Uncategorized

GM,

Published

1 week agoon

By

adminHere is my 15 year “seal of approval” from a popular LLM.

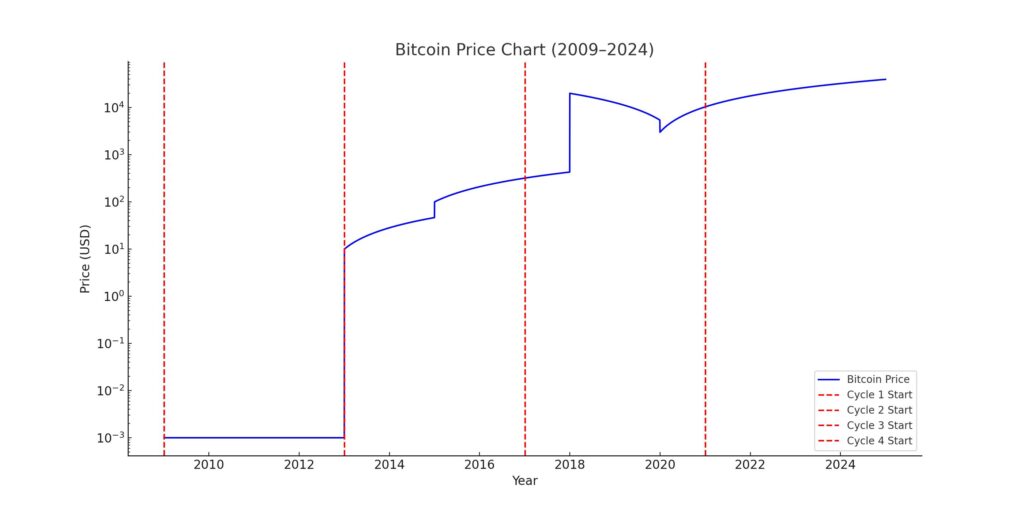

Bitcoin’s price history exhibits notable cyclical patterns, often aligned with its approximately four-year halving events. Halving’s reduce the reward for mining new blocks by half, effectively decreasing the rate at which new bitcoins are introduced into circulation. This mechanism has historically influenced Bitcoin’s supply-demand dynamics, contributing to its price cycles.

Bitcoin’s Price Evolution and 4-Year Cycles:

- 2009–2012: Genesis and Early Growth

- 2009: Bitcoin was introduced by Satoshi Nakamoto, with the genesis block mined in January. Initially, Bitcoin had negligible monetary value.

- 2010: The first recorded Bitcoin transaction established its value at $0.00099 per coin.

- 2011: Bitcoin reached parity with the U.S. dollar in February, later peaking at around $30 in June.

- 2012: The first halving event occurred in November, reducing the block reward from 50 BTC to 25 BTC.

- 2013–2016: First Major Bull and Bear Cycle

- 2013: Bitcoin’s price surged to over $1,100 in December, marking its first significant bull run.

- 2014–2015: A bear market ensued, with prices declining by approximately 84% from the peak, bottoming around $150.

- 2016: The second halving in July further reduced the block reward to 12.5 BTC.

- 2017–2020: Renewed Surge and Correction

- 2017: Bitcoin experienced a meteoric rise, reaching an all-time high near $20,000 in December.

- 2018: The market corrected sharply, with Bitcoin’s price dropping about 84% to lows around $3,200.

- 2020: The third halving in May decreased the block reward to 6.25 BTC.

- 2021–2024: Recent Trends and Projections

- 2021: Bitcoin achieved a new all-time high of approximately $68,789 in November.

- 2022: A significant downturn followed, with prices falling to around $15,495 by November.

- 2023: The market showed recovery, with Bitcoin’s price reaching $42,265 by December 31.

- 2024: The fourth halving occurred in April, reducing the block reward to 3.125 BTC.

Visualizing the 4-Year Cycles:

To illustrate these cycles, analysts often use logarithmic charts with vertical lines marking each halving event, effectively segmenting the chart into four-year intervals. These visualizations highlight the correlation between halving events and subsequent price movements. For example, a chart from TradingView delineates these cycles, showing price trends relative to each halving.

Understanding the Impact of Halving Events:

Each halving reduces the rate at which new bitcoins are generated, tightening supply. Historically, this scarcity effect, combined with sustained or increasing demand, has led to substantial price appreciation in the periods following each halving. However, these bullish phases are typically followed by corrections, leading to the observed cyclical pattern in Bitcoin’s price history.

Conclusion:

Bitcoin’s approximately four-year cycles, influenced by its halving events, have played a significant role in its price dynamics. Understanding these cycles provides valuable insights into Bitcoin’s historical performance and potential future trends.

You may like

What you are going to find out about email in the next few minutes will absolutely change the way you email forever. You can always thank us with crypto tokens here “myecrypto.eth”

Thank you to Lumen5 for their tools in creation of this video

Read Your Daily Mail, and watch your rewards go up!

Uncategorized

Vitalik calls out Saylor, Stocks have Worst day in Weeks, GOAT hits $870M

Published

2 months agoon

October 26, 2024By

admin

BTC ETFs: +$192m, ETH ETFs: +$1m. SOLETH continues to hit new highs, ETH weak. Vitalik calls Saylor’s custody view ‘batshit insane’. BTC to $200k by 2025: Bernstein. BTC options point to jump to $80k post-election. Ripple misses deadline in SEC case. Denmark plans 42% tax on unrealised crypto gains. Ripple CEO debanked by Citigroup.

Source link

Bitcoin

Prediction Markets Are Pricing In A Trump Victory. This Is Good For Bitcoin

Published

2 months agoon

October 22, 2024By

admin

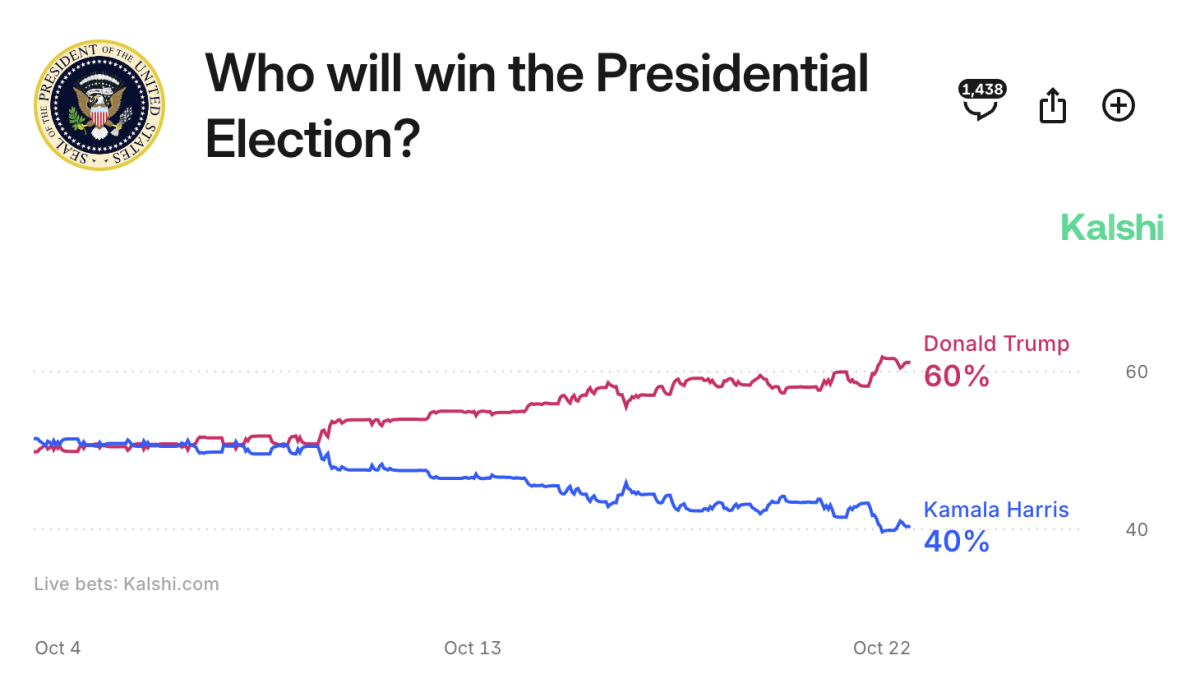

Earlier today, Vivek discussed why he thinks crypto native Polymarket, the world’s largest prediction market, is biased towards Trump in this upcoming U.S. presidential election. While it is plausible given the arguments he laid out, I still believe that it may not be as biased as he may think.

First and foremost, prediction market traders are betting on these odds to make money, not swear loyalty to their preferred politician. Traders are looking to make a profit and are trying to lock in their bets at attractive odds on who they think will win. Based on many factors, like positive incoming GOP voter registration data in swing states like Pennsylvania, there are signs that show Trump has a very solid chance of winning this election. Even billionaire Stanley Druckenmiller said that the recent positive upswing in markets is due to the markets pricing in a Trump victory.

Like Vivek, many claim that since Polymarket is crypto native, then of course its users support Trump because he is also pro-Bitcoin and crypto. So let’s take a look at another, non-crypto native, market predictions platform, Kalshi.

On Kalshi, a U.S. betting odds platform that settles contracts in dollars, not Bitcoin or crypto, Trump is also in a massive lead. Trump is currently up by 20% over Harris. The crowd of users on this platform appear to be choosing their bets on who they think will win the election, even putting aside their own personal political preferences. Reading the comments, I’m seeing many people say they want Trump to win, but are taking the other side of this bet as they believe there may be election fraud from the Democrats which would see Harris ‘win’.

“Y’all betting on Trump haven’t priced in the probability of delivery vans pulling into the polling stations at 3am with 10’s of thousands of ballots, 99% of which going to Kamala they suddenly ‘found,’” commented one user. “Kamala will win legitimately or not, you have been warned.”

It will be fascinating to watch how these prediction markets play out as we inch closer to the election, which is now only two weeks away. I agree with Vivek that as we get closer to the election, these margins will likely get narrower. It appears to me that Trump has got this one in the bag, but it ain’t over until it’s over. Last election most people went to sleep thinking Trump had won the election, just for the Democrats to find all these ballots voting for Biden at 3am to win him the election. If there is any election fraud and interference in this upcoming election, these prediction markets may be in for a very volatile time.

A Trump win would be massive for Bitcoin on a regulatory level and price wise, due to his proposed policies. Under Harris, on the other hand, the future of Bitcoin in this country would be uncertain, as she has not laid out any real details on policy she would implement while as president and has a four year track record of attacking the industry while in office as vice president.

Bitcoin Magazine is teaming up with Stand With Crypto to provide real time election coverage on November 5th. So if you’re a Bitcoiner tired of watching mainstream news and want to witness this election from the perspective of a Bitcoiner, make sure to tune into the stream. More details on the livestream and where to watch here.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Stablecoin Issuer Tether Invests $775,000,000 Into YouTube Rival Rumble

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential