24/7 Cryptocurrency News

MicroStrategy Announces Special Shareholders Meeting to Buy More Bitcoin

Published

1 day agoon

By

admin

Business intelligence firm MicroStrategy is doubling down on its Bitcoin strategy by discussing new financing options to fund the BTC purchase. As a result, the firm has announced a special meeting of shareholders to vote on proposals that aim at advancing the 21/21 plan. The goal is to enhance the company’s capital-raising capabilities while aligning director compensation with the Bitcoin-centric approach.

MicroStrategy Holds A Special Meeting With Shareholders

Soon after announcing a $516 million Bitcoin purchase on Monday, MicroStrategy announced its plans to hold a special meeting with shareholders to discuss further financial options and increase its Bitcoin holdings. As part of its 21/21 plan, the company to focus on enhancing its capital-raising capabilities further. Below are some of the firm’s key proposals.

- Increase in Class A Shares: The company seeks approval to raise the number of authorized Class A shares from 330 million to 10.33 billion, enabling more flexibility for future capital-raising efforts.

- Expansion of Preferred Shares: The authorized preferred shares would increase from 5 million to 1.005 billion. It will help in broadening financing options to support strategic initiatives.

- Amendment to Equity Incentive Plan: Proposed changes to the 2023 Equity Incentive Plan include automatic equity awards for newly appointed directors. This will ensure alignment with the company’s Bitcoin-focused vision.

This signifies Michael Saylor’s complete commitment towards MicroStrategy’s Bitcoin-centric strategy. In the last four years, the company has accumulated 439,000 Bitcoins, currently valued at approximately $42 billion. Besides, it has also propelled the company’s valuation to soar to $82 billion, an 80x surge after the company implemented its BTC plan for the first time in 2020.

This massive accumulation makes MicroStrategy the fourth-largest Bitcoin holder behind Bitcoin founder Satoshi Nakamoto, BlackRock Bitcoin ETF (IBIT), and crypto exchange Binance.

MSTR Stock on Downward Trajectory Despite Nasdaq 100 Inclusion

The MicroStrategy stock has been on a downward trajectory despite its inclusion in the Nasdaq 100 Index earlier in December. On Monday, the MSTR stock price corrected 8.78% slipping all the way to $332 levels. With this, it has extended its weekly losses to 19% and monthly losses to 17.65%. From its all-time high of $472 in November, the MSTR stock has corrected 30%. However, it has still been up by a massive 384% since the beginning of 2024.

Michael Saylor also remains hopeful of growth during the Donald Trump administration tenure as he proposing a strategic Bitcoin reserve to help the US pay its $36 trillion national debt. Commenting on the Republican win, Saylor said:

“With the red sweep, Bitcoin is surging up with tail winds, and the rest of the digital assets will also begin to surge. Taxes are coming down. All the rhetoric about unrealized capital gains taxes and wealth taxes is off the table. All of the hostility from the regulators to banks touching Bitcoin”.

Following last week’s all-time high of $108K, the Bitcoin price has witnessed increased selling pressure. In the last 24 hours, BTC has corrected another 2% extending its weekly losses to 11.52% and eyeing a further drop to $90,000. The Coinglass data shows $65 million in BTC liquidation with $45 million in long liquidations.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Malicious Google ad campaign redirects crypto users to fake Pudgy Penguins website

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Solana (SOL) Gearing Up: Is a New Surge on the Horizon?

24/7 Cryptocurrency News

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Published

1 hour agoon

December 25, 2024By

admin

The long-running SEC v Ripple case is in focus again as crypto-friendly Paul Atkins prepares to take over SEC Chairman responsibilities from outgoing Gary Gensler. Moreover, the January 15 deadline for the US SEC to file an opening brief in the XRP lawsuit in the 2nd Circuit Court of Appeals is approaching. Experts and lawyers have shared insights on what could happen next.

Incoming SEC Chair Paul Atkins to Dismiss Ripple Case

The crypto market, especially Bitcoin and XRP, has seen a paradigm shift after Donald Trump’s presidential election win. Moreover, pro-crypto Trump administration formation, including Paul Atkins’s nomination as SEC Chairman further sparked bullish sentiment in the crypto market.

This includes positive developments towards Ripple case dismissal or withdrawal and reduce former SEC Director Bill Hinman’s influence in the agency. Experts including pro-XRP lawyers Jeremy Hogan, Fred Rispoli, Bill Morgan cleared that there are high odds of XRP lawsuit dismissal under incoming SEC Chair Paul Atkins. This could lead to a rally in XRP price.

Moreover, an ethics investigation into SEC Corporation Finance Director Bill Hinman is now completed and issued to management. It is important to note that Ripple CLO Stuart Alderoty urged the incoming administration to “cleanse the lingering stain of Hinman from the agency.” He suggested starting with restoring trust in the SEC as Atkins works to repair the damage done under Gary Gensler.

The Digital Chamber said:

“The SEC has the opportunity to reset its historically troubled relationship with the industry This week, members of TDC’s Token Alliance Leadership Committee presented our 2025 SEC Digital Asset Policy Priorities to SEC staff.”

XRP Lawsuit Appeals Opening Brief Deadline Nears

The SEC must file its appeal opening brief in Ripple case by January 15, while the overall mood is on the lawsuit’s end. However, some believe Gensler to play his last major card in the Ripple vs SEC lawsuit as he leaves office, five days after the appeals opening brief deadline.

Notably, the SEC under Gensler has already filed an 81-page filing in Binance lawsuit opposing dismissal, what Ripple CLO called “failed arguments.” Gensler continues to affirm his claim that crypto has no inherent value.

Meanwhile, most experts including crypto executives are upbeat on appeals dismissal or withdrawal, which could lead to XRP price rally to $3 and higher. They believe the SEC under Gary Gensler went after crypto companies with their much-criticized regulation-by-enforcement approach. However, the new SEC should flip the script and work on pro-crypto Donald Trump’s agenda. The community also expects XRP ETF approval under new SEC.

Another long-running XRP lawsuit approaches an end, with the appeals court announcing the scheduled date. Ripple and CEO Brad Garlinghouse are to submit a reply in April.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Published

4 hours agoon

December 25, 2024By

admin

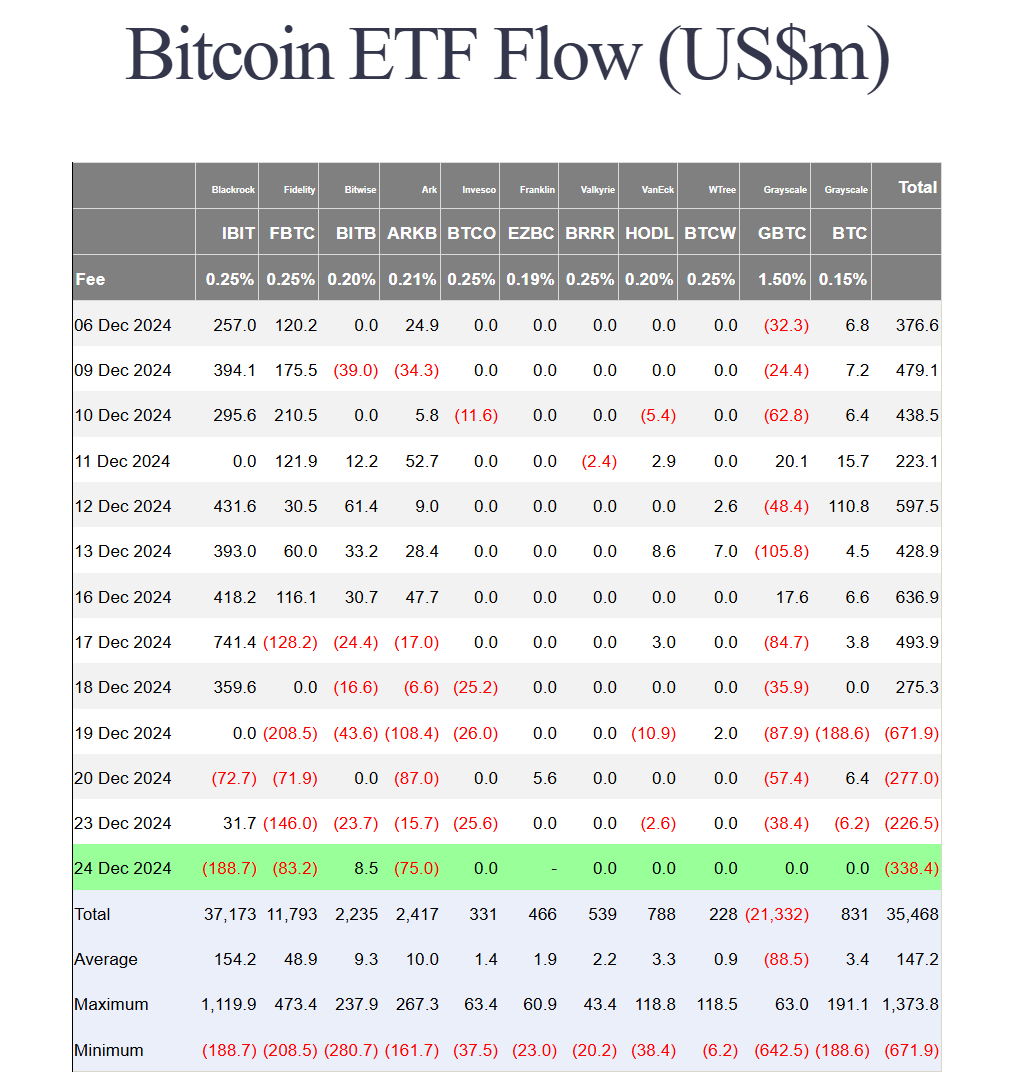

BlackRock’s iShares Bitcoin ETF (IBIT) has recorded its largest-ever $188.7 million in outflow on Tuesday, raising concerns over future implications. Also, US-based spot Bitcoin ETFs saw consecutive outflows for the fourth day as Fidelity’s FBTC and Ark Invest’s ARKB continued weak performance amid holidays. Bitcoin ETFs have now recorded over $1.5 billion in outflow in last 4 days.

BlackRock Bitcoin ETF Sees Biggest Outflow Since Launch

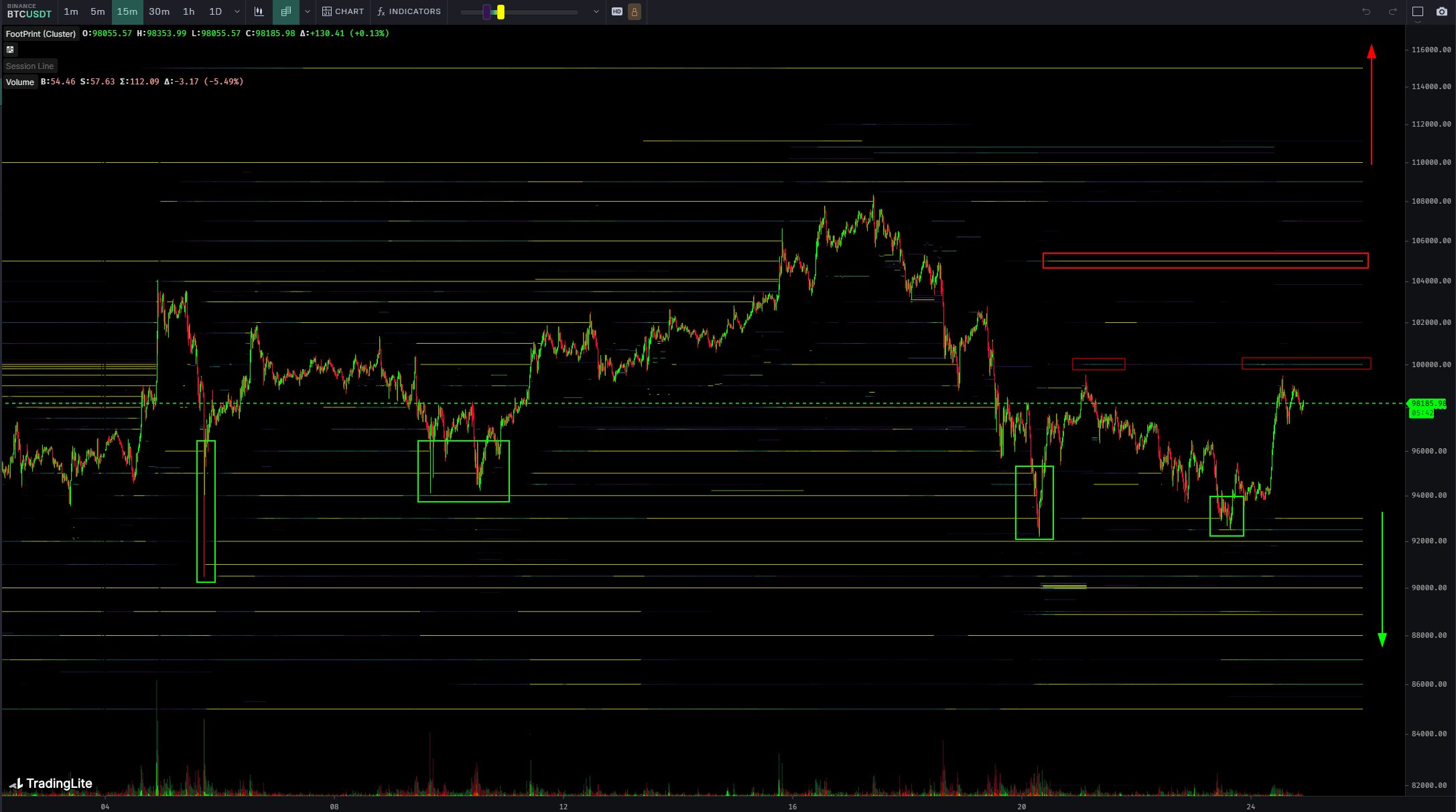

The crypto market showed signs of recovery as Bitcoin, Ethereum and other altcoins rebounded over the last 24 hours. Bitcoin price recovered from $94K to $99K today likely as traders FOMO Santa Claus rally. BTC currently holds above $98K, but a change in sentiment can trigger profit booking.

The promising factors for the change in sentiment could come from BlackRock Bitcoin ETF, which recorded its largest-ever outflow since launch on Tuesday, as per Farside Investors data on December 25. iShares Bitcoin ETF (IBIT) witnessed $188.7 million in outflow, almost double its previous largest outflow of $72.7 million last Friday.

The total outflow from US spot Bitcoin ETFs was $338.4 million, the fourth consecutive outflow. Fidelity’s FBTC saw $83.2 million and Ark 21Shares’ ARKB recorded $75 million in outflows. The flows for other crypto exchange-traded funds were negligible.

This has raised concerns among traders, raising problems for them as the year-end crypto expiry is almost here. While analysts and investors are primarily bullish, the recent prediction by experts including BitMEX co-founder Arthur Hayes about a potential crypto market crash near Donald Trump’s inauguration day sparked sell-offs.

However, crypto firms such as MicroStrategy, Metaplanet, Matador Technologies, and others buy the Bitcoin price dip. In fact, MicroStrategy’s Michael Saylor announced a special shareholder meeting to vote on a proposal for its 21/21 Bitcoin plan and boost its treasury.

What’s Next for Bitcoin Price?

BlackRock Bitcoin ETF’s largest-ever outflow and consecutive outflows from spot Bitcoin ETFs made investors to think about their next move.

Crypto analyst Skew revealed that the current passive ask liquidity is around $100K given quoting and previous LTF high, which is an important price area. Besides, ask liquidity and spot supply is around $105K. He believes flows and volatility will be a key factor here.

“Dynamic use of taker & limit bid for acquiring BTC here, likely a strategic play by some large market entity that expects higher prices into year end & early Q1.”

BTC price jumped 4% in the past 24 hours, with the price currently trading at $98,014. The 24-hour low and high are $93,744 and $99,404, respectively. Furthermore, the trading volume has decreased by 24% in the last 24 hours, indicating a decline in interest among traders.

Traders must keep an eye on volume and sentiment in the market for cues on direction in upcoming days, with BlackRock Bitcoin ETF also a major factor. Notably, 147 BTC options with $14.40 billion in notional value to expire on Deribit this Friday. The max pain price is $84,000 and put-call ratio is 0.68.

Varinder Singh

Varinder has over 10 years of experience and is known as a seasoned leader for his involvement in the fintech sector. With over 5 years dedicated to blockchain, crypto, and Web3 developments, he has experienced two Bitcoin halving events making him key opinion leader in the space.

At CoinGape Media, Varinder leads the editorial decisions, spearheading the news team to cover latest updates, markets trends and developments within the crypto industry. The company was recognized as “Best Crypto Media Company 2024” for high impact and quality reporting.

Being a Master of Technology degree holder, analytics thinker, technology enthusiast, Varinder has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Crypto Trader Turned $90 Into $3.25M As Token Skyrockets 5,500%

Published

8 hours agoon

December 25, 2024By

admin

Although Bitcoin’s impact is quite high on the crypto trading market, a few could create their own journey. This is exactly what a newly launched crypto token did: it surged 5,500% despite the crypto market crash and made millions for a crypto trader.

Crypto Trader Made $3.25M in Profits After Investing in UFD

Crypto trading is an intricate investment process that requires multiple strategies, correct timing, identifying opportunities, and much more to earn significant profits. However, there are incidents where traders have heavy returns in a finger snap. And this is what this crypto trader did, as he invested $90 in a newly launched Solana meme coin and earned $3.25M in profits after the token skyrocketed 5,500%.

Lookonchain, a famous crypto page, revealed this incident, in which the trader earned 36,067x returns over his UFD investment. More importantly, this happened within two days, leaving the netizens in shock. However, this is nothing new; investors have made such significant returns multiple times, including a crypto whale that earned 5M from the PENGU airdrop.

What can $90 get you?

This trader turned $90 into $3.25M in just 2 days by buying $UFD—an insane 36,067x return! #UFDhttps://t.co/wLEWwVnYAR pic.twitter.com/T1qs1Q7m1a

— Lookonchain (@lookonchain) December 19, 2024

What is Unicorn Fart Dust, and Why Does It Blew Up?

Over the years, many people have come to challenge the authenticity of crypto trading and become fans of its profit potential and use cases. The same happened with Basement Ron, a Gold enthusiast who wanted to prove that crypto is nothing and Gold is the real investment. To do so, he launched a Solana meme coin called Unicorn Fart Dust (UFD) and posted about this to let the people know how it failed. However, to his surprise, the token blew up within days, reaching a market cap of $500M. Moreover, the UFD price surged by 5,500%, making heavy returns for its holders, aka crypto traders.

The token currently trades at $0.1666 with a market capitalization of $165M after a 42% surge in the last 24 hours. It also has a trading volume of $53,519,706 per Coingecko, representing its high demand.

Interestingly, this is not the first time the crypto community has come together to prove someone wrong. Earlier, a GenZ kid launched a meme coin on pump.fun and attempted to use a rug pull scam. However, the crypto trading community pumped the token by 71,000%, leaving the kid with a minimal profit as he sold early.

What’s The Lesson Here?

Crypto trading is a vast industry, facilitating billions of trades. Some turn profitable, and others in loss. Here, the unpredictability and crypto market volatility make it even more challenging. However, a few with experience and crypto tradies strategies have made heavy returns, including this crypto trader who identified the opportunity in Unicorn Fart Dust (UFD) and turned his $90 into $3.25M. However, people must do proper technical analysis and research before investing.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Malicious Google ad campaign redirects crypto users to fake Pudgy Penguins website

BlackRock Bitcoin ETF (IBIT) Records Largest-Ever Outflow of $188M

Solana (SOL) Gearing Up: Is a New Surge on the Horizon?

XRP, SOL, NEAR, DOGEN, and DOT poised to explode

Crypto Trader Turned $90 Into $3.25M As Token Skyrockets 5,500%

Here’s a Potential Downside Price Target for Cardano If ADA Sees New Correction, According to Benjamin Cowen

Which crypto will explode in 2025? Expert insights and predictions

XRP Price Pumps 7% On Christmas Eve, Will It Reach Yearly Highs?

XRP firmly above $1, ADA and LCAI to steal the spotlight

The 69 Dumbest Moments of the Year: 2024 Crypto Edition

Here’s What To Expect After Pectra Upgrade

Top 5 meme coins for 12,000x gains

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: