24/7 Cryptocurrency News

Shiba Inu Burn Rate Soars 100% As Community Lauds Major Milestones

Published

1 day agoon

By

admin

The significant surge in Shiba Inu burn rate has once again garnered notable investor attention toward the renowned dog-themed meme crypto, SHIB. Recent burn data indicated that millions of coins were taken out of the token’s circulating supply, sparking noteworthy optimism surrounding the crypto amid recent ecosystem developments. Notably, market watchers are eyeing remarkable gains in the meme coin’s price ahead, primarily in the wake of recent community advancements despite broader volatility.

Shiba Inu Burn Rate Soars 100% Reverberating Market Optimism

As per the recent data from Shibburn as of December 25, the Shiba Inu burn rate witnessed a roughly 97% uptick, underlining a massive blow to the token’s circulating supply. Per the data, a whopping 6.26 million SHIB were sent to a null address, indicating that these tokens had been permanently removed from the circulating supply. Altogether, the burn rate surge glimmered hope for the asset’s future price movements, abiding by the law of supply and demand.

For context, the SHIB token burn mechanism focuses on reducing the dog-themed meme coin’s market supply, which many believe to be the reason for the asset’s sluggish performance over the years. In addition, other optimistic ecosystem developments have also poured investor optimism into the crypto’s future movements.

A recent CoinGape Media report revealed that the Shiba Inu community witnessed the ‘SHIB: The Metaverse’ launch this Christmas, enhancing the coin’s market visibility. Renowned community member KaalDhairya took to X, spotlighting the launch and garnering notable attention. Per Kaal, the platform has officially launched this Christmas, boasting jaw-dropping visuals that attract market participants. Also, the new platform uses Chainlink CCIP, pioneering a big step toward ‘multi-chain greatness for SHIB.’

Whilst the abovementioned endeavor marked a monumental stride, the looming launch of the TREAT token also weighed in, bringing additional investor optimism. SHIB lead developer Shyoshi Kusama recently hinted that ‘TREATS for the meme coin’s community are to arrive soon,’ sparking bullish market discussions. Overall, the aforementioned developments reverberated substantial optimism for the meme crypto’s future price movements despite a volatile market.

SHIB To Pump Hard Ahead?

Despite soaring optimism amid the mentioned developments, SHIB price witnessed heightened volatility intraday and is resting at $0.00002293. Its 24-hour low and high were $0.00002261 and $0.00002402, respectively. Notably, the top meme coin’s turbulent action aligns with the broader market’s volatile state. Nevertheless, long-term prospects for the token shine with bullishness.

Reportedly, SHIB price eyes a major rally ahead in the wake of its lead developer, Shytoshi Kusama, highlighting community developments. The token eyes a rebound to $0.000026 or even $0.000029 ahead, further supported by the Shiba Inu burn rate upswing and strong SHIB on-chain dynamics.

Meanwhile, recent Whale Alert data flagged a whopping 2.88 trillion SHIB accumulation, worth $65.70 million, from the Turkish crypto exchange BTCTurk. Overall, crypto market participants continue to eye the coin extensively, expecting bullish shifts amid the aforementioned market statistics that indicate a strong potential to rally against the backdrop of supple decline and increased buying.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Why 2025 Will See the Comeback of the ICO

Can Donald Trump Truly Make US The Crypto Capital?

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

24/7 Cryptocurrency News

Can Donald Trump Truly Make US The Crypto Capital?

Published

2 hours agoon

December 26, 2024By

admin

President-elect Donald Trump’s promise to ensure all remaining Bitcoin is “made in the USA” has sparked widespread debate. Announced during a meeting with crypto mining executives, the pledge reflects a shift in Trump’s stance on digital currencies. Despite this commitment, experts caution that achieving this goal may be unattainable due to various reasons discussed in this article.

Is Donald Trump Bitcoin Strategy Achievable?

Recent data indicate that 95% of Bitcoin has already been mined, leaving only a small fraction available for production. This reality makes President-elect Donald Trump’s promise to produce Bitcoin exclusively within the United States highly challenging. Bitcoin mining operates on a decentralized network, meaning no single country or entity can control the process.

Additionally, global mining operations dominate the industry, with US crypto miners contributing less than 50% of the total computing power. This disparity underscores the difficulty of centralizing Bitcoin production to a single nation. The highly competitive nature of the sector further complicates efforts to shift the balance entirely to domestic players.

More so, these challenges erupt even as Japan rejects Bitcoin for national reserves, prioritizing stability in its foreign exchange strategy. The government highlighted BTC price volatility and misalignment with traditional financial systems.

Interestingly, this cautious stance contrasts sharply with other Japanese private entities. For example, Japan’s MicroStrategy, Metaplanet, invested ¥9.5 billion to purchase 617 BTC, raising its total holdings to 1,761.98 BTC. This move boosted its Bitcoin treasury by 56% amid a price dip. The company reported a 309% yield on its BTC holdings in Q4, with CEO Simon Gerovich emphasizing Bitcoin’s role in safeguarding capital against the declining Yen.

Global Competition and Equipment Reliance Challenges

Bitcoin mining is increasingly driven by international players with deep resources, such as miners in Africa, Asia, and the Middle East. These regions often benefit from lower energy costs and fewer regulatory barriers, providing an edge over US operations. For example, countries like Ethiopia and Argentina offer access to cheap hydropower and stable revenue streams in US dollars. This boosts their competitiveness in the market.

Adding to the challenge, most Bitcoin mining equipment is manufactured by Chinese companies, particularly Bitmain. A trade war or tariff policies under Donald Trump’s administration could raise the cost of importing essential machinery, creating additional obstacles for US crypto miners.

However, despite the ambitious pledge, Donald Trump has found support from several US-based mining companies, such as CleanSpark Inc. and Riot Platforms Inc. These companies anticipate that his administration will reduce environmental regulations and increase industry support. However, some US miners are even turning to overseas partnerships to mitigate rising energy costs at home.

For instance, MARA Holdings Inc. has announced a joint venture with an Abu Dhabi sovereign wealth fund to establish one of the largest mining farms in the Middle East. While Donald Trump’s commitment to making Bitcoin “made in the USA” aligns with his broader economic goals, it faces structural and logistical barriers.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Bitcoin Price Is Falling Today: Is $80K Next?

Published

5 hours agoon

December 26, 2024By

admin

The recent dip in Bitcoin price has sparked concerns among investors while triggering massive selling pressure in the broader crypto market. In addition, the recent market developments also hint towards a further dip, with many predicting a potential slip to $80K or even below. Notably, this comes despite the strong institutional interest in the flagship crypto, as evidenced by the buying spree of MicroStrategy (MSTR) and others.

Why Is Bitcoin Price Falling Today?

Bitcoin price has recorded a sharp decline today, sparking concerns in the broader crypto market. A flurry of reasons could have weighed on the investors’ sentiment recently, which has also triggered massive selling pressure in the digital assets space.

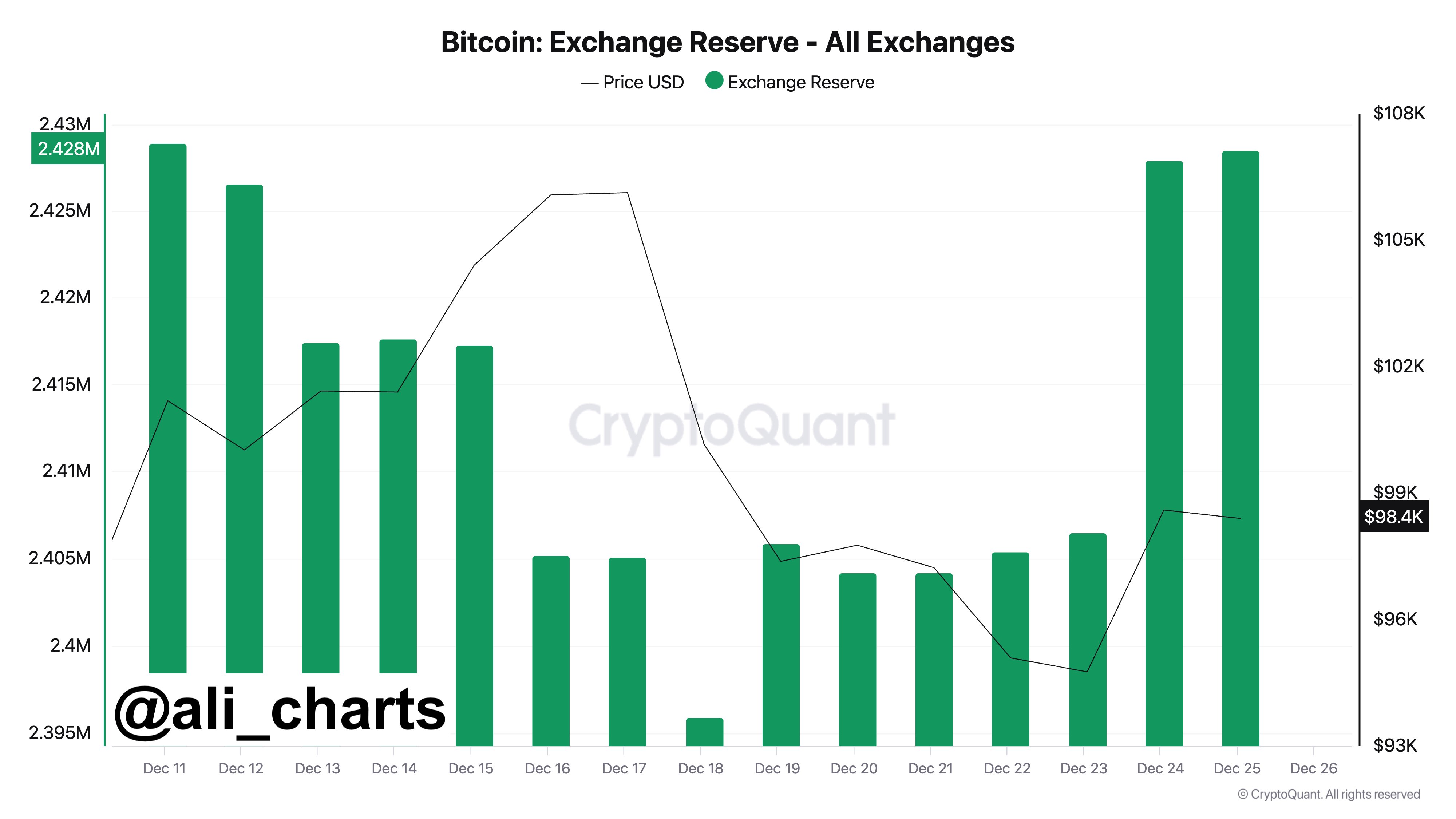

For context, BTC has recorded massive rallies since Donald Trump’s election win in November. Having said that, it also provided a profit-booking opportunity to many investors, with recent on-chain data indicating heavy selling pressure on the crypto. Top crypto market expert Ali Martinez highlighted the trend, saying that 33,000 BTC, worth over $3.23 billion, has moved to exchanges recently.

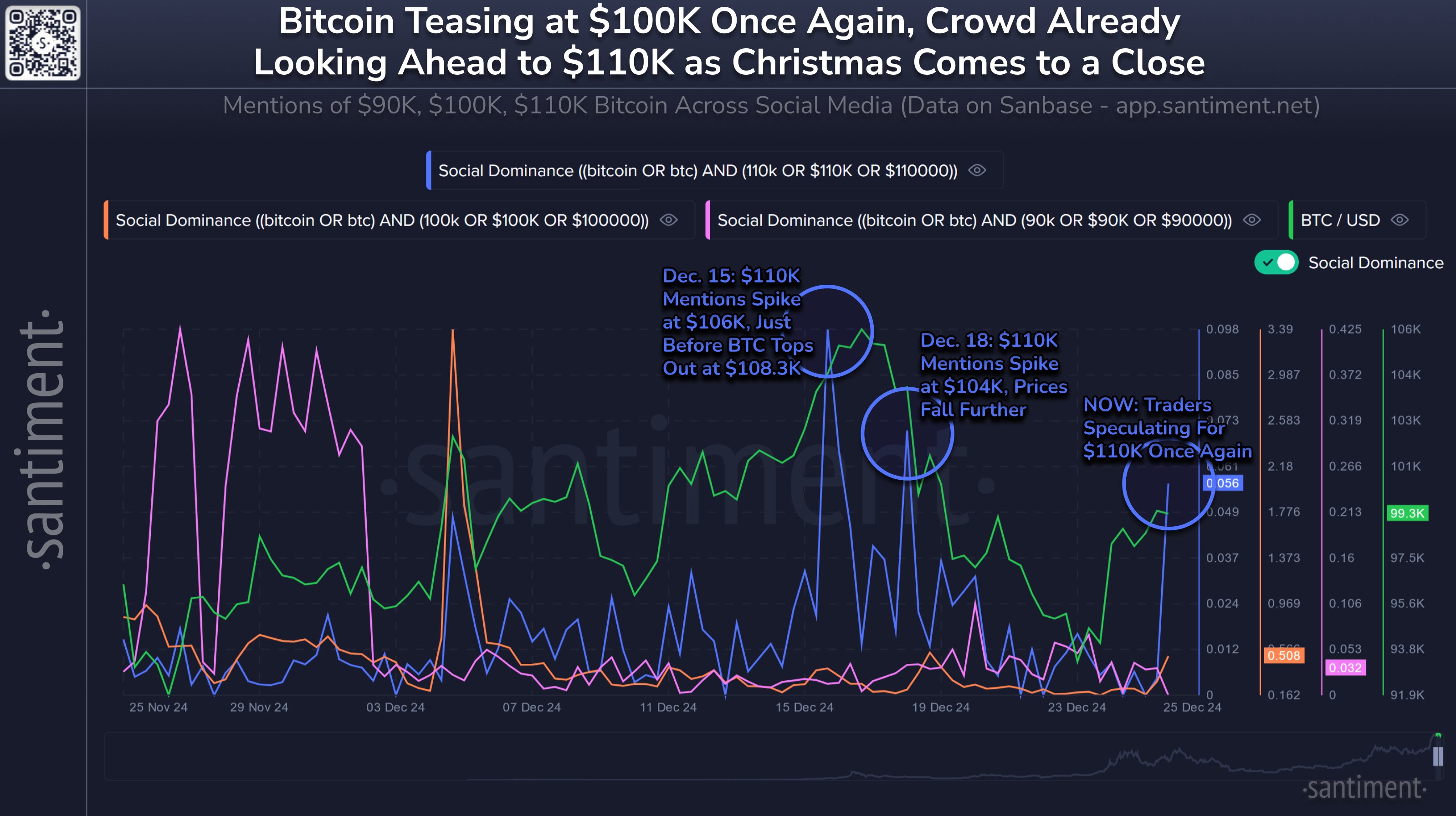

This indicates the profit-booking strategy, which the traders often use when an asset’s price goes higher. On the other hand, Santiment recently highlighted the BTC drop after reaching $99.8K on Christmas, sparked by bullish trader sentiment. The report noted that speculation of the cryptocurrency hitting $110K has also increased due to the recent rally.

However, Santiment suggests that historically, Bitcoin only reaches such highs when crowd expectations are low. This indicates that the current downturn may be a market correction, as traders’ high expectations for $110K may be self-fulfilling prophecies that prevent the price from rising further.

Bitcoin Options Expiry Sparks Concern

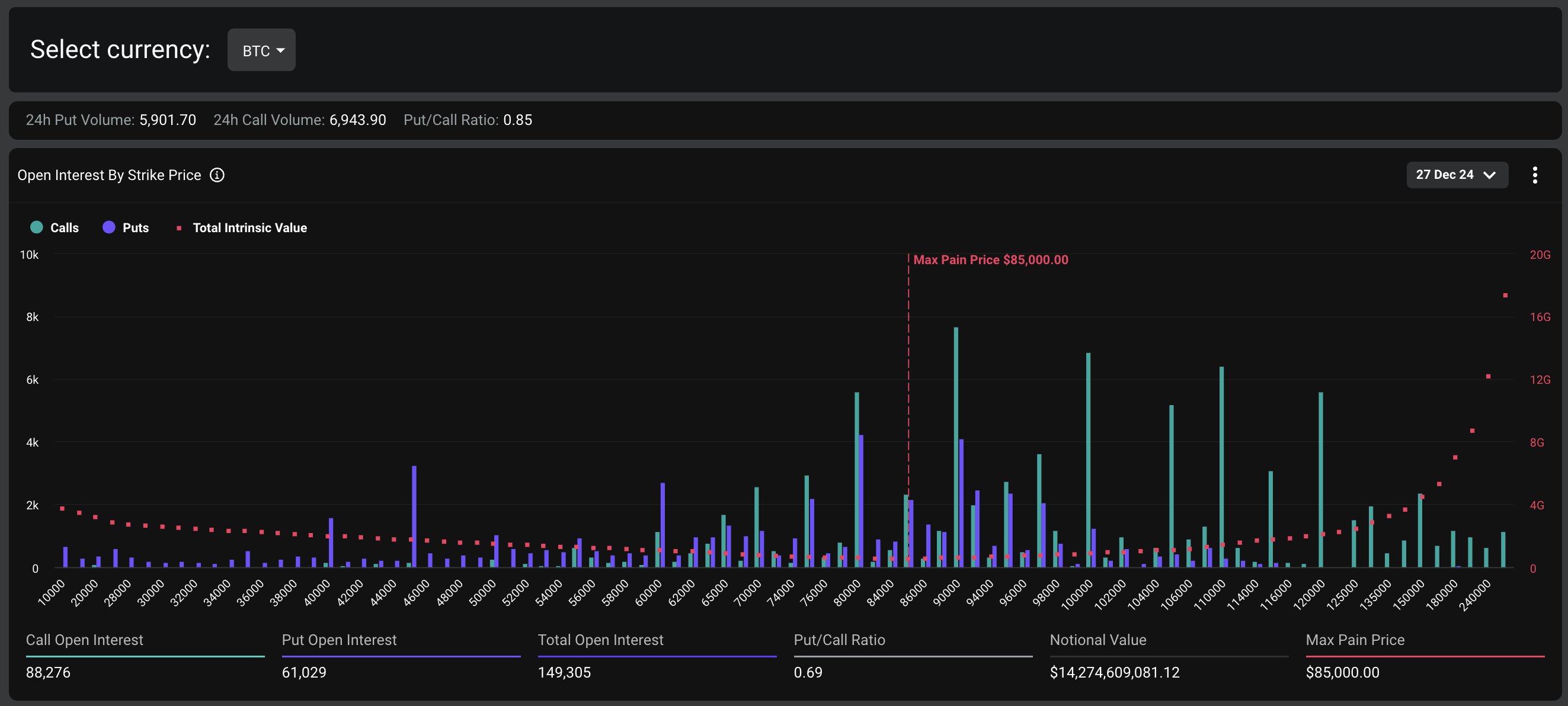

The recent downturn in Bitcoin price comes ahead of the largest crypto options expiry on the Deribit exchange, with over $18 billion in options set to expire tomorrow. The expiry has sparked directional uncertainty, with elevated volatility and “sharp swings in DVOL”, Deribit noted. Besides, market experts also warned that the heavily leveraged market to the upside could trigger a rapid snowball effect with any significant downside move, leading to high volatility.

Notably, the Bitcoin options expiry accounts for the majority of the total notional value, with $14.27 billion set to expire. The put/call ratio stands at 0.69, indicating a slightly bullish sentiment among traders. The max pain point for Bitcoin is $85,000, which could act as a resistance level in the event of a price swing.

On the other hand, Ethereum options expiring tomorrow account for $3.79 billion in notional value. The put/call ratio is 0.41, suggesting a more pronounced bullish bias among Ethereum traders. The max pain point for Ethereum is $3,000, which may influence the asset’s price movement.

BTC Dip To $80K Imminent?

The latest BTC price chart showed that the crypto plunged about 3.5% to $95,175, with its trading volume falling 1.5% to $42.45 billion. Notably, the crypto has touched a 24-hour high of $99,884, while maintaining a monthly gain of 2%. Further, BTC Futures Open Interest also fell about 3.5%, CoinGlass showed, indicating a bearish momentum hovering in the market.

Notably, the market picture indicates that despite soaring institutional interest, the recent developments have weighed on the market sentiment. For context, MicroStrategy (MSTR) stock recorded volatility recently amid its BTC buying strategy, which has fueled market speculations. Besides, many firms like KULR have also shifted their focus towards BTC accumulation.

Meanwhile, in a recent analysis, popular market expert Justin Bennett said that BTC is likely to fall to the $81K-$85K range. This analysis of Bitcoin price has fueled market concerns, with many other experts echoing a similar sentiment.

For context, Ali Martinez noted as Bitcoin dipped below the $97,300 mark, it indicates a bearish momentum for the crypto. However, he noted if BTC rebounds to this crucial support and rally to $100K, it could rally to $168,500 ahead.

Simultaneously, Peter Brandt has also predicted a potential BTC dip to $80K ahead, citing technical trends. On the other hand, popular market expert Tone Vays also said that if BTC trades below the $95,000 mark, it increases the probability of a correction to $75K.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BTC Hits $99K, BGB Jumps 26%, MOVE Surges 15%

Published

17 hours agoon

December 26, 2024By

admin

Crypto prices today are showcasing a bullish trend as Bitcoin (BTC) touched $99,000, recovering from a low of $92,000. Major altcoins are also exhibiting positive momentum. Bitget Exchange token (BGB) emerged as the top gainer in the last 24 hours, with an 18% surge. Over the past week, BGB has risen by 48%, outperforming other major altcoins, which showed bearish trends during the same period.

Movement (MOVE) became the second top gainer, with a 15% price increase. The global cryptocurrency market cap rose by approximately 1%, reaching $3.43 trillion, while overall trading volume dropped 11%, settling at $117 billion. The decline in volume is attributed to the ongoing Christmas holiday season globally.

Market activity is expected to rise next week as the United States prepares for Donald Trump’s presidential oath ceremony in three weeks. The Fear and Greed Index currently stands at 63, indicating that greed persists in the market. Here’s an overview of the leading cryptocurrencies by market capitalization and price movements.

Crypto Prices Today: BTC Climbs Higher, XRP, ETH, and SOL Show Positive Momentum

Crypto prices today reflect a strong bullish momentum, with Bitcoin (BTC) maintaining its position near $99,000. Ethereum (ETH) and XRP showed steady gains, while Solana (SOL) rebounded after recent losses. These developments highlight renewed investor confidence in major cryptocurrencies.

Bitcoin Price Today

Bitcoin (BTC) price was trading at $99,123, reflecting approximately a 1% increase in the last 24 hours. Its 24-hour low and high were $97,681 and $99,974, respectively. BTC’s market cap stood at $1.96 trillion, with trading volume dropping to just $35 billion due to reduced holiday activity. Bitcoin’s market dominance rose to 57.04%, up from the previous day. Moreover, Russia has been leveraging Bitcoin and other digital currencies for foreign trade to mitigate the impact of Western sanctions.

Ethereum Price Today

Ethereum (ETH) price was trading at $3,462, marking approximately a 0.5% increase in the last 24 hours. Its 24-hour low and high were $3,442 and $3,545, respectively. ETH’s market cap reached $417 billion, with a trading volume of $18 billion. Additionally, The Sonic Chain has expanded its reach by introducing a new bridge to connect with the Ethereum ecosystem, further bolstering its milestones and ties with Fantom (FTM).

XRP Price Today

XRP price was trading at $2.274, with a 24-hour low of $2.265 and a high of $2.329. Its market cap stood at $130 billion, while the trading volume was relatively low at $4 billion. Crypto analysts are predicting that XRP could potentially reach an all-time high of $3.775 in the near term.

Solana Price Today

Solana (SOL) price was trading at $198, with a 24-hour low of $195 and a high of $201. Its market cap stood at $94 billion, with a trading volume of $2.5 billion. Crypto prices today show a strong outlook for SOL, as a top expert recently predicted its price could reach $330, driven by soaring anticipation towards Solana’s potential ETF approval and other positive market developments.

Meme Crypto Prices Today

Meme crypto prices today are showing a bearish momentum, with top meme coins experiencing a decline. Dogecoin (DOGE) was down by 1%, trading at $0.33. Similarly, Shiba Inu (SHIB) saw a 3% drop, trading at $0.00002256. Despite the overall decline, there are signs of hope within the meme coin community.

In the last 24 hours, Shiba Inu’s burn rate surged by nearly 100%, sparking optimism among its supporters. This increase in burn rate is part of recent advancements within the Shiba Inu community, which have fueled speculation of a potential rally in the near future.

Other top meme coins like BONK, PEPE, and WIF also experienced declines, ranging from 4% to 6% in the last 24 hours. These coins are also facing the broader market pressure, but the recent Shiba Inu developments have added some excitement to the meme coin space.

Top Crypto Gainer Prices Today

Bitget Token

BGB price is making history today, with the coin up by 26% in the last 24 hours, currently trading at $6.291. Its 24-hour low and high are $4.87 and $6.30, respectively. Crypto prices today reflect the remarkable surge of BGB, which has seen a market cap of $8.8 billion and a trading volume of $800 million.

This coin has experienced impressive growth, rising by 300% in the last month and 500% in the past quarter. The extraordinary performance of BGB is drawing significant attention, and its rise continues to fuel optimism in the crypto space.

Movement

Movement (MOVE) price was up by 15% in the last 24 hours, trading at $1.156. Its 24-hour low and high were $0.99 and $1.21, respectively. With a market cap of $2.61 billion, MOVE continues to show positive momentum in the crypto market.

GateToken

GT price was up by 10%, trading at $15.32. Its 24-hour low and high were $13.85 and $15.42, respectively. With a market cap of $1.36 billion, GateToken is ranked among the top 100 coins by market cap, reflecting its strong performance in the crypto market.

Top Crypto Loser Prices Today

Hyperliquid

HYPE price was trading at $26.30, showing an 11% drop in the last 24 hours. Its 24-hour low and high were $25.64 and $30.46, respectively. Despite the recent decline, crypto prices today reflect a market cap of $7.17 billion, maintaining its significant presence in the market.

Helium

Helium (HNT) price was down by 9%, trading at $7. Its 24-hour low and high were $6.90 and $7.64, respectively. With a market cap of just $1.23 billion, HNT is facing a challenging period in the market.

Fartcoin

FARTCOIN price was down by 7% in the last 24 hours, with its 24-hour low and high at $1.112 and $1.288, respectively. Despite the recent decline, it was the top gainer yesterday, surging by 70%.

Besides, the crypto market has continued to hold upside momentum in the last few hours with positive signs of further upside in Bitcoin (BTC), Ethereum (ETH), and major altcoins. Traders are expecting a rally after Christmas from the year’s end crypto options expiry.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Why 2025 Will See the Comeback of the ICO

Can Donald Trump Truly Make US The Crypto Capital?

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

Flockerz presale enters final stage with 28 days remaining

What Happens to Ethereum Price If Bitcoin Crashes to $80,000?

XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

Coinbase CLO shares data on crypto hedge funds debanking, demands for answers

Here’s Why Dogecoin Price May Never Hit $50 or $100 Mark

Buying this token under $0.05 could be like buying Solana at $0.50

7 Massive Games From 2024 Worth Playing Over the Holiday Break

WhiteBIT Adds Pepe, Bonk, Sui & 57 New Crypto to Expand Collateral Options to 80

5 game-changing altcoins for December/January

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: