cryptocurrency

What are security tokens? A guide to asset-backed tokens

Published

2 weeks agoon

By

admin

You probably come across a lot of paperwork and restrictions when it comes to buying a piece of real estate or a company share in the real world.

Security tokens offer a solution to this problem by becoming a digital representation of your real-world asset in the blockchain world.

In this article, we’ll take a deep dive into what are security tokens, their types, how they work, and their future in the cryptocurrency world.

What is a security token?

Security tokens are the bridge between traditional finance and digital assets. These non-tangible tokens represent your ownership in the real world and hence make the whole process of buying, selling, and trading real-world assets a whole lot easier.

It can be any real-world asset including real estate, stocks, bonds, or even a piece of art. If it’s tangible and can be bought and sold, it can be tied to a security token through which ownership can be transferred easily from one person to another.

While normal cryptocurrencies may not be subject to many regulations, tokens acting as security must abide by stringent regulatory laws to keep operating as a security. They are usually issued through a process known as Security Token Offering (STO), in which interested investors buy tokens that represent their ownership of any physical or digital asset in the real world.

Now that we’ve explained security tokens, let’s learn how they work.

How do security tokens work?

Security tokens operate on blockchain platforms that are coded through smart contracts that abide by strict laws of ownership and transfer, coded within them. Each token represents an ownership or a real-world asset, and anyone who owns a token acting as security has a legal claim to a share of the asset to which the token is tied.

As discussed above, these tokens are issued through an STO which ensures the rights of both the issuer and investor of the token. Blockchain and smart contracts play a key role in automatically calculating and transferring ownership of security tokens from one party to another without the need for third-party intermediaries.

Furthermore, anyone can own a fraction of a real-world asset and isn’t bound to buy the whole asset, making this concept even more attractive for global investors.

Types of security tokens

There are many types and examples of security tokens in the real world, however, not all of them are popular. Here we will discuss some of the most commonly used tokens that act as securities for real-world assets:

Debt tokens: Companies can issue debt tokens that represent loans or bonds issued by them, and these tokens are then used for paying interest to token holders over time.

Equity tokens: Equity tokens are given to anyone who purchases a company’s share or ownership. In return for buying equity tokens, a person can vote on governance matters and claim the company’s profits as long as they hold the equity tokens and don’t transfer them to another user.

Asset-backed tokens: Asset-backed tokens are one of the classic security tokens examples, as they tied to tangible assets like real estate, gold, or artwork. These tokens give investors fractional ownership of these assets, making these big markets easier to access for a global audience.

Each type of token that acts as security offers unique opportunities for investors to diversify their portfolios and gain exposure to new asset classes while maintaining compliance with regulations.

Advantages of security tokens

Security tokens offer a lot of advantages to the global financial ecosystem which includes investors, issuers of these tokens, and the general public as well. Here are some of them:

Liquidity: Limited access means less liquidity and this restriction is lifted when real-world assets are tied to securities which are represented by digital tokens that can be bought by anyone in the world without much paperwork or travel.

Transparency: Every transaction on the blockchain has a permanent record, is secure, and is tamper-proof and all of this promotes transparency between the issuer of the tokens and the investors as well.

Fractional Ownership: Not everyone has the same level of financial capacity to buy an expensive piece of art or real estate. Instead, tokens acting as security allow everyone to buy some part of a real-world asset and sell their part of the asset in profits, when that asset has appreciated over time.

Automation: The lack of human involvement on the blockchain on which these tokens operate, reduces any administrative costs and errors. Real-world assets are bought and sold seamlessly, and dividend distribution and ownership transfers happen within seconds by following automated hard-coded laws in the blockchain’s smart contract.

Security token vs cryptocurrency

While both cryptocurrencies and security tokens may seem the same at first glance, in reality, they have a lot of differences between them.

You see cryptocurrencies like Bitcoin or Ethereum are digital money that are traded on crypto exchanges and are primarily not tied to any asset or claim, and are purely used as a store of monetary value.

On the other hand, tokens acting as security directly represent ownership of assets in the real world. They are also required to follow strict laws of traditional investments in the real world. Cryptocurrencies are unregulated and often decentralized, while tokens issued as securities are issued in a legal environment with regulated and documented laws.

Challenges and risks

Regulatory uncertainty poses the biggest challenge and risk in the mass adoption of tokens that are deemed as securities or plan to apply for becoming a security token. While many countries have shown interest in this concept, there is still confusion about when proper laws will be formed around these tokens that provide a sense of security for investors and issuers alike.

Not being widely accepted also means that liquidity can be a big problem as they are not yet traded on traditional exchanges. A limited market means it is difficult for a common investor to invest in tokens acting as security and choose to go for traditional cryptocurrencies instead.

Also, the technology behind these tokens on the blockchain is still evolving, which means a potential threat of security breaches is possible.

The future of security tokens

According to several experts, tokens registered as security have a bright future ahead of them and will completely transform the financial sector. This means that the capacity to tokenize a broad range of assets, is anticipated to grow and we may get to see more security token examples in the future.

Furthermore, advancements in smart contract technology will make asset ownership and transfer even more efficient. A wider institutional acceptance of blockchain-based securities is expected which might boost traditional financial sectors including private equity, real estate, and banking.

Overall, the future of these tokens is heavily dependent on two key factors. One is the extent of advancement in blockchain technology and whether it can handle the risks and capacity of challenges that will arise. And secondly, it is regulatory compliance on a global scale that will make or break the future of these tokens in the real world. In all of this uncertainty, your job is to learn what is a security token and spread awareness about its advantages and risks in your ecosystem which may fuel its adoption significantly.

Source link

You may like

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

Bitcoin

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Published

26 minutes agoon

December 24, 2024By

admin

Japan-based early-stage investment firm Metaplanet continues its Bitcoin (BTC) buying spree. The company announced today that it has purchased 619.7 BTC for $61 million – including fees and other expenses – making it the firm’s largest Bitcoin acquisition to date.

Metaplanet Increases BTC Holdings To 1,762

The recent crypto market downturn from its all-time highs (ATH) does not appear to bother Metaplanet, as the Tokyo-listed firm made its largest BTC purchase to date, buying 619.7 BTC worth $ 61 million at an average price of around $96,000.

Related Reading

To recall, Metaplanet started buying BTC earlier this year in May with a purchase of 97.9 BTC. Since then, the company has purchased BTC every month, barring September, and crossed the 1,000 BTC milestone in November. The latest acquisition has pushed Metaplanet’s total Bitcoin holdings to 1,762, bought at an average price of $75,600 per BTC.

Notably, this $61 million purchase is nearly double the value of Metaplanet’s previous largest acquisition, which occurred in November and was worth close to $30 million. The company’s consistent BTC accumulation has earned it the nickname “Asia’s MicroStrategy,” in reference to the US-based business intelligence firm known for its aggressive Bitcoin buying strategy.

It is worth highlighting that today’s BTC purchase comes a week after Metaplanet raised $60.6 million through two tranches of bond issuance for the purpose of “accelerating BTC purchases.” Metaplanet’s latest purchase also makes its BTC reserves the 12th-largest among publicly listed firms globally.

According to Metaplanet’s official announcement, its BTC Yield – a proprietary metric used to measure the performance of its Bitcoin acquisition strategy – stood at 310% from October 1 to December 23. The firm emphasized that this strategy is designed to be “accretive to shareholders.”

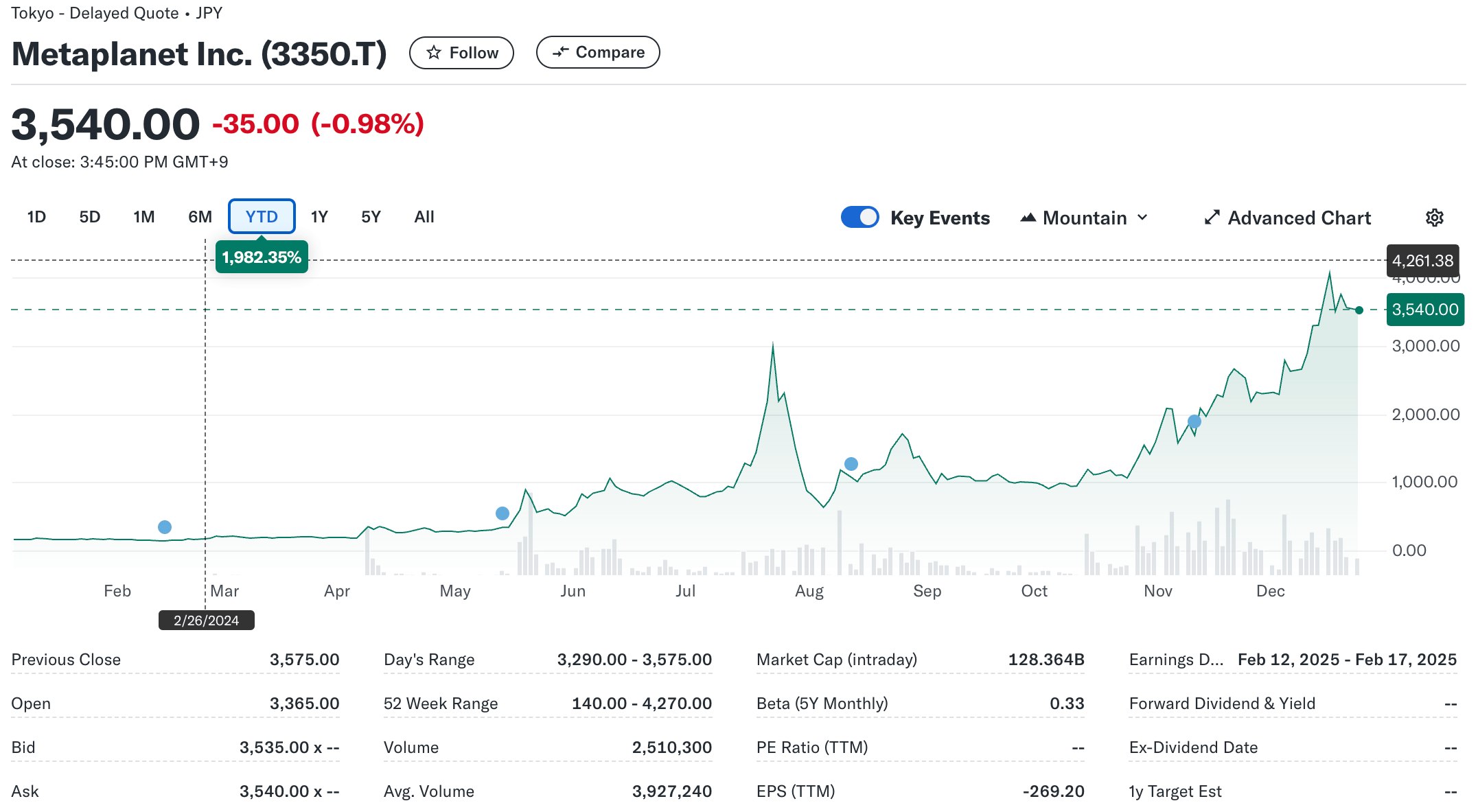

Despite today’s significant BTC purchase, Metaplanet’s stock price saw little movement, closing at $22.5, down 0.98% for the day. However, on a year-to-date basis, the company’s stock has surged by an astounding 1,982%, reflecting the long-term benefits of its Bitcoin-centric strategy.

Bitcoin Supply Crunch To Hasten Adoption?

With Bitcoin’s total maximum supply capped at 21 million, the digital asset has solidified its reputation as an inflation-resistant store of value. A recent report highlights that BTC supply on crypto exchanges has hit multi-year lows, indicating that holders are increasingly withdrawing BTC from exchanges, reducing circulating supply and potentially driving prices higher.

Related Reading

Bitcoin’s scarcity has triggered an unofficial race among corporations – and possibly even governments. For instance, Bitcoin mining firm Hut 8 recently purchased 990 BTC for $100 million, increasing its total holdings to over 10,000 BTC. Similarly, MARA, another Bitcoin mining company, acquired 703 BTC earlier this month, bringing its total holdings to 34,794 BTC.

Speculations surrounding a potential US strategic Bitcoin reserve are further strengthening BTC’s supply crunch narrative, which may fast-track its adoption. At press time, BTC trades at $94,003, down 1.5% in the past 24 hours.

Featured image from Unsplash, charts from Yahoo! Finance and Tradingview.com

Source link

Bitcoin

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Published

17 hours agoon

December 23, 2024By

admin

Tokyo-listed Metaplanet has purchased another 9.5 billion yen ($60.6 million) worth of Bitcoin, pushing its holdings to 1,761.98 BTC.

Metaplanet, a publicly traded Japanese company, has acquired 619.7 Bitcoin as part of its crypto treasury strategy, paying an average of 15,330,073 yen per (BTC), with a total investment of 9.5 billion yen.

According to the company’s latest financial disclosure, Metaplanet’s total Bitcoin holdings now stand at 1,761.98 BTC, with an average purchase price of 11,846,002 yen (~$75,628) per Bitcoin. The company has spent 20.872 billion yen in total on Bitcoin acquisitions, the document reads.

The latest purchase is the largest so far for the Tokyo-headquartered company and comes just days after Metaplanet issued its 5th Series of Ordinary Bonds via private placement with EVO FUND, raising 5 billion yen (approximately $32 million).

The proceeds from this issuance, as disclosed earlier, were allocated specifically for purchasing Bitcoin. These bonds, set to mature in June 2025, carry no interest and allow for early redemption under specific conditions.

Metaplanet buys dip

The company also shared updates on its BTC Yield, a metric used to measure the growth of Bitcoin holdings relative to fully diluted shares. From Oct. 1 to Dec. 23, Metaplanet’s BTC Yield surged to 309.82%, up from 41.7% in the previous quarter.

Bitcoin itself has seen strong performance this year, climbing 120% and outperforming assets like the Nasdaq 100 and S&P 500 indices. However, it has recently pulled back from its all-time high of $108,427, trading at $97,000 after the Federal Reserve indicated only two interest rate cuts in 2025.

Despite the retreat, on-chain metrics indicate that Bitcoin is still undervalued based on its Market Value to Realized Value (MVRV-Z) score, which stands at 2.84 — below the threshold of 3.7 that historically signals an asset is overvalued.

Source link

Blockchain

Horizen spikes 60% to lead gainers as BTC, ETH bounce

Published

3 days agoon

December 20, 2024By

admin

Horizen price spiked more than 60% in 24 hours as the cryptocurrency market looked to recover from a massive dump that saw top altcoins crash to key support levels.

On Dec. 20, as Bitcoin (BTC) traded to above $97k and Ethereum (ETH) bulls pushed above $3,400, the price of Horizen (ZEN) surged to highs of $26.34. The cryptocurrency, which rallied sharply following a recent Grayscale Investments announcement, reached a multi-year high and ranked among the top gainers in the 500 largest cryptocurrencies by market cap.

ZEN traded at lows of $14.55 on Dec. 19. However, despite the broader crypto crash and the staggering $1.4 billion liquidations, the altcoin’s price hovered above $26 in early trading during the U.S. trading session.

According to crypto.news price data, Horizen recorded a 24-hour trading volume of over $397 million, with its market cap exceeding $407 million. These metrics reflected increases of 294% and 62%, respectively, in the past 24 hours. While ZEN has surged nearly 200% over the past month, its current levels are still more than 84% below the all-time high of $168 reached in May 2021.

If the broader crypto market continues to rebound, ZEN bulls may aim for March 2022 highs near $50.

The positive momentum has benefited from Grayscale opening of the Grayscale ZEN Trust to qualified investors. Prices of the altcoin rose as the digital asset manager unveiled the fund to offer exposure to Horizen for qualified investors.

Earlier this month, Horizen’s native token underwent its final halving, which came as the project geared for a key change in its tokenomics. ZEN will not see any further halvings as the new network mechanism enables a declining emission rate.

That’s because Horizen, is shifting from the proof of work mining model that mirrored Bitcoin’s halving cycle to a new proof of stake mechanism in 2025. Horizen’s last halving occurred on Dec. 12, 2024.

New tokenomics for Horizen will come into effect in the first half of 2025.

Source link

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential