Opinion

The 69 Dumbest Moments of the Year: 2024 Crypto Edition

Published

1 day agoon

By

admin

Crypto was dumb in 2024—like, really dumb. This year’s meme coin supercycle spawned the most bizarre characters the industry has ever seen, which is saying a lot, and conferences had us cringing weekly, all while politicians begged on their knees for the crypto vote (or at least its money).

And with this, we’ve enjoyed some of the dumbest moments ever inscribed on the perfectly distributed, immutable, uncensorable Blockchain of Life. From a meme coin developer setting himself on fire to promote his meme coin (#6, below) to FARTCOIN itself piercing a billion-dollar market cap (a late breaker that we didn’t even count, but Stephen Colbert did), this year was truly something all of us can be proud of. These are the moments that define us, and which we can retell endlessly to our children, and our children’s children, all of whom will doubtless be basking in the generational wealth we created in 2024, and beyond.

To commemorate crypto’s awesomely idiotic year that was, we’ve randomly gathered an unranked list of 69 of the Dumbest Moments of the Year.

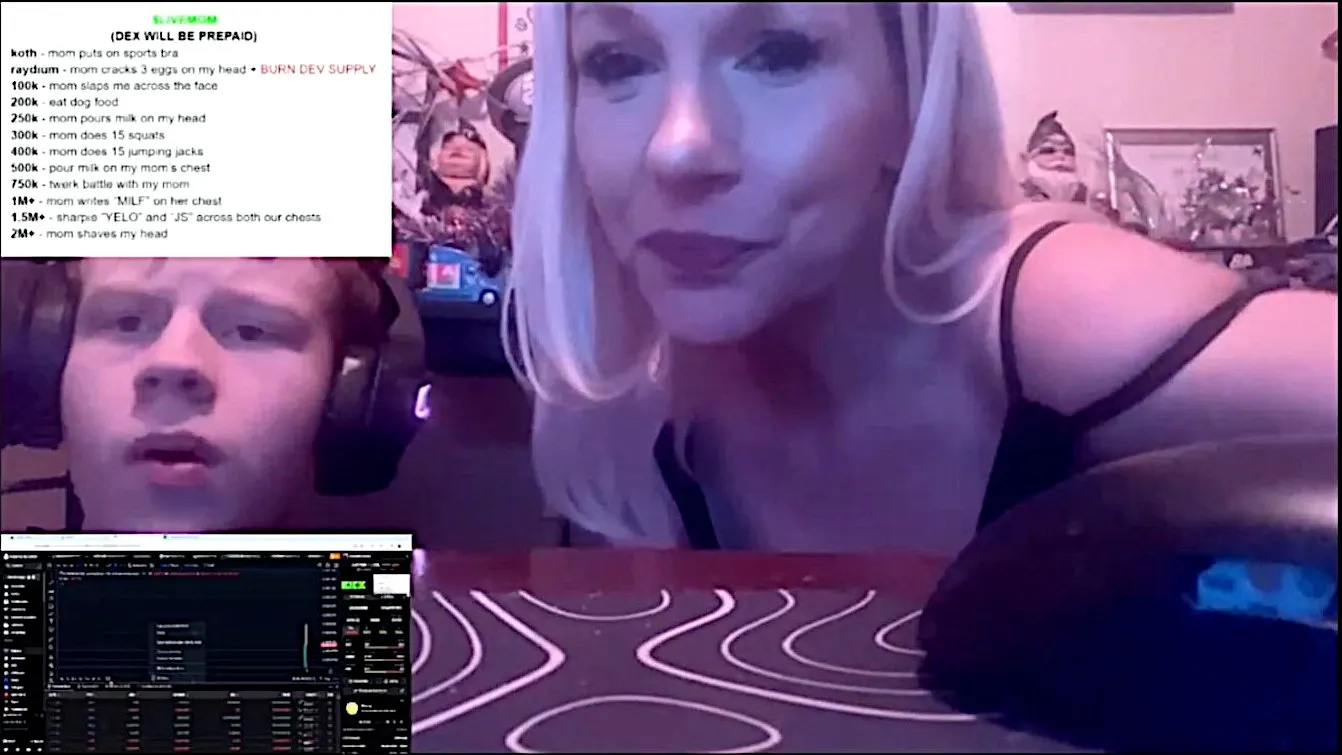

1. Meme coin mammories

An alleged mother joined her alleged son on a livestream to shake her boobs, begging viewers to invest in her son’s real meme coin.

“Do you wanna see him pour milk over these 36DDs?” she asked, noting—in case we weren’t already horrified enough—that her son “actually suckled on these. Now he’s going to get to pour milk on them.”

2. Getting cheeky

The viral success of LiveMom kick started a live streaming meta where meme coin devs would do stupid shit to boost their Pump.fun tokens—some would call it performance art.

One dude tied his hands so he couldn’t dump on investors, another claimed to have no arms at all (before he revealed them and sold everything), and a third dev said he had kidnapped someone. We wish that was the worst of it, but it definitely wasn’t: one guy lost his tooth while boxing, and another genius simply streamed their spread ass cheeks.

Recently, a guy created a token called $Hands and posed with a paper under his chin saying, “I have no hands, I can’t do a Rug Pull.”

But when it peaked, he pulled his hands out from behind his back and sold his tokens like a magician pulling a rabbit out of a hat pic.twitter.com/MalhNvz3Pb

— Rizz God (@Hirizzy) May 6, 2024

3. Making a lot of Mollah

Since the release of the Bitcoin whitepaper in 2008, people have wondered who Satoshi Nakamoto is. In October, one man stepped forward claiming to be the real deal.

British-Asian macroeconomist Stephen Mollah said he had been trying to reveal his true identity for some time but people kept stopping him. At the event (which he charged an entry fee of £500 for) he also claimed to have created the Twitter logo, ChatGPT, and the Eurobond, a type of debt.

Mollah rambled for over an hour, eventually claiming that he would move Bitcoin from the Genesis block “very soon” but he had to prepare for it. (Sadly, this still hasn’t happened.) When diving through his Twitter account, we found a spree of 2018 posts calling out all of the “Faketoshis” out there accompanied by some interesting images.

A man called Stephen Mollah has taken to the stage. He claims to be Satoshi Nakamoto – the mystery inventor of Bitcoin. He’s claimed this before and is currently in legal dispute about it. He will now provide evidence, he says. pic.twitter.com/XkapPT7y3c

— Joe Tidy BBC News (@joetidy) October 31, 2024

4. See the kitty? Pet the kitty. No, not that kitty…

Solana meme coin factory Pump.fun has been the home to some of the most jaw-dropping, idiotic moments in crypto. A case in point was when degens started trading a coin based on an “invisible cat” called Kieth… it’s just a photo of an empty room. And yes, it’s spelled that way.

5. Slerf’s up!

A developer accidentally burned $10 million worth of pre-sale tokens raised for the about-to-launch Slerf meme coin—rather than sending them to pre-sale participants. What happened next? The token shot up to a market cap over $700 million, of course.

6. Florida man says to Slerf dev hold my beer, burns self to pump token

A Florida meme coin dev set himself on fire in an attempt to pump his token. It worked, and the token spiked over 2,000% to a market cap of $2 million in just a few hours. But he was hospitalized with third-degree burns and couldn’t sell, due to the intense medical attention he immediately required. Once he recovered, he couldn’t properly use his hands and claimed his phone’s face ID didn’t recognize him.

Months later, he quit the project claiming he was taken advantage of. His biggest regret? Not selling.

7. Does this ass make my tattoo look fat?

A Gigachad investor decided to get his Solana meme coin’s contract address tattooed… but he spelled it wrong.

8. Does this hair make my head look fat?

A crypto degen started to collect his girlfriend’s hair, one strand at a time, placing them on a styrofoam mannequin head. As day two dawned, budget airline Ryanair reposted the account suggesting that the owner ought to fly to Turkey for a hair transplant, which apparently is a thing there. Of course, the token skyrocketed over 470% as it garnered more mainstream attention.

9. Unreality TV

A tour of the “Solana Villa,” part of a crypto reality TV show, went viral this year simply because it was so obnoxious.

“Check out this helipad. If you don’t have this, you’re poor. HA HA speed tour!” the influencer said, showing off an Airbnb property.

10. Remilia King

Remember Joe Exotic (the Tiger King)? Remember when he joined an NFT community called “Retardio” out of the blue? And then got airdropped a DeGod? Nah, didn’t think so.

11. Gold medal grifting

Caitlyn Jenner (inventor of the tokenized Olympic medal ploy!) kick-started a whole celebrity meme coin meta. What was particularly dumb was that Jenner launched a token on Ethereum the same week she launched her initial meme coin on Solana. The new token claimed to have the goal of supporting Donald Trump’s presidential campaign. Months later, both tokens had crashed below $1 million market caps.

12. This little Iggy never went to market

Part of the reason Caitlin Jenner wanted to relaunch her celebrity project was because she claimed to have been “scammed” by the person who helped her create it: Sahil Arora. Arora made a name for himself this year as the mastermind behind countless short-lived celebrity projects and the odd Twitter hack.

That’s why it was so dumb that people fell for his trap by sending $380,000 to a pre-sale wallet for an Iggy Azalea token that that disavowed by Ms. Azalea. One pre-sale participant said that Arora had “lost all his rep” as a result.

13. Who’s your DADDY?

Who can forget the heartwarming story of Andrew Tate, who in July was allowed to leave Romania while he awaited trial on charges of alleged human trafficking, rape, and forming a criminal gang to sexually exploit women? (All of which he denies.)

Upon hearing the news, Tate immediately announced a “global tour” for DADDY, a Solana token he’d been promoting to flip Iggy Azalea’s token MOTHER. Problem was, though Tate announced his tour would take him to “Tokyo, Dubai, [and] Miami,” he wasn’t allowed to leave the European Union.

Tate, who’s still awaiting trial, has denied the charges.

14. No, Iggy: Vitalik isn’t keeping your gas money

OK, we love Iggy Azalea, who is our SCENE Person of the Year, because she launched her own token and could be the only celebrity to actually keep supporting her project (MOTHER) months after launch. But it’s not all been smooth sailing for her.

In response to criticism from Ethereum co-founder Vitalik Buterin, the Australian singer questioned what he’s doing with ETH gas fees. This caused Crypto Twitter to clown Azalea since these fees don’t touch Buterin’s wallet—they feed back into the Ethereum ecosystem. She was younger then and we believe better educated now!

15. Crypto’s got ass…

Azalea upped the ante by hosting a stripper-filled party in Singapore, where some of the most degenerate clips of the year were born… which is saying a lot. Some examples:

16. …But Ethereum’s got talent!

Crypto conferences are usually serious events, filled with lengthy talks about blockchain technicalities and ever-imminent mainstream adoption. But at Token 2049: Singapore, Buterin decided to spin it up with a little crypto sing song—very much reminiscent of his 2019 rap.

“It’s mathematical. No more double spend, it’s encryptable,” he sang onstage. “A new form of wealth begins.”

Today, the massive cryptocurrency conference TOKEN2049 kicked off in Singapore!

Among the speakers? Ethereum’s own Vitalik Buterin.

And guess what? He broke into song right on stage check out the video!PS: Twitter’s losing it. Commenters are joking they’re selling all their pic.twitter.com/oiQehwo7YN

— kukat ⭐️ (@kukat23) September 18, 2024

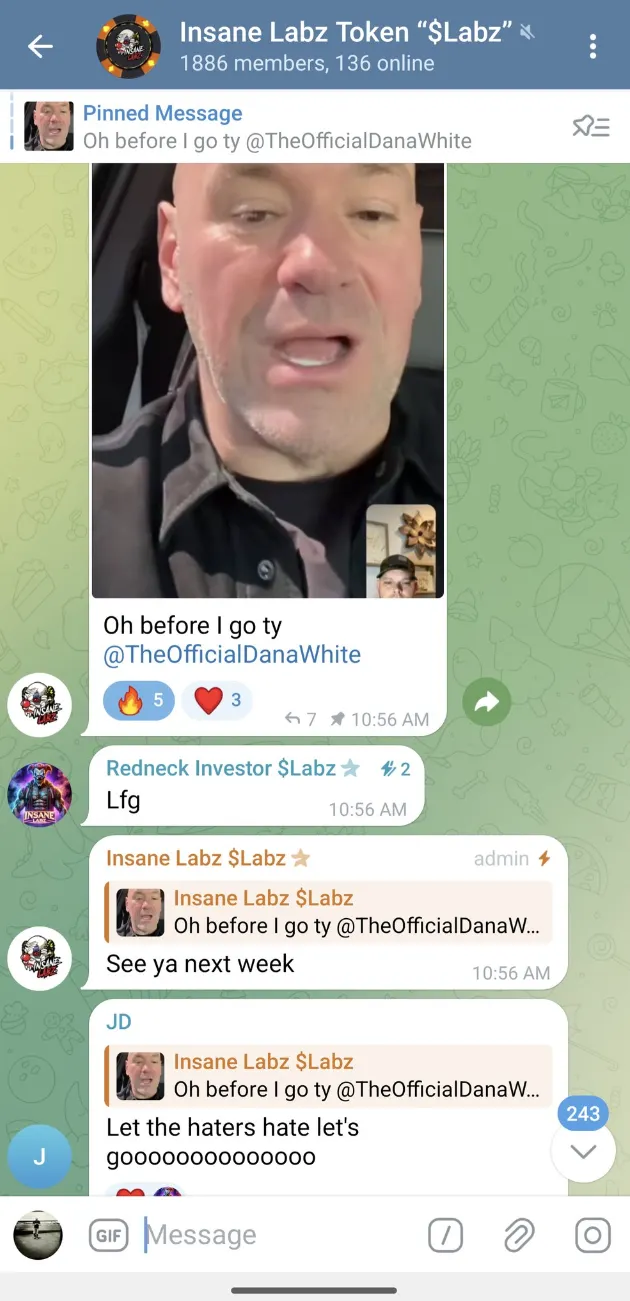

17. Buying tokens like these is insane!

Insane Labz, an Arkansas-based supplements company known throughout the MMA and Barstool Sports world, allegedly paid a group of online trolls to impersonate celebrities, fool its investors, and pump its token. And the scheme worked—until it didn’t. The trolls impersonated UFC President Dana White, MMA legend Nate Diaz, and social media sensation Hasbulla to hype up the LABZ token in the company’s Telegram group.

“We just did it for a laugh that got a bit out of hand,” one of the impersonators told Decrypt.

18. Simping for rug pulls

As an industry full of incels, virgins, and generally lonely men, it’s no surprise that thirst trap pump-and-dumps became commonplace this year. The recipe was simple: be a girl or know a willing one, create a Pump.fun token, wear few clothes, livestream, then sell all your tokens once a few people buy in. Easiest money you’ll ever make.

Kim entered the bath,

Kim launched the coin,

Kim sold all the coins in 1 minute,

Kim earned 0.30 SOL,

Kim got wet for nothing.

don’t be a Kim. pic.twitter.com/HbP6wMhSOg

— ferb (@ferbsol) May 12, 2024

19. Drugging for rug pulls

It was a banner year for drug addicts using the blockchain. First we had Meth’d Up Dev that, you guessed it, did meth on a livestream to pump his token. Then, we had Crack Head Dev who—actually, you didn’t guess it—overdosed on fentanyl while livestreaming. He later faked his death before becoming a full right-wing, racist Twitter personality. Who says there are no second acts in life?

Finally, we wrapped up the year with Meth Girl, who struggled to gain much traction since her Twitter accounts kept getting banned. Still, you go Meth Girl!

20. Currying for rug pulls

An enterprising fellow set up a meme coin for a curry stall in Lahore, Pakistan. But Decrypt did some digging, and it turned out the stall owners weren’t getting any money made from the token. So the streamer stopped the stream, and the CURRY coin tanked 92% in just a few hours. You’re welcome, Curry Guy.

21. Jumping the frog

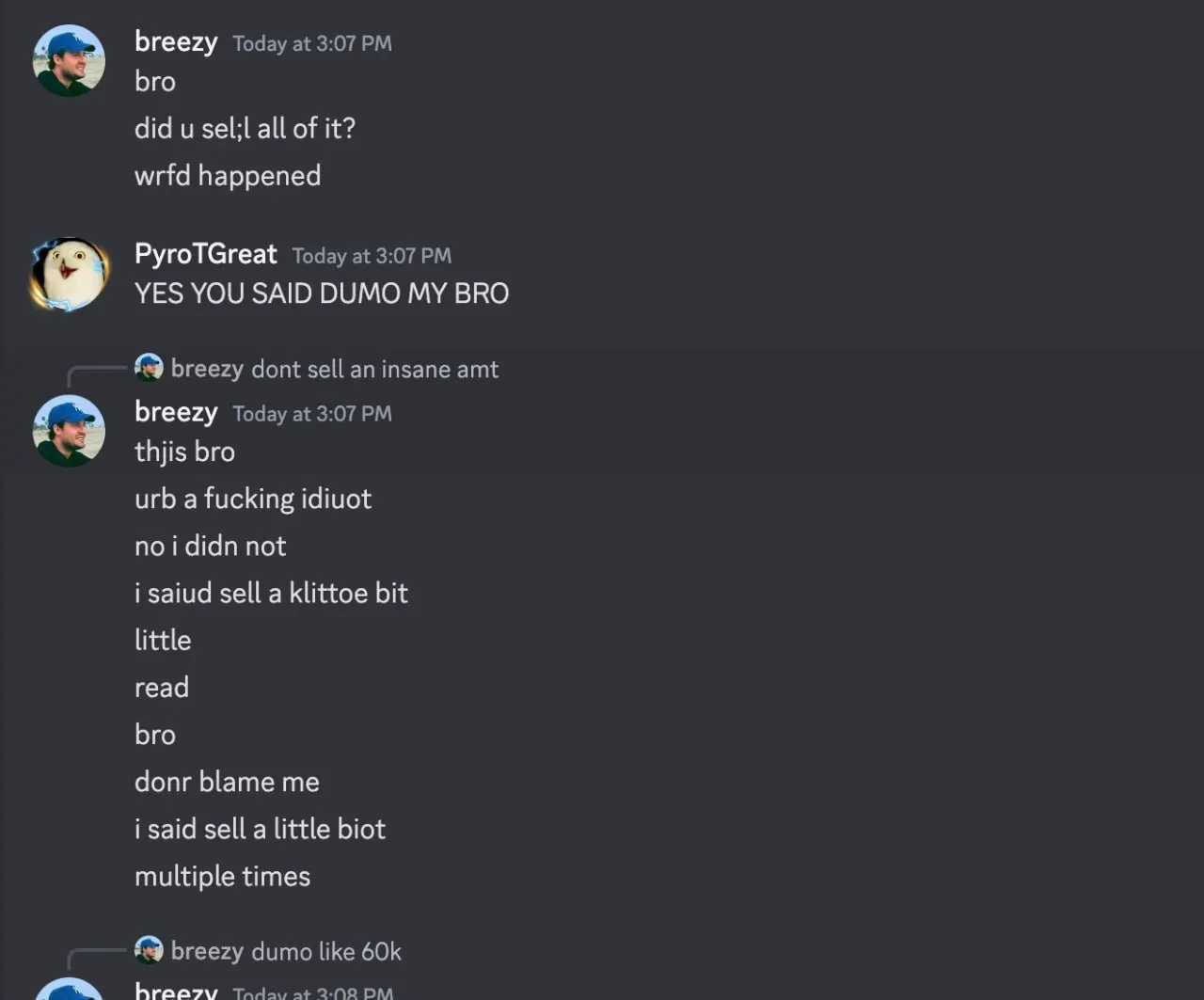

Flog the Frog (FLOG) was one of the most-hyped meme coin launches of the year due to its impressive artwork and influencer support. But its core team accidentally dumped on investors after an embarrassing miscommunication.

“DUMP IT,” project manager Breezy said in the leaked team chat, meaning to sell just a small percentage. Once he saw the token crash 91% in just one minute, he wrote, “Bro, did you sell it all?” Pyro, who was in control of the team funds, responded, “YES YOU SAID DUMP MY BRO.”

“You’re a fucking idiot,” Breezy explained. Fortunately for the artist, Flog relaunched as Fwog, ultimately becoming one of the more successful meme coins of the year.

22. Jumping the squirrel

Poor, Peanut the Squirrel. Only the good die young: The rodent, suspected of having rabies, was a general election meme—and, of course, meme coin. PNUT saw $150 million in daily volume in November, and became one of the largest meme coins by market capitalization.

In a tragic post-mortem twist, it was revealed that Peanut never had rabies and was murdered for nothing. RIP little buddy, may your meme coin live on and your memory be a blessing.

23. But wait! The squirrel coin lives!

Less than a month after the story of the not-rabid but very dead Peanut the squirrel captivated a world gone mad, the rodent’s owner—apparently miffed that carpetbaggers got rich off his personal tragedy—launched his own token. Never mind that “the PNUT community” supposedly donated $50,000 to the owner.

“The fact that people wanna make money off this is nothing short of despicable,” the bereaved owner stated in a Twitter video, before pivoting to launch the token called JUSTICE. Sadly, there was no justice for the JUSTICE token, which died deader than the fucking squirrel.

24. The father, the son, and the holy chicken

This year spawned a religion with followers worshipping a raw chicken with a fish head smoking a cigarette called “Lord Fishnu.” But that’s not the dumbest moment.

Known as the Church of the Smoking Chicken Fish, the meme coin-based religion baptizes followers in what’s called a “brothism.” Normally this is just done by reading out the “10 chickemandments” on Twitter Spaces, but one follower took it a step further by reading them aloud in a bath, while fully dressed, and with raw chicken on his head.

And that’s not even the dumbest moment: the church was planning on opening a physical space in Marfa, Texas.

25. And, even that wasn’t the dumbest moment

A few months later, the church’s leader Pastor Kelby went rogue and started using his influence over the religion to take payments and shill micro-cap meme coins. In turn, he got banished from the church.

Does this throw the physical church plans into turmoil? 🙁

26. The father, the wife, and the holy token

A Colorado pastor faced fraud allegations after he and his wife created, then sold “illiquid and practically worthless” crypto tokens to investors to fund their “lavish lifestyle,” authorities there alleged. In response, the pastor admitted that he made $1.3 million, but said that he was instructed by God to sell the tokens.

“God is not done with this project; God is not done with INDX coin,” he vowed.

27. In God we trust. All others pay in Solana

The CFTC filed a lawsuit against the former pastor of a Washington-based church of a multilevel marketing scheme that allegedly took more than $5.9 million in cash and digital assets for a fake “Solanofi platform.” The ex-holy man allegedly targeted “unsophisticated investors,” promising they could earn up to 34.9% monthly through a so-called leveraged staking platform, according to the complaint.

28. You can never trust a cabal

Meme coin devs, promising a massive “social experiment” on Solana, tried to jumpstart a spike in a token called CABAL after airdropping $10,000 worth to 10 Crypto Twitter influencers in August. Within a couple days, most of the influencers had dumped the thing. It now sits at a market cap of less than $15,000.

“I don’t know why they expected to hand someone $10,000 and have them not sell,” said one of the influencers. Notably, the list of influencers included Beaver, the person who said he paid Crack Head Dev (#16, above) to fake his own death.

29. Dog WIF your funds

As Dogwifhat (WIF) was establishing itself as a “blue-chip meme coin,” a group of investors—including one of the CABAL influencers, Ansem—decided to raise $700,000 to put the doggie meme coin on the Las Vegas Sphere. Eight months later, this still hasn’t happened… with Bitcoin even beating WIF to the punch. As time passes, more pressure mounts on those in control of the funds.

30. Anything WIF hat

Meme coin enthusiasts started putting pink beanies on everything they could, thanks to Dogwifhat’s popularity. “The hat stays on,” applied to pets, celebs, every meme coin in existence, and even cars.

31. You’re fired/rehired!

Polymarket, one of the most successful crypto projects of the year, not to mention a source of truth during the U.S. election, fired its intern for shilling an NFT project called “Retardio” on its Twitter.

Once there was enough backlash—against Polymarket that is—the intern was brought back into the fray.

UNRELATED: The UK’s Conduct Financial Authority subsequently issued a scam alert about the token, causing one to wonder: WHY JUST THAT ONE?

32. Buy the rumor…

When Trump went on a rant about Haitian migrants eating pets during his debate with Kamala Harris, degens rubbed their hands hungrily. That’s because there were already meme coins about the wild rumors, of course.

But their excitement was short-lived: The shitcoins quickly fell in value when the ABC debate moderator fact-checked the baseless claim in real time.

33. …Sell the news

As the rumor spread that Kamala Harris was picking Tim Walz as her running mate, we watched as meme coin communities that had formed around other potential VP picks began to tank. Sad!

Take for instance SHAPERO, the intentionally misspelled Josh Shapiro meme coin, which quickly dropped 94% as the Walz news started to spread across social media. Unbowed, the project’s anonymous leader urged followers on Telegram to stay the course and claimed that FUD (not the coin, but honest to god fear, uncertainty and doubt) was being orchestrated to push down the price.

Literally four minutes later, CNN reported that Walz was Harris’s VP pick.

“Oh my fuckin’ god, who rugged my bag?” one SHAPERO investor wailed in lament.

34. The President is not dead, he is just sleeping

Before he dropped out of the Presidential race, crypto degens were convinced that Joe Biden had died. Naturally, a flurry of meme coins hit the blockchain, though they were surpassed by a two-month-old token that predicted the exact date he would pass; it touched a market cap of $660,000.

All of these tokens tanked once the rumors were debunked. At the time of writing, Biden is still allegedly alive.

35. Who actually shot Trump?

Remember when Trump was nearly assassinated? No, not the second time, the first time.

Well, Pump.fun traders somehow identified the shooter hours before the FBI confirmed who had shot at the former president. While this was an impressive feat from our beloved degens, there were also countless coins that got it painfully wrong—including a popular token claiming it was an Italian journalist who, as it turned out, was peacefully sleeping at the time.

Also, just to add a bonus layer of crypto stupidity to the pile, then-popular Telegram tap-to-earn game Hamster Kombat turned Trump’s defiant fist pump into an absolutely bizarre tribute.

36. Vote crypto, mate

While crypto was a talking point—not to mention a massive source of funds—in the U.S. election, with Trump running on a number of pro-crypto policies, not a single U.K. political party mentioned crypto in their manifestos.

This was called a “missed opportunity” by a U.K. lobbying firm, as it ignored 10% of U.K. adults who own cryptocurrency, and, presumably, bet on foolish things. To make matters worse, the leader of the Tory party, Rishi Sunak, had previously made pro-crypto stances… but failed to bring it into the election. He went on to lose miserably.

37. Rug-pulled my Grandma

Once you’re invested in a meme coin, you can’t take your eyes off the chart—so much so that one trader posted a photo of them looking at DEX Screener next to their dying Grandma in a hospital bed.

“RIP Grandma,” they posted on Twitter. “Onboarding her estate though, it’s what she would have wanted.”

rip grandma fr 🙏🙏

onboarding her estate though it’s what she would have wanted

retardio in paradise pic.twitter.com/idc1nAK68g

— Booby Shill 🫷🤡🫸 (@BoobyShill) May 28, 2024

38. No (Dr.) Disrespect intended

Dr. Disrespect, popular streamer and co-founder of the studio behind crypto shooter Deadrop, admitted to inappropriately chatting with a minor on Twitter only to subsequently claim he didn’t.

In fact, he claims to have made the admission via a tweet to intentionally catch journalists out. Well, consider us caught, Doc. If that’s something you want to say in black and white, go ahead.

there’s no way Dr Disrespect is claiming he edited the word ‘minor’ out of his original statement on purpose to see if journalist would pick up on it 😭 pic.twitter.com/fMe4wOzGpl

— iqkev (@iqkev) September 6, 2024

39. Degens take their revenge on sassy kid who rugged them

A teenage Solana meme coin creator rug-pulled holders after his token hit a $1 million market cap. Exhilarated from the $30,000 he’d pocketed, the punk gave the punters a one-finger salute in a home video and yelled, “Thanks for the 20 bandos,” while skittering around his bedroom.

Humiliated but vowing retribution, our degens bravely fought back, massively trading the shitcoin until it surged to a $85 million market cap. Had the kid held on and treated his elders with respect, his little coin would have been worth more than $4 million. Take that, insolent child!

40. Top DOGE

When the fine specimen of a canine we all know as Doge (the mascot for Dogecoin) went to heaven in May, the owner got a replacement dog—a rescue Shiba Inu named Neiro. Predictably, the new, old Shiba spawned a raft of Neiro-themed coins, with major in-fighting and accusations of scams, cabals, and hatred. All of this despite the owner refusing to endorse any of them. Is nothing sacred?

Months later, in December, it was announced that members of the Own the Doge DAO will be voting on which meme coin will get the Neiro IP. “This is not wholesome,” the Twitter post said.

I see many tokens related to Kabosu and Neiro. To clarify, I do not endorse any crypto project except @ownthedoge $dog because they own the original Doge photo and IP (which I gave to them) and are committed to doing only good everyday, charitable works, and Doge culture. pic.twitter.com/9qsycpdQGV

— かぼすママ (@kabosumama) July 28, 2024

41. Fun with Bitcoin ETFs!

In January, the SEC’s official account tweeted that all 13 spot Bitcoin ETFs had been approved. But in fact, the SEC’s account had been hacked and none had been approved just yet.

SEC Chairman Gary Gensler’s revelation that the tweet was fake sent the price of Bitcoin plunging from $47,680 to just above $45,500. It was a good opp for someone to fill their bags, probably MicroStrategy’s Michael Saylor. (The actual ETF approval came one day later FYI.)

42. Bull dreams of Satoshi Nakamoto

Satoshi Nakamoto came to me in a dream last night and handed me Santa’s list. I saw Bitcoin next to Gates and Bezos… history’s being written.

— Scottie Pippen (@ScottiePippen) December 9, 2024

Scottie Pippen, the legendary NBA star, claimed to have several dreams this year wherein he met the legendary Bitcoin creator Satoshi Nakamoto.

In the first of the year, Pippen claimed that Satoshi was “proud” of his work for tokenizing the basketball used in game five of the Chicago Bulls vs. Los Angeles Lakers 1991 finals. Then in September, Satoshi visited him in a dream again to tell him that Bitcoin would be worth exactly $84,650 on November 5—which was about $14,000 off.

Pippen also claimed that Satoshi was sending him photos in his dream, that he kept laughing at the price of Bitcoin, and that Bitcoin, Bill Gates, and Jeff Bezos are on Santa’s list—he did not specify if it was naughty or nice.

43. Booing for Bitcoin

Crowd reactions to pro-bitcoin remarks at OSU’s commencement are telling. Bitcoin is a brand. And to this audience, an annoying or possible grifty one.pic.twitter.com/HinpbdMEup

— Andrew M. Bailey (@resistancemoney) May 6, 2024

Who among us hasn’t loaded up on ayahuasca, had a vision about the sanctity of alt assets, and given a commencement address shilling Bitcoin at Ohio State University? Chris Pan, the commencement speaker who was rudely (!) booed when he brought up crypto, spoke truth to power nonetheless.

His moving address ventured beyond digital currencies, too: “I didn’t go to give a speech,” he said later in an Instagram story. “I went to share truth so we stop funding wars. We have to stop the bloodshed.” Oh, he also gave a Michael Scott-esque karaoke rendition of “What’s Up?” by 4 Non Blondes.

I find it funny while everyone was concerned about the person who fell to their death at OSU Stadium, the commencement speaker is over here doing this pic.twitter.com/z22vuP6TZY

— Spotted Cat (Isaiah) (@Spottedcat123) May 5, 2024

44. Malaysia is crushing it, Bitcoin-wise

Malaysian authorities crushed 985 Bitcoin mining rigs as part of a countrywide crackdown on electricity theft. Yes, yes, extravagant use of electricity is, on occasion, sometimes associated with crypto miners. But had they simply invested in Bitcoin instead of destroying those precious miners, perhaps it would rank higher among the world’s countries by GDP. Actually, it is 37th of 195, which isn’t all that bad.

45. No sweetie, when a $6.5 million payment is made in error, you can’t keep it

This one seems a bit unfair: After centralized exchange Crypto.com mistakenly refunded a woman $6.8 million—instead of $65! LOL!—she (and her erstwhile partner) apparently spent $4.42 million of the money. Among other things, such as artwork, the couple apparently bought four homes in Australia. The woman was arrested while she was waiting to fly to… wait for it… Bitcoin-hating Malaysia!!! She served 209 days in prison and had to give back the money and other ill-gotten gains.

46. When scribbled on a legal pad, the words “BUY BITCOIN” are worth 10x more than a bitcoin

In 2017, Christian Langalis, a 22-year-old Cato Institute intern, scrawled “Buy Bitcoin” on a yellow legal notepad, then photobombed Janet Yellen with it during a televised House Financial Services Committee hearing.

Obviously the price of Bitcoin spiked by 3.7% right after the broadcast, making Langalis a BTC hero. In April, our man auctioned off his 15 minutes of fame for $1.019 million. Said he: “It’s good to finally liberate this number from my sock drawer and offer it back to the Bitcoin public.”

47. Betting on Bryan’s boner

If anyone is looking for evidence of the decline of Western civilization—indeed, civilization in general—look no further than the biohacker Bryan Johnson and his long-suffering penis. Johnson, a multi-millionaire who wants to live forever, makes your average health nut look like Homer Simpson.

In December, Polymarket bettors wagered on whether he could maintain a nighttime stiffy for more than two hours during sleep. Nighttime erections are “a significant biological age marker representing sexual, cardiovascular, and psychological health,” Johnson said, citing research that correlates a higher risk of death for men who don’t get wood in the night. As if you didn’t have enough to worry about.

There’s now an active betting market on @Polymarket for my nighttime erections.

A few things to consider when making your wager:

+ I return from China on the 16th of Dec and measurement will take place during the final week of the month. I’ve not previously measured how much… pic.twitter.com/1yZtCFkE1U

— Bryan Johnson /dd (@bryan_johnson) December 10, 2024

48. Heads I win, tails you’re a l0ser

It’s a good thing Polymarket became popular enough to allow degens to bet on anything, even Johnson’s johnson. In June, deep in the doldrums of a lifeless market, they were so bored that the poor bastards were actually betting on coin flips. Yep, just connect your wallet to a site called Degen Coin Flips. What could possibly go wrong?

49. What is it with hamsters?

In August, degens, apparently tired of betting on coin tosses, found a new obsession: Betting on live hamsters racing in little plastic cars. It was the second straight year that the premise had been tested, but the added cars arguably juiced the appeal.

50. Annals of stupid token launches, #1 in an infinite series

One of the largest DEXs on Solana, Raydium deployed a meme coin on a new token launchpad, but it backfired and “didn’t exactly go as expected,” with two identical tokens created and the first dropping 92% in just 10 minutes. The token initially had spiked to a $7 million market cap, before plummeting to $488,000. “Is it rug?” asked one well-trained Discord user.

51. Annals of stupid token launches, #2 in an infinite series

Imagine a meme coin that failed to pump before it could be dumped. That was the case with a celebrity coin apparently promoted by Brazilian footballer Neymar Jr, bassist and lyricist for Pink Floyd Roger Waters, and a number of other highly-followed accounts, including the CEO of a luxury lifestyle brand.

Despite the celeb tweets reaching over 3 million people, the token barely hit a market cap of $19,000. In fact, it was held by just two dozen holders, and had a scant $4 worth of liquidity. You’ve probably guessed by now that those luminaries had nothing to do with the token, and their X accounts had been hacked.

“It was the saddest launch I’ve ever seen,” said the CEO of on-chain analytics company Bubblemaps,

imagine hacking a Neymar jr fan account with 2M followers and Roger Waters’ account to promote a token

only to end up with $4 in liquidity

the celebrity meta is officially dead 😭 pic.twitter.com/WuT7vZ9Hle

— Bubblemaps (@bubblemaps) September 13, 2024

52. Binance says some of its best friends are people of color

Binance, the world’s biggest crypto exchange, posted a meme to X in June that appeared to suggest that it was discriminating against its users based on skin color. The exchange, of course, blamed an intern on its social media team who “lacks the corresponding cultural background” needed to understand what racism is.

“When they saw this MEME image in the community, they did not understand its meaning and posted it on X. This is our fault, and we will make sure to rectify this issue,” Binance wrote. The solution, the firm said, was to hire a new intern.

“WE CLEARLY NEED A NEW INTERN” – BINANCE APOLOGIZES FOR RACIST MEME POSTED TO ITS TWITTER ACCOUNT

“The social media team has recently been onboarded and lacks the corresponding cultural background” ~ Binance co-founder, Yi He.

– Only yesterday, the official @Binance X/Twitter… pic.twitter.com/6Z35pc8Gop

— BSCN (@BSCNews) June 16, 2024

53. Note to Kraken hackers: Your halloween mask doesn’t fool anyone

Some genius attempted to access a Kraken account in June by trying to talk a customer service rep into giving him access. The guy was literally wearing a cheap Halloween mask.

“Our agent was like: This is absolutely ridiculous. This is a rubber mask the guy’s wearing,” Kraken Chief Security Officer Nick Percoco told Decrypt.

54. The rugging and resurrection of the TrumpCoin

The Solana-based meme coin TrumpCoin—which launched in June amid a flurry of boasts over its claimed but still unproven connection to former U.S. President Donald Trump—lost 92% of its value after a hearty rugging.

The DJT token, inspired by the President-elect, went into freefall after the largest whale and owner (20% of the supply) sold off $2 million in tokens—some 2 billion of the suckers—in one massive dump. The token’s market capitalization plummeted from $55 million to $3 million in minutes. Ah, but who’s laughing now? The token nearly doubled its all-time-high price after Trump won the election, before plunging back to the floor.

55. America’s sweetheart awakens

Haliey Welch, aka the Hawk Tuah Girl, launched a HAWK token. Faster than you can say “spit on that thang,” the token climbed to a market capitalization of $490 million… before immediately collapsing by more than 93% in value. Some $3 million was pocketed by persons unknown.

“Haliey’s team has sold absolutely no tokens whatsoever,” her people said, denying they orchestrated a rug pull.

Welch attempted to answer questions from heartbroken investors in a Spaces, but when the going got tough, Welch got going: “I’m gonna go to bed” she said, and quit the chat, seemingly never to return to Crypto Twitter or our hearts again. Finally, on December 20, Sleeping Beauty awoke from her 372-hour slumber to proclaim that she’s working with the law firm that sued the HAWK token’s creators.

56. Hamster massage

Who knew that those personal massage devices were good for something other than sex toys? Russian gamers, that’s who!

Online retailer Wildberries reported a 179% month-over-month sales spike for percussion massagers in June, which was attributed to players of the massively popular Telegram game, Hamster Kombat.

Apparently someone figured out that they could jack up their in-game coin earnings by using the thing, which pulses rapidly to deliver faster screen taps than a human player can. But given that the game’s broadly disappointing airdrop delivered “dust,” we’d be surprised if they earned enough to even cover the cost of the vibrating device.

57. Too big to fail and not return as a crypto company

It’s baaaack: Enron, the symbol of fin de siècle dotcom excess, announced via X in early December that it was returning to “solv[e] the global energy crisis” with the aid of decentralized technology. Whether it’s a parody, real attempted comeback, or real attempted comeback that ends in parody remains to be seen. In the meantime, the firm says “permissionless innovation” will be central to its comeback.

58. Biting the banana that feeds you

We don’t know anything about art, but we know about dumb. And it is debatable what’s dumber: Buying a high-concept piece of art—a banana duct taped to a wall—for $6.2 million at a Sotheby’s auction, or eating the banana later. Both of which Justin Sun, the P.T. Barnum of crypto, did in November. That said, he was encouraged to routinely replace the banana anyway.

As a gesture of good will, Sun announced that he would purchase 100,000 bananas from the same New York sidewalk stall where the original banana came from—claiming he’d distribute them worldwide for free. But it was quickly revealed that this just isn’t possible. The vendor said they’d barely make any profit, and even then the logistics are a nightmare.

59. Even in jail, the scammer known as Razzlekhan keeps on shilling

Heather “Razzlekhan” Morgan, notorious for her role in the infamous $10.8 billion Bitfinex hack in 2016, has written a song! It is, apparently, a rap dedicated to the love of her life, husband and partner in crime, Ilya Lichtenstein, whom she hasn’t seen outside of a courtroom for three years. The song, which she says was written during a stint in solitary confinement, was released in a video and ends on an upbeat note: “Keep on praying for what the future brings. Inshallah.”

60. Congressman digs dog wif ski mask

A meme coin based on a dog in a ski mask pumped this month, apparently because U.S. Congressman Mike Collins (R-GA) acknowledged that he bought as much as $30,000 of it.

“I liked the coins, so I bought them,” the no-nonsense Collins told Decrypt. “Washington and Wall Street have stigmatized emerging technology in the crypto ecosystem for far too long, and it’s about time that we start treating this industry with the respect it deserves.” This is not dumb.

61. “Don’t worry about it”

Remilia Corporation took $20 million in a pre-sale for its CULT meme coin, then nothing happened for six months. Anyone who expressed concern was flooded with comments of “Don’t worry about it” from CULT members, despite those same people spreading fake news that the token launch had been cancelled.

Community members told Decrypt that they found it “humorous” that people were worried. The token did eventually launch in December.

62. Saving Democracy, one battle royale at a time

Popular battle royale game Off the Grid added player skins inspired by Donald Trump and Kamala Harris via its November “Save Democracy” content pack. The pack included two “Epic” weapons, as well as character emotes that show the faux politicians either building a wall or tossing a molotov cocktail. Best of all, the skins use true-to-life voices, with Trump saying “I feel like a Democrat” when he’s injured, or Harris quipping “Tax that fucker” when shooting at an enemy.

63. Rug your friends for fun and profit, without risk

Don’t have the ‘nads to create a meme coin, pump it up to a billion market cap, and then rug the poor schmuckos holding it? Then Rug.fun is the game for you! It simulates all the fun—and dumbnasity—of the real deal. Built on Coinbase’s Ethereum layer-2 network Base, players gamble on 10 tokens, eight of which will be rug pulled.

64. Every time you tickle a cat an angel gets its wings

Tapos is a “tickle-to-earn” game on the Aptos network that prompts users to tickle an on-screen cat for HEART tokens, helping the network record over 200 million transactions during two days in May. The Notcoin-esque cat clicker game records every click on-chain.

In August, the site claimed to have surpassed a total of 500 million transactions. But weirdly, it has since stopped giving updates.

65. X Empire players whine to an indifferent Elon Musk

Guys, despite the unusual “X” in its name, X Empire has absolutely nothing to do with X the social platform—despite it being previously called Musk Empire. Got that? In October, the Telegram tap-to-earn game X Empire revealed airdrop allocations to users, prompting a bunch of dim, ineligible players to tweet their complaints to Elon Musk.

“Totally scam project backed by your name,” tweeted one player. “X Empire. Elon Musk. Musk Empire. Do interrogation on X Empire team. They are just like scammer.”

Needless to say, the owner of X and master of all he surveys did not reply. Note, lads: In the future, do not vent at Musk for x-rated movies or anything having to do with x chromosomes. He is not responsible for those either. Yet.

66. See you, wouldn’t wanna be you

When Fantasy Top, a SocialFi game that incentivized influencers to farm Twitter engagement, went viral this summer, a degen known as Franklin decided to post every five minutes to maximize his points. Deadpan and consistent, gotta respect it.

Franklin, for those who were around for the NFT bull run, is also well known for sharing his Ls, including losing $150,000 in a “prank” NFT bid that he admitted was the “fumble of the century.”

67. Kamala is nowhere to be found-ala

For a while, it looked like Kamala Harris was actually taking an interest in crypto and might reconsider the Biden administration’s clueless crypto policies. It also appeared like she might even speak at Permissionless, Blockworks’ annual conference. And for a while, it even looked like she might win the General Election.

None of these things came to pass.

68. Donald Trump loves him some crypto

The President-elect, by contrast, embraced the crypto community. Notably, he delivered a rambling speech in July at the big Bitcoin Conference in Nashville, where he exposed how little he knew about crypto. His connection to crypto hardly stopped there.

In an interview with Rug Radio (like Decrypt, a wholly owned subsidiary of Dastan), Trump shilled his new “World Liberty Financial” project, which appears to be headed toward some kind of stablecoin offering. This seems very much in keeping with the whole ethos of crypto!

69. Litecoin? More like shitecoin

Due to current market conditions I now identify as a memecoin.

— Litecoin (@litecoin) November 14, 2024

After years of establishing itself as a legitimate decentralized digital currency, Litecoin’s Twitter intern decided to rebrand the project into a meme coin.

“Due to current market conditions I now identify as a meme coin,” the Twitter account posted, followed by a spree of shitposts including the creation of a stickman mascot called Lester. Ironically, this preceded a 79% price bump. Gosh, what a dumb—and lovable—industry this is!

Bonus Item: Let he or she who is without dumbness cast the first stone…

Decrypt had a metric shit ton of dumb errors last year, but delicacy prevents us from printing them all again. Here’s to many more in 2025.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Possible Deep Correction Could Push Cardano Price To $0.43, Here’s How

Crypto whales stockpile these 3 altcoins before the next bull run

Sonic Chain Launches Ethereum Bridge, FTM Price Reacts

Christmas gift as MOVE, BGB, ZEC lead altcoin gainers

MoonPay Considering $150,000,000 Acquisition of Crypto Payment Firm Helio: Report

Shiba Inu Burn Rate Soars 100% As Community Lauds Major Milestones

Bitcoin Wallets

Protect Your Non-Custodial Bitcoin Wallet — Support The Open Dialogue Foundation

Published

1 day agoon

December 24, 2024By

admin

In a new report, the Open Dialogue Foundation (ODF) provides an overview and analysis of upcoming regulatory proposals around non-custodial Bitcoin and crypto wallets in the European Union (E.U.).

Some of the proposals — many of which are based on FATF recommendations — will negatively affect users’ ability to transact with crypto assets privately.

EU & FATF 2025: Your Bitcoin Wallet's New Rules?

What is the best Christmas gift from human rights, privacy and Bitcoin advocates?@ODFoundation provides you with a comprehensive respond on what you should know while using #Bitcoin p2p wallet, privacy payments tools &… pic.twitter.com/YZIlCZjSiR

— Lyudmyla Kozlovska 🇪🇺🇺🇦 (@LyudaKozlovska) December 24, 2024

Important takeaways from the report include:

- According to guidelines from the European Banking Authority (EBA), the current regulatory framework around crypto assets in the E.U. allows for actions that pose significant risks, including immediate withdrawals to non-custodial wallets and the use of anonymity-enhancing tools like mixers.

- Forthcoming Markets in Crypto-Assets Regulation (MiCA) regulation may influence Crypto-Asset Service Providers (CASPs) to adopt stricter AML/KYC practices.

- Regulation from the E.U. may prohibit CASPs from facilitating anonymous transactions, which would both reduce privacy for users of crypto-assets and increase operational costs for CASPs.

- The obligations that may be imposed on CASPs will conflict with the rise of proliferation of open-source technologies like the Lightning Network, Fedimint and ecash, which let users transact privately and in a censorship-resistant manner.

Do I share this all because I’m trying to ruin your holiday season? No, sirs and ma’ams.

I share it because we should be grateful for the work that the Open Dialogue Foundation does in shedding light on what’s happening within the regulatory landscape in the E.U. (especially as it pertains to non-custodial crypto wallets) and in developing relationships with elected officials in the E.U. to educate them on the importance of Bitcoin and other freedom technologies.

So, if you’re looking to make a tax-deductible donation to a nonprofit before the year is out, consider donating to the ODF.

And if you’re thinking either “Well, I don’t live in the E.U., so this doesn’t affect me” or “I do live in the E.U., but I’ll just move if it passes bad regulation,” I’d asking you to consider the following two points, (the first of which I lifted directly from this recent ODF report):

- The European Union plays a central role in shaping global financial regulatory standards (which means that crypto transaction privacy advocates across the globe have something at stake here).

- The organization making many of the proposals for the new regulatory framework in the E.U. — the FATF — is an international one, and it will leverage any wins it chalks up in the E.U. to influence regulation in other jurisdictions.

But, again, don’t be scared; be grateful.

Donate to the ODF to support its efforts, or do what you can to amplify the organization’s messaging.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Blockchain

Most Layer 2 solutions are still struggling with scalability

Published

2 days agoon

December 23, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Since pivoting to a layer 2-centric approach, the Ethereum (ETH) ecosystem has relied heavily on L2 solutions to scale. However, these solutions are struggling to compete effectively, especially under pressure from alternatives like Solana (SOL). During the recent meme coin craze, Solana attracted much of the activity due to its advantages: low fees, high transaction speed, and user-friendliness.

To understand the challenges, it’s essential to examine why L2 solutions have not demonstrated the scalability and cost advantages that were widely anticipated.

Why meme projects favor Solana over Ethereum L2s

Meme projects have significantly contributed to the recent surge in market activity. These projects favor Solana for several reasons beyond user-friendliness:

- Low fees: Solana’s low transaction costs make it ideal for fee-sensitive applications like memecoins.

- High speed: Solana’s multithreaded architecture enables high throughput, ensuring seamless user experiences.

- Better developer experience: Solana’s tools and ecosystem are optimized for ease of use, attracting developers and projects.

Why is scalability important?

Scalability is fundamentally measured by the number of transactions a blockchain can process. A highly scalable blockchain can handle more TXs while offering lower fees, making it crucial for widespread adoption and maintaining a seamless user experience.

This is especially important for grassroots projects like meme coins, many of which are short-lived and highly fee-sensitive. Without scalability, these projects cannot thrive, and users will migrate to platforms that offer better efficiency and cost-effectiveness.

Why Ethereum L2s aren’t up to the challenge

Architectural limitations of Ethereum. Ethereum has long faced scalability issues, and L2 rollups are its primary solution to these problems. L2s operate as independent blockchains that process transactions off-chain while posting transaction results and proofs back to Ethereum’s mainnet. They inherit Ethereum’s security, making them a promising scaling approach.

However, Ethereum’s original design poses inherent challenges. Ethereum’s founder, Vitalik Buterin, has admitted that “Ethereum was never designed for scalability.” One of the key limitations is the lack of multithreading in the Ethereum Virtual Machine. The EVM, which processes transactions, is strictly single-threaded, meaning it can handle only one transaction at a time. In contrast, Solana’s multithreaded architecture allows it to process multiple transactions simultaneously, significantly increasing throughput.

L2s inheriting Ethereum’s limitations. Virtually all L2 solutions inherit Ethereum’s single-threaded EVM design, which results in low efficiency. For instance, Arbitrum: With a targeted gas limit of 7 million per second and each coin transfer costing 21,000 gas, Arbitrum can handle about 333 simple transactions per second. More complex smart contract calls consume even more gas, significantly reducing capacity. Optimism: With a gas limit of 5 million per block and a block time of 2 seconds, Optimism can handle only about 119 simple transfers per second. Gas-intensive operations further reduce this capacity.

Unstable fees. Another major issue with Ethereum and its L2 solutions is unstable fees during periods of high network activity. For applications relying on low and stable fees, this is a critical drawback. Projects like meme coins are especially fee-sensitive, making Ethereum-based L2s less attractive.

Lack of interoperability between L2s. The scalability argument for having multiple L2s only holds if contracts on different L2s can interact freely. However, rollups are essentially independent blockchains, and accessing data from one rollup to another is as challenging as cross-chain communication. This lack of interoperability significantly limits the potential of L2 scalability.

What can L2s do to further scale?

Embed features to enhance interoperability. Ethereum L1 needs to do more to support interoperability among L2s. For example, the recent ERC-7786: Cross-Chain Messaging Gateway is a step in the right direction. While it doesn’t fully resolve the interoperability issue, it simplifies communication between L2s and L1, laying the groundwork for further improvements.

Architectural updates: Diverge from the existing L1 design. To compete with multithreaded blockchains like Solana, L2s must break free from Ethereum’s single-threaded EVM design and adopt parallel execution. This may require a complete overhaul of the EVM, but the potential scalability gains make it a worthwhile endeavor.

Future milestones

Ethereum’s L2 solutions face significant challenges in delivering the scalability and cost-effectiveness that applications like meme coins demand. To stay competitive, the ecosystem must address fundamental architectural limitations, enhance interoperability, and embrace innovations in blockchain design. Only by doing so can Ethereum L2s achieve the scalability needed to support widespread adoption and fend off competition from emerging blockchains like Solana.

Laurent Zhang

Laurent Zhang is the president and founder of Arcology Network, a revolutionizing Ethereum layer-2 solution with the first-ever EVM-equivalent, multithreaded rollup—offering unparalleled performance and efficiency for developers building the next generation of decentralized applications. With an executive leadership and innovation background, Laurent holds a degree from Oxford Brookes University. Laurent’s professional journey includes over a decade of experience in science, research, engineering, and leadership roles. After graduating in 2005, he joined MKS Instruments as an Algorithm Engineer. From 2010 to 2012, he worked as a research engineer at the Alberta Machine Intelligence Institute, followed by a position as a research scientist at Baker Hughes from 2012 to 2014. He then served as vice president of engineering at Quikflo Health between 2016 and 2018. Since 2017, Laurent has been the president of Arcology Network, being a visionary of a future where blockchain technology reaches its full potential, offering unmatched scalability, efficiency, and innovation.

Source link

Recently, BlackRock released an educational video explaining Bitcoin, which I thought was great—it’s amazing to see Bitcoin being discussed on such a massive platform. But, of course, Bitcoin X (Twitter) had a meltdown over one specific line in the video: “There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.”

HealthRnager from Natural News claimed, “Bitcoin has become far too centralized, and now the wrong people largely control its algorithms. They are TELLING you in advance what they plan to do.”

Now, let me be clear: this is total nonsense. The controversy is overhyped, and the idea that BlackRock would—or even could—change bitcoin’s supply is laughable. The statement in their video is technically true, but it’s just a legal disclaimer. It doesn’t mean BlackRock is plotting to inflate bitcoin’s supply. And even if they were, they don’t have the power to pull it off.

Bitcoin’s 21 million cap is fundamental—it’s not up for debate. The entire Bitcoin ecosystem—miners, developers, and nodes—operates on this core principle. Without it, Bitcoin wouldn’t be Bitcoin. And while BlackRock is a financial giant and holds over 500,000 Bitcoin for its ETF, its influence over Bitcoin is practically nonexistent.

Bitcoin is a proof-of-work (PoW) system, not a proof-of-stake (PoS) system. It doesn’t matter how much bitcoin BlackRock owns; economic nodes hold the real power.

Let’s play devil’s advocate for a second. Say BlackRock tries to propose a protocol change to increase bitcoin’s supply. What happens? The vast network of nodes would simply reject it. Bitcoin’s history proves this. Remember Roger Ver and the Bitcoin Cash fork? He had significant influence and holdings, yet his version of bitcoin became irrelevant because the majority of economic actors didn’t follow him.

If Bitcoin could be controlled by a single entity like BlackRock, it would’ve failed a long time ago. The U.S. government, with its endless money printer, could easily acquire 10% of the supply if that’s all it took to control Bitcoin. But that’s not how Bitcoin works. Its decentralized nature ensures no single entity—no matter how powerful—can dictate its terms.

So, stop worrying about BlackRock “changing” Bitcoin. Their influence has hard limits. Even if they tried to push developers to change the protocol, nodes would reject it. Bitcoin’s decentralization is its greatest strength, and no one—not BlackRock, not Michael Saylor—can change that.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Possible Deep Correction Could Push Cardano Price To $0.43, Here’s How

Crypto whales stockpile these 3 altcoins before the next bull run

Sonic Chain Launches Ethereum Bridge, FTM Price Reacts

Referrals

Christmas gift as MOVE, BGB, ZEC lead altcoin gainers

MoonPay Considering $150,000,000 Acquisition of Crypto Payment Firm Helio: Report

Shiba Inu Burn Rate Soars 100% As Community Lauds Major Milestones

A Very Bitcoin Christmas

From DMM Bitcoin to the US Government: Largest Crypto Exploits and Hacks of 2024

Access control exploits account for nearly 80% of all crypto hacks in 2024

Will XRP Price Break All-Time Highs In 2025?

Why it’s a better investment than Solana or Ripple in 2024

Six Bitcoin (BTC) Mutual Funds to Launch in Israel Next Week: Report

What Happens If Paul Atkins Dismisses the XRP Lawsuit?

Malicious Google ad campaign redirects crypto users to fake Pudgy Penguins website

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential