Adoption

Ohio introduces second Bitcoin reserve bill

Published

3 months agoon

By

admin

The State of Ohio has introduced a second Bitcoin reserve bill as crypto legislation gains momentum across the U.S. ahead of Donald Trump’s inauguration.

Ohio House GOP Majority Whip Steve Demetriou proposed legislation to allow the state to manage a strategic Bitcoin (BTC) reserve, Satoshi Act Fund founder Dennis Porter shared on Dec. 19 during an X Spaces event.

Demetriou’s bill follows a similar proposal from Representative Derek Merrin, which would also position Ohio as a Bitcoin reserve holder. Speaking on X Spaces, Demetriou explained that his legislation would enable Ohio to allocate up to 10% of its state-controlled funds toward a BTC stockpile.

“Bitcoin can help tap into Ohio’s existing energy reserves,” Demetriou added. Ohio is famed for having massive natural gas reserves and a competitive energy grid.

The Ohio GOP Majority Whip provided no specific timeline for the bill’s passage but expressed hope that House bureaucracy would not delay progress.

BREAKING: Ohio introduces a 2nd bill to create a Strategic Bitcoin Reserve. This will be the lawmaker that passes it into law.

— Dennis Porter (@Dennis_Porter_) December 19, 2024

American legislative conversations have increasingly focused on BTC-related proposals following President-elect Donald Trump’s victory in the recent election.

Earlier, Porter said that the Bitcoin renaissance was spotted amassing momentum in over 12 states and counting. Texas, Ohio, and Pennsylvania were a few states that weighed BTC reserve laws.

In Washington, Senator Cynthia Lummis has advocated for federal BTC reserve policies. Responding to Federal Reserve Chair Jerome Powell, Lummis argued that the Senate should authorize the central bank to hold Bitcoin. Powell previously clarified that the Fed cannot own BTC under current laws.

Source link

You may like

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

Adoption

HK Asia Holdings Becomes First In China To Adopt Bitcoin Treasury

Published

3 days agoon

March 25, 2025By

admin

HK Asia Holdings (HKEX: 1723), soon to be renamed Moon Inc., has made history as the first publicly traded company in Greater China to adopt a Bitcoin treasury strategy. In a recent discussion hosted by Allen Helm of Bitcoin For Corporations, new CEO John Riggins outlined the company’s pivot, its regulatory alignment with Hong Kong, and the broader momentum building across Asia.

Riggins, a longtime Bitcoin advocate with extensive experience across China and Southeast Asia, explained that the move was driven by both long-term conviction and a favorable shift in regulatory posture in Hong Kong. He said the company had spent months consulting with regulators, public market investors, and local partners before executing the transition.

Originally focused on SIM cards and prepaid tech products, HK Asia Holdings now aims to integrate Bitcoin both as a balance sheet asset and into its business model. This includes plans to roll out Bitcoin-related offerings through its retail footprint, such as ATMs and prepaid Bitcoin products.

The company’s first steps included the acquisition of 8.88 BTC during a post-acquisition period, followed by another 10 BTC purchase once the leadership transition was finalized—bringing its total holdings to 18.88 BTC, valued at over $1.7 million at the time of announcement. Riggins said further accumulation is planned, though it will proceed in accordance with Hong Kong’s measured but transparent regulatory guidance.

“We see it as a way to protect our balance sheet, and we see it as a way to diversify, our treasury with an eye on how the rest of the world is moving,” said Riggins.

The strategic intent goes far beyond speculation. Riggins framed Bitcoin as a hedge against macro uncertainty, a tool for long-term resilience, and a bridge to emerging global financial infrastructure. He also emphasized how corporate boards in the region are beginning to engage more seriously with the idea, pointing to MetaPlanet in Japan and Strategy in the U.S. as compelling precedents.

While Asia’s corporate Bitcoin adoption is still in its early stages, interest is growing fast. Riggins highlighted South Korea, Thailand, Malaysia, and Indonesia as markets with clear potential to follow suit. Much of the movement, he noted, is happening quietly behind the scenes—especially in China, where institutional stakeholders and state-connected investors are actively monitoring U.S. policy shifts and corporate adoption trends.

“I’m flooded with messages more and more from, people in the government, people, you know, institutional investors who are kinda watching this space closely looking for inside information about what’s happening here,” said Riggins.

Although no formal public moves have been announced by Chinese state entities, Riggins believes Bitcoin is already being held indirectly through government-affiliated organizations, including state-connected investment arms. He suggested these holdings may be more significant than publicly known. With the U.S. moving toward a strategic Bitcoin reserve, he sees China closely watching—and potentially following—if global policy momentum continues to shift.

Looking ahead, Moon Inc. plans to expand its Bitcoin holdings within Hong Kong’s regulatory framework and serve as a model for other Asian companies exploring similar strategies. The company will co-host Bitcoin Asia this August in Hong Kong, positioning itself as a regional trailblazer and helping catalyze broader corporate adoption across Asia.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities. For full transparency, please note that BTC Inc., the parent company of UTXO Management, holds a stake in HK Asia Holdings Limited (1723.HK) in partnership with Sora Ventures and other entities.

Source link

Adoption

California Senator endorses Bitcoiner for seat on $500b pension fund board

Published

2 weeks agoon

March 12, 2025By

admin

California State Senator Ben Allen is eyeing further pro-crypto representation with an endorsement of Dom Bei for election to the board of California’s public pension fund.

Bei is the founder of Proof of Workforce, a Bitcoin (BTC) non-profit focused on promoting BTC adoption via educational initiatives targeting workers, unions and pension funds. He is in the race to join the California Public Employees’ Retirement System, CalPERS, as a board member.

Notably, CalPERS is the largest public pension fund in the United States with over $500 billion and serves more than 2 million public retirement system members. CalPERS manages the retirement assets of California’s police department, firefighters and teachers among others.

The pension fund also counts over 1.5 million individuals as members of its health program.

CalPERS board of trustees comprises 13 members. Endorsement from Sen. Allen could see Bei become the first bitcoin advocate to get elected.

“I’ve dedicated over a decade to championing workers and wage-earners. Now, I’m running for CalPERS Board of Trustees to protect our nation’s largest public pension, serving 2M+ participants,” Bei noted in a post on X.

The former firefighter previously served on the advisory board of the Santa Monica pension fund. His pro-bitcoin voice has seen him get support from across several players in the industry.

According to observers, election to CalPERS will be crucial to the overall push for BTC adoption across pensions and other public sector platforms. With his experience and as a Bitcoin holder, Bei could see the largest pension fund in the U.S. explore and potentially add the flagship digital asset to its holdings.

Other than Senator Allen, Bei has received endorsements from more than dozen state legislators. Santa Monica mayor Lana Negrete and California treasurer candidate Tony Vazquez have also talked up his chances. Meanwhile, Anthony Pompliano, founder and chief executive officer of Professional Capital Management, has also added his support.

In 2024, several pension and endowment funds disclosed exposure to Bitcoin, with this coming amid the rapid adoption that followed the Securities and Exchange Commission’s approval of the first spot BTC exchange-traded funds. They include state pension funds and multiple university endowment funds.

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

One of the most intriguing aspects of crypto is its sense of anonymity. Bitcoin (BTC), for example, was created in 2008 by an unknown figure using the pseudonym Satoshi Nakamoto, and to this day, the true identity of its inventor remains unknown. The veil of anonymity has allowed users to create distinct identities through wallet addresses, adding an extra layer of privacy and discretion to transactions.

This concept of openness and universal access is one of the core promises of digital currencies, allowing anyone with internet access to engage, regardless of their financial history or background. However, even though the ethos of crypto promotes inclusivity, the reality hasn’t always reflected this.

The early days of crypto were defined by the archetype “crypto bros,” referring to a specific demographic of young, tech-savvy men who influenced the industry’s direction. Their influence extended to the design of projects, development of key protocols, and framing of the culture surrounding digital assets.

However, as the industry matured and evolved, efforts were made to reflect and include more female voices. This shift helped address the imbalance between gender representation, bringing new perspectives into the industry.

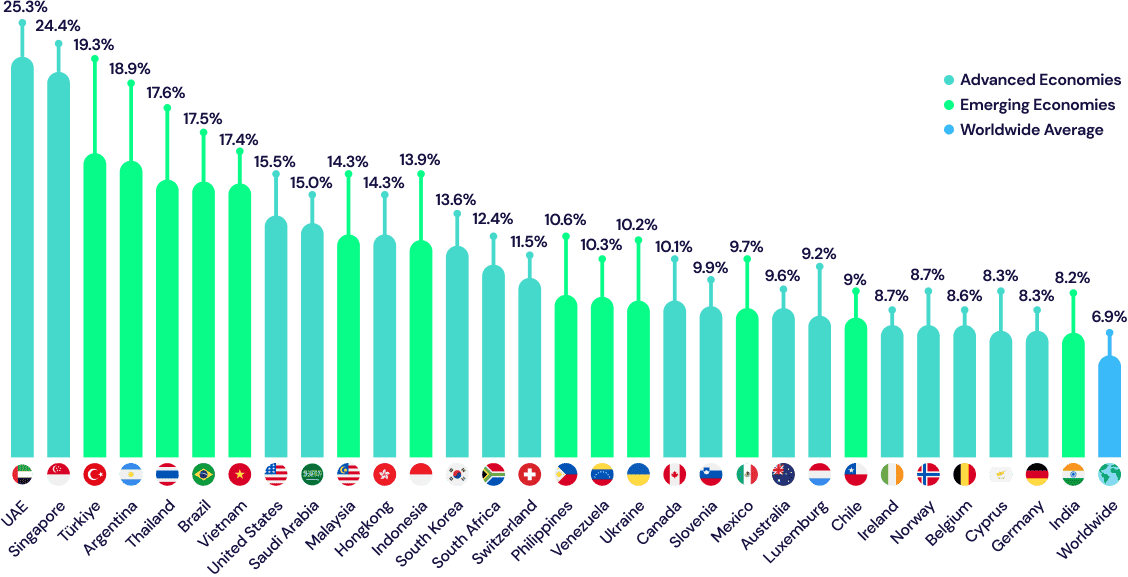

A 2024 study revealed that over 560 million cryptocurrency owners exist globally, with 61 percent identifying as male and 39 percent as female. This marks an increase from the previous year, when the global total was 420 million, with 37 percent of owners being female, signaling a positive shift.

In response to this trend, organizations have emerged to address crypto’s gender imbalances. Conferences and events once primarily targeted toward the male-dominated demographic have changed to allow women to step into the space and take the lead.

The Association for Women in Cryptocurrency, or AWC, for example, was founded in 2022 as a platform for women looking to enhance their knowledge and education in crypto. Led by Amanda Wick, AWC hosts various events, like webinars and in-person meetups, where women can learn from industry experts and connect with mentors who can guide them and help them discover new career opportunities.

Recently, Binance shared that it will offer global programs exclusively for women through its Binance Academy platform in honor of International Women’s Day. The events will be held across five continents at 11 venues to help women ease their way into the industry.

While women have made significant strides in the DeFi space, now accounting for 40 percent of Binance’s workforce, leadership positions have been predominantly held by men. Despite this, several women have established themselves as leaders in the space.

Perianne Boring, for instance, is the founder and CEO of the blockchain advocacy group The Digital Chamber, working alongside Congress and the government to promote and regulate blockchain technology. Her leadership role has made her an advocate for adopting blockchain technologies, as she has become a well-known voice in the space discussing the future of finance. In December, President Trump also considered Boring as a potential CFTC chair.

Another established female leader in the space is Joanna Liang, the founding partner of Jsquare, a tech-focused investment firm specializing in blockchain and web3. With a previous background as CIO at Digital Finance Group (DFG), a global Venture Capital firm focusing on crypto projects, Liang recently launched Jsquare’s latest fund, the Pioneer Fund. The fund has successfully raised $50 million in capital, making its first investment in the startup MinionLabs. The fund will focus on emerging technologies in the crypto space, including PayFi, real-world assets (RWAs), and consumer apps.

Laura Shin is also a prominent name in crypto and is recognized as one of the first mainstream media reporters to cover cryptocurrency full-time. She is the author of the book, ‘The Cryptopians: Idealism, Greed, Lies, and the Making of the First Big Cryptocurrency Craze,’ and the host of the podcast Unchained. Laura has shared her expertise at events such as TEDx San Francisco and the International Monetary Fund.

Over the past 16 years, women have been instrumental in helping legitimize crypto assets throughout the financial landscape. Their contributions have spanned various sectors in the ecosystem, helping shift the narrative around crypto from a niche, speculative asset to a more widely recognized and accepted financial tool.

Source link

Trader Says Ethereum-Based Altcoin Primed for 240%+ Rally if Major Resistance Level Breaks, Updates XRP Outlook

Congressman Ro Khanna Says Democrats Are Changing Their Tune On Bitcoin

France’s Public Investment Bank Bpifrance to Invest $27 Million in Crypto

Hong Kong SFC approves tokenized money market ETFs by HashKey, Bosera

CoreWeave Goes Public at $40 Per Share, Raises $1.5 Billion

Why is Bitcoin, Ethereum, XRP, and Dogecoin Price Dropping Today?

XRP Price Slides Slowly—Is a Bigger Drop Coming?

Darkweb actors claim to have over 100K of Gemini, Binance user info

Whale Who Netted $108,000,000 Profit on TRUMP Books Loss on the Memecoin After President’s Truth Social Post

Hardware Wallets: Bitcoin’s Biggest Adoption Barrier

SEC Officially Drops Cases Against Kraken, ConsenSys, and Cumberland DRW

Dogecoin could rally in double digits on three conditions

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain

Coinbase CLO Applauds US SEC Chair Nominee Paul Atkins Ahead of Senate Confirmation

Crypto Pundit Makes Case For Bitcoin Price At $260,000, But This Invalidation Level Threatens The Rally

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x