Bitcoin

Early-Era US Bitcoin Investor Sentenced to Two Years in Prison for Underreporting Gains From BTC Sales

Published

1 week agoon

By

admin

An ancient Bitcoin investor is going to spend the next two years in prison after underreporting his BTC gains, according to the U.S. Department of Justice (DOJ).

In a new press release, the DOJ says that Frank Richard Ahlgren III of Austin, Texas failed to accurately report the capital gains he earned after selling $3.7 million in Bitcoin.

He was sentenced Thursday to two years in prison for filing false tax returns.

The DOJ says that taxpayers are required to report any gains or losses from the sale of cryptocurrencies like Bitcoin.

Says Stuart Goldberg, the Acting Deputy Assistant Attorney General of the DOJ’s Tax Division,

“Frank Ahlgren III earned millions buying and selling Bitcoins. But instead of paying the taxes he knew were due, he lied to his accountant about the extent of a large portion of his gains, and sought to conceal another chunk of his profits through sophisticated techniques designed to obscure his transactions on the Bitcoin blockchain. That conduct today earned him a two-year sentence.”

Ahlgren made his first purchase of Bitcoin in 2011 and in 2015, he acquired about 1,366 BTC using top US crypto exchange Coinbase.

In October 2017, he sold about 640 BTC, each worth about $5,807 at the time, for a total of $3.7 million. He used most of the funds to buy a home in Park City, Utah.

But when he filed his 2017 tax return, he told his accountant he purchased the Bitcoin at a much higher price than he did, pretending his gains were less. He also sold BTC in 2018 and 2019 for over $650,000 but failed to report the sales.

According to the DOJ, Ahlgren’s false filings helped him avoid having to pay more than $1 million in taxes. In addition to his two-year prison term, Ahlgren is ordered to serve one year of supervised release and pay $1,095,031 in restitution to the United States.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

Bitcoin

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Published

50 minutes agoon

December 23, 2024By

admin

Tokyo-listed Metaplanet has purchased another 9.5 billion yen ($60.6 million) worth of Bitcoin, pushing its holdings to 1,761.98 BTC.

Metaplanet, a publicly traded Japanese company, has acquired 619.7 Bitcoin as part of its crypto treasury strategy, paying an average of 15,330,073 yen per (BTC), with a total investment of 9.5 billion yen.

According to the company’s latest financial disclosure, Metaplanet’s total Bitcoin holdings now stand at 1,761.98 BTC, with an average purchase price of 11,846,002 yen (~$75,628) per Bitcoin. The company has spent 20.872 billion yen in total on Bitcoin acquisitions, the document reads.

The latest purchase is the largest so far for the Tokyo-headquartered company and comes just days after Metaplanet issued its 5th Series of Ordinary Bonds via private placement with EVO FUND, raising 5 billion yen (approximately $32 million).

The proceeds from this issuance, as disclosed earlier, were allocated specifically for purchasing Bitcoin. These bonds, set to mature in June 2025, carry no interest and allow for early redemption under specific conditions.

Metaplanet buys dip

The company also shared updates on its BTC Yield, a metric used to measure the growth of Bitcoin holdings relative to fully diluted shares. From Oct. 1 to Dec. 23, Metaplanet’s BTC Yield surged to 309.82%, up from 41.7% in the previous quarter.

Bitcoin itself has seen strong performance this year, climbing 120% and outperforming assets like the Nasdaq 100 and S&P 500 indices. However, it has recently pulled back from its all-time high of $108,427, trading at $97,000 after the Federal Reserve indicated only two interest rate cuts in 2025.

Despite the retreat, on-chain metrics indicate that Bitcoin is still undervalued based on its Market Value to Realized Value (MVRV-Z) score, which stands at 2.84 — below the threshold of 3.7 that historically signals an asset is overvalued.

Source link

Altcoin Season

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Published

4 hours agoon

December 23, 2024By

admin

The creators of the crypto analytics firm Glassnode are warning that altcoins could lose all bullish momentum following last week’s market correction.

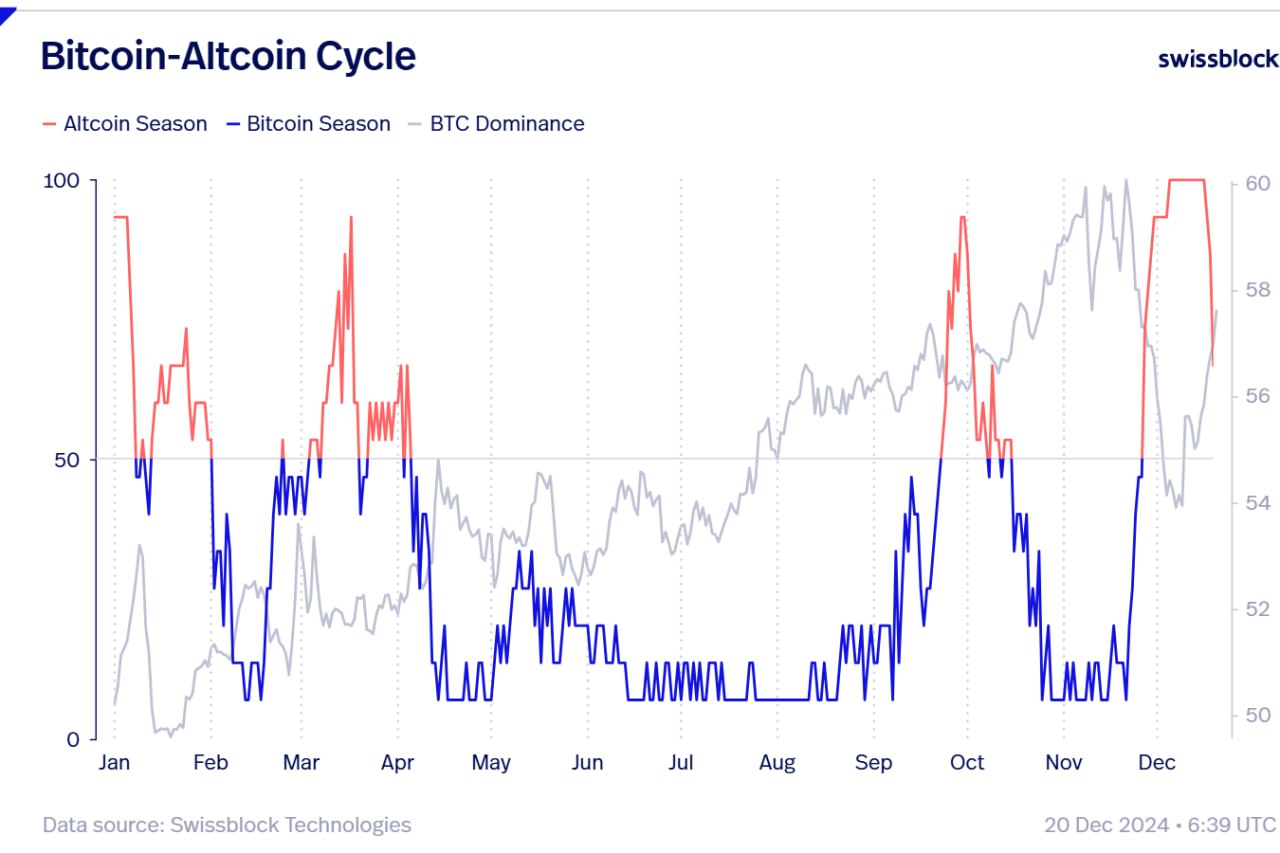

Jan Happel and Yann Allemann, who go by the handle Negentropic on the social media platform X, tell their 63,400 followers that “altcoin season,” which they say began in late November, could come to an abrupt end after alts witnessed deep pullbacks over the last seven days.

According to the Glassnode co-founders, traders and investors will likely have a risk-off approach on altcoins unless Bitcoin recovers a key psychological price point.

“Is This the End of Altcoin Season?

Bitcoin dominance is surging after dipping below $100,000, while altcoins are losing critical supports. Dominance has risen and resumed its upward trend, signaling a stronger BTC environment.

If BTC stabilizes above $100,00, we might see a pump in altcoins now in accumulation zones. Until then, Bitcoin appears poised to lead, leaving altcoins lagging behind.”

The Bitcoin Dominance (BTC.D) chart tracks how much of the total crypto market cap belongs to BTC. In the current state of the market, a surging BTC.D suggests that altcoins are losing value faster than Bitcoin.

At time of writing, BTC.D is hovering at 59%.

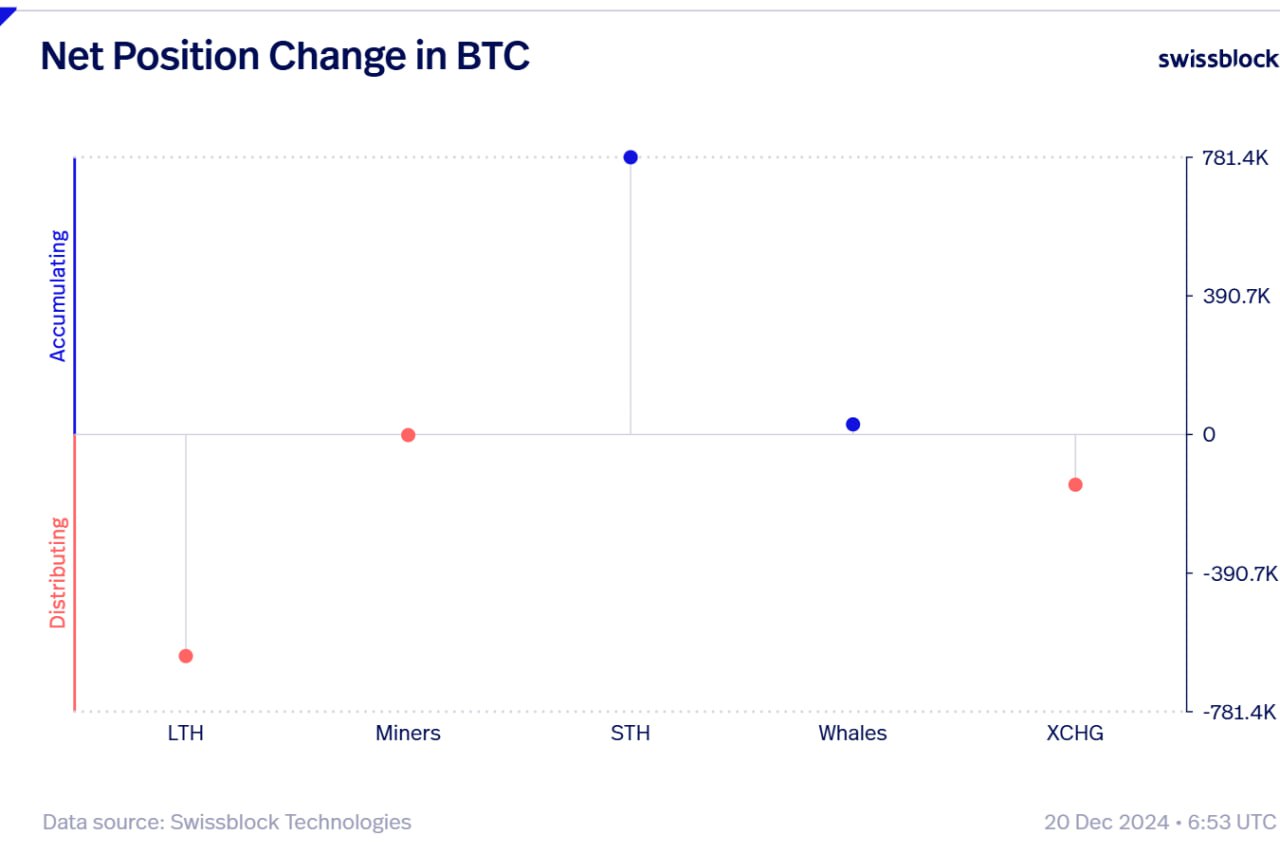

Looking at Bitcoin itself, the Glassnode executives say long-term Bitcoin holders are massively unloading their holdings as other investor cohorts pick up the slack.

“The Board Keeps Shifting.

As BTC continues flowing out of exchanges during this dip, long-term holders are exiting forcefully, while short-term holders step in without hesitation.

Whales quietly accumulate, miners remain neutral, and selling pressure has merely reshuffled the board.

New hands are absorbing the sales.”

At time of writing, Bitcoin is worth $97,246.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Altcoins

Bitwise CIO Matt Hougan Predicts Institutional Interest in Altcoins, Says 2025 the Year of Crypto Diversification

Published

20 hours agoon

December 22, 2024By

admin

Bitwise CIO Matt Hougan says a wave of institutional interest in altcoins is coming next year, largely due to potential regulatory clarity and more exchange-traded funds (ETFs).

In a new interview with Bloomberg, Hougan says that institutional money is in the early stages of broadening out to other crypto assets besides just Bitcoin (BTC).

Hougan forecasts that 2025 will be the year that institutional investors will begin to incorporate more diversification in their crypto-investing strategies the same way they do in other asset classes like equities or bonds.

“You’re already seeing it broaden out actually. A lot of people were worried about the Ethereum ETFs for instance, which launched this summer and had tepid inflows.

But over the last month or so, you’ve seen billions of dollars flow into those products.

Again, the things that have happened in crypto in the past keep happening. Historically, most people enter crypto through Bitcoin, and then they discover Ethereum, and then they think about Solana. There’s no reason to assume that the institutions that came into Bitcoin won’t move on to other assets in the future.

In fact, I think in 2025, you’re going to see an explosion of interest in index space strategies that give diversified exposure to crypto. Of course, [that is] something we’ve been doing at Bitwise since 2017 when we pioneered that concept. I think 2025 is when that becomes a mainstream way to allocate to this space, the same way it is to stocks and bonds and real estate and everything else.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Julien Tromeur/Sensvector

Source link

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

The introduction of Hydra could see Cardano surpass Ethereum with 100,000 TPS

Top 4 Altcoins to Hold Before 2025 Alt Season

DeFi Protocol Usual’s Surge Catapults Hashnote’s Tokenized Treasury Over BlackRock’s BUIDL

DOGE & SHIB holders embrace Lightchain AI for its growth and unique sports-crypto vision

Will Shiba Inu Price Hold Critical Support Amid Market Volatility?

Chainlink price double bottoms as whales accumulate

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential