DeFi

Sui soars by over 1,300% from its lowest level in 2023

Published

3 days agoon

By

admin

Sui resumed its strong uptrend, soaring by almost 20%. At last check Saturday, its price hovered at around $5.13.

Sui (SUI), a popular layer-2 network, has been one of the best-performing cryptocurrencies, soaring by over 1,312% from its lowest level in 2023.

This performance has brought its market cap to over $15 billion, making it the 13th biggest cryptocurrency in the industry.

Sui’s surge coincided with the continued ecosystem growth as the total value locked in its Decentralized Finance ecosystem soared to a record high of $1.96 billion.

The biggest players in its DeFi ecosystem are Suilend Protocol, NAVI Protocol, Cetus, Scallop Lend, and Aftermath Finance.

Sui partnerships

Sui also grew after securing major partnerships with top companies like VanEck, Grayscale, and Franklin Templeton. For example, Grayscale launched the Sui Trust, which has accumulated over $14 million in assets. If the Securities and Exchange Commission changes its view on crypto ETFs under Paul Atkins, that could signal that the firm will apply for a spot Sui ETF in 2025.

Sui has also had more successes that have propelled it to a record high. It has incorporated four stablecoins like USD Coin, AUSD, FDUSD, and USDY, which have a combined market cap of over $406 million.

It also launched Deepbook V3, its native onchain order book, whose trading volume jumped to over $1 billion. Its DEEP token has gained a market value of over $375 million.

Meanwhile, Sui’s DEX ecosystem is booming, handling over $46 billion in volume since its inception.

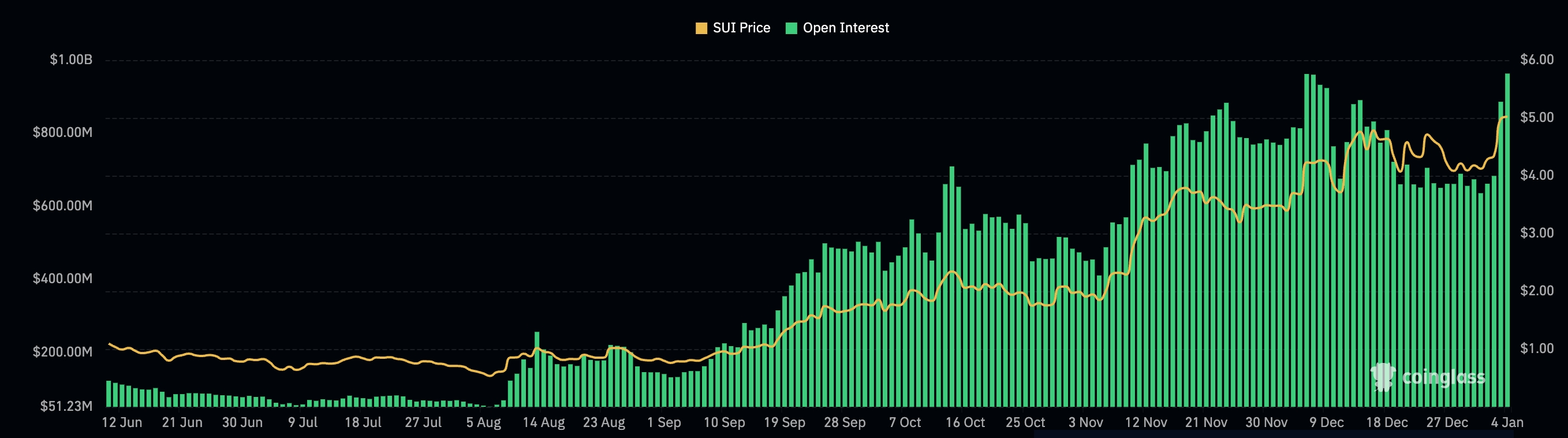

More data shows that Sui’s futures open interest soared to a record high of $963 million. This is a notable increase from this week’s low of $650 million and a sign that SUI’s token is gaining traction among investors.

Sui price forecast

The daily chart shows that the SUI token has been bullish this year, rising for four straight days and flipping the resistance at $5 into resistance. By doing that, the coin invalidated the risky double-top pattern whose neckline was at $4. A double-top is a popular reversal sign in the market.

The price of Sui has been supported by the 50-day moving average, which it has failed to move below since September last year. It is also a cheap coin, as the Z-score of the Market Value to Realized Value has fallen to 2.7. A cryptocurrency is said to be highly expensive when it has a Z score of 3.8.

Therefore, technicals suggest that the SUI price will rise to the extreme overshoot of the Murrey Math Lines at $5.50. A move above that level will raise the odds of it moving to the next crucial level at $10.

Source link

You may like

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

The Most Eye-Catching and Absurd AI Products Unveiled at CES 2025 So Far

Meet Jason Marquez: The Truck Driver Who made $750,000 on MicroStrategy

Why BTC, ETH, DOGE, & Other Altcoins Fell

Arbitrum Awards Biggest-Ever Foundation Grant to Lotte, the South Korean Megacorp

Bitcoin Layer 2 Foundations Should Buy Bitcoin For Their Treasuries

a16z

a16z crypto outlines top 5 trends shaping crypto’s future in 2025

Published

15 hours agoon

January 7, 2025By

admin

From mobile wallets to transaction fees, a16z crypto breaks down the top indicators shaping the crypto landscape in 2025.

The year 2024 was transformative for the crypto space as activity reached all-time highs, transaction fees dropped, stablecoins found practical use cases, and spot Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds finally received approval. Meanwhile, regulatory clarity began to emerge, offering the sector a more defined path forward. As 2025 begins, here are five metrics a16z’s partner Daren Matsuoka believes worth monitoring.

Mobile crypto wallets

Crypto wallets on mobile are where the action is. In 2024, over 35 million people were using them monthly, Matsuoka notes, bringing up such big names as Coinbase Wallet, MetaMask, and Trust Wallet, who are leading the charge. At the same time, newer apps like Solana-focused Phantom and World App are gaining steam too.

Mobile crypto applications have grown so popular that they now serve as an informal indicator of retail investor interest, with observers identifying a correlation between their high rankings in Apple’s App Store and rising crypto prices.

While millions own crypto, many remain passive holders. For broader adoption, Matsuoka says blockchain developers need to find the “right balance between security, privacy, and usability,” admitting that the task is “not trivial.” Nonetheless, the a16z partner believes blockchain infrastructure can now handle “hundreds of millions — or billions — of people on-chain,” adding it’s a “better time than ever to build a next-generation mobile wallet” than ever before.

According to data from Statista, the countries with the highest mobile wallet adoption are in Asia, despite the presence of major U.S. brands like PayPal, Apple Pay, and Google Pay. This trend is not accidental given that in emerging markets, mobile wallets are being used as a tool to address the issue of unbanked populations. As a result, the next major innovation in mobile crypto wallets may well emerge from this region.

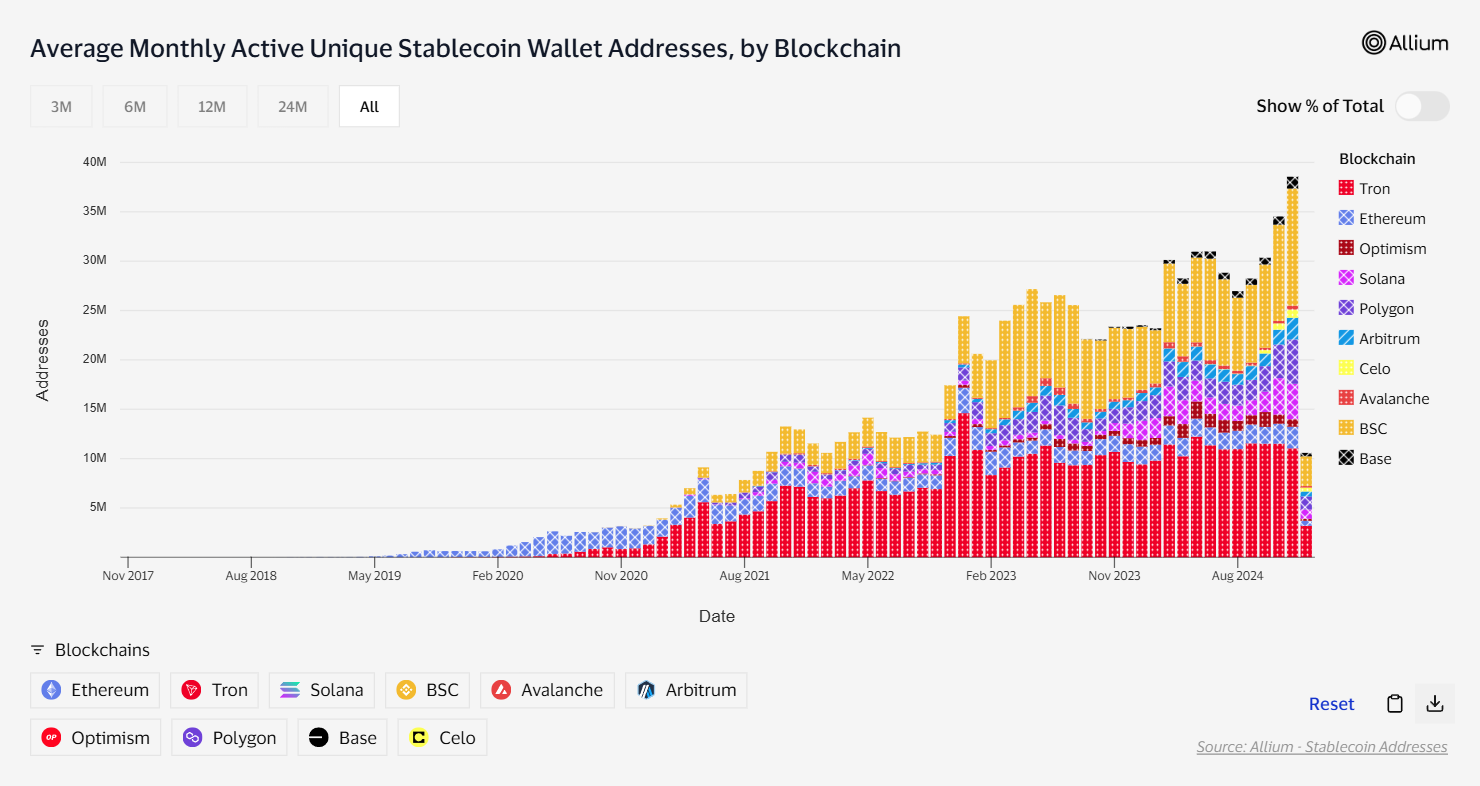

Stablecoins everywhere

Stablecoins had a big moment in 2024. Lower transaction fees made them even more useful for stuff like cross-border payments, remittances, and even just buying everyday stuff. They’re also helping people in countries with crazy inflation store value (e.g. Argentina and Turkey).

“Stablecoins are already the cheapest way to send a dollar, and we expect enterprises will increasingly accept stablecoins for payments.”

Daren Matsuoka

Yet, there’s still no dominant solution that brings stablecoin payments closer to traditional methods, leaving a significant gap in the market.

Matsuoka notes that stablecoin payments are quickly gaining traction and show no signs of slowing down as payment giant Visa has developed a dashboard to distinguish genuine stablecoin usage from bot-driven transactions.

“If stablecoin adoption — one of crypto’s most clear use cases — takes off in 2025, this metric will be one to watch,” says Matsuoka.

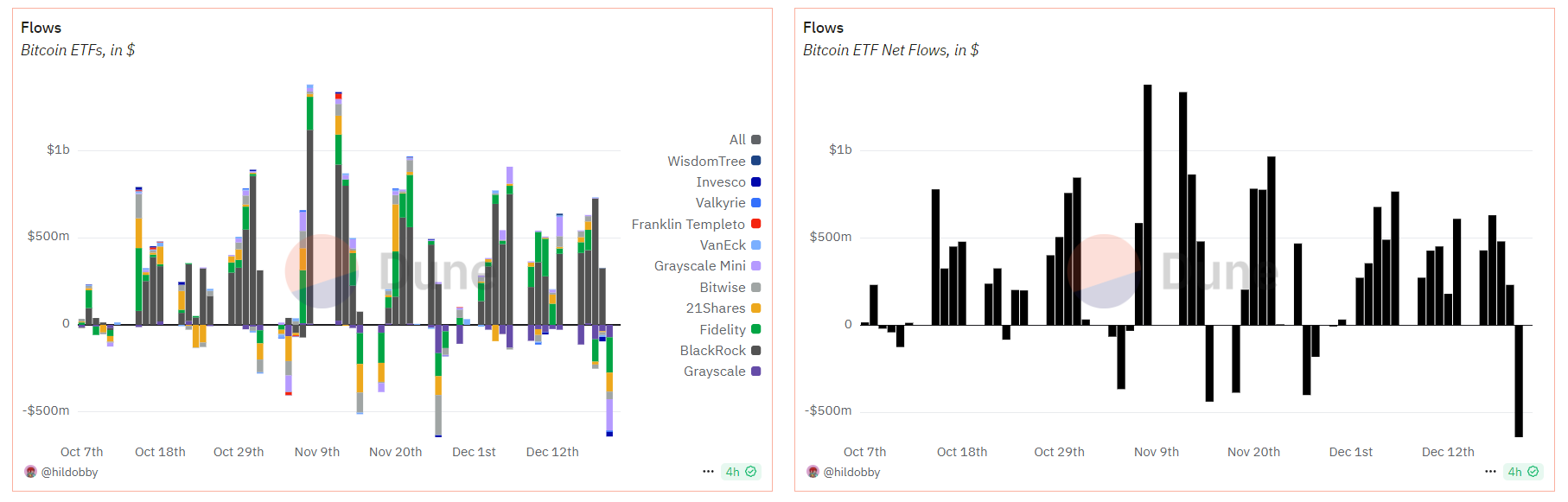

ETPs bring Bitcoin and Ethereum to masses

Last year, Bitcoin and Ethereum got their first proper exchange-traded funds approved in the U.S. This makes it way easier for regular people — and big institutions — to invest in crypto.

However, so far these ETFs have attracted only 515,000 BTC (around $110 billion) and 611,000 ETH (~$13 billion), Matsuoka notes, adding that “activating the distributors – the likes of Goldman Sachs, JP Morgan, and Merrill Lynch, who can get these products into retail investors’ portfolios – is going to take time.”

The a16z partner suggests tracking on-chain deposits and withdrawals of addresses “identified as custodians of the ETPs,” noting that more institutional investors are likely to seek exposure to crypto assets, which will lead to increased net flows for the ETPs.

DEXs vs CEXs

Decentralized exchanges are slowly eating into centralized exchanges’ market share. While their trading volume is still far from centralized rivals, they already handle about 11% of spot trading, Matsuoka pointed out, adding that the number’s climbing.

“Recently, DEX volume hit an all-time high — driven by a major uptick in transaction volume on high-throughput chains like Coinbase’s Base and Solana as new users entered the space.”

Daren Matsuoka

Although Matsuoka says DEXs are likely to keep gaining their share in 2025, it’s unclear whether retail investors will rush to switch from centralized platforms. So far, the pace has been slow, as it took decentralized trading platforms four years to capture more than 10% of spot trading volume compared to their centralized counterparts, per data from DefiLlama.

Transaction fees

In a bid to identify which blockchain network is gaining in popularity, transaction fees could show how much demand there is. But here’s the catch: while fees should show growth, they shouldn’t go so high they scare users away.

Last year, Solana passed Ethereum in total fees collected for the first time, even though Solana’s transactions are extremely cheap (less than 1 cent vs. $5+ on Ethereum). Matsuoka admits that that’s a big milestone, adding that many ecosystems and their associated fee markets are maturing, making it a “good time to start measuring the economic value facilitated by various blockchains.”

In the long run, demand for blockspace – measured as the total aggregate USD value of fees paid – could be the most important metric for tracking the crypto industry’s progress, as it reflects engagement in valuable economic activities and users’ willingness to pay for them, Matsuoka wrote.

Source link

Bitcoin Events & Conferences 2024

$1 Million In Seed Capital Awarded To DeFi Hedge Fund Boreal, Bitcoin Alpha Competition Winner

Published

5 days agoon

January 3, 2025By

admin

At Bitcoin 2024 this past July, Samara Alpha Management and Bitcoin Magazine Pro selected Boreal, a market neutral DeFi hedge fund, as the winner of this year’s Bitcoin Alpha Competition.

Boreal was awarded $1 million in seed capital as well as access to Samara’s institutional-grade infrastructure to help manage its fund.

Boreal stood out because of its trading strategy, which utilizes various DeFi protocols to generate yield on top of US dollars, bitcoin and ether.

“Even when things are super bearish, there’s always a way to generate returns in DeFi,” said Boreal’s founder Evan Morris, who has been in the crypto space since 2016 and who worked in traditional finance prior to that.

“I began in this space four years ago managing outside money with two friends and then ended up joining a larger firm as a portfolio manager where I ran a DeFi strategy for a few years. More recently, I’ve launched Boreal, and now, with the help of Samara, we can really take things to the next level,” he added.

Adil Abdulali, Chief Investment Officer at Samara Asset Management and one of the judges in the competition, commented on why Samara is excited to partner with Boreal.

“Evan is somebody who has a very good track record of work and the right risk framework for this type of strategy,” he said. “He has trading maturity, and since crypto is a young market, somebody with several years of experience in DeFi is rare.”

Abdulali also shared details on how Samara plans to support Morris.

“We thought if there’s a way to quickly get him off the ground with all the infrastructure like admin, auditing, accounting, subscription docs, a bank account, BitGo accounts, etc. — all of which we have — then let’s do it,” he said.

DeFi on Bitcoin

Moving forward, Morris sees bitcoin playing a much bigger role in the DeFi space.

“With bitcoin coming onto the DeFi scene, we’re able to do some of the same things that we were able to do with stablecoins over the past few years,” he said.

“DeFi 1.0 was very USDC- and Tether-based, but the future of DeFi is going to involve different types of wrapped bitcoin and bitcoin derivatives. And we’re happy to provide liquidity.”

Abdulali also feels that bitcoin will play a bigger role in DeFi, and his firm is well-positioned to help Boreal capitalize on this.

“Bitcoin is not just like all other coins — it’s some of the best collateral out there,” he said.

“We use bitcoin in our bitcoin-denominated fund, which we started over a year ago and which employs essentially the same type of strategies that our dollar-denominated market-neutral fund does. However, the fund transacts entirely in bitcoin,” he added.

“The idea is to use bitcoin in these new DeFi protocols like Babylon in market-making strategies instead of putting collateral like USDC or USDT on an exchange.”

The Future of DeFi

Morris explained that DeFi has become much more advanced than it was four years ago, when it first came on the scene as a sector of crypto.

“There are just so many more tools to get alerts on smart contracts and evaluate smart contract security,” he said.

“Cybersecurity and wallet technology is so much better, as well. This enables institutional-grade DeFi products,” he added.

And Abdulali wants to see Boreal take advantage of this institutional-grade DeFi before the institutions arrive.

“All this new institutional capital is not even going to touch DeFi for a while,” explained Abdulali. “They’ve hardly gotten into bitcoin, so it’s going to be a long time before the DeFi landscape becomes saturated and there’s too much capital,” he added.

“There are going to be some juicy returns for some of us that are willing to play in the space now.”

Source link

dao

USUAL fee switch activation could reshape DeFi ecosystem in 2025

Published

7 days agoon

January 1, 2025By

admin

Jan. 7 could mark a turning point, as Usual plans to activate the token fee switch for real value sharing.

The real-world asset stable coin protocol Usual (USUAL) has recently hinted at the activation of its token fee switch.

The fee switch era begins.

2025 marks a turning point for DeFi: real value, real distribution.

Get your USUAL ready for January 7th.

A new year, a new standard. Let’s make 2025 the year of USUAL. pic.twitter.com/kXQXTrinjK

— Usual (@usualmoney) January 1, 2025

This announcement comes at a pivotal time for USUAL, as the protocol has experienced a notable decline in its recent market performance.

The current price of USUAL is $0.91, reflects a 29.86% drop from the previous week. The current market capitalization stands at approximately $447.9 million, with a 24-hour trading volume of around $261.46 million. This represents a substantial decline from the token’s all-time high of $1.62, which was reached on Dec. 20, 2024.

The activation of the fee switch is anticipated to introduce a new revenue-sharing model within the Usual ecosystem, potentially providing token holders with a share of the protocol’s transaction fees. This move aims to enhance token utility and attract more participants to the platform.

Fee switches have become a big trend in the DeFi space, turning passive token ownership into a more rewarding experience. They allow for the redistribution of collected fees to key stakeholders, such as liquidity providers, stakers, and token holders, creating stronger incentives for participation and retention.

For USUAL and its community, the Jan. 7, 2025 activation of the fee switch could mark the beginning of a new era where real value and distribution take precedence, setting a new standard for success in the DeFi ecosystem.

Source link

Ripple CEO Brad Garlinghouse Confirms Mar-a-Lago Meeting with Donald Trump

The Most Eye-Catching and Absurd AI Products Unveiled at CES 2025 So Far

Meet Jason Marquez: The Truck Driver Who made $750,000 on MicroStrategy

Why BTC, ETH, DOGE, & Other Altcoins Fell

Arbitrum Awards Biggest-Ever Foundation Grant to Lotte, the South Korean Megacorp

Bitcoin Layer 2 Foundations Should Buy Bitcoin For Their Treasuries

Bitwise CIO Reacts As Czech Republic Mulls Bitcoin Reserve

XRP Could Rocket 470% If History Repeats, SuperTrend Suggests

From Laser Eyes to Upside-Down Pics: The New Bitcoin Campaign to Flip Gold

WazirX hack victims to receive aid from new CoinSwitch fund

Why Tim Draper Sees BTC as the ‘Next Netflix’?

‘Hype Cycle’ To Last Another Four Months for This Altcoin Sector, According to Real Vision Analyst Jamie Coutts

a16z crypto outlines top 5 trends shaping crypto’s future in 2025

US CFTC Chair Rostin Behnam To Depart On January 20

Crypto exchange Backpack, founded by former FTX execs, acquires FTX EU

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x