Europe

Floki DAO Floats Proposal Ahead of Possible European ETP, Second After Dogecoin

Published

1 day agoon

By

admin

Meme-turned-utility project Floki is working with an unidentified asset manager to develop an exchange-traded product (ETP) tracking its FLOKI token that could be available to investors in Europe early in the new year, one of the developers told CoinDesk.

If approved, FLOKI would be the only meme token other than dogecoin (DOGE) with an institutional product in Europe.

“We’ve been actively working with a respected Asset Manager and an ETP Issuer to launch a Floki ETP (Exchange-Traded Product) for quite a while now, and after months of due diligence and painstaking effort, we’ve been told that the Floki ETP is on track to go live in early Q1, 2025,” lead developer B told CoinDesk in a Telegram message on Wednesday.

The developers as seeking approval from the Floki DAO community to provide early liquidity to the product when it goes live. The vote runs for 48 hours and will end at 11:00 UTC on Dec. 27.

They are seeking approval to allocate part of the FLOKI required for the ETP from a treasury wallet that holds 16 billion tokens, worth just over $2.8 million at current prices. Tokens in that wallet were purchased from the open market over three years after the passage of another community vote.

If the proposal is approved, the FLOKI tokens would provide liquidity for the ETP while remaining Floki’s property and could be withdrawn if there is enough third-party liquidity in the ETP.

“The Floki ETP is currently in an advanced stage and will become tradable on the SIX Swiss Exchange, the largest stock exchange in Switzerland and the third-largest in Europe,” B said. “When it goes live, the Floki ETP will allow institutional investors, regulated entities and retail investors to get exposure to FLOKI in a regulated way.”

B said the team could not disclose further specifics about the ETP due to non-disclosure agreements, such as opening prices, fund structure and institutional partners.

FLOKI is up 1.1% in the past 24 hours, in line with the broader crypto market.

Source link

You may like

OKX Launches Perpetual Futures for GRIFFAIN and ZEREBRO

FTX Co-Founder Ryan Salame Sentence Reduced By 1 Year

Crypto Bull Market Much Closer To End Than We Realize, Warns Analyst Jason Pizzino

Trader who called BTC at $105k forecasts $0.0007 meme token at $1 in 2025

Top 5 Biggest Crypto Hacks of 2024

The Best Games of 2024 That You Can Snag for Under $25

Blockchain

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Published

3 days agoon

December 24, 2024By

admin

Blockchain security auditor Hacken is rolling out a new tool to automate security and compliance for web3 businesses as MiCA and DORA rules loom.

Hacken, an international blockchain auditor with Ukrainian roots, is rolling out a new solution that allows web3 businesses in an automated manner to comply with standards like Europe’s MiCA and DORA.

In a press release shared with crypto.news, Hacken co-founder and chief executive Dyma Budorin said the firm developed the so-called “Extractor” to address the “critical need for proactive monitoring and compliance in the crypto space.” According to the Tallinn-headquartered firm, Extractor brings compliance monitoring framework for web3 projects, making it easier to meet regulatory standards like MiCA, DORA, and ADGM.

Unlike other solutions available on the market, Hacken’s solution is said to be combining AML/CFT monitoring, transaction tracking, total value locked analysis, and circulating supply detection into a structured compliance approach. It also integrates real-time threat detection, automated safeguards, and post-incident reporting to ensure continuous protection and operational resilience, the press release reads.

Valentyna Kondratenko, Hacken’s legal counsel noted that beginning Jan. 17, 2025, DORA’s requirements “will become enforceable,” adding further that non-compliance “can result in severe penalties, such as fines of up to 2% of the total annual worldwide turnover or 1% of the average daily global turnover.”

It’s understood that the solution is compatible with multiple blockchain networks, including Ethereum and BNB Chain (formerly Binance Smart Chain), broadening its potential use.

MiCA regulations have created challenges for crypto companies aiming to expand in the European market. For example, crypto exchange Coinbase had to discontinue USDC rewards for EU clients due to MiCA, and later even delisted Tether (USDT) from its European platform.

Source link

CBDC

ECB official calls for urgency on digital euro amid global CBDC race

Published

1 month agoon

November 21, 2024By

admin

The European Central Bank is urging faster action on the digital euro as legislative delays risk hindering progress amid growing global competition.

The digital euro project is facing delays in the European Union, with the European Central Bank urging faster action to prevent Europe from falling behind global competitors.

Evelien Witlox, the ECB’s project manager for the digital euro, told Euronews in an interview that Europe should speed up with the development to avoid falling behind, as global competitors like the U.K. and China are also exploring central bank digital currencies.

Thus far, there is no pan-European digital payment solution as 13 of the 20 countries in the eurozone lack a national card scheme, relying instead on international players like Visa and Mastercard, the report notes. Witlox noted that the European market remains fragmented, with “the ones that come closest to covering the whole of Europe are non-European.”

To address this, the ECB launched a CBDC exploration project in October 2021. However, before the digital euro can move forward, the European Parliament and Council must finalize the legal framework—a process that has yet to be completed nearly 17 months after the European Commission’s proposal. This delay has raised concerns within the ECB, Witlox noted.

Although discussions on the digital euro have made progress, Witlox reiterated the need for urgency to keep “sufficient pace in this process so that we can ensure that the digital euro will be there when we really need it.” Although there is no set timeline for the digital euro’s launch, Witlox remains optimistic, stressing that Europe is still “at the forefront of the development [of a CBDC].”

Source link

crypto tax

UAE and Switzerland lead as premier locations with no crypto tax, research finds

Published

2 months agoon

November 1, 2024By

admin

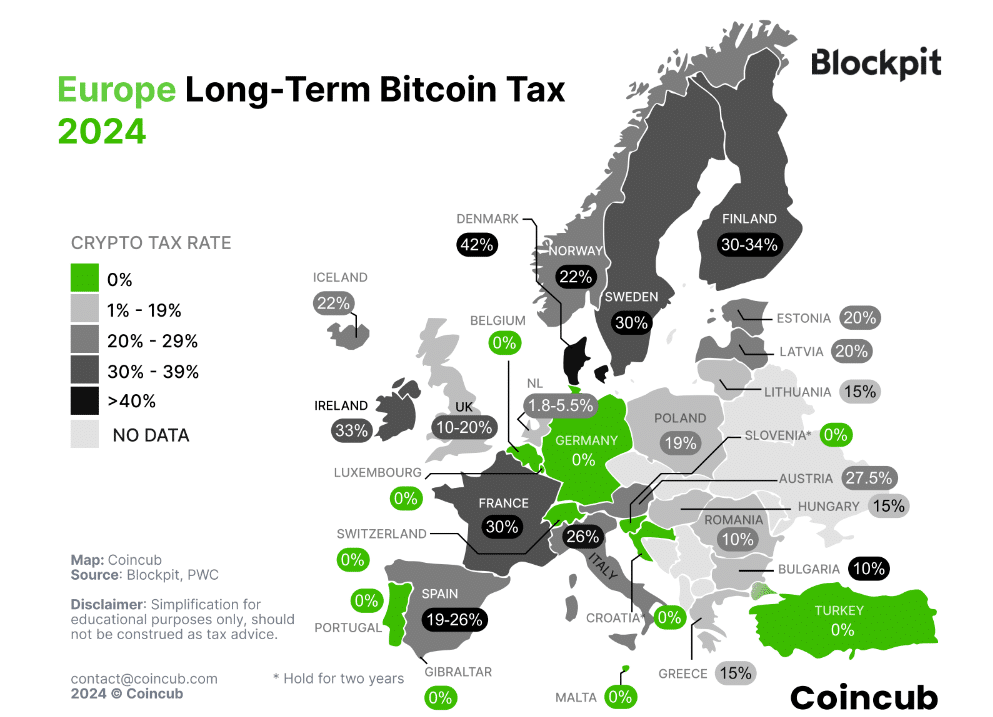

A recent research report by Coincub and Blockpit highlights how varying tax policies, from zero taxes in the UAE to high rates in the U.S., shape crypto investment strategies.

The crypto taxation landscape varies widely across the globe, as revealed by a research report from Blockpit and Coincub.

Data reveals that the UAE remains an attractive destination for crypto investors, with no personal income or capital gains tax on cryptocurrency gains for individuals. Similarly, Switzerland positions itself as a tax haven, offering zero personal income and capital gains tax on crypto gains.

In Europe, the situation is more mixed. While some nations provide favorable tax conditions for long-term holdings, others maintain elevated tax rates. For example, Denmark has one of the highest personal crypto tax rates globally, with up to 53% of long-term and short-term capital gains from crypto being taxed by the local watchdog.

The report notes that, on average, many European countries impose relatively high taxes on crypto gains, but the old continent “has the most tax breaks for long-term hodling your Bitcoin.”

Meanwhile, the United States has the highest total gains and average tax rates of 17.5% (long-term) and

23.5% (short-term), what could potentially bring in tax revenues approximately $1.87 billion, the analysts estimate. They warn that high taxation could “discourage investment,” pushing crypto activities underground, or force investors to relocate to more tax-friendly jurisdictions.

“Nations like Vietnam, Turkey, and Argentina might prioritize attracting crypto investment, fostering technological innovation, and providing alternatives to unstable local currencies over immediate tax collection.”

Blockpit

Analysts indicate that the global approach to crypto taxation is set to undergo significant changes starting in 2025, driven by international initiatives such as the Crypto-Asset Reporting Framework and the Tax Administration for the Reporting of Crypto-Asset Activities.

Developed by the Organization for Economic Co-operation and Development, CARF aims to enhance tax transparency and combat tax evasion by creating a global framework for reporting crypto transactions. In parallel, TARKA is designed to facilitate cooperation among tax authorities in the 48 participating countries, per the report.

Source link

OKX Launches Perpetual Futures for GRIFFAIN and ZEREBRO

FTX Co-Founder Ryan Salame Sentence Reduced By 1 Year

Crypto Bull Market Much Closer To End Than We Realize, Warns Analyst Jason Pizzino

Trader who called BTC at $105k forecasts $0.0007 meme token at $1 in 2025

Top 5 Biggest Crypto Hacks of 2024

The Best Games of 2024 That You Can Snag for Under $25

3 altcoins that could skyrocket by new year’s eve

Analyst Predicts XRP Price To Reach $27, Here’s Why

Monkey Please!

Texas, Ohio, and Pennsylvania to create Bitcoin reserves

Why 2025 Will See the Comeback of the ICO

Can Donald Trump Truly Make US The Crypto Capital?

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential