Avalanche (AVAX) exchange-traded fund (ETF) in the US.

The Nasdaq Stock Market submitted a proposal this week to the U.S. Securities and Exchange Commission (SEC) to list and trade shares of Grayscale Avalanche Trust, which would be entirely tied to the price of the layer-1 project’s native asset, AVAX.

Grayscale isn’t the first financial giant to file for an Avalanche ETF. Documents submitted to the state of Delaware earlier this month suggest VanEck also hopes to launch a fund tied to the Ethereum (ETH) rival.

Coinbase Custody will serve as the custodian for Grayscale’s Avalanche ETF if it’s approved. The crypto asset manager also hopes to launch funds tied to Cardano (ADA), Solana (SOL), XRP and Hedera (HBAR).

The SEC greenlit the first spot market Bitcoin (BTC) ETFs in January 2024, bringing in billions of dollars worth of inflows to the top digital asset by market cap. The regulator subsequently approved Ethereum ETFs for trading last July.

Two financial firms, Franklin Templeton and Hashdex, also launched joint BTC-ETH ETFs earlier this year.

AVAX is trading at $20.36 at time of writing. The 17th-ranked crypto asset by market cap is down nearly 8% in the past 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

This Week in Crypto Games: ‘Off the Grid’ Token, GameStop Goes Bitcoin, SEC Clears Immutable

Binance debuts centralized exchange to decentralized exchange trades

Why Is the Crypto Market Down Today? Bitcoin Drops to $82K as Traders Flee Risk Assets Amid Macro Worries

BTCFi: From passive asset to financial powerhouse?

Hyperliquid Delists $JELLY, Potentially Causing $900K in Losses. Here’s Why Best Wallet Token Can 100x

Cryptocurrencies to Sell Fast if Bitcoin Price Plunges Below $80K

‘Extremely High’ Odds of V-Shaped Recovery for Stock Market, According to Fundstrat’s Tom Lee

Is XRP price around $2 an opportunity or the bull market’s end? Analysts weigh in

What is Dogwifhat (WIF)? The Solana Dog Meme Coin With a Hat

Ethereum’s time is ‘meow?’ Vitalik Buterin video go ‘vrial’

Bitcoin Miner MARA Starts Massive $2B At-the-Market Stock Sale Plan to Buy More BTC

Paul Atkins “Conflict of Interest” Triggers $220M Withdrawals from Ripple Markets

Bitcoin CME Gap Close About To Happen With Push Toward $83k

Listing an altcoin traps exchanges on ‘forever hamster wheel’ — River CEO

Nasdaq Files To Launch a New Grayscale Avalanche (AVAX) Exchange-Traded Fund

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x