24/7 Cryptocurrency News

Why Is GMT Price Skyrocketing 40% While the Crypto Market is Falling?

Published

1 day agoon

By

admin

In a series of surprising events, the GMT price began skyrocketing, especially today, as it’s up 40%. It’s surprising, as the token has been under a major downtrend and consolidation for years. Interestingly, the token is up when the crypto market is falling, gaining every investor’s attention. So, let’s discuss why the FSL ecosystem’s native token is pumping out of the blue.

GMT Price Booming With Increased Trading Volume & OI

STEPN GMT’s price began rising around a month ago, but it fell short and declined again with the crypto market’s downtrend. After that, it hit the month’s bottom at $0.129 before starting a recovery three days ago. This happened because investors’ trading activity increased its demand. This becomes clearer when the 24-hour trading volume hits $1.92B after a 228.37% surge. Additionally, the Coinglass reports reveal a 63% increase in Open Interest.

As a result, the GMT token’s price has surged 40% over the last 24 hours. More importantly, it’s up by 60% over the week, pushing its market capitalization to $621.89M. Interestingly, there is no significant reason behind this increased investor interest, but there was a spike in short liquidations in December. Although this suggests that traders are betting against the current surge, they got liquidated with the GMT price rally.

Eventually, the shorts began rebuying the assets and accelerating the STEPN token price. However, in contrast, the crypto exchange has witnessed an increased inflow of the GMT token. If this inflow or dumping continues, it could eventually affect the GMT price. Additionally, a possible Bitcoin price crash to $60k could influence the entire crypto market’s performance, including GMT.

Will GMT’s Price Rally Sustain?

After a 60% rally over the week, the GMT chart is forming an inverse head and shoulders pattern, which is a sign of a potential bullish reversal. Additionally, the RSI is bullish, adding to the previous outlook, but it’s near the overbuying zone, which could change things in the long term.

However, the Awesome Oscillator is flipping bullish as it attempts to flip above the zero mean level. With that, a breakout above $0.248 could push the STEPN GMT token to $0.4155. However, the price could drop to $0.161 before this breakout, but any move down to $0.161 could disturb the bullish momentum. Careful consideration and strategic trades need to be placed between these zones.

What Investor’s Should Do?

The FSL ecosystem’s token hit its prime around three and half years ago when it achieved the ATH of $4.11. However, with years of struggle, the target has moved 95% away from that, putting the long holder in a major loss. However, the current situation has opened the opportunity for immediate gains, as the GMT price is constantly moving upwards. As a result, the investors are also getting ready for sale with the inflows rising on the crypto exchanges. Clear strategic planning and careful trades are needed to earn profits, as the STEPN GMT token’s chart forms an inverse head and shoulders pattern. This could push the price to $0.4155 and higher if things went well.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Solana struggles to break the $250 level, this SOL alternative plans 3,800% price rise

CryptoQuant CEO Questions Viability of Strategic Bitcoin Reserve

5 Biggest Crypto Airdrops of 2024

Neur.sh price surges 150%, Would pumps 85%, Bitcoin and Ethereum show little movement

BTC & Altcoins Volatile, Shiba Inu Community Advances

Bearish movement persists on Solana and Ethereum as investors switch to FXGuys for gains

24/7 Cryptocurrency News

CryptoQuant CEO Questions Viability of Strategic Bitcoin Reserve

Published

2 hours agoon

December 29, 2024By

admin

Amid the growing conversation around a strategic Bitcoin reserve in the United States, CryptoQuant co-founder and CEO Ki Young Ju has shared a differing opinion on the prospects. Going down the memory lane, he used the maneuver the US made in dealing with calls for a gold standard to buttress his points. He believes should the US economy continue growing, there might be a shift in Donald Trump’s stance regarding Bitcoin.

Bitcoin Strategic Reserve: The Feasibility

According to Ki Young Ju, economists like like Peter Schiff championed the quest for a return to the gold standard in the 1990s. He compared the advocacy at the time to the clamor by Bitcoin proponents for the strategic reserve as we have today.

While the prospects of a gold standard looked appealing at the time, the CryptoQuant CEO said the US have always devised a means to avoid such shifts. Today, he highlighted how the push for gold standard is now a thing of the past.

Meanwhile, Ki Young Ju is not dismissing the possibility of a Bitcoin purchase by the US, he believes the scope will differ from what advocates envisage.

Throughout history, whenever the United States perceived a threat to its dominance in the global economy, gold prices surged, and debates around the gold standard gained traction.

In the late 1990s, Peter Schiff championed gold as the true form of money, much like today’s…

— Ki Young Ju (@ki_young_ju) December 28, 2024

At the moment, a crypto advisory council is being convened to help guide on the possibilities of this reserve. However, the CryptoQuant CEO said as the US economy matures, the urgency to hedge the US Dollar with Bitcoin might not be there.

Big Bitcoin Bets, Countries Turning Their Backs

Amid the push by countries like the United States, Bhutan and El Salvador for a strategic Bitcoin Reserve, nations like Japan have shown how unreceptive they are to the idea. As reported earlier by Coingape, Japan has rejected the BTC national reserve idea as it plans to focus on building its economy’s stability.

Advocates of the Bitcoin reserve plans suggests it could drive a massive capital network, one that can help resolve mounting debts.

While countries have continued to lag in pushing for the adoption, private and publicly traded firms have started running with the idea. Firms like MicroStrategy, MARA Holdings, Metaplanet and RIOT Platforms have continued to buy Bitcoin at a consistent rate over the past few months.

Of the lastest purchases, Metaplanet bought 619.7 Bitcoin worth ¥9.5 billion, taking its total holdings to 1,761.98 BTC.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BTC & Altcoins Volatile, Shiba Inu Community Advances

Published

5 hours agoon

December 29, 2024By

admin

The dynamic realm of crypto has concluded yet another week, primarily with attention-nabbing developments witnessed across the industry. Despite soaring market optimism in light of investors expecting a bullish Q4, top cryptocurrency prices have encountered volatility. Nevertheless, meme coin Shiba Inu has retained a bullish stance, witnessing remarkable community developments.

Here’s a brief collection of some of the top crypto market updates reported by CoinGape Media over the past week.

Bitcoin & Top Crypto Remain Turbulent

BTC price closes the week at the $94K level, a mark indicating that the coin reversed recent gains. However, long-term prospects for the asset are still bullish as market participants reflect a buy-the-dip sentiment.

Despite a volatile action, American company KULR announced that it purchased $21M worth of BTC, sparking market optimism. However, Bitcoin ETFs have seen slight outflows this week, sparking an uncertain investor sentiment.

It’s noteworthy that Japan has rejected a Bitcoin National reserve proposal amid the recent volatile trend, sparking market speculations. Nevertheless, Robert Kiyosaki has given a bold prediction for BTC price, proclaiming it to hit $350K by 2025. Although recent market trends reflect volatility, market watchers remain optimistic about future movements in the wake of the abovementioned news.

On the other hand, CoinGape reported that despite the turbulence in the broader sector, even Altcoins are seeing remarkable gains ahead. Notably, popular market expert Titan of Crypto hinted towards a bullish path ahead for the crypto market. In addition, renowned crypto expert Michael van de Poppe also remained bullish on the altcoin market’s future.

Overall, market watchers are eagerly awaiting a market recovery in the coming days, with the bull run expected to continue in 2025.

Shiba Inu Sees Remarkable Community Advancements

Meanwhile, the renowned dog-themed meme crypto SHIB has seen remarkable community developments. Shiba Inu lead developer Shytoshi Kusama confirmed the TREAT token launch earlier this week. Simultaneously, the community also witnessed ‘SHIB: The Metaverse’ launch this week.

In addition, Shibarium addresses crossed the 2 million mark, adding to market optimism surrounding the meme coin. Also, the SHIB burn saga has continued reducing the token’s circulating supply, paving a bullish path for future movements.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

Published

8 hours agoon

December 29, 2024By

admin

Crypto analyst Jelle has provided a bullish outlook for the Bitcoin price for the remainder of this market cycle. The analyst predicted that the flagship crypto will reach $140,000 and revealed when this price surge could likely happen.

When The Bitcoin Price Will Jump To $140,000

In an X post, Crypto Jelle predicted that the Bitcoin price could rally to $140,000 in the next three months. This came as the analyst highlighted a cup and handle pattern, which put BTC’s price target at this level.

Crypto analyst Titan of Crypto also suggested that Bitcoin could rally to $140,000 in the next three months. In an X post, the analyst shared an accompanying chart, which he tagged as the ‘Bitcoin 2025 Roadmap.’

The accompanying chart showed that the Bitcoin price could reach $140,000 at the start of the new year. However, this price is unlikely to mark the top for Bitcoin, as it could still surge to $150,000.

Other market experts have even provided a more bullish outlook for the flagship crypto. Engineer Ted Boydston predicted that BTC could hit $225,000, the biggest bull run for the flagship crypto.

Meanwhile, renowned finance author Robert Kiyosaki predicted that the flagship crypto will hit $350,000 in 2025. While it remains to be seen if the flagship crypto could reach such heights, fundamentals such as Donald Trump’s inauguration support a bullish continuation.

A Price Rebound Is Imminent

In an X post, crypto analyst Ali Martinez stated that the Bitcoin price could be preparing for a rebound. The analyst mentioned that Bitcoin is showing a bullish divergence on the hourly chart against the Relative Strength Index (RSI).

The analyst added that the percentage of Binance traders going long on BTC has increased from 53.12% to 64%. These traders are said to have a solid record of being right.

Martinez further stated that the Bitcoin price needs to break above $94,800 to confirm this rebound. A break above this level could send BTC to $95,300 or even $96,000.

On the flip side, the analyst warned that if Bitcoin drops below $93,600, the bull case is off the table as the flagship crypto could drop to $84,000 or even $70,000.

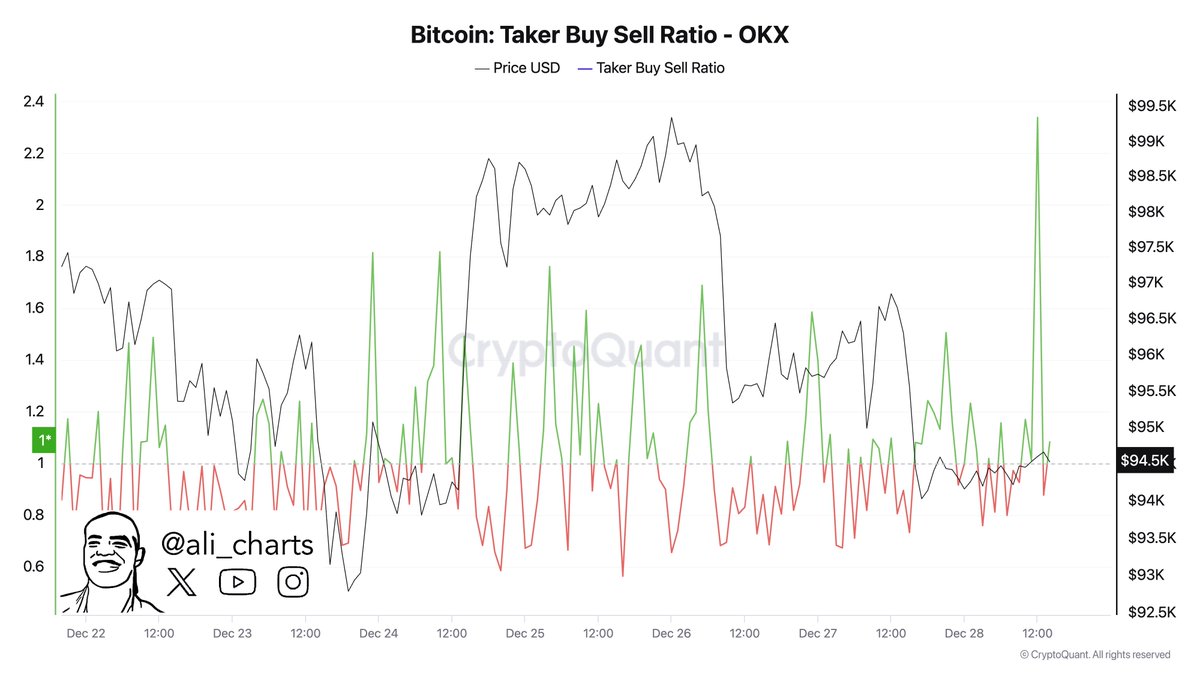

However, the bullish case is looking more likely. In another X post, the analyst revealed that there was a spike in Bitcoin’s Taker Buy/Sell ratio on the top crypto exchange OKX. This indicates a surge in aggressive buying, which is a sign of upward momentum ahead.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solana struggles to break the $250 level, this SOL alternative plans 3,800% price rise

CryptoQuant CEO Questions Viability of Strategic Bitcoin Reserve

5 Biggest Crypto Airdrops of 2024

Neur.sh price surges 150%, Would pumps 85%, Bitcoin and Ethereum show little movement

BTC & Altcoins Volatile, Shiba Inu Community Advances

Bearish movement persists on Solana and Ethereum as investors switch to FXGuys for gains

Vitalik Buterin Adopts Viral Hippo Moo Deng at Thailand Zoo

Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

How Lightchain AI Is combining AI and blockchain like never before

Here’s What To Do As ADA Bottoms

CME Gap Threatens Bitcoin With Potential Drop To $77,000

Analysts predict this under $1 token will surpass WIF and FLOKI in 2025; here’s why

Will Dogecoin Price Hit $20 On Its Next Leg Up?

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

XYZVerse tops the list with promising returns

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Altcoins5 months ago

Altcoins5 months agoEthereum Crash A Buying Opportunity? This Whale Thinks So

✓ Share: