Bitcoin

Michael Saylor Doesn’t Understand Bitcoin

Published

1 day agoon

By

admin

On a recent episode of the Galaxy Brains podcast, Michael Saylor made the case that bitcoin isn’t a currency and that it’s best to think of it as capital and capital only.

He also shared that Tether (USDT) and Circle’s USD Coin (USDC) are the real digital currencies and unveiled his “evil genius strategy” (his own words) to get the world to adopt the U.S. dollar stablecoins as opposed to bitcoin.

In this Take, I’ll cite some of Saylor’s own words from the podcast before breaking down why many of the points he made are off base.

Capital, Not Currency

“It’s not a currency, it’s capital,” said Saylor about halfway through the episode.

“You just have to come to grips with it — it is not digital currency. It is not cryptocurrency. It is digital capital. It is crypto capital,” he added.

I searched the Bitcoin Whitepaper to see how many times the word “capital” showed up.

It isn’t mentioned once.

However, in both the title and abstract of the text, bitcoin is referred to as “electronic cash.” While cash can of course also be capital, it’s not only capital. To think of bitcoin only as capital is to deny certain of its most essential properties — like the ability to use it to transact with anyone anywhere in the world permissionlessly.

To deny bitcoin as a currency is to deny a large part of its value proposition. Bitcoin’s roles as a Store of Value (SoV) and a Medium of Exchange (MoE) are inextricably linked. For more on this, I’d advise you (and Michael Saylor) to read Breez CEO Roy Sheinfeld’s piece “Bitcoin’s False Dichotomy between SoV and MoE”.

As the episode proceeded Saylor continued to (poorly) make the case for why bitcoin is capital and not currency.

“There are a lot of maxis who are like ‘No, we want it to be a currency. We want to be able to pay for coffee with our bitcoin. Pay me in bitcoin,’” he said. “It’s like ‘Pay me in gold. Pay me in a building. Pay me with a slice of your professional sports team. Pay me with a Picasso.’”

It’s actually not like that at all.

Sure, bitcoin is scarce, somewhat like gold, Manhattan real estate, sports teams or famous paintings, but it has a number of other properties that make it far different from any of these other assets.

To illustrate a dimension of that point, I’ll cite my colleague Alex Bergeron:

I invite anyone who thinks Bitcoin is like gold to launch a custodial gold wallet.

I’ll wait.

— Alex B (@bergealex4) December 22, 2024

And then Saylor cited — wait for it — Fed Chair Jerome Powell’s take on bitcoin in efforts to drive home his point that bitcoin is capital, not currency.

“The reason bitcoin rallied past $100,000 is because Jerome Powell on stage said to the world, bitcoin does not compete with the dollar, it competes with gold,” he said.

Oddly enough, Saylor said this without acknowledging that the man who said this is the head of the institution that Bitcoin should theoretically replace.

USDT, Not BTC

In the interview, Saylor also drove home the point that the real digital currencies are U.S. dollar stablecoins.

“The cryptocurrency, the digital currency, is Tether (USDT) and Circle (USDC),” he said. “It’s a stablecoin U.S. dollar — that’s the digital currency.”

This is when I started to get nauseous.

For those who don’t yet know this, Bitcoin came into the world in the wake of the Great Financial Crisis of 2008, when the U.S. government in conjunction with the U.S. Federal Reserve opted to print U.S. dollars en masse (debase the currency) to bail out failing banks, the burden of which was laid both on the U.S. taxpayers and U.S. dollar holders worldwide.

Bitcoin is a decentralized money that was created as an alternative to the U.S. dollar and all other fiat currencies. Trying to convince people that bitcoin is not this is disingenuous at best, deeply manipulative at worst.

But this isn’t even the worst of what Saylor had to say on the episode.

He went on to propose that the banks that got bailed out in the 2008 financial crisis issue their own stablecoins, which would help prop up the U.S. debt market.

“They ought to just create a normal regime to issue digital currency backed by U.S. treasuries,” said Saylor.

“The U.S. ought to have a framework so Tether relocates to New York City. That’s what you want, right? And then you ought to basically have a free-for-all where JP Morgan or Goldman Sachs can issue their own stablecoin,” he added.

No, Michael Saylor, that’s not what I want. In fact, it’s very far from what I want.

I don’t want Tether anywhere near New York City (my hometown) and I don’t want JP Morgan and Goldman Sachs issuing U.S. dollar stablecoins that they control, essentially the equivalent of CBDCs.

When I think about Goldman Sachs, the first thing that comes to mind is award-winning writer Matt Taibbi’s description of the institution from his New York Times bestseller Griftopia.

“The first thing you need to know about Goldman Sachs is that it’s everywhere,” began Taibbi in the book. “The world’s most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.”

Goldman Sachs, much like the U.S. Federal Reserve, is an institution that sucks the life force from humanity. Bitcoin was designed to take power away from such institutions, not strengthen them.

Toward the end of the episode, Saylor laid out his master plan for bitcoin and U.S. dollar stablecoins.

Here it is:

“Everybody outside the U.S. would give their left arm to be capitalized on U.S. bonds. So, my strategy would be — and I really think it’s an evil genius strategy; it’s so good that our enemies would hate us, but our allies would complain, too. And the U.S. would make $100 trillion in a heartbeat.

Here’s the strategy: You dump gold, demonetize the entire gold network. You buy bitcoin — 5 million or 6 million bitcoin — and you monetize the bitcoin network. All the capital in the world, sitting in Siberian real estate or Chinese natural gas or every other currency derivative that’s held as a long-term store of value — Europeans, Africans, South Americans, Asians, they all just dump their crappy property and their crappy capital assets and they buy bitcoin. The price of bitcoin goes to the moon.

The U.S. is the big beneficiary. U.S. companies are the big beneficiary. And while you’re doing that, you normalize and support digital currency, and you just define digital currency as the U.S. dollar backed by U.S. dollar equivalents in a regulated U.S. custodian that’s audited. What happens next?

$150 billion of stablecoins goes to $1 trillion, $2 trillion, $4 trillion, $8 trillion, probably somewhere between $8 and $16 trillion, and you create $10 to $20 trillion of demand for U.S. sovereign debt.

While you’re taking away a little bit of the demand because the capital asset of bitcoin grows, you’re adding back the demand to back the stablecoin. [The digital U.S. dollar then] replaces the CNY, the Rubble. It replaces every African currency. It replaces every South American currency. It replaces the euro.

If you really believe in U.S. world reserve currency and U.S. values, every single currency in the world will actually just merge into the U.S. dollar if it was freely available.”

At this point, I stopped listening to the episode and projectile vomited all over the New York City subway car in which I was sitting.

I didn’t come into the Bitcoin space to help the U.S. run a scheme in which it acquires a large percentage of the bitcoin while hooking the world on its trash currency, and it deeply saddens me that someone that many in the Bitcoin space look up to would come up with such a conniving plan.

Bitcoin Is Money

Bitcoin is money. It’s a type of money that cannot be censored or debased that has spectacularly grown in value over the past decade, making it one of, if not the most, powerful tool ever created for individuals.

To think of it as anything less, or to try to convince people that a new iteration of an incumbent version of money is better than it, is to be deeply misinformed.

While bitcoin is capital, that’s not all it is, and please don’t let Michael Saylor or anyone else convince you otherwise.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

XYZVerse tops the list with promising returns

Engineer Predicts Biggest Bull Run Coming Soon for Bitcoin; Here’s All

HSBC analysts reveal which one will reach $10 by January 1, 2025

Crypto and AI Hardware That Turned Heads in 2024

Bitcoin Clean Energy Usage Soar, Tesla To Accept BTC Payments?

Altcoins

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

Published

1 hour agoon

December 29, 2024By

admin

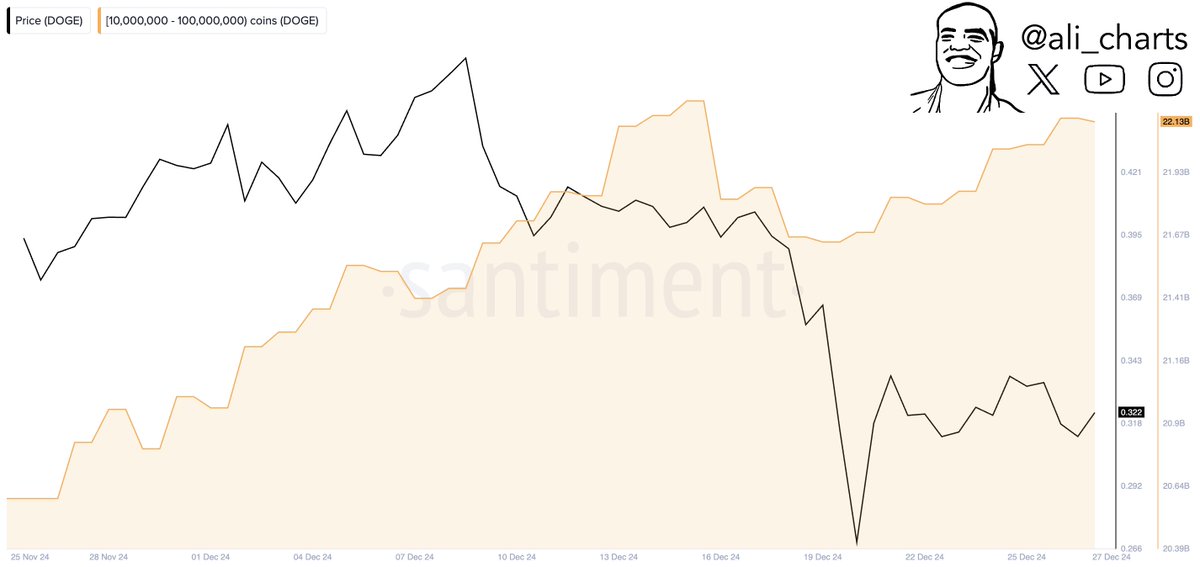

A popular crypto analyst says one technical signal suggests that top meme token Dogecoin (DOGE) could be primed for a bounce.

Ali Martinez tells his 104,600 followers on the social media platform X that the Tom DeMark (TD) Sequential Indicator presented a bullish signal for DOGE.

“The TD Sequential presents a buy signal on the Dogecoin DOGE four-hour chart, anticipating a price rebound!”

Traders use the TD Sequential Indicator to predict potential trend reversals for tokens based on the closing prices of their 13 previous bars or candles.

Martinez also notes that Dogecoin whales bought more than 90 million DOGE in the past two days.

DOGE is trading at $0.314 at time of writing, a fractional decrease in the past 24 hours.

Looking at Bitcoin (BTC), Martinez warns that traders should be worried if the top-ranked crypto asset by market cap drops below a certain price level.

“You don’t want BTC to dip below $92,730 – it’s essentially free-fall territory if that level breaks.”

Martinez suggests that below $92,730, the next on-chain support for BTC hovers at around $69,000 based on Glassnode’s UTXO (Unspent Transaction Output) Realized Price Distribution, a metric that shows the amount of Bitcoin that last moved within a specific price bucket.

But while Martinez is sounding the alarm about a potential pullback for BTC, he notes that a 20-30% correction represents “the most bullish thing that could happen to Bitcoin.”

Bitcoin is trading at $94,671 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Bitcoin Clean Energy Usage Soar, Tesla To Accept BTC Payments?

Published

6 hours agoon

December 28, 2024By

admin

The Bitcoin mining ecosystem is evolving at a very fast pace with visible progress in its utilization of clean energy. According to data insights from Woocharts, the percentage of clean or sustainable energy used in mining is now pegged at 56.76%. This reading has triggered a recall of an earlier promise from Elon Musk regarding Tesla Inc’s disposition to Bitcoin payments.

Tesla and the Bitcoin Payments Promise

According to the Woochart, the BTC clean energy usage has grown steadily since at least April 2021. The platform measures this clean energy usage using the Cambridge Center for Alternative Finance definition of sustainability in its computations.

The metric plotted hinges on the percentage of crypto mining sourced from energy sources like Wind, Solar, Hydro and even Nuclear. That this sustainable mining operation is above 50% means a lot for the industry. It might help usher in the adoption of the coin by top corporations like Tesla.

Recall that in 2021, Elon Musk’s Tesla bought $1.5 billion worth of BTC. Per recent report, the firm still have 11,509 BTC in its reserve as of the third quarter of this year. At the time it made the purchase, the firm also announced the acceptance of Bitcoin as a payment method.

The electric car maker shortly discontinued the payment option, citing the high energy usage of the coin. In a June 13, 2021 post, he said if the coin achieves approximately a 50% clean energy usage, Tesla will resume its Bitcoin payments.

Bitcoin mining clean energy usage has now hit 56%

Remember when Elon said this regarding Tesla BTC payments in 2021?

— Milk Road (@MilkRoadDaily) December 28, 2024

One major hurdle now remain whether the data source is enough to make Elon Musk make good on his promises.

BTC Miners Diversifying

Over the past years, firms like Riot Platforms, MARA Holdings and other Bitcoin mining have intensified investments in clean energy. However, the costs of mining has continued to grow amid current global energy crises. To beat the situation, most of these miners are diversifying their excess capital to buy Bitcoin.

MARA Holdings and Riot Platforms are championing this move. Following its latest purchase of 667 BTC units, Riot Platforms now hold a total balance to 17,429 BTC on its balance sheet.

The plan is to properly hedge their capital and benefit from the coin’s growth, a strategy that has led to the inclusion of pioneers like MicroStrategy in Nasdaq-100 index.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin (BTC) Institutional Adoption Accelerates as ETF Filings Show Investor Appetite

Published

9 hours agoon

December 28, 2024By

admin

The dominant crypto narrative for 2024 has been institutional adoption. From the U.S. approval of spot bitcoin (BTC) exchange-traded funds to the burgeoning number of companies pledging to buy the largest cryptocurrency for their treasuries, crypto has entered, more than ever before, the mainstream conversation.

Bitcoin has increased almost 130% this year, breaking record highs on several occasions. It is currently hovering near the psychological threshold of $100,000. The ETFs approved in January have seen net inflows of $36 billion and amassed over 1 million BTC.

In addition, the number of publicly traded companies saying they’re adding bitcoin to their corporate treasury is accelerating. The trend, which started with MicroStrategy (MSTR) in 2020, recently attracted KULR Technology (KULR), a maker of energy storage products for the space and defense industries. The Houston, Texas-based company said it bought 217.18 BTC for $21 million and is allocating up to 90% of the surplus to cash to BTC.

Now Bitwise Asset Management, which already has spot bitcoin and ether ETFs, has applied for an exchange-traded fund to track the shares of companies that hold at least 1,000 BTC in treasury. Other requirements for the fund, dubbed Bitwise Bitcoin Standard Corporations ETF, are a market capitalization of at least $100 million, a minimum average daily liquidity of at least $1 million and a public free float of less than 10%, according to the Dec. 26 filing.

A second Thursday filing was made by Strive Asset Management, co-founded by Vivek Ramaswamy, a politician in the administration of U.S. President-elect Donald Trump. The Bitcoin Bond ETF seeks exposure through derivative instruments such as MicroStrategy’s convertible securities in an actively managed ETF. The bonds have been a massive success. The 0% coupon bond maturing in 2027 is priced at 150% above par and has outperformed bitcoin since inception.

“Since our inception, Strive has called out the long-term investment risks caused by the global fiat debt crisis, inflation, and geopolitical tensions,” Strive CEO Matt Cole told CoinDesk. “We strongly believe there is no better long-term investment to hedge against these risks than thoughtful exposure to bitcoin.”

“Strive’s first of many planned bitcoin solutions will democratize access to bitcoin bonds, which are bonds issued by corporations to purchase bitcoin. We believe these bonds provide attractive risk-return exposure to bitcoin, yet they are not available to be purchased by most investors,” he added.

Source link

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

XYZVerse tops the list with promising returns

Engineer Predicts Biggest Bull Run Coming Soon for Bitcoin; Here’s All

HSBC analysts reveal which one will reach $10 by January 1, 2025

Crypto and AI Hardware That Turned Heads in 2024

Bitcoin Clean Energy Usage Soar, Tesla To Accept BTC Payments?

Lightchain AI among the most talked-about token of the next bull run

DeFi Education Fund Sues US IRS Over Controversial Tax Rules

Bitcoin (BTC) Institutional Adoption Accelerates as ETF Filings Show Investor Appetite

BONK reclaims top Solana meme coin spot, dethrones PENGU

US and EU Banks Accelerate Stablecoin Plans Amid Regulatory Progress

A 20%-30% Correction Is ‘The Most Bullish Thing’ That Could Happen To Bitcoin – Analyst

Blockchain groups challenge new broker reporting rule

Who Is Elisa Rossi and What’s Her Role?

Trader Issues Bitcoin Alert, Says BTC ‘Doesn’t Look Great’ After Double-Digit Percentage Fall From All-Time High

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Altcoins5 months ago

Altcoins5 months agoEthereum Crash A Buying Opportunity? This Whale Thinks So

✓ Share: