Aptos

Trump Makes More Pro-Crypto Appointments

Published

1 day agoon

By

admin

Welcome to The Protocol, CoinDesk’s weekly wrap-up of the most important stories in cryptocurrency tech development.

In this week’s issue of the Protocol newsletter:

- Trump’s crypto team

- Aptos’ leadership shake-up

- TikTok meets tokens

- Kraken scales up

This article is featured in the latest issue of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday.

Network News

TRUMP CRYPTO APPOINTMENTS: President-elect Donald Trump continues to make high-profile appointments embracing cryptocurrency and emerging technologies in his second term. 1) Stephen Miran, tapped as Chair of the Council of Economic Advisers, is a pro-crypto advocate who aims to integrate blockchain and decentralized finance into the U.S. economy. 2) Bo Hines, a former college football player, will head the newly formed Crypto Council. Hines is tasked with balancing innovation and consumer protection as he builds a regulatory framework for digital assets. 3) David Sacks, a veteran of Silicon Valley and vocal blockchain supporter, is stepping in as AI and Crypto Czar. Sacks plans to merge blockchain with AI while bolstering U.S. dominance in both sectors. These appointments signal a clear shift from Trump’s earlier skepticism of digital assets. The big question now is how these moves translate into meaningful policy amid regulatory gridlock and political friction.

APTOS LEADERSHIP SHIFT: Aptos Labs CEO and co-founder Mo Shaikh has stepped down, with co-founder Avery Ching taking over as CEO. Shaikh, who will remain a strategic adviser, highlighted the company’s achievements, including raising $400 million in venture funding and building a thriving ecosystem supported by partners like BlackRock, Google, Mastercard, and PayPal. Known for its layer-1 blockchain leveraging the Move programming language from Facebook’s Diem project, Aptos Labs is expanding into finance and AI applications with the help of advisers like former Grayscale CEO Michael Sonnenshein and OpenAI’s Kevin Weil. The leadership transition underscores the company’s ongoing focus on scalability, security, and innovation in blockchain technology.

SONIC TO AIRDROP TIKTOK: Sonic, a Layer 2 solution on the Solana blockchain, has announced plans to airdrop its native token, SONIC, to TikTok users. This initiative aims to introduce TikTok’s vast user base to decentralized finance (DeFi) by integrating blockchain technology with social media platforms. The airdrop is part of Sonic’s strategy to enhance user engagement and promote the adoption of Layer 2 solutions for improved scalability and reduced transaction costs on the Solana network. By targeting TikTok users, Sonic seeks to bridge the gap between mainstream social media audiences and the DeFi ecosystem, fostering broader participation in decentralized financial services.

ALSO:

- MicroStrategy added 5,262 BTC to its holdings as its stock secures a spot on the Nasdaq 100, reinforcing its long-standing Bitcoin strategy.

- Nokia enters the crypto world with a patented technology for encrypting digital assets, signaling its move into blockchain innovation.

- Ripple’s legal chief urges Congress to focus on regulating crypto practices rather than stifling innovation by targeting the technology itself.

Feature: Kraken’s Ink Layer-2 Goes Live

Kraken, the seventh-largest crypto exchange, said its layer-2 rollup network, built on top of the Ethereum blockchain, has gone live.

The network, called Ink, is based on the OP stack, a customizable framework that lets developers build their own rollups using Optimism’s technology. The team had originally planned for Ink to go live in early 2025, so the launch of its main network is ahead of schedule.

Kraken agreed to receive 25 million OP tokens (worth about $58 million) as part of a deal to build on the OP Stack. Optimism has acknowledged that handing out developer grants for participants building on the stack is part of its strategy, which in turn contributes back to the wider “Superchain” ecosystem.Kraken competitor Coinbase said in August 2023 that it would build a layer-2 network with OP Stack.

The product, called Base, is now the second-largest rollup network according to L2beat. At the time, Optimism said the Base team would receive up to 118 million OP tokens and, in return, would contribute the higher of 2.5% of its sequencer revenue or 15% of its profits to the Optimism Collective.

Read the full story by Margaux Nijkerk here

Money Center

Fundraising

- Avalon Labs has secured $10 million in a Series A funding round to expand its Bitcoin-backed stablecoin, aiming to enhance liquidity and stability in the cryptocurrency market. The investment reflects growing interest in Bitcoin-collateralized financial products as a bridge between traditional finance and digital assets.

Deals & Grants

- Tether has announced a $75 million deal to acquire a stake in Rumble, a video-sharing platform. The investment aims to support decentralized media and aligns with Tether’s commitment to fostering open communication technologies.

Data & Tokens

- Bonk (BONK) surged 30%, leading a rebound among dog-themed meme tokens, with Shiba Inu (SHIB) and Dogecoin (DOGE) also experiencing gains. Additionally, the Commodity Futures Trading Commission (CFTC) classified Floki (FLOKI) as a utility token, potentially influencing its regulatory status.

Data Corner: 60M USDC Outflows Hit Hyper Liquid

Hyper Liquid, a cryptocurrency exchange focused on perpetual contracts, has reported a record outflow of $60 million in USDC amid speculation that North Korea is investigating the platform. The sudden exodus of funds raises questions about the exchange’s liquidity and the stability of its operations. This highlights the growing tension of crypto markets with geopolitical issues, as regulatory scrutiny and potential misuse of platforms by state actors come into focus. The incident underscores the vulnerabilities in crypto markets, particularly for exchanges dealing with high-risk financial products like perpetual contracts. Hyper Liquid’s situation may prompt further scrutiny of similar platforms, emphasizing the need for stronger safeguards in the face of increasing global regulatory pressure.

Get the full scoop by Omkar Godbole here

Calendar

- Jan 9-12, 2025: CES, Las Vegas

- Jan. 15-19: World Economic Forum, Davos, Switzerland

- January 21-25: WAGMI conference, Miami.

- Jan. 24-25: Adopting Bitcoin, Cape Town, South Africa.

- Jan. 30-31: PLAN B Forum, San Salvador, El Salvador.

- Feb. 1-6: Satoshi Roundtable, Dubai

- Feb. 19-20, 2025: ConsensusHK, Hong Kong.

- Feb. 23-24: NFT Paris

- Feb 23-March 2: ETHDenver

- March 18-19: Digital Asset Summit, London

- May 14-16: Consensus, Toronto.

- May 27-29: Bitcoin 2025, Las Vegas.

Source link

You may like

XRP, SOL, NEAR, DOGEN, and DOT poised to explode

Crypto Trader Turned $90 Into $3.25M As Token Skyrockets 5,500%

Here’s a Potential Downside Price Target for Cardano If ADA Sees New Correction, According to Benjamin Cowen

Which crypto will explode in 2025? Expert insights and predictions

XRP Price Pumps 7% On Christmas Eve, Will It Reach Yearly Highs?

XRP firmly above $1, ADA and LCAI to steal the spotlight

Aptos

Aptos Labs CEO Mo Shaikh Quits; Avery Ching to Take His Place

Published

5 days agoon

December 20, 2024By

admin

Mo Shaikh, co-founder of Aptos Labs, announced that he’s stepping down as CEO of the company.

Aptos is a layer-1 blockchain that claims to offer enhanced scalability, security and transaction speeds. The platform leverages a unique blockchain programming language called Move, which was originally created for Facebook’s shuttered “Diem” project.

In a lengthy post on X, Shaikh, who co-founded Aptos with Avery Ching three years ago, expressed pride in the progress made by the company, which included raising a mammoth $400 million in venture capital funding and building “one of the most robust ecosystems, trusted by over a thousand builders and innovators around the globe.”

For as long as I can remember, I’ve been passionate about building systems that empower people—fairer, more open systems. Since 2016, I have been deeply involved in the blockchain world, both exploring and contributing to its transformative social and economic potential.

Three…

— Mo Shaikh 🌐 aptOS (@moshaikhs) December 19, 2024

Ching, Shaikh said, will assume the role of CEO and lead the company into its next phase of growth.

In his X post, Shaikh acknowledged the work of Aptos’ partners and investors, including firms like BlackRock, Google, Mastercard and PayPal.

“None of this would have been possible without the unwavering support of our incredible investors. I want to extend my deepest gratitude to Dragonfly, Blocktower, Haun Ventures, Hashed, IRONGREY, a16z, Apollo, Coinbase, Parafi, Scribble, PayPal, Franklin Templeton, and the amazing angels who believed in our vision,” he wrote.

Shaikh said he will remain with the company as a strategic adviser and plans to take time to reflect on the future of blockchain and financial systems. “I will always remain a champion of Aptos and its mission,” he wrote, adding that he will “look forward to continuing to help Aptos maintain its role as the world’s leading blockchain.”

Source link

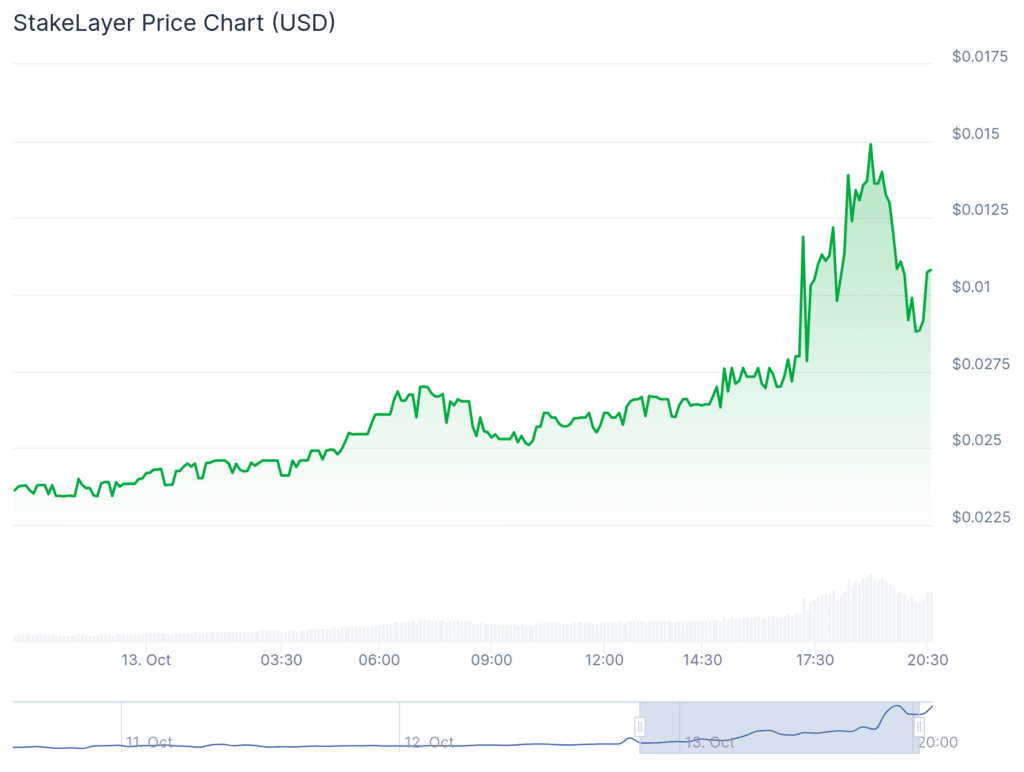

Amidst the slumpy market conditions, StakeLayer has surged by over 250% alongside Thala, Dream Machine Token, which surged by double digits.

The crypto market cap has dropped by over 1.5% in the last 24 hours. As per CoinMarketCap data, it currently stands at $2.17 trillion.

Bitcoin (BTC) is bleeding alongside Ethereum (ETH) in single digits. However, the Stakelayer token is up by over 250% during the same period.

Stakelayer market cap eyes $50 million with the pump

Data from CoinGecko reveals interesting price movement for the cross-chain staking and restaking platform’s token. The token has pumped from a 24 hour low of $0.00344 to a high of $0.001489.

The rally has however cooled down as the token is trading at $0.01299 at press time. StakeLayer also touched an all time high today and is down by over 27% from that high.

The token has also earned its spot as the largest gainer on CoinGecko in the last 24 hours. A look at their X account reveals that the team had announced a buyback and burn initiative, which could be one reason for its price surge.

🚨 Announcing that Buyback and Burn Initiative has Begun, with $STAKELAYER surging over +350% in just 24 hours! 📈

At StakeLayer, we are committed to building long-term value and stability.

Stay tuned as we continue to deliver on our vision and strengthen the ecosystem! 💪🌐 pic.twitter.com/Xb3QqlrayT

— StakeLayer (@StakeLayerIO) October 13, 2024

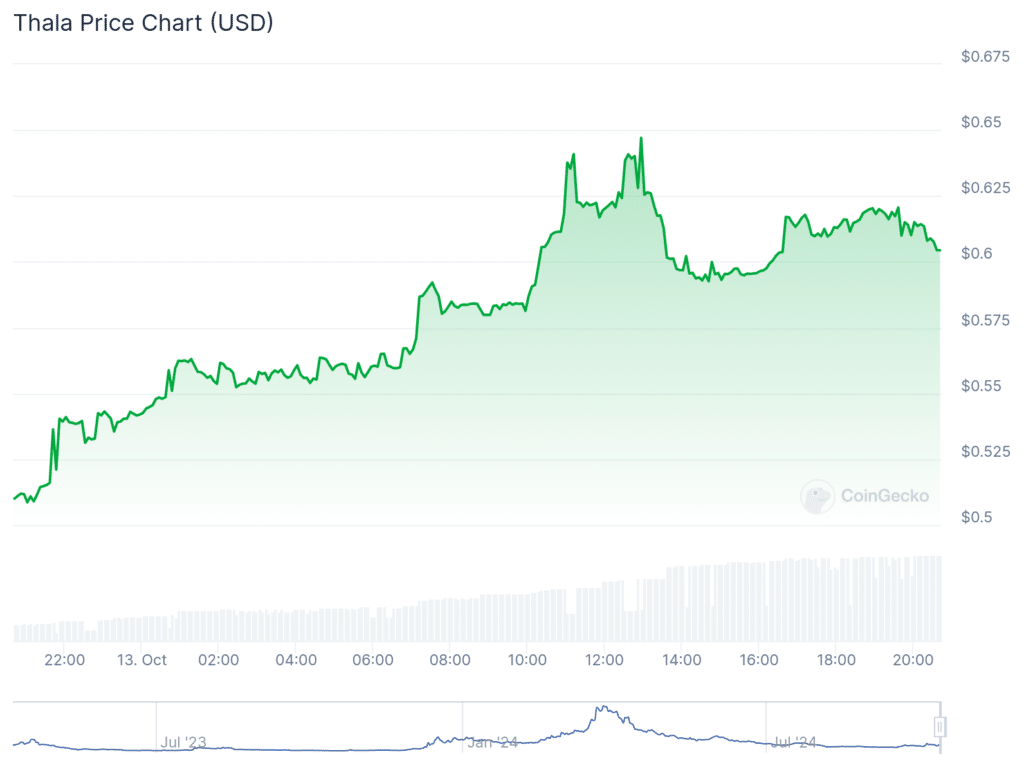

Thala and Dream Machine Token surge double digits

Interestingly, during the same timeframe, Thala (THL) and Dream Machine Token (DMT) surged by double digits. As per CoinGecko data, THL price is up by over 18.5%, while DMT has pumped by 20%.

Even though the exact reason for the surge in DMT’s price is unclear, THL’s price surge can be attributed to the price pump of Aptos (APT). Thala Labs is an ecosystem protocol that aids in borrowing, lending, trading, staking and validating APT.

The recent surge in APT’s price, which saw it touch as high as $10.27 from a weekly low of $7.87, is likely the primary catalyst for the surge in its price. THL is up by over 71% in the last 30 days.

The token has also shown a decent surge in the last week, with its price touching as high as $0.6354 from a low of $0.4228.

Source link

Adoption

Le Poisson Rouge brings ticketing on-chain with Aptos integration

Published

5 months agoon

July 17, 2024By

admin

Le Poisson Rouge (LPR), an iconic music venue in New York City, has sealed an exclusive partnership with live event ticketing platform KYD Labs to bring its ticketing system on-chain.

On Tuesday, Aptos Labs announced that KYD Labs and LPR had entered an exclusive four-year deal that will see the Aptos blockchain power all of the historic NYC venue’s shows and tickets.

LPR is first major U.S. venue to go all on-chain

The collaboration is the first instance where a major U.S. venue has gone fully on-chain, the Aptos team posted on X. It’s a major milestone for Web3, Aptos added, with this partnership set to offer Le Poisson Rouge’s event goers and music fans a new experience.

“A major US venue with hundreds of thousands of tickets per year transitioning to on-chain ticketing is a big step forward for blockchain utility. Eventually, ticketing will all be on-chain. Better interoperability, directly connecting event organizers to buyers, easy promotions, and verified secondary sales are some big advantages,” Avery Ching, the CTO and co-founder of Aptos Labs, said.

KYD Labs will help LPR tap into the benefits of blockchain technology to improve the ticketing experience for fans. Leveraging Aptos’s technology will also be crucial to artists, who can further engage with fans via on-chain initiatives.

Going on-chain removes challenges and barriers associated with legacy ticketing systems.

Overall, LPR will leverage Aptos to not only monitor secondary ticket sales but also offer a transparent mechanism for its loyalty programs, pricing, and booking rates.

Le Poisson Rouge opened in 2008 and has grown into a historic music venue in New York. Aptos is a Layer-1 blockchain that launched in October 2022 and offers a scalable, low-transaction costs network.

Source link

XRP, SOL, NEAR, DOGEN, and DOT poised to explode

Crypto Trader Turned $90 Into $3.25M As Token Skyrockets 5,500%

Here’s a Potential Downside Price Target for Cardano If ADA Sees New Correction, According to Benjamin Cowen

Which crypto will explode in 2025? Expert insights and predictions

XRP Price Pumps 7% On Christmas Eve, Will It Reach Yearly Highs?

XRP firmly above $1, ADA and LCAI to steal the spotlight

The 69 Dumbest Moments of the Year: 2024 Crypto Edition

Here’s What To Expect After Pectra Upgrade

Top 5 meme coins for 12,000x gains

Cardano Price Eyes Rally To New Highs As Bull Flag Appears

Coinbase CEO, Other Crypto Insiders Billions Richer After Seeking to Steer Elections

Protect Your Non-Custodial Bitcoin Wallet — Support The Open Dialogue Foundation

BOUNCEBIT price jumps 16% after major partnership

Bullish Lists RLUSD Stablecoin, Here Are Trading Pairs

Wave 2 And 5 Targets Put XRP At $7 And $13

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential